On the surface stocks just seem to be trading calmly in a trading range. Under the surface things are setting up for continuation of the bear market which is why UBS now predicts market bottom around 3,200 for the S&P 500 (SPY). Get 40 year investment veteran, Steve Reitmeister’s, updated market outlook, trading plan and top picks to profit even as stocks head lower.

shutterstock.com – StockNews

The S&P 500 (SPY) is virtually frozen week over week. But don’t let that calm exterior fool ya’. There has been a serious spike in volatility since the Fed meeting.

What does it mean?

In a word…NOTHING!

If you are interested in a deeper explanation, with a trading plan for what comes next, then keep on reading this week’s edition of Reitmeister Total Return commentary.

Market Commentary

In last week’s commentary I was preparing folks for the Fed’s Wednesday announcement. Here were the key points that proved to be quite true:

“Let’s start with the Fed’s game plan as clearly spelled out in Chairman Powell’s Jackson Hole speech in August:

- This is a long-term battle to get inflation back to 2% target

- Do NOT expect lower Fed rates through 2023

- Expect “economic pain” which was further described as below trend growth and a weakening of employment.

Now let’s remember that this speech quickly sobered up investors who were enjoying a 18% summer rally up to 4,300. A month later we were making new lows below 3,600.

The Fed cherishes clarity and consistency in their communication. And thus, I say that any investor who thinks there will be a meaningful change in policy announced Wednesday, only a couple months after the Jackson Hole speech, is smoking something that is still quite illegal.

Now we get down to the tricky part. That being to determine which is the more likely scenario going forward.

Scenario 1: Inflation moderates sooner than expected leading to less total Fed intervention and creation of soft landing for economy. In this case, it is not unreasonable to say that we have reached market bottom and new bull market emerging.

Scenario 2: We have already opened up Pandoras box with the economy. Once the wheels are in motion to move towards recession, then the economy can go through a vicious cycle that grinds lower and lower. In this case the bear market is still in play with likely bottom closer to 3,000.

Which scenario is right?

I believe Scenario 2 is much more likely and why I remain bearish. However, Scenario 1 is a possible outcome that needs to be monitored closely.”

(End of 10/28/22 Commentary)

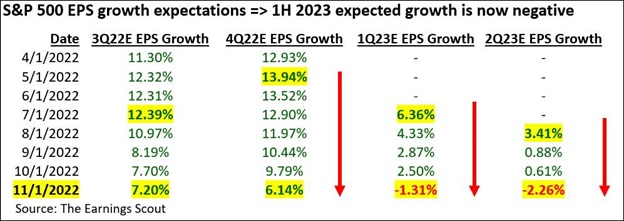

Now let’s remember the key point made by Chairman Powell on Wednesday. That being the window to create a soft landing has narrowed. That statement was the nail in the coffin for stocks as the S&P 500 (SPY) went screaming lower by -2.50% on the session.

Therefore Scenario 1 of a soft landing is even less likely than I stated last week and therefore the bearish Scenario 2 is that much more likely.

None of the news since then has been a positive for stocks including:

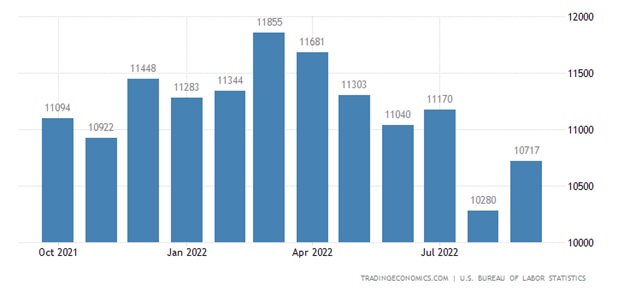

- Slew of large layoffs from leading tech companies like Twitters, Meta, Peleton, Ford, Snap, Wayfair, Robinhood. The list is much longer. Read more here if you can stomach it.

- PMI Composite Index for October ends at 48.2 down from 49.5. Even worse is the Services component at 47.8. (Under 50 = contraction).

- NFIB Small Business Optimism Index drops to 3 month low of 91.3 (below 100 is bad news). Here is the key line from NFIB Chief Economist, Bill Dunkelberg: “Owners continue to show a dismal view about future sales growth and business conditions, but are still looking to hire new workers.”

