Anthony Noto, SoFi CEO, joins ‘Money Movers’ to discuss the current state of the consumer, red flags from the consumer, and how Americans feel about their retirement accounts.

Anthony Noto, SoFi CEO, joins ‘Money Movers’ to discuss the current state of the consumer, red flags from the consumer, and how Americans feel about their retirement accounts.

Personal loan repayment terms often range between two to five years. However, some lenders offer terms that are longer than that — sometimes as long as 12 years.

A longer repayment term means more time to repay your balance and, as a result, likely smaller monthly payments. On the flip side, a longer term could mean spending more on interest over the life of the loan, so it’s important to choose a lender that offers lower interest rates and doesn’t charge early payoff or prepayment penalties in case you decide to repay the balance quicker.

With that in mind, here are CNBC Select’s picks for 2024’s best personal loan lenders that offer longer loan terms. We considered key factors like interest rates, fees, loan amounts and, of course, term lengths offered, plus other features including how your funds are distributed, autopay discounts, customer service and how fast you can get your funds. (Read more about our methodology below.)

7.99%—25.99%* APR with AutoPay

Debt consolidation, home improvement, auto financing, medical expenses, and others

24 to 144 months* dependent on loan purpose

Terms apply. *AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Excellent credit required for lowest rate. Rates vary by loan purpose.

Who’s this for? LightStream is an online lender that offers for nearly every purpose except for higher education and small business. It allows eligible borrowers to apply for as little as $5,000 and as much as $100,000 in funding. This is one of the largest personal loans you can get.

Standout benefits: LightStream offers loans with terms as long as 144 months (12 years), which is longer than any other lender we reviewed. It also offers a Rate Beat Program in which it will beat any competing lender’s unsecured loan by .10 percentage points. Loans can be approved and funded as soon as the same business day if you complete the application process by 2:30 p.m. ET. If you can’t make this deadline, you should be able to receive your funds the next business day.

Debt consolidation/refinancing, home improvement, major purchase

1.85% to 9.99%, deducted from loan proceeds

Up to $10 (with 15-day grace period)

Why Upgrade is the best for financial literacy:

Who’s this for? Upgrade is a fintech company that aims to provide affordable financial products. It stands out for considering borrowers with fair credit. It offers personal loan amounts starting at $1,000, which makes it appealing to those who only need to borrow a smaller amount. Eligible borrowers have up to 84 months (seven years) to repay their loan balance in full. Its personal loans have an origination fee ranging from 1.85% to 9.99% that is deducted directly from your loan proceeds so be sure to account for this when deciding on the loan amount.

Standout benefits: This lender lets you check what rate you may qualify for based on self-reported information, such as your desired loan amount and personal information, without impacting your credit score. It also accepts joint applications, which can be useful if your credit needs work. Funds are available as soon as one business day after accepting a loan offer and there are no prepayment penalties for paying a loan off early.

8.99% – 29.99% when you sign up for autopay

Debt consolidation/refinancing, home improvement, relocation assistance or medical expenses

Who’s this for? SoFi allows eligible borrowers to repay their loans over up to 84 months (seven years) and allows potential borrowers to have a co-applicant. A co-applicant is someone who applies for the loan with you and is equally responsible for paying back the full loan amount.

In many cases, having a co-applicant can be advantageous since a co-applicant with a higher credit score can help you get approved for a lower interest rate and other more beneficial terms. The idea is that you may be seen as a less risky borrower since two individuals, each with a source of income, are signing on to repay the entire loan.

Standout benefits: SoFi allows eligible borrowers to apply for as much as $100,000, making it another solid contender for those who need to borrow larger amounts of money. Loan applicants can choose between variable and fixed APR, which isn’t always an option most lenders only offer fixed-rate personal loans. It also allows applicants to check their rate before applying without impacting their credit score. SoFi members also enjoy various perks like rate discounts on other SoFi loans and complimentary access to financial planners.

Debt consolidation, home improvement, wedding or vacation

36, 48, 60, 72 and 84 months

Who’s this for? Discover Personal Loans provides borrowers funding as soon as the next business day as long as their application is error-free and the loan is funded on a weekday. This option is handy if you require funding in a pinch. However, its maximum loan amount of $40,000 is on the lower end compared to some other lenders on this list.

Standout benefit: Discover allows applicants to check their rate online before applying without impacting their credit score. Shopping around with a few lenders can help increase your odds of landing terms that work best for you.

Debt consolidation, home improvement, medical bills or emergencies

Who’s this for? First Tech Credit Union is ideal for those who prefer to bank with a credit union to potentially get lower rates and better terms. The credit union offers loan terms as long as 84 months.

You must be a First Tech member to apply for this loan, but there are many ways to join. You can qualify if someone in your family is already a member, you or a family member work for a partner company, you live in Lane County, Oregon or you belong to the Computer History Museum or the Financial Fitness Association.

Standout benefits: You can check your two-year loan rate before applying without impacting your credit score. Borrowers have the option to defer their first loan payment for up to 45 days after their funding date, which can be useful for those who need quick funding and a little more time to start repayments. Just keep in mind that deferring your first payment doesn’t defer the interest charges so you may end up paying more interest over the life of the loan.

Debt consolidation, home improvement, moving expenses, major purchases, adoption and more

0.99% to 8.99% of the loan amount

$15 fee if the borrower’s bank account has insufficient funds

*The Best Egg Secured Loan is a personal loan secured using a lien against fixtures permanently attached to your home such as built-in cabinets, light fixtures, and bathroom vanities. Rest assured, your home itself will not be used as collateral.

Who’s this for? Most personal loans are unsecured and many lenders don’t offer the ability to secure them with collateral. However, Best Egg offers the option to secure a personal loan using permanent fixtures in your home as collateral. Permanent fixtures can include built-in cabinets, light fixtures, shelving and more. With this option, borrowers do not need to put up personal possessions or the home itself as collateral, according to the lender’s website.

Standout benefits: Best Egg allows for repeat borrowers, however, when applying for a second loan your total outstanding loan balance cannot exceed $100,000. Borrowers are charged an origination fee of 0.99% to 8.99% which is deducted from the loan proceeds. To be considered for a term of up to 84 months, you must apply for the secured loan option. Otherwise, the maximum loan term is 60 months.

Here are some common personal loan terms you need to know before applying.

A long-term personal loan is a personal loan that offers a longer amount of time to repay the balance. Many personal loan lenders give borrowers up to 60 months (five years) to repay their loan, but some offer longer terms (six years or more).

Keep in mind that because personal loans are a form of installment credit, borrowers must repay the balance in fixed, equal monthly amounts for a specified period.

Personal loans can range in size from $500 to $100,000. Before you apply, consider how much you can afford to make as a monthly payment. Also, keep in mind that your creditworthiness may also determine the size loan you qualify for.

As with any other form of credit, personal loans can impact your credit score positively or negatively. When you apply for a personal loan, a lender launches a hard inquiry on your credit report, which can result in a slight credit score dip at first. However, getting a personal loan can contribute to diversifying your credit mix, which may improve your credit score. Making on-time loan payments consistently can also improve your credit score over time.

As with any other form of credit, your interest rate for your personal loan is decided based on factors such as your credit score, credit history, income, the loan’s size and term. Keep in mind that when taking on a personal loan with a longer repayment term, you may be subject to higher interest rates.

