Why investors are no longer rewarding earnings beats, according to Goldman Sachs

- Order Reprints

- Print Article

Why investors are no longer rewarding earnings beats, according to Goldman Sachs

Interactive Brokers Group IBKR -1.79%decrease; red down pointing triangle

The online brokerage platform said Thursday that client trading volumes in stocks and options climbed 67% and 27%, respectively, in the quarter. Futures volume, meanwhile, decreased 7%. Customer accounts increased by 32% to 4.1 million, with customer equity up 40% to $757.5 billion.

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

While the U.S. trading week is shortened by the Thanksgiving holiday, it’s important to watch the stock market’s performance to see if the rally of the past month can be sustained through the year-end.

Stocks have rallied in November so far, with the S&P 500 index SPX logging a 8.6% gain month-to-date, while it’s up 18.6% so far this year, according to FactSet data.

“If…

Already a subscriber?

Log In

Morgan Stanley said late Wednesday that Co-President Edward “Ted” Pick will become its chief executive, effective Jan. 1.

Outgoing Chief Executive James Gorman will become executive chairman, Morgan Stanley said. Pick will also join the firm’s board of directors.

“The board has unanimously determined that Ted Pick is the right person to lead Morgan Stanley and build on the success the firm has achieved under James Gorman’s exceptional leadership,” the company said in a statement.

“Ted is a strategic leader with a strong track record of building and growing our client franchise, developing and retaining talent, allocating capital with sound risk management, and carrying forward our culture and values,” it said.

Gorman had announced his intention to step down in May, setting off a “Sucession”-like run for the top job at the investment bank.

Pick’s name had been among those in the running. The executive joined Morgan Stanley in 1990, and was promoted to managing director in 2002, according to his bio on the company’s website.

Gorman became CEO in January 2010, having joined the firm in 2006.

The lack of a clear successor at Morgan Stanley has weighed on its stock lately.

The shares are down 24% in the last three months, three times the losses for the S&P 500 index

SPX

in the same period. So far this year, Morgan Stanley shares are down 16%, contrasting with an advance of about 9% for the S&P.

U.S. stocks and bonds are both falling again, with the S&P 500 just wrapping up its worst quarterly performance in a year after another surge in Treasury yields.

“That creates a lot of anxiety,” as there’s still a fair amount of “investor PTSD” from last year, when markets were rocked by losses in both equities and bonds, said Phil Camporeale, a portfolio manager for J.P. Morgan Asset Management’s global allocation strategy, by phone.

But it’s not the same environment.

Last year was about the Federal Reserve rushing to tame runaway inflation with rapid interest-rate hikes after being “behind the curve,” he said. Now investors are grappling with a surge in Treasury yields after the Fed in September doubled its U.S. growth forecast this year to 2.1%, according to Camporeale, pointing to the central bank’s latest summary of economic projections.

“This is your kiss-your-recession-goodbye trade,” he said, with sharp market moves in September reflecting the notion that “the Fed is not easing anytime soon.”

The U.S. labor market has been strong despite the central bank’s aggressive tightening of monetary policy, with the unemployment rate at a historically low 3.8% in August. In September, the Fed projected the jobless rate could move up to 4.1% by the end of next year, below its previous forecast from June.

“Inflation is falling,” Camporeale said. “The most important metric right now is the labor market.”

As he sees it, investors are worried that the Fed will hold interest rates higher for longer should the unemployment rate remain low and the labor market “tight.” The Fed projected in September that it could raise rates once more this year before reaching the end of its hiking cycle, with fewer potential rate cuts penciled in for 2024 than previously forecast.

Investors expect to get a look at the U.S. employment report for September this coming week, with nonfarm payrolls data scheduled to be released on Oct. 6.

See: Government shutdown averted for now as Congress approves 45-day funding bridge

Meanwhile, the U.S. stock market ended mostly lower Friday, with the Dow Jones Industrial Average

DJIA,

S&P 500

SPX

and Nasdaq Composite

COMP

all closing out September with monthly losses as investors weighed fresh data on inflation.

