Bessent Says ‘Tenfold’ Growth in Stablecoins Will Lift Demand for Treasurys

Tag: Banking/Credit

-

BOE to Embrace Uncertainty, and Bernanke’s Guidance, With Communications Revamp

The central bank place will more emphasis on developments that could upend its expectations and less on forecasts that convey too much certainty about the future.

Paul Hannon

Source link -

Canada’s Bank Supervisor to Propose Easing of Financial-Stability Rules

OTTAWA—Canada’s banking regulator said the watchdog would issue proposals in the coming months to ease capital-buffer requirements amid the abrupt change in the geopolitical dynamics fueled by President Trump’s tariff policy.

Peter Routledge, the head of the Office of the Superintendent of Financial Institutions, said domestic lenders “argue that the shift before us demands more intelligent risk-taking, risk-taking to help economies shift their economic model to the world emerging.”

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Paul Vieira

Source link -

Canada’s Banking Sector Needs Increased Competition, Bank of Canada Official Says

OTTAWA—The Bank of Canada’s No. 2 official endorsed a competition shakeup in the highly concentrated financial-services industry, saying the country’s banking sector is an oligopoly and changes could help lift Canada’s prolonged productivity slump.

Carolyn Rogers, the central bank’s senior deputy governor, on Thursday said Canadian authorities have done a stellar job in regulating banks by ensuring they have enough capital to survive shocks such as the 2008-09 financial crisis and the Covid-19 pandemic. “It would also be hard to argue, on any objective measure, that Canada’s banking system is anything other than an oligopoly,” Rogers told a blue-chip Toronto audience.

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Paul Vieira

Source link -

Comerica Stock Soars. Fifth Third to Buy Peer for $10.9 Billion as Bank Mergers Heat Up.

Fifth Third Buys Comerica for $10.9B in Year’s Biggest Bank Deal. Which Firms Might Be Next.

-

Trump says Powell is being ‘political’ with interest rates

Former President Donald Trump on Friday criticized Federal Reserve Chair Jerome Powell and said he’s playing politics with interest-rate policy.

“It looks to me like he’s trying to lower interest rates for the sake of maybe getting people elected,” Trump said, in an interview on the Fox Business Network.

“I think he’s political,” added Trump, the likely 2024 Republican nominee for president.

Asked if he would reappoint Powell to a third four-year term, Trump replied “no.”

Trump said he has a couple of choices in mind to replace Powell, but wouldn’t say who.

Trump said he thinks lowering interest rates would lead to massive inflation. The conflict in the Middle East is likely to lead to “big inflation” from a spike in oil prices, he added.

“Trump said he thinks lowering interest rates would lead to massive inflation. The conflict in the Middle East is likely to lead to “big inflation” from a spike in oil prices, he added.”

Powell “is not going to be able to do anything,” Trump said.

On Wednesday, Powell said he wasn’t giving a potential third term any thought. Powell’s current term expires in early 2026.

Speculation on a third term “is not something I’m focused on,” Powell said.

“We’re focused on doing our jobs. This year is going to be a highly consequential year for the Fed and monetary policy. We’re, all of us, very buckled down, focused on doing our jobs,” Powell said.

Analysts say that the Fed will be criticized by both parties in the election year.

On Sunday, Powell will appear on the CBS News program “60 Minutes” and will likely face more questions about the election.

Earlier this week, top Democrats on the Senate Banking Committee urged the Fed to cut rates quickly, saying they were too high and hurting the housing market.

“Keeping interest rates high will be detrimental to American workers and their families and do little to bring down prices or promote moderate economic growth,” said Sen. Sherrod Brown, a Democrat from Ohio, and the chairman of the Banking Committee, in a letter to Powell prior to Wednesday’s Fed meeting.

At the meeting on Wednesday, the Fed kept its benchmark interest rate unchanged in a range of 5.25%-5.5%.

Asked about the letter from the Democrats on Wednesday, Powell said Congress has given the Fed the job of stable prices. High inflation hurts people at the lower end of the income spectrum, he added.

“It’s what society has asked us to do is to get inflation down. The tools we use to do it are interest rates,” he said.

The Fed has penciled in three rate cuts for 2024. Powell said that a cut at the Fed’s next meeting in March was unlikely. He said the Fed wants to see more good inflation reports so it can have greater confidence that inflation is coming down to the 2% target.

-

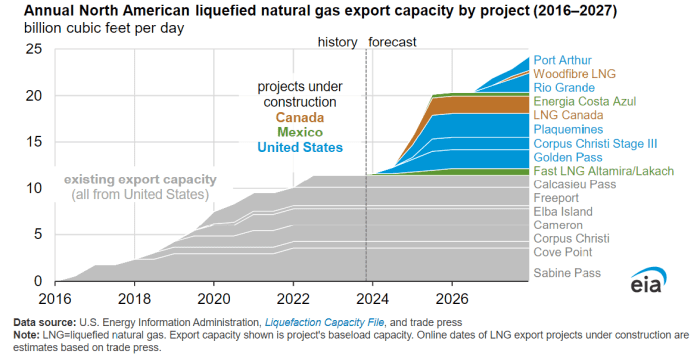

What Biden’s decision to pause new U.S. LNG exports means for the energy market

The Biden administration’s announcement Friday that it’s pausing liquefied natural gas export approvals sparked political backlash, drew cheers from climate activists and stoked uncertainty in energy markets, but is unlikely to see the U.S. give up its title as the world’s top LNG exporter.

