I’ve seen many startups succeed, and many fail. I’ve consulted for and invested in lots of them. My previous startup, Anchor, navigated its own challenges and missteps; we were fortunate to survive them, and ultimately Spotify acquired the company in 2019.

Over the years, I’ve come to think of startups as a game of Minesweeper. Remember that game from early PCs? You’d start with a grid of clickable squares, with cartoon mines hidden throughout. Your job was to take a few guesses, gain some information about where the mines were, and logic your way through finding them all. Similarly, startup founders start with an empty board. And although nobody can know their locations, the mines are guaranteed to be there — and certain types of mines are common to every kind of business. A founder can save a lot of time, money, and energy if they know how to avoid these pitfalls from the very start.

After many years of navigating mines, I’ve identified the 50 most common ones. (I share lessons like this regularly in my newsletter — which you can find at my website, zaxis.page.) To be clear, this list is far from exhaustive. And while there are certainly exceptions, it can be a great shortcut for anyone leading a new initiative, at any sized company.

Related: The Path to Success Is Filled With Mistakes. Do These Four Things to Tap Into Their Growth Potential.

Ready to find your mines? Here they are.

1. Thinking you have all the answers

My favorite piece of advice for startup founders: You’ll be 90% wrong about your assumptions. The problem is that you don’t know which 90%. Therefore, do everything you can to challenge your convictions, and be willing to shed them or tweak them as needed. Rapid iteration and an open mind are two necessary ingredients for a successful startup journey.

2. Ignoring the impact of compounding

Meaningful long-term change takes time, be it learning new skills, obtaining new customers, or establishing a brand. The most underrated way to drive improvement is through incremental steps that compound over time. Einstein apocryphally called compound interest the “eighth wonder of the world.” Tiny changes each day multiply to astronomical gains, so long as you’re consistent and committed.

3. Disregarding the law of funnels

Any action a user or customer needs to take is considered the top of a “conversion funnel.” The goal is to get them to the bottom. One of the easiest ways to lose someone along that journey (a phenomenon known as churn) is to require them to go through too many steps. I call this the “Law of Funnels.” It states: “The more steps a user has to go through to do something, the less likely they are to complete it.”

4. Hiring based on experience

Startups have very little time and resources to focus on the wrong thing, but it’s impossible to predict what they will need to focus on. So don’t waste energy and precious hires on what a person has done in the past. It’s 97% irrelevant to what they will be doing in the future. Instead of hiring for relevant experience, hire people who are adaptable and good problem-solvers.

5. Focusing on scaling too early (see fig. 1)

Many startups overengineer and future-proof in the early days, which is almost certain to result in a tremendous waste of energy. At the start of the journey, there are very few knowns (see mistake No. 1). But one thing that is known is that there is a fundamental difference between the friction that prevents a product from taking off and the friction that prevents it from scaling.

Related: Failed Startups Made These 7 Marketing Mistakes — Are You Making Them, Too?

6. Wearing too many hats

In my favorite brainteaser of all time, 100 prisoners wear different colored hats and strategize ways to identify their own hat colors. A startup often has far fewer than 100 employees, but often has far more than 100 hats. Context-switching carries a real cost, and early-stage employees who fail to delegate responsibility often end up performing all tasks poorly. Find people you can trust to take some of those hats off your head, and bring them in early.

7. Comparing your work-in-progress to others’ finished works

One of the easiest ways to get discouraged while running the startup marathon is to compare your rough drafts and works-in-progress to polished success stories. All difficult tasks (be they entrepreneurial, creative, educational, etc.) require iteration and more iteration, revision and more revision. The mistakes along the way are countless, sure, but they are also priceless. Comparing a work-in-progress to the finished products we see every day is not only demotivating — it’s also disingenuous. It’s comparing a sapling to a fully grown tree.

8. Trying to solve unbounded problems

To be solved effectively and efficiently, problems must be segmented and bounded. First, split your intractable problems into small, digestible challenges with a single goal in mind for each. Second, ensure that their solution is bounded to a finite solution space. Not realizing this is almost always a recipe for wasted resources and disappointing outcomes.

9. Being frightened of incumbents

Founders are often scared to take on powerful incumbents, believing those paths to be dead ends. This is a mistake. Taking on a monopoly is often a missed opportunity with enormous upside, and with lower costs than you think. There are four main reasons: Monopolies have already proven the industry is viable and lucrative. They refuse to cannibalize their own dominance. They’ve institutionalized their inefficiencies. And perhaps most importantly, they have the most to lose from making mistakes. Startups, by contrast, have the most to gain.

