U.S. stocks ended modestly higher Thursday in choppy trade as worries about potential weakness in the banking system resurfaced a day after the Federal Reserve increased hikes by 25 basis points. The Dow Jones Industrial Average

DJIA,

rose about 73 points, or 0.2%, ending near 32,103, down about 400 points from the session’s high. The S&P 500 index

SPX,

gained 0.3% and the Nasdaq Composite Index

COMP,

closed up 1%, according to preliminary figures from FactSet. Stocks closed off the session’s highs, but gained ground after Treasury Secretary Janet Yellen told a Senate committee that the federal government would take extra steps to stabilize the U.S. banking system, if necessary. Stocks closed sharply lower Wednesday after the Fed raised its policy rate to a range of 4.75% to 5%, up a year ago from close to zero. But some analysts said a catalyst of the selloff was comments from Yellen indicating she wasn’t yet considering ways to guarantee all bank deposits, despite regulators providing an exception to depositors in Silicon Valley Bank and Signature Bank, which failed earlier this month. Sheila Bair, who ran the Federal Deposit Insurance Corp. from 2006 to 2011, told MarketWatch on Thursday that the focus should be on underwater securities at all banks, not only regional lenders.

Tag: SPX

-

Dow, S&P 500 post modest gains Thursday as investor focus returns to banking risks

+0.23% +0.30% +1.01% -

‘This is a risk confronting all banks,’ ex-FDIC chief Sheila Bair tells MarketWatch

Regional banks shouldn’t be the only source of worry for potential fallout from the Federal Reserve’s rapid pace of interest-rate hikes in the past year, said a former top banking regulator.

“I don’t see regional banks as having any particular problem,” said Sheila Bair, who ran the Federal Deposit Insurance Corp. from 2006 to 2011, in an interview with MarketWatch on Thursday. “We need to be mindful of all unmarked securities at banks — small, medium and large.”

Bair called the hyperfocus on regional banks and interest-rate risks “counter productive” in the wake of the collapse earlier in March of Silicon Valley Bank and Signature Bank

SBNY,

-22.87%

of New York.“This is a risk confronting all banks,” she said. “All examiners need to be on alert for how interest-rate risk is being managed. If there is a run, they will need to sell these securities. Those are the kinds of things all-size banks, and all examiners should be worried about.”

A run on deposits at Silicon Valley Bank snowballed after it disclosed a $1.8 billion loss on a sudden sale of $21 billion worth of high-quality, rate-sensitive mortgage and Treasury securities. It was the biggest U.S. bank failure since Washington Mutual’s collapse in 2008.

The FDIC estimated that U.S. banks had some $620 billion of unrealized losses from securities on their books as of the end of 2022, including longer-duration Treasurys and mortgage securities that have become worth less than their face value.

“Unrealized losses on securities have meaningfully reduced the reported equity capital of the banking industry,” FDIC Chairman Martin Gruenberg said on March 6, in a speech at the Institute of International Bankers.

Days after that gathering, Silicon Valley Bank and Signature Bank both collapsed, prompting regulators to roll out a new emergency bank funding program to help head off any liquidity strains at other U.S. lenders. Regulators also backstopped all deposits at the two failed lenders.

Bair earlier this month argued that if U.S. banking authorities see systemic risks they should go to Congress and ask for a backstop against uninsured deposits, beyond the standard $250,000 cap per depositor, at a single bank. Specifically, she wants zero-interest accounts, or those used for payroll and other operational expenses, to be fully covered, as was the case for a few years in the wake of the global financial crisis to stop runs on community banks.

Treasury Secretary Janet Yellen said Wednesday that blanket deposit insurance protection isn’t something her department is considering, but added that the appropriate level of protection could be debated in the future.

Fed Chairman Jerome Powell on Wednesday said the U.S. banking system “is sound and resilient, with strong capital and liquidity,” after hiking rates by another 25 basis points to a range of 4.75% to 5%, up from almost zero a year ago.

See: Fed hikes interest rates again, pencils in just one more rate rise this year

Bair has been calling for a pause on Fed rate hikes since December. She said that instead of raising rates by another 25 basis points on Wednesday, Fed Chair Powell should have hit pause and said the central bank needs time to assess.

“If we have a financial crisis, we won’t have a soft landing,” Bair said. “We have to avoid that at all costs.”

Read: Bank failures like SVB are a reminder that ‘risk-free’ assets can still wreck portfolios

Stocks closed modestly higher Thursday in choppy trade, with the Dow Jones Industrial Average

DJIA,

+0.23%

up 0.2% and S&P 500 index

SPX,

+0.30%

advancing 0.3%, while the Nasdaq Composite Index

COMP,

+1.01%

gained 1%. -

Moody’s sees risk that U.S. banking ‘turmoil’ can’t be contained

Despite quick action by regulators and policy makers, there’s a rising risk that banking-system stress will spill over into other sectors and the U.S. economy, “unleashing greater financial and economic damage than we anticipated,” said Moody’s Investors Service, one of the Big Three credit-ratings firms.

Simply put, the risk is that officials “will be unable to curtail the current turmoil without longer-lasting and potentially severe repercussions within and beyond the banking sector,” Atsi Sheth, Moody’s managing director of credit strategy, and others wrote in a note distributed on Thursday. Still, the agency’s baseline view is that U.S. officials will “broadly succeed.”

Moody’s warning came as Treasury Secretary Janet Yellen indicated that the U.S. could take additional actions if needed to stabilize the banking system, and after Federal Reserve Chairman Jerome Powell assured Americans on Wednesday that the central bank would use its tools to protect depositors.

