Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Wednesday’s key moments. 1. The S & P 500 erased much of its earlier losses Wednesday as September continued to live up to its reputation as a volatile month. The in-line August consumer price index didn’t change the market bet on a quarter-point interest rate cut by the Fed at next week’s meeting. The presidential debate Tuesday night didn’t give investors any real reasons to change their views on the broader market. “If you’re acting on anything that you saw this morning or last night, then you’re acting out of fear, not out of strength,” Jim Cramer said Wednesday. “There’s nothing there.” 2. If there were any winners from the debate, solar stocks would be it. Both Kamala Harris and Donald Trump said they are in favor of renewable energy. That helped shares of Club name Nextracker rally more than 6% in Wednesday’s volatile market. “What [Nextracker] does is make solar fields more efficient,” Jim said. “That is just a classic case of what you want,” with solar playing a significant role in the generation of energy in the United States in the years to come. Other solar stocks such as Array and First Solar were soaring as well. 3. Shares of Morgan Stanley dropped 1% on Wednesday after Goldman Sachs research analysts downgraded the portfolio-held bank to a neutral rating from buy. Analysts believe other banks are better positioned to gain from the capital markets recovery. They also said Morgan Stanley’s stock valuation is expensive relative to its peers. Jim has been frustrated with Morgan Stanley, saying it needs to figure out what to do with E-trade. He added he would rather Goldman Sachs shares than Morgan Stanley. It’s something he’s still thinking about. 4. Stocks covered in Wednesday’s rapid fire at the end of the video were Williams-Sonoma , Campbell Soup , Viking Therapeutics , Dave & Buster’s , and Shopify . (Jim Cramer’s Charitable Trust is long NXT, MS. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Tag: Shopify Inc

-

Investors in Airbnb arbitrage business allege they were defrauded in scheme promising ‘higher returns than the stock market’

Illustration by Elham Ataeiazar

Daryn Carr is no stranger to side hustles. After his mom died from Covid in 2020, he used funds from her pension to pay off some bills and buy a car. With the remaining money, he invested in crypto and started an ATM business.

One day in 2022, while scrolling through Instagram, he came upon another opportunity. Carr found a guy named Anthony Agyeman, who was promoting a type of arbitrage on Airbnb that involved taking listings from hotel booking and short-term rental sites and relisting them on Airbnb at a higher price, retaining the profit.

Agyeman claimed in marketing materials that his business, Hands-Free Automation, had “5-year exclusivity contracts” with thousands of property owners that gave it permission to relist their properties at a higher price.

Getting involved with Hands-Free Automation, or HFA, required a payment of between $20,000 and $30,000 to effectively own a piece of Airbnb listings. Agyeman described it as a “minimal to no risk” path to extra income with a guaranteed return in three to six months of investment, “then pure profit after.”

HFA has no affiliation with Airbnb but found a way to make money on the marketplace using a practice that Airbnb explicitly prohibits. Agyeman was following similar tactics that he’d used on Amazon and Shopify, where he promoted the opportunity for investors to passively own virtual storefronts.

The tech companies that own these marketplaces all say they use a combination of artificial intelligence and automation along with manual reviews to monitor vendor and customer activity for fraud and other misbehavior, but they’ve been ill-equipped to deal with the volume of complaints stemming from various sorts of scams.

The Federal Trade Commission and the Department of Justice have cracked down on companies similar to HFA, accusing them of advertising their products with false promises of profit and success and allegedly selling “automated” software that didn’t work. HFA and Agyeman haven’t been charged by the Justice Department, FTC or any law enforcement agency.

Airbnb told CNBC it was unaware of any contact from regulators regarding HFA.

For a clearer picture of HFA’s inner workings, CNBC spoke with investors in a lawsuit filed against the company in February 2023, as well as six former HFA employees, an Airbnb customer who unwittingly stayed at an HFA-listed property, and a property owner who said his listings were uploaded to Airbnb by HFA without permission. CNBC has granted anonymity to those who requested it because they weren’t authorized to speak publicly on HFA’s operations, or feared retribution from the company.

Brian Chesky, co-founder and CEO of Airbnb, Inc., speaks during an interview with CNBC on the floor of the New York Stock Exchange in New York City, May 10, 2023.