10. Fearing the pivot

For most startups, there are only two viable outcomes. In the unlikely case, they will be a big success. In the more likely scenario, they will fail. Don’t stick to early product or strategy decisions that raise the likelihood of the latter. If your startup fails, the value of all your decisions will be zero — so do everything you can to maximize the likelihood of success. If that requires pivoting from what you know and are comfortable with, so be it.

Related: I Have Helped Founders Raise Millions. Here Are 7 Fundraising Mistakes I See Many Startups Making — And What You Need To Do Instead.

11. Thinking you need to be first

Passionate and creative thinkers often believe that in order to succeed, they need to be the first mover. This is wrong. Being the first mover is often a tremendous disadvantage. What matters is not being first but having consumers think you were first, all while benefitting from the courses charted by your forerunners.

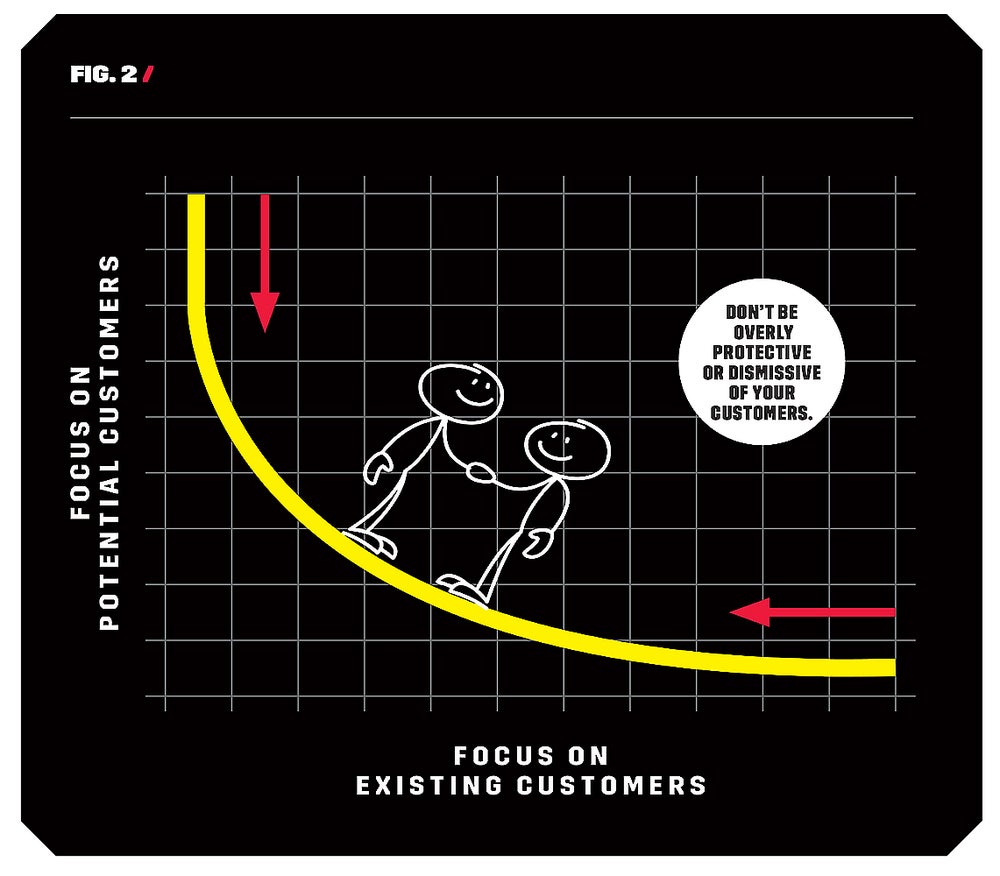

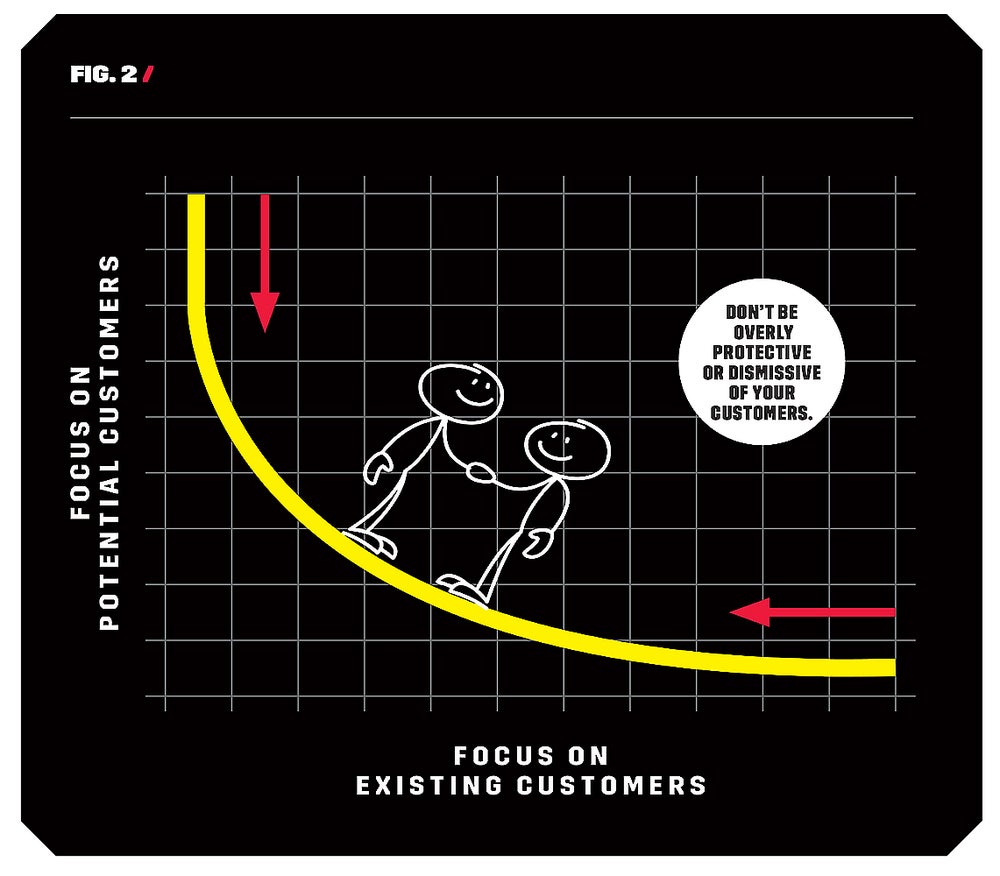

12. Catering too much to existing users (see fig. 2)

Your existing users or customers are critically important; you wouldn’t have a business without them. But focusing too much on their needs necessarily comes at the expense of the audience you haven’t yet reached, and for whom you’re still struggling to showcase value. Catering to those who have reached the bottom of your funnel prevents you from serving the needs of those higher in the funnel, whose needs have not yet been served. This is the push and pull of product development, and there is a flip side to it. That’s the next mistake…

13. Catering too much to potential users (see fig. 2)

