Wells Fargo & Co.

WFC,

said it will pay up to $1.8 billion to the Federal Deposit Insurance Co.’s deposit insurance fund as part of the government’s special assessment following the regional-bank crisis earlier this year. Wells Fargo said it will expense the entire amount upon the FDIC’s finalization of the rule. “The proposed rule may be changed prior to finalization and any changes may affect the timing or amount of the special assessment,” Wells Fargo said in a filing late Tuesday. Bank of America Corp.

BAC,

estimated its cost for the same effort would be $1.9 billion, according to a Monday filing.

Tag: Wells Fargo & Co.

-

Wells Fargo, Bank of America to pay FDIC up to $3.7 billion combined for bank failure special assessment

-1.56% -1.49% -

The nation’s biggest banks are gearing up for more consumer struggles ahead

JPMorgan Chase & Co. Chief Executive Jamie Dimon on Friday said the U.S. economy was basically doing OK, even if customers were spending “a little more slowly.”

But with rivals like Bank of America Corp., Goldman Sachs Group Inc. and American Express Co. set to report quarterly results this week, recession agita still prevails.

For evidence, look no further than JPMorgan’s

JPM,

+0.60%

own quarterly results. The bank’s second-quarter profit blew past expectations, but it set aside $2.9 billion during the second quarter to cover potentially bad loans, amid concerns that more consumers could run into more difficulty paying their bills on time as higher prices manage to stick at stores.That figure was well up from $1.1 billion in the same quarter last year, although still far below the billions it stowed away when the pandemic first hit. Similarly, Wells Fargo & Co.

WFC,

-0.34%

on Friday set aside $1.7 billion for loan losses in this year’s second quarter, nearly triple what it was a year ago.The figures underscore the anxiety over the second half of this year, when many economists expect the economy to tilt into a recession. However, for the 500 companies in the S&P 500 index, Wall Street analysts still expect profit growth.

Any downturn could be exacerbated by the pressure investors have put on companies, potentially via more layoffs and money-saving technology, to keep prices high and cut costs to replicate the abnormally large profit-margin gains they put up in 2021 and 2022. Businesses have indeed kept prices high, at least for many basic necessities, in an effort to cover their own higher costs and to pad profits.

When Bank of America

BAC,

-1.89%

reports this week, the results will narrow the lens on lending and spending in the U.S. Results from Morgan Stanley

MS,

-0.50%

and Goldman Sachs

GS,

-0.76%

will fill in the gaps on trading and deal-making. American Express

AXP,

-0.49%

will give a more detailed breakdown of what consumers are still spending their money on, after Delta Air Lines Inc.

DAL,

-2.35%

— which has a partnership with AmEx — said that travel demand remained “robust.”Banks shoveled more money into their reserve stockpiles in 2020 to bulk up against the pandemic’s shutdown of the economy. A year later, they started releasing those funds as the economy reopened and recovered. FactSet expects the broader banking sector to plump up its cash cushion during this year’s second quarter to account for more late loan payments or potential defaults.

In a report on Friday, FactSet said the 15 banking-industry companies in the S&P 500 Index tracked by the firm were on pace to set aside $9.9 billion to cover losses from souring loans in the second quarter. That’s more than double the amount set aside a year ago. And if that $9.9 billion figure, based on actual and projected financial figures, ends up as the actual figure at the end of the quarter, it would mark the highest since the beginning of the pandemic and the third highest in five years, according to FactSet data.

“The U.S. economy continues to be resilient,” Dimon said in a statement on Friday. “Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly. Labor markets have softened somewhat, but job growth remains strong.”

However, he noted difficulties in JPMorgan’s investment banking segment. And he said consumer savings were slowly eroding as inflation endures.

As the nation’s biggest bank, JPMorgan has flexed its financial muscle this year, swallowing up First Republic after that bank got into trouble. But as it consolidates power and influence, building thicker armor against shocks to the economy, its financial results might not always reflect the struggles of its smaller rivals, where difficulties are likely felt more acutely. Analysts at Raymond James said that while JPMorgan remained a “best in breed” bank, its outlook pointed to “heightened challenges for smaller banks.”

See also: Jamie Dimon says U.S. consumers are in ‘good shape.’ This evidence may prove otherwise.

This week in earnings

For the week ahead, 60 S&P 500 companies, including five from the Dow, will report quarterly results, according to FactSet. Two big oil companies, Halliburton Co.

HAL,

-2.28%

and Baker Hughes Co.,

BKR,

-0.95%

will report, as oil prices fall from levels seen last year. Results from two transportation giants — trucking company J.B. Hunt Transport Services

JBHT,

-0.42%

and railroad operator CSX Corp.

CSX,

-0.27%

— will also be a proxy for how much people are buying things and having them shipped. United Airlines Holdings Inc.

UAL,

-3.42%

and American Airlines Group

AAL,

-1.68%

will also report.The call to put on your calendar

Netflix results: Hollywood shutdown, ‘slow-growth’ expectations. Hollywood’s writers — and now its actors — have gone on strike, and Netflix Inc.

NFLX,

-1.88%

reports second-quarter results on Wednesday. The streaming platform will likely face questions over how much content it has left in the tank, as the strike upends studio-production schedules and leaves viewers with vast expanses of reruns. Still, Macquarie analyst Tim Nollen said that the production standstill “may ironically drive even more viewers to streaming services.”The writers and actors argue that the studio industry — increasingly consolidated, increasingly publicly traded, increasingly oriented around a handful of film franchises — has profited immensely while skimping on things benefits and streaming residuals. But after a decade-long rise, and a recent shift in investor focus from subscriber growth to profit growth, Netflix has emerged as one of the biggest production powerhouses in the business. And after years of flooding customers with new films and shows, it’s trying to squeeze out sales via more boring ways: things like a password-sharing crackdown and ads.