Brendan McDermid | Reuters

Carr, who lives in New York, wired HFA $1,000 through his crypto debit card at the urging of a salesperson and borrowed an additional $18,490 to pay for HFA’s entry-level package. In total, Carr paid HFA $19,497, according to the lawsuit, which Carr filed along with 11 other investors. The plaintiffs alleged that HFA falsely claimed it had relationships with the properties, and that HFA’s services violated Airbnb’s terms of service. The case is still proceeding.

Carr told CNBC that his investment with HFA disappeared, leaving him in debt and working a customer service job to make ends meet. He claims he got scammed and suspects that much of his money went toward subsidizing Agyeman’s lifestyle.

“I couldn’t believe that I lost $20,000 into thin air,” Carr said.

Thomas Hunker, an attorney for Agyeman and HFA, denied that customer money had been used for anything except the business.

“We have always honored our fiduciary obligations with respect to allocation of company money in the best interest of the company,” Hunker said in a written response to CNBC.

‘It’s proven and it works’

HFA admitted to customers that it was “continuously encountering problems with” Airbnb “due to the constant changes they have made to their terms and services,” according to the lawsuit.

Plaintiffs in the suit against Agyeman and other defendants are asking for at least $624,000 in damages from their lost investments. Meanwhile, the defendants continue to advertise and sell products to prospective investors under a new company called Wealthway. They’re deploying a team that aims to generate more than $3.5 million in monthly sales, Wessel Botes, a former sales employee who left the company in November, told CNBC.

Hunker said in an email to CNBC that HFA identifies properties to list from third-party websites used by hotels and other property owners to “increase bookings.” That gives HFA “indirect permission” through those third-party sites to relist rooms on Airbnb, he said, adding that the base price of the booking goes back to the property owner.

However, Airbnb has banned the practice in its terms of service and community policy since at least 2021.

“Using a 3rd party to book a hotel or 3rd party accommodation and listing it on Airbnb at an inflated rate is not allowed,” the policy says.

Airbnb told CNBC that business practices such as Agyeman’s aren’t permitted. The company said it continues to improve systems that identify and remove fake or misleading listings, adding that it had blocked more than 216,000 suspicious listings as of September.

Hunker said HFA doesn’t have investors, but rather has clients who pay a “flat fee” for an arbitrage service. Yet, HFA says on its LinkedIn page that it helps “Airbnb investors add 300+ properties to their account without having to purchase the properties.”

Before connecting CNBC with his attorney, Agyeman said in an interview that he wasn’t involved in the day-to-day operations at HFA and he denied any financial improprieties.

Airbnb told CNBC it had no business relationship with Agyeman and had taken action to curtail his operations. The company said multiple accounts linked to Agyeman and HFA had been removed.

The opportunity for property owners to make money is fundamental to Airbnb’s business model. The company says that, since its founding in 2007, hosts have made more than $180 billion. En route to upending the hotel industry, Airbnb’s market cap has swelled to almost $95 billion, making it bigger than any hotel chain.

Airbnb acknowledged in its annual report that “perpetrators of fraud” use “complex and constantly evolving” tactics on the site and that “fraudsters have created fake guest accounts, fake host accounts, or both, to perpetrate financial fraud.”

Agyeman, who started HFA with co-founder Megan Shears, claims to have created proprietary software that would fully automate the arbitrage process by trawling the internet for properties to relist at a markup. HFA’s employees would take care of booking properties and handle guest inquiries and complaints.

Agyeman, 27, lives in Texas, as does Shears, 26, according to public records. Their social media posts show luxurious vacation spots next to screenshots of Airbnb bookings purportedly worth thousands of dollars. Several investors said in court filings that they first learned about Agyeman and Shears through Instagram.

“It’s proven and it works and you get higher returns than the stock market,” one HFA promotional video said.

Investors in the lawsuit say otherwise. And some customers who used the service to book travel say they lost money and were left scrambling for a place to stay.

In February 2022, a customer named Kathy booked a beachside Airbnb on Florida’s Sanibel Island for a five-night spring break vacation with her family. Kathy, who spoke on condition that CNBC not use her last name, paid $4,600 upfront for what she thought was a “fantastic” poolside one-bedroom apartment. CNBC identified Kathy as an HFA customer because her name and phone number were posted on HFA’s Instagram account.

