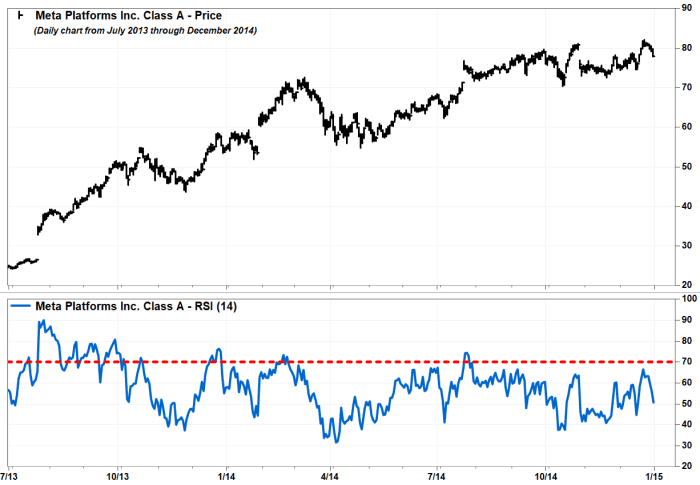

There’s a common belief that “overbought” is a technical condition for a stock, but in practice it seems to be more of an ability.

Meta Platforms Inc.’s stock

META,

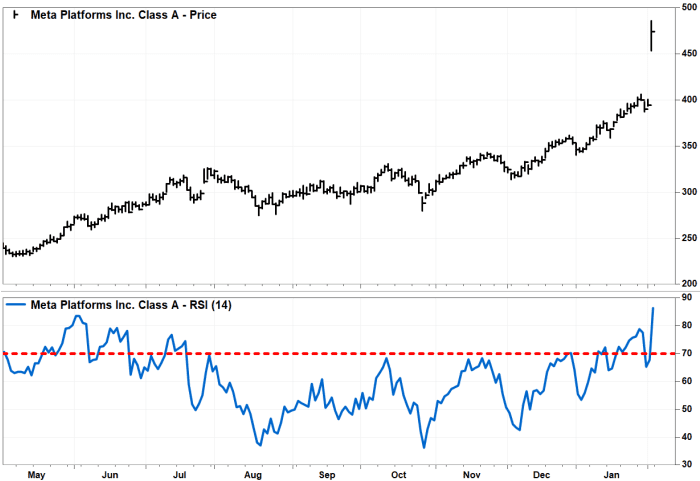

soared so much Friday after a blowout earnings report, that some technical readings have reached levels not seen in 11 years.

The stock rocketed 20.9% to close at a record $474.99, to book the third-biggest gain since going public in May 2012. The only bigger rallies were 23.3% on Feb. 2, 2023 and 29.6% on July 25, 2013, which were also after earnings reports.

The stock’s Relative Strength Index, which is a momentum indicator that measures the magnitudes of recent gains and losses, climbed to 86.48. That’s the highest level seen since it closed at a record 89.39 on July 30, 2013.

But that shouldn’t scare off Meta bulls.

Many chart watchers believe RSI readings above 70 are signs of “overbought” conditions, which suggests bulls need a breather after running faster and farther than they are used to.

There are also many who believe the ability to become overbought is a sign of underlying strength, since a stock tends to be trending higher when RSI hurdles 70. (Read Constance Brown’s “Technical Analysis for the Trading Professional.”)

For example, the record RSI reading came three days after the record stock-price rally of 29.6% on July 25, 2013. Even though RSI closed at what was then a record of 88.27 after a record price gain on the 25th, the stock continued to rally and become even more overbought.

It was that spike that snapped the stock out of the year-long doldrum that followed the initial public offering, and flipped the long-term narrative on the stock to bullish. (Read “Facebook’s ‘breakaway gap’ is a bullish game changer,” from The Wall Street Journal.)

FactSet, MarketWatch

And while the record RSI readings in July 2013 did lead to a minor short-term pullback, it didn’t stop the stock from embarking on a long-term uptrend, in which RSI made multiple forays above 70.

FactSet, MarketWatch

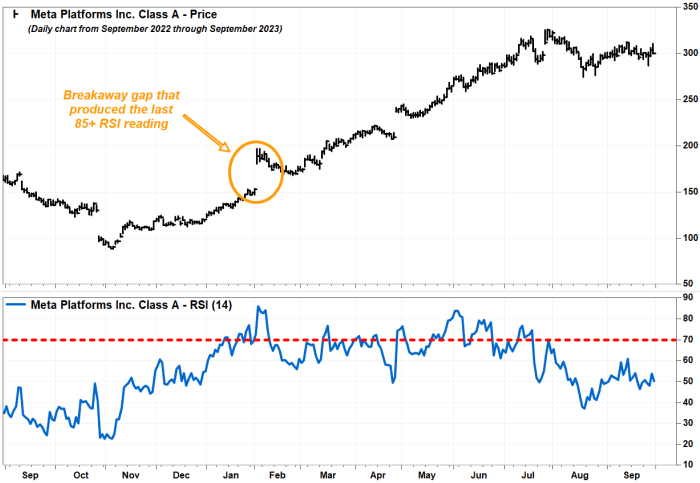

And the last time RSI closed above 85 was Feb. 2, 2023, when it closed at 86.07, also after a blowout earnings report.

And similar to 10 years earlier, that historically high overbought reading helped launch another long-term rally.

FactSet, MarketWatch

So yes, Meta’s stock is now facing historically high overbought conditions. But as many chart watchers like to say, overbought doesn’t mean over.

One thing to consider, however, is that the two prior times RSI spiked above 85 were while the long-term fates of the stock were still in question — the stocks were working on short-term bounces following long-term downtrends.

FactSet, MarketWatch

But Friday’s blast off happened just days after the stock closed at a record high. There was no resistance to hurdle, so rather than a bullish “breakaway gap,” Friday’s jump could be considered more a bullish leap of faith.

Also read:

Meta’s killer stock rally could add $200 billion in market cap — a historic haul.

Nvidia’s stock could rise above $600 — despite signs it’s already overbought.