A reading Friday of the Fed’s preferred inflation gauge showed that core prices, which exclude volatile food and energy categories, edged up 0.1% in August. That was slightly less than expected. Meanwhile, the core inflation rate slowed to 3.9% over the 12 months through August.

But headline inflation measured by the personal-consumption-expenditures price index rose more than the core reading on a month-over-month basis, as higher gas prices fueled its increase.

Investors have been anxious that the Fed may keep rates high for longer to bring inflation down to its 2% target.

Friday’s close left the S&P 500 logging its worst month since December, dropping 4.9% in September for back-to-back monthly losses. The S&P 500 sank 3.6% in the third quarter, suffering its biggest quarterly loss since the three months through September in 2022, according to Dow Jones Market Data.

The U.S. stock market has been startled by surging bond yields following the Fed’s policy meeting in September, after being jolted by the rise in Treasury rates in August.

“The price to pay for a resilient economy is higher yields,” said Steven Wieting, chief economist and chief investment strategist at Citi Global Wealth, in an interview. “We’re probably near the peak in yields.”

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

ended September at 4.572%, after rising just days earlier to its highest level since October 2007, according to Dow Jones Market Data. Yields and debt prices move opposite each other.

But for Camporeale, it’s still too early to venture out to the back end of the U.S. Treasury market’s yield curve to add duration to bondholdings. That’s because the yield curve is not yet “re-steepened” and he views the U.S. economy as currently on course for a soft landing with rates staying higher for longer.

“If you avoid recession, why should you have a lower yield as you go out in time?” said Camporeale. “You should be compensated for having more yield as you go out in time if you avoid recession, not less.”

The 2-year Treasury rate

BX:TMUBMUSD02Y

finished September at 5.046%, continuing to yield more than 10-year Treasury notes.

The yield curve has been inverted for a while, with short-term Treasurys offering higher rates than longer-term ones. The situation is being monitored by investors because historically such inversion has preceded a recession.

“If we were nervous about growth we would be buying the 10-year part of the curve or the 30-year part of the curve,” said Camporeale. “But we are not doing that right now.”

As for asset allocation, he said he’s now neutral stocks and overweight U.S. high-yield credit, particularly bonds with shorter durations of one to three years.

Camporeale sees junk bonds as a “nice” trade as he is not expecting a recession in the next 12 months and they are providing “enticing” yields versus the U.S. equity market, which probably has most of its returns in “versus what we think you get through the rest of the year.”

The S&P 500 index was up 11.7% this year through September, FactSet data show.

While watching for any signs of deterioration in the labor market, Camporeale said he now anticipates the earliest the Fed may cut rates is in the second half of next year. To his thinking, the recent move higher in 10-year Treasury yields was appropriate “in a world where maybe the yield curve has to re-steepen.”

Bond prices in the U.S. broadly dropped in September along with the stocks.

The iShares Core U.S. Aggregate Bond ETF

AGG

was down 2.6% last month on a total return basis, bringing its total loss for the third quarter to 3.2%, according to FactSet data. That was the fund’s worst quarterly performance since the third quarter of 2022.

The ETF, which tracks an index of investment-grade bonds in the U.S. such as Treasurys and corporate debt, has lost 1% on a total return basis so far this year through September, FactSet data show. Meanwhile, the iShares 20+ Year Treasury Bond ETF

TLT

has seen a total loss of 9% over the same period.

“Few investors want to call the top for peak rates,” said George Catrambone, head of fixed income at DWS, in a phone interview. Some bond investors had started to extend into long-term Treasurys in July. “That’s been the pain trade, I think, ever since then,” said Catrambone.

As for the equity market, the speed of the move up in 10-year Treasury yields hurt stocks, with the rate climbing “well beyond what many assumed would be the upper end,” according to Liz Ann Sonders, chief investment strategist at Charles Schwab.

With higher rates pressuring equity valuations, “clearly what’s going to matter is third-quarter-earnings season, once that kicks in” during October, she said by phone. Company “earnings are going to have to start to do some more heavy lifting.”