Days went by without word from her host. Kathy, who lives in Texas, repeatedly reached out to Airbnb, but was told she’d have to engage directly with the host to cancel her booking.

Kathy looked up the property’s address on Google Maps. Rather than a tropical apartment building, she saw what appeared to be a vacant lot. “Please refund my money,” she recalled telling the host.

Desperate to make sure she had a place to stay, Kathy booked a room at a resort in Fort Myers, more than 40 miles from Sanibel Island. Ultimately, after days of back-and-forth messages, Airbnb refunded about half her money.

It ended up being “a super expensive vacation,” Kathy said. “I will never use it again,” she said of Airbnb.

‘Proprietary relationships’

For Agyeman and Shears, Airbnb was just one of their stomping grounds. They had an Amazon and Shopify automation business, a trucking business, and a line of vegan gummies. Agyeman also helped run a YouTube channel focused in part on swapping tips for running a successful business.

The duo broke into the arbitrage business in 2020. According to the lawsuit, Agyeman and Shears claimed in marketing material that they had more than 200,000 properties and had “proprietary relationships with Airbnb and Vrbo,” Expedia’s vacation rental site.

Agyeman relied on freelancers who would take data from other travel booking sites to use on their Airbnb and Vrbo listings, according to former employees and internal documents. An internal training video viewed by CNBC instructed copywriters on how to recycle the original listings’ details for Airbnb or Vrbo.

“PLEASE ANYWHERE IN THE LISTING DO NOT MENTION THAT THIS IS A HOTEL OR THE HOTEL NAMES OF THE HOTEL OR RESORTS,” a training document said.

HFA said its software algorithmically adjusted the price of a property in response to changes on the original listing. Agyeman said on social media that his employees were “the only ones tapped into Airbnb & Vrbo Arbitrage Automation.”

One spreadsheet listed 68 different clients as Airbnb investors. Going at least as far back as July 2022, HFA attracted 120-plus investors who collectively paid close to $3 million for “automated” Airbnb, Shopify, or Amazon businesses, according to internal payment tracking and financial records reviewed by CNBC.

Carr, who was listed as a property host, said that when it came to his experience with HFA, there was chaos on both sides of the marketplace. On one occasion, he said, he was contacted by the owner of a hotel who found one of its rooms on Airbnb. Another time, a woman messaged him 30 to 40 times when she couldn’t find her booking.

“People are going to the hotels saying I got an Airbnb, and they’re like, ‘What are you talking about?’” Carr said.

Carr and other HFA investors told CNBC their frustrations were dismissed or met with legal threats. But in a letter to investors cited in the lawsuit, HFA conceded that its Airbnb business had been disappointing.

“Due to Airbnb constant changes we believe this program will take much longer than anticipated to help you our client reach your goals,” HFA wrote.

Still, HFA declined to refund investors’ funds, instead offering them an Amazon or Shopify storefront, according to the letter and the lawsuit. Hunker said this was contemplated by the parties’ agreements.

Getting properties listed on Airbnb involved some finagling, because the company requires hosts to prove ownership. To get around Airbnb’s rules, HFA instructed its investors to list their own homes, a former employee and two investors told CNBC. Hunker denies that HFA gave those instructions. Once validated as a property owner, investors could then add more listings that HFA would pull from other websites.

Negative reviews flowed in from unhappy would-be vacationers, outraged investors and a business owner who’d discovered his property had been listed without consent.

An HFA investor told CNBC that one listing received a comment from a guest who said he paid $800 for a motel room that cost less than half that amount and described it as a “total scam.”

“Host does not own the property,” the reviewer said, according to a screenshot of the message seen by CNBC. “It is a standard motel room, no frills.”

On a hot September day in Las Vegas in 2022, another guest showed up at an MGM hotel only to discover there was no reservation through Airbnb. Neither the guest nor Airbnb could get in touch with the listed host for hours. Carr, the HFA investor host on record for the property, provided CNBC with screenshots of the messages.

“I had my family double parked on the Vegas strip for three hours wasting gas while I was running back and forth between the three MGMs in 103 degree weather being told each time after waiting in line that there was no reservation in my name,” the guest wrote.

