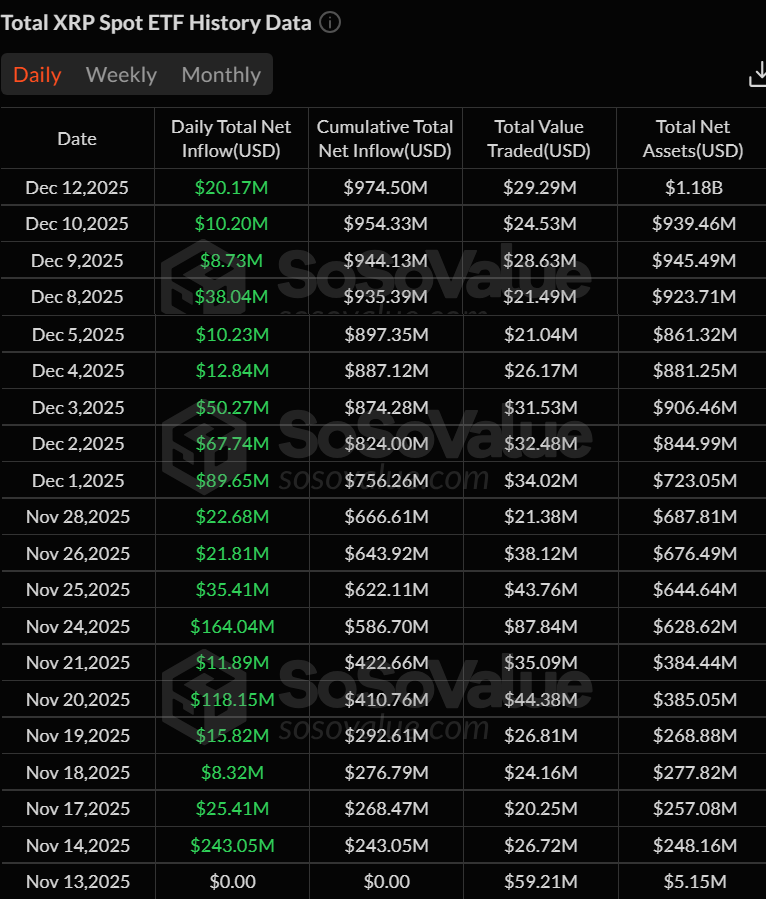

US-listed spot XRP ETFs just put together a streak that’s hard to ignore: 19 straight trading days of net inflows, with zero outflow sessions over the run, according to daily flow data compiled by Sosovalue.

The numbers add up quickly. By Dec. 12, cumulative net inflows sat at $974.50 million, while total net assets across the products were shown at roughly $1.18 billion.

XRP ETFs Log 19 Straight Trading Days Of Inflows

The early days did most of the heavy lifting. Sosovalue’s table shows $243.05 million of net inflow on Nov. 14, then another surge on Nov. 24 ($164.04 million). There were also chunky adds on Nov. 20 ($118.15 million) and Dec. 1 ($89.65 million). Even as the pace cooled, inflows didn’t flip—Dec. 8 posted $38.04 million, and Dec. 12 added another $20.17 million.

On X, Bitmern Mining founder and CEO Giannis Andreou framed it bluntly today: “19 consecutive trading days of inflows. Zero outflow days. Nearly $1B in net capital added.” He called it “sustained institutional positioning,” not retail froth.

