Morgan Stanley’s preference for defensive quality stocks has only increased since June, even as major U.S. indexes have continued to reach new highs. “After a substantial rise in volatility the past two weeks, markets (and investors) are looking for direction. Our view remains that growth is now the primary concern for equity investors, rather than inflation and rates,” Michael Wilson, the firm’s chief U.S. equity strategist, wrote in a Monday note to clients. He added that an economic soft landing is still his base case scenario. “We still think it makes sense to skew more defensively in one’s portfolio as rates fall further,” he said. Wilson highlighted his stock screen of quality and defensive names, which are long ideas with overweight ratings from the firm’s analysts that are also in the top 1,000 universe by market cap. From this screener, the analyst also added three names to his “Fresh Money Buy List”: Public Service Enterprise Group , AbbVie and Northrop Grumman . Take a look at some of Morgan Stanley’s favorite names below: AbbVie made the cut as one of the firm’s top quality and defensive stocks. The pharmaceutical company “is increasingly diversifying their drug pipeline and is able to deliver above industry average revenue and EPS growth,” Wilson wrote in the note, adding that the firm’s research suggests that biotech, more broadly, will see outperformance after the Federal Reserve’s first interest rate cut. AbbVie, which has seen sales of its once-top-selling Humira drug plummet due to competition from cheaper biosimilars, still has a couple of key immunology treatments that are witnessing strong sales growth. Analysts surveyed by FactSet have a price target on AbbVie shares that suggest just 3.2% upside from its latest close. This year, the stock is up roughly 23%. Aerospace and defense company Northrop Grumman is a firm favorite due to its long-term visibility and stability. Morgan Stanley analyst Kristine Liwag views shares as “undervalued” and reiterated her overweight rating on the stock on Friday, noting its attractive free cash flow growth profile among its peers and resilience of its product portfolio tied to the U.S. nuclear triad. Her $592 price target — which is substantially more bullish than analysts’ average price target per FactSet — suggests 19.7% upside for the stock. Facebook parent Meta Platforms is one of the few tech names listed in the firm’s screener. Morgan Stanley analyst Brian Nowak said in an Aug. 6 note that Meta’s “micro-level innovation and growth drivers will likely enable it to better navigate and grow than the others” in the consumer internet space, but that the stock’s multiple has compressed less than its peers, putting it at a greater risk if the consumer landscape slows further. Still, the firm thinks Meta is best positioned among megacap tech to navigate an uncertain macroeconomic landscape, given its artificial intelligence advances that have driven higher engagement and monetizable time on its platform. Meta shares have jumped more than 45% this year, and investors have maintained their bullish outlook on the stock after the company exceeded second-quarter earnings expectations and gave a rosy forecast. Other Morgan Stanley defensive and quality favorites include consumer discretionary names Walmart and Lowe’s .

Tag: Walmart Inc

-

5 things to know before the stock market opens Thursday

Here are five key things investors need to know to start the trading day:

1. Big new number

The S&P 500 hit a fresh new milestone on Wednesday, closing above 5,600 for the first time ever thanks to a rise in semiconductor stocks. The broad market index jumped 1.02%, and marked a seventh straight day of gains. The Nasdaq Composite, meanwhile, climbed 1.18% and also hit a new all-time high, while the Dow Jones Industrial Average joined the trend, adding 429.39 points, or 1.09%. Chip stocks led the day, with Taiwan Semiconductor rising 3.5% and Nvidia adding 2.7%, while Qualcomm and Broadcom rose about 0.8% and 0.7%, respectively. Follow live market updates.

2. Earnings season takes off

Budrul Chukrut | Lightrocket | Getty Images

Delta shares tumbled nearly 10% in premarket trading Thursday morning after the airline kicked off earnings season with a forecast that fell short of analysts’ estimates. Delta forecast record revenue for the third quarter, thanks to booming summer travel demand, but it expects to grow its flying capacity by 5% to 6% compared with last year, slower than the 8% it had expected in the second quarter. Airlines are seeing travel demand break records, but profits have lagged as the industry faces higher costs. Meanwhile, Delta also reported earnings in line with expectations and adjusted revenue of $15.41 billion, slightly less than the $15.45 billion expected, based on consensus estimates from LSEG.

3. One ring

An attendee films Samsung Electronics’ Galaxy Smart Ring during its unveiling ceremony in Seoul, South Korea, July 8, 2024.

Kim Hong-ji | Reuters

Samsung wants to put a ring on it. The tech giant launched the Galaxy Ring on Wednesday, a lightweight “smart ring” equipped with sensors designed for health monitoring 24 hours a day. The ring starts at $399.99. The announcement follows rival Apple‘s push into that space and comes as users hold onto smartphones for longer, inspiring device makers to look for add-on electronics products. Among other things, Samsung also unveiled its latest foldable smartphones, which are packed with AI features, at an event in Paris. The Samsung Galaxy Z Fold6 starts at $1,899.99 and opens like a book to have a bigger screen, while the Z Flip6 is a more traditional flip phone with a bendable screen and starts at $1,099.99.

4. Not the spot

Pavlo Gonchar | Lightrocket | Getty Images

Shares of software company Hubspot plunged 12% Wednesday after Bloomberg reported that Google parent Alphabet has shelved plans to buy the company. Alphabet expressed its interest in a deal earlier this year, “but the sides didn’t reach a point of detailed discussions about due diligence,” according to the report, which cited people with knowledge of the matter. Hubspot, which makes software that other companies use to automate marketing and reach prospective customers, has reported strong revenue growth and sales in recent quarters. An acquisition would have helped Google grow revenue from its business software and cloud infrastructure, but U.S. regulators have been pushing back on deals involving Big Tech companies.

5. Costs go up

Customers enter a Costco Wholesale Corp. warehouse store in Hawthorne, California, on June 12, 2024.

Patrick T. Fallon | Afp | Getty Images

Costco is going to cost more. The retailer said Wednesday that the price of a standard annual membership would rise by $5, to $65 from $60, in the U.S. and Canada starting Sept. 1. The higher tier of its membership, the “Executive Plan” would increase by $10, to $130 a year from $120. It’s the first time in seven years that Costco has raised its membership fees and has delayed its usual timeline of upping the price every five and a half years as consumers dealt with high inflation.

— CNBC’s Brian Evans, Leslie Josephs, Arjun Kharpal, Jordan Novet, Jennifer Elias and Melissa Repko contributed to this report.

— Follow broader market action like a pro on CNBC Pro.

-

How Walmart turned Bentonville, Arkansas into a boomtown

Walmart’s hometown of Bentonville, Arkansas has become a boomtown with many amenities you might expect to find in New York or San Francisco – fancy restaurants, craft cocktails, bike paths and a world-class art museum. The town has more cranes per capita than any other U.S. city as Walmart builds a 350-acre new headquarters. Bentonville’s population is expected to triple by 2050. But with the boom comes big-city economic challenges. CNBC’s Melissa Repko travels to Bentonville for the story.