A credit score in the good to excellent range (a FICO score of 670 or higher) is generally needed for a personal loan but some lenders consider fair or poor credit scores as well. Just keep in mind that the lower your credit score, the higher your interest rate may be.

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every personal loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best long-term personal loans.

To determine which long-term personal loans are the best, CNBC Select analyzed dozens of U.S. personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with no origination or signup fees, fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best personal loans, we focused on the following features:

After reviewing the above features, we sorted our recommendations by best for overall financing needs, borrowing larger amounts, no fees, low credit scores and next-day funding.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

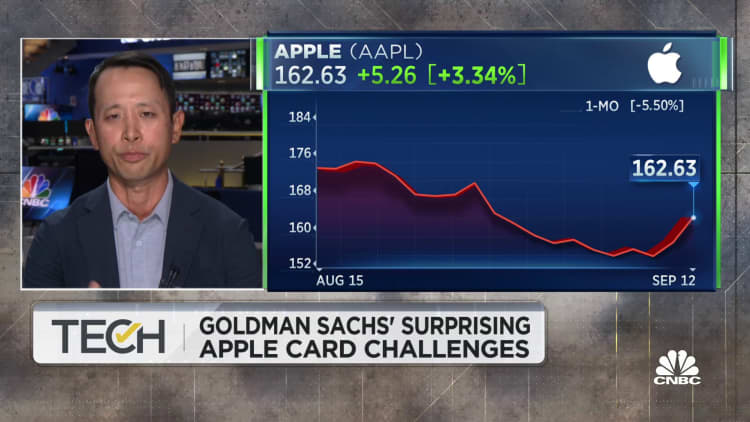

As equities soared in 2020 and consumers flocked to trading apps like Robinhood, Apple and Goldman Sachs were working on an investing feature that would let consumers buy and sell stocks, according to three people familiar with the plans.

The project was shelved last year as the markets turned south, said the sources, who asked not to be named because they weren’t authorized to speak on the matter.

The effort, which has not been previously reported, would have added to Apple’s suite of financial products powered by Goldman. Apple first teamed up with the Wall Street bank to offer a credit card in 2019, and then added buy now, pay later (BNPL) loans and a high-yield savings account. The company said last month that the savings account offering had climbed past $10 billion in user deposits.

Representatives for Apple and Goldman declined to comment.

Apple CEO Tim Cook holds a new iPhone 15 Pro during the ‘Wonderlust’ event at the company’s headquarters in Cupertino, California, U.S. September 12, 2023.

Loren Elliott | Reuters

Apple was working on the investing feature at a time of zero interest rates during Covid, when consumers were stuck at home and spending more of their time and their record savings in trading shares, including meme stocks like GameStop and AMC, from their smartphones.

Apple’s conversations with Goldman began during that hype cycle in 2020, two sources said. Their work progressed, and an Apple investing feature was meant to roll out in 2022. One hypothetical use case pitched by executives involved the ability for iPhone users with extra cash to put money into Apple shares, one person said.

But as markets were roiled by higher rates and soaring inflation, the Apple team feared user backlash if people lost money in the stock market with the assistance of an Apple product, the sources said. That’s when the iPhone maker and Goldman switched directions and pushed the plan to launch savings accounts, which benefit from higher rates.

The status of the stock-trading project is unclear after Goldman CEO David Solomon bowed to internal and external pressure and decided to retrench from nearly all of the bank’s consumer efforts. One source said the infrastructure for an investing feature is mostly built and ready to go should Apple eventually decide to move forward with it.

The Apple Card launched with much fanfare three years ago, but the business brought regulatory heat and racked up losses as its user base expanded. Earlier this year, Goldman rolled out a high-interest savings account for Apple Card users, offering a 4.15% annual percentage yield.

Goldman was also central to Apple’s BNPL offering. The product, called Apple Pay Later, can be used for purchases of $50 to $100 “at most websites and apps that accept Apple Pay,” according to the support page. Borrowers can split a purchase into four payments over six weeks without incurring interest or fees.

Before Goldman’s pivot away from retail banking, the company examined ways to expand its partnership with Apple, sources said. More recently, Goldman was in discussions to offload both its card and savings account to American Express.

Had plans for the trading app progressed, Apple would have entered a market with stiff competition, featuring the likes of Robinhood, SoFi and Block’s Square, along with traditional brokerage firms such as Charles Schwab and Morgan Stanley’s E-Trade.

Stock trading has become another way for financial firms to keep customers and drive engagement on their platforms. Apple was pursuing the same approach, one source said. It’s a move that could capture the interest of regulators, who have scrutinized Apple for its App Store practices. Robinhood has also been grilled by regulators for what they described as “gamifying” markets.

Other tech companies have been pushing into the space. Elon Musk’s X, formerly known as Twitter, is working on a way to let users buy stocks and cryptocurrencies through a partnership with eToro. PayPal had plans to launch stock trading after hiring a key industry executive in 2021. But the company abandoned those plans, and said on an earnings call that it would cut spending and refocus on its core e-commerce business.

Anthony Noto, SoFi CEO, joins CNBC’s Julia Boorstin and ‘Closing Bell Overtime’ to talk the latest inflation data, the Supreme Court’s student loan ruling and more.

03:50

Thu, Jul 13 20234:31 PM EDT

Charles Schwab Corp. is the largest publicly traded brokerage business in the United States with $7.5 trillion of client assets, and is a leading service provider for financial advisors, among the top exchange-traded fund asset managers and one of the biggest banks.

“It would be fair to characterize Charles Schwab as a financial services supermarket,” Michael Wong, director of North American equity research and financial services at Morningstar, told CNBC. “Anything that you want, you can find in Charles Schwab’s platform.”

Over the decades, Charles Schwab helped usher in a low-cost investing revolution while surviving market crashes and fierce competition — even when the game was taken up a notch to zero-fee commissions in 2019.

“Inherently, this is a scale business. The larger you are, the more efficient you are from an expense perspective,” Alex Fitch, portfolio manager for the Oakmark Select Fund and the Oakmark Equity and Income Fund, which invests in Charles Schwab, told CNBC. “It enables you to cut prices.”

Various facets of Charles Schwab’s business compete against many legacy full-service brokers and investment bankers, including Fidelity, Edward Jones, Interactive Brokers, Stifel, JPMorgan, Morgan Stanley and UBS. And, it has to battle in the financial tech market against companies like Robinhood, Ally Financial and SoFi.

The melee reached a turning point in 2019 when Charles Schwab announced it was slashing commissions for stock, ETF and options trades to zero, matching the fees offered by Robinhood when it entered the market in 2014.

Quickly, other companies followed suit and cut fees, which damaged TD Ameritrade’s business enough that Charles Schwab ended up acquiring it in a $26 billion all-stock deal less two months later.

Charles Schwab was among the firms that benefited from the growth of retail investing during the coronavirus pandemic, and it’s now facing the consequences of Federal Reserve’s aggressive interest rate hikes.

That’s because of Charles Schwab’s huge banking business that generates revenue from sweep accounts, which are when the firm uses money leftover in investors’ portfolios and reinvests it in securities, like government bonds, to help turn a profit.

Charles Schwab told CNBC it was unable to participate in this documentary.

Watch the video above to learn more about how Charles Schwab battled the ever-evolving financial services market – from fees to fintech – and how the reward doesn’t come without the risk.

Eugene Simuni, SVB MoffettNathanson research analyst, joins ‘Closing Bell Overtime’ to discuss Affirm, the state of the Fintech space, and more.

