Just a couple of weeks from now, the U.S. could have its first spot bitcoin ETF. The excitement around the prospect has been building for months, but the market may be a little overheated now. The chances that the ETF approval will be a sell-the-news event have been getting higher, according to CryptoQuant, which points to the fact that investors have been sitting on high unrealized profits – a trend that historically has preceded price corrections. In this case, bitcoin could correct all the way down to $32,000, the short-term holder realized price, the crypto data provider said. “A lot of unrealized profits have been building up because of the price rally in anticipation of the ETF approval, and now those unrealized profits are at extremely high levels for short-term holders and also for miners,” said Julio Moreno, CryptoQuant’s head of research. “Because there is so much unrealized profit we argue that, once the news of ETF approval is confirmed, market participants would want to realize those profits by selling bitcoin.” Meanwhile, with the recent surge in bitcoin price and transaction fees, miners have entered “extremely overpaid” territory, according to CryptoQuant, and have been selling lately with the price remaining above $40,000. The ETF has been the story of the second half of the year in crypto. Bitcoin has gained 57% over the past three months, as the Securities and Exchange Commission’s engagement with potential ETF issuers appeared to increase and optimism started to intensify. The coin is up 11% for December. Approval would allow the first ever spot bitcoin ETFs to launch in the U.S. It’s regarded by many as a key catalyst for bitcoin and crypto broadly in the new year, the bull case being that it would bring a flood of new investors into the market. (Of course, it’s also possible the SEC issues rejections, but broad consensus is that that’s unlikely.) Mark Connors, head of research at investment fund manager 3iQ — which launched a spot bitcoin ETF in Canada in 2021 — said there’s a “strong likelihood” of a pause or brief pullback should a bitcoin ETF, or several, receive SEC approval. However, he doesn’t expect the sell-the-news phenomenon to take shape. “We have seen demand from clients for our spot bitcoin ETF in anticipation of a U.S. spot bitcoin ETF approval, so there may be some selling, but most of these clients are aligned with our price expectation for bitcoin, looking at recent purchases as good entry points for a longer term buy, less a short-term trade,” Connors said. Assuming a U.S. bitcoin ETF gets greenlit, Connors said he expects bitcoin to trade between $45,000 and $55,000 on the day. The price could bounce in a $10,000 range but with a positive skew, as it did in March, when bitcoin rallied on banking crisis woes in the U.S. He added that bitcoin could reach $100,000 by the end of 2024. “Any pause in bitcoin’s appreciation will be short and perilous for market timers,” Connors said. Ric Edelman, founder of the Digital Asset Council of Financial Professionals, said the day the SEC gives the greenlight could be anticlimactic but that it wouldn’t change the bull case for it. “The price will rise, but not necessarily as much as some might expect,” he said. “Advisors and firms have clearly stated that they are not buying bitcoin until they can do so via these products. So, yes, there is buying occurring now in anticipation of SEC approval, but that approval would be the start of the action, not the end.” It’s entirely possible that rather than investors jumping into bitcoin ETFs on day one, new flow take place gradually over time – and that that trend gets misunderstood as low appetite for the ETFs. Already, some on Wall Street are concerned that expectations for institutions are overinflated and that a bitcoin ETF alone may not convert “nocoiners ” (crypto slang for a person who has never bought any crypto before) into buyers. “I want to be humble about the effect of spot ETF … if the initial inflow isn’t as much as people expect, I am concerned about the reversal of current momentum,” said Oppenheimer analyst Owen Lau. “It takes time for people to understand the advantage of holding bitcoin. I don’t expect a big initial inflow initially, it is more likely to be a steady increase. But the recent price action suggests a big pile of money like tens of billions dollar is waiting to get in. It may not be a good setup.” Galaxy Digital , which is in line with the SEC for a spot bitcoin ETF in partnership with Invesco, estimates the addressable market size of a U.S. bitcoin ETF to be roughly $14 trillion in the first year after a launch, and expanding to $26 trillion in the following year and $39 trillion in the third year. While it may be reasonable to expect a short-term dip on ETF approval, Matt Sigel, head of digital assets research at VanEck, emphasized that the event itself would nevertheless create new pathways for inflows from institutions with a long view. “If the flows don’t materialize, short-term traders may look to push bitcoin lower into the halving, the next big catalyst,” he said. “Keep in mind, however, that many of largest institutions may offer these ETFs on an unsolicited basis only to start. As time goes on, they will integrate bitcoin into their asset allocation models. That may be more meaningful than the initial launch.”

Tag: Stock markets

-

China's Xiaomi unveils its first EV as it looks to compete with Porsche, Tesla

Chinese smartphone company Xiaomi revealed on Dec. 28, 2023, its forthcoming electric car, the SU7 sedan.

CNBC | Evelyn Cheng

BEIJING — Chinese consumer electronics company Xiaomi on Thursday detailed plans to enter China’s oversaturated electric vehicle market and compete with automaker giants Tesla and Porsche with a car model it says it spent more than 10 billion yuan ($1.4 billion) to develop.

The company’s car model, known as Xiaomi SU7, “is in trial production and it will hit the domestic market in a few months,” CEO Lei Jun said in a Tuesday post on the X social media platform, formerly known as Twitter. “The price has not been finalized yet.”

Pronounced “Sue Qi” in Mandarin, the Xiaomi SU7 beats Porsche’s Taycan and Tesla’s Model S on acceleration and other metrics, Lei said during a three-hour presentation on Thursday.

He laid out bold ambitions to become an industry leader, including in autonomous driving and noted that the SU7 design team previously worked at BMW and Mercedes Benz.

Sales are due to begin in 2024, after more than three years of development— during which electric vehicles have taken off in China’s highly competitive market, and domestic automakers have begun to differentiate their products through ambitious offerings of car-compatible tech.

This is an area of potential advantage for Xiaomi, which is best known for its smartphones and home appliances and previously said it wants to create a “‘Human x Car x Home’ smart ecosystem.”

The SU7 is integrated with Xiaomi’s smartphones and internet-connected home appliances, Lei announced Thursday. He emphasized the company’s efforts to ensure data privacy among the devices and create a car that surpasses U.S. safety standards for rear-end collisions.