The U.S. will delay its decisions on new LNG exports to non-free trade agreement countries, allowing time for the Energy Department to update the underlying analyses for LNG export authorizations, the White House said.

Those analyses are roughly five years old and “no longer adequately account for considerations” such as potential cost increases for American consumers and manufacturers or the “latest assessment of the impact of greenhouse gas emissions,” it said.

The Biden administration likely “realizes the role of LNG in foreign policy, but at the same time it needs to show the Democrat base that it is doing something for climate change,” said Anas Alhajji, an independent energy expert and managing partner at Energy Outlook Advisors, pointing out that the announcement comes during a presidential election year.

“Delaying one project or stopping it may not be a big deal, but it is a problem if it becomes a trend,” he said in emailed commentary.

Environmental groups, which have pushed for action, cheered the decision.

The 12 impacted projects in the U.S. “would spew out as much climate-warming pollution as 223 coal plants per year, and they present explosion risks to the communities where they’re located and emit other health-harming chemicals,” the Sierra Club, an environmental group, said in a statement welcoming the decision.

Top exporter

The announcement is particularly important for a nation that became the world’s biggest LNG exporter in the span of less than a decade.

The U.S. became the world’s largest LNG exporter during the first half of 2022 on the back of increases in LNG export capacity, international natural gas and LNG prices, and global demand, particularly in Europe, according to the Energy Information Administration.

Less than a decade ago, U.S. LNG exports were negligible. The country had only started exporting LNG from the Lower 48 states in 2016, the EIA said.

The country’s exports of LNG climbed to a fresh record in November 2023, with the EIA reporting domestic exports of 386.2 billion cubic feet, up from 384.4 bcf a month earlier. Exports in December 2016 were at just 41.8 bcf.

U.S. LNG exports soared after 2016.

EIA

With 90% of U.S. LNG going to non-free trade agreement destinations, withholding licensing effectively “halts project development,” John Miller, managing director, ESG and sustainability policy at TD Cowen wrote in a Friday note.

Equities

LNG equities with operating facilities likely won’t benefit from the administration’s announcement, at least not immediately, until the impacts of this pause in export approvals to non-FTA countries becomes more clear, Jason Gabelman, director, sustainability & energy transition at TD Cowen said.

U.S. companies with government approvals that have not been sanctioned, “could have a higher probability of moving forward this year, albeit modestly” as offtakers may be hesitant to sign up to new U.S. projects with LNG development getting “politicized,” he said. Among those, he pointed out approvals for proposed liquefaction units at NextDecade Corp.’s

NEXT,

+2.30%

Rio Grande LNG export facility project in Brownsville, Texas.At the same time, it would not be a surprise if U.S. LNG companies pursuing growth that do not yet have non-FTA approval see downside pressure, said Gabelman.

LNG projects take around 4 years to build and any delays to project sanctions today will take “multiple years to manifest in the market,” he said.

Still, the U.S. announcement “introduces the risk of more stringent oversight that could limit new U.S. capacity” more than four years out, Gabelman said.

Companies that supply equipment to LNG liquefaction projects include Baker Hughes Co.

BKR,

+0.59%

and Chart Industries Inc.

GTLS,

-7.54% ,

said Marc Bianchi, a senior energy analyst at TD Cowen.Any slowing of approval would create “overhand on order growth,” he said.

Climate change

The White House said Friday that its decision will not impact the ability of the U.S. to continue supplying LNG to its allies in the near term but also acknowledged environmental concerns.

“I think we’ve got to be clear eyed about the challenges that we face. The climate crisis is an existential crisis, and we’ve got to be, I think, really forward leaning into making sure that we’re taking that head on,” said Ali Zaidi, the White House national climate adviser, told reporters Friday.

He added that given the number of approvals already completed, the number of projects under construction are set to double existing capacity with approvals beyond that set to double capacity yet again.

“So there’s a long runway here, and we’re taking a step back and thinking, OK, let’s take a hard look before that runway continues to build out,” he said.

Rob Thummel, senior portfolio manager at Tortoise, argued that U.S. LNG exports actually reduce global carbon emissions as natural gas typically “displaces coal to generate electricity in countries such as China and India.”

They also improve global energy security as U.S. natural gas is becoming Europe’s primary energy supplier, replacing Russia, he said.

In a statement Friday, Sen. Joe Manchin, a West Virginia Democrat and chairman of the U.S. Senate Energy and Natural Resources Committee, said that if the Biden administration has facts to prove that additional LNG export capacity would hurt Americans, it needs to make that information public. But if the pause is “another political ploy to pander to keep-it-in-the-ground climate activists,” he said he would “do everything in my power to end this pause immediately.