Daniel Morgan, senior portfolio at Synovus Trust Co., said Netflix still faced a plenty of streaming competition amid “muted” subscriber growth. But Wedbush analyst Michael Pachter said investors should look at Netflix as a profitable, albeit more mature company.

“We think Netflix is well-positioned in this murky environment as streamers are shifting strategy, and should be valued as an immensely profitable, slow-growth company,” Pachter said in a research note on Friday.

“Even while the ad-supported tier is not yet directly accretive (we think it will be accretive over time), the ad-tier should continue to reduce churn and draw new subscribers to the service,” he continued.

The number to watch

Tesla sales. Electric-vehicle maker Tesla Inc. also reports second-quarter results on Wednesday. And like streaming, some analysts say the fervor for EVs has faded.

However, they also said that Tesla

TSLA,

+1.25%

had so far been immune from the malaise. And even though Elon Musk remains preoccupied with Twitter — which now faces competition from Meta Platforms Inc.’s

META,

-1.45%

Threads — Tesla’s second-quarter deliveries were far above expectations. Sales are expected to be big. And one analyst said that price cuts, which Tesla has used to capture more of the auto market in China, were likely “fairly minimal” during the second quarter. But some analysts wondered what the blowout delivery figures would mean for margins. And the industry, broadly, has increasingly tested the patience of profit-minded investors.“We’ve now seen a market where demand is constrained, capital has been tighter, and there is less tolerance for EV related losses,” Barclays analysts said in a note last week, adding that there was a “step back from EV euphoria.”

Claudia Assis contributed reporting.

-

S&P 500 ends above 4,500 level for first time in 15 months as stocks gain ahead of bank earnings

Stocks rose for a fourth day in a row on Thursday, a day ahead of second-quarter earnings from America’s biggest lenders. The Dow Jones Industrial Average

DJIA,

+0.14%

rose about 46 points, or 0.1%, ending near 34,394, according to preliminary data from FactSet. But the S&P 500 index

SPX,

+0.85%

gained 0.9% to end at 4,509, clearing the 4,500 mark for the first time since April 5, 2022 when it ended at 4,545.86, according to Dow Jones Market Data. The Nasdaq Composite Index

COMP,

+1.58%

scored another blockbuster day, up 1.6%. Investors have been optimistic as inflation pressures ease and as perhaps the best-telegraphed U.S. economic recession in recent history has yet to materialize. The S&P 500 and Nasdaq have been charging higher on buzz about AI technology, with much of this year’s stock-market gains fueled by a small group of stocks. The risk-on tone ahead of earnings from JPMorgan Chase and Co.,

JPM,

+0.49%

Wells Fargo

WFC,

+1.04%

and Citigroup

C,

+0.63% ,

had the U.S. dollar

DXY,

-0.74%

earlier on pace to end at its lowest level since early April 2022. Treasury yields also continued to fall, with the 10-year

TMUBMUSD10Y,

3.768%

rate back down to 3.759%, after topping 4% in recent weeks. The six biggest banks are expected to issue a deluge of fresh debt after earnings, despite the Federal Reserve having sharply increased rates and borrowing costs for businesses and households to tame inflation. -

Worried that stocks are too expensive? This value approach can highlight bargains.

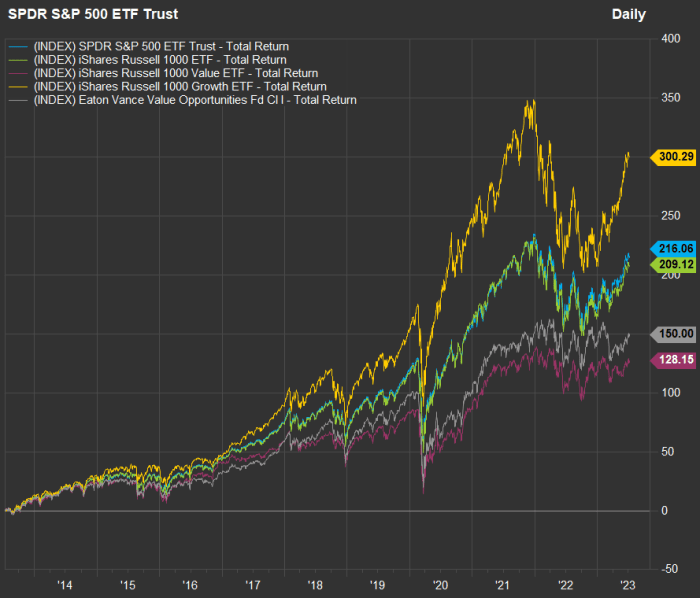

At a time when many investors seem euphoric, others are warning that stock valuations have once again turned frothy. It may pay to take a look back at valuation and performance and consider your own risk tolerance.

A value-based approach that offers lower volatility and good long-term returns can be expected to be less flashy than one focused on the hottest technology stocks. But depending on how much it bothers you when the stock market gyrates, it may be a better way for you to invest. Lower volatility might help you to avoid the type of emotional reaction that can lead to selling into a declining market or attempting to time the market, both of which tend to be losing strategies.