Lei said the vehicle will also be compatible with Apple’s iPhone, iPad, CarPlay and AirPlay. The U.S. giant has yet to release a car despite widespread speculation of such plans.

Xiaomi

Two Xiaomi SU7 models appeared on a list of tax-exempt new energy vehicles published by the Ministry of Industry and Information Technology on Tuesday.

The document described the cars as purely battery powered, with driving range of 628 kilometers (390 miles) to 800 kilometers. The ministry listed a subsidiary of state-owned BAIC Group as the manufacturer for the Xiaomi SU7.

While the car isn’t yet available, Xiaomi has started selling its flagship smartphone and smart watch in the “aqua blue” and “olive oil green” colors of the SU7 sedan.

A price for the SU7 has yet to be revealed, but Lei hinted the purchase would not be cheap and dismissed rumors of a 99,000 yuan or 140,000 yuan price tag.

The Xiaomi car tech event comes as several domestic EV players have recently revealed new electric vehicles.

- Nio on Saturday debuted its 800,000 yuan ($113,090) ET9, set to begin deliveries in the first quarter of 2025.

- Huawei’s Aito brand on Tuesday unveiled its M9 SUV — starting at 469,800 yuan and due to begin mass deliveries in late February 2024.

- Zeekr, backed by Geely, on Wednesday announced its 007 sedan would start at 209,000 yuan with deliveries beginning on Jan. 1.

Xpeng, which Xiaomi backed in 2019, is set to launch its X9 vehicle on Jan. 1, 2024. Ahead of the Thursday event, Lei shared pictures on popular Chinese social media platform Weibo which showed buildings lit up with messages of Xiaomi saying it salutes BYD, Nio, Xpeng, Li Auto and Huawei.

Xiaomi shares closed 0.25% lower in Hong Kong trading on Thursday. The company’s Hong Kong-traded shares are up by more than 40% so far this year. The business claimed record sales of more than $3 billion across various e-commerce platforms during this year’s Singles Day shopping festival.

Xiaomi has said it expects to spend 20 billion yuan ($2.8 billion) on research on development this year, up by 25% from 2022 and more than double the amount spent in 2020.

-

What should Canadian investors do: Sell or hold with preferred share losses? – MoneySense

1. Rate reset preferred shares

These became popular following the financial crisis in 2008/2009 to entice investors to buy preferred shares despite low interest rates at that time. They generally “reset” every five years with the dividend rate for the next five years based on a premium over the 5-year Government of Canada bond rate at the time. Rate reset preferred shares currently represent 73% of the Canadian preferred share market.

2. Perpetual preferred shares

These represent 25% of the Canadian preferred share market. Perpetuals have no reset date. Their dividend rate is set when they are issued, and they continue in perpetuity.

3. Floating or variable rate preferred shares

These are like rate resets in that the rate changes, but those changes are more frequent—typically quarterly. The rate is generally based on a premium to the 3-month Government of Canada treasury bill rate. Together, floating/variable rate and convertible preferred shares represent less than 3% of the Canadian preferred share market.

4. Convertible preferred shares

A convertible security can be converted into another class of securities of the issuer. For example, a convertible preferred share may be convertible into common shares of the company that issued the shares.

Preferred shares Indexes for Canadian investors

The S&P/TSX Preferred Share Index is currently 57% financials, 20% energy and 12% utilities. Communication services, real estate, and consumer staples makes up the remainder of the market. The financials are tilted slightly more towards banks than insurance companies.

The current distribution yield of the S&P/TSX Preferred Share Index is about 6.1%. This is the dividend income an investor might anticipate over the coming year. The trailing 12-month yield is about 5.9%. These are attractive rates, Mario, but you can earn comparable rates in guaranteed investment certificates (GICs) with no risk or volatility. So, the high yields need to be put into perspective.

What to do with preferred shares at a loss

One consideration, Mario, is if you own your preferred shares in a taxable non-registered account, you could sell them to trigger a loss, if you have other investments that you have sold or intend to sell for a capital gain.

“Tax loss selling” is when you sell an investment for a loss to harvest the tax benefit of that loss. You can claim capital losses against capital gains in the current year. If you have a net capital loss for all investments sold in your taxable accounts in a given year, you can carry that loss back to offset capital gains income you paid tax on in the previous three years. Or you can carry the loss forward to use in the future against capital gains.

Jason Heath, CFP

Source link -

AI boom fails to propel China's cloud market growth

An AI sign is seen at the World Artificial Intelligence Conference in Shanghai on July 6, 2023.

Aly Song | Reuters

BEIJING — Excitement over artificial intelligence isn’t yet fueling a boom in cloud services spending in mainland China.

“The Chinese cloud services market remains conservative, relying heavily on government and state-owned enterprises to drive growth,” tech market analysis firm Canalys said in a report Wednesday.

Training AI models on the cloud, following a surge of interest in the potential of ChatGPT-like services, has been expected to drive the industry’s growth.

Alibaba‘s cloud business, with the country’s largest market share at 39%, reported just 2% year-on-year revenue growth in the quarter ended Sept. 30. The tech giant in November also scrapped plans to publicly list its cloud operations.

Huawei, which isn’t publicly traded and is the second largest cloud player, didn’t separately state its cloud revenue for the third quarter, nor did Hong Kong-listed Tencent.

The three largest cloud players in China held the same market share in the third quarter as they did in the prior one, while the segment’s overall growth slowed to 10% in 2022 and is expected to be at 12% in 2023 — sharply lower than the 45% surge in 2021, the Canalys report showed.

Domestic spending on cloud services grew by 18% year-on-year in the third quarter to $9.2 billion, according to the report.

However, it slowed drastically to 5.7% from 13% in the second quarter, according to CNBC analysis of Canalys data.

The mainland Chinese cloud market accounted for 12% of the global cloud spend in the third quarter, Canalys said. Third-quarter global cloud spending rose 1.5% from the previous quarter, CNBC analysis found.

The research firm pointed out the industry has been investing “heavily” in AI and looking to monetize AI offerings via the development of “partner ecosystems.” That includes a network of developers, software companies and experts, the report said.

This, however, is yet to translate into meaningful growth for the cloud segment.