04:29

2 hours ago

Editor’s Note: APRs listed in this article are up-to-date as of the time of publication. They may fluctuate (up or down) as the Fed rate changes. Select will update as changes are made public.

Personal loans are a form of installment credit that must be paid back in regular increments over a set period of time. Many people use personal loans as an affordable alternative to credit cards because they often have lower interest rates and consumers can use them to cover a wide range of expenses. These loans typically range from $1,000 to $50,000, but you may be able to borrow smaller or larger amounts of money with some lenders.

CNBC Select evaluated dozens of lenders to round up the best personal loans of 2023. We looked at key factors like interest rates, fees, loan amounts and term lengths offered, plus other features including how your funds are distributed, autopay discounts, customer service and how fast you can get your funds. (Read more about our methodology below.)

7.49%—24.49%* with AutoPay

Debt consolidation, home improvement, auto financing, medical expenses, and others

24 to 144 months* dependent on loan purpose

Who’s this for? LightStream, the online lending arm of SunTrust Bank, offers low-interest loans with flexible terms for people with good credit or higher. LightStream is known for providing loans for nearly every purpose except for higher education and small business. You could get a LightStream personal loan to buy a new car, remodel the bathroom, consolidate debt, or cover medical expenses, according to the company’s website.

You can receive your funds on the same day, if you apply on a banking business day, your application is approved and you electronically sign your loan agreement and verify your direct deposit banking account information by 2:30 p.m. ET.

LightStream offers the lowest APRs of any lender on this list, including a discount when you sign up for autopay. Interest rates vary by loan purpose, and you can view all ranges on LightStream’s website before you apply. This is subject to change as the Fed rates fluctuate.

If you select the invoicing option for repayment, your APR will be 0.50% higher than if you sign up for autopay. The APR is fixed, which means your monthly payment will stay the same for the lifetime of the loan. Terms range from 24 to 144 months, dependent on loan purpose — the longest-term option among the loans on our best-of list.

LightStream does not charge any origination fees, administration fees or early payoff fees.

Debt consolidation/refinancing

0% to 5% (based on credit score and application)

5% of monthly payment amount or $15, whichever is greater (with 15-day grace period)

How Payoff is designed to help you stay motivated:

*Based on a study of Happy Money Members between February 2020 to August 2020, members who use a Happy Money Loan to eliminate at least $5,000 of credit card balances reportedly see an average FICO Score boost of 40 points. (Results may vary and are not guaranteed.)

Who’s this for? A Happy Money personal loan is a good choice if you’re looking to consolidate your credit card debt and pay it down over time at a lower interest rate.

Happy Money’s mission is to help consumers get out of credit card debt once and for all, which is why its loans are geared specifically toward debt consolidation. You can’t use a Happy Money loan for home renovations, major purchases, education, etc.

Borrowers can take out loan amounts between $5,000 and $40,000, and the loan terms range from 24 to 60 months. There’s a soft inquiry tool on its website, which allows you to look at possible loan options based on your credit report without impacting your credit score.

Happy Money doesn’t charge late payment fees, or early payoff penalties if you decide to pay off your debt faster than you initially intended, but there is an origination fee of up to 5% based on your credit score and application. The higher your score, the lower your origination fee and interest rates are likely to be.

Unlike some lenders, Happy Money allows you to deposit the money you borrow into your linked bank account or send it directly to your creditors. Another perk you get from taking out a Happy Money loan is access to various financial literacy tools, such as free FICO score updates, a team that performs quarterly check-ins with you during your first year of working with Happy Money and tools to help members improve their relationship with money through personality, stress and cash flow assessments.

8.99% to 25.81% when you sign up for autopay

Debt consolidation/refinancing, home improvement, relocation assistance or medical expenses

Who’s this for? SoFi got its start refinancing student loans, but the company has since expanded to offer personal loans up to $100,000 depending on creditworthiness, making it an ideal lender for when you need to refinance high-interest credit card debt.

If you have high-interest debt on one or more card, and you want to save money by refinancing to a lower APR, SoFi offers a simple sign-up and application process, plus a user-friendly app to manage your payments.

Another unique aspect of SoFi lending is that you can choose between a variable or fixed APR, whereas most other personal loans come with a fixed interest rate. Variable rates can go up and down over the lifetime of your loan, which means you could potentially save if the APR goes down (but it’s important to remember that the APR can also go up). However, fixed rates guarantee you’ll have the same monthly payment for the duration of the loan’s term, which makes it easier to budget for repayment.

By setting up automatic electronic payments, you can earn a 0.25% discount on your APR. You can also set up online bill pay to SoFi through your bank, or you can send in a paper check.

Once you apply for and get approved for a SoFi personal loan, your funds should generally be available within a few days of signing your agreement. You can both apply for and manage your loan on SoFi’s mobile app.

While taking on a sizable loan can be nerve-wracking, SoFi offers some help if you lose your job: You can temporarily pause your monthly bill (with the option to make interest-only payments) while you look for new employment. You may still incur interest, but your payment history will remain unharmed. You can read more about SoFi’s Unemployment Protection program in its FAQs.

Debt consolidation, home improvement, medical expenses, auto financing and more

Who’s this for? PenFed is a federal credit union that offers membership to the general public and provides a number of personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more.

While most lenders have a $1,000 minimum for loans, you can get a $600 loan from PenFed with terms ranging from one to five years. You don’t need to be a member to apply, but you will need to sign up for a PenFed membership and keep $5 in a qualifying savings account to receive your funds.

While PenFed loans are a good option for smaller amounts, one drawback is that funds come in the form of a paper check. If there is a PenFed location near you, you can pick up your check directly from the bank. However, if you don’t live close to a branch, you have to pay for expedited shipping to get your check the next day.

Unlike some lenders, PenFed doesn’t offer a discount for autopay.

Debt consolidation, home improvement, wedding or vacation

36, 48, 60, 72 and 84 months

Who’s this for? Discover Personal Loans can be used for consolidating debt, home improvement, weddings and vacations. You can receive your money as early as the next business day provided that your application was submitted without any errors (and the loan was funded on a weekday). Otherwise, your funds will take no later than a week.

While there are no origination fees, Discover does charge a late fee of $39 if you fail to repay your loan on time each month. There’s no penalty for paying your loan off early or making extra payments in the same month to cut down on the interest.

If you’re getting a debt consolidation loan, Discover can pay your creditors directly. Once you’re approved for and accept your personal loan, you can link the credit card accounts so Discover will send the money directly. You just need to provide information such as account numbers, the amount you’d like paid and payment address information.

Any money remaining after paying your creditors can be deposited directly into your preferred bank account.

Debt consolidation, credit card refinancing, home improvement, wedding, moving or medical

Credit score of 300 on at least one credit report (but will accept applicants whose credit history is so insufficient they don’t have a credit score)

0% to 10% of the target amount

The greater of 5% of last amount due or $15, whichever is greater

Who’s this for? Upstart is ideal for individuals with a low credit score or even no credit history. It is one of the few companies that look at factors beyond your credit score when determining eligibility. It also allows you to apply with a co-applicant, so if you don’t have sufficient credit, you still have the opportunity to receive a lower interest rate.

Upstart considers factors like education, employment, credit history and work experience. If you want to find out your APR before you apply, Upstart will perform a soft credit check. Once you apply for the loan, the company will perform a hard credit inquiry which will temporarily ding your credit score.

