As Democrats push to extend expiring health insurance subsidies, President Donald Trump proposed sending money directly to Americans so they can negotiate with insurers. It’s an approach he says would benefit ordinary people over insurance companies.

On Nov. 16, a reporter asked Trump whether he was negotiating with Democrats over the expiring Affordable Care Act subsidies. Trump focused his reply on health insurance companies’ profits.

“The insurance companies are making a fortune,” Trump said. “Their stock is up over 1,000% over a short period of time. … So when I see this, and when I’ve seen this over the last pretty short period of time, I said, (why don’t) we just pay this money directly to the people of our country and let them buy their own health insurance?”

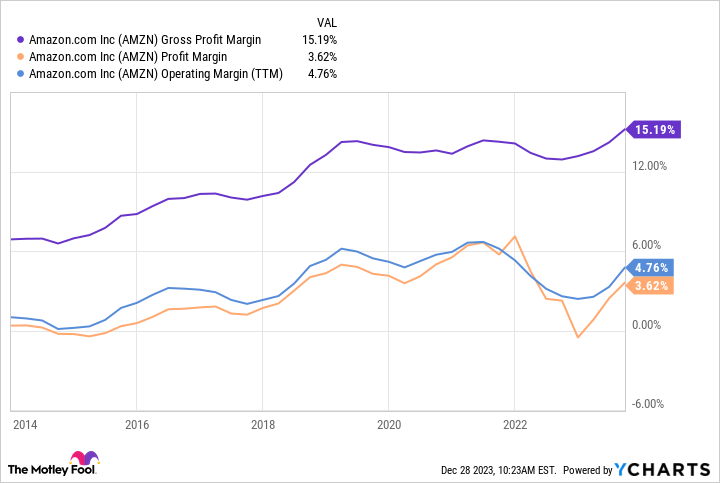

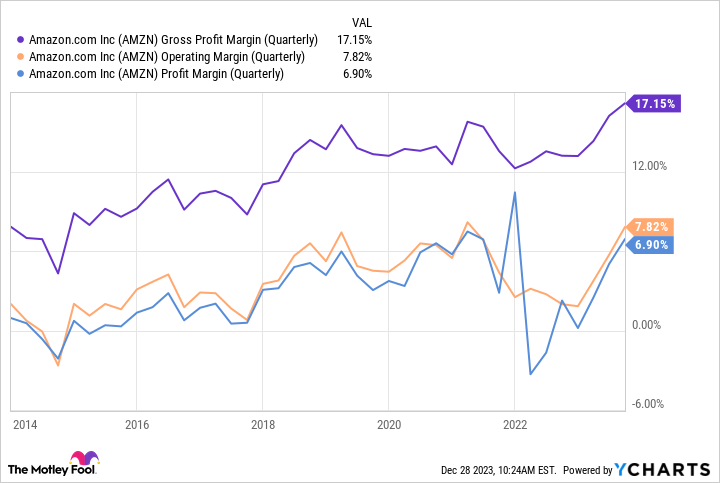

Information that Trump appeared to be citing, based on charts he shared separately on social media, measured health insurers’ stock prices over 15 years and showed stock price increases generally in the 500% to 750% range. But the data on the charts stops in 2024, ignoring a period of time when most of these companies’ stock prices have fallen.

Experts shared Trump’s concern about an overreliance on for-profit insurance providers in the U.S. health care system.

“More and more of our health care ecosystem is relying on, and in some cases subservient to, for-profit companies,” including nearly $1 trillion flowing to shareholders through dividends or stock buybacks, said Cary Gross, a Yale University professor of medicine and public health.

CEO salaries are a concern, said Dylan H. Roby, a University of California-Irvine professor in population and public health.

How much did stock prices rise?

Trump didn’t cite a source when he said health insurance stock is up 1,000%, and the White House did not respond to an inquiry for this article. However, on Nov. 9 Trump posted on Truth Social twice about health insurer stock prices, and data in two charts in those posts appears to overlap with his remark. Although Trump referenced a “short period of time,” each chart shows a span of at least 15 years.

One post included a chart with no source credit that tracked the stock price for seven health insurers — Aetna, Centene, Cigna, Elevance (formerly Anthem), Humana, Molina and UnitedHealth Group.

The chart says one company, UnitedHealth, saw its stock price increase by 1,177% from March 2010 to November 2025. The other six companies did not reach the 1,000% threshold; their increases ranged from a low of 414% (Elevance) to a high of 859% (Molina) during that 15-year period.

The other chart Trump shared came from Paragon Health Institute, a group headed by Brian Blase, who served as Trump’s special assistant for economic policy during his first term.

Paragon first published the chart on its website in March 2024. An accompanying blog post said the data showed that health insurer stock prices began rising after the 2014 implementation of the Affordable Care Act, a development the blog post said “produced a windfall for health insurers” to the detriment of taxpayers.