Read: Regional banks get the attention, but worries are more widespread, says ex-FDIC chief Bair and Debate over expanding deposit insurance weighs on bank stocks. Here’s what to know.

Beneath the surface, though, is lingering worry. Hedge-fund manager Bill Ackman, for example, is warning of an acceleration of deposit outflows from banks and the latest global fund manager survey from Bank of America

BAC,

-2.42%

found that 31% of 212 managers polled regard a systemic credit crunch as the biggest threat to markets.Of the three ways in which banking-system troubles could spill over more broadly, one of them is potentially the “most potent,” according to Moody’s: That is a general aversion to risk by financial-market players and a decision by banks to retrench from providing credit. Such a scenario could lead to the “crystallization of risk in multiple pockets simultaneously,” the ratings agency said.

Source: Moody’s Investors Service

“Over the course of 2023, as financial conditions remain tight and growth slows, a range of sectors and entities with existing credit challenges will face risks to their credit profiles,” the Moody’s team wrote. Banks are not the only type of players with exposure to interest-rate shocks, and “market scrutiny will focus on those entities that are exposed to similar risks as the troubled banks.”

A second potential channel for spillover is through the direct and indirect exposure to troubled banks that private and public entities have — via deposits, loans, transactional facilities, essential services, or holdings in those banks’ bonds and stocks. And a third way in which banking problems could spread more broadly is through a misstep by policy makers, who have been focused on inflation and may not be able to respond effectively enough to evolving developments, Moody’s said.

On Thursday, U.S. stocks

DJIA,

+0.23% COMP,

+1.01%

finished higher as investors continued to weigh the risks to the banking sector. The policy-sensitive 2-year Treasury yield

TMUBMUSD02Y,

3.833%

fell to its lowest level this year, while gold futures settled at a more than one-year high.Last week, Fitch Ratings said that nonbank financial institutions, insurers, and funds were experiencing a variety of “knock-on effects” as the result of the sudden deterioration of a few U.S. banks.

-

Americans will dump up to $1.1 trillion in stocks this year, and move the cash to credit and money-market funds, says Goldman.

This year could mark the end of the affair — between Americans and their stockholdings.

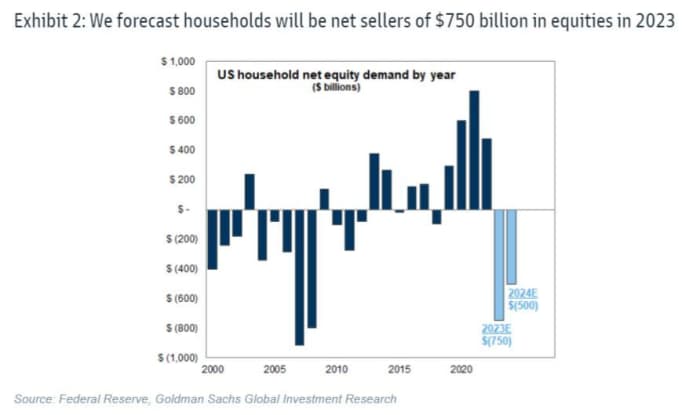

That’s according to Goldman Sachs analysts who say due to the rise in bond yields since the start of 2022, and increased flows to bond and money-market funds, U.S. households could end up dumping up to $1.1 trillion of equity holdings this year.

“The current level of market yields clearly shows that the era of TINA (There is No Alternative) has ended and that now there are reasonable alternatives (TARA) to equities,” said a team of strategists led by Cormac Conners and David Kostin.

“Although equity demand remained resilient amid sharply rising rates in 2022, we believe the YTD [year-to-date] flows into money market and bond funds signal an escalating household shift away from equities and toward the alternatives.”

Their model of household equity demand is based on the 10-year U.S. Treasury yield and personal savings rate. The analysts say that higher yields and lower savings tend to be associated with a decrease in demand for equity among households.

In their base case, they estimate net selling of $750 billion this year, alongside their forecast for the yield on the 10-year Treasury note

TMUBMUSD10Y,

3.435%

to rise from around 3.6% currently to 4.2% by the end of this year, and the personal savings rate will rise to 5.3% from 4.5%. Conners and the team said such stock selling would reverse six previous quarters of household equity demand.

Uncredited

Should bond yields tilt lower, and the savings rate move higher, Goldman sees that estimate nearly halved to $400 billion in equity sales. In a worst-case scenario, where yields push even higher and the savings rate lower, household selling would reach $1.1 trillion, they cautioned.

As for the idea that there are now reasonable alternatives to equities (TARA), Goldman said households tend to buy fixed income products during years in which they sell stocks. They pointed to data showing $51 billion has flowed out of U.S. equity mutual funds and exchange-traded funds, year to date, while $282 billion has poured into U.S. money-market funds and $137 billion into U.S. bond funds.

Read: Money-market funds swell to record $5.4 trillion as savers pull money from bank deposits

Picking up some of the slack left by U.S. investors, the Goldman team predict foreign investors and corporations will be net stock buyers of $550 billion and $350 billion, respectively.

“We expect buyback and cash M&A activity will slow but remain relatively robust this year, driving corporations to be net buyers of U.S. stocks – though a potential [second-half] recovery in equity issuance presents one risk to this forecast. A weaker dollar should drive foreign investors to be net buyers of U.S. stocks in 2023. Pension funds will also be net buyers of $200 billion in equities in 2023,” said the strategists.