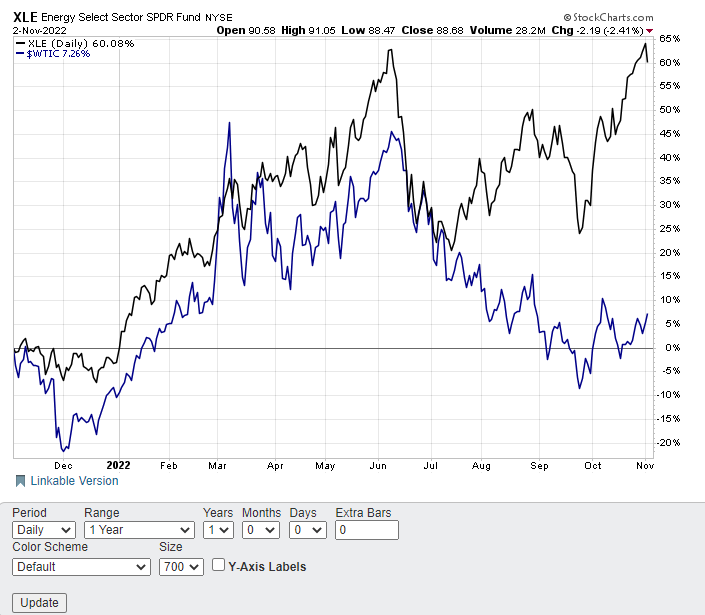

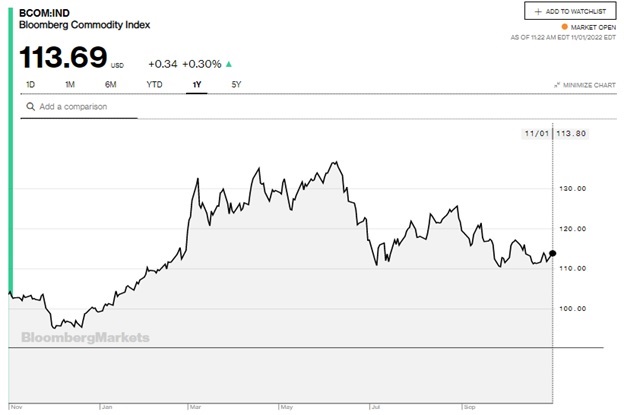

- Commodity prices, especially energy, have spiked once again not helping the inflation picture. See that here.

Reity, if all of this is true…then why are stocks not falling farther, faster?

Because that is not how the market works.

Even during the most raging bull market there are countless pullbacks and corrections before stocks make their next leap forward. That is no different with a bear market. Just everything is 180 degrees in the opposite direction.

Meaning that during bear markets we have tremendous drops followed by rip roaring rallies followed by the next drop to new lows. The sooner you are comfortable with this pattern, the easier it will be to ride out the highs and lows.

So at this stage the price movements are just noise and nonsense. Quite likely investors are awaiting the next obvious catalyst. I suspect that will come on the employment front that has been a bit too robust for investors to fully fret a looming recession.

Simply these newly announced layoffs are just the tip of the iceberg that starts the souring of the employment picture. Once that negative trend gets a foothold, investors know it will only get worse.

That is when we likely start the next leg lower for stock prices. First retesting the recent lows just under 3,600. And after that quite a bit lower.

Remember 34% is the average bear market decline. That equates to 3,180 and probably explains why UBS recently talked about market bottom around 3,200.

What will be the lowest price we reach? And when?

Unknown and unknowable at this time. Yet, I am confident predicting much lower than we are now…and probably another 3-6 months until that final capitulation before the next bull market begins.

As such, keep your bearish bias in place with trading strategies to generate profits as stocks head lower.

What To Do Next?

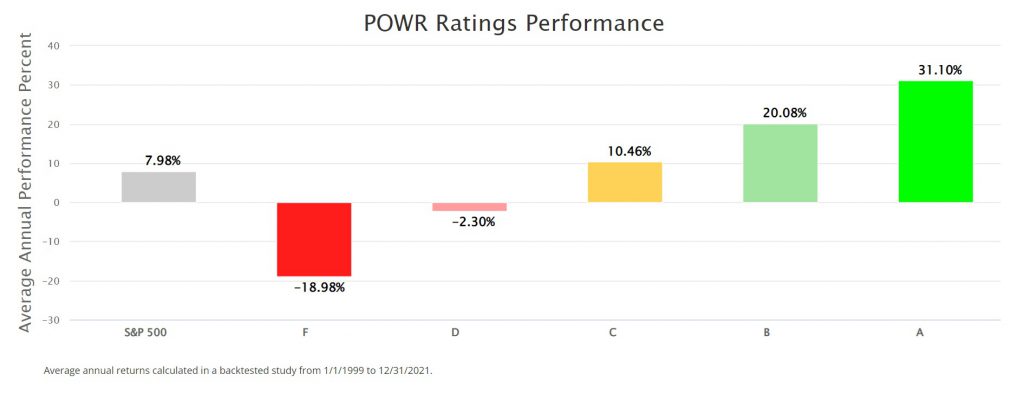

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a robust gain for investors as the market tanked.

And now is great time to load back up as we make even lower lows in the weeks and months ahead.

If you have been successful navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next…then do consider getting my updated “Bear Market Game Plan” that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares fell $0.10 (-0.03%) in after-hours trading Tuesday. Year-to-date, SPY has declined -18.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post The Calm Before the NEXT Stock Storm appeared first on StockNews.com

Steve Reitmeister

Source link