-

Walmart-backed fintech One introduces buy now, pay later as it prepares bigger push into lending

Customers shop in a Walmart Supercenter on February 20, 2024 in Hallandale Beach, Florida.

Joe Raedle | Getty Images News | Getty Images

Walmart’s majority-owned fintech startup One has begun offering buy now, pay later loans for big-ticket items at some of the retailer’s more than 4,600 U.S. stores, CNBC has learned.

The move puts One in direct competition with Affirm, the BNPL leader and exclusive provider of installment loans for Walmart customers since 2019. It’s a relationship that the Bentonville, Arkansas, retailer expanded recently, introducing Affirm as a payment option at Walmart self-checkout kiosks.

It also likely signals that a battle is brewing in the store aisles and ecommerce portals of America’s largest retailer. At stake is the role of a wide spectrum of players, from fintech firms to card companies and established banks.

One’s push into lending is the clearest sign yet of its ambition to become a financial superapp, a mobile one-stop shop for saving, spending and borrowing money.

Since it burst onto the scene in 2021, luring Goldman Sachs veteran Omer Ismail as CEO, the fintech startup has intrigued and threatened a financial landscape dominated by banks — and poached talent from more established lenders and payments firms.

But the company, based out of a cramped Manhattan WeWork space, has operated mostly in stealth mode while developing its early products, including a debit account released in 2022.

Now, One is going head-to-head with some of Walmart’s existing partners like Affirm who helped the retail giant generate $648 billion in revenue last year.

Walmart’s Fintech startup One is now offering BNPL loans in Secaucus, New Jersey.

Hugh Son | CNBC

On a recent visit by CNBC to a New Jersey Walmart location, ads for both One and Affirm vied for attention among the Apple products and Android smartphones in the store’s electronics section.

Offerings from both One and Affirm were available at checkout, and loans from either provider were available for purchases starting at around $100 and costing as much as several thousand dollars at an annual interest rate of between 10% to 36%, according to their respective websites.

Electronics, jewelry, power tools and automotive accessories are eligible for the loans, while groceries, alcohol and weapons are not.

Buy now, pay later has gained popularity with consumers for everyday items as well as larger purchases. From January through March of this year, BNPL drove $19.2 billion in online spending, according to Adobe Analytics. That’s a 12% year-over-year increase.

Walmart and One declined to comment for this article.

Who stays, who goes?

One’s expanding role at Walmart raises the possibility that the company could force Affirm, Capital One and other third parties out of some of the most coveted partnerships in American retail, according to industry experts.

“I have to imagine the goal is to have all this stuff, whether it’s a credit card, buy now, pay later loans or remittances, to have it all unified in an app under a single brand, delivered online and through Walmart’s physical footprint,” said Jason Mikula, a consultant formerly employed at Goldman’s consumer division.

Affirm declined to comment about its Walmart partnership. Shares of Affirm climbed 2% Tuesday, rebounding after falling more than 8% in premarket activity.

For Walmart, One is part of its broader effort to develop new revenue sources beyond its retail stores in areas including finance and health care, following rival Amazon’s playbook with cloud computing and streaming, among other segments. Walmart’s newer businesses have higher margins than retail and are a part of its plan to grow profits faster than sales.

In February, Walmart said it was buying TV maker Vizio for $2.3 billion to boost its advertising business, another growth area for the retailer.

‘Bank of Walmart’

When it comes to finance, One is just Walmart’s latest attempt to break into the banking business. Starting in the 1990s, Walmart made repeated efforts to enter the industry through direct ownership of a banking arm, each time getting blocked by lawmakers and industry groups concerned that a “Bank of Walmart” would crush small lenders and squeeze big ones.

To sidestep those concerns, Walmart adopted a more arms-length approach this time around. For One, the retailer created a joint venture with investment firm firm Ribbit Capital — known for backing fintech firms including Robinhood, Credit Karma and Affirm — and staffed the business with executives from across finance.

Walmart has not disclosed the size of its investment in One.

The startup has said that it makes decisions independent of Walmart, though its board includes Walmart U.S. CEO, John Furner, and its finance chief, John David Rainey.

One doesn’t have a banking license, but partners with Coastal Community Bank for the debit card and installment loans.

After its failed early attempts in banking, Walmart pursued a partnership strategy, teaming up with a constellation of providers, including Capital One, Synchrony, MoneyGram, Green Dot, and more recently, Affirm. Leaning on partners, the retailer opened thousands of physical MoneyCenter locations within its stores to offer check cashing, sending and receiving payments, and tax services.

From paper to pixels

But Walmart and One executives have made no secret of their ambition to become a major player in financial services by leapfrogging existing players with a clean-slate effort.

One’s no-fee approach is especially relevant to low- and middle-income Americans who are “underserved financially,” Rainey, a former PayPal executive, noted during a December conference.

“We see a lot of that customer demographic, so I think it gives us the ability to participate in this space in maybe a way that others don’t,” Rainey said. “We can digitize a lot of the services that we do physically today. One is the platform for that.”

One could generate roughly $1.6 billion in annual revenue from debit cards and lending in the near term, and more than $4 billion if it expands into investing and other areas, according to Morgan Stanley.

Walmart can use its scale to grow One in other ways. It is the largest private employer in the U.S. with about 1.6 million employees, and it already offers its workers early access to wages if they sign up for a corporate version of One.

Walmart’s next card

There are signs that One is making a deeper push into lending beyond installment loans.

Walmart recently prevailed in a legal dispute with Capital One, allowing the retailer to end its credit-card partnership years ahead of schedule. Walmart sued Capital One last year, alleging that its exclusive partnership with the card issuer was void after it failed to live up to contractual obligations around customer service, assertions that Capital One denied.

The lawsuit led to speculation that Walmart intends to have One take over management of the retailer’s co-branded and store cards. In fact, in legal filings Capital One itself alleged that Walmart’s rationale was less about servicing complaints and more about moving transactions to a company it owns.

“Upon information and belief, Walmart intends to offer its branded credit cards through One in the future,” Capital One said last year in response to Walmart’s suit. “With One, Walmart is positioning itself to compete directly with Capital One to provide credit and payment products to Walmart customers.”

A Capital One Walmart credit card sign is seen at a store in Mountain View, California, United States on Tuesday, November 19, 2019.

Yichuan Cao | Nurphoto | Getty Images

Capital One said last month that it could appeal the decision. The company declined to comment further.

Meanwhile, Walmart said last year when its lawsuit became public that it would soon announce a new credit card option with “meaningful benefits and rewards.”

One has obtained lending licenses that allow it to operate in nearly every U.S. state, according to filings and its website. The company’s app tells users that credit building and credit score monitoring services are coming soon.

Catching Cash App, Chime

And while One’s expansion threatens to supersede Walmart’s existing financial partners, Walmart’s efforts could also be seen as defensive.