You can choose a three-year or five-year loan and borrow anywhere from $1,000 to $50,000. Plus, Upstart has fast service — you’ll get your money the next business day if you accept the loan before 5 p.m. EST Monday through Friday.

One other major draw for Upstart is that this lender doesn’t charge any prepayment penalties. However, if you’re more than 10 days late on a payment, you’ll owe 5% of the unpaid amount or $15, whichever is greater. You’ll also have to pay an origination fee of up to 12% of the loan amount.

Personal loans are a form of installment credit that can be a more affordable way to finance the big expenses in your life. You can use a personal loan to fund a number of expenses, from debt consolidation to home renovations, weddings, travel and medical expenses.

Before taking out a loan, make sure you have a plan for how you will use it and pay it off. Ask yourself how much you need, how many months you need to repay it comfortably and how you plan to budget for the new monthly expense. (Learn more about what to consider when taking out a loan.)

Most loan terms range anywhere from six months to seven years. The longer the term, the lower your monthly payments will be, but they usually also have higher interest rates, so it’s best to elect for the shortest term you can afford. When deciding on a loan term, consider how much you will end up paying in interest overall.

Once you’re approved for a personal loan, the cash is usually delivered directly to your checking account. However, if you opt for a debt consolidation loan, you can sometimes have your lender pay your credit card accounts directly. Any extra cash left over will be deposited into your bank account.

Your monthly loan bill will include your installment payment plus interest charges. If you think you may want to pay off the loan earlier than planned, be sure to check if the lender charges an early payoff or prepayment penalty. Sometimes lenders charge a fee if you make extra payments to pay your debt down quicker, since they are losing out on that prospective interest. The fee could be a flat rate, a percentage of your loan amount or the rest of the interest you would have owed them. None of the lenders on our list have early payoff penalties.

Once you receive the money from your loan, you have to pay back the lender in monthly installments, usually starting within 30 days.

When your personal loan is paid off, the credit line is closed and you can no longer access it.

Most personal loans come with fixed-rate APRs, so your monthly payment stays the same for the loan’s lifetime. In a few cases, you can take out a variable-rate personal loan. If you go that route, make sure you’re comfortable with your monthly payments changing if rates go up or down.

Personal loan APRs average slightly above 10%, while the average credit card interest rate is nearly 20%. Given that the average rate of return in the stock market tends to be around 10% when adjusted for inflation, the best personal loan interest rates would be below 10%. That way, you know that you could still earn more than you’re paying in interest.

However, it’s not always easy to qualify for personal loans with interest rates lower than 10% APR. Your interest rate will be decided based on your credit score, credit history and income, as well as other factors like the loan’s size and term.

Some lenders charge origination, or sign-up, fees, but none of the loans on this list do. All personal loans charge interest, which you pay over the lifetime of the loan. The lenders on our list do not charge borrowers for paying off loans early, so you can save money on interest by making bigger payments and paying your loan off faster.

As you shop for a low-interest loan or credit card, remember that banks are looking for reliable borrowers who make timely payments. Financial institutions will look at your credit score, income, payment history and, in some cases, cash reserves when deciding what APR to give you.

To get approved for any kind of credit product (credit card, loan, mortgage, etc.), you’ll first submit an application and agree to let the lender pull your credit report. This helps lenders understand how much debt you owe, what your current monthly payments are and how much additional debt you have the capacity to take on.

Once you submit your application, you may be approved for a variety of loan options. Each will have a different length of time to pay the loan back (your term) and a different interest rate. Your interest rate will be decided based on your credit score, credit history and income, as well as other factors like the loan’s size and term. Generally, loans with longer terms have higher interest rates than loans you bay back over a shorter period of time.

CNBC Select now has a widget where you can put in your personal information and get matched with personal loan offers without damaging your credit score.

The loan’s term is the length of time you have to pay off the loan. Terms are usually between six months and seven years. Typically, the longer the term, the smaller the monthly payments and the higher the interest rates.

Lenders offer a wide range of loan sizes, from $500 to $100,000. Before you apply, consider how much you can afford to make as a monthly payment, as you’ll have to pay back the full amount of the loan, plus interest.

Here are some common personal loan terms you need to know before applying.

To determine which personal loans are the best, CNBC Select analyzed dozens of U.S. personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with no origination or signup fees, fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best personal loans, we focused on the following features:

After reviewing the above features, we sorted our recommendations by best for overall financing needs, debt consolidation and refinancing, small loans, next-day funding and lower credit scores.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date

Subscribe to the CNBC Select Newsletter!

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here.

*Your LightStream loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $10,000 loan at 7.99% APR with a term of three years would result in 36 monthly payments of $313.32.

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

The disruption of traditional bricks-and-mortar banks by fintech companies was already occurring when the pandemic sent startups offering banking services faster, cheaper, and more digitally accessible into overdrive.

A rush of venture capital followed, with fintech companies raising more than $130 billion in 2021 alone, creating more than 100 new unicorns, or companies with at least $1 billion in valuation.

However, as the field of fintechs got more crowded and the economy has entered a more recessionary environment, funding has dried up and several fintechs have taken valuation cuts. The fintech reckoning is going well beyond private companies, as public markets have not been kind to former Disrupters Dave and SoFi, both trading well off their IPO prices. Legacy banks have seen their efforts to disruptor these disruptors fall short of expectations – for example, Goldman Sachs recently pulled back on its fintech ambitions.

Making that banking picture even fuzzier is the recent collapse of Silicon Valley Bank and the wave of concerns that followed.

But Chris Britt, CEO of Chime, which ranked No. 15 on the 2023 CNBC Disruptor 50 list, says even with much of the banking system on edge, he still sees a strong market need for fintechs.

“It’s very difficult for [the big banks] structurally to compete for the segment that we aim to serve, which is sort of mainstream middle and more lower income consumers,” Britt said on CNBC’s “Squawk on the Street” on Tuesday. “Big banks do a pretty good job with high income, high FICO score folks who have big deposits and are credit worthy, but for most Americans, the 65% that live paycheck to paycheck, the only way that big banks can make the math work on serving them is by being very punitive on fees.”

Addressing the part of the population that has been disillusioned by traditional banking was part of the impetus for Britt and Ryan King to found Chime in 2010. This year marks the fourth time Chime has been featured on the CNBC Disruptor 50 list.

“The trust levels that mainstream Americans have in banks is extremely low, and that was part of the opportunity that we pursued,” Britt said.

Those trust levels waned in recent weeks with the collapse of Signature Bank and Silicon Valley Bank, followed by the eventual government seizure and sale of First Republic Bank. Nearly half of the adults polled in a recent Gallup survey said they were “very worried” (19%) or “moderately worried” (29%) about the safety of the money they had in a bank or other financial institution.

Britt said that although Chime has a relationship with SVB, it “hasn’t seen much of a change as a result of the SVB situation” from members, as “99.9% of our consumer deposits are FDIC insured because they’re well below the $250,000 threshold.”

Chime’s focus on having a primary account relationship with members as opposed to other fintechs that may focus on one-off or peer-to-peer transactions has helped the company’s business be “very resilient.”

“Most of our members use Chime for non-discretionary spend; they’re going out and shopping at Target or Amazon or Subway, and they’re using it for their everyday purchases,” Britt said. The majority of Chime’s revenue comes from network partners like Visa when members use their cards at the point of sale.