“The innate complexity of AI technology presents challenges in terms of adoption and deployment,” Canalys said, “yet simultaneously unlocks opportunities for a broader AI ecosystem.”

Alibaba, Huawei and Tencent have each released AI models and products this year, as have Baidu and other companies in China.

-

Inflation has created a dark cloud over how everyday Americans view the economy

Grocery items are offered for sale at a supermarket on August 09, 2023 in Chicago, Illinois.

Scott Olson | Getty Images

When Kyle Connolly looks back at 2023, she sees it as a year defined by changes and challenges.

The newly single parent reentered the workforce, only to be laid off from her job at a custom home-building company in November. At the same time, Connolly has seen prices climb for everything from her Aldi’s grocery basket to her condo’s utility costs.

In turn, she’s cut back on everyday luxuries like eating out or going to the movies. Christmas will look pared down for her three kids compared to years prior.

“I’ve trimmed everything that I possibly can,” said the 41-year-old. “It sucks having to tell my kids no. It sucks when they ask for a little something extra when we’re checking out at the grocery store and having to tell them, ‘No, I’m sorry, we can’t.’”

Economic woes have seemed more apparent within her community in Florida’s panhandle. Connolly has noticed fewer 2022 Chevy Suburbans on the road, replaced by older Toyota Camry models. The waters typically filled with boats have been eerily quiet as owners either sold them or tried to cut back on gas costs. Fellow parents have taken to Facebook groups to discuss ways to better conserve money or rake in extra income.

The struggles among Connolly and her neighbors highlight a key conundrum puzzling economists: Why does the average American feel so bad about an economy that’s otherwise considered strong?

‘High prices really hurt’

By many accounts, it has been a good year on this front. The annualized rate of price growth is sliding closer to a level preferred by the Federal Reserve, while the labor market has remained strong. There’s rising hope that monetary policymakers have successfully cooled inflation without tipping the economy into a recession.

Yet closely watched survey data from the University of Michigan shows consumer sentiment, while improving, is a far cry from pre-pandemic levels. December’s index reading showed sentiment improved by almost 17% from a year prior, but was still nearly 30% off from where it sat during the same month in 2019.

“The main issue is that high prices really hurt,” said Joanne Hsu, Michigan’s director of consumer surveys. “Americans are still trying to come to grips with the idea that we’re not going back to the extended period of low inflation, low interest rates that we had in the 2010s. And that reality is not the current reality.”

Still, Hsu sees reason for optimism when zooming in. Sentiment has largely improved from its all-time low seen in June 2022 — the same month the consumer price index rose 9.1% from a year earlier — as people started noticing inflationary pressures recede, she said.

One notable caveat was the drop in sentiment this past May, which she tied to the U.S. debt ceiling negotiations. The 2024 presidential election has added to feelings of economic uncertainty for some, Hsu said.

Inflation vs. the job market

Continued strength in the labor market is something economists expected to sweeten everyday Americans’ views of the economy. But because consumers independently decide how they feel, jobs may hold less importance in their mental calculations than inflation.

There are still more job openings than there are unemployed people, according to the latest data from the Bureau of Labor Statistics. Average hourly pay has continued rising — albeit at a slower rate than during the pandemic — and was about 20% higher in November than it was in the same month four years ago, seasonally adjusted Labor Department figures show.

That’s helped boost another widely followed indicator of vibes: the Conference Board’s consumer confidence index. Its preliminary December reading was around 14% lower than the same month in 2019, meaning it has rebounded far more than the Michigan index.

While the Michigan index compiles questions focused on financial conditions and purchasing power, the Conference Board’s more closely gauges one’s feelings about the job market. That puts the latter more in line with data painting a rosier picture of the economy, according to Camelia Kuhnen, a finance professor at the University of North Carolina.

“You think that they’re talking about different countries,” Kuhnen said of the two measures. “They look different because they focus on different aspects of what people would consider as part of their economic reality.”

A hot job market can be a double-edged sword for sentiment, Michigan’s Hsu noted. Yes, it allows workers to clinch better roles or higher pay, she said. But when those same workers put on their consumer hats, a tight market means shorter hours or limited availability at their repair company or veterinarian’s office.

Silver linings for some

Other reasons why consumers feel positively about the economy this year can only be true for certain — and often wealthier — groups, economists say.

UNC’s Kuhnen said Americans would be pleased if they are homeowners seeing price appreciation. Another reason for optimism: If they had investments during 2023’s stock market rebound.

Without those cushions, people on the lower end of the income spectrum may feel more of a pinch as higher costs bite into any leftover savings from pandemic stimulus, Kuhnen said. Elsewhere, the resumption of student loan payments this year likely also caused discontent for those with outstanding dues, according to Karen Dynan, a Harvard professor and former chief economist for the U.S. Treasury Department.

Marissa Lyda moved with her husband and two kids to Phoenix from Portland earlier this year, in part due to lower housing costs. With profits from the value gained on the property she bought in 2019, her family was able to get a nicer house in the Grand Canyon state.

Yet she’s had to contend with an interest rate that’s more than double what she was paying on her old home. Though Arizona’s lower income tax has fattened her family’s wallet, Lyda has found herself allocating a sizable chunk of that money to her rising grocery bill.

The stay-at-home mom has switched her go-to grocer from Kroger to Walmart as value became increasingly important. She’s also found herself searching harder in the aisles for store-brand food and hunting for recipes with fewer ingredients.

Her family’s financial situation certainly doesn’t feel like it reflects the economy she hears experts talking about, Lyda said. It’s more akin to the videos she sees on TikTok and chatter among friends about how inflation is still pinching pocketbooks.

“I look at the news and see how they’re like, ‘Oh, best earnings, there’s been great growth,’” the 29-year-old said. “And I’m like, ‘Where’s that been?’”

‘Just trying to hold on’

Economists wonder if social media discourse and discussion about a potential recession have made Americans think they should feel worse about the economy than they actually do. That would help explain why consumer spending remains strong, despite the fact that people typically tighten their belts when they foresee financial turmoil.

There’s also a feeling of whiplash from the runaway inflation that snapped a long period of low-to-normal price growth, said Harvard’s Dynan. Now, even as the annual rate of inflation has cooled to more acceptable levels, consumers remain on edge as prices continue to creep higher.

