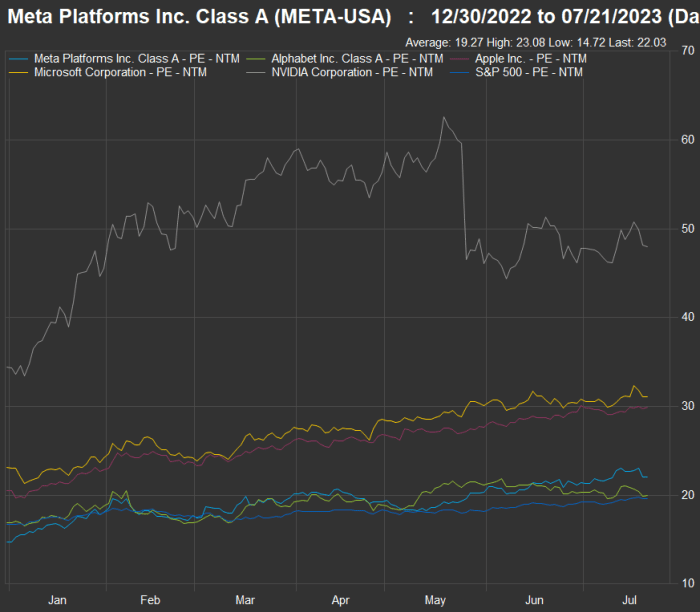

Shares of big tech companies have coasted through this year on AI euphoria, but as Microsoft Corp., Alphabet Inc. and Meta Platforms Inc. prepare to report results this week, some investors are starting to ask how much those AI advancements might actually cost.

Those questions have surfaced after several months during simply saying “AI” on earnings calls appeared to be enough for investors. If the economy sours though — as some expect in the second half of this year or next year — big tech’s AI ambitions could go with it.

“Given the exorbitant costs associated with the development, hosting and serving of AI products, many investors are concerned about the potential for [fiscal 2024] commentary regarding a material increase,” Jefferies analyst Brent Thill wrote, according to a MarketWatch earnings preview for Microsoft’s

MSFT,

results.

Microsoft and Alphabet Inc.

GOOGL,

GOOG,

which both report on Tuesday, have been in heated competition in the world of online search and digital advertisements, as Microsoft leans more on its massive investments in research lab OpenAI to muscle up its own search capabilities. But a Deutsche Bank analyst said that so far, Google appears to have the upper hand in that battle.

Still, for Microsoft, after a broader pullback in IT spending earlier this year, analysts have found more to like about its cloud-computing business — namely market-share gains, generally-sturdy demand, and whatever ways AI can fit into the equation. Wolfe Research analyst Alex Zukin, in a recent note, said he believed “the focus will turn from what is good enough, to how good can it be,” as Microsoft moves deeper into AI.

“How good can it be?” might also be a question for Meta

META,

which reports second-quarter results on Wednesday.

Shares of the social-media company have more than doubled in value so far this year. JMP analyst Andrew Boone, in a recent note, cited likely improvements in Meta’s digital ad segment, better engagement, and a broader advertising backdrop that “appears to be stable” after a slowdown in spending, Still, there are signs that the initial user attraction to Threads, Meta’s answer to Twitter, has fizzled.

This week in earnings

For the week ahead, 166 companies in the S&P 500 index report results, including 12 from the Dow, according to FactSet. Among them are Domino’s Pizza Inc.

DPZ,

which now plans to deliver pizza via Uber Eats after years of chafing at third-party delivery apps. Industrials General Electric Co.

GE,

and 3M Co.

MMM,

also report, after 3M agreed to pay $10.3 billion to settle accusations it was responsible for so-called “forever chemicals” in drinking water.

Quick-service restaurant chains Chipotle Mexican Grill Inc.

CMG,

and McDonald’s Corp.

MCD,

also report, with BofA analysts expecting an “almost normal” quarter for the industry, after spending at chain restaurants grew last month and costs for some ingredients started to ease following two years of supply disruptions. Auto makers General Motors Co.

GM,

and Ford Motor Co.

F,

also report, and while parts shortages that have constrained vehicle production have shown signs of fading, so has electric-vehicle “euphoria.”

The calls to put on your calendar

Visa, Mastercard: Earlier this month executives from the big banks said U.S. consumers are generally doing OK despite still-rampant inflation, although perhaps less OK than in prior months. This week credit-card giants Visa Inc. and Mastercard Inc. report results on Tuesday and Thursday, respectively. The profit, sales and credit-card volume figures from Visa

V,

and Mastercard

MA,

will offer more specifics on consumer spending, as vacations and concerts compete with more expensive and more pressing needs, like groceries and other bills.

Shares of Visa and Mastercard are up so far this year, but some analysts said there could be more room investors to step in. SVB MoffettNathanson analyst Lisa Ellis recently said shares of both companies were hovering at “unusually attractive” levels.

The number to watch

Mattel outlook, and anything ‘Barbie’-related: The “Barbie” movie hit theaters nationwide on Friday. And after an epic marketing campaign, Mattel Inc.’s investors, banking on the film to drive a rebound for the toy maker during the second half of this year, will be zeroed in on the box-office results following the film’s debut on Friday.

Expectations for the film are huge. And when Mattel

MAT,

reports second-quarter results on Wednesday, executives could offer the first answers to some big questions: Has the film helped revive toy sales? Sales for anything else? Will the “Barbenheimer” effect help or hurt financials?

The film — directed by Greta Gerwig, written Gerwig and Noah Baumbach, and starring Margot Robbie and Ryan Gosling — brings together two writers with indie bona fides and two actors with mainstream starpower. Reviews so far have been favorable, and Barbie is already Mattel’s most profitable franchise. But the movie isn’t directly geared toward children, movie theaters have struggled to get back on track after pandemic lockdowns, and toy demand through this year has been weak after ballooning during the pandemic. And some analysts don’t expect “Barbie” to do much for Mattel’s stock.

Emily Bary and Jon Swartz contributed reporting to this story.