Chime, which was valued at $1.5 billion in 2019, reached a valuation of $25 billion in 2021. The company became profitable on an EBITDA basis during the pandemic, Britt told CNBC in September 2020.

However, the company has not been immune from the current challenges. In November, Chime laid off 12% of its workforce, or about 160 people, in a move that Britt said would help the company thrive “regardless of market conditions.”

Still, Chime is still open to a future IPO, Britt told CNBC’s Julia Boorstin, something that the company has long been rumored for well ahead of the current frozen IPO market for new offerings from venture-backed startups.

Upgrade CEO Renaud Laplanche speaks at a conference in Brooklyn, New York, in 2018.

Alex Flynn | Bloomberg via Getty Images

The technology industry is known for innovation and spawning the next big thing. But at a time of economic uncertainty and rising interest rates, a growing piece of the tech sector is going after one of the most noninnovative products on the planet: yield.

With U.S. Treasury yields climbing late last year to their highest in more than a decade, consumers and investors can finally generate returns just by parking their money in savings accounts.

Banks are responding by offering higher-yielding offerings. American Express, for example, offers consumers a 3.75% annual percentage yield (APY), and First Citizens‘ CIT Bank has a 4.75% APY for customers with at least $5,000 in deposits. Ally Bank, which is online only, is promoting a 4.8% certificate of deposit.

However, some of the highest rates available to savers aren’t coming from traditional financial firms or credit unions, but rather from companies in and around Silicon Valley.

Apple is the most notable new entrant. Last month, the iPhone maker launched its Apple Card savings account with a generous 4.15% APY in partnership with Wall Street giant Goldman Sachs.

Then there’s the whole fintech market, consisting of companies offering consumer financial services with a focus on digital products and a friendly mobile experience instead of physical branches with costly bank tellers and loan officers.

Stock trading app Robinhood has a feature called Robinhood Gold, which offers 4.65% APY. Interest is earned on uninvested cash swept from the client’s brokerage account to partner banks. It’s part of a $5-a-month subscription that also includes lower borrowing costs for margin investing and research for stock investing.

The company lifted its yield from 4.4% on Wednesday after the Federal Reserve approved its 10th rate increase in a little more than a year, raising its benchmark borrowing rate by 0.25 percentage point to a target range of 5%-5.25%.

Fed Chair Jerome Powell speaks during a conference at the Federal Reserve Bank of Chicago on June 4, 2019.

Scott Olson | Getty Images

“At Robinhood, we’re always looking for ways to help our customers make their money work for them,” the company said in a press release announcing its hike.

LendingClub, an online lender, is promoting an account with a 4.25% yield. The company told CNBC that deposit growth was up 13% for the first quarter of 2023 compared with the prior quarter, “as depositors looked to diversify their money out of traditional banks and earn increased savings.” Year over year, savings deposits have increased by 81%.

And Upgrade, which is led by LendingClub founder Renaud Laplanche, offers 4.56% for customers with a minimum balance of $1,000.

“It’s really a trade-off for consumers, between safety or the appearance of safety, and yield,” Laplanche told CNBC. Upgrade, which is based in San Francisco, and most other fintech players keep customer deposits with institutions backed by the Federal Deposit Insurance Corp., so consumer funds are safe up to the $250,000 threshold.

SoFi is the rare example of a fintech with a banking charter, which it acquired last year. It offers a high-yield savings product with a 4.2% APY.

The story isn’t just about rising interest rates.

Across the emerging fintech spectrum, companies like Upgrade are, intentionally or not, taking advantage of a moment of upheaval in traditional finance. On Monday, First Republic became the third American bank to fail since March, following the collapses of Silicon Valley Bank and Signature Bank. All three saw depositors rush for the exits as concerns about a liquidity crunch led to a cycle of doom.

Shares of PacWest and other regional banks have plummeted this week, even after First Republic’s orchestrated sale to JPMorgan Chase was meant to signal stability in the system.

After the collapse of SVB, Laplanche said Upgrade’s banking partners came to the company and asked it to step up the inflow of funds, an apparent effort to stanch the withdrawals at smaller banks. Upgrade farms out the money it attracts to a network of 200 small- and medium-sized banks and credit unions that pay the company for the deposits.

For well over a decade, before the recent jump in rates, savings accounts were dead money. Borrowing rates were so low that banks couldn’t profitably offer yield on deposits. Also, stocks were on such a tear that investors were doing just fine in equities and index funds. A subset of those with a stomach for risk went big in crypto.

As the price of bitcoin soared, a number of crypto exchanges and lenders began mimicking the banks’ savings model, offering very high yield (up to 20% annually) for investors to store their crypto. Those exchanges are now bankrupt following the crypto industry’s meltdown last year, and many thousands of clients lost their funds.

There is some potential instability for fintechs, even those outside of the crypto space. Many of them, including Upgrade and Affirm, partner with Cross River Bank, which serves as the regulated bank for companies that don’t have charters, allowing them to offer lending and credit products.

Last week, Cross River was hit with a consent order from the FDIC for what the agency called “unsafe or unsound banking practices.”

Cross River said in a statement that the order was focused on fair lending issues that occurred in 2021, and that it “places no limitations on our extensive existing fintech partnerships or the credit products we presently offer in partnership with them.”

While fintechs broadly are under far less regulatory pressure than crypto companies, the FDIC’s action suggests that regulators are beginning to pay closer attention to the kinds of products that high-yield accounts are designed to complement.

Still, the emerging group of high-yield savings products are much more mainstream than what the crypto platforms were promoting. That’s largely because the deposits come with government-backed insurance protections, which have a long history of safety.

They’re also not designed to be big profit centers. Rather, by offering high yields for consumers who have long housed their money in stagnant accounts, tech and fintech companies are opening the door to potentially new customers.

Apple has a whole suite of financial products, including a credit card and payments app, that pair smoothly with the savings account, which is only available to the 6 million-plus Apple Card holders. Those customers reportedly put in nearly $1 billion in deposits in the first four days the service was on the market.

Apple didn’t respond to a request for comment. CEO Tim Cook said on the company’s earnings call Thursday that, “we are very pleased with the initial response on it. It’s been incredible.”

Apple savings account

Apple

Robinhood, meanwhile, wants more people to use its trading platform, and companies like LendingClub and SoFi are building relationships with potential borrowers.

Laplanche said high-yield savings accounts, while compelling for the consumer, aren’t core to most fintech businesses but serve as an onboarding tool to more lucrative products, like consumer lending or conventional credit cards.

“We started with credit,” Laplanche said. “We think that’s a better strategy.”

SoFi launched its high-yield savings account in February of last year. In its annual SEC filing, the company said that offering checking and high-yield savings accounts provided “more daily interactions with our members.”

Affirm, best known as a buy now, pay later firm, has offered a savings account since 2020 as part of a “full suite” of financial products. Its yield is currently 3.75%.

“Consumers can use our app to manage payments, open a high-yield savings account, and access a personalized marketplace,” the company said in a 2022 SEC filing. A spokesperson for Affirm told CNBC that the saving account is “one of the many solutions in our suite of products that empower consumers with a smarter way to manage their finances.”

Set against the backdrop of a regional banking crisis, savings products from anywhere but a national bank might seem unappealing. But chasing yield does come with at least a little bit of risk.