“People are still angry about the inflation we saw in 2021 and, in particular, 2022,” Dynan said. “There’s something about the salience of … the bill for lunch that you see every single day that just maybe resonates in your brain, relative to the pay increase you get once a year.”

Federal Reserve Board Chairman Jerome Powell speaks during a press conference following a closed two-day meeting of the Federal Open Market Committee on interest rate policy at the Federal Reserve in Washington, U.S., December 13, 2023.

Kevin Lamarque | Reuters

Another potential problem: The average person may not completely understand that some inflation is considered normal. In fact, the Federal Reserve, which sets U.S. monetary policy, aims for a 2% increase in prices each year. Deflation, which is when prices decrease, is actually seen as bad for the economy.

Despite these quandaries, economists are optimistic for the new year as it appears increasingly likely that a recession has been avoided and the Fed can lower the cost of borrowing money. For everyday Americans like Connolly and Lyda, inflation and their financial standing will remain top of mind.

Lyda has cut treats like weekly Starbucks lattes out of the budget to ensure her family can afford a memorable first holiday season in their new home. In 2024, she’ll be watching to see if the Fed cuts interest rates, potentially creating an opportunity to refinance the loan on that house.

“You just have to realize that every season of life may not be this huge financial season,” Lyda said. “Sometimes you’re in a season where you’re just trying to hold on. And I feel like that’s what it’s been like for most Americans.”

-

China's potential new gaming rules will hit smaller developers more, analyst says

Mobile games in China range from League of Legends-like Honor of Kings to

Source: Apple Inc.

BEIJING — China’s proposed gaming rules would hit smaller developers more than large ones, while also reducing overall online advertising revenue, according to UBS.

Tencent, NetEase and Bilibili shares plunged to their lowest in more than a year Friday after China’s National Press and Publication Administration published draft rules that would prohibit incentivizing daily sign-ins for games, among other revenue-generating practices.

The comment period is open until Jan. 24. Hong Kong markets are closed Monday and Tuesday for Christmas.

“Big game developers or big DAU [daily active user] social games should fare better: This is because they have other means to boost gamers engagement, reach out to users and have stronger R&D capabilities to attract and retain gamers,” Kenneth Fong, head of China internet research, UBS, said in a note.

“With a lower revenue for online games, the ad industry would be impacted too,” he said. UBS estimates online games account for about 20% of the online ad industry’s revenue.

Gaming accounts for the majority of NetEase’s revenue, and about one-fifth or less at Tencent and Bilibili, third-quarter releases show.

Many other companies develop and publish games in China, although Beijing has in recent years made clear it would like to restrict game play, especially among minors.

It’s “very common” for online games to encourage daily sign-in and offer rewards for the initial in-app purchase, UBS’s Fong said. He pointed out that incentivizing users to sign in every day boosts engagement and allows for collection of user statistics, which can help developers adjust games in real time.

However, Fong said it is hard to quantify the financial impact of the proposed regulation since it’s unclear whether it would apply only to new games or also existing ones.

The National Press and Publication Administration, which controls the publication of new games, said Monday that it approved more than 100 new domestic games, after saying Friday that it approved 40 imported games.

Generally, Fong expects new games to be affected more than old ones. “As the online game is a very creative industry,” he said, “we believe the game developers would likely design other means to attract and retain users.”

-

Making sense of the markets this week: December 24, 2023 – MoneySense

So, given that context, we’re pretty proud of how these predictions held up.

Inflation will continue to dominate the news

“People who are unemployed feel the unemployment rate: but everyone feels the inflation rate.

“Nothing gets people’s attention faster than paying higher prices for housing, gas and groceries. That’s what makes it such a tempting news story to keep reporting on. It also makes it almost impossible for politicians and policy makers to ignore.

“Until the inflation rate comes down, to at least 4% (it’s currently 6.8%), I don’t see most investment commentators talking about much else.”

Grade: A

OK, admittedly, I started with a layup. Given how important inflation and interest rates are to the pricing of assets in almost every market, it was a high-probability bet that this would dominate markets in 2023. That said, it’s undeniable that the rapid pace of interest-rate rises took up most of the oxygen in the room this year. Over the last few months inflation has been coming down to the 3% to 4% level. And, as predicted, we’re finally seeing some other stories emerge. This week, for example, the Bank of Canada (BoC) announced a headline inflation rate of 3.1% and it failed to lead the news anywhere I looked (despite being slightly higher than predicted).

The Russian invasion remains predictably unpredictable

“None of the experts I read about a year ago predicted Russia would invade its neighbours and send geopolitical shockwaves reaching every corner of the planet.

“None of the experts I read about 10 months ago predicted the Ukrainian military response would be able to stand up to the Russian war machine for more than a few days.

“At some point maybe it would be best to admit that the experts really have no idea where this conflict is headed. Despite the tragic loss of life and catastrophic disruption of society, it seems to me that there is little evidence that either side will back down as we enter 2023.

“If—and this appears the more likely situation—the war drags on or escalates, it becomes difficult to quantify the damage inflicted on economies, like Germany’s, which are so dependent on Russia’s energy.

“Sure, demand destruction and the Green Revolution are coming… eventually… and at substantial cost. Even scarier is the unpredictable nature of the response to food shortages in desperate countries around the world. Generally speaking, food riots aren’t good for business (or humanity).”

Grade: B+

It’s not fun predicting that war will be awful. The tragedy taking place in Ukraine continues to be a struggle for all parties involved, and I don’t think we’re much closer to a long-term peace than we were at this time last year. The war has definitely contributed to high food costs around the world and continues to be quite disruptive within specific industries.

That said, much of Europe adapted to new energy supply chains more quickly than originally anticipated. A new market equilibrium appears to have been established, but there is no question that the war continues to be a worldwide drain on resources and, more importantly, an absolute tragedy.

The much-talked-about recession will continue to be talked about

“At this point, I feel like we might forecast a recession forever.

“Whether a recession will ever actually arrive or not is another story.

“With inflation in the U.S. falling to an annualized rate of 3.7% over the last three months, I’d argue we’re not only past peak inflation, but are actually well on our way to some sort of ‘new normal.’ With a substantial lag between when monetary policy is announced, and when its full effects are felt, we might not need a recession to lower inflation despite all of the headlines.