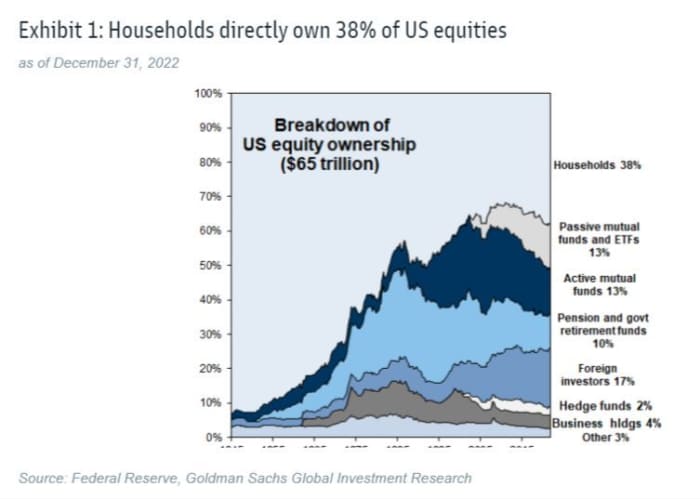

The pace of household buying has been slowing, they noted. Citing the Federal Reserve’s Financial Accounts data, Goldman said households are estimated to own 38% of the total equity market. From the start of 2020 through mid-2022, they bought $1.7 trillion in equities, but in 2022 demand for those assets fell 40% to $480 billion.

“Adjusting the Fed’s household demand series for our estimate of hedge fund net equity demand (which is included in the household category by default), implies households were net buyers of just $209 billion in equities in 2022, a 78% decline from 2021,” they said.

Up 2% so far this year, the S&P 500

SPX,

+0.25%

lost 19% in 2022, the worst year for the index since the global financial crisis of 2008, as a war in Europe added to inflationary pressures across the globe, driving central banks such as the Federal Reserve to raise interest rates sharply. Wednesday’s 25-basis point Fed rate hike marked the ninth rise since March 2022.From under 1.5% at the start of 2022, the yield on the 10-year Treasury note

TY00,

+0.60%

has climbed to around 3.468%, levels not seen since the 2008 crisis. -

Dow skids 530 points, stocks close sharply lower after Fed raises rates, says cuts unlikely this year

U.S. stocks closed sharply lower on Wednesday, giving up earlier gains, after the Federal Reserve raises interest rates by 25 basis points as expected, but talked down the possibility of cuts to rates this year. The Dow Jones Industrial Average

DJIA,

-1.63%

tumbled 531 points, or 1.6%, ending near 32,028, while the S&P 500 index

SPX,

-1.65%

shed 1.7% and the Nasdaq Composite Index

COMP,

-1.60%

closed down 1.6%, according to preliminary FactSet figures. Fed Chairman Jerome Powell said the U.S. banking system remained resilient after it and regulators rolled out liquidity measures to help shore up confidence in the banking system after the collapse of Silicon Valley Bank and Signature Bank earlier in March. Powell also said that tighter credit conditions for consumers, following the bank failures, would likely work like rate hikes in terms of lowering inflation. It will be a key area of focus for the Fed in the coming weeks and months, he said. The 10-year Treasury rate

TMUBMUSD10Y,

3.444%

fell Wednesday to 3.46%, a sign that investors in the bond market think growth will be slower. -

S&P 500 pushes above 4,010 level, stocks turn higher after Fed raises rates by 25 basis points

U.S. stocks turned higher, shaking off earlier weakness, after the Federal Reserve on Wednesday raised its policy rate as expected by 25 basis points to help fight inflation. The increase in interest rates comes despite recent weakness in the banking system after the collapse earlier in March of Silicon Valley Bank. The S&P 500 index

SPX,

-0.55%

was up 14 points, or 0.4%, to about 4,016, at last check, while the Dow Jones Industrial Average

DJIA,

-0.68%

was up 0.2% near 32,609 and the Nasdaq Composite Index was 0.7% higher. The Fed also said the U.S. banking system remains resilient, in its policy statement. The 10-year Treasury rate

TMUBMUSD10Y,

3.507%

was lower at 3.52%. -

S&P 500 reclaims 4,000 mark, stocks end higher ahead of Fed rate decision

The S&P 500 on Tuesday posted its highest close since the collapse of Silicon Valley Bank earlier this month, which sent shockwaves through financial markets and raised concerns about the stability of the U.S. banking system. The S&P 500 index

SPX,

+1.30%

closed up about 51 points, or 1.3%, ending near 4,003, according to preliminary data from FactSet. That was its highest close since May 6, four days before the failure of Silicon Valley, the biggest bank collapse since the 2008 global financial crisis. The Dow Jones Industrial Average

DJIA,

+0.98%

rose 1% Tuesday, while the Nasdaq Composite Index

COMP,

+1.58%

swept to a 1.6% gain. Banks and companies with heavy exposure to rate-sensitive assets, including property loans, have been under pressure since Silicon Valley Bank’s implosion. It drew attention to some $600 billion in paper losses at banks from their holdings of “safe” but low-coupon securities that have fallen in value in the year since the Federal Reserve began rapidly increasing interest rates to combat high inflation. Those older bonds end up worth less when investors have access to new securities with higher yields, with a similar low-risk profile in terms of credit risks. The failure of several regional banks in March, plus the sale of Credit Suisse

CS,

+2.46%

to rival bank UBS

UBS,

+11.97%

over the weekend, has reawakened fears of potentially broader problems in the banking system as central bank have increased rates and ended an era of easy money. Even so, stocks were rallying as the Federal Reserve at the conclusion of its 2-day policy meeting on Wednesday is expected to raise its policy rate by another 25 basis points. -

First Republic stock rockets toward record gain, but recovers less than half of Monday’s plunge

Shares of First Republic Bank

FRC,

+42.71%

rocketed 43.7% on heavy volume, putting them on track for a record one-day gain, as Treasury Secretary Janet Yellen said the U.S. government was committed to keeping the banking system safe, and amid reports JPMorgan Chase & Co.