Manchin plans to hold a hearing on the decision in the coming weeks.

Market impact

The U.S. decision to delay new LNG export permits is unlikely to have an impact on domestic natural-gas supplies or prices, said Energy Outlook Advisors’ Alhajji.

Still, the EIA noted in its Annual Energy Outlook released in March of last year that it remains uncertain as to how LNG export capacity will affect domestic prices, consumption and supply.

LNG prices and the rate at which new LNG export terminals can be constructed help determine LNG export volumes, the EIA said, and higher LNG exports can result in upward pressure on U.S. natural-gas prices, while lower U.S. LNG exports can pressure prices.

On Friday, natural gas for February delivery

NG00,

+0.23% NGG24,

+0.26%

settled at $2.71 per million British thermal units, up 7.7% for the week.Meanwhile, the U.S. is likely to keep its position as the world’s top LNG exporter, according to Tortoise’s Thummel.

The U.S. is the currently the largest LNG exporter at almost 12 bcf per day, with Qatar coming in second, he said.

Qatar is expanding its LNG export capacity and is expected to have the ability to export almost 20 bcf per day by 2028, he said. The EIA reported recently that Qatar has averaged 10.3 bcf per day in exports during the last 10 years.

That would mark sizable growth. But the EIA reported in November that LNG export capacity from North America is likely to more than double from around 11.4 bcf per day to 24.3 bcf per day by the end of 2027.

The EIA said North America’s LNG export capacity is likely to more than double by 2027.

EIA

Given expected growth in U.S. LNG export capacity, the U.S. is likely to “remain the largest exporter of LNG in the world” despite the U.S. announcement, said Thummel.

—Victor Reklaitis contributed.

-

3 things to know about how the Fed might roll back quantitative tightening

The notion that the Federal Reserve will soon slow, or perhaps even end, its program of quantitative tightening is increasingly being talked about on Wall Street like a foregone conclusion.

But while investors wait to hear more on the subject from Fed Chair Jerome Powell during next week’s post-meeting press conference, they could be forgiven for asking themselves some questions.

What might an imminent taper of the Fed’s balance-sheet runoff look like? Why has it suddenly become so urgent? What might it mean for the six or so interest-rate cuts investors are expecting from the Fed this year, as well as for markets more broadly?

We aim to answer these questions below.

What inspired talk of tapering QT?

It wasn’t until the minutes from the Federal Reserve’s December policy meeting were published earlier this month that investors started to take the notion of the Fed declaring “mission accomplished” on QT seriously.

The minutes revealed that a number of senior Fed officials felt it was nearly time to “begin to discuss” the technical factors that would govern the Fed’s decision to slow the runoff of maturing bonds from its balance sheet.

Shortly after the minutes’ release, several senior Fed officials came forward to discuss the importance of ending the balance-sheet runoff. Dallas Fed President Lorie Logan, the first senior Fed official to expand on what was noted in the minutes, said earlier this month that the Fed should start to slow the pace of its balance-sheet shrinkage once assets locked up in the Fed’s reverse-repo facility fell below a certain level.

According to Logan, senior Fed officials had been unsettled by the drain of $2 trillion in assets from the RRP facility last year.

But there was another issue that was also likely bothering monetary policymakers heading into the Fed’s December meeting.

Sudden spikes in overnight repo rates late last year drew uncomfortable comparisons to the repo-market crisis of September 2019, which foreshadowed the end of the Fed’s previous attempt at tapering its balance sheet, according to TS Lombard’s Steve Blitz.

See: Something strange is happening in the financial plumbing under Wall Street

See: One of Wall Street’s most important lending rates will stay elevated for weeks, Barclays says

TS LOMBARD

What is the Fed’s ‘lowest comfortable level of reserves’?

A re-run of the repo-market crisis of 2019 is what the Fed is presumably trying to avoid. Economists are so concerned the central bank might accidentally bump up against the lower bound for reserves in the banking system, that they have come up with a name for the concept: They’re calling it the “lowest comfortable level of reserves.”

According to this idea, strain in overnight-financing markets should emerge once reserves in the banking system retreat below a certain threshold. This would, in turn, likely force the central bank to scale back or even reverse quantitative tightening immediately, according to several economists.

In order to avoid such a risk, Jefferies economist Thomas Simons said in a note to clients earlier this month that he expects the Fed will announce plans to start tapering QT after its March meeting.

Across Wall Street, most economists expect the Fed will begin by tapering the pace at which Treasurys are redeemed from its balance sheet — perhaps cutting it in half to start, from $60 billion a month to $30 billion a month. Reducing the pace at which mortgage-backed securities are running off won’t matter as much until prepayments begin to climb.

Going even further, economists at Evercore ISI said in a report shared with MarketWatch earlier this week that they expect the tapering to begin around the middle of 2024 and continue potentially through 2025, until the Fed has succeeded in reducing the size of its balance sheet to about $7 trillion.

