As the U.S. Federal Reserve’s three-year reign in the headlines potentially comes to an end, an analysis of this year’s market themes can offer valuable insights for predicting trends and ensuring attractive returns in 2024.

Beyond the central bank’s actions, pivotal factors shaping the investment landscape this year include fiscal policies, election outcomes, interest rates and earnings prospects.

Throughout 2023, a prominent theme emerged: that equities are influenced by factors beyond monetary policy. That trend is likely to persist.

A decline in interest rates could significantly increase the relative valuations of equities while simultaneously reducing interest expenses, potentially transforming market dynamics. Contrary to consensus estimates, 2023 brought a more robust earnings rebound, leaving analysts optimistic about 2024.

The 2024 U.S. presidential election, meanwhile, introduces a new element of uncertainty with the potential to cast a shadow over the market during much of the coming year.

Choppy trading, modest earnings growth

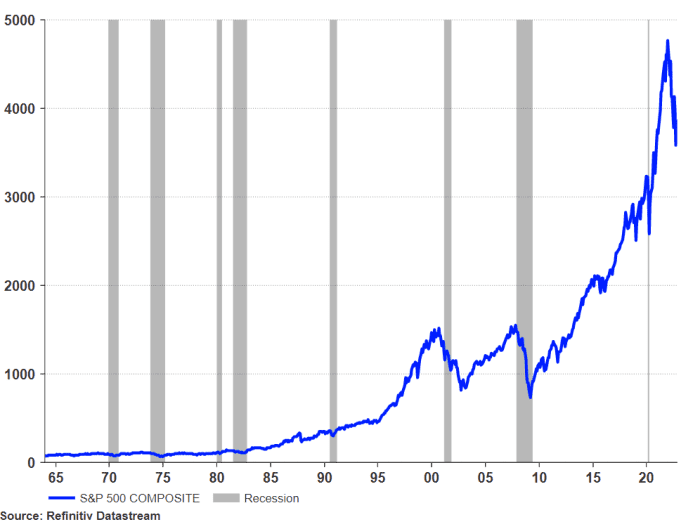

Anticipating a choppy first half of the year due to sluggish economic growth, we see a better opportunity for cyclicals and small-cap stocks to rebound in the latter part of the year. As uncertainty around the election and recession fears dissipate, a broad rally that includes previously ignored cyclicals and small-caps should help propel the S&P 500

SPX

higher.

Broader macroeconomic conditions support mid-single-digit growth in earnings per share throughout 2024. Factors such as moderate economic expansion, controlled inflation and stable interest rates are expected to provide a conducive environment for companies, enabling them to sustain and potentially improve their earnings performance. We estimate EPS growth of 6.5%. This projected growth aligns with the broader market sentiment indicating a steady upward trajectory in earnings for the upcoming year, fostering investor confidence and supporting valuation expectations across various sectors.

“ If the economy has not been in recession at the time of the first rate cut but enters one within a year, the Dow enters a bear market.”

When it comes to U.S. stock-market performance around rate cuts, the phase of the economic cycle matters. When there has been no recession, lower rates have juiced the markets, with the Dow Jones Industrial Average

DJIA

rallying by an average of 23.8% one year later.

If the economy has not been in recession at the time of the first cut but enters one within a year, the Dow has entered a bear market every time, declining by an average of 4.9% one year later. Our base case is a soft landing, but history shows how critical avoiding recession is for the bull market as the Fed prepares to ease policy.

Big on small-caps

This past year has posed a hurdle for small-cap stocks due to the absence of a driving force. These stocks typically perform better as the economy emerges from a recession. While they are currently undervalued, their earnings growth has been notably lacking. If concerns about a recession diminish, a normal yield curve could serve as a potential catalyst for small-cap stocks.

Growth vs. value

The ongoing outperformance of megacap growth stocks that we saw in 2023 might hinge on their ability to sustain superior earnings growth, validating their current valuations. Defensive sectors in the value category, meanwhile, are notably oversold and might exhibit strong performance, particularly toward the latter part of the first quarter. Should concerns about a recession dissipate, cyclical sectors within the value category could outperform, particularly if broader market conditions turn favorable in the latter half of the year.

Handling uncertainty

The Fed’s enduring influence regarding the prospect of a soft landing in 2024 remains a pivotal point in the market’s focus. Considering the themes of the past year and the multifaceted influences on equities beyond monetary policy, investors are advised to navigate through uncertainties stemming from unintended fiscal shifts, upcoming elections and the impact of fluctuating interest rates. While a potentially choppy start to the year is anticipated, it could create opportunities for cyclical and small-cap stocks later in the year.

Ed Clissold is chief of U.S. strategies at Ned Davis Research.

Also read: Mortgage rates dip after Fed meeting. Freddie Mac expects rates to decline more.

More: After the Fed’s comments, grab these CD rates while you still can