Late on Wednesday, Tesla Inc.

TSLA,

reported that quarterly sales were up 47% from a year earlier. But the stock tumbled 10% on Thursday.

Tesla’s shares are still up 113% this year. The company is among a group of 13 in the S&P 500 that stand out with high growth expectations for sales, earnings and free cash flow through 2025.

But less than half of analysts polled by FactSet rate Tesla a buy. Emily Bary explains what they are worried about.

Traders have placed large short bets against Tesla and two of its rival EV makers — Rivian Automotive Inc.

RIVN,

and Nio Inc.

NIO,

Claudia Assis looks into how well those trades have been working out.

Cody Willard explains why he remains confident that Tesla and Rivian will dominate the EV market over the long term.

Related coverage:

Here’s what may propel U.S. stocks for years.

Chipotle Mexican Grill is among 14 stocks named by Michael Brush for consideration by investors looking to ride along with long-term improvement of U.S. labor productivity.

AP

The S&P 500

SPX,

has returned 19% this year, following its 18% decline in 2022. On the same basis, with dividends reinvested, the benchmark index is still down 2% since the end of 2021.

What is going on? Michael Brush believes that a high level of corporate investment in new technology and equipment is setting the stage for a long phase of earnings growth for U.S. companies. He shares four developments behind the coming productivity boom and 14 stocks expected to benefit from it.

A signal for the stock-market’s health

Getty Images

The Dow Jones Industrial Average

DJIA,

is up 6% this year. The venerable index has trailed the S&P 500, but its closing level of 35,255.18 on Thursday was only 4% shy of its record close a 36,799.65 on Jan. 4, 2022. Joseph Adinolfi explains Dow Theory, which according to technical analysts is sending a strong bullish signal for the stock market.

Other opinions about market sentiment:

- Investors are the most bullish on stocks since before the 2022 bear market, says Vanguard

- Be greedy in your 401(k): The ‘big money’ is still fearful

Even if you have resisted the idea of a Roth IRA, you may soon be forced to have one

This year if you are age 50 or older and are already maxing-out your contribution to a 401(K), 403(B) or other qualified employer-sponsored tax-deferred retirement plan at $22,500, you can make an additional “catch up” tax deductible contribution of $7,500 for a total of $30,000. But starting in 2024, the catch up contribution will no longer be tax deductible if you earn at least $145,000 a year. You can still make the contribution with after-tax money into a Roth 401(K) account that your plan administrator may already have set up for you.

Alessandra Malito provides more details and news about employers’ efforts to delay the rule’s implementation.

Beth Pinker writes the Fix My Portfolio column. This week she digs into Roth IRA conversions, through which you can simplify your taxes down the line.

A hot vote in Spain

The center of Madrid on July 15, 2023. A brutal heat wave could affect turnout for the country’s general election on July 23.

Uncredited

Barbara Kollmeyer reports from Spain about a highly contested election on Sunday, with controversy over the government’s policies during the pandemic, parties’ social policies and the possibility of a coalition government that might rattle financial markets.

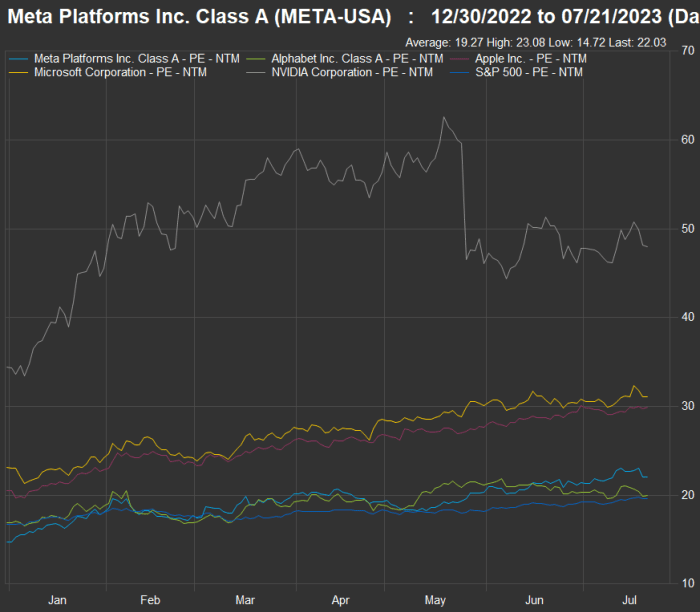

Meta vs. Alphabet

Shares of Meta Platforms Inc. and Alphabet Inc. trade only slightly higher than the S&P 500 on a forward price-to-earnings bases, while Nvidia Corp., Microsoft Corp. and Apple Inc. trade much higher.

FactSet

Leslie Albrecht looks at Meta Platforms Inc.

META,

which is Facebook’s holding company and has a hit on its hands with the new Threads social-media platform, and Google holding company Alphabet Inc.

GOOGL,

to consider which stock is a better buy.

Brett Arends: ‘I used to work at Nvidia. The stock I got is now half my portfolio. Should I sell?’

The Ratings Game

In The Ratings Game column, MarketWatch reporters track analysts’ thoughts about various stocks. Here’s a sampling of this week’s coverage:

You don’t know every bad factor causing air travel to be nothing but harassment

Getting there is half the fun.

Getty Images

The U.S. flying scene — from shortages of equipment and labor (and runways) to ill-staffed air-traffic control towers — is a well-known nightmare for U.S. travelers. But there is more to the story. Jeremy Binckes looks into other factors that may surprise you and cause great inconvenience this summer.

The Federal Reserve is expected to raise interest rates again next week

The Federal Open Market Committee will meet next Tuesday and Wednesday, to be immediately followed by a policy announcement. Economists expect the central to raise the federal-funds rate by another quarter point. The question is whether or not this will end the Fed’s inflation-fighting rate cycle.

More coverage of the Fed:

- Bernanke says it is clear Fed will hike interest rates next week, but a September move is ‘up for grabs’

- FedNow launches today. What to know about the Fed’s real-time payment service.

How much would you pay for 100% downside protection in the stock market?

MarketWatch illustration/iStockphoto

Over the past 30 years, the SPDR S&P 500 ETF Trust

SPY,

has returned 1,650%, for an average annual return of 10%, with dividends reinvested, according to FactSet. But it hasn’t been a smooth ride. The ETF, which tracks the benchmark S&P 500, fell 18% last year and 37% during 2008, for example. And there have been even larger declines if the analysis isn’t confined to calendar years.

But can you ride through market declines? Many studies have shown that most investors who try to time the market sell after a decline has started and buy back in well after a recovery is under way, which means their long-term performance can suffer significantly.

In this week’s ETF Wrap column (and emailed newsletter), Isabel Wang describes a new buffered fund that can give you 100% downside protection over a two-year period, in return for a cap on your potential gains in the stock market. Here’s the price you would pay for the protection.

The World Cup games have started

Hannah Wilkinson scored the home team’s first goal against Norway during the first World Cup game in Auckland, New Zealand, on July 20.

Getty Images

The Women’s World Cup began Thursday with an upset victory by New Zealand over Norway.

James Rogers reports on what is expected to be a much easier environment for FIFA and corporate sponsors than that of last year’s Men’s World Cup in Qatar.

U.S. Soccer Federation President Cindy Parlow Cone participated in MarketWatch’s Best New Ideas in Money podcast and spoke about the long-term effort to achieve equal treatment for women soccer players.

More coverage of the World Cup:

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.