When we contacted Paragon about how it assembled the data, a spokesperson said the group tracked the stock prices for six large health insurers who sell Affordable Care Act plans — Centene, Cigna, Elevance, Humana, Molina and UnitedHealth Group — from January 2010 to January 2024.

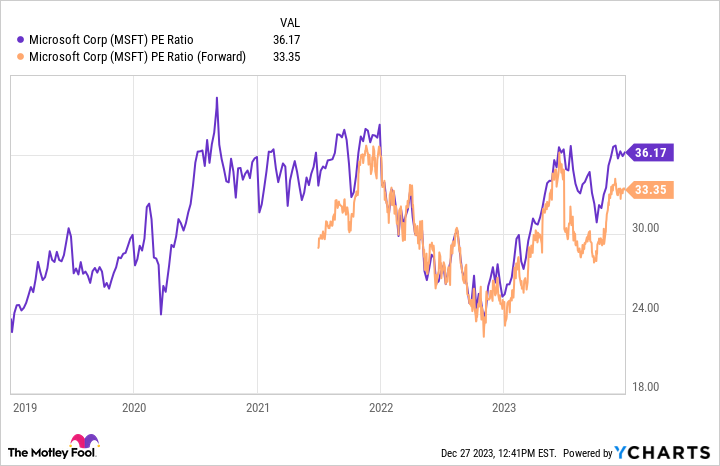

Paragon’s chart compares a “market weighted” average of the six large insurers’ stock prices over time to three comparison measures: the broader stock market, a basket of insurance stocks and a basket of health care stocks.

The chart shows that the weighted average of health insurer stock prices significantly outpaced the growth of the broader stock market and the health and insurance sectors. The chart shows that by January 2024, the health insurers’ stock price average was about eight times its 2010 level, a 700% increase. The other three benchmarks rose about three to 4.5 times their 2010 level.

Assuming that he was referencing the Paragon data, Trump omitted key information when speaking Nov. 16.

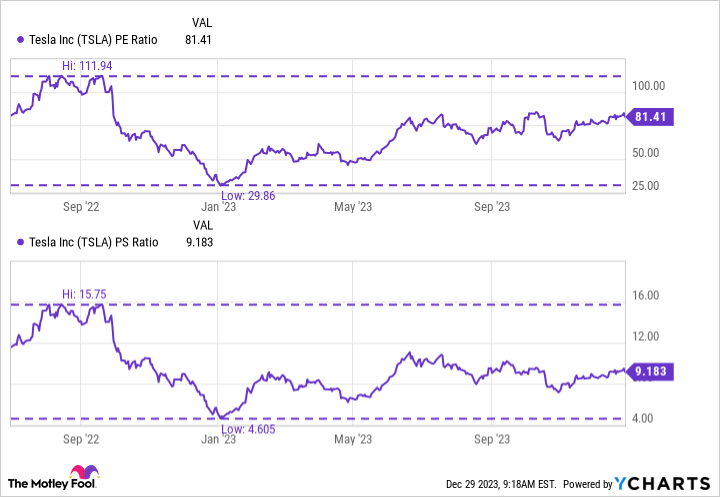

The period of time Paragon measured ended in January 2024. Health insurer stock prices have fallen significantly since then, partly because of concerns about the ACA subsidies’ looming expiration and the possibility of other legislative overhauls. Only one of the six insurers, Molina, has seen its stock price increase since January 2024. The other five fell in value, ranging from 6% to 50%, during that period.

Is there another way to look at the numbers?

The way Paragon calculated the data made the stock price rise seem especially large, in a way that other methods would not have.

The Paragon stock price data is “weighted,” meaning it was adjusted for each company’s market capitalization — the value of all of its outstanding shares. Weighting allows multiple companies’ stock prices to be combined into a single measure in a way that gives bigger companies a larger impact on the metric.

Of the six companies Paragon tracked, UnitedHealth has the largest market capitalization. It also had the most robust stock price growth of any of the companies. So its gains drove the weighted average higher.

Fact-checking Trump’s claim, however, doesn’t require a weighted average: It’s possible to look at the raw increase of each company’s stock price individually to see if any met his 1,000% increase threshold.

Using Paragon’s time frame — from January 2010 to January 2024 — the stock prices of UnitedHealth, Centene and Humana grew by 1,000% to 2,027% without weighting. Elevance and Cigna grew by 800% to 900%.

But measuring stock values from January 2010 to now without weighting, only UnitedHealth meets the 1,000% threshold, at 1,216%. The other five insurers saw increases from 492% to 719%.

Our ruling

Trump said stock prices for health insurance companies are “up over 1,000% over a short period of time.”

Major health insurers have seen stock price increases in recent years, some of them dramatic.

Information that Trump has cited before measured health insurers’ stock prices over 15 years and showed stock price increases generally in the 500% to 750% range. But the data on the charts stops in 2024, ignoring a period of time when most of these companies’ stock prices have fallen.

While major health insurers did experience stock price increases, Trump exaggerated their scale and ignored recent stock price decreases.

The statement is partially accurate but leaves out important details. We rate it Half True.