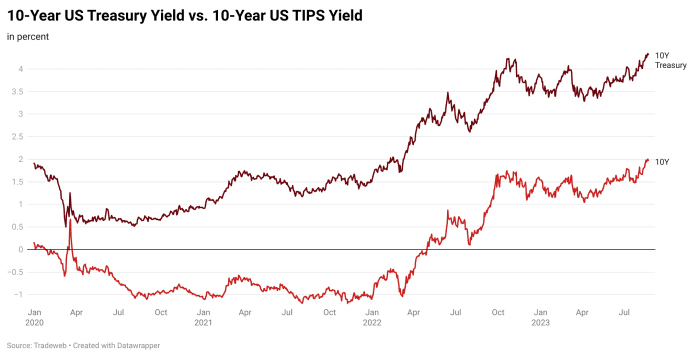

The recent rise in long-dated Treasury yields boils down to mostly one single thing, which is higher real rates resulting from changing expectations for U.S. economic growth, according to Joseph Kalish, chief global macro strategist at Ned Davis Research.

Kalish attributes 90% of the increase to that factor alone. He points out that 5-

BX:TMUBMUSD05Y,

7-

BX:TMUBMUSD07Y,

10-

BX:TMUBMUSD10Y

and 20-year Treasury yields are all up significantly since 2021-2022. On Tuesday, the 10-year rate finished at 4.327%, slightly off its almost 16-year high. Meanwhile, the 5-year Treasury yield, which reflects the intermediate part of the Treasury curve known as the belly, has trended higher as traders and investors factor in prospects for a stronger U.S. economy beyond the next few years.

Source: Tradeweb

Source: Tradeweb

Ordinarily, Treasury yields tend to rise based on a range of factors, such as the possibility of higher future inflation and investors’ demands to be compensated for that risk. This time around appears to be a bit different.

Real rates, as measured by yields on Treasury inflation-protected securities, reflect the market’s view of how the economy is performing after subtracting inflation. In other words, they present a purer read on how the U.S. is likely to do when inflation isn’t a factor. And right now, real yields are rising on the strength of recent economic data as investors hold out some hope for a soft landing, or scenario in which inflation comes down on its own without a recession or major jump in unemployment, or even no landing at all.

“Bond yields have come a long way in a short period of time,” Kalish wrote in a note distributed on Tuesday. “Nearly all of the rise has been due to higher real yields,” though an increase in the supply of U.S. government debt is also likely playing a contributing role.

As of Monday, 10- and 30-year Treasury yields

BX:TMUBMUSD30Y

had respectively jumped by 105.4 basis points and 91.7 basis points since early April, and closed at their highest levels since Nov. 6, 2007, and April 27, 2011. However, they ended lower on Tuesday at 4.327% and 4.410% as investors and traders took a break from the aggressive selloff of long-dated government debt seen over the past week.

The runup in Treasury yields has been blamed for a stock-market pullback, which has seen the S&P 500

SPX

retreat 4.4% so far in August. The large-cap benchmark remains up 14.3% so far this year.

As traders and investors await Federal Reserve Chairman Jerome Powell’s Jackson Hole address on Friday, Kalish wrote that “the market has been consistently underpricing the risk of additional rate hikes and overpricing the speed of rate cuts.” Powell will be “pleased at the progress on goods inflation, hopeful that the labor market is getting into better balance, but concerned about the economy growing faster than trend.”