Fintech players including Block’s Cash App, PayPal and Chime dominate account growth among people who switch bank accounts and have made inroads with Walmart’s core demographic. The three services made up 60% of digital player signups last year, according to data and consultancy firm Curinos.

But One has the advantage of being majority owned by a company whose customers make more than 200 million visits a week.

It can offer them enticements including 3% cashback on Walmart purchases and a savings account that pays 5% interest annually, far higher than most banks, according to customer emails from One.

Those terms keep customers spending and saving within the Walmart ecosystem and helps the retailer better understand them, Morgan Stanley analysts said in a 2022 research note.

“One has access to Walmart’s sizable and sticky customer base, the largest in retail,” the analysts wrote. “This captive and underserved customer base gives One a leg up vs. other fintechs.”

-

Klarna to debut $7.99 monthly plan as buy now, pay later firm seeks new revenue sources ahead of IPO

Swedish buy now, pay later firm Klarna unveils a $7.99 monthly subscription plan called Klarna Plus

Courtesy: Klarna

Swedish fintech firm Klarna is launching a monthly subscription plan in the U.S. to lock in its heaviest users ahead of an expected initial public offering this year, the company told CNBC.

The product is set to be announced later Wednesday and will cost $7.99 per month, the Stockholm-based company said.

Users of the subscription plan, named Klarna Plus, will get service fees waived, earn double rewards points and have access to curated discounts from partners including Nike and Instacart, according to Chief Marketing Officer David Sandstrom.

Buy now, pay later services such as Klarna and Affirm have surged in popularity in recent years as more Americans rely on a new, fintech-enabled form of credit. The services typically break up a purchase into four payments.

When Klarna users shop outside the firm’s network of 500,000 retailers — at places such as Walmart, Target, Amazon and Costco — they pay $1 to $2 in transaction fees.

“The main proposition of Klarna Plus right now is that you don’t pay any service fees,” Sandstrom said. “So if you love Klarna and if you love shopping at Target and Walmart, it makes a ton of sense financially.”

Klarna’s IPO year

Klarna’s monthly plan is the latest example of a fintech player building out its offerings to boost recurring revenue. Wall Street investors tend to favor subscription revenue because of its predictability versus one-time transactions. Rival Affirm has explored its own subscription plan, though it hasn’t released one yet.

The approach is especially timely as Klarna nears an IPO that could value it at more than $15 billion, Sky News reported in November. Klarna CEO Sebastian Siemiatkowski told Bloomberg this week that a listing in the U.S., the firm’s largest market, was probably imminent.

Achieving that valuation would be a redemption of sorts for Klarna. The company was Europe’s most valuable startup before a collapse made it the poster child for so-called “down rounds” of funding. Klarna’s valuation sank 85% to $6.7 billion in 2022 as rising interest rates reined in high-flying fintech firms.

Savings sweetener

Klarna Plus could help persuade investors that the company can grow beyond its core product. The subscription, which was piloted in Utah for six months last year, is a “no brainer” for about 15% of the firm’s heaviest users, Sandstrom said. The company said it has about 37 million American customers.

“The thing we need to prove to ourselves and to the market is that we can add a new kind of revenue stream to Klarna,” Sandstrom said. “That’s something that a lot of companies have struggled to do.”

Up next for the U.S. is a high-yield savings account, Sandstrom said. Klarna Plus customers would probably earn a higher interest rate on savings than nonusers, he added.

“If you look at our business from the outside, it looks very much like ‘buy now, pay later,’” Sandstrom said. But “a world of opportunity opens up with someone you’ve helped in a financial relationship. You get to say, ‘Hey, wouldn’t it make sense to get the Klarna card?’”

Correction: This story has been updated to correct that Klarna’s subscription plan, Klarna Plus, was piloted in Utah after the company corrected information it had earlier provided.

-

How to find hidden cameras in hotels and house rentals: We tested five ways — and one's the clear winner

Hidden cameras are being found in hotel rooms, house rentals, cruise ships, and even airplane bathrooms, leaving many travelers to wonder:

“Could a hidden camera be watching me?”

Spycams, as they’re called, are getting smaller, harder to find and easier to buy.

From alarm clocks to air fresheners, water bottles and toothbrush holders, cameras come embedded in common household items that seamlessly blend with home decor. They can be purchased in shops or online, and through retailers like Amazon and Walmart.

And rather than having to retrieve the camera to obtain the recording, owners can stream live images straight to their phones, said Pieter Tjia, CEO of the Singapore-based tech services company OMG Solutions.

Even worse, voyeurs can sell the footage to porn sites, where it can be viewed thousands of times.

It’s no wonder why websites, from YouTube to TikTok, are filled with videos of people recommending simple ways to find hidden cameras.

But do they these suggestions work?

To find out, Tjia and his team hid 27 cameras in a home, and then provided CNBC with commonly recommended devices to find them.

In total, CNBC conducted five rounds of tests to see which method was the most effective.

Test 1: Using the ‘naked eye’

First, we examined the rooms using the easiest and cheapest method of all: the “naked eye” test.

My colleague, Victor Loh, went from room to room, noting that nothing seemed out of place or suspicious. After 20 minutes of searching, he found one camera embedded inside a working clock — tipped off because the time was wrong.

“I found one,” he said. “But it’s so well camouflaged.”

Cost: $0 | Cameras found: 1

Test 2: Using a mobile phone

For this round, Victor downloaded a popular app called Fing, which scans Wi-Fi networks for cameras. He also used his phone’s flashlight to make it easier to see camera lenses, a common online recommendation.

The app showed 22 devices were connected to the home’s Wi-Fi — but no cameras.

Tjia explained that when members of his team set up the cameras in the house, they also set up a second wireless network. They then connected the hidden cameras to that network, bypassing the home’s main network.

“Even if we didn’t do this, the app would show cameras are in the house, but not where they are located,” he said.

Victor had better luck using his phone’s flashlight. With it, he found three more cameras — in a Wi-Fi repeater, a shirt button and a teddy bear — the last one, like the clock, catching his eye because of something amiss.

“It’s not grammatically correct,” he said of the bear’s T-shirt, before finding a camera behind one of its eyes.

Tjia said most hidden cameras are made in China, where, ironically, they are banned.

Cost: $25/year for app subscription | Cameras found: 3

Test 3: Using a radio frequency detector

With only four of 27 cameras located, it was time to turn to handheld devices designed to find hidden cameras — like a radio frequency detector which beeps when it’s close to a spycam.

Those work when cameras are turned on and connected to Wi-Fi, which means they won’t find cameras that use SD cards to store data, said Tjia.

They are also prone to false alarms, he added, as we watched Victor search the rooms, for the third time, through a barrage of piercing beeps.

The device also had a built-in lens detector, but the beeping proved so distracting that Victor didn’t locate a single camera with this device. It even beeped when he was in parts of the house that had no cameras at all, said Tjia.

Cost: $100-$200 | Cameras found: 0

Test 4: Using a lens detector

Next up: a basic lens detector, which is cheap, portable and easy to use. The device emits infrared light, which reflects back from a camera lens as a red dot.