“Citi or Chase, feels like it’s safe,” to the consumer, Laplanche said. “Apple and Goldman aren’t inherently risky, but it’s not the same as Chase.”

— CNBC’s Darla Mercado contributed to this report.

WATCH: Consumers are spending more for the same items than they were a year ago

A mortgage is essential for anyone looking to buy a home but doesn’t have the cash to pay for it in full. However, with dozens of lenders to choose from, it can be challenging to pick the one that best suits your needs. Some are geared toward first-time homebuyers looking for flexible loan options, while others may be better for seasoned investors seeking speedy pre-approvals.

Mortgage interest rates can fluctuate quite often depending on the market, and the rate you are likely to receive will heavily depend on your location, credit score and credit report. The higher your credit score, the lower your interest rate and monthly mortgage payments will be.

The mortgage approval and acceptance process also comes with many lender fees. Some lenders may waive certain fees or provide discounts on fees so it’s always a good idea to ask which fees have the potential to be waived. Though some lenders advertise no closing costs, they may pass on the cost through a higher interest rate.

Below, CNBC Select rounded up a list of five of the best mortgage lenders of 2023 based on the types of loans offered, customer support and minimum down payment amount, among others (see our methodology below.)

Apply online for personalized rates

Conventional loans, FHA loans, VA loans and Jumbo loans

8 – 29 years, including 15-year and 30-year terms

Typically requires a 620 credit score but will consider applicants with a 580 credit score as long as other eligibility criteria are met

3.5% if moving forward with an FHA loan

Who’s this for? Rocket Mortgage is one of the biggest U.S. mortgage lenders and has become a household name. Most mortgage lenders look for a minimum credit score of 620 but Rocket Mortgage accepts applicants with lower credit scores at 580.

The lender even has a program called the Fresh Start program that’s aimed at helping potential applicants boost their credit score before applying. Keep in mind, though, that if you apply for a mortgage with a lower credit score, you may be subject to interest rates on the higher end of the lender’s APR range.

This lender offers conventional loans, FHA loans, VA loans and jumbo loans but not USDA loans, which means this lender may not be the most appealing for potential homebuyers who want to make a purchase with a 0% down payment. Rocket Mortgage doesn’t offer construction loans (if you want to build a brand new custom home) or HELOCs, but if you’re a homebuyer who only plans to purchase a single-family home, a second home, or a condo that’s already on the market, this shouldn’t be a drawback for you.

This lender offers flexible loan repayment terms that range from 8 – 29 years in addition to standard 15-year and 30-year terms.

On average, it takes about 47 days to close on a home through Rocket Mortgage. However, keep in mind that, in general, much of the closing timeline will depend on how quickly you can provide all the information and documentation that’s needed and whether or not they can be processed without a major hitch.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, FHA loans, VA loans, DreaMaker℠ loans and Jumbo loans

3% if moving forward with a DreaMaker℠ loan

Who’s this for? Chase Bank provides several options for homebuyers who would prefer to make a lower down payment on their home. The traditional advice has been to make a down payment that’s about 20% of the price of the home, however, Chase offers a loan option called the DreaMaker loan that would allow homebuyers to make a down payment that’s as low as 3% (by comparison, the FHA loan requires borrowers to make a 3.5% down payment).

This option is made for those who can only afford a smaller down payment, but it also comes with stricter income requirements compared to their other loans (the annual income used to qualify the customer must not exceed 80% of the Area Median Income (AMI), according to the Chase team). If you meet the income requirements for the DreaMaker loan, this option could be very attractive for those who would prefer to make a down payment that’s as small as possible so they can have more money reserved for other homebuying expenses.

In addition to the DreaMaker loan, Chase also offers a conventional loan, FHA loan, VA loan and jumbo loan (USDA loans and HELOCs are not offered by this lender). Much like other lenders, Chase has a minimum credit score requirement of 620 for their mortgage options.

Chase offers mortgage terms that range from 10 years to 30 years, as well as fixed rate and adjustable-rate mortgages (ARM). This lender also offers discounts for existing customers, but the requirements are rather high: For $500 off your mortgage processing fee, you need to have $150,000–$499,999 between Chase deposit accounts and Chase investment accounts; $500,000 or more in these accounts can get you up to $1,150 off the processing fee.

On top of this, Chase provides a number of resources to help their customers navigate the process and feel comfortable managing their mortgage, including online customer support, mortgage calculators and educational articles. Chase customers typically close on their house within three weeks.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, HomeReady loan and Jumbo loans

3% if moving forward with a HomeReady loan

Who’s this for? It’s common for lenders to charge a number of fees on mortgage applications, including an application fee, origination fee, processing fee and underwriting fee — these fees can end up costing a significant amount during the home-buying process. Ally Bank doesn’t charge any of these fees (they may, however, charge an appraisal fee and recording fee, and may charge title search and insurance). You can get pre-approved for a loan in as little as three minutes online and submit your application in just 15 minutes as long as you have all the necessary documents handy.

Ally offers a HomeReady mortgage program that is geared toward low- to mid-income homebuyers (regardless of whether it’s their first time or if they’re a repeat buyer) that would allow them to put down as little as 3% for a down payment. Applicants must also have a debt-to-income ratio of no more than 50%, their income must be equal to or less than 80% of the area’s median income and at least one borrower must take a homeowner education course.

In addition to this loan option, homebuyers can also apply for a jumbo loan (FHA loans, VA and USDA loans are not available through this lender). Customers can also choose between fixed-rate and adjustable-rate mortgages, and 15-year, 20-year and 30-year loan terms.

Ally Bank customers take an average of 36 days to close on their homes.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, HELOCs, Community Loan and Medical Professional Loan

0% if moving forward with a USDA loan

Who’s this for? It’s sometimes tough to find lenders that offer USDA loans in addition to other standard mortgage options, but PNC Bank includes USDA loans in their lineup. This lender also offers conventional loans, FHA loans, VA loans, jumbo loans and a PNC Bank Community Loan, which is a special program that allows homebuyers to put down as little as 3% (without paying private mortgage insurance) while still choosing between fixed-rate and adjustable-rate mortgage terms.

This lender also offers a special loan option catered to medical professionals who are looking to buy a primary residence only. With this loan, medical professionals can apply for as much as $1 million and won’t have to pay private mortgage insurance (PMI), regardless of their down payment amount. They can also choose between fixed-rate and adjustable-rate terms.

PNC Bank offers online and in-person mortgage application processes, which can be a plus for homebuyers who don’t live near a PNC Bank location but still want to apply for a loan. You can get online prequalifications in as little as 30 minutes as long as you have all the documentation on hand and similar to most other lenders, PNC Bank has a minimum credit score requirement of 620.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, jumbo loans, HELOCs

Who’s this for? SoFi offers homebuyers a number of discounts that can help them save as much money as possible throughout their home-buying process. When you lock in 30-year rate for a conventional loan, you can receive a 0.25% discount. And when you purchase a home through the SoFi Real Estate Center, which is powered by HomeStory, you can receive up to $9,500 in cash back. Another appealing perk is that SoFi members can get a $500 discount on their mortgage loan.

This lender offers an online-only experience for those looking to qualify for a conventional loan, jumbo loan, or HELOC (SoFi doesn’t offer FHA, VA, or USDA mortgage loans). Terms range from 10 to 30 years and are both fixed and adjustable-rate. Similar to most other lenders, SoFi considers applicants with a minimum credit score of 620.

