Bulls had to slow their roll on Tuesday as the immediate +3.5% rally was shaved by 80% into the close. Why did the rally fritter away? And what does it mean next for the stock market (SPY) going forward? 40 year veteran Steve Reitmeister shares his timely market outlook, trading plan and 8 top picks to generate gains in the weeks ahead.

shutterstock.com – StockNews

It felt like every trader on earth hit the buy button at 8:30am ET Tuesday morning as the softer than expected CPI report came out. This led to a shocking +3.5% surge in stock futures. If that held up it would have put the S&P 500 all the way up at 4,130.

But that didn’t hold up…neither did the recent high of 4,100…neither did the 200 day moving average at 4033…instead stocks only closed up modestly higher at 4,019.

Why did the rally fritter away? And what does it mean next for the bull/bear battle going forward?

That will be the focus of this week’s Reitmeister Total Return commentary.

Market Commentary

First, and foremost a reminder to watch my “2023 Stock Market Outlook” if you have not already. That’s because it covers the following vital topics:

- Why 2023 is a “Jekyll & Hyde” year for stocks

- 5 Warnings Signs the Bear Returns in Early 2023

- 8 Trades to Profit on the Way Down

- Plan to Bottom Fish @ Market Bottom

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

Watch Now: “2023 Stock Market Outlook” >

The above outlook provides an important backdrop in which to discuss all new information including the CPI report from Tuesday morning. Assuming you have watched it already…then let’s pick up the story from there.

Yes, the Consumer Price Index (CPI) came in softer than expected this morning (7.1% yearly increase vs. 7.3% expected). And yes, this softer than expected trend is happening more and more often.

Now the wakeup call.

7.1% is not the same as 2% target (for those with who did poorly in math class).

Also the Producer Price Index last week was higher than expected. And that is the leading indicator of where CPI will be in the future. That’s because these are the input prices for manufactures and service providers which shows up in their offerings down the road. Meaning this softer than expected read may give way to higher readings in the future given the foreshadowing in PPI.

On top of that many of the forms of “sticky” inflation remain, well…STICKY.

Things like wages and rents are still too hot. The former issue of high wage inflation was on display in the 2X higher than expected monthly increase for wages found in the Government Employment Situation report back on 12/5…and helped spark a 4% selloff the following week.

Think of it this way…CPI looks backwards and PPI looks forward. So which is more important? (he asks rhetorically).

Yes, PPI. And that is telling you quite clearly that problem of high inflation is far from solved.

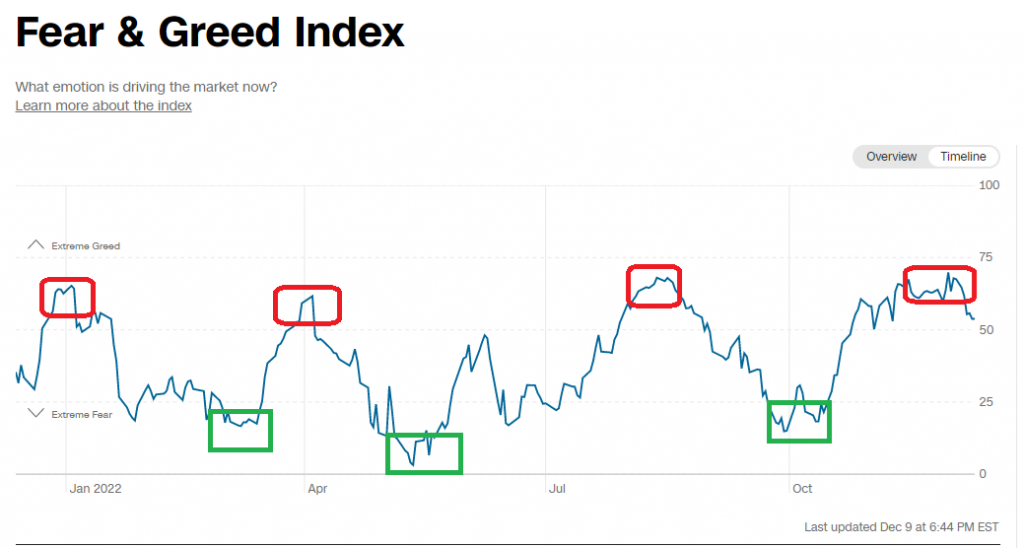

I sense that as the early morning excitement wore off, and investors sobered up, they began to realize that it was a bit too early to celebrate the death of inflation. And perhaps they need to wait to see what the Fed says Wednesday afternoon.

That’s because inflation is like a horror movie monster. You can’t just shoot it once and assume it’s dead. It will keep getting up each time you think the job is done and the death defying chase resumes.

In fact, Powell has discussed this many times over that the worst thing they can do is take their foot of the brakes too soon and inflation comes back with a vengeance. Inflation needs to be “dead and buried” before the Fed reverses course with lower rates.

As great proof of that notice how every time that we have one of these big stock rallies on news of softening inflation that commodity prices soar…which yes, speaks to inflation rising once again. The exact problem we are trying to solve.

