U.S. stocks opened mixed on Tuesday as investors weighed a reading on inflation that was largely in line with economists’ forecasts. The Dow Jones Industrial Average

DJIA,

was up less than 0.1% soon after the opening bell, while the S&P 500

SPX,

slipped 0.2% and the Nasdaq Composite

COMP,

fell 0.1%, according to FactSet data, at last check. The Bureau of Labor Statistics said Tuesday that inflation, as measured by the consumer-price index, rose 0.1% in November for a year-over-year rate of 3.1%. Economists polled by the Wall Street Journal had forecast that inflation would be unchanged in November while rising at an annual pace of 3.1%. So-called core inflation, which excludes energy and food prices, climbed 0.3% last month to increase 4% in the 12 months through November. That was in line with economists’ expectations. In the bond market, the yield on the 10-year Treasury note

TMUBMUSD10Y,

was up one basis point at around 4.24%, according to FactSet data, at last check.

Tag: Investing/Securities

-

U.S. stocks open mixed as investors weigh fresh data on inflation

+0.35% +0.07% +0.07% 4.234% -

U.S. stocks open mostly lower as investors look ahead to inflation data, Fed policy meeting

U.S. stocks opened mostly lower on Monday, after six straight weeks of gains, as investors look ahead to inflation data and the Federal Reserve’s policy meeting this week. The Dow Jones Industrial Average

DJIA,

+0.17%

was up 0.2% soon after the opening bell, while the S&P 500

SPX,

+0.03%

shed 0.1% and the Nasdaq Composite

COMP,

-0.27%

fell 0.4%, according to FactSet data, at last check. A reading on November inflation, as measured by the consumer-price index, will be released on Tuesday. The following day, the Fed will release a statement on its monetary policy, after concluding its two-day meeting. Last week, all three major U.S. stock benchmarks closed at their highest levels of the year, with the S&P 500 finishing Friday at its highest value since March 29, 2022. -

This week's Fed meeting could slam brakes on year-end stock rally

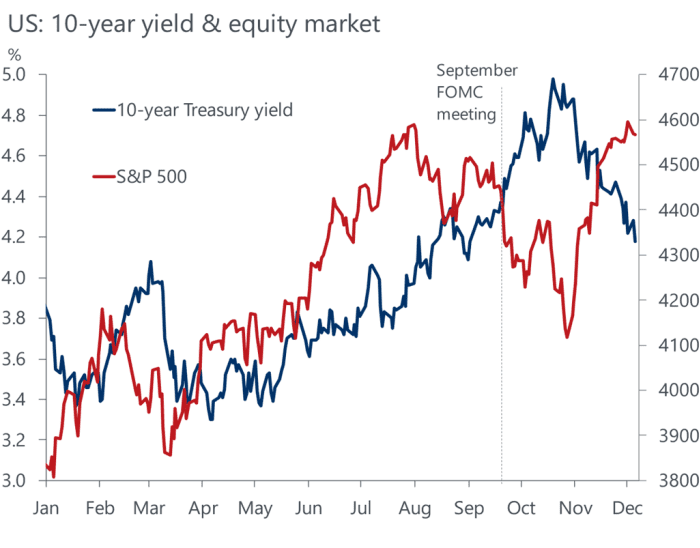

The rally lifting U.S. stocks to fresh 2023 highs in the year’s home stretch could be at risk if the Federal Reserve on Wednesday crushes expectations for interest-rate cuts in 2024.

U.S. central bankers and investors haven’t exactly been seeing eye-to-eye about when the Fed will start easing its monetary policy, according to Melissa Brown, senior principal of applied research at Axioma.

Traders also have been flip-flopping on their forecasts for rate cuts over the past few months, based on fed-funds futures data.

Oxford Economics/Bloomberg

Given the whipsaw of recent volatility, it isn’t hard to imagine a jittery market backdrop as investors wait to hear from Fed Chairman Jerome Powell on Wednesday, even though the central bank isn’t expected to change its range for short-term interest rates. Since July, the Fed funds rate rate has been at a 22-year high in a 5.25% to 5.5% range.