The balance sheet presently stands at $7.7 trillion, according to data published by the Fed. It peaked at nearly $9 trillion in April 2022.

However, one key issue may complicate the Fed’s efforts to ascertain the “LCLoR.” According to Jefferies’ Simons, the amount of banking-system reserves counted as liabilities on the Fed’s balance sheet has been more or less steady since the Fed started its latest round of balance-sheet tapering. It stood at roughly $3.3 trillion recently, according to Fed data cited by Jefferies.

Why stop at $7 trillion if bank reserves haven’t been all that heavily impacted by QT anyway? It’s probably worth noting that, whatever happens, nobody on Wall Street expects the Fed would attempt to shrink the size of its balance sheet back toward pre-crisis levels, when the amount of bonds on its balance sheet was miniscule compared to today.

Why? Because there is simply too much debt sloshing around the global financial system to justify such a withdrawal of support, according to Steven Ricchiuto, chief economist at Mizuho Americas.

“The Fed is not in a position to remove all that extra liquidity because now the system needs it just to function,” Ricchiuto said.

What does this mean for markets?

Because quantitative tightening is a hawkish policy stance, its rolling back should be bullish for stocks and bonds. But there are other considerations that could impact the outcome, market strategists said.

Not only would a reduction in the pace of the Fed’s monthly runoff introduce a fresh dovish tilt to the Fed’s monetary policy, but by reducing the amount of bonds it allows to roll off its balance sheet every month, the Fed would become more active in the Treasury market, said James St. Aubin, chief investment officer at Sierra Investment Management, during an interview.

There are also a few contextual factors that could impact how the equity market reacts. For example, as St. Aubin pointed out, context is equally as important as the nature of the decision itself. Should the Fed decide to end QT abruptly because the U.S. economy is sliding into a recession, then the decision could hurt stocks.

Another issue, raised by a different market strategist, is the notion that the Fed could decide to start tapering QT in lieu of cutting interest rates — or at least in lieu of cutting them as quickly as investors expect. This could buy the central bank more time to press its battle against inflation while mitigating the risks that it could hurt the economy by keeping policy uncomfortably tight for too long, economists said.

Ben Jeffery, U.S. interest-rate strategist at BMO, said in a recent note to clients that, based on Logan’s comments from earlier this month, he would lean toward this being the most likely scenario. Additionally, he said, tapering QT could potentially impact the Treasury’s refunding announcement due in May.

Jeffery calculated that the Fed tapering QT by $20 billion beginning in April would save the Treasury from issuing nearly $250 billion in bonds compared to if the Fed had continued with its balance-sheet runoff apace.

This should lead to lower Treasury yields, all else being equal. And lower long-dated Treasury yields are typically seen as beneficial for stocks, according to Callie Cox, a U.S. equity strategist at eToro.

Although, once again, the outcome for markets would likely depend on the specific context.

“Higher yields probably aren’t a good thing for stock investors these days, but in particular environments, higher yields and less Fed intervention could hint that the economy is healing,” Cox said.

-

Oaktree Capital calls commercial real estate ‘most acute area of risk’ right now

Distressed-debt giant Oaktree Capital sees big opportunities in credit unfolding over the next few years as a wall of debt comes due.

Oaktree’s incoming co-chief executives Armen Panossian, head of performing credit, and Bob O’Leary, portfolio manager for global opportunities, see a roughly $13 trillion market that will be ripe for the picking.

Within that realm is high-yield bonds, BBB-rated bonds, leveraged loans and private credit — four areas of the market that have only mushroomed from their nearly $3 trillion size right before the 2007-2008 global financial crisis.

“Clearly, the most acute area of risk right now is commercial real estate,” the co-CEOs said in a Wednesday client note. “That’s because the maturity wall is already upon us and it’s not going to abate for several years.”

More than $1 trillion of commercial real-estate loans are set to come due in 2024 and 2025, according to the Mortgage Bankers Association.

A retreat in the benchmark 10-year Treasury yield

BX:TMUBMUSD10Y,

to about 4.1% on Wednesday from a 5% peak in October, has provided some relief even though many borrowers likely will still struggle to refinance.Related: Commercial real estate a top threat to financial system in 2024, U.S. regulators say

“There’s a need for capital, especially for office properties where there are vacancies, rental growth hasn’t materialized, or the rate of borrowing has gone up materially over the last three years. This capital may or may not be readily available, and for certain types of office properties, it absolutely isn’t available,” the Oaktree team said.

With that backdrop, the firm expects to dust off its playbook from the financial crisis and acquire portfolios of commercial real-estate loans from banks, but also plans to participate in “credit-risk transfer” deals that help lenders reduce exposure.

Oaktree also sees opportunities brewing in private credit, as well as in high-yield and leveraged loans, where “several hundred” of the estimated 1,500 companies that have issued such debt are likely “to be just fine” even if defaults rise, they said.

