Wall Street looks ready to build on Monday’s gains, the first in five sessions for the S&P 500

SPX

and Nasdaq Composite

COMP.

That’s as expectations build around Nvidia, which has had a lackluster August, to knock it out of the park with earnings on Wednesday.

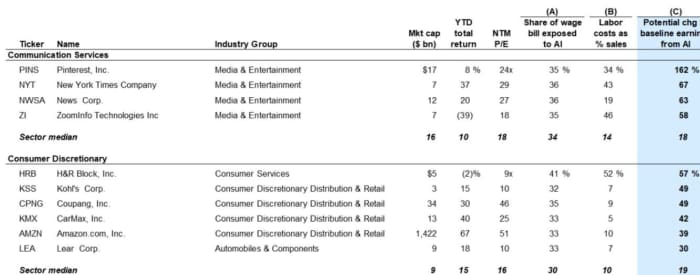

Investors have had months to focus on AI darlings such as Nvidia. In our call of the day, Goldman Sachs takes a look at stocks to trade after the big AI trade. A team led by strategists Ryan Hammond and David Kostin complied a basket of companies with the biggest potential long-term earnings per share boost from the impact of AI adoption on labor productivity.

Their analysis indicates that following widespread AI adoption, EPS for the median stock in that basket could be 72% higher than the baseline, versus 19% for the median Russell 1000 stock.

“We estimate the potential productivity-related EPS boost from increased revenues or increased margins, using a combination of company-level estimates of the share of the wage bill exposed to AI automation and the labor cost to revenue ratio,” said the Goldman team.

Since early 2023, when AI emerged as a theme for investors, they note their long-term basket of stocks has outperformed the equal-weight S&P 500 by just 6 percentage points, far less than near-term beneficiaries such as Nvidia

NVDA,

Microsoft

MSFT,

or Meta

META,

Goldman Sachs Investment Research

“The estimated AI-driven earnings boost is likely to occur over the next few years, but should be reflected in stock valuations sooner. However, the eventual share price impact will depend on the ability of companies to use AI to enhance earnings,” said Goldman.

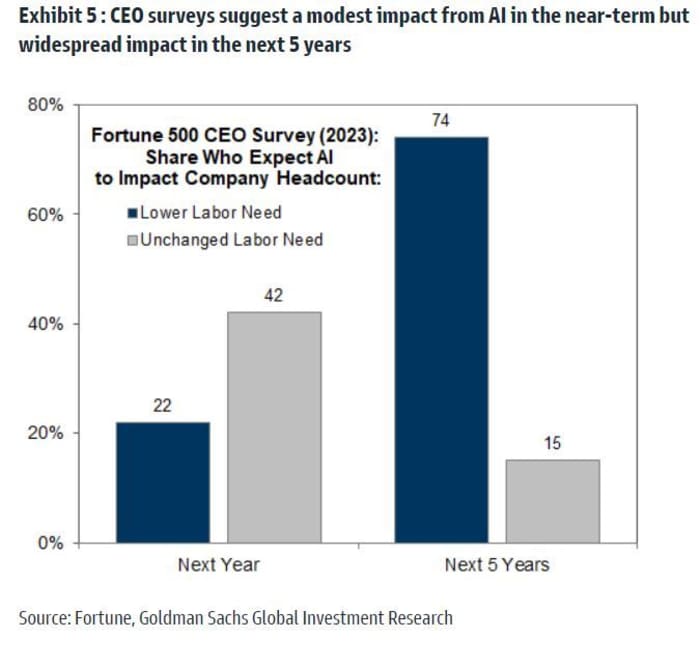

While unable to pin it exactly, Goldman expects AI adoption will start to a have a “meaningful macro impact” between 2025 and 2030, with regulatory constraints and data privacy concerns likely to slow widespread adoption. Nearly 75% of CEOs see AI take-up impacting companies or cutting labor needs within the next five years, even if they don’t right now.

Firms with the biggest workforce exposure to AI and larger and more innovative ones, will likely adopt generative AI earlier than others, say the strategists. They say to “expect valuation multiples for these companies to increase first as the adoption timeline crystallizes, even if actual adoption and the associated EPS boost is occur later.”

Goldman’s estimates on the potential earnings boost for those long-term AI beneficiaries consist of several factors: the share of each company’s wage bill exposed to AI automation, how much of a company’s wage bill is exposed to AI automation and labor cost as a share of revenue.

“For the typical Russell 1000 stock, 33% of the wage bill is potentially exposed to AI automation and labor costs currently represent 14% of total sales. The potential boost from higher sales would increase earnings by 11% and reduced labor costs would increase earnings by 26%, all else equal,” say the strategists.