U.S. stocks advanced this year after a bruising 2022, adding big gains in November, as benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

tumbled from a 16-year high of 5%. The Dow Jones Industrial Average

DJIA

closed on Friday only 1.5% away from its record close nearly two years ago. The S&P 500 index

SPX

booked its highest finish since March 2022, according to Dow Jones Market Data.Year Ahead: The VIX says stocks are ‘reliably in a bull market’ heading into 2024. Here’s how to read it.

“I don’t see any report on the horizon that would really make them [the Fed] change their stance on where we are on monetary policy,” said Alex McGrath, chief investment officer at NorthEnd Private Wealth. It is mostly the expectation of Fed rate cuts next year that have supported stock and bond markets rallies recently, he said.

The Dow Jones closed 9.4% higher on the year through Friday, the S&P 500 was up 19.9% and the Nasdaq Composite advanced 37.6% for the same period, according to FactSet data.

“We have been a little skeptical of the market’s excitement over rate cuts early next year,” said Ed Clissold, chief U.S. strategist at Ned Davis Research.

It takes a gradual process for the Fed to move away from its monetary policy tightening, Clissold told MarketWatch. The Fed is likely to pivot its tone from being very hawkish to neutral, remove the tightening bias, and then talk about rate cuts, noted Clissold.

The bond market on Friday already was again flashing signs of a potential rethink by investors about the path of interest rates in 2024.

Junk bonds

JNKHYG,

often a canary in the coal mine for markets, hit pause on a rally that started in late October as benchmark borrowing costs fell, even though the sector has benefited from big inflows of funds in recent weeks.Treasury yields for 10-year and 30-year

BX:TMUBMUSD30Y

bonds also shot higher Friday, echoing volatility that took hold in mid-October.Read: Investors have fought a 2-year battle with the bond market. Here’s what’s next.

Mike Sanders, head of fixed income at Madison Investments, has been similarly cautious. “I think the market is a little too aggressive in terms of thinking that cuts are going to occur in March,” Sanders said. It is more likely that the Fed will start cutting rates in the second half of next year, he said.

“I think the biggest thing is that the continued strength in the labor market continues to make the services inflation stickier,” Sanders said. “Right now we just don’t see the weakness that we need to get that down.”

Friday’s U.S. employment report adds to his concerns. About 199,000 new jobs were created in November, the government said Friday. Economists polled by the Wall Street Journal had forecast 190,000 jobs. The report also showed rising wages and a retreating unemployment rate to a four-month low of 3.7% from 3.9%.

The U.S. central bank will likely “try their best to push back on the narrative of cuts coming very soon,” Sanders said. That could be accomplished in its updated “dot plot” interest rate forecast, also due Wednesday, which will provide the Fed’s latest thinking on the likely path of monetary policy. The Fed’s update in September surprised some in the market as it bolstered the central bank’s stance of higher rates for longer.

There’s still a chance that inflation will reaccelerate, Sanders said. “The Fed is worried about the inflation side more than anything else. For them to take the foot off the brake sooner, it just doesn’t do them any good.”

Ahead of the Fed decision, an inflation update is due Tuesday in the November consumer-price index, while the producer-price index is due Wednesday.

Still, seasonality factors could aid the stock market in December. The Dow Jones Industrial Average in December rises about 70% of the time, regardless of whether it is in a bull or bear market, according to historical data.

See: Stock market barrels into year-end with momentum. What that means for December and beyond.

“The overall market outlook remains constructive,” said Ned Davis’s Clissold. “A soft landing scenario could support the bull market continuing.”

Last week the Dow eked out a gain of less than 0.1%, the S&P 500 edged up 0.2% and the Nasdaq rose 0.7%. All three major indexes went up for a sixth straight week, with the Dow logging its longest weekly winning streak since February 2019, according to Dow Jones Market Data.