JPM,

+2.95%

was working to help the bank. The previous record rally was 27.0% on March 14, 2023. Trading volume ballooned to 87.8 million shares, already nearly triple the full-day average, and enough to make stock the the most actively traded on major U.S. exchanges. Meanwhile, the stock’s price gain of $5.33 means it has only recovered about 49% of Monday’s $10.85, or 47.1% selloff, that took the stock to a record-low close of $12.18. The stock has plummeted 85.6% year to date, while the SPDR S&P Regional Banking exchange-traded fund

KRE,

+5.48%

has tumbled 22.2% and the S&P 500

SPX,

+0.73%

has gained 3.7%. -

Housing stocks see broad rally after strong home-sales data

The home-building sector enjoyed a broad rally in morning trading Tuesday, after data showing existing-home sales in February rose a lot more than expected. The iShares U.S. Home Construction exchange-traded fund

ITB,

+0.99%

climbed 1.3% toward a five-week high, with all 48 equity components gaining ground. Among the ETF’s more active components, shares of Home Depot Inc.

HD,

-0.02%

advanced 0.9%, D.R. Horton Inc.

DHI,

+0.04%

rose 0.5%, KB Home

KBH,

+2.83%

tacked on 2.4%, Lennar Corp.

LEN,

+1.27%

rallied 1.3% and PulteGroup Inc.

PHM,

+1.03%

was up 1.1%. The National Association of Realtors said Tuesday that existing-home sales for February leapt 14.5% to an annual rate of 4.58 million, the largest increase since July 2020, enough to reverse 12 months of losses and well above expectations of 4.2 million. The home construction ETF has hiked up 12.0% over the past three months, while the S&P 500

SPX,

+1.27%

has gained 2.7%. -

U.S. stocks end higher, kicking week off with gains ahead of Fed policy meeting

U.S. stocks ended higher Monday, kicking the week off with gains led by the blue-chip gauge Dow Jones Industrial Average ahead of the Federal Reserve’s meeting this week. The Dow Jones Industrial Average

DJIA,

+1.20%

rose more than 350 points to close 1.2% higher, while the S&P 500

SPX,

+0.89%

gained 0.9% and the technology-heavy Nasdaq Composite

COMP,

+0.39%

climbed 0.4%, according to preliminary data from FactSet. The Fed’s two-day policy meeting begins Tuesday, with many investors expecting the central bank to announce on Wednesday that it’s lifting its benchmark interest rate by a quarter of a percentage point to a target range of 4.75% to 5% in an effort to bring down high inflation. Fed-funds futures on Monday afternoon indicated a 73.1% chance of such a rate hike, according to the CME FedWatch Tool, at last check. Odds of the Fed deciding to pause its rate hikes after recent emergency steps to bolster the banking system were at 26.9% based on fed-fund futures trading. -

Asian stocks tumble after Credit Suisse takeover

BEIJING (AP) — Asian stock markets fell Monday after Swiss authorities arranged the takeover of troubled Credit Suisse amid fears of a global banking crisis ahead of a Federal Reserve meeting to decide on more possible interest rate hikes.

Shanghai, Tokyo and Hong Kong declined. Oil prices retreated, and U.S. equity futures were tilting lower after initially rising on the takeover news.

Swiss authorities on Sunday announced UBS would acquire its smaller rival as regulators try to ease fears about banks following the collapse of two U.S. lenders. Central banks announced coordinated efforts to stabilize lenders including a facility to borrow U.S. dollars if necessary.

Investors worry banks are cracking under the strain of unexpectedly fast, large rate hikes over the past year to cool economic activity and inflation. That caused prices of bonds and other assets on their books to fall, fueling unease about the industry’s financial health.

“Investors are waiting to see where the dust settles on the banking saga before making any bold moves,” Stephen Innes of SPI Asset Management said in a report.

The Hang Seng

HSI,

-2.65%

in Hong Kong lost 3% to 18,920 and the Nikkei 225

NIK,

-1.42%

in Tokyo shed 1.2% to 26,990.25.The Shanghai Composite Index

SHCOMP,

-0.48%

lost 0.2% to 3,241 after the Chinese central bank on Friday freed up additional money for lending by reducing the amount of money commercial are required to hold in reserve. Hong Kong shares of HSBC

5,

-6.23%

dropped over 6%.The Kospi

180721,

-0.69%

in Seoul retreated 0.6% to 2,382.03 and Sydney’s S&P-ASX 200

XJO,

-1.38%

lost 1.4% to 6,900.00.India’s Sensex opened down 1.1% at 57,341.79. New Zealand and Southeast Asian markets also declined.

The Swiss government said UBS will acquire Credit Suisse for almost $3.25 billion after a plan for the troubled lender to borrow as much as $54 billion from Switzerland’s central bank failed to reassure investors and customers.

U.S. regulators have also sought to calm fears over threats to banking systems. The Federal Reserve said cash-short banks had borrowed about $300 billion from the Federal Reserve in the week up to Thursday.

Separately, New York Community Bank

NYCB,

-4.66%

agreed to buy a significant chunk of the failed Signature Bank in a $2.7 billion deal, the Federal Deposit Insurance Corp. said late Sunday. The FDIC said $60 billion in Signature Bank’s loans will remain in receivership and are expected to be sold off in time.Concerns persist about other lenders with shaky finances. Credit Suisse is among 30 institutions known as globally systemically important banks. Ahead of its takeover, Wall Street’s benchmark S&P 500 index

SPX,

-1.10%

lost 1.1% on Friday to 3,916.64.Shares of First Republic Bank

FRC,

-32.80%

sank nearly 33% to bring their plunge for the week to 71.8%.The Dow Jones Industrial Average

DJIA,

-1.19%

lost 1.2% to 31,861.98. The Nasdaq Composite

COMP,

-0.74%

fell 0.7% to 11,630.51. Dow futures

YM00,

-0.70%

fell 0.3% early Monday, while S&P 500 futures

ES00,

-0.60%

and Nasdaq-100 futures

NQ00,

-0.33%

were steady.The unexpectedly large, fast rate hikes by the Fed and other central banks to cool inflation that is close to multi-decade highs have caused prices of bonds and other assets on their books to fall.