The danger outlined in mistake No. 12 swings the other way too. Neglecting to serve the needs of your existing users runs the risk of causing unnecessary churn. The cost of retaining customers you have already converted is substantially lower than the cost of obtaining new ones. Don’t be overly protective of the users you have, but don’t be overly dismissive either.

14. Not understanding employee motivation

Your employees are motivated by different things, and failing to recognize their different styles often leads to poor management as well as to employee dissatisfaction. I categorized people into a “Climber, Hiker, Runner” framework: Climbers are driven by the prospect of unlocking future opportunities. Hikers prefer to take on new challenges and learn new things. And Runners are happy when they can dive deep into what they’re good at. Approaching motivation this way has made me a better manager, and has helped me identify effective ways to keep employees happy.

15. Focusing too much on short-term gains

Successfully growing a startup is a marathon (see mistake No. 2). Short-term wins offer little beyond dopamine hits and the stroking of egos. In long-term success stories, accomplishing tough goals takes time but yields meaningful and lasting benefits. While it takes many short-term wins to get to the finish line, don’t miss the forest for the trees. Those incremental achievements are not the true goal. They are the means to an end.

Related: 7 Common Mistakes to Avoid When Scaling Your Business

16. Putting off hard conversations

Your life is divided into two parts: that which occurs before you have the awkward, unpleasant, or emotionally taxing conversation you’re putting off, and that which occurs after. Which would you rather extend? If it’s the latter, why not do everything in your power to cross the boundary right now?

