The notion that the Federal Reserve will soon slow, or perhaps even end, its program of quantitative tightening is increasingly being talked about on Wall Street like a foregone conclusion.

But while investors wait to hear more on the subject from Fed Chair Jerome Powell during next week’s post-meeting press conference, they could be forgiven for asking themselves some questions.

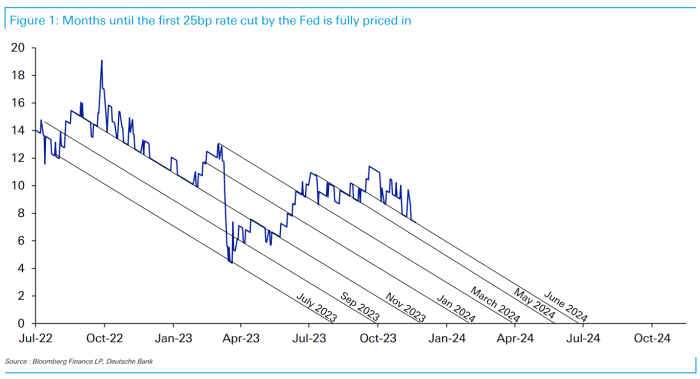

What might an imminent taper of the Fed’s balance-sheet runoff look like? Why has it suddenly become so urgent? What might it mean for the six or so interest-rate cuts investors are expecting from the Fed this year, as well as for markets more broadly?

We aim to answer these questions below.

What inspired talk of tapering QT?

It wasn’t until the minutes from the Federal Reserve’s December policy meeting were published earlier this month that investors started to take the notion of the Fed declaring “mission accomplished” on QT seriously.

The minutes revealed that a number of senior Fed officials felt it was nearly time to “begin to discuss” the technical factors that would govern the Fed’s decision to slow the runoff of maturing bonds from its balance sheet.

Shortly after the minutes’ release, several senior Fed officials came forward to discuss the importance of ending the balance-sheet runoff. Dallas Fed President Lorie Logan, the first senior Fed official to expand on what was noted in the minutes, said earlier this month that the Fed should start to slow the pace of its balance-sheet shrinkage once assets locked up in the Fed’s reverse-repo facility fell below a certain level.

According to Logan, senior Fed officials had been unsettled by the drain of $2 trillion in assets from the RRP facility last year.

But there was another issue that was also likely bothering monetary policymakers heading into the Fed’s December meeting.

Sudden spikes in overnight repo rates late last year drew uncomfortable comparisons to the repo-market crisis of September 2019, which foreshadowed the end of the Fed’s previous attempt at tapering its balance sheet, according to TS Lombard’s Steve Blitz.

See: Something strange is happening in the financial plumbing under Wall Street

See: One of Wall Street’s most important lending rates will stay elevated for weeks, Barclays says

What is the Fed’s ‘lowest comfortable level of reserves’?

A re-run of the repo-market crisis of 2019 is what the Fed is presumably trying to avoid. Economists are so concerned the central bank might accidentally bump up against the lower bound for reserves in the banking system, that they have come up with a name for the concept: They’re calling it the “lowest comfortable level of reserves.”

According to this idea, strain in overnight-financing markets should emerge once reserves in the banking system retreat below a certain threshold. This would, in turn, likely force the central bank to scale back or even reverse quantitative tightening immediately, according to several economists.

In order to avoid such a risk, Jefferies economist Thomas Simons said in a note to clients earlier this month that he expects the Fed will announce plans to start tapering QT after its March meeting.

Across Wall Street, most economists expect the Fed will begin by tapering the pace at which Treasurys are redeemed from its balance sheet — perhaps cutting it in half to start, from $60 billion a month to $30 billion a month. Reducing the pace at which mortgage-backed securities are running off won’t matter as much until prepayments begin to climb.

Going even further, economists at Evercore ISI said in a report shared with MarketWatch earlier this week that they expect the tapering to begin around the middle of 2024 and continue potentially through 2025, until the Fed has succeeded in reducing the size of its balance sheet to about $7 trillion.

The balance sheet presently stands at $7.7 trillion, according to data published by the Fed. It peaked at nearly $9 trillion in April 2022.

However, one key issue may complicate the Fed’s efforts to ascertain the “LCLoR.” According to Jefferies’ Simons, the amount of banking-system reserves counted as liabilities on the Fed’s balance sheet has been more or less steady since the Fed started its latest round of balance-sheet tapering. It stood at roughly $3.3 trillion recently, according to Fed data cited by Jefferies.

Why stop at $7 trillion if bank reserves haven’t been all that heavily impacted by QT anyway? It’s probably worth noting that, whatever happens, nobody on Wall Street expects the Fed would attempt to shrink the size of its balance sheet back toward pre-crisis levels, when the amount of bonds on its balance sheet was miniscule compared to today.

Why? Because there is simply too much debt sloshing around the global financial system to justify such a withdrawal of support, according to Steven Ricchiuto, chief economist at Mizuho Americas.

“The Fed is not in a position to remove all that extra liquidity because now the system needs it just to function,” Ricchiuto said.

What does this mean for markets?

Because quantitative tightening is a hawkish policy stance, its rolling back should be bullish for stocks and bonds. But there are other considerations that could impact the outcome, market strategists said.

Not only would a reduction in the pace of the Fed’s monthly runoff introduce a fresh dovish tilt to the Fed’s monetary policy, but by reducing the amount of bonds it allows to roll off its balance sheet every month, the Fed would become more active in the Treasury market, said James St. Aubin, chief investment officer at Sierra Investment Management, during an interview.

There are also a few contextual factors that could impact how the equity market reacts. For example, as St. Aubin pointed out, context is equally as important as the nature of the decision itself. Should the Fed decide to end QT abruptly because the U.S. economy is sliding into a recession, then the decision could hurt stocks.

Another issue, raised by a different market strategist, is the notion that the Fed could decide to start tapering QT in lieu of cutting interest rates — or at least in lieu of cutting them as quickly as investors expect. This could buy the central bank more time to press its battle against inflation while mitigating the risks that it could hurt the economy by keeping policy uncomfortably tight for too long, economists said.

Ben Jeffery, U.S. interest-rate strategist at BMO, said in a recent note to clients that, based on Logan’s comments from earlier this month, he would lean toward this being the most likely scenario. Additionally, he said, tapering QT could potentially impact the Treasury’s refunding announcement due in May.

Jeffery calculated that the Fed tapering QT by $20 billion beginning in April would save the Treasury from issuing nearly $250 billion in bonds compared to if the Fed had continued with its balance-sheet runoff apace.

This should lead to lower Treasury yields, all else being equal. And lower long-dated Treasury yields are typically seen as beneficial for stocks, according to Callie Cox, a U.S. equity strategist at eToro.

Although, once again, the outcome for markets would likely depend on the specific context.

“Higher yields probably aren’t a good thing for stock investors these days, but in particular environments, higher yields and less Fed intervention could hint that the economy is healing,” Cox said.