The problem? You must be close to the camera for it to work.

Lens detectors are a popular way to locate spycams, but CNBC only found two cameras with this one.

CNBC

Despite its popularity online, Victor found only two cameras with this device — one in an essential oil diffuser, and the other in a Wi-Fi mesh device.

Cost: $50 | Cameras found: 2

Test 5: Using an advanced lens detector

For the final test, Victor used a more sophisticated lens detector.

Resembling binoculars, it also accentuates light that is reflected from a camera lens. However, this device works from a distance, allowing Victor to see cameras from across the room. It also works in brightly-lit or dark rooms, said Tjia.

“Oh wow,” said Victor, as he located cameras — in a tissue box and leather bag, with another buried between files under a desk. But he noted he needed to look straight into the lens to see it. “The angle matters.”

In total, he found 11 cameras with this device — more than all the other cameras found in the other test rounds, combined.

Cost: $400 | Cameras found: 11

The final outcome

In total, Victor found 17 out of 27 cameras — not a bad result, but not a great one either, especially given the time he spent locating them.

“When you are traveling, you are really exhausted,” he said. “The last thing you want to do is spend … one hour scrutinizing every nook and cranny just to locate a camera.”

Social media posts about hidden cameras have increased nearly 400% in the past two years, according to the data company Sprout Social — with countless articles dedicated to finding a quick and easy solution to the growing problem.

But in this cat-and-mouse game, the cameras have the upper hand, said Tjia.

The detecting devices are getting better, but so are the cameras being hidden, he said.

-

Red Sea crisis boosts shipping costs, delays – and inflation worries

The Maersk Sentosa container ship sails southbound to exit the Suez Canal in Suez, Egypt, on Thursday, Dec. 21, 2023.

Stringer | Bloomberg | Getty Images

Attacks on ships in the Red Sea continue to push ocean freight rates higher, triggering warnings of inflation and delayed goods.

To avoid strikes by Iran-backed Houthi militants based in Yemen, carriers have already diverted more than $200 billion in trade over the past several weeks away from the crucial Middle East trade route, which, along with the Suez Canal, connects the Mediterranean Sea to the Indian Ocean.

This has created a multiple-front storm for global trade, according to logistics managers: Freight rates increasing daily, additional surcharges, longer shipping times, and the threat that spring and summer products will be late due to vessels arriving late in China as they travel the long way around South Africa’s Cape of Good Hope.

“The supply chain pressures that caused the ‘transitory’ part of inflation in 2022 may be about to return if the problems in the Red Sea and Indian Ocean continue,” said Larry Lindsey, chief executive of global economic advisory firm the Lindsey Group. “Neither the Fed nor the ECB can do anything about them and will likely ‘look through’ the inflation they cause, potentially leading to rate cuts despite somewhat heightened inflation pressures.”

The persistent violence against commercial ships drew a stern warning from the United States, Japan, the United Kingdom and nine other nations on Wednesday. “The Houthis will bear the responsibility of the consequences should they continue to threaten lives, the global economy, and free flow of commerce in the region’s critical waterways,” the countries said in a joint statement.

In the meantime, about 20% of vessel capacity isn’t being used due to a massive drop in manufacturing orders, according to industry experts. Instead, ocean carriers continue to cut their sailings while tight capacity and longer travel times are fueling rate increases.

Rates for freight traveling from Asia to northern Europe more than doubled this week to above $4,000 per 40-foot-equivalent unit (container). Asia-Mediterranean prices climbed to $5,175 per container. Some carriers have announced rates above $6,000 per 40-foot container for Mediterranean shipments starting mid-month, with surcharges ranging from $500 to $2,700 per container.

A cargo ship crosses the Suez Canal, one of the most critical human-made waterways, in Ismailia, Egypt on December 29, 2023.

Fareed Kotb | Anadolu | Getty Images

“Given the sudden upward movement of ocean freight pricing, we should expect to see these higher costs trickle down the supply chain and impact consumers as we move through the first quarter,” said Alan Baer, CEO of shipping firm OL-USA. Companies, reflecting lessons they learned during the supply chain chaos of 2021-22, will adjust prices sooner rather than later, he added.

Rates from Asia to North America’s East Coast have risen by 55% to $3,900 per 40-foot container. West Coast prices climbed 63% to more than $2,700. More shippers are expected to start avoiding the East Coast and favor the West Coast ports. Likewise, rates are on track to rise again starting Jan. 15 due to previously announced increases.

“This is a big deal as it’s been mostly the fall in goods prices that have eased the inflation strain,” Peter Boockvar, investment chief at Bleakly Financial Group, told CNBC. “And while the battles going on in the Red Sea could end at any moment if the war in Gaza ends, it’s a reminder to the Fed that they can’t get complacent with their inflation fight if they don’t want to repeat the 1970s.”

The impact of longer routes

Diversions from Egypt’s Suez Canal, which feeds into the Red Sea, are hurting capacity. Rerouting vessels around the Cape of Good Hope adds two to four weeks to a round-trip voyage, according to Honour Lane Shipping (HLS). Ocean alliances need more ships on each Asia-East Coast route to maintain an efficient network schedule.

“Some 25%-30% of global container shipping volumes pass through the Suez Canal (mainly on Asia-Europe trade), and it is estimated that widespread re-routing around Africa could reduce effective global container shipping capacity by 10%-15%,” said the note. “While the disruption continues, carriers may have to reduce the number of port calls to offset the impact of longer routes.”

A grab from handout footage released by Yemen’s Huthi Ansarullah Media Centre on November 19, 2023, reportedly shows members of the rebel group during the capture of an Israel-linked cargo vessel at an undefined location in the Red Sea. Israeli ships are a “legitimate target”, Yemen’s Huthi rebels warned on November 20, a day after their seizure of the Galaxy Leader and its 25 international crew following an earlier threat to target Israeli shipping over the Israel-Hamas war.

– | Afp | Getty Images

The longer travel time could also delay the arrival of spring goods that are traditionally picked up before the Chinese Lunar New Year, set for February, when factories close and employees go on vacation. Containers that were supposed to arrive on the East Coast in December are arriving now, according to logistics managers. Items include spring and summer clothing, pools, pool supplies, Easter products, patio furniture, and home and garden products.

North American East Coast ports in December, amid the Houthi attacks, “lost” several calls, which were instead pushed into January, according to data from maritime intelligence firm eeSEA. The vessels will instead arrive in January and February.

So vessels are not only late in dropping off their containers to their final destinations, they’re also late getting back to Asia to load containers. As a result, HLS is urging clients to book their container space four to five weeks in advance to secure a spot.

It’s reminiscent of what freight companies experienced during Covid’s earlier days.

“We used to book out four to six weeks out during Covid,” said OL-USA’s Baer. “During Covid, we had way too much cargo, and all the ships were full, so you have to forecast your bookings out. Now while there is vessel capacity, the vessels are late, so it’s a scramble to make sure you get your container on that vessel.”