Aaron Dunn is a co-head of the value equity team at Eaton Vance, which is based in Boston and is a unit of Morgan Stanley. During an interview, he explained how he and Brad Galko, who co-heads the team, select stocks for the Eaton Vance Focused Value Opportunities Fund. The fund’s performance benchmark is the Russell 1000 Value Index

RLV,

+1.08% .First, let’s take a broad look at how aggregate forward price-to-earnings ratios have moved for exchange-traded funds tracking several broad indexes over the past 10 years:

FactSet

The valuations are lower than their 2020 peaks. But for all but one, the valuations still appear to be high when compared with their 10-year averages:

ETF Ticker Current forward P/E 10-year average forward P/E Current valuation to 10-year average SPDR S&P 500 ETF Trust SPY,

+0.64% 19.06 15.93 120% iShares Russell 1000 ETF IWB,

+0.80% 18.94 16.02 118% iShares Russell 1000 Value ETF IWD,

+1.07% 14.33 13.94 103% iShares Russell 1000 Growth ETF IWF,

+0.50% 26.63 19.00 140% Source: FactSet All of the listed ETFs listed here are trading well above their 10-year average P/E valuations except the iShares Russell 1000 Value ETF, which is only slightly higher. These numbers back the notion that the broad market is expensive and that a value approach may be more reasonable. It is also worth keeping in mind that during 2022, when the SPDR S&P 500 ETF Trust

SPY,

+0.64%

declined 18.2% and the iShares Russell 1000 ETF

IWB,

+0.80%

fell 19.2%, the iShares Russell 1000 Value ETF

IWD,

+1.07%

pulled back 7.7% and the Eaton Vance Focused Value Opportunity Fund’s Class I shares were down only 3.3%, all with dividends reinvested.If we look at 10-year total returns, the nonvalue indexes, so heavily weighted to the largest technology-oriented companies, have been excellent performers for investors who could remain committed through thick and thin:

FactSet

Fund Ticker 3-year average annual return 5-year average annual return 10-year average annual return SPDR S&P 500 ETF Trust SPY,

+0.64% 13.2% 11.4% 12.3% iShares Russell 1000 ETF IWB,

+0.80% 12.5% 11.0% 12.1% iShares Russell 1000 Growth ETF IWF,

+0.50% 11.2% 14.0% 15.0% iShares Russell 1000 Value ETF IWD,

+1.07% 13.7% 7.3% 8.7% Eaton Vance Value Opportunities Fund – Class I EIFVX,

+0.92% 14.8% 8.7% 9.7% Source: FactSet For five and 10 years, the growth-oriented approaches have shined. But for three years, which includes the 2022 disruption, the Eaton Vance Value Opportunities Fund has fared best, even outperforming its benchmark.

A selective approach to value

The Eaton Vance Focused Value Opportunity Fund’s Class I

EIFVX,

+0.92%

shares are rated four stars (out of five) within Morningstar’s Large Value fund category. The fund’s Class A

EAFVX,

+0.93%

shares are rated three stars. The difference is that the Class I shares, which are typically distributed through investment advisers, have annual expenses of 0.74% of assets under management, while the Class A shares have an expense ratio of 0.99%. You can purchase Class I shares directly through brokerage platforms for a $50 fee.Dunn said that when selecting stocks for the fund, he and Galko take a bottom-up approach to identify quality companies. The want to see high returns on invested capital (ROIC) over the long term, as well as a “good competitive position” for a company and a strong management team.

They also prefer companies with low debt. “We do not want to buy overlevered companies and be in a situation where we are diluting through equity raises and putting capital at risk,” he said.

Dunn added that he and Galko look closely at free cash flow generation. A company’s free cash flow is its remaining cash flow after capital expenditures. This is money that can be used to fund expansion, acquisitions, dividend increases or share buybacks, or for other corporate purposes.

“Philosophically, what this results in is that we hold up well in markets such as last year’s. And we find upside in stocks trading below intrinsic value,” he said.

“We focus on finding ideas where there is a good skew for upside relative to downside,” he added.

According to Morningstar, the fund’s active share when compared with IWD is high, at 91.45%. Active share is a measure of how much an actively managed fund differs in investment exposure from its benchmark index. If you are paying more for active management than you would to invest in an index fund, active share is something to consider. If it is low, you might be overpaying for a “closet indexer.” You can read about how Morningstar assesses active shares here.

The fund is concentrated, typically holding between 25 and 45 companies.

According to Morningstar’s most recent data, these were the fund’s top 10 holdings (out of 28 stocks) as of May 31:

Company Ticker % of Eaton Vance Focused Value Opportunity Fund Forward P/E 2023 total return Alphabet Inc. Class A GOOGL,

+0.59% 5.0% 19.6 32% Micron Technology Inc. MU,

+1.79% 4.8% N/A 25% American International Group Inc. AIG,

+1.15% 4.3% 8.1 -7% Reinsurance Group of America Inc. RGA,

-0.34% 4.2% 8.0 1% Bristol Myers Squibb Co. BMY,

+0.50% 4.1% 7.7 -11% Wells Fargo & Co. WFC,

+0.99% 4.0% 8.9 4% ConocoPhillips COP,

+2.96% 4.0% 10.5 -10% Constellation Brands Inc. Class A STZ,

+0.30% 3.9% 20.4 9% NextEra Energy Inc. NEE,

+0.67% 3.8% 21.9 -13% Charles Schwab Corp. SCHW,

-0.43% 3.8% 16.0 -30% Source: FactSet Click the tickers for more about each company, fund or index.

There is no forward price-to-earnings ratio for Micron Technology Inc.

MU,

+1.79% ,

because the company’s combined EPS for the next 12 months are expected to be negative.Micron is a company in transition, caught up in diplomatic conflict between the U.S. and China, whose government directed some manufacturers in May to stop purchasing memory chips made by the company. Then again, in June, Micron highlighted its “commitment to China” when announcing a new investment in its plant in Xi’an.