Eventually MGM found the room had been booked through Expedia, which is where HFA turned after receiving the reservation request on Airbnb.

An Expedia spokesperson declined to comment.

Collin Ballard was shocked in May 2022, when he saw photos from his Dallas hostel advertised on Airbnb. Most alarming was the price: $1,760 a night vs. his starting nightly rate of $40.

Collin Ballard found a room from his Dallas hostel listed on Airbnb without his permission.

Collin Ballard

Ballard wrote to the host, telling him he was the owner and asking him to remove the listing.

“I just figured it was someone scamming,” Ballard said in an interview, adding that he knew nothing about Airbnb arbitrage.

Ballard said nobody ever responded to his message, but the listing was eventually taken down.

Gains never materialized

Airbnb ultimately removed most if not all of HFA’s listings over the course of several months in 2022, according to the lawsuit, though employees and investors told CNBC they weren’t sure why.

Several investors told CNBC that they encountered verification problems because it was impossible to prove they owned their listings. HFA responded by forging bills or other documents with the stolen listings’ address, according to investors, the lawsuit, an HFA training video, and a former employee.

If the allegations are true, HFA was sidestepping a key safety feature. False information can make it difficult for Airbnb to respond in an emergency or a situation that calls for the involvement of its safety team.

Airbnb told CNBC that it was rolling out a more robust verification process in the U.S. and elsewhere beginning as early as 2024.

Hunker denied allegations that HFA forges documents, and said Airbnb doesn’t require the lister to be the property owner.

By the end of last year, HFA’s investors realized that their promised gains were not materializing. Dozens unsuccessfully pressed for refunds of their deposits, according to a former employee, an internal HFA document, and the investor lawsuit.

A month after HFA’s then-counsel wrote to two dozen investors in January 2023 declining to provide refunds, investors filed their lawsuit, with 22 plaintiffs saying they received fewer than five bookings each, including 16 who said they had no bookings at all.

Hunker said HFA could present records showing its clients profited from the company’s services on the condition that CNBC sign a nondisclosure agreement. CNBC declined.

Agyeman continues promoting his businesses on social media. In his Instagram bio, he includes a new private equity venture called OKU Capital. Agyeman is its only member, according to Florida state filings and the firm’s LinkedIn profile.

Agyeman’s Wealthway advertises “fully managed,” “automated” vacation rental businesses with “minimal to no risk.” It’s similar to HFA, down to the branding on its website.

On its website, Wealthway has a video appearing to show a meeting between Agyeman and an Airbnb executive named David Levine, whose LinkedIn profile says he’s Airbnb’s head of API and enterprise partnerships for North America.

“What you guys have been doing at Wealthway is incredible and you guys have been following our partner guidelines,” Levine says in the recording.

In November, Botes, the former HFA salesman, became suspicious of the clip and sent it to Levine in a LinkedIn message.

“That video appears to have been taken out of context and altered,” Levine replied, according to screenshots of the messages viewed by CNBC. “Neither I, nor Airbnb, have any affiliation with Wealth Ways Vacation Rentals.”

Airbnb said it believes the clip is inauthentic. Levine didn’t respond to CNBC’s LinkedIn message. Hunker didn’t respond to a question about the video’s authenticity.

-

Amazon's latest layoffs hit its Buy with Prime unit

A worker delivers Amazon packages in San Francisco on Oct. 5, 2022.

Bloomberg | Bloomberg | Getty Images

Amazon is laying off some employees in its Buy with Prime unit, the company confirmed, as it continues to look for ways to trim costs.

The cuts affect fewer than 5% of staff in the Buy with Prime division, Amazon said. Buy with Prime is a service that lets online stores offer the same two-day shipping benefits available to Prime subscribers. Amazon has expanded the program since its launch in April 2022, including tie-ups with Shopify and Salesforce.

Amazon didn’t say how many staffers are in its Buy with Prime segment.

“We regularly review the structure of our teams and make adjustments based on the needs of the business and, following a recent review, we’ve made the difficult decision to eliminate a small number of roles on our Buy with Prime team,” an Amazon spokesperson said in a statement.

The spokesperson said Buy with Prime remains “a top priority for Amazon” and the company plans to continue investing “significant resources” in the program.

