[ad_1]

Ethereum (CRYPTO: ETH) co-founder Vitalik Buterin once revealed that his decision to leave college wasn’t a planned move driven by conviction, but a reaction to realities he faced at the time.

In an essay titled “The End of My Childhood” from 2024, Buterin reminisced about his early days in the cryptocurrency world and how he was drawn to leadership roles.

Buterin said he intended to pursue a paid internship at blockchain company Ripple (CRYPTO: XRP) in 2013. At the time, he was enrolled in the University of Waterloo in Canada. However, due to complications with his U.S. visa, he found himself working on Bitcoin Magazine, a print publication he had co-founded earlier.

Don’t Miss:

By the end of August that year, Buterin chose to extend his vacation by a year to “spend more time exploring the cryptocurrency world.”

Then the Bitcoin Miami Conference happened, which changed his life forever.

“Only in January 2014, when I saw the social proof of hundreds of people cheering on my presentation introducing Ethereum at BTC Miami, did I finally realize that the choice was made for me to leave university for good,” Buterin said.

Trending: It’s no wonder Jeff Bezos holds over $250 million in art — this alternative asset has outpaced the S&P 500 since 1995, delivering an average annual return of 11.4%. Here’s how everyday investors are getting started.

The cryptocurrency mogul stated that the decision to drop out wasn’t a “big, brave step done out of conviction” and that most of his decisions in Ethereum involved responding to other people’s pressures and requests.

Buterin started building Ethereum, an alternative to the Bitcoin (CRYPTO: BTC) blockchain, with broader use cases in decentralized finance. In 2015, he and his team, including Charles Hoskinson, co-founder of Cardano (CRYPTO: ADA), deployed the Ethereum blockchain.

Today, it’s the largest blockchain for decentralized finance, with over $54 billion in total value locked according to DeFiLlama. Moreover, its native token, ETH, is the second-largest cryptocurrency by market capitalization.

Read Next:

Photo Courtesy: Alexey Smyshlyaev on Shutterstock.com

[ad_2]

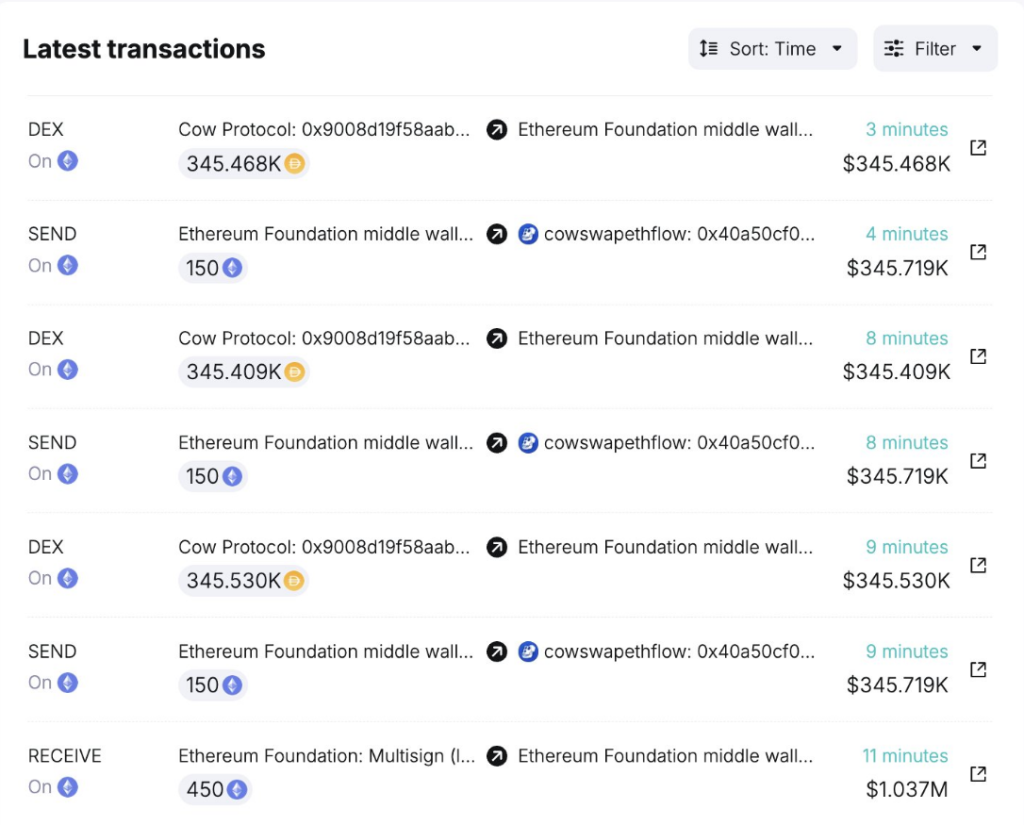

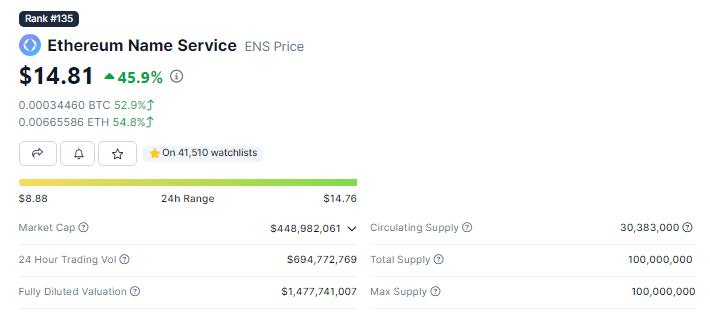

Source: Coingecko

Source: Coingecko