Apple Inc. posted its largest revenue decline in more than six years amid underwhelming sales of iPhones, Macs and wearables, but its shares pared back most of their initial losses in after-hours trading Thursday after the company blamed its smartphone declines on supply issues.

Apple’s

AAPL,

iPhone revenue fell to $65.8 billion in the fiscal first quarter from $71.6 billion a year before, whereas analysts tracked by FactSet were looking for $67.8 billion. The performance comes after Apple warned in November that its iPhone 14 Pro and Pro Max shipments would be impacted by pandemic-fueled production constraints at a major Foxconn

2354,

facility in China.

Chief Executive Tim Cook said on Apple’s earnings call that he believes the company would have shown iPhone sales growth in the quarter had it not been for the supply constraints.

At the same time, he noted that it’s “very hard” to estimate the company’s ability to recapture lost sales, “because you have to know exactly what would’ve happened.”

Apple shares ended the extended session Thursday down 3.2%, after having been down as much as 5.6% in after-hours trading.

After reporting a quarterly revenue record for Macs in the September quarter, Apple fell way short of those heights in the December quarter with its Thursday afternoon report, and the company missed expectations by a wide margin. Mac sales declined to $7.7 billion from $10.9 billion a year earlier, while analysts had been looking for $9.4 billion.

Those big misses helped drive total revenue lower on the year and fueled a miss on the top line, despite a sizable beat in the iPad category. Overall revenue declined to $117.2 billion from $123.9 billion a year ago, while analysts were looking for $121.4 billion.

Dating back to its report for the December 2017 quarter, Apple has only missed revenue expectations twice, according to FactSet, including one time when the company issued a formal warning ahead of its official results.

The smartphone giant’s sales decline of 5.48% was its steepest year-over-year fall since the September quarter of 2016, when sales slipped 8.12%, according to Dow Jones Market Data.

Apple executives once again declined to provide a traditional financial forecast, though Chief Financial Officer Luca Maestri shared on the call that he expects Apple’s year-over-year revenue performance in the March quarter to be similar to what was seen in the December quarter. That would actually mark an acceleration of sorts, he said, since the December quarter benefited from an extra week.

Within iPhones specifically, Maestri also anticipates that year-over-year revenue growth will accelerate.

Apple’s profits fell as well in the latest period, as the company generated net income of $30.0 billion, or $1.88 a share, compared with $34.6 billion, or $2.10 a share, a year earlier. Analysts were modeling $1.94 in earnings per share.

Maestri called out “significant foreign-exchange headwinds, supply constraints on iPhone 14 Pro and iPhone 14 Pro Max and a challenging macroeconomic environment” in discussing the company’s smartphone performance. Mac growth was negatively impacted by economic conditions, currency pressures and tough comparisons to a year before.

Within its iPad segment, Apple showed sharp growth. Revenue increased to $9.4 billion from $7.3 billion a year earlier. The FactSet consensus was for $7.8 billion.

Maestri noted that the iPad business benefited from the launch of new iPads during the quarter as well as comparisons to a year-earlier period in which Apple faced supply constraints.

Revenue for wearables, home and accessories came in at $13.5 billion, down from $14.7 billion a year before and far below the $15.3 billion that analysts were modeling. Services revenue rose to $20.8 billion from $19.5 billion and beat the FactSet consensus, which was for $20.4 billion.

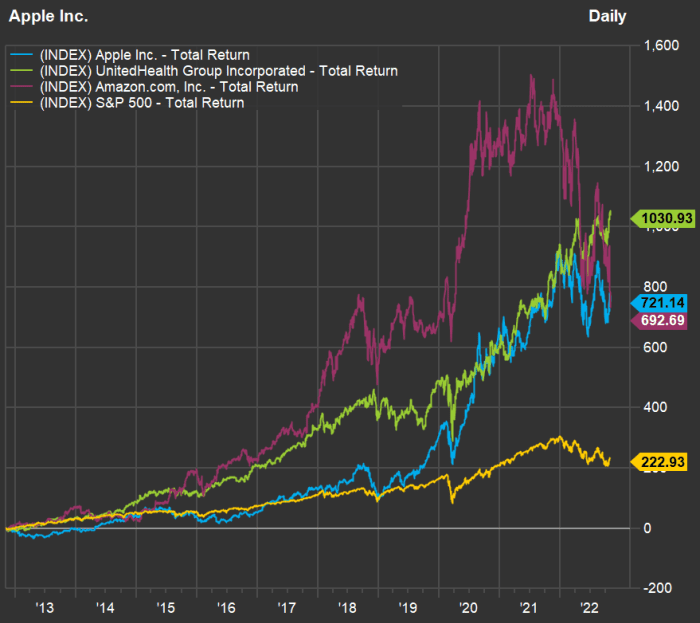

Shares of Apple have fallen 14.2% over the past 12 months, though they’re up 16.1% to start 2023. The Dow Jones Industrial Average

DJIA,

is off 4.4% over a 12-month span but ahead 2.7% so far this year.