Recent weakness in the U.S. stock market is likely to persist over the near-term, according to Wall Street’s most bullish strategist, who still thinks the S&P 500 is on a path to a record high this year.

John Stoltzfus, chief investment strategist at Oppenheimer Asset Management Inc., in late July projected the S&P 500 would rise above 4,900 by the end of 2023. That is the highest price target for the large-cap index among 20 Wall Street firms surveyed by MarketWatch in August.

It implies the S&P 500 would rise above its earlier closing record high of 4,796 reached on Jan. 3, 2022 by the end of the year. The path up, however, could get bumpy.

“Bullishness [in the stock market] is relatively high while the Fed remains shy of its inflation target,” said a team of Oppenheimer strategists led by Stoltzfus in a Sunday note. They also said, “we persist in suggesting that investors curb their enthusiasm [in the stock market] for a long rate pause or even a rate cut and instead right-size expectations.”

Expectations that the Federal Reserve is nearing an end to its current interest-rate hiking cycle, as well as optimism around artificial intelligence boosted the U.S. stock market in the first seven months of 2023. However, the rally came to a brief halt in August as investors worried the Fed could be forced to keep rates elevated as a batch of stronger-than-expected economic data and rising oil prices fueled concerns that still-sticky inflation would mean that borrowing costs will stay higher for longer.

Investors should not brush off those pressures, even through the Fed appears to be nearing the end to its current rate-hike cycle, Stoltzfus and his team said. “The stickiness evidenced in food, services, energy and other prices warrants the Fed remaining vigilant along with a potential for one more hike this year and perhaps another next year,” they said.

See: When will consumers stop buying more stuff? It’s a key question for the stock market.

However, Stoltzfus doesn’t see current headwinds for stocks as something that would prevent the S&P 500 from achieving his team’s new peak target.

Stock-market investors expect this week’s August inflation report to offer more clarity on whether the central bank will continue to ratchet up its fight against inflation. The headline component of the consumer-price index is forecast to accelerate to 0.6% in August from July’s 0.2% gain, while the core measure that strips out volatile food and fuel costs is expected to rise a mild 0.2% from a month earlier, according to a survey of economists by The Wall Street Journal.

Meanwhile, a key Wall Street volatility index also pointed to “some choppiness” in the stock market in the near term to keep investors on their toes, said Stoltzfus. The CBOE Volatility Index

VIX,

at a level of 13.82 on Monday, hovered around its 12-month low and traded about 30% below its one-year average level of 19.9, and 37% below its two-year average of 21.88 (see chart below).

Stoltzfus and his team suggest that investors use market weakness to seek out “babies that get thrown out with the bath water” in periods of volatility. They said the S&P 500 Energy Sector

XX:SP500.10

looks increasingly attractive as policy makers in the U.S. and abroad strive to contain inflation and manage economic growth.

“We believe that prospects are looking better that the Fed’s success thus far in bringing down the rate of inflation could lead to a [rate] pause next year, thus lessening pressures on economic growth,” the strategists said. An improved economic growth, along with fiscal stimulus from investment in stateside infrastructure projects and stateside chip manufacturing efforts, could contribute to profitability in the energy sector into 2024, the team added.

The Energy Select Sector SPDR Fund

XLE,

which is seen as a proxy of the energy sector of the S&P 500, has advanced 3.9% year to date versus a 8.5% increase in the price of the U.S. benchmark West Texas Intermediate crude oil

CL00,

CL.1,

according to FactSet data.

Oil futures

CLV23,

BRNX23,

traded at their highest levels of the year on Monday morning, a week after Russia and Saudi Arabia caught markets off guard with their output cut extension announcements, but they settled modestly lower on Monday afternoon.

See: Energy ETFs are outshining the S&P 500, but it’s not just because of the oil rally

Stoltzfus in late July projected the S&P 500

SPX

would rise above its record high by the end of 2023, lifting his year-end price target for the large-cap index to 4,900 from an earlier 4,400 projection from December. It implies a 9.2% advance from where the S&P 500 settled on Monday, at around 4,487.