“Of course, I continue to refer to the fact that whether we see two quarters of -0.1%, and -0.1% GDP shrinkage, or a quarter of -0.3% growth followed by a quarter of 0.2% growth, the distinction of ‘recession or not’ is irrelevant. The first scenario is a technical recession by most definitions. The second scenario is just a bad quarter followed by a less bad quarter. Whether we have a recession or not really isn’t that important in the long term.

“Have the asset markets (such as stock or property markets) in which I’ve invested my money already anticipated the bad stuff coming by ‘pricing it in’?

“Almost assuredly.

“Remember that the stock market and the economy are not the same thing. Professional investors look past current events—they’re aware of the recency bias. They foresaw some rough waters ahead throughout 2022, but that doesn’t mean 2023 will also be so bleak.”

Grade: A+

Given the gross domestic product (GDP) situation Canada announced two weeks ago, we’re comfortable saying we knocked this one out of the park. Considering how many experts were predicting a recession at the end of 2022 and calling for falling markets, the theory that markets had priced in a pretty rough ride was the correct one.

Kyle Prevost

Source link -

China's EV and chip giants need workers — not necessarily college grads

YANTAI, CHINA – SEPTEMBER 8, 2023 – Students conduct an industrial robot training at Yantai Cultural and Tourism Vocational College in Yantai, East China’s Shandong province, Sept 8, 2023. At present, China has built the largest vocational education system in the world, and the middle and higher vocational schools train about 10 million high-quality technical talents every year. (Photo by Costfoto/NurPhoto via Getty Images)

Nurphoto | Nurphoto | Getty Images

BEIJING — China’s vocational school push is producing workers the country’s electric car and semiconductor industries want to hire.

Despite tech company layoffs and record-high youth unemployment in recent years, public filings analyzed by CNBC show marked headcount growth at key industry giants – who largely depend on technical, advanced manufacturing labor.

Electric battery heavyweight CATL‘s staff more than tripled within three years to 118,914 in 2022 – with nearly 80% holding less than a bachelor’s degree.

Chinese semiconductor company SMIC‘s research and development team grew by nearly 30% since 2021 to 2,283 as of June. While doctorate and master’s degree holders contributed the most to the increase, the number of staff with a junior college or lower background rose by 10% — in contrast to an 8% drop for those with bachelor’s degrees.

China’s efforts to build up its own technological capabilities have intensified since the U.S. started to restrict Chinese companies’ access to critical tech such as advanced semiconductors.

The Chinese government has also long tried to develop its vocational education system and learn from similar programs in countries such as Germany.

Beijing made two important changes in 2019 to spur vocational education – a nationally recognized skills certification framework and a call for 300 business entities to provide or sponsor training, pointed out Anyi Wang, associate research scholar at Columbia University and co-author of a 2020 paper on vocational education in China.

“Right now, I think the government is trying to put vocational education in a more important place in the whole education system,” he said, noting other policy changes that indicate Beijing’s recognition that high-tech workers need longer training times.

More complex machines and software systems also mean factory workers aren’t just filling labor-intensive roles anymore, but may be overseeing automated production.

Skills mismatch

While the industry changes, slower economic growth and crackdowns on real estate and internet platform companies have revealed a stark mismatch between graduates’ skills and available jobs.

The unemployment rate for young people ages 16 to 24 climbed to records above 20% this summer before authorities suspended the data release.

“The supply of [what we call] workers with generalized skills to the market is more than the economy can actually [absorb], so you can find a lot of the graduates, they graduate directly into unemployment,” Wang said.

The number of bachelor’s degree graduates rose by 10% in 2022 to 4.7 million, while higher-level vocational schools saw a 24% surge in graduates to 4.9 million, according to the Ministry of Education.

There’s no official jobless rate breakdown by educational background.

But what’s clear is vocational positions require specific skills, Wang said. “So they are having a shortage of workers or applicants.”

Surging demand for auto workers

The latest available official tally of nationwide labor shortages for 2022 found that sales people were in greatest demand, followed by automobile manufacturing workers in second place, up from 19th place previously.

Semiconductor-related manufacturing jobs also made the top 100 positions with the greatest need for workers, the report said.

The number of students focusing on the auto sector has increased significantly over the last several years to about two-thirds of the current enrollment at Nanjing Vocational University of Industry Technology’s transportation school, its dean Wang Wenkai said in a phone interview.

“The market has increased demand for this,” he said in Mandarin, translated by CNBC.

Corporate partnership

In a well-managed vocational education program, a significant benefit for students comes from corporate partners who provide hands-on experience, if not a job after graduation.

Schools CNBC spoke with had existing programs with companies such as CATL, Baidu’s autonomous driving unit and Chinese electric car giant BYD.

Public announcements in the last year also show at least 10 different vocational education schools are in talks for or have launched training institutes with BYD.

Among them, a “BYD Field Engineer College” was launched on Sept. 10 in collaboration with vocational schools in Henan province, whose capital city of Zhengzhou is home to a new BYD factory.

Based on its 2023 strategic plan, BYD will need a large number of field engineers in manufacturing and after-sales service, Liu Junpeng, director of school-enterprise cooperation at BYD’s human resources department, said at the college’s launch event, according to a release by Henan Mechanical and Electrical Vocational College.

BYD did not immediately respond to a CNBC request for comment.

The company does not disclose its workers’ educational background. But public filings reveal its workforce more than tripled over the last six years to 631,500 as of June.

Corporate partnerships also help schools make sure their curriculum is current.

Every summer, teachers at Shaanxi Polytechnic Institute go to work at BYD in the city of Xi’an, according to Xu Jiyang, dean of the institute’s automotive school.

At Shenzhen Polytechnic University, BYD engineers help construct the courses, parts of which also take students to learn on-site at the company, said Zhu Xiaochun, deputy dean of the school of automobiles and transportation.

He claimed junior college students had an employment rate of well over 90%. “In addition to our better students in the bachelor program, [BYD] also needs a large number of workers,” Zhu said in Mandarin, via a CNBC translation. “It’s too easy for our students to find jobs.”