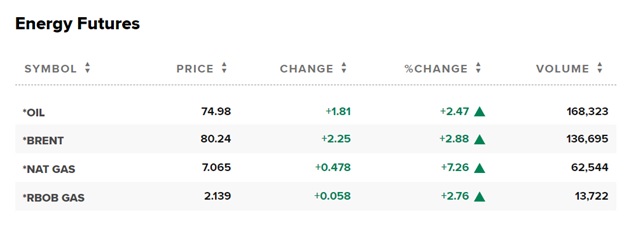

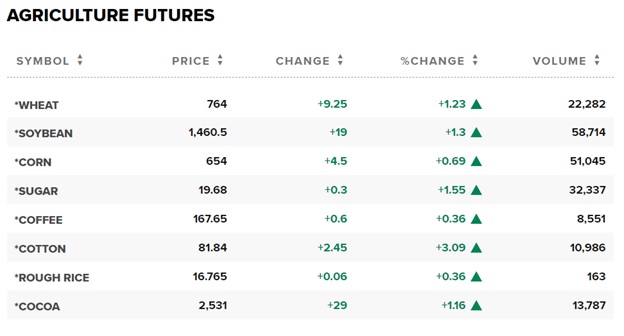

Here was the early morning read for energy and key commodities as stock futures soared:

Long story short, the Fed has splashed cold water on exuberant traders several times this year. Thus, it pays to see what happens with the rate hike and announcement on Wednesday afternoon.

50 basis points is the expectation. The real key is the “dot plot” of where rates likely go in the future (how high…for how long) along with any statements they make that foreshadows future plans.

There we will find out if the Fed agrees with traders that inflation is moderating nicely and they do not have to be as hawkish for as long as previously expected. On the other hand, they may state quite clearly that they continue to see inflation as being more sticky and persistent than they would like, keeping them on the job much longer…with more pain to the economy…and likely lower stock prices.

The answer to that tells you whether stocks are truly ready to break out above the all important 200 day moving average (4,033). Or if it is time to head lower once again?

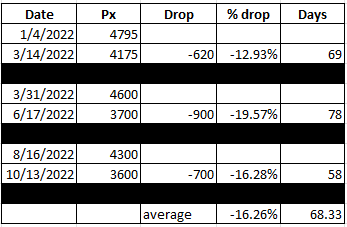

However, we are getting foolishly sucked into the investing worlds myopic fixation on inflation and the Fed. There is much more going on…like the health of the overall economy that is moving closer and closer still to recession. That was the central theme of my 2023 Stock Market Outlook presentation from last week with several leading indicators pointing in that darkening direction.

A prime example of this recessionary concern was on full display Tuesday morning from another low reading for the NFIB Small Business Outlook. Here is the key statement from their report:

“…most of the readings were still consistent with a recession and weak economic activity.”

So as the recessionary storm clouds keep circling…and inflation is far from dead…with the Fed still to keep their foot firmly on the brakes with higher rates on the way …then I see no wisdom in chasing this rally as stocks going down over the next 3-6 months makes a lot more sense then new bull market emerging now.

The only thing at this moment to change my mind is a clear Fed pivot on Wednesday to say indeed inflation is coming under control and they do not need to be as Hawkish as previously advertised.

This is possible…but highly improbable given the slew of statements that have made in the recent past. And that we have already seen the data they are looking at which includes too hot readings for PPI and wage inflation. And the nature they are slow and deliberate. Added altogether and it would be the shock of shocks for them to say “Mission Accomplished” on Wednesday.

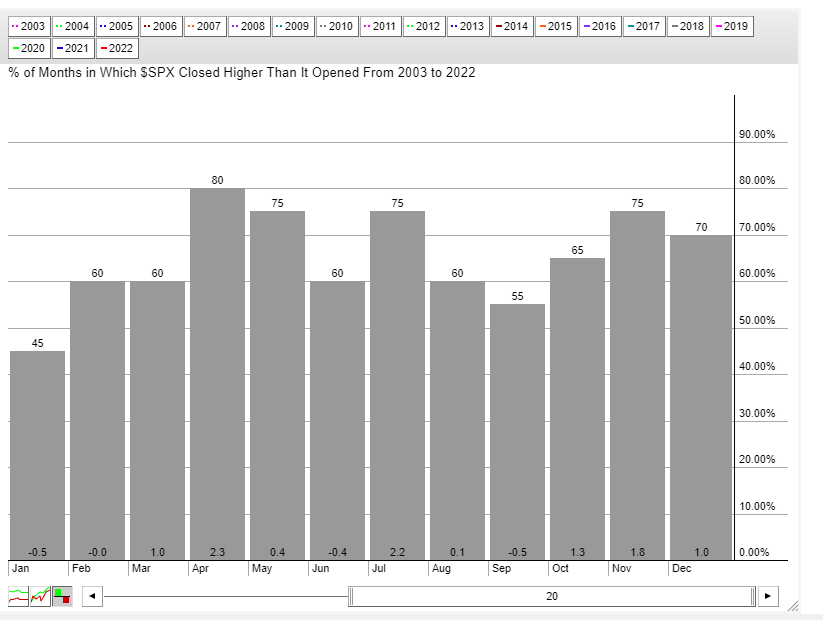

Worst case scenario is another 2-3% upside into year end thanks to current momentum plus bullish bias of Santa Claus rally.

On the other hand, if still a bear market…which is the base case…then retreating to the previous lows of 3,491 in the New Years is still in the cards. And likely much lower.

What To Do Next?

Watch my brand new presentation: “2023 Stock Market Outlook” covering:

- Why 2023 is a “Jekyll & Hyde” year for stocks

- 5 Warnings Signs the Bear Returns in Early 2023

- 8 Trades to Profit on the Way Down

- Plan to Bottom Fish @ Market Bottom

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

Watch Now: “2023 Stock Market Outlook” >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares fell $0.22 (-0.05%) in after-hours trading Tuesday. Year-to-date, SPY has declined -14.39%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Why Did the Tuesday Rally Shrink So Much…So Fast? appeared first on StockNews.com

Steve Reitmeister

Source link