Homebuyers can also take advantage of a host of resources from SoFi, like a home affordability calculator, a mortgage calculator and a home improvement cost calculator, which can really come in handy if you’re purchasing a home that needs some work done and you need to figure out ahead of time how much to budget for renovations.

Just keep in mind, though, that SoFi’s mortgage loans are available in states except for Hawaii.

Pre-approval is a statement or letter from a lender that details how much money you can borrow to purchase a home and what your interest rate might be. To get pre-approved, you may have to provide bank statements, pay stubs, tax forms and employment verification, to name a few. Once you’re pre-approved, you’ll receive a mortgage pre-approval letter, which you can use to begin viewing homes and start making offers. It’s best to get pre-approved at the start of your home-buying journey before you start looking at homes.

A mortgage is a type of loan that you can use to purchase a home. It’s also an agreement between you and the lender that essentially says that you can purchase a home without paying for it in-full upfront — you’ll just put some of the money down upfront (usually between 3% and 20% of the home price) and pay smaller, fixed equal monthly payments for a certain number of years plus interest.

For example, you probably can’t pay $400,000 for a home upfront, however, maybe you can afford to pay $30,000 upfront; a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for $370,000 (the remaining amount) and you agree to repay that amount plus interest to the lender over the course of 15 or 30 years.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance (PMI) payments in addition to your monthly mortgage payments. However, you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

A conventional loan is a loan that’s funded by private lenders and sold to government enterprises like Fannie Mae and Freddie Mac. It’s the most common type of loan and some lenders may require a down payment as low as 3% or 5% for this loan.

A Federal Housing Administration loan (FHA loan) is a loan that typically allows you to purchase a home with looser requirements. For example, this type of loan may allow you to get approved with a lower credit score and applicants may be able to get away with a higher debt-to-income ratio. You typically only need a 3.5% down payment with an FHA loan.

A USDA loan is a loan offered through the United States Department of Agriculture and is aimed at individuals who want to purchase a home in a rural area. A USDA loan requires a minimum down payment of 0% — in other words, you can use this loan to buy a rural home without making a down payment.

A VA mortgage loan is provided through the U.S. Department of Veterans Affairs and is meant for service members, veterans and their spouses. They require a 0% down payment and no mortgage insurance.

A jumbo loan is meant for home buyers who need to borrow more than $647,200 to purchase a home. Jumbo loans are not sponsored by Fannie Mae or Freddie Mac and they typically have stricter credit score and debt-to-income ratio requirements.

Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. While the Federal Reserve doesn’t set mortgage rates, mortgage rates tend to move in reaction to actions taken by the Federal Reserve on its interest rates.

Market forces may influence the general range of mortgage rates but your specific mortgage rate will depend on your location, credit report and credit score. The higher your credit score, the more likely you are to be qualified for a lower mortgage interest rate.

It can also be worth shopping around with different mortgage lenders to see which one offers you the lowest interest rate.

A 15-year mortgage gives homeowners 15 years to pay off their mortgage in fixed, equal amounts plus interest. By contrast, a 30-year mortgage gives homeowners 30 years to pay off their mortgage. With a 30-year mortgage, your monthly payments will be lower since you’ll have a longer period of time to pay off the loan. However, you’ll wind up paying more in interest over the life of the loan since interest is charged monthly. A 15-year mortgage lets you save on interest but you will likely have a higher monthly payment.

Subscribe to the CNBC Select Newsletter!

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here.

To determine which mortgage lenders are the best, CNBC Select analyzed dozens of U.S. mortgages offered by both online and brick-and-mortar banks, including large credit unions, that come with fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best mortgages, we focused on the following features:

After reviewing the above features, we sorted our recommendations by best for overall financing needs, quick closing timeline, lower interest rates and flexible terms.

Note that the rates and fee structures advertised for mortgages are subject to fluctuate in accordance with the Fed rate. However, once you accept your mortgage agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan, unless you choose to refinance your mortgage at a later date for a potentially lower APR. Your APR, monthly payment and loan amount depend on your credit history, creditworthiness, debt-to-income ratio and the desired loan term. To take out a mortgage, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date.

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

Most homebuyers use mortgages to purchase their homes. However, with dozens of lenders to choose from, it can be challenging to pick the one that best suits your needs. For instance, are you a first-time homebuyer or purchasing an investment property?

Mortgage interest rates can fluctuate quite often, and the rate you are likely to receive will heavily depend on your location, credit score and credit report.

The mortgage approval and acceptance process also comes with many fees, collectively called “lender fees.” This can include an origination fee, processing fee, application fee and an underwriting fee. In addition to lender fees, you may also pay a document preparation fee, an appraisal fee, title search fee, title insurance and more.

Some lenders may waive certain fees or provide discounts on fees so it’s always a good idea to ask which fees have the potential to be waived. However, when you decide to move forward with a particular loan from a lender, prepare yourself to account for these additional charges.

Below, CNBC Select rounded up a list of five of the best mortgage lenders of 2022 based on the types of loans offered, customer support and minimum down payment amount, among others (see our methodology below.)

Apply online for personalized rates

Conventional loans, FHA loans, VA loans and Jumbo loans

8 – 29 years, including 15-year and 30-year terms

Typically requires a 620 credit score but will consider applicants with a 580 credit score as long as other eligibility criteria are met

3.5% if moving forward with an FHA loan

Who’s this for? Rocket Mortgage is one of the biggest U.S. mortgage lenders and has become a household name. Most mortgage lenders look for a minimum credit score of 620 but Rocket Mortgage accepts applicants with lower credit scores at 580.

The lender even has a program called the Fresh Start program that’s aimed at helping potential applicants boost their credit scores before applying. Keep in mind, though, that if you apply for a mortgage with a lower credit score, you may be subject to interest rates on the higher end of the lender’s APR range.

This lender offers conventional loans, FHA loans, VA loans and jumbo loans but not USDA loans, which means this lender may not be the most appealing for potential homebuyers who want to make a purchase with a 0% down payment. Rocket Mortgage doesn’t offer construction loans (if you want to build a brand new custom home) or HELOCs, but if you’re a homebuyer who only plans to purchase a single-family home, a second home, or a condo that’s already on the market, this shouldn’t be a drawback for you.

This lender offers flexible loan repayment terms that range from 8 – 29 years in addition to standard 15-year and 30-year terms.

On average, it takes about 47 days to close on a home through Rocket Mortgage. However, keep in mind that, in general, much of the closing timeline will depend on how quickly you can provide all the information and documentation that’s needed and whether or not they can be processed without a major hitch.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, FHA loans, VA loans, DreaMaker℠ loans and Jumbo loans

3% if moving forward with a DreaMaker℠ loan

Who’s this for? Chase Bank provides several options for homebuyers who would prefer to make a lower down payment on their home. The traditional advice has been to make a down payment that’s about 20% of the price of the home, however, Chase offers a loan option called the DreaMaker loan that would allow homebuyers to make a down payment that’s as low as 3% (by comparison, the FHA loan requires borrowers to make a 3.5% down payment).

This option is made for those who can only afford a smaller down payment, but it also comes with stricter income requirements compared to their other loans (the annual income used to qualify the customer must not exceed 80% of the Area Median Income (AMI), according to the Chase team). If you meet the income requirements for the DreaMaker loan, this option could be very attractive for those who would prefer to make a down payment that’s as small as possible so they can have more money reserved for other homebuying expenses.