-

S&P 500 ends at 2023 high, books longest weekly win streak in 4 years

U.S. stocks closed higher on Friday, shaking off earlier weakness after a strong monthly jobs report, to clinch a sixth straight week in a row of gains. The Dow Jones Industrial Average

DJIA,

+0.36%

advanced about 130 points, or 0.4%, to end near 36,247, according to preliminary FactSet data. The S&P 500 index gained 0.4% Friday and the Nasdaq Composite finished 0.5% higher. A string of weekly gains propelled the S&P 500 index

SPX,

+0.41%

to a fresh 2023 closing high and left the Dow about 1.4% away from its record close set nearly two years ago, according to Dow Jones Market Data. Equities have benefitted from a risk-on tone going into year end, which has been driven by falling 10-year Treasury yields

TMUBMUSD10Y,

4.230%

and optimism around the Federal Reserve potentially cutting interest rates in the year ahead. That hinges on if inflation continues to ease. November’s robust jobs report served as a reminder Friday of the tough path of the “last mile” in getting inflation down to the Fed’s 2% annual target. As part of this, the 10-year Treasury yield jumped about 11.5 basis points Friday to 4.244%, but still was about 74 basis points lower than its October high. For the week, the Dow was only fractionally higher, the S&P 500 gained 0.2% and the Nasdaq climbed 0.7%. -

U.S. stocks finish lower as S&P 500, Dow industrials suffer three straight sessions of declines

U.S. stock indexes ended lower on Wednesday, with the S&P 500

SPX,

-0.39%

and the Dow Jones Industrial Average

DJIA,

-0.19%

booking a third straight session of losses as investors awaited more labor-market data for clarity about the state of the economy. The Dow industrials fell 70 points, or 0.2%, to end at 36,054, while the S&P 500 finished 0.4% lower and the Nasdaq Composite

COMP,

-0.58%

retreated 0.6%. U.S. businesses added 103,000 new jobs in November, paycheck company ADP said on Wednesday, in another sign of slower hiring and a softer labor market. Investors will monitor jobless claims numbers on Thursday morning before contemplating the widely followed official data on nonfarm payrolls, wages and the unemployment rate, due out Friday 8:30 a.m. Eastern time. -

China’s Colossal Hidden-Debt Problem Is Coming to a Head

China’s Colossal Hidden-Debt Problem Is Coming to a Head

-

Why the U.S. economy isn't out of the woods as stock market soars

A rally in the U.S. stock and bond markets in the past week defied the bears and fueled hopes for more gains to come by year-end and in 2024 as Wall Street bought into the idea that the economy will pull off a “soft landing” after a run of interest-rate hikes by the Federal Reserve.

But market skeptics are putting investors on alert that the “soft-landing” scenario is still at risk with consumer spending and job growth slowing, along with corporate earnings.

“The equity market is misguided,” said Josh Schachter, senior portfolio manager at Easterly Investment Partners, in a phone interview with MarketWatch. “The markets are behaving in almost a bipolar fashion — some asset classes such as bonds

BX:TMUBMUSD10Y,

oil

BRN00,

-0.29% ,

and dollar

DXY,

are being priced for a recession, while other assets such as equities and bitcoin

BTCUSD,

+2.16% ,

are priced risk-on.”U.S. stocks built on their November gains in the past week, with the S&P 500 index

SPX

ending at new 2023 high on Friday and the Dow Jones Industrial Average

DJIA

logging its fifth week in the green. The rebound in stocks was due in part to bond investors starting to believe the Fed is done raising interest rates and is likely to begin cutting them by the first quarter of 2024.Meanwhile, the narrative that a resilient labor market and steadier-than-expected economic growth should keep a recession at bay has gained traction, bolstering the “goldilocks” scenario for the financial markets.

However, signs are emerging that consumer spending, which accounts for about 70% of the U.S. economic output and has boosted the economy this year, has likely run its course following the post-pandemic recovery. Credit card and car loan delinquency rates are rising, student loan payments have resumed, consumer spending is cooling, and there are warnings from top retailers.