Read: Micron recovery debated by analysts as bottom is called in memory-chip market

Dunn said downside for Micron’s stock was “mitigated” because of the company’s relatively low debt. He also said that as companies continue to adopt more cloud services and deploy artificial-intelligence technology, demand for memory chips will increase.

While there is no current forward P/E for Micron, the stock always trades at low valuations relative to most other large tech companies. Dunn touted Micron’s strong cash flow and said the stock was “underappreciated” and remained “an interesting play on cloud and AI.”

While it is not among the top 10 holdings listed above, Dunn highlighted Dollar Tree Inc.

DLTR,

+1.80%

as an example of the type of value stock he favors. The company “was not well run” following its acquisition of Family Dollar in 2015. But he has been impressed with its more recent turnaround efforts, including improvements in how products are shipped to stores, better efficiency and “a lot of work going on with culture, how they operate, how they treat employees [and] adding some shelf space to move more product.”It is interesting to see NextEra Energy Inc.

NEE,

+0.67%

among the fund’s largest holdings. This has been quite a strong grower over the past 10 years, with a total return of 346% as the owner of Florida Power & Light has grown along with its customer base and has become a leader in the build-out of solar-power generation.Dunn said the company is “still growing in the mid-single digits. For a utility company, that is a strong profile.”

When discussing Alphabet Inc.

GOOGL,

+0.59% ,

the fund’s largest holding as of May 31, Dunn said that “it is really an advertising business with other businesses around it” and that its P/E valuation was “not extremely taxing.” He said Alphabet had been “less aggressive with cost cutting” than other technology giants and added that the company’s “targeted search” through Google and other properties, such as YouTube, “probably provides a better return on investment than broadcast advertising, and that really is the key.”Don’t miss: This stock investing strategy has blown away the S&P 500. Here’s a way to refine it for quality.

-

Fed stress tests see large banks able to handle recession and slide in commercial real estate prices

The U.S. Federal Reserve said Wednesday that all 23 banks in this year’s stress tests withstood a hypothetical “severe” global recession and losses of up to $541 billion as well as a 40% decline in commercial real estate prices.

The banks in the 2023 stress tests hold about 20% of the office and downtown commercial real estate loans held by banks and should be able to handle office space weakness that has loomed amid slack demand for space in the wake of the COVID-19 pandemic.

“The projected decline in commercial real estate prices, combined with

the substantial increase in office vacancies, contributes to projected loss rates on office properties that are roughly triple the levels reached during the 2008 financial crisis,” the Fed said in a prepared statement.Fed vice chair of supervision Michael S. Barr said the exams confirm that the U.S. banking system remains resilient, even in the wake of the failure of Silicon Valley Bank, Signature Bank and First Republic Bank earlier this year.

Barr also alluded to comments he made last week when he said the Fed should consider a wider range of risks that could derail banks in a process he described as reverse stress tests.

“We should remain humble about how risks can arise and continue our

work to ensure that banks are resilient to a range of economic scenarios, market shocks, and other stresses,” Barr said in a prepared statement.The bank stress tests are closely watched because they help determine what capital banks have left over for stock buybacks and dividends. However, expectations are not particularly high at the current time for any huge payouts to investors given talk by regulators about high capital requirements tied to Basel III international banking laws, as well as a challenging economic environment with interest rates on the rise in an attempt to cool economic activity and tame inflation.

Senior Fed officials said banks will be clear to provide updates on their stock buybacks and dividends after the market close on Friday.

For the first time, the Fed conducted an “exploratory market shock” on the trading books of the U.S.’s eight largest banks including greater inflationary pressures and rising interest rates.

The results showed that the largest banks’ trading books were resilient to the rising rate environment tested. That group included Bank of America Corp., the Bank of New York Mellon, Citigroup Inc., the Goldman Sachs Group Inc., JPMorgan Chase & Co. , Morgan Stanley , State Street Corp, and Wells Fargo & Co.

Senior federal officials said they’re studying a wider application of the exploratory market shock to other banks.

In last year’s tests, the Fed did not place an emphasis on a rapid rise in interest rates partly because expectations were high for a recession with lower interest rates in 2023. Instead, interest rates rose. That market dynamic was a factor in the collapse of Silicon Valley Bank, which sold securities with lower interest rates at a loss to cover an increase in withdrawals, only to spark a run on the bank.

All told, the Fed said the 23 banks in the stress test managed to maintain their capital requirements even with a projected $541 billion in losses. (See breakdown below).

U.S. Federal Reserve chart

Under the most severe stress, the aggregate common equity risk-based capital ratio would decline by 2.3% to a minimum of 10.1%.

Other facets of the hypothetical recession included a “substantial” increase in office vacancies, a 38% reduction in house prices and a 6.4% increase in U.S. unemployment to a high of 10%. The drop in house prices in this year’s stress tests is worse than the decline in the Global Financial Crisis in 2008.

“The results looked pretty good,” said Maclyn Clouse, a professor of finance at the University of Denver’s Daniels College of Business. “The banks were in pretty good shape from a capital standpoint and they’d be able to withstand some shock. It’s good news.”

Barr’s remark on Fed officials being “humble” reflects the fact that regulators largely missed the Global Financial Crisis as well as the sudden demise of Silicon Valley Bank in March.

“They need to be humble,” Clouse said. “We need to be a little more humble about the results and a little more alert about new challenges that normally haven’t been looked at with stress tests.”

This year, the banks that took part in the stress tests including Bank of America Corp.

BAC,

-0.60% ,

Bank of New York Mellon Corp.

BK,

-0.64% ,

Capitol One Financial Corp.