17. Failing to recognize power laws

Power laws govern everything you do. Most of the work you put into your startup will yield little clear benefit. Most of the success you see will come from a handful of bets. Internalizing this phenomenon leads to better decision making, less emotional turbulence, and healthier, more sustainable businesses.

18. Overprotecting your idea

Have a brilliant idea and an NDA preventing anyone from peeking at it? You’re likely not doing yourself any favors. Truly successful companies win with superior execution, not superior ideas (see mistake No. 11). And by overprotecting your idea from being prodded and challenged, you’re weakening its probability of ever coming to fruition. Often, those individuals who frighten you as potential competitors are those whose feedback is most valuable. And if you fear them stealing the idea, be comforted in knowing that there is no shortage of great ideas in the world. There is, however, a dire shortage of people who know what to do with them.

19. Keeping interactions inside the office

Whether in person or remote, the value of having your team “break the ice” cannot be overstated. I mean that in two ways. First, it’s of course good for your colleagues to get to know one another (and hopefully like one another), which leads to happier employees and higher productivity. Second, when people let loose, it “breaks the ice” of the day-to-day mayhem of startup life — or what I like to call “a necessary thawing period.”

20. Getting too comfortable (see fig. 3)

There is a big difference between being at a local minimum and being at a global one. Yet from a day-to-day vantage point, they look the same. Any change in any direction means more work, more stress, and more risk. We must zoom out and look at the entirety of our options. Sometimes the best paths or strategies lie just beyond a hill we’re scared to climb.

Related: I Made These 3 Big Mistakes When Starting a Business — Here’s What I Learned From Them

21. Not putting things in perspective

When lost in the hustle and bustle of the early stages of a company, it’s important to remember that most stressful things don’t actually matter in the long term. They will do little to affect the eventual outcome, but they will heavily drain you in the near term. Please take regular moments to stop yourself, look at your small stressors, and ask if this really matters in life. It probably doesn’t.

22. Not quantifying goals

Goals without metrics are unbounded (see mistake No. 8). This makes them harder to achieve — and how will you know when you do achieve them? How will you hold yourself accountable when you’ve veered too far off course? Particularly when working as part of a team, quantifiable and measurable goals are of paramount importance to achieve any level of alignment.

23. Waiting to find a technical cofounder

Nearly everything I’ve needed to learn to become a technical cofounder, I taught myself (with the guidance of great mentors). You live in an age of wonders, where anyone can learn anything with incredible efficiency. Do not allow the search for a technical cofounder to prevent you from pursuing your dream. Become the technical cofounder yourself.

For instance: Are you interested in AI but think you’ll never understand how it works? Think again.

24. Looking for complicated answers when there may be simple ones

Often, problems that seem intractable have elegant and simple solutions. We are trained to look for complexity, and to value those perspectives that overcomplicate the world. Ignore that instinct! The greatest insights I had as a founder came from light-bulb moments when I realized things were simpler than I’d assumed, not more complicated.

25. Assuming there is only one path to success (see fig. 4)

While other people’s success stories can motivate and inspire you, they can also be dangerous. Everyone’s path is unique, and often meandering. Anyone who says that your journey to success must follow a single trajectory has never built a company of their own; they’ve merely studied other people’s.

Related: Business Owners: Are You Making These 10 Mistakes?

26. Not filtering out high-frequency noise

Most day-to-day problems are just noise. Sometimes it’s angry employees or customers. Sometimes it’s a deal gone bad or failing servers. Successful leaders adopt what I call a low-pass mentality. Just as low-pass filters in engineering absorb short-term shocks by filtering out the high-frequency ups and downs, a startup founder must filter out the noise and focus on solving long-term, systemic issues that will have a high impact.

27. Putting your eggs in one basket

As shown in mistake No. 1, you’ll be wrong about pretty much all your assumptions. So why risk your business on a single bet? Of course, it’s important to have convictions — but that doesn’t preclude you from simultaneously having other convictions, particularly at the very early stages. If the primary goal of a startup is to reach product-market fit quickly (see mistake No. 5), the risk of being wrong about your one big bet would be extremely costly.

28. Putting your eggs in too many baskets

Just as it is dangerous to wear too many hats (see mistake No. 6), it is similarly dangerous to tackle too many strategies at once. Successful leaders prioritize ruthlessly; that means tackling “critical” tasks before ones that are only “very important.” It means committing to seeing through strategies before expending energy on other ones. And it means rallying the whole team around a single milestone or goal, rather than splitting their attention and making everyone worse off because of it.

