It has been a while since a hot inflation report sparked wild gyrations in U.S. stocks, like it frequently did in 2022, but that doesn’t mean Tuesday’s consumer price index for October is destined to be a snooze-fest for markets.

To the contrary, some Wall Street analysts believe it is possible, even likely, that the October CPI report could emerge as a critical catalyst for stocks, with the potential to propel the market higher on a softer-than-expected number.

At least one prominent economist expects the data to show that consumer prices were largely unchanged last month, or even fell.

“I would not be surprised to see a negative CPI inflation print for October,” said Neil Dutta, head of economics at Renaissance Macro Research, in commentary emailed to MarketWatch.

“After all, retail gasoline and heating oil prices declined a little over 10% over the month and we know that energy, while representing a small share of total CPI, roughly 7%, can account for a large chunk of the month-to-month swings in CPI.”

Markets at a crossroads

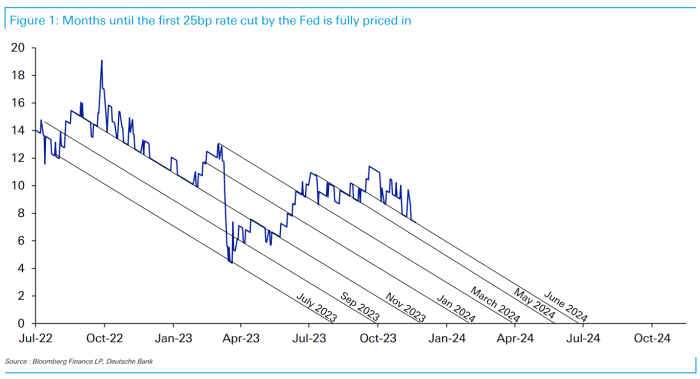

The October CPI report arrives at a critical juncture for markets. Investors are trying to anticipate whether the Federal Reserve will follow through with one more interest rate increase, as it indicated in its latest batch of projections, released in September.

Speaking on Thursday, Federal Reserve Chairman Jerome Powell left the door open to another move, but qualified this — as the Fed almost always has — by insisting that whatever the Fed decides, it will ultimately depend on the data.

These comments added even more emphasis to next week’s data, said Thierry Wizman, Macquarie’s global FX and interest rate strategist, in commentary emailed to MarketWatch on Friday.

“Our own view — expressed over the past few days — is that the Fed — and by extension the fixed-income markets — won’t be anticipatory. Rather, the Fed will be highly reactive to the data,” he said. “The next milestone is…CPI. It is likely to have a calming effect on markets, as traders weigh the prospect that a very low headline CPI result will further cool the prospect of excessive wage demands in the labor market.”

Asymmetric risks

While assessing the potential impact of a soft inflation report next week, at least one market analyst expects the market’s reaction to the June CPI report, released on July 12, might serve as a helpful template.

Stocks touched their highest levels of the year within that month, as many interpreted the slower-than-expected increase in prices as an important turning point in the Fed’s battle against inflation. The S&P 500 logged its 2023 closing high on July 31, according to FactSet data,

Tom Lee, who anticipated both the outcome of the June CPI report and the market’s reaction, told MarketWatch that, at this point, inflation would need to meaningfully reaccelerate to have an adverse impact on the stock market.

The upshot of this is that the risks for investors heading into Tuesday’s report are likely skewed to the upside. Even a slightly hotter-than-expected number likely wouldn’t be enough to derail the market’s November rebound rally. While a soft reading could reinforce expectations that the Fed is done hiking rates, likely precipitating a rally in both stocks and bonds.

“I’d say the setup looks pretty favorable,” Lee said.

Even a modestly hotter-than-expected number likely wouldn’t be enough to derail the market’s November rebound.

“I think the reaction function is changing for the stock market,” Lee said.

“Because the Federal Reserve and public market kind of viewed the September CPI as a pretty decent number, and Powell even referred to it as such. Earlier in 2023, I think people would have viewed it as a miss.”

U.S. inflation has eased substantially since peaking above 9% on a year-over-year basis last summer, the highest rate in four decades. The data released last month showed consumer prices climbed 0.4% in September, softer than the 0.6% from the prior month, but still slightly above expectations.

However, the more closely watched “core” reading reflected only a 0.3% increase, which was in-line with expectations.

How long will the ‘last mile’ take?

There is a perception on Wall Street and within the Federal Reserve that driving inflation down from 3% to the Fed’s 2% target could pose more difficulty for the Fed. After all, most of the easing from last summer’s highs was driven by falling commodity prices and supply-chain normalization as the economic impact of the COVID-19 pandemic faded.

Powell has repeatedly warned of a “bumpy ride,” and he reiterated on Thursday that the battle against inflation is far from over.

See: Powell says Fed is wary of ‘head fakes’ from inflation

Inflation data released this month, and in the months to come, could help to define investors’ expectations for how long this “last mile” might take, helping these reports regain their significance for markets.

“I like a calm market, but I think CPI is coming more in focus these days now that we’re getting closer to that 2% target,” said Callie Cox, U.S. investment analyst at eToro, during a phone call with MarketWatch.

Since the start of 2023, the S&P 500 index hasn’t seen a single move of 1% or greater on a CPI release day, according to FactSet data. By comparison, the biggest daily swings seen in 2022 occurred on CPI days, with the large-cap index sometimes swinging 4% or more in a single session.

Economists polled by FactSet expect consumer prices rose 0.1% in October, following a 0.4% bump in September. They expect a 0.3% increase for core prices, which excludes volatile food and energy. Powell has said that he’s keeping a close eye on core inflation, as well as so-called “supercore” inflation, which measures the cost of services inflation excluding housing.

To be sure, the CPI report isn’t the only piece of potentially market-moving news due during the coming week. Investors will also receive a monthly update from the Treasury that includes data on foreign purchases and sales of Treasury bonds, as well as a flurry of other economic reports, including potentially market-moving readings on housing-market and manufacturing activity.

There is also the producer-price index, another closely watched barometer of inflation, which is due out Thursday.

U.S. stocks have risen sharply since the start of November, with the S&P 500

SPX

up more than 5.3%, according to FactSet data.