COF,

+0.52% ,

Charles Schwab Corp.

SCHW,

+1.01% ,

Citigroup

C,

-0.37% ,

Citizens Financial Group Inc.

CFG,

-1.61%

and Goldman Sachs Group Inc.

GS,

+0.07% .Other exams took place at J.P. Morgan Chase & Co.

JPM,

-0.44% ,

M&T Bank Corp.

MTB,

-0.18% ,

Morgan Stanley

MS,

-0.52% ,

Northern Trust Corp.

NTRS,

-0.46% ,

PNC Financial Services Group Inc.

PNC,

-0.36% ,

State Street Corp.

STT,

-0.62% ,

Truist Financial Corp.

TFC,

-0.07% ,

U.S. Bancorp

USB,

-0.71%

and Wells Fargo & Co.

WFC,

-0.71% .In 2022, the Fed said banks could withstand 10% unemployment and a 55% drop in stock prices as part of the year-ago stress test.

KBW analyst David Konrad said in a June 22 research note he expected no “huge surprises” in addition to capital uncertainty around dividends and buybacks already expected by Wall Street.

Providing guidance on how the Fed will study bank strength, Fed chair of supervision Michael Barr said last week that the Fed needs to consider “reverse stress tests” to look at “different ways an institution can die” instead of simply submitting banks to a specific list of hypothetical hardships.

“We have to work harder at looking at patterns we haven’t seen before,” Barr said at an appearance on June 20.

Also Read: Fed official eyes ‘reverse stress tests’ for banks as results awaited after 2023 bank failures

-

HELOCs are back. Cash-strapped borrowers are tapping into a $33 trillion pile of home equity.

Goodbye pandemic refi cash-outs. Hello HELOCs?

Home-equity lines of credit (HELOCs) and second-lien mortgages have been staging a notable comeback as U.S. homeowners look for liquidity and ways to monetize the pandemic surge in home prices, according to BofA Global.

It used to be that borrowers sitting on an estimated $33 trillion pile of equity built up in their homes could simply refinance and pull out cash, until the Federal Reserve’s rapid rate hikes began squelching the option.

Now, with mortgage rates above 6%, and the Fed penciling in two more rate hikes in 2023, cash-strapped homeowners have been seeking out alternatives to extract cash from their properties.

While cash-out refinances tumbled 83% in the fourth quarter of 2022 from a year before, HELOCs rose 7% and home-equity loans grew 31%, according to the latest TransUnion data.

“Borrower demand remains high, particularly given household budgets have been pressured by rising food and energy costs,” a BofA Global credit strategy team led by Pratik Gupta’s, wrote in a weekly client note.

Risky loans to subprime borrowers and home equity products helped precipitate the 2007-2008 global financial crisis and the era’s wave of devastating home foreclosures.

At the time, households had more than $1.2 trillion of home equity revolving and available credit (see chart), whereas the figure was closer to $900 billion in the first quarter of this year.

Home equity products are making a big comeback as households seek liquidity

BofA Global, New York Fed Consumer Credit Panel/Equifax

The pandemic saw home prices surge, giving a big boost to home equity levels. The Urban Institute pegged home equity in the U.S. at $33 trillion as of May, up from a post-2008 peak of about $15 trillion.

BofA analysts argued this time home equity products look different, with roughly $17 trillion of tappable equity across 117 million U.S. homeowners, and most borrowers having high credit scores and low rates.

“The vast majority of that — $14 trillion — is from the cohort of homeowners who own their homes free & clear,” Gupta’s team wrote.

Another $1.6 trillion of equity could be available from Freddie Mac and Fannie Mae borrowers, according to his team, which pegged an estimated 94% of all outstanding U.S. first-lien home mortgages now below 4% rates.

Major banks own the bulk of home equity balances (see chart), led by Bank of America Corp.

BAC,

+1.23% ,

PNC Bank

PNC,

+0.57% ,

Wells Fargo,

WFC,

-0.05% ,

JPMorgan Chase

JPM,

+0.24%

and Citizens

CFG,

+0.35% ,

according to the team, which notes several other major banks appear to have hit pause on their programs.A smaller portion of HELOCs and second-lien mortgages have been securitized, or packaged up and sold as bond deals, while nonbank lenders have been offering the products as well.

Stocks closed lower Monday, taking a pause from a recent rally, as investors monitored weekend tumult in Russia. The Dow Jones Industrial Average

DJIA,

-0.04%

was less than 0.1% lower, while the S&P 500 index

SPX,

-0.45%

was off 0.5% and the Nasdaq Composite

COMP,

-1.16%

fell 1.2%, according to FactSet.Related: The economy was supposed to cave in by now. It hasn’t — and GDP is set to rise again.

-

Wells Fargo settles shareholder lawsuit for $1 billion: report

Wells Fargo & Co. has agreed to pay $1 billion to settle a shareholders lawsuit related to its 2016 fake-accounts scandal, according to the Wall Street Journal.

Citing court documents, the Journal reported Monday night that Wells Fargo

WFC,

+3.41%

settled a class-action suit brought by shareholders who claimed bank executives overstated the bank’s progress at cleaning up its risk-management systems and governance in the wake of the scandal.In a statement to the Journal, Wells Fargo said: “While we disagree with the allegations in this case, we are pleased to have resolved this matter.”

The settlement, which still needs to be approved by a judge, likely would be the 17th-largest ever for a shareholders’ class action, the Journal reported.

Wells Fargo has paid billions in fines and settlements related to the scandal. In December, the Consumer Financial Protection Bureau ordered Wells Fargo to pay $3.7 billion as a result of alleged widespread mismanagement, and in March, a former Wells Fargo executive accused of overseeing the fake-account scheme pleaded guilty to criminal charges, agreeing to a 16-month prison term and a $17 million fine.