Joseph Quinlan, head of CIO market strategy for Merrill and Bank of America Private Bank, said the “softness” in the U.S. consumer sector is visible but not huge, referring to that as “a canary in a coal mine,” he told MarketWatch via phone on Thursday.

The pullback in consumer spending is welcome news for Fed officials, who have increased interest rates 11 times since March 2022 to get inflation back to its preferred target of 2%. However, some analysts are worried that high interest rates and a decline in pandemic savings could eventually translate to weaker consumers in 2024, potentially another sign of a long-predicted slowdown in the U.S. economy.

“One of the things I’m most concerned about is consumers’ ability to continue to pace the economy — you’ve got several headwinds that haven’t really borne completely out yet,” said Jason Heller, senior executive vice president at Coastal Wealth. “Does the consumer continue to behave the way they behaved the last 36 months? I think you will eventually see a slowdown in consumer spending which is going to mandate a slowdown in the labor market.”

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, acknowledged that a modest slowdown in inflation and employment growth means that a “Fed relief rally” in stocks can be sustained, but her concern is this late-cycle limbo is no different than those of the past, which is a moment of “goldilocks” before the very reason that inflation is moderating — slowing economic growth and employment — becomes clear in the data.

See: ‘We Are Still Headed for a Pretty Hard Landing,’ Ex-Treasury Secretary Larry Summers Says

That’s why the November employment report, which will be released by the Bureau of Labor Statistics next Friday at 8:30 a.m. Eastern, will be key for investors to watch. The U.S is expected to add 172,500 jobs in November after a 150,000 increase in the prior month, according to economists polled by Dow Jones. The percentage of jobless Americans seeking work is forecast to stay the same at 3.9%, leaving it at the highest level since the beginning of 2022.

See: U.S. job growth pick up on the radar this coming week

In fact, nonfarm payroll report publication days have been among the most volatile for stocks in 2023, compared with the release of monthly consumer-price index readings, which sparked some of the biggest daily up and down moves for the S&P 500 and other major indexes in 2022.

See also: Do CPI days still rock the stock market? How 2023 stacks up to 2022

This year, the S&P 500 saw an absolute average percentage change of 1.12% on employment situation release dates, compared with an average percentage move of 0.64% on CPI days, according to figures compiled by Dow Jones Market Data.

That said, analysts are skeptical if the employment data is able to tell “a radically different story” but suggest the labor market will remain relatively tight into 2024, said Quinlan and Lauren Sanfilippo at Merrill and Bank of America Private Bank, in a phone interview.

See: What 2024 S&P 500 forecasts really say about the stock market

Too much optimism in 2024 earnings growth

Corporate America and their shares are telling investors a different story about next year.

With an estimated average S&P 500 earnings growth of 11.7% next year, the U.S. stock market is nowhere near recessionary concerns, said Heller. “We’ve [the stocks] priced in pretty significant growth in 2024.”

Strategists at Merrill and Bank of America Private Bank are in the camp of expecting a “mid-single digit” earnings growth for the S&P 500 in 2024, as earnings have troughed and the economy will fall back to the 2%-level of real growth after high rates confine consumer spending and corporate profits, cooling a red-hot economy.

To be sure, Wall Street analysts tend to overestimate the earnings-per-share (EPS) for the S&P 500, said John Butters, senior earnings analyst at FactSet.

The current bottom-up EPS estimate for the S&P 500 in 2024 is $246.30. If that holds true, that would be the highest EPS number reported by the large-cap index since FactSet began tracking this metric in 1996.

However, over the past 25 years, the average difference between the EPS estimate at the beginning of the year and the actual EPS number has been 6.9%, meaning analysts on average have overestimated the earnings one year in advance, said Butters in a Friday note (see chart below).