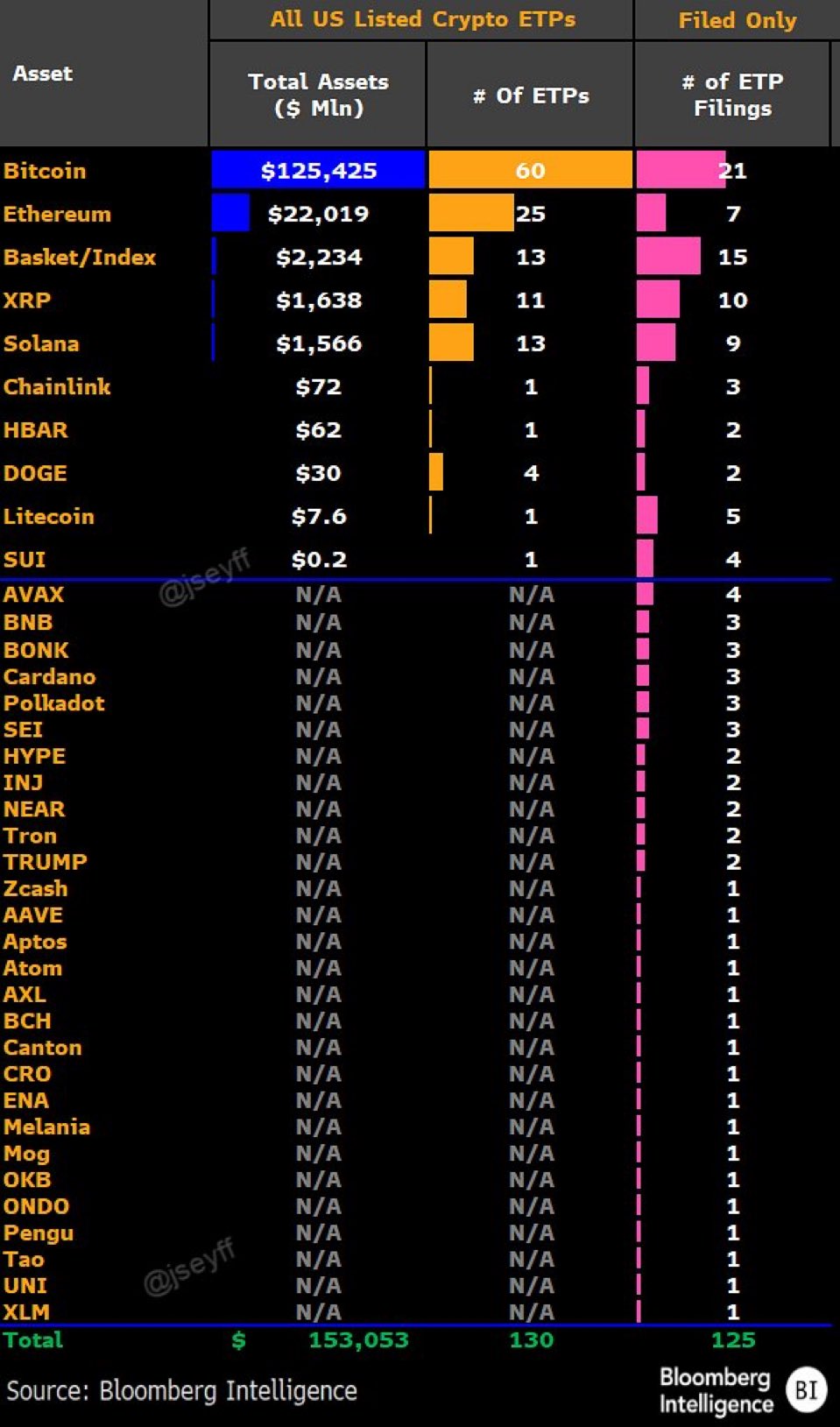

That “institutional bid” angle is also showing up in the asset rankings. In a Dec. 13 post, Canary Capital CEO Steven McClurg pointed to a separate snapshot of the US crypto ETP landscape showing XRP products now edging out Solana by total assets under management.

Bloomberg Intelligence data in the chart puts XRP ETP assets at about $1.638 billion, just ahead of Solana at $1.566 billion, in a market where Bitcoin still towers over everything at $125.425 billion and Ethereum sits at $22.019 billion.

McClurg’s explanation for the flip was less about Solana underperforming and more about where each asset “fits” in the wrapper trade.

“SOL ETFs launched before XRP, but XRP ETFs have now passed SOL in total AUM. I expected this,” McClurg wrote, adding “SOL is much more efficient to hold on-chain and to stake directly for retail audiences, whereas XRP has more institutional demand and no staking. As with everything, there will be an audience that prefers direct ownership, and an audience that prefers the ease of financial instruments. Some will do both.”

Notably, from Dec. 8 to Dec. 12, Bitcoin spot ETFs recorded net inflows of $287 million for the week, while Ethereum spot ETFs saw weekly net inflows of $209 million. SOL spot ETFs recorded net inflows of $33.6 million.

At press time, XRP once again fell below the $2 mark. The token traded at $1.98 and thus at the key support zone. A drop below the red support band could strengthen the bear case for a deeper crash to the 100-week or even 200-week Exponential Moving Average (EMA). XRP visited the latter during the October 10 crash.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Jake Simmons

Source link