Traders expect last week’s turmoil to push the Fed to limit a rate hike at its meeting this week to 0.25 percentage points. That would be the same as the previous increase and half the margin traders expected earlier.

A survey released Friday by the University of Michigan showed inflation expectations among American consumers are falling. That matters to the Fed, which has said such expectations can feed into virtuous and vicious cycles.

In energy markets, benchmark U.S. crude

CL.1,

-3.27%

sank 93 cents to $64.81 in electronic trading on the New York Mercantile Exchange. The contract fell $1.61 on Friday to $66.74. Brent crude

BRN00,

-3.29% ,

the price basis for international oils, declined $1.05 cents to $71.92 per barrel in London. It retreated $1.73 the previous session to $72.97.The dollar

DXY,

+0.13%

gained to 131.83 yen from Friday’s 131.67 yen. The euro

EURUSD,

-0.11%

declined to $1.0676 from $1.0681.MarketWatch contributed to this report.

-

U.S. stock-market futures edge higher after historic deal to rescue Credit Suisse

U.S. stock-index futures opened with modest gains Sunday evening as investors assessed a historic deal to rescue troubled Swiss lender Credit Suisse, the latest maneuver by authorities attempting to prevent a deeper loss of confidence in the global banking system.

Swiss bank UBS Group

UBS,

-5.50%

agreed to buy rival Credit Suisse

CS,

-6.94% CSGN,

-8.01%

for more than $3 billion, a substantial discount to its Friday closing price, in a deal shepherded by Swiss regulators and closely watched by monetary and economic policy makers around the world.Don’t miss: Here’s why UBS’s deal to buy Credit Suisse matters to U.S. investors

Also Sunday, the Federal Reserve and five other major central banks announced they were taking steps to ensure that U.S. dollars remained readily accessible throughout the global financial system.

Futures on the Dow Jones Industrial Average

YM00,

+0.64%

rose 123 points, or 0.4%, while futures on the S&P 500

ES00,

+0.65%

and Nasdaq-100

NQ00,

+0.42%

were also up 0.4%,Oil futures ticked higher after suffering their worst week of 2023 and ending Friday at their lowest since December 2021, with analysts tying the plunge largely to rising recession fears. April West Texas Intermediate crude

CL.1,

+0.55% CLJ23,

+0.55%

rose 0.3% to $66.92 a barrel on the New York Mercantile Exchange, while May Brent crude

BRN00,

+0.52% ,

the global benchmark, ticked up 0.1% to $73.05 a barrel on ICE Futures Europe.The positive initial tone in markets late Sunday was reflected in a weaker tone for the Japanese yen, which has seen haven-related support this month on rising banking worries. The U.S. dollar was up 0.3% versus the Japanese currency

USDJPY,

+0.60%

at 132.18 yen. The ICE U.S. Dollar Index

DXY,

+0.08% ,

a measure of the currency against a basket of six major rivals, was up 0.1%.Futures on U.S. Treasurys

TY00,

-0.82% ,

which also tend to serve as a haven during periods of crisis, were slightly lower. Treasurys rose sharply last week, dragging down yields, which move opposite to price, in volatile trading.Credit Suisse’s 167-year run came to an end after a collapse in the value of its shares and bonds last week. Economists, investors and authorities worried that a collapse by Credit Suisse could amplify contagion fears in the global banking system after the demise earlier this month of California’s Silicon Valley Bank, or SVB.

Economists expect U.S. banks to significantly tighten lending standards in response to the upheaval, raising the odds of the economy falling into recession.

The Tell: ‘Hard landing’ in store for U.S. economy as bank crisis intensifies: economist

As a result, fed-funds futures traders abandon expectations for a return to a supersized 50-basis-point, or half-percentage-point, rise in the Fed’s benchmark interest rate when policy makers complete a two-day meeting on Wednesday. The market at the end of last week showed traders saw a nearly 75% chance of a 25-basis-point hike, and a roughly 25% chance the Fed would hold rates unchanged.

Traders also priced in the potential for significant rate cuts by the end of the year, signaling rising recession expectations. Those shifting expectations helped drive the Treasury rally, particularly for the policy-sensitive 2-year note

TMUBMUSD02Y,

4.003% .Analysts said the Fed may be reluctant to hold off on a rate hike this week given still-elevated inflation readings and data so far that that shows the job market remains tight. Some economists see the Fed echoing the European Central Bank’s lead from last week, when it followed through with an earlier pledge to hike rates by 50 basis points while making clear that further rate moves would depend on future developments and data.

Don’t miss: What’s at stake for stocks, bonds as Federal Reserve weighs bank chaos against inflation fight

“While the Fed is obviously wary of contagion risks, it still views the banking sector as being well-capitalized, and it will want to stress that the inflation battle is not won, and it remains too high, so a 25-bps hike seems very likely, though like the ECB it will likely stress a high level of uncertainty, and offer no guidance, and emphasize data and financial conditions dependency,” said Marc Ostwald, London-based chief economist and global strategist at ADM Investor Services, in a note.