However, one of the biggest challenges for vocational education remains public perception.

“We live in an era of high aspiration. Parents want that for their children,” said Stephen Billett, professor of adult and vocational education at the School of Education and Professional Studies at Griffith University in Australia.

“But often vocational education is being seen as something as far less desirable than those developed through higher education,” he said. “That then leads to this issue of how that can be changed and also how we can have effective vocational education systems.”

-

How Tesla rose to retail investor stardom: 'It's always in people's minds'

Several Tesla electric vehicles are parked in front of a Tesla service center in the Kearny Mesa region, in San Diego, California, U.S., October 31, 2023.

Abhirup Roy | Reuters

Marko Sustic has bet big on Tesla this year.

The investor, who also happens to work in the European auto industry, bought Tesla shares nearly every month in 2023 and has almost doubled the size of his position over the course of the year. Sustic has no other electric vehicle holdings out of a belief that competitors won’t be able to beat Tesla’s technology.

“There is no catching up with them,” said the 32-year-old, who also has two Tesla cars at his home in Croatia. “It’s just a matter of time when the stock will explode.”

Sustic isn’t alone. Tesla, which entered the S&P 500 three years ago this week, is on pace to attract the largest flow of individual investor dollars of any security in 2023, according to data from Vanda Research. The firm calculates net inflows to find these favorites, subtracting the amount of stock sold from what was bought.

That means Tesla will eclipse even the SPDR S&P 500 ETF Trust (SPY), which tracks the largest stock market index in the world. This underscores the stock’s fast ascent to retail-investor glory, especially considering Tesla wasn’t even among the top 20 equities that individual investors bought before 2019, Vanda data shows.

A banner year

Tesla’s increasing favor among retail traders can be tied to its comeback in 2023, according to Christopher Schwarz, a finance professor at the University of California Irvine. After plunging 65% in 2022, the Elon Musk-led stock has more than doubled in 2023.

The stock has outperformed the market this year in tandem with other mega-cap technology equities dubbed the “Magnificent 7.” Many investors looking to play “disruptive” technology in this elite group have focused on Tesla and chipmaker Nvidia. But after more than tripling this year thanks to an appetite for all things tied to artificial intelligence, Schwarz said Nvidia may be too expensive for many individual investors.

Schwarz researches retail trader behavior, and thinks a lot of attention comes from Musk. The Tesla CEO’s contentious purchase of X, formerly known as Twitter, has brought increased media coverage as well as scrutiny of the billionaire business mogul, Schwarz said.

When faced with thousands of stocks to choose from, Schwarz said individual traders mainly look for names that grab their attention, are familiar and have saliency to current trends. Given Musk’s persona, the growing ubiquity of Teslas on the road and concerns about climate change, Schwarz said Tesla checks many boxes for everyday investors.

“It’s always in people’s minds to trade when they’re looking for something to trade,” Schwarz said.

Tesla over the last 5 years

‘That was a bargain’

Individual investors told CNBC that Tesla’s bumpy ride in recent years hasn’t made them doubt the company as much as it’s created opportunities to pick up shares at cheaper prices. To them, there’s little doubt Tesla’s share price will continue to surge.

One of those is Jeremy Ford, a construction contractor in Virginia who first bought Tesla shares as the pandemic took hold in 2020. He became interested when his wife considered — and ultimately ended up — purchasing a Tesla.

Ford has tried to time buying and selling shares to Tesla news over the past year. For example, he sold some stock before what turned out to be poor third-quarter delivery numbers, only to load back up ahead of the release of new details about Tesla’s electric pickup truck.

The 48-year-old now holds about the same number of Tesla shares as he did when 2023 began, but lowered his cost basis. Given an interest in disruptive technology, Ford reallocated some of those profits to new stakes in Palantir and Nvidia. The latter is tracking to see the fourth largest net inflows this year, while the former is not in the top 20, according to Vanda data.

Elon Musk speaks onstage during The New York Times Dealbook Summit 2023 at Jazz at Lincoln Center on November 29, 2023 in New York City.

Slaven Vlasic | Getty Images

Still, he’s all in on Tesla’s story, citing the push into robots and AI chips as cause for long-term optimism. His only serious concern would be if Musk left and the company’s performance worsened.

“If you can find a company that makes a product that people love, and it’s different than anything that other people have, then you have that chance to really make substantial money,” Ford said. “At some point, I do believe that I’ll look back at the price of the stock now and go, ‘Wow, that was a bargain.’”

‘Guts and heart’

Despite Tesla’s strong year on Wall Street and Main Street, others see challenges ahead. Roth MKM analyst Craig Irwin said profit margins could come under pressure from additional price cuts amid cooling growth.

But that may not dent individual investors’ enthusiasm. In fact, Irwin said the stock could be a beneficiary of turbulence in the electric vehicle industry, because any uncertainty would lead investors to companies like Tesla that have proven they can design, make and sell vehicles.

Given their affinity for the brand, Irwin said retail investors may also stick with Tesla longer than institutional investors. That could keep Tesla stock “levitating” above where it would otherwise be priced.

“Retail tends to trade on guts and heart,” Irwin said. “And a lot of people love Tesla.”

Changes in individual investor sentiment are so key to Tesla’s stock performance that hedge funds take note of these trends when evaluating what to do, the analyst noted earlier this year.

Irwin is in the majority on Wall Street in giving Tesla a neutral rating of no more than “hold,” neither recommending it be bought nor sold. Following 2023’s rebound, the average analyst surveyed by LSEG sees the stock falling about 13% over the next year.

Individual investors have often been the butt of the joke, with investing experts pointing to their inability to time the market and best allocate their money.

Yet individual traders have gained attention following the rise of short-squeezed “meme” stocks during the pandemic. Even as that craze fizzled, retail trading remains popular: Everyday investors put more than four times the amount of money into their 20 most-bought securities in 2023 than they did in all of 2018, according to Vanda data from early December.

For Schwarz, the UC professor, the flight to Tesla this year is complicated.

It’s concerning, he said, if individual investors are making bigger bets on single stocks than funds that invest in diversified indexes like the S&P 500 ETF. Still, while investments that spread bets across a pool of stocks is safer, trying to pick certain companies is more desirable than not being in the market at all, he said.