29. Underinvesting in long-term relationships

Most of the key turning points in my business career came through the strength of relationships fostered over many years. Small decisions to help others, to build trust, and to keep in touch can have a tremendous impact on your future in unpredictable ways. The worst-case scenario? Some wasted social energy. The best-case scenario? You open doors you never knew were there.

30. Failing to recognize recurring patterns

Despite all the unpredictable noise in business, there is an often-overlooked consistency between market cycles and the players within them. While it’s dangerous to place too much emphasis on individual success stories (see mistake No. 25), it is even more dangerous to overlook the cyclical nature of market dynamics. Human psychology is notoriously predictable — and notoriously forgetful.

Related: How to Turn Your Mistakes Into Opportunities

31. Not talking to other founders

As a founder myself, I overlooked the learned experience of other founders. There is so much guidance buried in their success stories. There is even more to take away from their failures. As I said at the top of this article, startups are like a game of Minesweeper. You can tackle a blank board and start clicking away, or you can put aside your ego and get help from those who have played that board before. If you choose the latter, the likelihood of success can skyrocket.

32. Focusing on vanity metrics

There is a reason they are called vanity metrics. Hitting them is the kind of short-term gain I advised you to disregard in mistake No. 15. Why achieve goals that look good but aren’t strategically important? Why care about the number of users if those users are a poor fit and don’t stick around? Why focus on time spent using your product if that number is only high because your product is hard to use (see mistake No. 3)? Identify your desired outcomes, and then find the metrics that actually map to those outcomes.

33. Misunderstanding the CAP principle

In computer science, there is a fundamental limitation on how database systems can be built. One can never achieve more than two of the following three goals: consistency, availability, and partition tolerance (or “CAP”). The same is true of companies, which will inevitably see a decline in one of these as they invest in the other two. For instance, when ensuring all teams can talk to each other (availability) and that there is always an individual who can be the “source of truth” for others (consistency), your ability to manage when an employee leaves or communication channels go offline (partition tolerance) drops considerably.

34. Never setting arbitrary deadlines

Arbitrary deadlines are a tool. Like most tools, they can be good or bad, depending on who’s using them and for what. Yet while there are many times a team needs the space to think, build, and iterate without undue pressure, there are just as many instances that benefit from the structure and direction provided by arbitrary deadlines. Importantly, arbitrary deadlines should be recognized as arbitrary, and they should be adjusted if needed. But that doesn’t diminish their power in aligning a team and incentivizing productivity. In the right circumstances, I’ve seen them work wonders.

35. Ignoring uncertainty principles

Early-stage entrepreneurship, as in quantum physics, presents an inescapable tradeoff. Resources (time, money, etc.) can be spent on investing in a specific strategy or on keeping open optionality; they cannot do both. I call this phenomenon the Startup Uncertainty Principle. It shows that the more you focus on the present, the less you’re able to prep for the future. And the more you prep for the future, the less effective you’ll be now. Companies that attempt to do both at once are fighting a losing battle.

Related: Common Mistakes First-Time Entrepreneurs Make and How to Stop Them

36. Not prioritizing low-hanging fruit

As shown in mistake No. 28, successful companies prioritize ruthlessly. When companies spread themselves and their employees too thin, they hurt productivity and morale. Of course, there is value in investing in longer-term projects with higher costs and higher rewards. Yet it is also critical to regularly prioritize easy wins and short-term opportunities that move the needle incrementally. In addition to laying the foundation for compounding improvements (see mistake No. 2), it will also reengage your teammates and keep morale high.

37. Overlooking unexplored markets

As founders and dollars race to build in competitive, high-growth markets, opportunities often exist in “hidden layers” of industry. Companies that focus there can ride waves of market growth while avoiding fierce competition, by turning potential competitors into actual customers. Some of the most valuable companies in the world have taken this approach (including the two most valuable) and it has paid dividends (literally).

38. Not relying on proven technology

New technological solutions to longstanding problems can be attractive. But the hidden downsides can surface much too late — often when you’re already dependent. New technologies can break, can go out of business, can have unexpected side effects. By contrast, longstanding problems tend to have proven longstanding solutions. While not as exciting to use, they work, and that’s what matters most.