Some of the affected employees worked in Amazon’s multichannel fulfillment unit, which sits alongside Buy with Prime under the “Project Santos” organization, overseen by Peter Larsen, a longtime vice president at the company, a person with knowledge of the cuts said. Multichannel fulfillment allows merchants to ship and store products using Amazon’s services regardless of whether they’re selling on the home site.

Amazon has cut more than 27,000 jobs across the company as part of rolling layoffs that began in late 2022. Job reductions have continued this year, with Amazon letting go staffers in its Prime Video, MGM, Twitch, Audible and Amazon Pay units last week. Other tech companies including Google, Discord, Xerox and Unity have also announced layoffs since the start of the new year.

Amazon said it’s assisting Buy with Prime employees who were laid off in finding new roles elsewhere within the company. Employees will continue to receive their pay and benefits for at least 60 days, and they will be eligible for a severance package.

WATCH: Amazon lays off hundreds of roles across Twitch, Prime Video and MGM Studios

Don’t miss these stories from CNBC PRO:

-

One paycheck not enough: Digital bank Current finds almost half its customers have multiple jobs

The need for second — and often third — incomes is mounting, according to a top digital bank executive.

Current CEO Stuart Sopp finds almost half of the firm’s payment customers have more than one job.

“If you’re having a paycheck over the past year, 20, 25% of paycheck depositors have at least one extra job. A further 20% incremental from there have two jobs,” Sopp told CNBC’s “Fast Money” on Thursday. “They’re trying to make that money go further because of inflation.”

From DoorDash to Shopify to side businesses, Sopp finds the number is higher than prior years because money doesn’t go as far.

“Wage inflation is moderating quite substantially,” he said. “America has a sort of tail of two cities right now. Two groups: The wealthy and less affluent.”

Sopp launched Current, which provides mobile banking without monthly fees and offers secured credit cards, in 2015. It originally focused on helping medium to lower income customers. His company Current reports almost five million members.

He’s particularly concerned about less affluent consumers spiraling into debt to pay for basic necessities.

“They’re being forced into risks like risky credit cards,” noted Sopp, a former Morgan Stanley trader. “Unsecured credit cards… are not suitable for everyone.”

The Federal Reserve Bank of New York found credit card debt topped $1 trillion for the first time ever in the second quarter.

“It’s going to be way bigger this year,” Sopp said.

-

ARK CEO Cathie Wood says she swerved the Arm IPO frenzy. Here’s why

Cathie Wood, CEO of Ark Invest, speaks during an interview on CNBC on the floor of the New York Stock Exchange (NYSE) in New York City, February 27, 2023.

Brendan McDermid | Reuters

ARK Invest CEO Cathie Wood said she did not participate in Arm‘s blockbuster initial public offering last week because she finds the British chip designer was overvalued relative to its competitive position.

Arm, the Cambridge-based company controlled by Japanese investment giant SoftBank, listed on New York’s Nasdaq on Thursday at an IPO price of $51 a share for a valuation of almost $60 billion. Shares jumped almost 25% on the first day of trading to close at $63.59.

The initial buzz has since fizzled, with the stock suffering successive daily declines to end the Tuesday trade session at $55.17.

Speaking on CNBC’s “Squawk Box Europe” on Wednesday, Wood said the recent frenzy around AI-exposed companies was justified and that “innovation is undervalued given the enormous opportunities that we see ahead, catalyzed very importantly by artificial intelligence.”

“As far as Arm, I think there might be a little bit too much emphasis on AI when it comes to Arm and maybe not enough focus on the competitive dynamics out there,” she added.

Arm CEO Rene Haas and executives cheer, as Softbank’s Arm, chip design firm, holds an initial public offering (IPO) at Nasdaq Market site in New York, U.S., September 14, 2023.

Brendan Mcdermid | Reuters

“So we did not participate in that IPO, and we also compare it to the stocks in our portfolios. Arm came out, we think, from a valuation point of view on the high side, and we see within our portfolios much lower priced names with much more exposure to AI.”

Arm declined to comment.

The top holdings in Wood’s flagship ARK Innovation ETF include Tesla, Shopify, UiPath, Unity, Zoom, Twilio, Coinbase, Roku, Block and DraftKings.