Wells Fargo shares are down 6% year to date and are off 8% over the past 12 months, compared to the S&P 500’s

SPX,

+0.30%

8% gain in 2023 and 3% rise over the past year. -

U.S. stocks end mostly higher as banks helped buoy S&P 500 after First Citizens deal

U.S. stocks closed mostly higher Monday, as bank shares climbed after First Citizens BancShares Inc.

FCNCA,

+53.74%

agreed to buy failed Silicon Valley Bank’s deposits and loans. The Dow Jones Industrial Average

DJIA,

+0.60%

finished 0.6% higher, while the S&P 500

SPX,

+0.16%

gained 0.2% and the technology-heavy Nasdaq Composite

COMP,

-0.47%

slipped 0.5%, according to preliminary data from FactSet. Regional and big banks helped buoy the S&P 500, with First Republic Bank

FRC,

+11.81%

among the index’s top-performing stocks, FactSet data show. Shares of major Wall Street banks such as Bank of America Corp.

BAC,

+4.97% ,

Citigroup Inc.

C,

+3.87% ,

Wells Fargo & Co.

WFC,

+3.42%

and JPMorgan Chase & Co.

JPM,

+2.87%

also saw sharp gains in Monday’s trading session. -

U.S. stocks end higher, S&P 500 books back-to-back weekly gains despite bank jitters spurred by Deutsche Bank

U.S. stocks finished Friday higher, despite a jump in the cost of Deutsche Bank’s credit-default swaps helping to reignite banking-sector worries. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite each booked weekly gains.

How stocks traded

-

The Dow Jones Industrial Average

DJIA,

+0.41%

rose 132.28 points, or 0.4%, to close at 32,237.53. -

The S&P 500

SPX,

+0.56%

gained 22.27 points, or 0.6%, to finish at 3,970.99. -

The Nasdaq Composite

COMP,

+0.31%

added 36.56 points, or 0.3%, to end at 11,823.96.

For the week, the Dow gained 1.2%, while the S&P 500 rose 1.4% and the Nasdaq advanced 1.7%, according to FactSet data. The Dow snapped two straight weeks of losses, while the S&P 500 and Nasdaq each booked back-to-back weekly gains.

What drove markets

U.S. stocks ended modestly higher Friday to notch weekly gains even as worries over the banking system lingered.

Bank concerns have cast a “heavy cloud over the market,” with investors worried about “weak links,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management, in a phone interview Friday. Ma said he expects investors will be looking to sell, potentially into any rallies, “until some of these clouds are lifted.”

Shares of Germany’s Deutsche Bank AG

DBK,

-8.53% DB,

-3.11%

dropped Friday, after the cost of insuring the bank against a credit default jumped. The bank’s credit-default swaps had risen to the highest level since late 2018, according to a Reuters report Friday.Treasury Secretary Janet Yellen announced Friday she called an unscheduled meeting of the Financial Stability Oversight Council or FSOC which was created in the wake of the 2008 financial crisis to help the government combat threats to financial stability. The FSOC issued a short statement after the market closed Friday saying that “while some institutions have come under stress, the U.S. banking system remains sound and resilient”.

“Clearly, somebody thinks there are some concerns there,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab. The problems facing European banks stem back to the era of negative interest rates, which set banks up for large losses on their bond holdings, he said.

The selloff in Deutsche Bank shares weighed on banks in the U.S. and Europe, as banking-sector fears reemerged. Shares of UBS Group

UBS,

-0.94% ,

which recently agreed to buy rival Credit Suisse Group, fell Friday.Other major European lenders, including Italy’s UniCredit S.p.A

UCG,

-4.06%

and Spain’s Banco Santander SA

SAN,

-3.00% ,

also saw their shares sink.“The thing that’s important to know about financials is there probably are banks that have problems, but there are others that don’t,” Frederick told MarketWatch during a phone interview. “People need to do some research.”

The S&P 500’s financial sector fell 0.1% Friday, according to FactSet data.

While banking-sector woes have hammered the financial sector this month, the outperformance of megacap technology stocks and other sectors have helped prop up the broader U.S. equities market. So far this month, the S&P 500 index is up less than 0.1%, FactSet data show.

Concerns about the fragility of the banking sector have been percolating following a year of the Federal Reserve’s aggressive interest rate hikes. On Wednesday, the Fed announced that it hiked its policy rate by a quarter point to a range of 4.75% to 5% while projecting it could deliver one more 25 basis-point hike in 2023.

In his first comments since the rapid collapse of Silicon Valley Bank two weeks ago, St. Louis Federal Reserve President James Bullard said Friday the latest drop in Treasury yields could help cushion some of the stress facing the banking sector.

Yields on the 2-year Treasury note

TMUBMUSD02Y,

3.779%

and 10-year Treasury note

TMUBMUSD10Y,

3.376%

each fell Friday in their third straight week of declines, according to Dow Jones Market Data. Two-year yields slid to 3.777% on Friday, the lowest level since September based on 3 p.m. Eastern time levels, while 10-year Treasury yields dropped to 3.379%, their lowest rate since January.Read: ‘Red alert recession signals.’ Gundlach expects the Fed to cut rates substantially ‘soon.’

In U.S. economic data, a report Friday on sales of durable goods showed orders fell 1% in February, largely because of waning demand for passenger planes and new cars. Meanwhile, the S&P Global Flash U.S. services-sector index rose to an 11-month high of 53.8 in March.