Here is a taster of their long-term AI beneficiaries basket:

Goldman Sachs

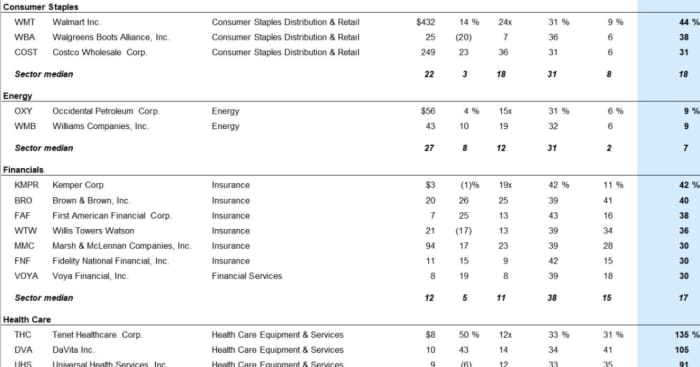

And a few more:

Goldman Sachs

Read: U.S. stocks may bounce this week, but summer selloff is only halfway done, analysts warn

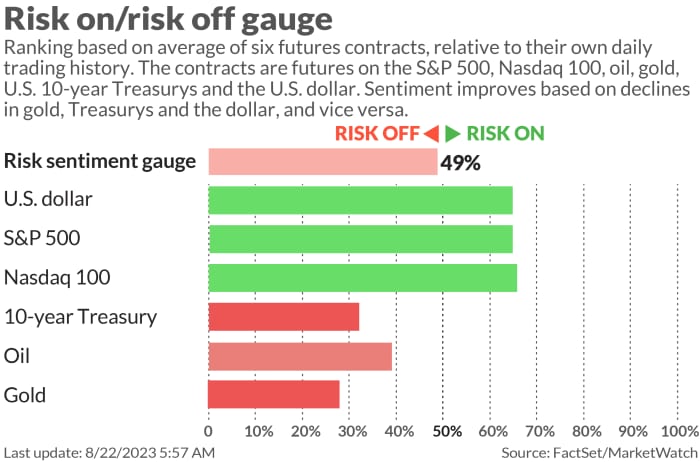

The markets

U.S. stocks

SPX

COMP

are trading mixed. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

is steady at 4.33%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Microsoft

MSFT,

has proposed a Ubisoft license to win U.K. regulatory approval for its Activision Blizzard

ATVI,

buyout. Activision shares and Ubisoft

UBI,

surged in Paris.

On the heels of a 7% surge, EV-maker Tesla

TSLA,

is up 1.8%.

Opinion: SoftBank’s Arm is going public, but it faces a rapidly growing threat

Lowe’s shares

LOW,

are up after the DIY retailer’s earnings topped expectations, though it notes lower discretionary demand.

Among Monday’s late earnings news: Fabrinet

FN,

is up 18% after the high-tech manufacturing services company upbeat forecast, with new AI products helping drive results. Videoconferencing group Zoom Video Communications

ZM,

is up 4% after reporting an earnings jump and guidance.

Read: Why Amazon is this analyst’s top internet stock pick

The world’s biggest miner BHP

BHP,

reported a 58% slump in annual profit amid tumbling commodity prices in part due to China’s economic troubles. U.S.-listed shares are up 4%.

Arm Holdings filed its long-awaited IPO, which could be the year’s biggest. The chip designer aims to raise up to $10 billion with a valuation of $60 billion to $70 billion.

Existing home sales for July are due at 10 a.m., with several Fed speakers throughout the day: Richmond Fed President Tom Barkin at 7:30 a.m. and Chicago Fed President Austan Goolsbee and Fed. Gov. Michelle Bowman both at 2:30 p.m.

Best of the web

New video shows the day police raided 98-year old Kansas newspaper owner’s home.

Hitler’s birth house in Austria will be turned into a police station with a human rights training center.

The tickers

These were the top tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

TTOO, |

T2 Biosystems |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

The chart

Is tech dancing to the beat of its own drum? The Chart Report flagged this one from Scott Brown, founder of Brown Technical Insights, showing performance of the Technology Select Sector SPDR ETF

XLK

:

@scottcharts

“It’s only been a week, but consensus and conventional wisdom suggest higher yields are bad for Growth/Tech stocks. Meanwhile, Tech is acting like it never got the memo. It’s still too early to tell if Tech is trying to tell us something, but Scott points out that the sector is facing a crucial test this week at the March 2022 highs (around $163). $XLK is solidly above $163 after today’s bounce, but where it ends the week will likely hinge on $NVDA, as the company releases earnings on Wednesday evening,” says Patrick Dunuwila, editor and co-founder of The Chart Report.

Random reads

“We are the champions.” Spain erupted in celebrations to welcome its Women’s World Cup victors. And England’s Lionesses got a 1,000 soccer-ball tribute.

No, Tropical Storm Hilary didn’t flood Dodger Stadium.

These thirsty beer-drinking thieves are raccoons.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EXKKFK7XDBJ63KQSUZF7C7NJB4.jpg)