After taking a beating during the recent cycle of aggressive interest rate hikes from the U.S. Federal Reserve, the ARK ETF resurged this year, as investors flocked to stocks with AI exposure. Wood said that the anticipation of interest rates peaking would further this trend.

“The appetite for innovation is stirring here, and I think one of the reasons is because many investors and analysts are starting to look over the interest rate hike moves we’ve seen, record breaking in the last year or so, and to the other side,” she explained.

With inflation coming down across major economies and with central banks expected to begin unwinding their aggressive monetary policy tightening over the next year, Wood suggested the coming period “should be a very good environment for innovation and global megatrend strategies.”

ARK Invest on Wednesday acquired British thematic ETF issuer Rize ETF for £5.25 million ($6.5 million), marking the company’s first venture into the European passive investment market.

Wood said that Europe has not had access to actually invest in the company’s U.S.-based ETFs until now, despite accounting for around 25% of demand for the company’s research since ARK’s inception in 2014.

“The cost of technology, especially with artificial intelligence now, is collapsing, and therefore it’s going to be much easier to build and scale tech companies anywhere in the world. This is no longer just the purview of Silicon Valley,” Wood said. “We are very open-minded about technologies flourishing throughout the world, including Europe.”

-

Bank stocks show more signs of life after a tumultuous year. Here’s what’s causing the run and why we’re optimistic on these financial names

A combination file photo shows Wells Fargo, Citibank, Morgan Stanley, JPMorgan Chase, Bank of America and Goldman Sachs.

Reuters

The financial sector is making a comeback, and it looks to stay there.

Club names Morgan Stanley (MS) and Wells Fargo (WFC), in particular, have perked up recently. Still, we think shares have more room to run.

Banks have been rallying since their recent lows in late August on signs of life in the long-dormant IPO market and hopes for more mergers and acquisitions activity, which could boost investment banking services for Wall Street giants like Morgan Stanley.

It was San Francisco-based Instacart‘s (CART) turn on Tuesday to go public. Shares gained more than 30% on their first day of trading, one day after the newly Nasdaq-listed company priced its initial public offering at the top of the expected range at $31 per share. Venture capital firm Sequoia is Instacart’s biggest investor, with a fully diluted stake of 15%.

The debut of the grocery delivery service came less than a week after U.K. semiconductor designer Arm Holdings (ARM) was listed on the Nasdaq in a blockbuster IPO. Shares closed their first session up nearly 25% last Thursday for a market value of more than $63 billion. However, Softbank-owned Arm has been on a sharp, three-session losing streak — and on Tuesday, it was trading less than 8% above its $51-per-share offer price.

Key Points

- Club names Wells Fargo and Morgan Stanley still have room to run higher.

- Those stocks and the banking industry overall have experienced a boost recently as the sluggish IPO market of the past two years heats up.

- Banks do face some risk going forward in the form of proposed tighter regulations in response to the March SBV failure.

Morgan Stanley did not have a hand in either of those IPOs, but it is a lead book runner on the upcoming IPO of marketing automation company Klaviyo, which disclosed in a filing Monday an increase in the offer range, targeting a fully diluted market valuation of $9 billion. E-commerce company Shopify (SHOP) owns about 11% of Klaviyo shares.

The outlook for the industry overall seems to be turning the corner since a mini-banking crisis erupted earlier this year following the March collapse of Silicon Valley Bank. The S&P 500 Financials sector index, while up about 1% year to date, has gained more than 12% since its 2023 lows in March. The overall S&P 500 index has gained 15% year to date and a little less than that from mid-March levels. (We recently did an in-depth report on all 11 sectors of the S&P 500 and where our 35 Club stocks fit in.)

Financials sector vs. S&P 500 year-to-date

The crisis of confidence in the banking industry ensued after SVB failed to manage risk and hedge for interest rates as the Federal Reserve continued to raise borrowing costs earlier this year. Other regionals such as Signature shuttered as well, accelerating the market selloff. First Republic was seized by federal regulators and sold for a song to JPMorgan. Tremors spread abroad, too, with Swiss bank UBS taking over its ailing rival Credit Suisse. Big banks, like Morgan Stanley and Wells Fargo, were never in any trouble but were painted with a broad brush of industry distrust.