The role of regional banks in the U.S. economy is “huge,” said Sandi Bragar, chief client officer at wealth management firm Aspiriant, in a phone interview Friday. Bragar said she worries that recent regional bank failures will result in a pullback in lending that leads to slower economic growth and potentially a recession.

“Our stance has been to be very diversified and we have been remaining on the defensive side of things,” she said.

Within equities, that has meant holding “high-quality companies” that should be resilient in “poor economic times,” including stocks in areas such as healthcare, information technology and consumer staples, said Bragar.

Companies in focus

-

Deutsche Bank

DBK,

-8.53% DB,

-3.11%

shares dropped 8.5% but finished off lows seen when the German bank’s credit default swaps jumped without an apparent catalyst. -

Wells Fargo

WFC,

-1.04%

shares slid 1% while JPMorgan

JPM,

-1.52%

fell 1.5%, with bank stocks remaining under pressure in the wake of regional U.S. bank failures. -

Activision Blizzard

ATVI,

+5.91%

climbed 5.9% and after the U.K. Competition and Markets Authority dropped some of its concerns with the potential purchase of the company by Microsoft. Shares of Microsoft

MSFT,

+1.05%

rose slightly more than 1%.

–Steve Goldstein contributed to this report.

-

The Dow Jones Industrial Average

-

U.S. bank stocks end with solid gains as 11 banks pledge $30 billon to First Republic

U.S. bank stocks ended regular trading with solid gains on Thursday, as banks announced a $30 billion deposit capital infusion for First Republic Bank and as Treasury Secretary Janet Yellen cited the strength of the financial system.

The 11 banks confirmed a report from the Wall Street Journal and others about providing financial support for First Republic Bank FRC.

U.S….

-

Dow closes up more than 100 points as earnings season begins, stocks book best week of gains in 2 months

U.S. stocks finished higher Friday, as investors weighed a flurry of bank earnings results for the fourth quarter and fresh data on consumer sentiment and inflation expectations.

All three major benchmarks also booked their best weekly percentage gains since Nov. 11, according to Dow Jones Market Data.

How stock indexes traded

-

The Dow Jones Industrial Average

DJIA,

+0.33%

rose 112.64 points, or 0.3%, to close at 34,302.61. -

The S&P 500

SPX,

+0.40%

added 15.92 points, or 0.4%, to finish at 3,999.09. -

The Nasdaq Composite

COMP,

-1.10%

gained 78.05 points, or 0.7%, to end at 11,079.16.

For the week, the Dow rose 2%, the S&P 500 advanced 2.7% and the Nasdaq gained 4.8% gain.

Read: Goldman Sachs sees these ‘prospective’ total returns across assets in 2023

What drove markets

Major stock indexes posted their best week of gains in two months on Friday after companies began reporting their fourth-quarter results, with big banks kicking off the earnings season.

No big surprises have come from the banks’ earnings results so far, with Bank of America Corp. and JPMorgan Chase & Co. indicating a potentially mild recession this year, according to Anthony Saglimbene, chief market strategist at Ameriprise Financial.

“I think the base case for most of the market right now is that we’re going to see a mild recession,” Saglimbene said in a phone interview Friday. “I don’t think anything that was said across bank earnings today surprised investors.”

Typically, the release of megabank earnings marks the unofficial start of the U.S. earnings reporting season, and market analysts will be watching closely this quarter for indications of how America’s largest companies are bracing for an expected economic downturn driven by higher interest rates.

JPMorgan

JPM,

+2.52% ,

Bank of America

BAC,

+2.20% ,

Wells Fargo & Co.

WFC,

+3.25%

and Citigroup

C,

+1.69%

were among banks that reported their fourth-quarter earnings Friday. JPMorgan was the top performer in the Dow Jones Industrial Average, with its shares closing 2.5% higher, FactSet data show.Earnings will continue to be a “big focus” for markets this month, according to Saglimbene. “Analysts took down estimates pretty aggressively in the fourth quarter,” he said. “So the bar is pretty low for companies. We’ll see if they can hurdle past that.”

In U.S. economic data released Friday, the University of Michigan consumer sentiment index climbed in January to its highest level in nine months, as expectations for the rate of inflation one year out moderated.

“Signs that inflation has peaked and is moderating slowly kind of eases some of the anxiety that we’re going to see runaway inflation this year,” said Saglimbene.

A reading from the consumer-price index on Thursday showed U.S. inflation fell in December. Many investors are expecting that the Federal Reserve will slow its pace of interest rate hikes this year as the cost of living has cooled.

Read: Inflation slows again and clears path for slower Fed rate hikes

Stocks on Thursday pushed higher after St. Louis Federal Reserve Bank President James Bullard said the probability of a soft landing for the economy has increased due to “encouraging” inflation data.

Steve Sosnick, chief strategist at Interactive Brokers, said by phone Friday that he still favors consumer-staples stocks and companies with “more steady streams than more cyclical streams” of income. “If you’re looking at an economy that’s likely to slow down, it’s really hard for me to think that somehow ‘the cyclicals’ will be immune from the economic cycle,” he said.

Read: Why earnings season could be a ‘market-moving event’

Companies in focus

-

JPMorgan

JPM,

+2.52%

shares gained 2.5% after reporting fourth-quarter earnings and revenue before the bell that topped Wall Street expectations. The bank said a mild recession is now the “central case.” -

Wells Fargo

WFC,

+3.25%

shares rose 3.3% after reporting falling profits, as it was hit by a recent settlement and the need to build reserves. -

Bank of America

BAC,

+2.20%

shares gained 2.2% after reporting earnings per share of 85 cents last quarter, above the 77 cents a share expected by analysts. Revenue also beat expectations. However, the bank’s net interest income fell slightly below expectations despite jumping interest rates. -

Delta Air Lines Inc.