U.S. stocks finished higher on Monday, boosted by technology shares as Nasdaq Composite

COMP

advanced 1.1%. The S&P 500 was up 0.7% and the Dow Jones Industrial Average

DJIA

ended 0.3% higher, according to FactSet data.

For Apple fans, it’s almost that time of year again.

The company is expected to launch the iPhone 15 at an event Tuesday, but don’t get too excited about the new phone. This year, the biggest change from Apple

AAPL,

could be the iPhone’s price.

Apple tends to introduce new iPhones every year in the fall, and lately, the company has been keeping prices the same even as it upgrades the technology. That may not be the case this year, though, with some thinking that Apple could boost the price of its Pro-level models by $100 or $200 compared with what an iPhone 14 Pro currently sells for.

That’s notable because iPhones are already pretty expensive, with the cheapest iPhone 14 Pro option selling for $999 and the priciest iPhone 14 Pro Max configuration going for $1,599.

“Given the popularity of the iPhone 14 Pro models compared to the iPhone 14 models, Apple may believe consumers will be willing to pay more without much fuss,” Monness, Crespi, Hardt & Co. analyst Brian White wrote in a recent report. “Moreover, Apple may feel a price hike is warranted given the inflationary forces that have disrupted the economy over the past couple of years.”

Morgan Stanley’s Erik Woodring is less certain that Apple will hike prices broadly. The company could boost the price of its Pro Max phone by $150 to account for an expected new rear-facing periscope lens, but it’s “very un-Apple-like to raise prices across the board in the midst of a smartphone market down 11%,” he wrote. He said he expects the company to keep prices the same on the regular Pro model and its two base-level options.

One key issue for iPhone enthusiasts — and Apple investors — is when the new phones will be ready for sale. Most of the iPhone models Apple introduced last year hit stores in mid-September, but there are some concerns about potential production delays this year.

Read: Waiting for the iPhone 15? You might have to hold out longer than you think.

“The broad availability of the iPhone 15 Pro Max could be October given some manufacturing challenges,” BofA Securities analyst Wamsi Mohan wrote recently.

iPhone feature updates have become more incremental in recent years, and Apple watchers aren’t expecting anything groundbreaking this time around either. New iPhones always tend to be a little faster than their predecessors, and this year’s models might charge more quickly too. There’s a catch, though, as Apple is expected to switch out its proprietary Lightning cable for the more universal USB-C cord.

While the Pro models get a lot of attention, White said that those looking to buy base-level models could see some enhancements. Reports “have highlighted the potential for the iPhone 15 and iPhone 15 Plus to be graced with certain features found on last year’s more expensive Pro models, including the A16 chip, Dynamic Island, and a 48-megapixel camera,” he wrote.

Why go Pro? Apple could move to a titanium frame from its prior stainless-steel casing and make camera enhancements. Mohan highlighted the potential for a periscope-type telephoto lens on Max versions.

Apple fans “should also see more casing quality color differentiation between the Pro and regular series to help drive vanity switchers to the higher-priced models,” Jefferies analyst Andrew Uerkwitz wrote recently.

There could be a dark blue color option for the iPhone Pro line this year, for example, according to 9to5Mac. That said, those content with the base-level model might be enticed by a pink version of that phone, with 9to5Mac noting that that’s one of several rumored pastel color options.

Read: Here’s why Wall Street may be overreacting about Apple’s China’s challenges

Apple is also expected to refresh its Apple Watch lineup at Tuesday’s event. Bloomberg News has reported that the Apple Watch Series 9 could feature a faster processor, though it will have the same general design as past models. Apple is also expected to keep the look the same on an upgraded version of its Ultra Watch, and that might come in a black color option.

The event kicks off at 1 p.m. Eastern time Tuesday and will be available for live viewing on Apple’s site.

With second-quarter earnings season now largely behind the market, stock investors have been focusing on the latest economic data.