Several months later, however, it seems like investors want back into big bank names again. Morgan Stanley and Wells Fargo were up 6.2% and 5% in the past five days, respectively, as of Monday’s close. However, those stocks, which were lower in Tuesday’s broader market sell-off, and the rest of the industry do face some uncertainty going forward.

Financial regulators are cracking down on banks with at least $100 billion of assets by increasing capital requirements in a bid to curb the risk of future insolvency issues. In response to the failure of SVB, regulators unveiled proposed changes in July that would require more banks to include unrealized losses and gains from securities in their capital ratios.

Still, Wells Fargo and Morgan Stanley are both well capitalized and haven’t been at risk of a run on deposits, according to the Fed’s latest stress test results. These new rules shouldn’t hit their bottom lines either, but there’s an argument to be made that an increase in capital requirements may weigh on revenue streams from net interest income as lending conditions tighten.

However, Chris Kotowski, senior research analyst at Oppenheimer told CNBC that if implemented, firms would adjust to the new regulations.

“Banks will adapt to capitals over time, but if there’s a sudden increase in capital requirements, you know, in the quarter or two or a year after, they can’t necessarily adjust to that instantly, but they will adjust,” Kotowski said in an interview. “If the capital charge on a certain kind of trading inventory is suddenly 20% more, all the market makers in that trading category are going to want to hold 20% less capital.”

Morgan Stanley YTD

During last week’s Barclays Financial Conference, management at Morgan Stanley said that capital markets are set to improve next year, with 2024 likely being a much better year for the economy as well. This could boost investment banking more broadly because companies will feel less inclined to preserve capital and more confident in going public or making acquisitions.

“We are more confident now than any time this year about an improved outlook for 2024,” Morgan Stanley Head of Investment Management Dan Simkowitz said at the event. “It’s clear to us now that the first half of the second quarter was probably the low point in sentiment around capital markets and M&A.” For context, global M&A value declined by 44% in the first five months of 2023, according to analytics firm GlobalData.

Simkowitz added that Morgan Stanley is seeing “improved execution quality across the capital markets and M&A,” leading him to believe the bank is “in the midst of a sustainable recovery.”

An upbeat economic outlook, along with a pickup in M&A and IPO activity, could certainly boost a dormant and crucial part of Morgan Stanley’s business. Due to the volatile nature of capital markets, Morgan Stanley has been putting a heavier focus recently on wealth management and other recurring fee-based revenue.

Wells Fargo YTD

Wells Fargo doesn’t stand to benefit quite as much as Morgan Stanley on a pickup in investment banking. However, management’s remarks at last week’s Barclays conference are showing signs of continued recovery. Wells Fargo Chief Financial Officer Michael Santomassimo said the macroeconomic picture is “much better than people would have expected at this point.”

“You still have a resilient employment picture. On the consumer side, the activity is still really good. People are out spending money. You see debit card spend up a couple of percent from what it was a year ago through the quarter,” according to Santomassimo. “You see strong growth in credit card spend, double-digit growth.”

Wells Fargo’s management reiterated the bank’s solid forward guidance while demonstrating an improving efficiency ratio as they continue to cut costs through layoffs and various restructuring plans. “A lack of bad news turned out to be good news,” CNBC Investing Club Director of Portfolio Analysis Jeff Marks said during last Thursday’s Morning Meeting.

The recent comments from Wells Fargo show further progress in the bank’s multi-year turnaround plan after the Fed imposed an asset cap on the firm in 2018. We see the timing of the financial regulator’s decision to lift the asset cap as a “when, not if” scenario, which would allow the bank to not only increase its balance sheet but also generate more profits.

(Jim Cramer’s Charitable Trust is long MS, WFC. See here for a full list of the stocks.)

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

-

Shopify cuts 20% of its workforce; shares surge on earnings beat

An employee works at Shopify’s headquarters in Ottawa, Ontario, Canada.

Chris Wattie | Reuters

Shopify on Thursday announced it’s cutting 20% of its workforce. The news came as it reported first-quarter earnings that beat analyst estimates on both the top and bottom lines.

Shares of Shopify surged more than 26% in early trading.

CEO Tobi Lütke announced the job cuts in a memo to employees posted on the company’s website. He didn’t specify which units will be affected as a result of the layoffs.