Ocean carriers are also expanding land-freight services for those using West Coast ports intead of the East Coast. This is a similar strategy deployed by Hapag-Lloyd during Covid, when it offered clients service across land to the West Coast from the East Coast because it was faster.

These diversions in trade will create opportunities for West Coast railroad companies, Union Pacific and BNSF, a subsidiary of Berkshire Hathaway. The extra containers will also be a boost for trucking companies that also service those ports.

“Coming out of the holiday break we are seeing significant volumes being routed from Asia to the U.S. West Coast and via the Panama Canal to the U.S. East Coast to avoid the Suez Canal,” said Paul Brashier, vice president of drayage and intermodal at ITS Logistics. “We are forecasting this activity to increase as we get closer to the Lunar New Year peak season.”

-

Inflation has created a dark cloud over how everyday Americans view the economy

Grocery items are offered for sale at a supermarket on August 09, 2023 in Chicago, Illinois.

Scott Olson | Getty Images

When Kyle Connolly looks back at 2023, she sees it as a year defined by changes and challenges.

The newly single parent reentered the workforce, only to be laid off from her job at a custom home-building company in November. At the same time, Connolly has seen prices climb for everything from her Aldi’s grocery basket to her condo’s utility costs.

In turn, she’s cut back on everyday luxuries like eating out or going to the movies. Christmas will look pared down for her three kids compared to years prior.

“I’ve trimmed everything that I possibly can,” said the 41-year-old. “It sucks having to tell my kids no. It sucks when they ask for a little something extra when we’re checking out at the grocery store and having to tell them, ‘No, I’m sorry, we can’t.’”

Economic woes have seemed more apparent within her community in Florida’s panhandle. Connolly has noticed fewer 2022 Chevy Suburbans on the road, replaced by older Toyota Camry models. The waters typically filled with boats have been eerily quiet as owners either sold them or tried to cut back on gas costs. Fellow parents have taken to Facebook groups to discuss ways to better conserve money or rake in extra income.

The struggles among Connolly and her neighbors highlight a key conundrum puzzling economists: Why does the average American feel so bad about an economy that’s otherwise considered strong?

‘High prices really hurt’

By many accounts, it has been a good year on this front. The annualized rate of price growth is sliding closer to a level preferred by the Federal Reserve, while the labor market has remained strong. There’s rising hope that monetary policymakers have successfully cooled inflation without tipping the economy into a recession.

Yet closely watched survey data from the University of Michigan shows consumer sentiment, while improving, is a far cry from pre-pandemic levels. December’s index reading showed sentiment improved by almost 17% from a year prior, but was still nearly 30% off from where it sat during the same month in 2019.

“The main issue is that high prices really hurt,” said Joanne Hsu, Michigan’s director of consumer surveys. “Americans are still trying to come to grips with the idea that we’re not going back to the extended period of low inflation, low interest rates that we had in the 2010s. And that reality is not the current reality.”

Still, Hsu sees reason for optimism when zooming in. Sentiment has largely improved from its all-time low seen in June 2022 — the same month the consumer price index rose 9.1% from a year earlier — as people started noticing inflationary pressures recede, she said.

One notable caveat was the drop in sentiment this past May, which she tied to the U.S. debt ceiling negotiations. The 2024 presidential election has added to feelings of economic uncertainty for some, Hsu said.

Inflation vs. the job market

Continued strength in the labor market is something economists expected to sweeten everyday Americans’ views of the economy. But because consumers independently decide how they feel, jobs may hold less importance in their mental calculations than inflation.

There are still more job openings than there are unemployed people, according to the latest data from the Bureau of Labor Statistics. Average hourly pay has continued rising — albeit at a slower rate than during the pandemic — and was about 20% higher in November than it was in the same month four years ago, seasonally adjusted Labor Department figures show.

That’s helped boost another widely followed indicator of vibes: the Conference Board’s consumer confidence index. Its preliminary December reading was around 14% lower than the same month in 2019, meaning it has rebounded far more than the Michigan index.

While the Michigan index compiles questions focused on financial conditions and purchasing power, the Conference Board’s more closely gauges one’s feelings about the job market. That puts the latter more in line with data painting a rosier picture of the economy, according to Camelia Kuhnen, a finance professor at the University of North Carolina.

“You think that they’re talking about different countries,” Kuhnen said of the two measures. “They look different because they focus on different aspects of what people would consider as part of their economic reality.”

A hot job market can be a double-edged sword for sentiment, Michigan’s Hsu noted. Yes, it allows workers to clinch better roles or higher pay, she said. But when those same workers put on their consumer hats, a tight market means shorter hours or limited availability at their repair company or veterinarian’s office.

Silver linings for some

Other reasons why consumers feel positively about the economy this year can only be true for certain — and often wealthier — groups, economists say.

UNC’s Kuhnen said Americans would be pleased if they are homeowners seeing price appreciation. Another reason for optimism: If they had investments during 2023’s stock market rebound.

Without those cushions, people on the lower end of the income spectrum may feel more of a pinch as higher costs bite into any leftover savings from pandemic stimulus, Kuhnen said. Elsewhere, the resumption of student loan payments this year likely also caused discontent for those with outstanding dues, according to Karen Dynan, a Harvard professor and former chief economist for the U.S. Treasury Department.

Marissa Lyda moved with her husband and two kids to Phoenix from Portland earlier this year, in part due to lower housing costs. With profits from the value gained on the property she bought in 2019, her family was able to get a nicer house in the Grand Canyon state.

Yet she’s had to contend with an interest rate that’s more than double what she was paying on her old home. Though Arizona’s lower income tax has fattened her family’s wallet, Lyda has found herself allocating a sizable chunk of that money to her rising grocery bill.

The stay-at-home mom has switched her go-to grocer from Kroger to Walmart as value became increasingly important. She’s also found herself searching harder in the aisles for store-brand food and hunting for recipes with fewer ingredients.

Her family’s financial situation certainly doesn’t feel like it reflects the economy she hears experts talking about, Lyda said. It’s more akin to the videos she sees on TikTok and chatter among friends about how inflation is still pinching pocketbooks.

“I look at the news and see how they’re like, ‘Oh, best earnings, there’s been great growth,’” the 29-year-old said. “And I’m like, ‘Where’s that been?’”

‘Just trying to hold on’

Economists wonder if social media discourse and discussion about a potential recession have made Americans think they should feel worse about the economy than they actually do. That would help explain why consumer spending remains strong, despite the fact that people typically tighten their belts when they foresee financial turmoil.

There’s also a feeling of whiplash from the runaway inflation that snapped a long period of low-to-normal price growth, said Harvard’s Dynan. Now, even as the annual rate of inflation has cooled to more acceptable levels, consumers remain on edge as prices continue to creep higher.