Despite efforts by the Fed and other U.S. regulators to ringfence SVB and a pair of other collapsed banks while moving to backstop deposits, other regional banks have faced significant pressure. While all depositors at those banks were made whole, calls have increased for the U.S. to formally remove a $250,000 cap on insured deposits.

Meanwhile, First Republic Bank

FRC,

-32.80%

saw its credit rating downgraded further into junk territory by S&P Global Ratings, news reports said. The ratings firm cut the bank’s credit rating three notches to B-plus from BB-plus and warned further downgrades were possible, according to Reuters.First Republic has been a top concern for investors and regulators following the collapse of SVB. Last week a group of 11 large banks agreed to provide a combined $30 billion in deposits to First Republic in an effort to shore up confidence in the lender. Shares of First Republic have plunged more than 80% so far in March.

U.S. stocks ended lower Friday amid banking sector fears, with the Dow

DJIA,

-1.19%

booking back-to-back weekly losses.The S&P 500

SPX,

-1.10%

rose 1.4% last week, while the technology-heavy Nasdaq Composite

COMP,

-0.74%

climbed 4.4% in its biggest weekly percentage gain since January, according to Dow Jones Market Data. -

Here’s why UBS’s deal to buy Credit Suisse matters to U.S. investors

Thousands of miles away from U.S. shores last Wednesday, a headline began working its way across Europe, then Wall Street, sparking fresh panic as it dawned on investors that they may be facing yet another banking crisis.

Shares of Credit Suisse

CS,

-6.94% CSGN,

-8.01%

would eventually sink 25% last week to a fresh record low, unable to find footing days after the head of top shareholder Saudi National Bank said they won’t invest any more in the bank. By Sunday, the struggling Swiss bank had a new owner, leaving investors to wonder if at least one chapter in a current roller coaster of global banking stress can be closed.Swiss authorities steered rival UBS AG

UBS,

-5.50%

to an all-stock deal worth 3 billion francs ($3.25 billion), or 0.76 francs per share, a not-so-slight discount to the 1.86 franc close on Friday of Credit Suisse. So important was the agreement, it was announced by Switzerland’s President Alain Berset, with both banks and the chairman of the Swiss National Bank on either side of him.“With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation,” the SNB said in a statement.

The Swiss National Bank said either Swiss bank can borrow up to 100 billion francs in a liquidity assistance loan, and Credit Suisse will get a liquidity assistance loan of up to 100 billion francs, backed by a federal default guarantee. The U.S. Federal Reserve had worked with its Swiss counterpart on the deal as well.

“We welcome the announcements by the Swiss authorities today to support financial stability. The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient,” said a statement Sunday by Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell.

European Central Bank President Christine Lagarde also praised Swiss authorities for “restoring orderly market conditions and ensuring financial stability,” while reiterating the “resilience” of the euro-area banking sector. She said the ECB stands ready to provide liquidity if needed.

Her comment comes days after the the ECB pulled the trigger Thursday on a 50-basis-point rate hike, as it warned “inflation is projected to remain too high for too long.”

The deal for Credit Suisse comes in the wake of stress on the U.S. banking sector, triggered by the collapse of Silvergate Bank, Silicon Valley Bank and Signature Bank, all within the space of a week.

“Virtually everyone at this high-level Swiss press conference — government officials, regulator, central bank governor, and executives of the two banks — blamed the US banking sector turmoil for being the catalyst for the financial turmoil in #Switzerland,” tweeted Mohamed A. El-Erian, chief economic adviser at Allianz, of the press conference Sunday with Swiss authorities to announce the deal.

And for U.S. investors who have had quite enough anxiety lately, a logical question would be to ask if the deal that brings together the two Swiss banking giants will now remove one layer of stress from global markets, and hence Wall Street.

For that reason, many will be watching how Asian and U.S. equity futures trade later on Sunday, as well as Europe’s opening reaction on Monday.

The Credit Suisse news may only go so far to assuage investors, with some raising an eyebrow over Powell and Yellen’s Sunday statement about the Swiss deal. “Seriously, if everyone truly believed the ‘The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient’ … Would they have to tell us? Are these words enough?” said Jim Bianco, president of Bianco Research, on Twitter. “Or do investors want to see Warren Buffett writing checks to regional banks in the next two hours (before Asia opens)?”

Fox News and other media outlets reported over the weekend that the Berkshire Hathaway

BRK.A,

-2.76% BRK.B,

-2.81%

chairman and CEO had been talking to President Joe Biden’s administration in recent days over possible investments in the battered regional bank sector, and offering his advice.The billionaire investor was responsible for a capital injection to Bank of America

BAC,

-3.97%

in 2011 as its shares tumbled due to subprime mortgages, as well as $5 billion to Goldman Sachs

GS,

-3.67%

amid the 2008 financial crisis.Some had said ahead of the deal last week that global-market stability depended on the Swiss first getting their house in order.

“I don’t think there are any direct consequences for U.S. investors, but it’s extremely negative for sentiment if a major Swiss bank fails, hot on the heels of SVB/SBNY,” Simon Ree, the founder of Tao of Trading options academy school and author of the book by the same name, told MarketWatch last week.

“The market will be (temporarily) wondering who’s next. It could start to have the optics of a global banking crisis, rather than an idiosyncratic failure of a niche U.S. regional bank,” said Ree.

Credit Suisse’s troubles came amid a revamp and five straight money-losing quarters, following a painful legacy that included billions worth of exposure to the collapsed Archegos family office and $10 billion worth of funds tied to Greensil Capital it had to freeze.

Read: In its delayed annual report, Credit Suisse admitted to financial control weaknesses

“The SNB and the Swiss government are fully aware that the failure of Credit Suisse or even any losses by deposit holders would destroy Switzerland’s reputation as a financial center,” said Otavio Marenzi, CEO of Opimas, a management consulting firm focused on global capital markets, in a note to clients last week.

