[ad_1]

The Biden administration’s announcement Friday that it’s pausing liquefied natural gas export approvals sparked political backlash, drew cheers from climate activists and stoked uncertainty in energy markets, but is unlikely to see the U.S. give up its title as the world’s top LNG exporter.

The U.S. will delay its decisions on new LNG exports to non-free trade agreement countries, allowing time for the Energy Department to update the underlying analyses for LNG export authorizations, the White House said.

Those analyses are roughly five years old and “no longer adequately account for considerations” such as potential cost increases for American consumers and manufacturers or the “latest assessment of the impact of greenhouse gas emissions,” it said.

The Biden administration likely “realizes the role of LNG in foreign policy, but at the same time it needs to show the Democrat base that it is doing something for climate change,” said Anas Alhajji, an independent energy expert and managing partner at Energy Outlook Advisors, pointing out that the announcement comes during a presidential election year.

“Delaying one project or stopping it may not be a big deal, but it is a problem if it becomes a trend,” he said in emailed commentary.

Environmental groups, which have pushed for action, cheered the decision.

The 12 impacted projects in the U.S. “would spew out as much climate-warming pollution as 223 coal plants per year, and they present explosion risks to the communities where they’re located and emit other health-harming chemicals,” the Sierra Club, an environmental group, said in a statement welcoming the decision.

Top exporter

The announcement is particularly important for a nation that became the world’s biggest LNG exporter in the span of less than a decade.

The U.S. became the world’s largest LNG exporter during the first half of 2022 on the back of increases in LNG export capacity, international natural gas and LNG prices, and global demand, particularly in Europe, according to the Energy Information Administration.

Less than a decade ago, U.S. LNG exports were negligible. The country had only started exporting LNG from the Lower 48 states in 2016, the EIA said.

The country’s exports of LNG climbed to a fresh record in November 2023, with the EIA reporting domestic exports of 386.2 billion cubic feet, up from 384.4 bcf a month earlier. Exports in December 2016 were at just 41.8 bcf.

U.S. LNG exports soared after 2016.

EIA

With 90% of U.S. LNG going to non-free trade agreement destinations, withholding licensing effectively “halts project development,” John Miller, managing director, ESG and sustainability policy at TD Cowen wrote in a Friday note.

Equities

LNG equities with operating facilities likely won’t benefit from the administration’s announcement, at least not immediately, until the impacts of this pause in export approvals to non-FTA countries becomes more clear, Jason Gabelman, director, sustainability & energy transition at TD Cowen said.

U.S. companies with government approvals that have not been sanctioned, “could have a higher probability of moving forward this year, albeit modestly” as offtakers may be hesitant to sign up to new U.S. projects with LNG development getting “politicized,” he said. Among those, he pointed out approvals for proposed liquefaction units at NextDecade Corp.’s

NEXT,

Rio Grande LNG export facility project in Brownsville, Texas.

At the same time, it would not be a surprise if U.S. LNG companies pursuing growth that do not yet have non-FTA approval see downside pressure, said Gabelman.

LNG projects take around 4 years to build and any delays to project sanctions today will take “multiple years to manifest in the market,” he said.

Still, the U.S. announcement “introduces the risk of more stringent oversight that could limit new U.S. capacity” more than four years out, Gabelman said.

Companies that supply equipment to LNG liquefaction projects include Baker Hughes Co.

BKR,

and Chart Industries Inc.

GTLS,

said Marc Bianchi, a senior energy analyst at TD Cowen.

Any slowing of approval would create “overhand on order growth,” he said.

Climate change

The White House said Friday that its decision will not impact the ability of the U.S. to continue supplying LNG to its allies in the near term but also acknowledged environmental concerns.

“I think we’ve got to be clear eyed about the challenges that we face. The climate crisis is an existential crisis, and we’ve got to be, I think, really forward leaning into making sure that we’re taking that head on,” said Ali Zaidi, the White House national climate adviser, told reporters Friday.

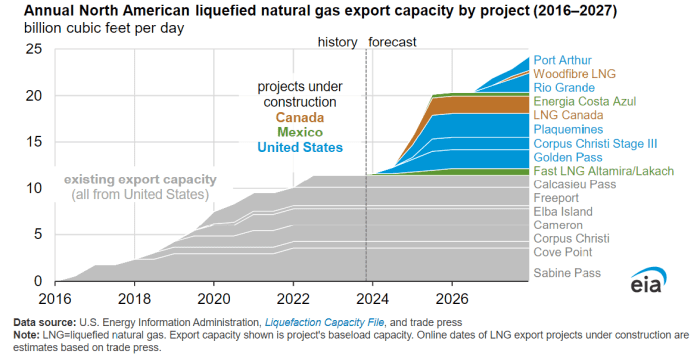

He added that given the number of approvals already completed, the number of projects under construction are set to double existing capacity with approvals beyond that set to double capacity yet again.

“So there’s a long runway here, and we’re taking a step back and thinking, OK, let’s take a hard look before that runway continues to build out,” he said.

Rob Thummel, senior portfolio manager at Tortoise, argued that U.S. LNG exports actually reduce global carbon emissions as natural gas typically “displaces coal to generate electricity in countries such as China and India.”

They also improve global energy security as U.S. natural gas is becoming Europe’s primary energy supplier, replacing Russia, he said.

In a statement Friday, Sen. Joe Manchin, a West Virginia Democrat and chairman of the U.S. Senate Energy and Natural Resources Committee, said that if the Biden administration has facts to prove that additional LNG export capacity would hurt Americans, it needs to make that information public. But if the pause is “another political ploy to pander to keep-it-in-the-ground climate activists,” he said he would “do everything in my power to end this pause immediately.

Manchin plans to hold a hearing on the decision in the coming weeks.

Market impact

The U.S. decision to delay new LNG export permits is unlikely to have an impact on domestic natural-gas supplies or prices, said Energy Outlook Advisors’ Alhajji.

Still, the EIA noted in its Annual Energy Outlook released in March of last year that it remains uncertain as to how LNG export capacity will affect domestic prices, consumption and supply.

LNG prices and the rate at which new LNG export terminals can be constructed help determine LNG export volumes, the EIA said, and higher LNG exports can result in upward pressure on U.S. natural-gas prices, while lower U.S. LNG exports can pressure prices.

On Friday, natural gas for February delivery

NG00,

NGG24,

settled at $2.71 per million British thermal units, up 7.7% for the week.

Meanwhile, the U.S. is likely to keep its position as the world’s top LNG exporter, according to Tortoise’s Thummel.

The U.S. is the currently the largest LNG exporter at almost 12 bcf per day, with Qatar coming in second, he said.

Qatar is expanding its LNG export capacity and is expected to have the ability to export almost 20 bcf per day by 2028, he said. The EIA reported recently that Qatar has averaged 10.3 bcf per day in exports during the last 10 years.

That would mark sizable growth. But the EIA reported in November that LNG export capacity from North America is likely to more than double from around 11.4 bcf per day to 24.3 bcf per day by the end of 2027.

The EIA said North America’s LNG export capacity is likely to more than double by 2027.

EIA

Given expected growth in U.S. LNG export capacity, the U.S. is likely to “remain the largest exporter of LNG in the world” despite the U.S. announcement, said Thummel.

—Victor Reklaitis contributed.

[ad_2]

Source link