They have, for the most part, been reacting positively to “bad economic news,” or any data that may point to an economic slowdown.

It’s been almost nine months since the trend emerged, as softening economic data and lower inflation may mean the Federal Reserve can stop raising interest rates, said Chris Fasciano, portfolio manager at Commonwealth Financial Network.

Traders in federal-funds futures, as of Friday, are pricing in an over 90% chance that the Fed will hold its policy interest rate unchanged at its September meeting, and a roughly 35% likelihood that the U.S. central bank will raise interest rates by 25 basis points in November.

U.S. stocks closed the week higher ahead of the Labor Day holiday weekend, after data released Friday indicated a cooling labor market, though there was speculation that a “mirage” concerning the conclusion of summertime jobs may have factored. The U.S. created 187,000 new jobs in August, while the unemployment rate jumped to 3.8% from 3.5%.

The data support the narrative of a gradual slowdown in the labor market, but there are no signs that the economy is weakening significantly, according to Richard Flax, chief investment officer at Moneyfarm.

Also read: ‘Near perfect’ jobs report has traders expecting Fed to be done hiking rates this year

“The economic data has not been bad. It is just softening. If you saw really bad economic data, that wouldn’t be taken particularly positively,” Flax said.

Meanwhile, “what we’re experiencing is a rolling recession,” said Jamie Cox, managing partner at Harris Financial Group. “Recession activity actually goes from sector to sector, but it doesn’t translate into this big broad-based decline.”

However, if investors see a significant decline in the housing and labor markets, that could change the narrative, Cox noted.

To break the cycle in which bad economic news is good news for stocks, economic data have to be much worse than now, indicating more damage from high interest rates, noted Flax.

The trend may also reverse if there is a “meaningful downgrade” of corporate earnings expectations, said Flax. “I think you need to see it when macro data translates into weakened profitability.”

Investors should also be alert of the possibility that inflation may accelerate again, according to David Merrell, founder and managing member at TBH Advisors.

Data showed that the personal consumption expenditures price index rose a mild 0.2% in July, but the yearly inflation rate crept up to 3.3% from 3%, the government said Thursday.

“Inflation overall has been trending down nicely. But if it starts to kick back up, that could mean bad news becomes bad news now,” said Merrell.

If investors start to treat bad economic news as bad news for the stock market, it could put pressure on the 2023 stock-market rally, with the S&P 500

SPX

up 17.6% since the start of the year and the Nasdaq Composite

COMP

up 34%.

In the past week, the Dow Jones Industrial Average

DJIA

climbed 1.4%, the S&P 500 advanced 2.5% and the Nasdaq gained 3.2%, according to Dow Jones Market Data. The S&P 500 posted its biggest weekly gain since the week ending June 16.

This week, investors will be expecting data on the July U.S. international trade deficit and the ISM services sector activity for August on Tuesday, weekly initial jobless benefit claims data on Thursday, and the July wholesale inventories data on Friday. They will also tune into the speeches of a number of Fed speakers, looking for clues on whether the central bank is ready to be done with its rates hikes.

Economic calendar: On this week’s economic-data docket are the Fed Beige Book, factory orders, unemployment claims and more

The Institute for Supply Management’s manufacturing index is due for release Tuesday, which outside of inflationary periods (i.e., now), tends to be one of the more important economic indicators for financial markets, given its record as a bellwether.

Even compared to other rate-hike cycles, the ISM manufacturing series has been one of the worst in history, points out Jason Daw, head of North America rates strategy at RBC Dominion Securities. Daw makes the case that the U.S. economy overall is not very strong for this period of the cycle, and the manufacturing data, not just ISM but also industrial production, has been particularly feeble.