Another area to watch will be the roughly $26 trillion Treasury market, where Oaktree has some concerns “about where the 10-year Treasury yield goes from here” — given not only the U.S. budget deficit and the deluge of supply that investors face, but also how foreign buyers, once the “largest owners in prior years, may be tapped out.”

Related: Here are two reasons why the 10-year Treasury yield is back above 4%

U.S. stocks

SPXCOMP

fell Wednesday after strong retail-sales data for December pointed to a resilient U.S. economy, despite the Federal Reserve having kept its policy rate at a 22-year high since July. -

Hang Seng leads selloff for Asia stocks, with 4% slump after China data

TOKYO (AP) — Asian shares slid Wednesday after a decline overnight on Wall Street and disappointing China growth data, while Tokyo’s main benchmark momentarily hit another 30-year high.

Japan’s benchmark Nikkei 225

NIY00,

-0.95%

reached a session high of 36,239.22, but reverted lower, last down 0.3% to 35,477. The Nikkei has been hitting new 34-year highs, or the best since February 1990 during the so-called financial bubble. Buying focused on semiconductor-related shares, and a cheap yen helped boost exporter issues.Don’t miss: Wall Street firms catch up to Buffett enthusiasm on Japan as Nikkei keeps hitting records

Hong Kong’s Hang Seng

HK:HSCI

tumbled 4% to 15,220.72, with losses building after data showed China hitting its economic growth target of 5.2% for 2023, surpassing government expectations, but short of the 5.3% some analysts expected. The Shanghai Composite

CN:SHCOMP

shed 2% to 2,833.62.Read on: China hit its economic-growth target without ‘massive stimulus,’ boasts Premier Li Qiang

Australia’s S&P/ASX 200

AU:ASX10000

slipped 0.2% to 7,401.30. South Korea’s Kospi

KR:180721

dropped 2.4% to 2,435.90.Investors were keeping their eyes on upcoming earnings reports, as well as potential moves by the world’s central banks, to gauge their next moves.

Wall Street slipped in a lackluster return to trading following a three-day holiday weekend.See: What’s next for stocks as ‘tired’ market stalls in 2024 ahead of closely watched retail sales

The S&P 500

SPX

fell 17.85 points, or 0.4%, to 4,765.98. The Dow Jones Industrial Average

DJIA

dropped 231.86, or 0.6%, to 37,361.12, and the Nasdaq

COMP

sank 28.41, or 0.2%, to 14,944.35.Spirit Airlines

SAVE,

-47.09%

lost 47.1% after a U.S. judge blocked its takeover by JetBlue Airways

JBLU,

+4.91%

on concerns it would mean higher airfares for flyers. JetBlue rose 4.9%.Stocks of banks were mixed, meanwhile, as earnings reporting season ramps up for the final three months of 2023. Morgan Stanley

MS,

-4.16%

sank 4.2% after it said a legal matter and a special assessment knocked $535 million off its pretax earnings, while Goldman Sachs

GS,

+0.71%

edged 0.7% higher after reporting results that topped Wall Street’s forecasts.Companies across the S&P 500 are likely to report meager growth in profits for the fourth quarter from a year earlier, if any, if Wall Street analysts’ forecasts are to be believed. Earnings have been under pressure for more than a year because of rising costs amid high inflation.

But optimism is higher for 2024, where analysts are forecasting a strong 11.8% growth in earnings per share for S&P 500 companies, according to FactSet. That, plus expectations for several cuts to interest rates by the Federal Reserve this year, have helped the S&P 500 rally to 10 winning weeks in the last 11. The index remains within 0.6% of its all-time high set two years ago.

Treasury yields

BX:TMUBMUSD10Y

have already sunk on expectations for upcoming cuts to interest rates, which traders believe could begin as early as March. It’s a sharp turnaround from the past couple years, when the Federal Reserve was hiking rates drastically in hopes of getting high inflation under control.The Tell: No rate cuts in 2024? Why investors should think about the ‘unthinkable.’

Easier rates and yields relax the pressure on the economy and financial system, while also boosting prices for investments. And for the past six months, interest rates have been the main force moving the stock market, according to Michael Wilson, strategist at Morgan Stanley.

He sees that dynamic continuing in the near term, with the “bond market still in charge.”

For now, traders are penciling in many more cuts to rates through 2024 than the Fed itself has indicated. That raises the potential for big market swings around each speech by a Fed official or economic report.

Yields rose in the bond market after Fed governor Christopher Waller said in a speech that “policy is set properly” on interest rates. Following the speech, traders pushed some bets for the Fed’s first cut to rates to happen in May instead of March.

On Wall Street, Boeing fell to one of the market’s sharper losses as worries continue about troubles for its 737 Max 9 aircraft following the recent in-flight blowout of an Alaska Air

ALK,

-2.13%

jet. Boeing

BA,

-7.89%

lost 7.9%.In energy trading, benchmark U.S. crude

CL00,

-1.55%

lost 90 cents to $71.75 a barrel. Brent crude

BRN00,

-1.37% ,

the international standard, fell 78 cents to $77.68 a barrel.In currency trading, the U.S. dollar

USDJPY,

+0.44%

rose to 147.90 Japanese yen from 147.09 yen. The euro

EURUSD,

-0.10%

cost $1.0868, down from $1.0880.MarketWatch contributed to this report

-

SEC weighing ‘additional measures’ after hacked post on bitcoin ETF approval

The Securities and Exchange Commission on Friday said that a social-media post on X falsely stating that it had approved spot bitcoin exchange-traded funds was created after an “unauthorized party” obtained control over the phone number connected with the agency’s account on the platform.

