TOKYO (AP) — Asian shares slid Wednesday after a decline overnight on Wall Street and disappointing China growth data, while Tokyo’s main benchmark momentarily hit another 30-year high.

Japan’s benchmark Nikkei 225

NIY00,

reached a session high of 36,239.22, but reverted lower, last down 0.3% to 35,477. The Nikkei has been hitting new 34-year highs, or the best since February 1990 during the so-called financial bubble. Buying focused on semiconductor-related shares, and a cheap yen helped boost exporter issues.

Don’t miss: Wall Street firms catch up to Buffett enthusiasm on Japan as Nikkei keeps hitting records

Hong Kong’s Hang Seng

HK:HSCI

tumbled 4% to 15,220.72, with losses building after data showed China hitting its economic growth target of 5.2% for 2023, surpassing government expectations, but short of the 5.3% some analysts expected. The Shanghai Composite

CN:SHCOMP

shed 2% to 2,833.62.

Read on: China hit its economic-growth target without ‘massive stimulus,’ boasts Premier Li Qiang

Australia’s S&P/ASX 200

AU:ASX10000

slipped 0.2% to 7,401.30. South Korea’s Kospi

KR:180721

dropped 2.4% to 2,435.90.

Investors were keeping their eyes on upcoming earnings reports, as well as potential moves by the world’s central banks, to gauge their next moves.

Wall Street slipped in a lackluster return to trading following a three-day holiday weekend.

See: What’s next for stocks as ‘tired’ market stalls in 2024 ahead of closely watched retail sales

The S&P 500

SPX

fell 17.85 points, or 0.4%, to 4,765.98. The Dow Jones Industrial Average

DJIA

dropped 231.86, or 0.6%, to 37,361.12, and the Nasdaq

COMP

sank 28.41, or 0.2%, to 14,944.35.

Spirit Airlines

SAVE,

lost 47.1% after a U.S. judge blocked its takeover by JetBlue Airways

JBLU,

on concerns it would mean higher airfares for flyers. JetBlue rose 4.9%.

Stocks of banks were mixed, meanwhile, as earnings reporting season ramps up for the final three months of 2023. Morgan Stanley

MS,

sank 4.2% after it said a legal matter and a special assessment knocked $535 million off its pretax earnings, while Goldman Sachs

GS,

edged 0.7% higher after reporting results that topped Wall Street’s forecasts.

Companies across the S&P 500 are likely to report meager growth in profits for the fourth quarter from a year earlier, if any, if Wall Street analysts’ forecasts are to be believed. Earnings have been under pressure for more than a year because of rising costs amid high inflation.

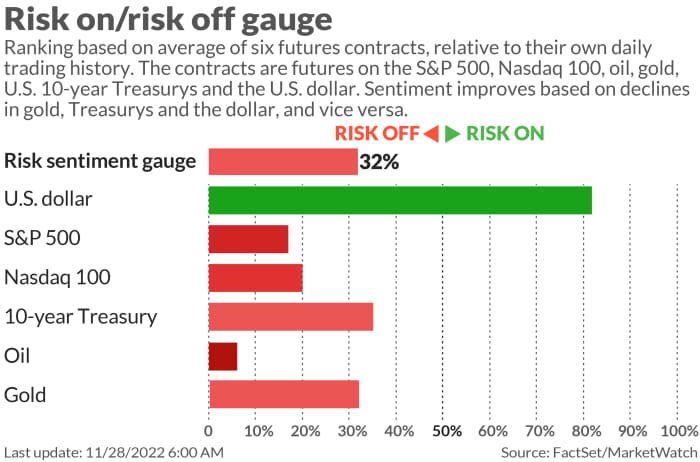

But optimism is higher for 2024, where analysts are forecasting a strong 11.8% growth in earnings per share for S&P 500 companies, according to FactSet. That, plus expectations for several cuts to interest rates by the Federal Reserve this year, have helped the S&P 500 rally to 10 winning weeks in the last 11. The index remains within 0.6% of its all-time high set two years ago.

Treasury yields

BX:TMUBMUSD10Y

have already sunk on expectations for upcoming cuts to interest rates, which traders believe could begin as early as March. It’s a sharp turnaround from the past couple years, when the Federal Reserve was hiking rates drastically in hopes of getting high inflation under control.

The Tell: No rate cuts in 2024? Why investors should think about the ‘unthinkable.’

Easier rates and yields relax the pressure on the economy and financial system, while also boosting prices for investments. And for the past six months, interest rates have been the main force moving the stock market, according to Michael Wilson, strategist at Morgan Stanley.

He sees that dynamic continuing in the near term, with the “bond market still in charge.”

For now, traders are penciling in many more cuts to rates through 2024 than the Fed itself has indicated. That raises the potential for big market swings around each speech by a Fed official or economic report.

Yields rose in the bond market after Fed governor Christopher Waller said in a speech that “policy is set properly” on interest rates. Following the speech, traders pushed some bets for the Fed’s first cut to rates to happen in May instead of March.

On Wall Street, Boeing fell to one of the market’s sharper losses as worries continue about troubles for its 737 Max 9 aircraft following the recent in-flight blowout of an Alaska Air

ALK,

jet. Boeing

BA,

lost 7.9%.

In energy trading, benchmark U.S. crude

CL00,

lost 90 cents to $71.75 a barrel. Brent crude

BRN00,

the international standard, fell 78 cents to $77.68 a barrel.

In currency trading, the U.S. dollar

USDJPY,

rose to 147.90 Japanese yen from 147.09 yen. The euro

EURUSD,

cost $1.0868, down from $1.0880.

MarketWatch contributed to this report