“Traders would be much better off if they just bought [the] index and forgot the password to their brokerage account,” he said. But, “even if Tesla doesn’t do as well as the market, it’s still better than probably just spending it on useless consumption and not participating.”

-

Fed sparking irrational market optimism over potential rate cuts, former FDIC Chair Sheila Bair warns

Market optimism over the potential for interest rate cuts next year is dangerously overdone, according to former FDIC Chair Sheila Bair.

Bair, who ran the FDIC during the 2008 financial crisis, suggests Federal Reserve Chair Jerome Powell was irresponsibly dovish at last week’s policy meeting by creating “irrational exuberance” among investors.

“The focus still needs to be on inflation,” Bair told CNBC’s “Fast Money” on Thursday. “There’s a long way to go on this fight. I do worry they’re [the Fed] blinking a bit and now trying to pivot and worry about recession, when I don’t see any of that risk in the data so far.”

After holding rates steady Wednesday for the third time in a row, the Fed set an expectation for at least three rate cuts next year totaling 75 basis points. And the markets ran with it.

The Dow hit all-time highs in the final three days of last week. The blue-chip index is on its longest weekly win streak since 2019 while the S&P 500 is on its longest weekly win streak since 2017. It’s now 115% above its Covid-19 pandemic low.

Bair believes the market’s bullish reaction to the Fed is on borrowed time.

“This is a mistake. I think they need to keep their eye on the inflation ball and tame the market, not reinforce it with this … dovish dot plot,” Bair said. “My concern is the prospect of the significant lowering of rates in 2024.”

Bair still sees prices for services and rental housing as serious sticky spots. Plus, she worries that deficit spending, trade restrictions and an aging population will also create meaningful inflation pressures.

“[Rates] should stay put. We’ve got good trend lines. We need to be patient and watch and see how this plays out,” Bair said.

-

'Good one, Donald': Biden flaunts stock market record highs, mocks Trump for predicting 'collapse'

U.S. President Joe Biden speaks during an event about lowering health care costs in the East Room of the White House on July 7, 2023 in Washington, DC.

Drew Angerer | Getty Images News | Getty Images

President Joe Biden paraded this week’s stock market record highs Friday in a new campaign video that trolled his predecessor, Donald Trump, for predicting a market collapse if Biden were elected.

“Good one, Donald,” Biden wrote in the post on X.

During the 2020 presidential campaign, then-President Trump claimed, “If Biden wins, you’re gonna have a stock market collapse the likes of which you’ve never had.”

The video replayed that clip, followed by soundbites of news anchors touting the stock market’s recent gains. One memorable snippet showed Larry Kudlow, Trump’s former top economic aide, marveling at the market’s performance on his Fox Business show.

“Uh, let’s just talk for a moment about the stock market. Boom,” Kudlow says.

Facing the prospect of a rematch with Trump in 2024, Biden is seizing on the stock market gains to try to get through to voters.

The video reflects a growing willingness by the Biden campaign to take direct aim at Trump, who leads the Republican primary field by more than 40 points.

It also reflects a shifting tone from the Biden campaign, which has spent the past year focused on a positive message and touting Biden’s economic gains and job creation.

But this strategy has so far failed to resonate with voters, polls show. A pivot to more negative campaign messages, and reminding voters of how Trump governed in office, could help to energize disaffected Democrats.

A poll last month from The New York Times and Siena College found voters trusted Trump — who inherited a stronger economy than Biden did and left office in the middle of the pandemic — over Biden, on the economy.

-

Fed’s John Williams says the central bank isn't ‘really talking about rate cuts right now’

New York Federal Reserve President John Williams said Friday rate cuts are not a topic of discussion at the moment for the central bank.

“We aren’t really talking about rate cuts right now,” he said on CNBC’s “Squawk Box.” “We’re very focused on the question in front of us, which as chair Powell said… is, have we gotten monetary policy to sufficiently restrictive stance in order to ensure the inflation comes back down to 2%? That’s the question in front of us.”

The Dow Jones Industrial average shot to a record and the 10-year Treasury yield fell below 4.3% this week as traders took the Fed’s Wednesday forecast for three rate cuts next year as a sign the central bank was changing its tough stance and would start cutting rates sooner than expected next year.

Traders are betting that the central bank would cut rates deeper than three times, according to fed funds futures. Futures markets also indicate that the Fed could start cutting rates as soon as March.

Williams is reining in some of that enthusiasm a bit, it appears.

“I just think it’s just premature to be even thinking about that,” Williams said, when asked about futures pricing for a rate cut in March.

Williams said the Fed will remain data dependent, and if the trend of easing inflation were to reverse, it’s ready to tighten policy again.

“It is looking like we are at or near that in terms of sufficiently restrictive, but things can change,” Williams said. “One thing we’ve learned even over the past year is that the data can move and in surprising ways, we need to be ready to move to tighten the policy further, if the progress of inflation were to stall or reverse.”

The Fed projected that its favorite inflation gauge — the core personal consumption expenditures price index — will fall to 2.4% in 2024, and further decline to 2.2% by 2025 and finally reach its 2% target in 2026. The gauge rose 3.5% in October on a year-over-year basis.

“We’re definitely seeing slowing in inflation. Monetary policy is working as intended,” Williams said. “We just got to make sure that … inflation is coming back to 2% on a sustained basis.”

Don’t miss these stories from CNBC PRO:

-

There are not enough houses to satisfy demand, says NAR's Tracy Kasper

Tracy Kasper, president of the National Association of Realtors, joins ‘The Exchange’ to discuss the housing market’s outlook for 2024, the drop in mortgage rates, and more.

