While the U.S. stock market has been pricing in a “soft-landing” scenario for the economy, a blowout January jobs report, relatively strong corporate earnings, and Federal Reserve Jerome Powell’s comments during the past week could point to the possibility of “no landing,” where the economy is resilient while inflation stays on target.

Such a scenario could still be positive for U.S. stocks, as long as inflation remains steady, according to Richard Flax, chief investment officer at Moneyfarm. However, if inflation reaccelerates, the Fed may be hesitant to cut its policy interest rate much, which could spell trouble, Flax said in a call.

What the past week tells us

Investors have just gone through the busiest week so far this year for economic data and corporate earnings reports, with stocks ending at or near their record highs.

The Dow Jones Industrial Average

DJIA

finished the week with its nineth record close of 2024, according to Dow Jones Market Data. The S&P 500 index

SPX

scored its seventh record close this year on Friday, while the Nasdaq Composite

COMP

is about 2.7% lower from its peak.

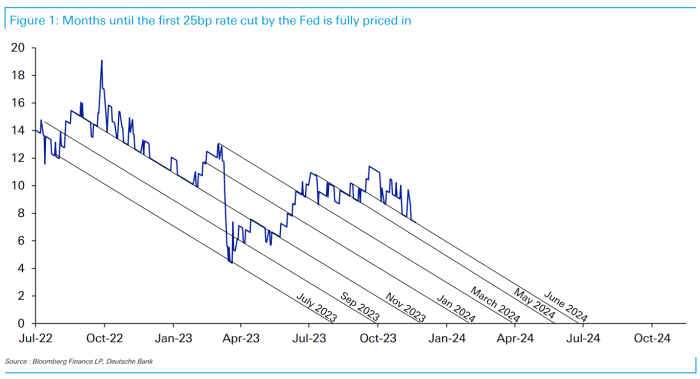

The Fed kept its policy interest rate unchanged in the range of 5.25% to 5.5% at its Wednesday meeting, as expected. However, in the subsequent press conference, Fed Chair Jerome Powell threw cold water on market expectations that the central bank may start cutting its key interest rate in March, and underscored that they want “greater confidence” in disinflation.

Roger Ferguson, former Fed vice chairman, said Powell introduced “a new kind of risk, the risk of no landing.”

In that scenario, inflation will stop falling, while the economy is strong, Ferguson said in an interview with CNBC on Thursday. However, Ferguson said he doesn’t think it is the likely outcome.

Traders were pricing in a 20.5% likelihood on Friday that the Fed will cut its interest rates in its March meeting, according to the CME FedWatch tool and that’s down from over 46% chance a week ago. The likelihood that the Fed will kick off its rate cutting program in May stood at 58.6% on Friday.

The stronger-than-expected January jobs data released on Friday further eliminates the chance of a rate cut in March, said Flax.

The U.S. economy added a whopping 353,000 new jobs in January while economists polled by The Wall Street Journal had forecast a 185,000 increase in new jobs. Hourly wages rose a sharp 0.6% in January, the biggest increase in almost two years.

The past week has also been heavy with earnings reports, as several tech giants including Microsoft

MSFT,

Apple

AAPL,

Meta

META,

and Amazon

AMZN,

reported their financial results for the fourth quarter of 2023.

Among the 220 S&P 500 companies that have reported their earnings so far, 68% have beaten estimates, with their earnings exceeding the expectation by a median of 7%, analysts at Fundstrat wrote in a Friday note.

While the reported earnings by big tech companies have been “okay,” the guidance was not, said José Torres, senior economist at Interactive Brokers.

What has been driving the tech stocks’ rally since last year was mostly the prospect of sales from artificial intelligence products, but tech companies are not able to monetize the trend yet, Torres said in a phone interview.

Adding to the headwinds is a comeback of concerns around regional banks.

On Thursday, New York Community Bancorp Inc.’s stock triggered the steepest drop in regional-bank stocks since the collapse of Silicon Valley Bank in March 2023. New York Community Bancorp on Wednesday posted a surprise loss and signaled challenges in the commercial real estate sector with troubled loans.

Meanwhile, the Fed’s bank term funding program, which was launched in March last year to bolster the capacity of the banking system, will expire on March 11.

If the Fed could start cutting its key interest rate in March, it would be “sort of like the ambulance that was going to pick regional banks up and save them,” said Torres. “Now the ambulance is coming in May at the earliest, I think that we’re in a particularly risky period from now to May,” Torres said.

What should investors do

Investors should go risk-off before May, according to Torres. “Last year, goods and commodities helped a lot on the disinflationary front. This year for disinflation to continue, we’re going to need services to start contributing to that. Then we’re going to need to see an increase in the unemployment rate,” Torres said.

He said he prefers U.S. Treasurys with a tenor of four years or shorter, as the long-dated ones may be susceptible to risks around the fiscal deficit and government borrowing. For stocks, he prefers the healthcare, utilities, consumer staples and energy sectors, he said.

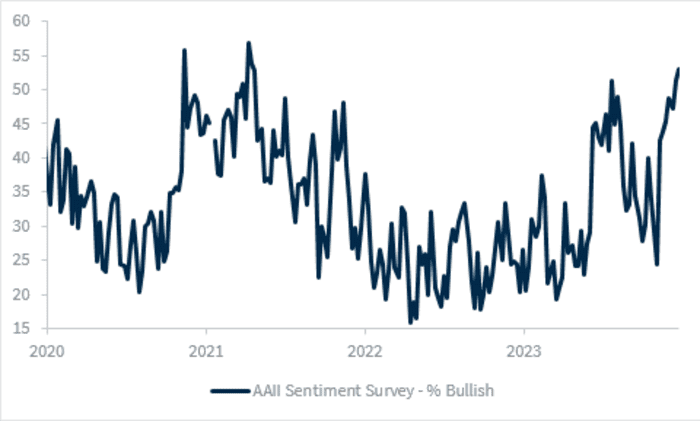

Keith Buchanan, senior portfolio manager at Globalt Investments, is more optimistic. The slowdown in inflation and the relatively strong economic data and earnings “don’t really paint a picture for a risk-off scenario,” he said. “The setup for risk assets still leans towards the bullish expectation,” Buchanan added.

In the week ahead, investors will be watching the ISM services sector data on Monday, the U.S. trade deficit on Wednesday and weekly initial jobless benefit claims numbers on Thursday. Several Fed officials will speak as well, potentially providing more clues on the possible trajectory of rate cuts.