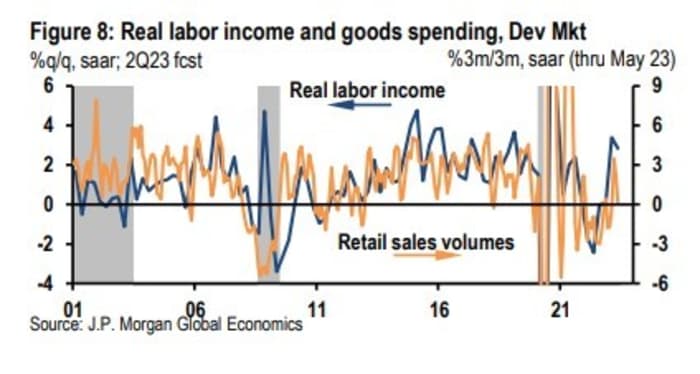

But the call of the day comes from JPMorgan’s economic team. They note that while global manufacturing stalled in the first half, the non-manufacturing components rose at a 3.2% annualized rate, allowing the global economy to grow at an above trend 2.7% rate.

The team led by Bruce Kasman say that the typical channels through which weak manufacturing would bring down the broader economy haven’t materialized. “A major channel by which weakness in goods sectors broadens out is through depressing corporate income and pricing power. While our start-of-year outlook anticipated elevated wage gains to pressure corporate profits, the surprising strength in [first-half] global GDP was accompanied by upside surprises to inflation,” they say. In turn, there have been solid gains in both labor income and profits, and while margins have come off their peaks, they are well above pre-pandemic levels.

Business hiring, they add, is the ultimate signal of confidence, and employment growth has continued even though expectations have soured.

Now, say the JPMorgan team, the stage is set for a goods sector recovery. Labor income, when adjusted for inflation, is rising, while finished goods inflation is falling sharply.

Also, business capital spending continues to expand, particularly in emerging economies outside of China. And importantly, inventories are swinging from a drag to a lift. In the first half, the step down in the pace of stock building depressed global industrial production by 3.4 percentage points.

“Even if the pace of stockbuilding was only to level off, the impulse to global industry would be material. Add to that a potential desire to align the pace to firming demand growth and the boost could generate a jump in factory output in the coming months,” they say.

Finally, they note, the tech spending decline after the 2020 to 2021 surge looks to be ending, and global motor vehicle production is picking up as supply-chain bottlenecks ease.

After an okay finish for the S&P 500

SPX,

to a strong July, U.S. stock futures

ES00,

NQ00,

were a bit lower as the seasonally weak month of August commenced. Gold futures

GC00,

were trading below $2,000 an ounce. The dollar

DXY,

rose.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The ISM report is due out at 10 a.m. Eastern, when the job openings and construction spending reports also come out. Monthly auto sales also will be released throughout the day.

Pfizer

PFE,

Caterpillar

CAT,

Uber Technologies

UBER,

and after the close, Starbucks

SBUX,

and Electronic Arts

EA,

highlight the day’s earnings reports. Pfizer lowered its sales guidance while Caterpillar beat Wall Street earnings estimates and Uber reported a surprise profit.

JetBlue Airlines stock

JBLU,

slumped as the airline says it no longer expects to report a profit in the third quarter, owing to what it called a challenging environment in the northeast, as well as a preference by consumers for long-haul international flights.

CVS Health

CVS,

is going to cut 5,000 corporate jobs, according to The Wall Street Journal.

BlackRock

BLK,

and MSCI

MSCI,

are targets of a Congressional probe into facilitating U.S. investment in China.

The first new U.S. nuclear reactor in nearly seven years starts operations.

Modern-day Oppenheimers see the future of nuclear energy — and it’s mobile.