SOURCE: FACTSET

-

Dow posts highest close in nearly 2 years, equities extend rally to five straight weeks

U.S. stocks powered higher on Friday, shrugging off tough talk from Federal Reserve Chairman Jerome Powell about it being too early to talk about rate cuts. The Dow Jones Industrial Average

DJIA,

+0.82%

gained about 294 points, or 0.8%, ending near 36,245, according to preliminary FactSet data. The S&P 500 index

SPX,

+0.59%

rose 0.6%, while the Nasdaq Composite Index

COMP,

+0.55%

gained 0.6%. All three indexes also ended the week higher for five straight weeks. The gains allowed the Dow to clinch its highest close since since January 2022, while the S&P 500 finished at its highest level since March 2022, according to Dow Jones Market Data. The powerful rally in equities since early November has been attributed to easing inflation, falling long-term Treasury yields and expectations for rate cuts next year The 10-year Treasury yield

TMUBMUSD10Y,

4.200%

fell to 4.225% on Friday, after hitting 5% in October, ending the week at its lowest yield since early September, according to DJMD. -

Bitcoin is up 130% this year. Could it extend the rally in December and 2024?

Bitcoin has extended its rally on Friday, rising to the loftiest level since May 2022, pushing its yearly gain up to over 130%, on pace to be one of the best performing assets this year.

The crypto

BTCUSD,

+1.28%

rose about 2.5% over the past 24 hours to around $38,676 Friday afternoon, as excitement about the potential approval of bitcoin exchange-traded funds continues to build. Bitcoin is still 44% down from its all-time high in 2021.Risk assets in general performed well in November, as concerns eased around several pressure points, including the surge in long-term Treasury yields and inflation, analysts at Grayscale Research wrote in a Friday note.

Despite outperforming many major assets year-to-date, bitcoin underperformed long-term Treasurys and the S&P 500 in November on a volatility-adjusted basis, gaining 9% for the month.

Bloomberg; Grayscale Investments

Sam Callahan, market analyst at Swan Bitcoin, said he expects bitcoin to trade between $36,000 and $40,000 by the end of the year, “provided that the macroeconomic environment doesn’t take a turn for the worse, and barring any significant positive development, such as the approval of a Spot Bitcoin ETF or the adoption of Bitcoin by a major corporation, sovereign-wealth fund, or nation-state.”

Despite bitcoin’s rally so far this year, December has historically been a particularly volatile month for the crypto, since it was created in 2009. It rose seven out of 13 times in December, according to Dow Jones Market Data.

In years when bitcoin gained more than 100% through November, the digital asset saw an average gain of 20% in December, rising four of the six times it occurred, according to Dow Jones Market Data.

To be sure, bitcoin has a relatively short history and was particularly volatile during its early years.

-

Will George Santos still qualify for a pension and strolling around the House floor?

Rep. George Santos was expelled from Congress in an historic vote Friday, following a House panel’s findings of substantial evidence of lawbreaking by the New York Republican.

But could Santos, 35, still enjoy some of the benefits that come with having served as his Long Island district’s congressman?

The answer is yes for some perks, but not all. Read on for details.

Question: Can an expelled member of Congress still collect a pension?

Answer: No, not if the lawmaker has served for less than five years. Santos was sworn into office just 11 months ago, after Republicans picked up enough seats in November 2022’s midterm elections to gain a small majority in the House.

U.S. lawmakers are eligible for a pension at age 62 only if they have completed at least five years of service, according to a Congressional Research Service report.

What’s more, lawmakers can lose their pension if they’re convicted of fraud-related offenses, and Santos is facing such charges. But that provision came relatively recently, with 2007’s Honest Leadership and Open Government Act, and some watchdogs say that law has loopholes that need to be closed up.

Question: Does an expelled member of Congress still get free healthcare?

Answer: It’s a myth that House lawmakers and U.S. senators get totally free healthcare, according to the office of Rep. Rep. Scott Perry of Pennsylvania.

Current members of Congress are authorized to receive free outpatient medical care and emergency dental care at military facilities in the Washington, D.C., area, but they’re billed for inpatient services and former members aren’t eligible, according to a separate CRS report.