The bank’s plummeting stock price and soaring bond yields was “mimicking Silicon Valley Bank’s recent collapse in a frightening way. In terms of the outflow of deposits, Credit Suisse’s position looks even worse,” said Marenzi.

Over there?

As far as some are concerned, the market may have more stress ahead of it.

“The SVB failure highlights the potential for other skeletons to be hidden in closets and the market will spend the next few weeks/months hunting them out. Even just the extreme volatility we’ve seen on bond markets the last five days renders any attempt to ascribe a value to other asset classes redundant,” said Ree.

Plus: Here’s what’s really protecting your bank deposits

His view is shared by many analysts, who in part point to increasing uncertainty around how the Federal Reserve will react going forward as it tries to balance market and economic risks. Some now see full percentage rate cuts by year-end, amid banking stress.

Samantha LaDuc, the founder of LaDucTrading.com who specializes in timing major market inflections, said she stands by her advice (that she shared with MarketWatch in February) that investors are being “paid to wait,” by staying in cash.

Read: Looking for a place for your cash? Grab these 5% CDs while you still can.

“I have been literally recommending and tweeting to clients that we are PAID TO WAIT in T-bills at 5% until [the] bond market can figure out if we have recession or not. All that happened last week pulled forward recession risk,” she told MarketWatch.

Prior to the SVB crisis, she had been recommending clients short reflation trades, such as banks

XLF,

-3.22% KRE,

-5.99% ,

energy

XLE,

-1.57%

and metals and mining

XME,

-0.78% SLX,

-1.96% ,

and has been saying she sees “unattractive risk-reward for either stocks or bonds.”Opimas’ Marenzi said the threat to Wall Street from Credit Suisse was simple:

“You mean what do American investors who do not own any non-American stocks and do not own a passport and could not find Switzerland on a map and who think that anyone who speaks any language other than English is a bit weird have to worry about? Not a lot, other than the contagion spreading back into the US banking system and causing a meltdown,” he told MarketWatch.

-

U.S. stocks finish lower but cling to weekly gains as Nasdaq beats Dow by widest margin since 2020

U.S. stocks finished lower on Friday as worries about banking-sector stability reemerged. But Friday’s pullback wasn’t large enough to stop both the S&P 500 and Nasdaq Composite from finishing the week in the green, while the Dow was the only major U.S. equity benchmark to finish lower. The S&P 500

SPX,

-1.10%

shed 43.69 points, or 1.1%, to finish Friday at 3,916.59 according to preliminary closing data, reducing its weekly gain to 1.4%. The Dow Jones Industrial Average

DJIA,

-1.19%

fell by 384.43 points, or 1.2%, to 31,862.12, for a weekly drop of 0.2%. The Nasdaq Composite

COMP,

-0.74%

declined by 86.76 points, or 0.7%, to 11,630.51, but still clinched a weekly gain of 4.4%. The Nasdaq managed to outperform the Dow by 4.6%, its widest weekly outperformance since the week ended March 20, 2020, according to Dow Jones Market Data. -

U.S. stocks end lower, Dow books back-to-back weekly losses as banking sector stress reemerges

U.S. stocks ended lower Friday as worries about banking-sector stability reemerged following a bankruptcy filing by SVB Financial Group and the release of data showing banks borrowed $165 billion from the Federal Reserve over the past week.

How stocks traded

-

The Dow Jones Industrial Average

DJIA,

-1.19%

fell 384.57 points, or 1.2%, to close at 31,861.98. -

The S&P 500

SPX,

-1.10%

dropped 43.64 points, or 1.1%, to finish at 3,916.64. -

The Nasdaq Composite

COMP,

-0.74%

slid 86.76 points, or 0.7%, to end at 11,630.51, snapping a four-day win streak.

For the week, the Dow fell 0.1%, the S&P 500 gained 1.4% and the Nasdaq climbed 4.4%, according to Dow Jones Market Data. The Dow booked back-to-back weekly losses while the Nasdaq saw its biggest weekly percentage gain since January.

What drove markets

U.S. stocks fell Friday as worries about the banking sector persisted.

“The markets are up and down all this week, and they’re moving typically in big amounts, because there really isn’t any consensus on how the strains in the banking system will play” into the economy, said Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute, in a phone interview Friday. Investors are trying to get a sense for how quickly the economy may be slowing and whether the problems in the banking sector will lead to an “accelerated slowing,” he said.

Concerns about the banking sector’s ability to withstand deposit flight reemerged Friday morning after SVB Financial Group

SIVB,

-60.41%

announced it had filed for Chapter 11 bankruptcy protection. SVB is the holding company of Silicon Valley Bank , which was put into FDIC receivership last Friday.On Thursday, First Republic Bank announced that it would receive $30 billion of uninsured deposits from a group of large U.S. banks. JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp. and Wells Fargo & Co. were among the 11 banks that agreed to provide the deposits.

Meanwhile, Federal Reserve data released Thursday afternoon in New York showed banks borrowed a combined $165 billion from the central bank. Most of the borrowing occurred via the Fed’s discount window. But a small amount was also tapped through the Fed’s new Bank Term Funding Program that allows bonds trading at a discount to be used as collateral, at par value. The fact that borrowing through the discount window has soared to a record high was adding to the market’s concerns about the banking sector, analysts said.