The markets regulator said its staff would “continue to assess whether additional remedial measures are warranted” in the wake of the breach, which occurred Tuesday and raised questions about cybersecurity at both the agency and the social-media platform, formerly known as Twitter.

The agency said it was coordinating with law enforcement on the matter, including with the FBI and the Department of Homeland Security.

“Commission staff are still assessing the impacts of this incident on the agency, investors, and the marketplace but recognize that those impacts include concerns about the security of the SEC’s social media accounts,” the SEC said in a statement.

The confusion began on Tuesday afternoon, when the hacked post appeared on the SEC’s X account.

“Today the SEC grants approval for #Bitcoin ETFs for listing on registered national securities exchanges,” the post read. “The approved Bitcoin ETFs will be subject to ongoing surveillance and compliance measures to ensure continued investor protection.”

A second post appeared two minutes later that simply read “$BTC,” the SEC noted in its statement. The unauthorized user soon deleted that second post, but also liked two other posts by non-SEC accounts, according to the agency. The price of bitcoin

BTCUSD,

-0.71%

rose sharply in the wake of the posts, before soon pulling back.In response to the hack, SEC staff posted on the official X account of SEC Chair Gary Gensler announcing that the agency’s main account had been compromised, and that it had not yet approved any spot bitcoin exchange-traded products. Staff then deleted the initial unauthorized post, un-liked the liked posts and used the official SEC account to make a new post clarifying the situation, the agency said Friday.

The SEC also said that it had reached out to X for assistance Tuesday in the wake of the incident, and that agency staff believe the unauthorized access to the SEC’s account was “terminated” later in the day.

“While SEC staff is still assessing the scope of the incident, there is currently no evidence that the unauthorized party gained access to SEC systems, data, devices, or other social media accounts,” the agency said.

The following day, the SEC announced that it had, in fact, approved the listing and trading of spot bitcoin ETFs.

Wednesday’s move marked a breakthrough for the crypto industry, which for years has tried to get such ETFs off the ground in hopes of drawing more traditional investors to the digital-asset space.

Bitcoin was down 7.6% over a 24-period as of Friday evening.

-

After Bitcoin ETFs, watch for the next most popular crypto to go the same route

After long-awaited spot bitcoin exchange-traded funds made their debut this week, investors are now weighing the prospects of eventual approval of similar ether ETFs.

The U.S. Securities and Exchange Commission on Wednesday greenlighted 11 spot bitcoin

BTCUSD,

-1.58%

ETFs for the first time. The products, which made its debut trading on Thursday, logged a relatively strong first day.However, bitcoin fell 6.8% on Friday, leaving it with a 3.2% gain over the past seven days, according to CoinDesk data. It underperformed ether

ETHUSD,

+1.82% ,

which rose 17.6% over the past seven days while it declined 1.2% on Friday.The news about bitcoin ETFs was mostly priced in, while investors are now looking past it to a potential approval of ether ETFs, analysts said.

“I see value in having an ETH ETF,” Larry Fink, chief executive at the world’s largest asset manager BlackRock, told CNBC’s Squawk Box on Friday. BlackRock, which just launched its iShares bitcoin Trust

IBIT,

in November filed an application for a spot ether ETF.“It’s hard to know exactly what the U.S. regulators would do” about ether ETF applications, said Alonso de Gortari, chief economist at Mysten Labs, an internet infrastructure company.

However, “I would expect that once you open the door, it becomes easier and I think the industry is very excited about it,” de Gortari said. If bitcoin ETFs see an impressive institutional inflow in the coming months, it could make such products more established and set a good precedent for other crypto ETF applications, he said.

Also see: Why the debut of bitcoin ETFs could be bad news for crypto stocks, futures ETFs

The enormous competition and huge inflows into bitcoin ETFs will only boost investors’ interests in an ether ETF, according to Paul Brody, EY’s global blockchain leader. “There’s no doubt that ETH is the next big market and has immediately become a priority for financial services companies,” Brody said in emailed comments.

Compared with bitcoin, the Ethereum blockchain offers more utility and has unique advantages, noted Fadi Aboualfa, head of research at digital assets custodian Copper.

Sandy Kaul, head of digital asset and industry advisory services at Franklin Templeton, said she eventually expects the arrival of ETFs that track a basket of cryptocurrencies. Such products, instead of those based on single crypto, would dominate the space if they are approved, she said.

“Just like the S&P 500 has 500 stocks in it, right? You don’t have just one stock.” Kaul said in a phone interview. The arrival of a bitcoin ETF, is just a “baby step into really beginning to think about the future market structure of crypto,” Kaul added.