“I recognize the crushing impact this decision has on some of you, and did not make this decision lightly,” Lütke wrote.

Shopify had about 11,600 employees and contractors as of Dec. 31, according to a securities filing.

The cuts mark the second round of layoffs for the Canadian e-commerce company. Shopify last July laid off 10% of its workforce after Lütke said the company had misjudged how long the Covid pandemic-fueled e-commerce boom would last.

Lütke said Shopify is slimming down as a company as it focuses on its core business, which is making tools for companies to sell products online. The company separately announced Thursday that it’s offloading its logistics unit to Flexport, a sale that includes Deliverr, the last-mile delivery company it acquired for $2.1 billion last May.

Shopify is also selling 6 River Systems, the warehouse robot maker it acquired in 2019 for $450 million, to U.K. retail tech company Ocado. Terms of the Flexport and Ocado deals weren’t disclosed.

The moves bring an end to Shopify’s yearslong effort to build its own logistics business. Lütke called that effort a “worthwhile side quest” that could be an independent company in the future, but said Shopify is refocusing its priorities on e-commerce software, as well as newer initiatives such as artificial intelligence.

“Shopify has the privilege of being amongst the companies with the best chances of using AI to help our customers,” Lütke said.

Shopify also beat Wall Street estimates for the first quarter. The company reported revenue of $1.51 billion, which was up 25% from a year earlier, and exceeded Wall Street’s projected $1.43 billion, according to Refinitiv.

It posted earnings of 5 cents per share. Excluding items, Shopify earned 1 cent per share, while analysts were expecting a loss of 4 cents per share. In the year-ago period, Shopify reported a net loss of $1.5 billion, or $1.17 a share, a year ago.

Clarification: This story has been updated to clarify that excluding items, Shopify earned 1 cent per share, while analysts were expecting a loss of 4 cents per share.

-

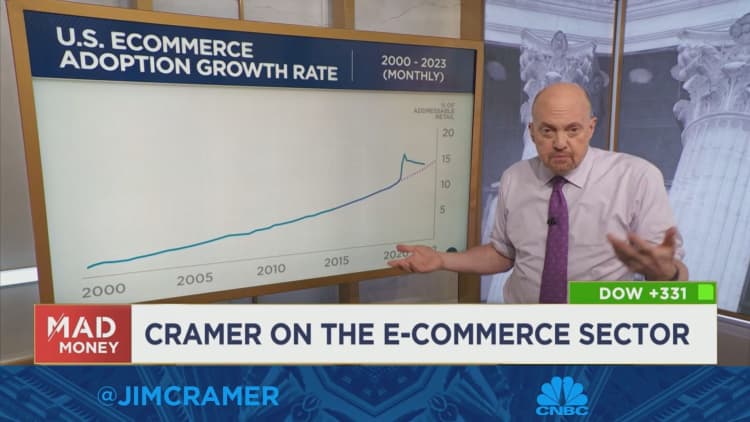

Jim Cramer names 6 e-commerce plays that are buys, says to wait on Amazon

CNBC’s Jim Cramer on Friday offered investors a list of e-commerce plays he believes are worth buying, despite the group’s rough performance in 2022.

“There are still some e-commerce plays that I’m willing to get behind here, the ones that have truly prioritized profitability,” he said.

Here is his list:

E-commerce stocks skyrocketed during the height of the Covid pandemic, as at-home consumers made purchases online rather than in-store. But when the economy reopened, consumers prioritized spending on travel and experiences over goods.

That shift, along with the Federal Reserve’s interest rate hikes, sent e-commerce stocks tumbling from their highs last year.

Cramer cautioned that while he believes the group’s struggles are temporary, it’s still too early to buy many of the names in the e-commerce space — including Amazon.

He said that one of his biggest concerns with the company is that it needs to cut more costs. Amazon said earlier this month that it plans to lay off over 18,000 employees.

While that might seem like a sizable cut, “this is a company with well over a million employees — to them, this is a drop in the bucket,” Cramer said.

But Amazon’s stock will eventually bottom, he said. “I think the business can eventually make a big comeback and there will come a point where the stock’s a screaming buy.”

Disclaimer: Cramer’s Charitable Trust owns shares of Amazon.