See: Banks have borrowed $165 billion from the Fed in past week after SVB failure

First Republic Bank

FRC,

-32.80%

shares plunged 32.8% Friday, while Credit Suisse Group

CS,

-6.94% ,

which earlier this week got a lifeline from the Swiss National Bank, closed 6.9% lower, according to FactSet data.At least four major banks have put restrictions on trades that involve troubled Swiss lender Credit Suisse Group or its securities, Reuters reported Friday, citing people with direct knowledge of the matter.

“I think there are still a lot of questions right now,” said Mark Luschini, chief investment strategist at Janney, during a phone interview with MarketWatch. “Investors can’t seem to hold their enthusiasm for equities for longer than a 24-hour news cycle.”

It’s not hard to understand why investors are still so anxious about the banking sector given the surge in borrowing from the Fed, said Matt Maley, chief market strategist at Miller Tabak + Co.

“Given that banks borrowed over $150bn at the Fed’s discount window on Wednesday, which compares to $4.4bn the week before, one can understand why investors are worried that the situation might be a bit more dire than the authorities are admitting to right now,” Maley said in emailed commentary.

In economic news, the Conference Board said Friday that the U.S. leading economic index fell 0.3% in February, marking the 11th straight monthly decline. U.S. industrial production was flat in February, data released Friday by the Fed show.

Meanwhile, the University of Michigan’s latest reading on consumer sentiment showed consumers were more downbeat in March than at ay time in the last four months.

While stocks fell Friday, they finished the week mostly higher. The Dow Jones Industrial Average slipped 0.1% for the week, while the S&P 500 booked a 1.4% weekly gain and the technology-heavy Nasdaq Composite saw a weekly rise of 4.4%, according to Dow Jones Market Data.

Companies in focus

-

FedEx Corp.’s stock

FDX,

+7.97%

jumped 8% after beating analyst estimates in its fiscal third-quarter earnings. The shipping firm also lifted its profit forecast for the full fiscal year. -

Shares of PacWest Bancorp

PACW,

-18.95%

and Western Alliance Bancorp

WAL,

-15.14%

tumbled as regional banks continued to face pressure, with PacWest falling almost 19% and Western Alliance dropping 15.1%. -

Shares of Microsoft Corp.

MSFT,

+1.17%

rose 1.2% as analysts saw the latest iteration of Chat GPT giving the tech giant an even greater edge. In other megacap tech names, Alphabet Inc.’s Class A

GOOGL,

+1.30%

shares gained 1.3% while semiconductor giant Nvidia Corp.

NVDA,

+0.72%

advanced 0.7%.

—Steve Goldstein contributed to this report.

-

The Dow Jones Industrial Average

-

White House calls for China’s Xi to talk with Ukraine’s Zelensky

The Biden administration hopes that Chinese President Xi Jinping will reach out to Ukrainian President Volodymyr Zelensky directly because it’s important that Xi hears Ukraine’s perspective and not just Russia’s, White House spokesman John Kirby told reporters on Friday. Kirby’s remarks come after Beijing and Moscow announced earlier Friday that Xi will visit Russia from Monday to Wednesday, in an apparent show of support for Russian President Vladimir Putin as the Russia-Ukraine war continues. Kirby criticized China’s call for a cease-fire between Ukraine and Moscow, saying while that approach might sound good, it wouldn’t respect Ukrainian sovereignty and instead would recognize Russia’s gains in Ukraine.

-

U.S. stocks finish sharply higher as First Republic gets rescue from banks

CORRECTION: An earlier version of this pulse said stocks finished higher on Friday. U.S. stocks finished sharply higher on Thursday, erasing losses from earlier in the session, as a group of big banks deposited $30 billion with troubled lender First Republic Bank. The S&P 500 SPX gained 68.36, or 1.8%, to close at 3,960.28, according to preliminary closing data from FactSet. The Dow Jones Industrial Average DJIA rose 371.98 points, or 1.2%, to 32,246.55. The Nasdaq Composite COMP gained 283.22 points, or 2.5%, to 11,717.28.

…

-

Dow drops almost 300 points as stocks close mostly lower amid bank fears

U.S. stocks ended lower Wednesday, with the Dow Jones Industrial Average falling almost 300 points, as concerns over troubled Credit Suisse Group CS added to worries about the banking system. The Dow DJIA closed 0.9% lower, while the S&P 500 SPX shed 0.7% and the technology-heavy Nasdaq Composite COMP edged up around 0.1%, according to preliminary data from FactSet. The Swiss National Bank said Wednesday that it will provide liquidity to Credit Suisse “if necessary.” The S&P 500’s financial sector slumped 2.8% Wednesday, one of the index’s worst performing sectors along with energy and materials and industrials.

…

-

Swiss National Bank to provide liquidity to Credit Suisse ‘if necessary’

The Swiss National Bank will provide liquidity to troubled lender Credit Suisse if necessary, the central bank said late Wednesday, in a joint statement with the Swiss Financial Market Supervisory Authority, or FINMA. The “problems of certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets,” SNB and FINMA said. “The strict capital and liquidity requirements applicable to Swiss financial institutions ensure their stability. Credit Suisse meets the capital and liquidity requirements imposed on systemically important banks. If necessary, the SNB will provide CS with liquidity,” they…

-

Stocks trim losses after report Credit Suisse, Swiss authorities hold talks

U.S. stocks trimmed sharp losses Wednesday afternoon following a report that Swiss authorities and Credit Suisse held talks aimed at stabilizing the troubled lender. Bloomberg, citing people familiar with the matter, said CS leaders and government officials have discussed options that ranged from a public statement of support to a potential liquidity backstop. Ideas also discussed included a spinoff of the Swiss unit or a tieup with rival UBS Group AG, the report said, adding that people involved cautioned it was unclear what, if any, measures would be executed. The Dow Jones Industrial Average DJIA, was off 331 points,…