“People are still angry about the inflation we saw in 2021 and, in particular, 2022,” Dynan said. “There’s something about the salience of … the bill for lunch that you see every single day that just maybe resonates in your brain, relative to the pay increase you get once a year.”

Federal Reserve Board Chairman Jerome Powell speaks during a press conference following a closed two-day meeting of the Federal Open Market Committee on interest rate policy at the Federal Reserve in Washington, U.S., December 13, 2023.

Kevin Lamarque | Reuters

Another potential problem: The average person may not completely understand that some inflation is considered normal. In fact, the Federal Reserve, which sets U.S. monetary policy, aims for a 2% increase in prices each year. Deflation, which is when prices decrease, is actually seen as bad for the economy.

Despite these quandaries, economists are optimistic for the new year as it appears increasingly likely that a recession has been avoided and the Fed can lower the cost of borrowing money. For everyday Americans like Connolly and Lyda, inflation and their financial standing will remain top of mind.

Lyda has cut treats like weekly Starbucks lattes out of the budget to ensure her family can afford a memorable first holiday season in their new home. In 2024, she’ll be watching to see if the Fed cuts interest rates, potentially creating an opportunity to refinance the loan on that house.

“You just have to realize that every season of life may not be this huge financial season,” Lyda said. “Sometimes you’re in a season where you’re just trying to hold on. And I feel like that’s what it’s been like for most Americans.”

-

Online shopping for holidays exceeds 2020 pandemic high, CNBC economic survey shows

Click. Click. Gift.

After a two-year slump below its pandemic high, online shopping made a comeback this holiday season. The CNBC All-America Economic Survey finds 57% of Americans naming online shopping as their top one or two destinations for Christmas gifts.

In 2006, online shopping accounted for just 18% of responses. It hit an all-time high in 2020, at the height of the pandemic, when 55% responded it was the top destination. It scaled back to 51% last year, holding on to some but not all of its pandemic gains. But this year, hit yet another all-time high.

The survey of 1,002 Americans throughout the country was conducted Dec. 8 through 12 and has a margin of error of +/-3.1%.

The reason for the surge is unclear but a look at those spending more online this year suggests it could center around a search for bargains to combat inflation. Among those groups spending more online are women 50 and older who as a group reported more frugal holiday spending plans than average and are more concerned about inflation and the overall condition of the economy. Still, the group shops less online than younger women aged 18-49. Also spending more online this year than last are those with incomes below $30,000 and those who plan to spend only $200 on gifts, far below the $1,300 average.

“We know from the rest of the data that inflation is a major factor in why people are spending less and more,” said Micah Roberts of Public Opinion Strategies, the Republican pollster for the survey. “Everything costs more, so you’re going to have to spend more to buy it.”

Amazon top destination

While groups differ over how much they spend online, where they spend is fairly uniform: Amazon. Once again — and continuously since the question was first asked six years ago — Amazon is the No. 1 destination for online shopping and no one else is really close. Back in 2017, just 35% of the public said Amazon was their top online destination. Today, that percentage has risen to a commanding 74%, unchanged from last year but below its 2019 high.

The only other competitor, Walmart, has made some modest gains, rising to 16% from 12% last year and from just 4% in 2017. Specialty goods stores, like Etsy and local store websites, also gained from 8% to 14%.

Americans say they plan to use debt to pay for gifts this year in about the same percentages as prior, with 31% saying they will carry a balance from holiday spending, up 1 point from last year. But 10% say they will use “buy-now-pay-later” plans.

The full survey can be viewed here.

-

Bad news for Black Friday: Retailers cast doubt on holiday shopping with cautious guidance

A person walks past a sales advertisement at Saks Off 5th department store ahead of the Thanksgiving holiday sales in Washington, D.C., on Nov. 21, 2023.

Saul Loeb | AFP | Getty Images

There’s a dark cloud hanging over Black Friday.

A slew of retailers have issued tepid, cautious or downright disappointing fourth-quarter outlooks over the past few weeks, casting a pall over the crucial holiday season right as they gear up for the biggest shopping day of the year.

The companies, which include everyone from luxury goods giant Tapestry to big boxer BJ’s Wholesale Club, cited a host of dynamics that led them to reduce their outlooks or issue forecasts that came in below expectations.

Some, such as Best Buy and Nordstrom, cited the uncertain state of the consumer following months of persistent inflation, while others, such as Hanesbrands, said demand is simply drying up for its basic T-shirts, socks and underwear as wholesalers look to keep inventories in check.

Even Dick’s Sporting Goods and Abercrombie & Fitch, which both raised their full-year guidance on Tuesday after strong third quarters, managed to underwhelm with their holiday forecasts.

If there’s one theme that captures the commentary, it’s caution, and while some retailers may have been overly conservative with their outlooks, the resounding lack of confidence spells trouble for the holiday quarter and raises questions about the overall health of the economy.

“Consumers are still spending, but pressures like higher interest rates, the resumption of student loan repayments, increased credit card debt and reduced savings rates have left them with less discretionary income, forcing them to make trade-offs,” Target CEO Brian Cornell told analysts on a call last week.

“As we look at recent trends across the retail industry, dollar sales are being driven by higher prices with consumers buying fewer units per trip. In fact, overall unit demand across the industry has been down 2% to 4% in recent quarters, and the industry has experienced seven consecutive quarters of declines in discretionary dollars and units,” he said.

When asked about the upcoming holiday season, Cornell said it was too soon to weigh in on early sales, saying only that the company was “watching the trends carefully.”

Ho-hum growth for holiday spend

The holiday shopping season over the past couple of years has seen outsize growth brought on by the Covid-19 pandemic, which gave consumers stimulus payments and an opportunity to pad their bank accounts while they were stuck at home and unable to travel or dine out.

In 2020, holiday spend was up 9.1% from the year prior, according to the National Retail Federation. In 2021, spend was up 12.7% year over year, and in 2022, it was up 5.4%.

As 2023 comes to a close, savings accounts dwindle and consumers continue to face inflation and high interest rates, that growth in holiday spend is expected to slow to 3% to 4%, according to the NRF. That’s consistent with the slower growth rates seen between 2010 and 2019 in the lead up to the pandemic.

The expected slowdown has led many retailers to approach the holiday season with more caution than Wall Street anticipated.

On Monday, Bank of America’s consumer team found that out of 43 retailers that issued earnings forecasts, 37, or 86%, came in light of Street expectations.

Take Walmart, for example. The retailer struck a cautious tone with its outlook, which came in below expectations, after it saw consumer spending weaken toward the end of October. Last week, it said it expects adjusted earnings per share of $6.40 to $6.48 for the year, lower than the $6.48 analysts had projected, according to LSEG, formerly known as Refinitiv.

“Halloween was good overall,” Chief Financial Officer John David Rainey said on a call with CNBC. “But in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

For some retailers, even good news wasn’t cheery enough.