Overall, just as tens of millions of Americans make use of employer-sponsored health insurance, members of Congress and designated congressional staff receive employer-sponsored insurance through the District of Columbia’s Obamacare exchange, known as DC Health Link, the report said, though some lawmakers have opted to pay for other health plans.

Question: Does an expelled member of Congress still get access to the House floor?

Answer: Yes. Former members of the House are entitled to admission to that chamber’s floor while it’s in session, as long as they aren’t lobbyists, according to another CRS report.

It’s among the courtesies and privileges for ex-lawmakers that come from U.S. law, chamber rules or as a matter of custom, the report said. Others include access to parking, athletic and dining facilities.

However, Santos on Friday sounded like he wouldn’t make use of his floor privileges or other such perks. “Why would I want to stay here? To hell with this place,” he told reporters after his expulsion, according to a CNN report.

Question: Can former House lawmakers lobby their old colleagues?

Answer: Yes, once they go through a one-year “cooling off” period.

Turning to lobbying is a common move. For example, at least 15 members of the 115th Congress had taken up work at lobbying firms by March 2019, just two months after the 116th Congress had been sworn in.

-

7% Dividend Yields or Higher: The S&P 500’s 6 Best Payouts

7% Dividend Yields or Higher: The S&P 500’s 6 Best Payouts

-

Why do people keep suing celebrities like Ronaldo and Tom Brady over crypto losses?

Ever since the collapse of crypto currencies last year, the lawsuits have been flying.

But a series of class-action suits targeting celebrity endorsers of crypto exchanges like FTX and Binance have been piling up in federal court in Miami, all filed by the same group of south Florida lawyers.

The latest suit names global soccer superstar Cristiano Ronaldo for allegedly promoting “the mass solicitation of investments in unregistered securities” sold by Binance, the crypto exchange that was hit with a $4 billion fine last week after pleading guilty to violating the bank secrecy act.

The suit was filed in federal court in the southern district of Florida this week and centered around Ronaldo’s role in a global marketing campaign launched in 2022 for a series of Binance NFTs — or non-fungible tokens, a form of blockchain-backed art works that were, for a brief time, wildly popular.

A representative for Ronaldo didn’t immediately respond to a message seeking comment.

The filing against Ronaldo on Monday came alongside similar class action suits naming Major League Baseball, Formula 1 racing, Mercedes Benz and the advertising giants Dentsu and Wasserman, who created much of FTX’s global promotion campaign.

Messages left with representatives for MLB, Formula 1, Mercedes Benz, Dentsu and Wasserman weren’t immediately returned.

Those suits are the latest in a series of similar class action suits starting last year against celebrity endorsers of failed crypto exchanges such as Voyager and FTX, in which customers lost billions of dollars in deposits.

Over the past 18 months, a group of south Florida lawyers led by Adam Moskowitz have brought the suits on behalf of investors who lost money in last year’s crypto collapse, against paid celebrity endorsers including Shaquille O’Neal, Mark Cuban, Tom Brady, Gisele Bundchen, Shohei Ohtani, Larry David, Steph Curry and Naomi Osaka.

“All of these celebrities were paid hundreds of millions of dollars taken directly from customer deposits,” Moskowitz said in a statement. “Some of the most famous and wealthiest groups in the world may now be held responsible for the dramatic $20 billion dollar crypto collapse and biggest financial scandals in U.S. history.”

Moskowitz, who has been joined in the suits by lawyers with the firms Mark Migdal & Hayden and Boies Schiller and Flexner, headed by famed litigator David Boies, is seeking at least $5 billion in damages from those who helped promote the crypto exchanges.

The cases from last year are ongoing and each of the celebrities named have been fighting the suits in court.

Moskowitz, who specializes in class-action lawsuits, says issues revolving around crypto first got his attention more than two years ago, before the entire market crashed, when he came to believe that the special tokens each exchange was minting amounted to an unregistered security.