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

TUP, |

Tupperware Brands |

|

NIO, |

Nio |

|

AMC, |

AMC Entertainment |

|

PLTR, |

Palantir Technologies |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

NKLA, |

Nikola |

|

AMSC, |

American Superconductor |

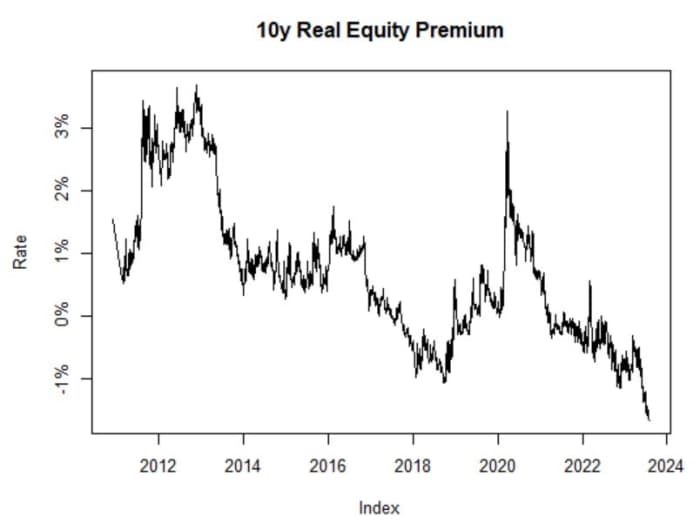

The inflation-adjusted equity premium is looking pretty bleak. That’s calculated by taking the expected return to the S&P 500 and subtracting 10-year TIPS yields. “While admittedly this graphic is skewed by the few megacaps trading at huge multiples, it’s sobering nonetheless,” says Michael Ashton, better known as the Inflation Guy.

Granted, Philadelphia’s a big sports town, but there were actual tailgates to get the Eagles’ throwback Kelly green jerseys that went on sale.

A Chinese zoo has denied that a bear is human after video of the creature standing on two feet.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

New weightings for the largest stocks in the Nasdaq 100 are taking effect on Monday following the index’s second “special rebalancing” in 25 years.

See: Nasdaq rebalancing is coming, and it’s boosting interest in Friday’s $2.3 trillion option expiration

These new levels were shared ahead of time with Goldman Sachs Group Chief U.S. Equity Analyst David Kostin. Kostin and his team have published a report on the changes that was shared with Goldman clients and the press last week.

Here are four of the most important shifts highlighted in Kostin’s note:

The Goldman analyst summarized how the new weightings would impact the index’s 25 largest constituents in the chart below.

According to Nasdaq representatives, the Nasdaq 100 is the most popular of the exchange’s indexes. So far this year, it has outperformed the Nasdaq Composite, a broader index including every company traded on the exchange. The Nasdaq 100 is up 41.2%, to the Composite’s 34.4%, according to FactSet data.

EPFR data show $261 billion in mutual fund and exchange-traded fund assets are benchmarked to the Nasdaq 100, including the Invesco QQQ Trust Series

QQQ,

better known by its ticker QQQ. More than $250 billion of this money is invested in passive benchmark-tracking strategies.

Nasdaq decided to implement the special rebalancing earlier this month to try and ward off concentration risk after its seven largest components surged earlier this year. According to its official index-management methodology, Nasdaq aims to keep the combined weighting of its largest constituents to 40%.

Kostin said he doesn’t expect these changes to have much of an impact on markets, arguing that the previous special rebalancing didn’t move the index much, either.

Both the Nasdaq 100 and Nasdaq Composite were slightly lower on Monday as big-tech names continued to lag the S&P 500 and suddenly high-flying Dow Jones Industrial Average

DJIA,

just like they did last week.

Nasdaq 100-tracking QQQ

QQQ,

was off by 0.2% at $374 per share Monday morning, while the Nasdaq Composite

COMP,

was down 0.2% at 14, 013.

JPMorgan Chase & Co. Chief Executive Jamie Dimon on Friday said the U.S. economy was basically doing OK, even if customers were spending “a little more slowly.”

But with rivals like Bank of America Corp., Goldman Sachs Group Inc. and American Express Co. set to report quarterly results this week, recession agita still prevails.

For evidence, look no further than JPMorgan’s

JPM,

own quarterly results. The bank’s second-quarter profit blew past expectations, but it set aside $2.9 billion during the second quarter to cover potentially bad loans, amid concerns that more consumers could run into more difficulty paying their bills on time as higher prices manage to stick at stores.