Dick’s Sporting Goods raised its forecast Tuesday after posting strong top- and bottom-line beats and said it now expects full-year earnings per share of between $11.45 and $12.05, compared with the $11.27 to $12.39 range that analysts had projected, according to LSEG.

But compared to its strong third-quarter results, the outlook came off as tempered.

The retailer said it was “excited” for the holiday but couched that optimism with executives repeatedly noting they were looking forward to the things “within our control” — a refrain heard four times during the hour-long call.

“We are very excited about what we have within our control for Q4. Our products are in stock. We’ve got tremendous gifts … and the teams are pumped to deliver an amazing holiday experience,” CEO Lauren Hobart said on a call with analysts. “We’re balancing all of that with caution about the macroeconomic environment and the consumer, because we know that consumers are going through a lot right now. So, I think, we’ve been reasonably cautious in our guidance.”

— CNBC’s Melissa Repko contributed to this report.

Don’t miss these stories from CNBC PRO:

-

Walmart shares slide as retailer gives a cautious outlook about consumer spending

Atchison, Kansas. Walmart store logo with gardening products for sale.

Universal Images Group | Getty Images

Walmart on Thursday topped Wall Street’s fiscal third-quarter earnings estimates as sales rose, but the big-box retailer struck a cautious tone with its outlook after it saw consumer spending weaken at the end of the period.

The company’s shares slid more than about 8% on Thursday after they touched an all-time high the previous day. Walmart gave a slightly lower-than-expected forecast for the year as it enters the critical holiday shopping season.

The company anticipates adjusted earnings per share of $6.40 to $6.48 for the year, lower than the $6.48 analysts expect but higher than its previous range. Walmart expects consolidated net sales will rise 5% to 5.5%, also an increase from its prior range.

Inflation has also waned — and for some categories, deflation has taken hold — a trend that could help Walmart’s shoppers but hurt the company’s sales. Prices of some grocery items remain higher, but they have fallen for dairy, eggs, chicken and seafood, CEO Doug McMillon said on the company’s earnings call. He added that relief is coming for customers as they look for holiday gifts.

General merchandise prices have continued to fall, setting up the company for a turnabout. Its sales have risen in part because shoppers have had to pay higher prices for many items during a period of inflation.

“In the U.S., we may be managing through a period of deflation in the months to come and while that would put more unit pressure on us, we welcome it, because it’s better for our customers,” he said.

In a separate interview with CNBC, Chief Financial Officer John David Rainey said consumers are “leaning heavily” into major promotions as they watch their spending and search for deals. As customers hold out for lower prices, the company has seen a drop in purchases before and after a sales event.

“Our events have been strong,” he said. “We’ve been pleased with those. Halloween was good overall. But in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

At the start of the holiday quarter, however, he said sales of items including clothing picked up as holiday promotions gained momentum.

Here’s what Walmart reported for the three-month period ended Oct. 31 compared with what analysts were expecting, according to consensus estimates from LSEG, formerly known as Refinitiv:

- Earnings per share: $1.53 adjusted vs. $1.52 expected

- Revenue: $160.80 billion vs. $159.72 billion expected

In the fiscal third quarter, Walmart’s net income rose to $453 million, or 17 cents per share, compared with a loss of $1.8 billion, or 66 cents per share, in the year ago period. Walmart posted a loss in that quarter due to a settlement of opioid-related legal charges.

Revenue rose from $152.81 billion in the year-ago period. It climbed on the strength of the retailer’s grocery business, which has thrived during a period of high inflation, and digital sales.

Comparable sales, an industry metric also known as same-store sales, rose 4.9% for Walmart U.S. and at Sam’s Club, they rose 3.8% year over year.

In the U.S., shoppers both visited and spent more. Customer transactions rose 3.4% and the average ticket grew 1.5% compared with a year earlier. E-commerce sales increased 24% in the U.S. and 15% across the globe year over year.

Walmart is also making money in newer ways, such as selling ads and annual memberships to Walmart+, its answer to Amazon Prime.

Revenue for its ad business, Walmart Connect, jumped 26% from the prior-year period.

As the holidays approach, investors have bet the big-box retailer has the ingredients to drive sales, even as shoppers are more discerning. It’s the nation’s largest grocer, which helps drum up steadier foot traffic.

Shares of the company touched an all-time high Wednesday dating to when Walmart debuted on the New York Stock Exchange in August 1972. The stock closed at nearly $170 on Wednesday, up about 19% for the year. On Thursday, however, shares closed the day at $156.04.

Don’t miss these stories from CNBC PRO:

-

5 things to know before the stock market opens Friday

Here are the most important news items that investors need to start their trading day:

1. Steady as she goes

Stock futures were up Friday morning as the major indexes look for their third straight week of gains. Futures tied to the Dow Jones Industrial Average rose about 80 points, or 0.24%, while S&P 500 futures advanced 0.2%, and Nasdaq 100 futures were essentially flat. On the week, the Dow is up 1.9% through Thursday’s close, the S&P 500 is up 2.1% and the Nasdaq is up 2.3%. Follow live market updates.

2. Deflation nation

People shop in a holiday section ahead of Black Friday at a Walmart Supercenter on November 14, 2023 in Burbank, California.

Mario Tama | Getty Images News | Getty Images

According to Walmart, Christmas may come relatively cheap this year. CEO Doug McMillon said alongside the company’s quarterly earnings report that the retailer expects to see lower prices in some general merchandise and key grocery items. “In the U.S., we may be managing through a period of deflation in the months to come,” he said. “And while that would put more unit pressure on us, we welcome it, because it’s better for our customers.” Shares of the big-box retailer fell 8% on the day following the cautious outlook.

3. Order up

A Boeing 777-9 jetliner aircraft is pictured on the tarmac during the 2023 Dubai Airshow at Dubai World Central – Al-Maktoum International Airport in Dubai on November 13, 2023.

Giuseppe Cacace | AFP | Getty Images

Aircraft manufacturer Boeing racked up 295 orders across four days of the 2023 Dubai Air Show, trouncing its French rival Airbus’ 86 orders, according to company reports and third-party tallies. Each year the Middle East’s largest aviation event comes flush with jet orders. This year’s buyers showed a particular appetite for wide-body planes, CNBC’s Natasha Turak reports. Boeing’s popularity at the show represents a notable rebound after years of safety concerns.

4. Done deal

United Auto Workers members strike the General Motors Lansing Delta Assembly Plant on September 29, 2023 in Lansing, Michigan.

Bill Pugliano | Getty Images

Union workers at General Motors ratified a labor deal with the United Auto Workers, according to results posted by the union Thursday. With tallies from all local chapters in, the agreement received 54.7% of the nearly 36,000 votes cast. It came after a contentious final few days of voting, with several major plants rejecting the contracts. But enough workers at smaller facilities voted in support to seal up ratification. Union workers at Ford Motor and Stellantis are still voting on similar contracts. So far, those agreements have won the support of roughly two-thirds of each automaker’s voting population.