DAL,

-3.54%

reported fourth-quarter profit and revenue before the bell that beat expectations. Shares of the airline fell 3.5%. -

Tesla Inc.

TSLA,

-0.94%

shares fell after the company cut prices in the U.S. and Europe again, according to listings on the company’s website Thursday night. Tesla finished down 0.9%. -

Shares of UnitedHealth Group Inc.

UNH,

-1.23%

dropped 1.2% after the health-insurance giant shared its results. -

BlackRock Inc.

BLK,

+0.00%

shares closed about flat after the asset-management giant reported a decline in fourth-quarter results.

—Barbara Kollmeyer contributed to this article.

-

The Dow Jones Industrial Average

-

Wells Fargo, once a mortgage giant, shrinks home-lending business

Wells Fargo said late Tuesday it was shrinking its home-mortgage business, aiming to serve its own bank customers as well as people in “minority communities.”

Wells Fargo

WFC,

-0.07%

also said it was exiting the correspondent business, in which a bank serves as a third-party intermediary in transactions, and that it plans to reduce the size of its loan-servicing portfolio.The stock edged lower in the extended session after ending the regular trading day down less than 0.1%.

“These plans continue the work the company has advanced over the past three years to simplify this business,” Wells Fargo said in a statement.

Mortgage is “an important relationship product,” hence the decision to continue to be a lender to Wells Fargo bank customers as well as minority home buyers, Kleber Santos, chief executive of consumer lending, said.

“We are making the decision to continue to reduce risk in the mortgage business by reducing its size and narrowing its focus,” Santos said.

“As the largest bank lender to Black and Hispanic families for the last decade, we remain deeply committed to advancing racial equity in homeownership.”

Wells Fargo was once among the top mortgage lenders in the U.S.

Late last month, the Consumer Financial Protection Bureau ordered it to pay $3.7 billion relating to alleged mismanagement of auto loans, mortgages and deposit accounts. The bank did not admit wrongdoing as part of the settlement.

Shares of Wells Fargo have lost about 24% in the past 12 months, compared with losses of around 16% for the S&P 500 index.

SPX,

+0.70% -

Wells Fargo ordered to pay $3.7 billion for alleged mismanagement of auto loans, mortgages and deposit accounts

The Consumer Financial Protection Board on Tuesday said it is requiring Wells Fargo & Co. to pay $3.7 billion as a result of alleged widespread mismanagement of auto loans, mortgages and deposit accounts.

The CFPB said Wells Fargo “repeatedly misapplied loan payments, wrongfully foreclosed on homes and illegally repossessed vehicles, incorrectly assessed fees and interest, charged surprise overdraft fees, along with other illegal activity affecting over 16 million consumer accounts.”

Wells Fargo

WFC,

-2.01%

has been ordered to pay more than $2 billion in redress to consumers in addition to a $1.7 billion civil penalty for legal violations.“Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank,” the CFBP said.

Wells Fargo did not admit wrongdoing as part of the settlement.

Wells Fargo CEO Charlie Scharf said the settlement marks an “important milestone in our work to transform the operating practices of Wells Fargo and to put these issues behind us.”

As a result of the settlement, the CFPB will terminate a 2016 consent order, Wells Fargo said.

The settlement will also provide clarity and a path forward for termination of a 2018 consent order and will underscore that the CFPB “recognizes recent acceleration of efforts,” the bank said.

“The CFPB recognized that since 2020, the company has accelerated corrective actions and remediation, including to address the matters covered by today’s settlement,” the bank said in a statement.

Wells Fargo warned it will book an operating-loss expense of $3.5 billion, or $2.8 billion net of tax, when it reports fourth-quarter results on Jan. 13.

“Wells Fargo has made significant progress in strengthening its risk and control infrastructure over the past several years,” the bank said.

Jefferies analyst Ken Usdin said in a research note that the CFPB action marks a “positive step in the regulatory improvement process” for Wells Fargo.

But he said Wells Fargo’s plan to book a fourth-quarter operating loss of $3.5 billion does not mean that the bank’s accrual for probable and estimable losses (RPL), which it discloses every quarter, will go to zero.

“We would hope that probable and estimated losses would decline somewhat after [the fourth quarter] given the magnitude of today’s settlement,” Usdin said. “[Wells Fargo’s] separate announcement that it will book $3.5 billion of operating losses in [the fourth quarter] suggests that only some of the CFPB-specific settlement was already reserved for. But this sizable [fourth-quarter] number also means that [Wells Fargo] has been booking losses for other actions along the way that are still open-ended.”

Scharf has been CEO of Wells Fargo since late 2019 and has been focusing on bringing the megabank into regulatory compliance.

While an asset cap has remained in place for Wells Fargo since 2018 as punishment for its phony-accounts scandal, other regulatory matters are now in the rear-view mirror.

In December 2021, the Office of the Comptroller of the Currency (OCC) terminated a consent order issued in 2015 regarding add-on products that the bank sold to retail banking customers.

A CFPB consent order issued in 2016 regarding the bank’s retail practices expired in 2021, and a 2015 consent order from the OCC regarding Wells Fargo’s bank-secrecy and anti-money-laundering compliance was terminated in January 2021.

Finally, a CFPB consent order issued in 2015 regarding claims that the bank violated the Real Estate Settlement Procedures Act expired in January 2020.

Shares of Wells Fargo fell 0.3% on Tuesday. The stock is down 13.1% in 2022, compared with a 19.6% loss by the S&P 500

SPX,

+0.10% .