However, not everyone is that optimistic. Will McDonough, founder and chairman of Corestone Capital, said the approval of an Ethereum ETF has “a long way to go.”

SEC chairman Gary Gensler previously said bitcoin was the only cryptocurrency he was prepared to publicly label a commodity, rather than a security.

The agency also went after companies that offered crypto staking, which allows investors to earn yields by locking their coins to secure blockchains such as Ethereum. The SEC shut down crypto exchange Kraken’s staking business in the U.S. last year.

One possibility is that “companies will be able to offer an ETH ETF, but they will not be allowed to stake that ETH and earn yield,” noted EY’s Brody.

-

Vanguard Won’t Offer Spot Bitcoin ETFs on Its Platform

Updated Jan. 11, 2024 3:06 pm ET

Bitcoin’s trip to Main Street just took a detour.

Vanguard said Thursday it won’t offer the new spot bitcoin exchange-traded funds on its brokerage platform.

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-

Bitcoin ETFs finally approved after a chaotic, ‘embarrassing’ 24 hours for SEC

On Wednesday, the U.S. Securities and Exchange Commission for the first time greenlighted several exchange-traded funds investing directly in bitcoin.

But the 24 hours leading up to that approval were chaotic, to say the least.

The SEC approved the launch of 11 bitcoin

BTCUSD,

+0.09%

ETFs, according to a filing posted on the regulatory agency’s website. The ETFs are due to start trading on Thursday.On Tuesday, however, the SEC’s official account on X, formerly known as Twitter, published what the agency described as an “unauthorized” post indicating that it had approved the spot bitcoin ETFs. In reality, the regulator had not approved any such ETFs as of Tuesday and its X account had been “compromised,” SEC Chair Gary Gensler said on the social-media platform. The SEC subsequently deleted the unauthorized post.

The agency found “there was unauthorized access to and activity on” the its X account by “an unknown party,” an SEC spokesperson said on Tuesday, adding that the “unauthorized access has been terminated” and that the SEC would work with law enforcement to investigate the matter.

Bitcoin’s price briefly shot 2% higher after the unauthorized tweet went out on Tuesday before soon pulling back.

Then on Wednesday, shortly before the U.S. stock market closed for the day, the SEC posted an actual approval order of bitcoin ETFs on its website — but the link was soon broken, leading to an “error 404” page. The same filing was later reposted by the SEC.

It is unclear why the first link was broken. A SEC spokesperson did not respond to an email seeking comment on the matter.

The events of the past 24 hours have proven “a bit embarrassing” for the SEC, especially as the agency has stressed that cryptocurrencies are exceptionally risky and vulnerable to market manipulation, according to Greg Magadini, director of derivatives at Amberdata.

Despite those warnings, Magadini said he doesn’t expect investors to be deterred from investing in the bitcoin ETFs.

Bitcoin has actually seen lower volatility on Tuesday and Wednesday than options traders had priced in, Magadini said. The crypto was up about 0.4% over the past 24 hours to around $46,400 on Wednesday evening, according to CoinDesk data.

Investors have been pricing in $1 to $2 billion of initial flows into the bitcoin ETFs.

Read: Bitcoin in spotlight as SEC approves new ETFs, ether rallies. Here’s why.

Steven Lubka, head of private clients and family offices at Swan Bitcoin, echoed Magadini’s point, noting that the hiccups on the way to SEC approval are unlikely to impact investor interest in the funds.

“Ultimately, the SEC is not the one that launches the ETFs,” Lubka said in a call. “If anything, it shows how much attention is on these ETF products.”

-

SEC Approves Bitcoin ETFs for Everyday Investors

Updated Jan. 10, 2024 5:56 pm ET

The U.S. Securities and Exchange Commission voted Wednesday to allow mainstream investors to buy and sell bitcoin as easily as stocks and mutual funds, a decision hailed by the industry as a game changer.

The SEC decision clears the way for the first U.S. exchange-traded funds that hold bitcoin to be sold to the public. Expectations of U.S. regulatory approval for such funds drove the price of bitcoin to the highest level in about two years. The digital currency fell to just below $46,000 late Wednesday, up from $17,000 in January 2023.

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-

Alphabet, Heico, Bluebird Bio, Plug Power, UBS, FedEx, and More Stock Market Movers

Dec 19, 2023, 4:31 am EST

Stock futures traded flat Tuesday, a day after the S&P 500 finished up 0.5% and moved closer to its all-time. The broad market index stands just 1.2% below its record of 4,796.56 reached in early January 2022.

Continue reading this article with a Barron’s subscription.

-

Fed could be the Grinch who 'stole' cash earning 5%. What a Powell pivot means for investors.

Yields on 3-month

BX:TMUBMUSD03M

and 6-month

BX:TMUBMUSD06M

Treasury bills have been seeing yields north of 5% since March when Silicon Valley Bank’s collapse ignited fears of a broader instability in the U.S. banking sector from rapid-fire Fed rate hikes.Six months later, the Fed, in its final meeting of the year, opted to keep its policy rate unchanged at 5.25% to 5.5%, a 22-year high, but Powell also finally signaled that enough was likely enough, and that a policy pivot to interest rate cuts was likely next year.