5. Debt relief

WASHINGTON, DC – OCTOBER 04: U.S. President Joe Biden delivers remarks on new Administration efforts to cancel student debt and support borrowers at the White House on October 04, 2023 in Washington, DC.

Kevin Dietsch | Getty Images

More student loan borrowers are walking away from their debt in bankruptcy proceedings — the result of a policy change by the Biden administration intended to help people who were saddled with debt and struggling financially. Ten months after the policy change, student loan borrowers have filed more than 630 bankruptcy cases, marking a “significant increase” from recent years, officials with the Biden administration said. “Our efforts have made a real difference in borrowers’ lives,” Associate Attorney General Vanita Gupta said Thursday. Outstanding student debt in the U.S. exceeds $1.7 trillion. Economists have said the swelling debt load could slow the U.S. economy.

– CNBC’s Brian Evans, Melissa Repko, Natasha Turak, Michael Wayland and Annie Nova contributed to this report.

— Follow broader market action like a pro on CNBC Pro.

-

Walmart’s shareholders may have anticipated today’s selloff — if they’d been watching its bonds

Shareholders of Walmart Inc. may have had an inkling of today’s stock selloff if they had been watching the performance of its bonds over the last two weeks.

The bonds have seen net selling even as spreads have tightened, according to data solutions company BondCliQ Media Services.

The same is true for Costco Wholesale Corp.

COST,

-3.12% ,

as the company’s stock fell in sympathy with Walmart on Thursday. That was after Walmart

WMT,

-8.11%

Chief Executive Doug McMillon said he expects to see a U.S. deflation trend in the coming months.McMillon was the first retail executive to raise the specter of deflation on an earnings call this season so far.

For more, read: Walmart’s stock on pace for largest daily percentage decline in over a year after earnings

The comment came after the retail giant posted better-than-expected third-quarter earnings, but offered per-share earnings guidance that was below consensus, sending the stock down more than 7%.

The following charts show what’s been happening with Walmart and Costco bonds in the run-up to today’s numbers.

Bondholders tend to be keenly focused on a company’s underlying financials and closely watched metrics such as cash flow to ensure it can cover interest payments.

That’s because, by buying corporate bonds, they are effectively lending money to a company for a set term and want to be sure they will get their full investment back once they mature. Shareholders tend to be more tuned into daily stock-price movements.

Bonds of Walmart and Costco Wholesale by maturity bucket. Source: BondCliQ Media Services

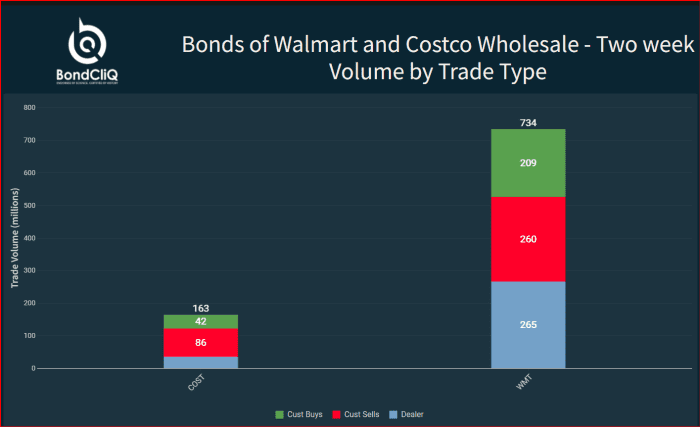

The following chart shows the two-week volume for the bonds by trade type.

Bonds of Walmart and Costco Wholesale — two-week volume by trade type. Source: BondCliQ Media Services

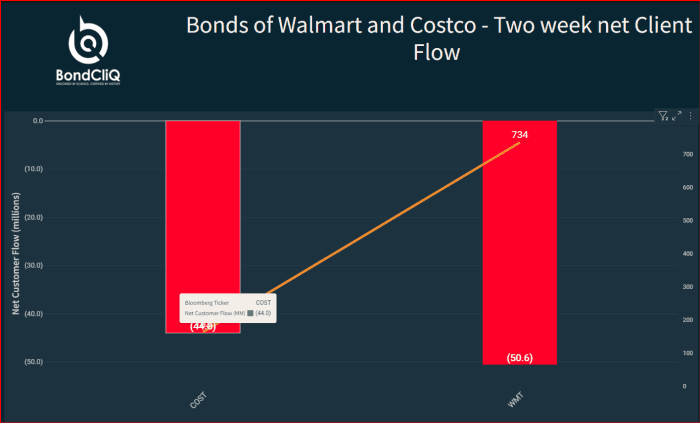

The next chart focuses on two-week client flows, showing net selling for both issuers over the period.

Bonds of Walmart and Costco – two-week net client flow. Source: BondCliQ media Services

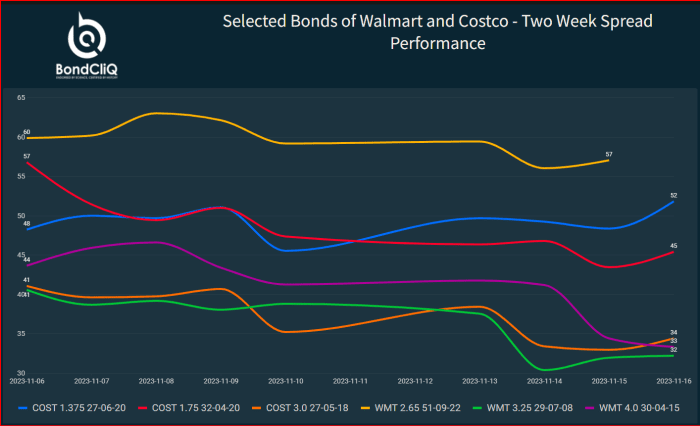

The selling has come as spreads have been tightening, as the next chart illustrates.

Select bonds of Walmart and Costco – two-week spread performance. Source: BondCliQ Media Services

Walmart’s numbers come after other retailers this week said they are seeing signs of pushback from their customers, especially when it comes to big-ticket items.

That was the message from Target Corp.

TGT,

-1.00%

on Wednesday, with that company’s sales number lagging consensus. Chief Executive Brian Cornell the company saw soft industry trends in discretionary categories, as well as higher inventory shrink.See also: Target CEO says consumers are still spending, but sees pressure on discretionary items

On Tuesday, Home Depot Inc.

HD,

-0.79%

said its customers were avoiding big-ticket items.“The third quarter was in line with our expectations – similar to the second quarter, we saw continued customer engagement with smaller projects and experienced pressure in certain big-ticket, discretionary categories,” said Home Depot CEO Ted Decker, during a conference call to discuss the results.

For more, see: Home Depot CEO says 2023 ‘a period of moderation’ in home improvement spending

Costco’s stock was down 2.5%, while Home Depot was down 0.7% and Target was down 0.2%.

The SPDR S&P Retail exchange-traded fund

XRT

was down 3% and has gained 2% in the year to date, while the S&P 500

SPX

has gained 17%.