In addition to the DreaMaker loan, Chase also offers a conventional loan, FHA loan, VA loan and jumbo loan (USDA loans and HELOCs are not offered by this lender). Much like other lenders, Chase has a minimum credit score requirement of 620 for their mortgage options.

Chase offers mortgage terms that range from 10 years to 30 years, as well as fixed-rate and adjustable-rate mortgages (ARM). This lender also offers discounts for existing customers, but the requirements are rather high: For $500 off your mortgage processing fee, you need to have $150,000–$499,999 between Chase deposit accounts and Chase investment accounts; $500,000 or more in these accounts can get you up to $1,150 off the processing fee.

On top of this, Chase provides a number of resources to help their customers navigate the process and feel comfortable managing their mortgage, including online customer support, mortgage calculators and educational articles. Chase customers typically close on their house within three weeks.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, HomeReady loan and Jumbo loans

3% if moving forward with a HomeReady loan

Who’s this for? It’s common for lenders to charge a number of fees on mortgage applications, including an application fee, origination fee, processing fee and underwriting fee — these fees can end up costing a significant amount during the home-buying process. Ally Bank doesn’t charge any of these fees (they may, however, charge an appraisal fee and recording fee, and may charge title search and insurance). You can get pre-approved for a loan in as little as three minutes online and submit your application in just 15 minutes as long as you have all the necessary documents handy.

Ally offers a HomeReady mortgage program that is geared toward low- to mid-income homebuyers (regardless of whether it’s their first time or if they’re a repeat buyer) that would allow them to put down as little as 3% for a down payment. Applicants must also have a debt-to-income ratio of no more than 50%, their income must be equal to or less than 80% of the area’s median income and at least one borrower must take a homeowner education course.

In addition to this loan option, homebuyers can also apply for a jumbo loan (FHA loans, VA and USDA loans are not available through this lender). Customers can also choose between fixed rate and adjustable rate mortgages, and 15-year, 20-year and 30-year loan terms.

Ally Bank customers also take an average of 36 days to close on their home. One important drawback, though, is that Ally mortgage loans are not available in every state — residents of Hawaii, Nevada, New Hampshire and New York would be unable to apply.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, HELOCs, Community Loan and Medical Professional Loan

0% if moving forward with a USDA loan

Who’s this for? It’s sometimes tough to find lenders that offer USDA loans in addition to other standard mortgage options, but PNC Bank includes USDA loans in their lineup. This lender also offers conventional loans, FHA loans, VA loans, jumbo loans and a PNC Bank Community Loan, which is a special program that allows homebuyers to put down as little as 3% (without paying private mortgage insurance) while still choosing between fixed-rate and adjustable-rate mortgage terms.

This lender also offers a special loan option catered to medical professionals who are looking to buy a primary residence only. With this loan, medical professionals can apply for as much as $1 million and won’t have to pay private mortgage insurance (PMI), regardless of their down payment amount. They can also choose between fixed-rate and adjustable-rate terms.

PNC Bank offers online and in-person mortgage application processes, which can be a plus for homebuyers who don’t live near a PNC Bank location but still want to apply for a loan. You can get online pre-approval in as little as 30 minutes as long as you have all the documentation on hand and similar to most other lenders, PNC Bank has a minimum credit score requirement of 620.

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

Conventional loans, jumbo loans, HELOCs

Who’s this for? SoFi offers homebuyers a number of discounts that can help them save as much money as possible throughout their home buying process. When you lock in 30-year rate for a conventional loan, you can receive a 0.25% discount. And when you purchase a home through the SoFi Real Estate Center, which is powered by HomeStory, you can receive up to $9,500 in cash back. Another appealing perk is that SoFi members can get a $500 discount on their mortgage loan.

This lender offers an online-only experience for those looking to qualify for a conventional loan, jumbo loan, or HELOC (SoFi doesn’t offer FHA, VA, or USDA mortgage loans). Terms range from 10 to 30 years and are both fixed and adjustable-rate. Similar to most other lenders, SoFi considers applicants with a minimum credit score of 620.

Homebuyers can also take advantage of a host of resources from SoFi, like a home affordability calculator, a mortgage calculator and a home improvement cost calculator, which can really come in handy if you’re purchasing a home that needs some work done and you need to figure out ahead of time how much to budget for renovations.

Just keep in mind, though, that SoFi’s mortgage loans are only available in 47 states and Washington, D.C. — residents of Hawaii, New York and New Mexico would be unable to apply.

Pre-approval is a statement or letter from a lender that details how much money you can borrow to purchase a home and what your interest rate might be. To get pre-approved, you may have to provide bank statements, pay stubs, tax forms and employment verification, to name a few. Once you’re pre-approved, you’ll receive a mortgage pre-approval letter, which you can use to begin viewing homes and start making offers. It’s best to get pre-approved at the start of your home-buying journey before you start looking at homes.

A mortgage is a type of loan that you can use to purchase a home. It’s also an agreement between you and the lender that essentially says that you can purchase a home without paying for it in-full upfront — you’ll just put some of the money down upfront (usually between 3% and 20% of the home price) and pay smaller, fixed equal monthly payments for a certain number of years plus interest.

For example, you probably can’t pay $400,000 for a home upfront, however, maybe you can afford to pay $30,000 upfront; a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for $370,000 (the remaining amount) and you agree to repay that amount plus interest to the lender over the course of 15 or 30 years.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance (PMI) payments in addition to your monthly mortgage payments. However, you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

A conventional loan is a loan that’s funded by private lenders and sold to government enterprises like Fannie Mae and Freddie Mac. It’s the most common type of loan and some lenders may require a down payment as low as 3% or 5% for this loan.

A Federal Housing Administration loan (FHA loan) is a loan that typically allows you to purchase a home with looser requirements. For example, this type of loan may allow you to get approved with a lower credit score and applicants may be able to get away with a higher debt-to-income ratio. You typically only need a 3.5% down payment with an FHA loan.

A USDA loan is a loan offered through the United States Department of Agriculture and is aimed at individuals who want to purchase a home in a rural area. A USDA loan requires a minimum down payment of 0% — in other words, you can use this loan to buy a rural home without making a down payment.

A VA mortgage loan is provided through the U.S. Department of Veterans Affairs and is meant for service members, veterans and their spouses. They require a 0% down payment and no mortgage insurance.

A jumbo loan is meant for home buyers who need to borrow more than $647,200 to purchase a home. Jumbo loans are not sponsored by Fannie Mae or Freddie Mac and they typically have stricter credit score and debt-to-income ratio requirements.

Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. While the Federal Reserve doesn’t set mortgage rates, mortgage rates tend to move in reaction to actions taken by the Federal Reserve on its interest rates.

Market forces may influence the general range of mortgage rates but your specific mortgage rate will depend on your location, credit report and credit score. The higher your credit score, the more likely you are to be qualified for a lower mortgage interest rate.

A 15-year mortgage gives homeowners 15 years to pay off their mortgage in fixed, equal amounts plus interest. By contrast, a 30-year mortgage gives homeowners 30 years to pay off their mortgage. With a 30-year mortgage, your monthly payments will be lower since you’ll have a longer period of time to pay off the loan. However, you’ll wind up paying more in interest over the life of the loan since interest is charged monthly. A 15-year mortgage lets you save on interest but you will likely have a higher monthly payment.

Subscribe to the Select Newsletter!