03:07

Thu, Dec 14 20232:02 PM EST

-

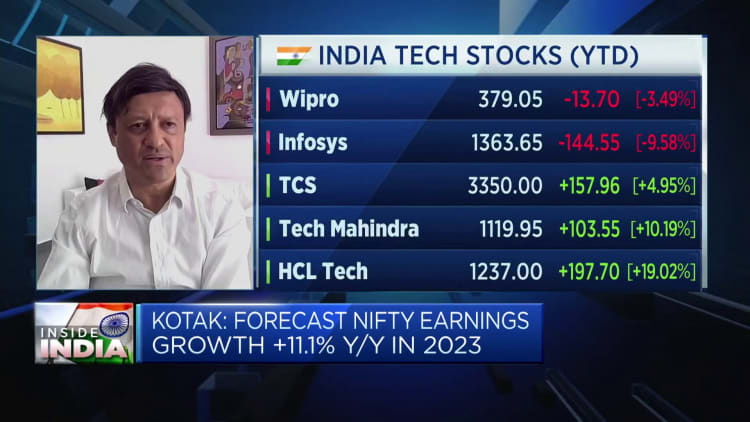

Five reasons why India stocks are rallying and could keep going

Beautiful and colorful aerial view of Mumbai skyline during twilight seen from Currey Road, on February 16, 2022 in Mumbai, India.

Pratik Chorge | Hindustan Times | Getty Images

India’s stock markets have staged record-breaking rallies this year, making the country a favorite among its Asia-Pacific counterparts.

The Nifty 50 index has repeatedly notched fresh all-time highs, reaching yet another peak on Tuesday. The index is set for an eighth year of gains, up more than 15% year-to-date.

Optimism about India’s growth prospects, increased liquidity and greater domestic participation have all contributed to the surge in stock markets. In fact, India’s stock market value has overtaken Hong Kong’s to become the seventh largest in the world.

As of the end of November, the total market capitalization of the National Stock Exchange of India was $3.989 trillion versus Hong Kong’s $3.984 trillion, according to data from the World Federation of Exchanges.

Numbers from the WFE also showed that India’s NSE saw more new stock listings than the HKEX. India’s stock market had 22 new listings vs. Hong Kong’s seven, as of November.

Here are the five reasons why India’s stock markets have reached new highs this year;

Growth prospects

India has been one of South Asia’s fastest growing economies, with expectations only building up for next year.

The world’s most populous country has grown at a consistently strong pace this year, with the most recent reading on third-quarter GDP showing a much higher-than-expected growth rate of 7.6%.

Bets on India driving growth in Asia have also been rising. S&P Global predicted India’s GDP for the fiscal year ending March 2024 hit 6.4%, more than its earlier forecast of 6%.

Strong earnings

The Indian stock market has also shown sound fundamentals and robust earnings, which are expected to grow through 2024.

HSBC forecasts earnings growth of 17.8% for India in 2024 — among the fastest rates in Asia. Sectors such as banks, health care and energy, which have already done well this year are best positioned for 2024, according to HSBC.

Sectors such as autos, retailers, real estate and telecoms were also relatively well positioned for 2024, while fast-moving consumer goods, utilities and chemicals are among those HSBC said were unfavorable.

Domestic participation

There has also been an uptick in domestic participation in Indian stock markets this year, especially in high-growth areas, according to research by HSBC.

“While foreign investors tend to be active in large caps, it is local investors that dominate the small and mid-cap space, which partly explains the outperformance – fund flows into midcap-small schemes of domestic MFs (i.e. mutual funds with a mandate to invest in small/midcaps) have been disproportionately high,” HSBC noted.

It also expects this trend to continue into the next year.

Rate cuts are coming

The Reserve Bank of India held its main lending rate steady at 6.5% last Friday and said its expects the country to grow at a pace of 7% this year. The central bank did warn that inflation, even as it continues to cool, still remains above its target as underlying price pressures were stubborn.

That, however, does not mean market players aren’t expecting rate cuts next year.

“We expect the policy pause to be extended for now and expect 100bp (basis points) of cumulative rate cuts starting from August 2024,” analysts at Nomura wrote in a client note.

Lower lending rates often boost liquidity and boost more risk-taking sentiment in stock markets.

Policy continuity

As India gears up for a big election year in 2024, markets remain optimistic on further policy continuity.

Analysts predict it could be another victory for the ruling nationalist Bharatiya Janata Party, with recent polls and recent state elections showing the right-wing BJP could retain power.

“The ruling Bharatiya Janata Party (BJP) outdid its national and regional rivals at the recently held state elections. This strong run fed expectations of political stability at the upcoming general elections in April/May24, addressing earlier concerns that a weak showing at the state polls might have stoked a fiscally populist agenda in the coming months,” DBS senior economist Radhika Rao said in a client note.

-

Jim Cramer dismisses recession fears and names sectors poised to soar after Fed meeting

CNBC’s Jim Cramer said the Federal Reserve’s decision to hold rates steady is a win for the bulls and is a sign the tightening cycle is coming to an end. With inflation easing and the potential for rate cuts next year, Cramer said the economy has managed a soft landing and more sectors are ready to soar.

“Sure, the easy money has been made in a couple of sectors — mostly tech — but now it’s time for a bunch of other sectors to shine, the economically sensitive ones that were supposed to be crushed by an inevitable recession,” Cramer said. “These stocks aren’t liked. May I suggest you cotton to them because the plane has landed, our seatbelts are unbuckled, we’re going down the gangway, calling an Uber and getting the heck out of the airport.”

The Fed held its key interest rate steady for the third straight time, and committee members indicated there could be at least three rate cuts in 2024.

Some on Wall Street worry this Fed action suggests there’s a recession on the horizon, but Cramer said it would be wise to ignore this outlook, adding that a strong labor report on Friday indicates the contrary. To Cramer, potential rate cuts would mean “smooth sailing” for stocks, with investors becoming less interested in bonds.

Although the market has been up for weeks, Cramer said there’s still money to be made in cyclical stocks and sectors that benefit from lower interest rates such as homebuilders, autos and financials. Cramer suggested buying financials that have hit lows recently, including Bank of America, JPMorgan Chase and even regional banks that suffered after the banking crisis in March. He also named Caterpillar, Stanley Black & Decker, Ford and General Motors.

“Not only is the Fed no longer our enemy, it’s much more likely to become our pal, assuming the economy stays on its current, slower course,” Cramer said. “This is the about-face that the bulls were waiting for.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Caterpillar and Stanley Black & Decker.

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – InstagramQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com

-

We like food and beverage stocks in China and 'active stock-picking' is key: Goldman Sachs

Si Fu of Goldman Sachs discusses investing opportunities in China as consumer demand continues to recover.