39. Sugarcoating bad news

Managers sometimes believe that when things get hard — and they inevitably will, many times over — bad news is better delivered indirectly or with a positive spin. This is an innate human desire. But employees are smart. Being disingenuous about the state of the business or the rationale for business decisions will hurt your company over the long term. This applies to everything from layoffs to pivots to cutting perks. Your employees will see through the euphemisms, rendering your sugarcoating fruitless, and they will respect you less for your lack of directness.

40. Ignoring entropy

It’s a law of the universe that everything trends toward disorder. Knowledge and control are no different. No matter what, eventually you’ll be wrong. Your convictions will need to adapt as the world in which they exist evolves. The stable parts of your business will suffer from unexpected market dynamics, new competition, and shifting consumer attitudes. Those who succeed in the long term embrace entropy as a fact of life, and they know that they cannot hold anything too sacred for too long.

Related: 10 Mistakes I Made While Selling My First Startup (and How You Can Avoid Them)

41. Forgetting your only advantage

With limited time and limited resources, only so much can get done. A startup has every disadvantage relative to more well-funded incumbents, and only one advantage: speed. Leverage this. Big players are slow to move and slow to turn, like giant cruise ships. Startups are small and nimble sailboats that can race faster and turn on a dime when it matters.

42. Treating money like it isn’t fungible

A dollar is a dollar is a dollar. Every single dollar spent—no matter how it’s accounted for — is money not spent on something else. This is all the more reason to prioritize ruthlessly (see mistake No. 28). Resources have a habit of disappearing faster than you’d expect.

43. Not explicitly deciding how to balance productivity and alignment (see fig. 5)

Companies that overinvest in aligning their team members do so at the expense of productivity. Those that focus on productivity do so at the expense of alignment. The optimal balance depends on the company, its size, and its unique journey. But the important takeaway is that you are making this trade-off whether you explicitly choose the balance or not — so you might as well choose it.

44. Only talking to people you know

The “birthday paradox” shows that if you put 23 people in a room together, there is a 50% chance two will share the same birthday. By the same mathematical logic, if any conversation has even a 0.3% chance of being life-changing, then putting a few dozen people in a room together is virtually guaranteed to lead to some life-changing conversations. The takeaway? Meet more people. (Here’s a good way to do that.)

45. Working only from home

Startup stress can seep across any boundaries you’ve set. To drive both productivity and better mental health, don’t work exclusively from where you sleep and spend time with family. I say “exclusively” because I have seen startups achieve great success in a fully remote setup. Still, the early days of startups rely critically on serendipitous conversations and ideations — and that can only happen when employees are colocated. Get the team together now and then.

Related: 5 Marketing Mistakes Startups Must Avoid in Order to Survive

46. Working only from an office

Most founders I know get their best ideas when they’re not at work. There’s something about the change of scenery, the connections between unrelated neurons, and the exposure of a problem or challenge to a new environment. Whereas mistake No. 45 showcases why it’s important to sometimes bring your team together, this one recognizes that it’s equally important to take them out of their comfort zones and get them to interact in brand-new places and brand-new ways.

47. Forgetting to revisit whatever motivates you

When things get difficult (and they will), it’s important to reflect on the things that helped motivate you to start in the first place. Have it readily accessible—be it a movie or a podcast episode or a book or a soundtrack — and revisit it when you feel the morale drop. For me in my Anchor days, it was Daft Punk’s Random Access Memories. To this day, if I need a jump-start in motivational energy, I just put on that album and get to work.

48. Not taking pictures

You’re going to miss the early days. You’ll wish they were better documented. If things end up working out, you’ll look at those moments in time and say, “Wow, look how far we’ve come.” And if things don’t, you’ll say, “Wow, look how hard we worked. If I did that, I can handle anything.”

49. Assuming you have product-market fit

Product-market fit is the elusive transition point at which you realize who your customers are and what value you’re providing for them. Hardly anyone reaches this point without considerable effort, and the easiest way for a brand-new enterprise to fail is to assume they have reached this point when they have not. There are only two ways — talking to customers and looking at data — that can verify the milestone has been hit. Once there, things get considerably easier.

50. Thinking there are only 50 startup mistakes

I suppose I’m guilty of this one right now. No list of startup advice is exhaustive. Every new entrepreneurial journey is bound to uncover unique challenges. Yet that’s also part of the fun of the startup journey: You never know what’ll happen next.

A version of this article originally appeared on Nir Zicherman’s newsletter, Z-Axis.