He first filed a lawsuit against Voyager early last year, before the exchange collapsed and the Securities and Exchange Commission began filing suits against many in the industry accusing them of dealing in unregistered securities.

“Right then what we were doing started to gain traction,” he said.

A series of favorable court rulings have allowed his cases to gain steam, he said, and has allowed to him to take the lead in such actions.

In another class action suit filed earlier this year, Moskowitz and his partners sued a group of YouTube financial influencers for their role in promoting FTX, accusing them of taking cash for uncritically singing the exchange’s praises.

Moskowitz said several of those suits have been settled but that others have continued.

-

Dow Jones ends about 80 points higher as U.S. bond yields keep falling

U.S. stocks posted modest gains on Tuesday, resuming a strong rally in November that has been propelled by tumbling U.S. bond yields. The Dow Jones Industrial Average DJIA closed up about 83 points, or 0.2%, ending near 35,416, according to preliminary FactSet data. The S&P 500 index SPX was 0.1% higher, while the Nasdaq Composite Index COMP closed up 0.3%. Equity investors were emboldened after Fed Governor Christopher Waller said on Tuesday that a cooling economy could help bring inflation down to the central bank’s 2% yearly target, even though he also said it’s unclear if more interest rate hikes were warranted. The…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

No, Jeff Bezos hasn’t been unloading Amazon stock

A number of Amazon.com Inc. executives have disclosed sales of some of their Amazon stock holdings in recent weeks, but Jeff Bezos, the company’s executive chair and a mega-shareholder, was not among them.

Despite some reports to the contrary, Bezos hasn’t disclosed any sales of Amazon shares AMZN for two years, but he has given some shares away to nonprofit organizations.

There…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

Stock market is gaining momentum. What that means for December and beyond.

Barring a sudden bout of post-Thanksgiving indigestion, the U.S. stock market looks poised to log a healthy November rally. And while there are certainly no guarantees, history says momentum is likely to beget momentum into year-end.

“I think the market is set up for a strong final six weeks of 2023 and I would expect the market to build on that momentum into year-end,” said Michael Arone, chief investment strategist at State Street, in a phone interview.

Drivers…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

Congress returns to face big to-do list: Israel and Ukraine aid, possible border or tax deals, and more

Both the House and Senate are due to get back to work this week after their Thanksgiving break, and lawmakers have a lot on their plates.

A divided Washington put off the threat of a partial government shutdown until mid-January by enacting a short-term spending bill in mid-November, but the measure didn’t address President Joe Biden’s $106 billion funding request that includes wartime aid for Israel and Ukraine.

So…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

Here’s how the stock market has performed on Black Friday going back to 1990

Major U.S. stock indexes were struggling to make any big moves on Friday as traders returned from the Thanksgiving Day holiday, in line with holiday-shortened Black Friday trading sessions over more than three decades.

U.S. stock exchanges are due to close at 1 p.m. Eastern time Friday, three hours earlier than usual. As the table below from Dow Jones Market Data shows, trading on the day after Thanksgiving has not tended to produce big moves.

Not…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

Why wealthy investors put $125 billion into this new type of private-equity fund last year

Private-equity funds aimed at wealthy individuals continue to draw in fresh capital as the universe of alternative investments grows beyond its roots serving endowments, pension funds and other institutions, according to industry data.

Registered funds that take investments from individuals and smaller institutions rose by about $125 billion in 2022 from the previous year to total assets under management (AUM) of $425 billion, according to data from private-equity investor and data provider Hamilton Lane Inc. HLNE.

The…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

-

Why stocks’ Thanksgiving-week performance is important to watch

While the U.S. trading week is shortened by the Thanksgiving holiday, it’s important to watch the stock market’s performance to see if the rally of the past month can be sustained through the year-end.

Stocks have rallied in November so far, with the S&P 500 index SPX logging a 8.6% gain month-to-date, while it’s up 18.6% so far this year, according to FactSet data.

“If…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In