Importantly, the central bank chair also said he doesn’t want to make the mistake of keeping borrowing costs too high for too long. Powell’s comments helped lift the Dow Jones Industrial Average

DJIA

above 37,000 for the first time ever on Wednesday, while the blue-chip index on Friday scored a third record close in a row.“People were really shocked by Powell’s comments,” said Robert Tipp, chief investment strategist, at PGIM Fixed Income. Rather than dampen rate-cut exuberance building in markets, Powell instead opened the door to rate cuts by midyear, he said.

New York Fed President John Williams on Friday tried to temper speculation about rate cuts, but as Tipp argued, Williams also affirmed the central bank’s new “dot plot” reflecting a path to lower rates.

“Eventually, you end up with a lower fed-funds rate,” Tipp said in an interview. The risk is that cuts come suddenly, and can erase 5% yields on T-bills, money-market funds and other “cash-like” investments in the blink of an eye.

Swift pace of Fed cuts

When the Fed cut rates in the past 30 years it has been swift about it, often bringing them down quickly.

Fed rate-cutting cycles since the ’90s trace the sharp pullback also seen in 3-month T-bill rates, as shown below. They fell to about 1% from 6.5% after the early 2000 dot-com stock bust. They also dropped to almost zero from 5% in the teeth of the global financial crisis in 2008, and raced back down to a bottom during the COVID crisis in 2020.

Rates on 3-month Treasury bills dropped suddenly in past Fed rate-cutting cycles

FRED data

“I don’t think we are moving, in any way, back to a zero interest-rate world,” said Tim Horan, chief investment officer fixed income at Chilton Trust. “We are going to still be in a world where real interest rates matter.”

Burt Horan also said the market has reacted to Powell’s pivot signal by “partying on,” pointing to stocks that were back to record territory and benchmark 10-year Treasury yield’s

BX:TMUBMUSD10Y

that has dropped from a 5% peak in October to 3.927% Friday, the lowest yield in about five months.“The question now, in my mind,” Horan said, is how does the Fed orchestrate a pivot to rate cuts if financial conditions continue to loosen meanwhile.

“When they begin, the are going to continue with rate cuts,” said Horan, a former Fed staffer. With that, he expects the Fed to remain very cautious before pulling the trigger on the first cut of the cycle.

“What we are witnessing,” he said, “is a repositioning for that.”

Pivoting on the pivot

The most recent data for money-market funds shows a shift, even if temporary, out of “cash-like” assets.

The rush into money-market funds, which continued to attract record levels of assets this year after the failure of Silicon Valley Bank, fell in the past week by about $11.6 billion to roughly $5.9 trillion through Dec. 13, according to the Investment Company Institute.

Investors also pulled about $2.6 billion out of short and intermediate government and Treasury fixed income exchange-traded funds in the past week, according to the latest LSEG Lipper data.

Tipp at PGIM Fixed Income said he expects to see another “ping pong” year in long-term yields, akin to the volatility of 2023, with the 10-year yield likely to hinge on economic data, and what it means for the Fed as it works on the last leg of getting inflation down to its 2% annual target.

“The big driver in bonds is going to be the yield,” Tipp said. “If you are extending duration in bonds, you have a lot more assurance of earning an income stream over people who stay in cash.”

Molly McGown, U.S. rates strategist at TD Securities, said that economic data will continue to be a driving force in signaling if the Fed’s first rate cut of this cycle happens sooner or later.

With that backdrop, she expects next Friday’s reading of the personal-consumption expenditures price index, or PCE, for November to be a focus for markets, especially with Wall Street likely to be more sparsely staffed in the final week before the Christmas holiday.

The PCE is the Fed’s preferred inflation gauge, and it eased to a 3% annual rate in October from 3.4% a month before, but still sits above the Fed’s 2% annual target.

“Our view is that the Fed will hold rates at these levels in first half of 2024, before starting cutting rates in second half and 2025,” said Sid Vaidya, U.S. Wealth Chief Investment Strategist at TD Wealth.

U.S. housing data due on Monday, Tuesday and Wednesday of next week also will be a focus for investors, particularly with 30-year fixed mortgage rate falling below 7% for the first time since August.

The major U.S. stock indexes logged a seventh straight week of gains. The Dow advanced 2.9% for the week, while the S&P 500

SPX

gained 2.5%, ending 1.6% away from its Jan. 3, 2022 record close, according to Dow Jones Market Data.The Nasdaq Composite Index

COMP

advanced 2.9% for the week and the small-cap Russell 2000 index

RUT

outperformed, gaining 5.6% for the week.Read: Russell 2000 on pace for best month versus S&P 500 in nearly 3 years

Year Ahead: The VIX says stocks are ‘reliably in a bull market’ heading into 2024. Here’s how to read it.