That figure was well up from $1.1 billion in the same quarter last year, although still far below the billions it stowed away when the pandemic first hit. Similarly, Wells Fargo & Co.

WFC,

on Friday set aside $1.7 billion for loan losses in this year’s second quarter, nearly triple what it was a year ago.

The figures underscore the anxiety over the second half of this year, when many economists expect the economy to tilt into a recession. However, for the 500 companies in the S&P 500 index, Wall Street analysts still expect profit growth.

Any downturn could be exacerbated by the pressure investors have put on companies, potentially via more layoffs and money-saving technology, to keep prices high and cut costs to replicate the abnormally large profit-margin gains they put up in 2021 and 2022. Businesses have indeed kept prices high, at least for many basic necessities, in an effort to cover their own higher costs and to pad profits.

When Bank of America

BAC,

reports this week, the results will narrow the lens on lending and spending in the U.S. Results from Morgan Stanley

MS,

and Goldman Sachs

GS,

will fill in the gaps on trading and deal-making. American Express

AXP,

will give a more detailed breakdown of what consumers are still spending their money on, after Delta Air Lines Inc.

DAL,

— which has a partnership with AmEx — said that travel demand remained “robust.”

Banks shoveled more money into their reserve stockpiles in 2020 to bulk up against the pandemic’s shutdown of the economy. A year later, they started releasing those funds as the economy reopened and recovered. FactSet expects the broader banking sector to plump up its cash cushion during this year’s second quarter to account for more late loan payments or potential defaults.

In a report on Friday, FactSet said the 15 banking-industry companies in the S&P 500 Index tracked by the firm were on pace to set aside $9.9 billion to cover losses from souring loans in the second quarter. That’s more than double the amount set aside a year ago. And if that $9.9 billion figure, based on actual and projected financial figures, ends up as the actual figure at the end of the quarter, it would mark the highest since the beginning of the pandemic and the third highest in five years, according to FactSet data.

“The U.S. economy continues to be resilient,” Dimon said in a statement on Friday. “Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly. Labor markets have softened somewhat, but job growth remains strong.”

However, he noted difficulties in JPMorgan’s investment banking segment. And he said consumer savings were slowly eroding as inflation endures.

As the nation’s biggest bank, JPMorgan has flexed its financial muscle this year, swallowing up First Republic after that bank got into trouble. But as it consolidates power and influence, building thicker armor against shocks to the economy, its financial results might not always reflect the struggles of its smaller rivals, where difficulties are likely felt more acutely. Analysts at Raymond James said that while JPMorgan remained a “best in breed” bank, its outlook pointed to “heightened challenges for smaller banks.”

See also: Jamie Dimon says U.S. consumers are in ‘good shape.’ This evidence may prove otherwise.

For the week ahead, 60 S&P 500 companies, including five from the Dow, will report quarterly results, according to FactSet. Two big oil companies, Halliburton Co.

HAL,

and Baker Hughes Co.,

BKR,

will report, as oil prices fall from levels seen last year. Results from two transportation giants — trucking company J.B. Hunt Transport Services

JBHT,

and railroad operator CSX Corp.

CSX,

— will also be a proxy for how much people are buying things and having them shipped. United Airlines Holdings Inc.

UAL,

and American Airlines Group

AAL,

will also report.

Netflix results: Hollywood shutdown, ‘slow-growth’ expectations. Hollywood’s writers — and now its actors — have gone on strike, and Netflix Inc.

NFLX,

reports second-quarter results on Wednesday. The streaming platform will likely face questions over how much content it has left in the tank, as the strike upends studio-production schedules and leaves viewers with vast expanses of reruns. Still, Macquarie analyst Tim Nollen said that the production standstill “may ironically drive even more viewers to streaming services.”

The writers and actors argue that the studio industry — increasingly consolidated, increasingly publicly traded, increasingly oriented around a handful of film franchises — has profited immensely while skimping on things benefits and streaming residuals. But after a decade-long rise, and a recent shift in investor focus from subscriber growth to profit growth, Netflix has emerged as one of the biggest production powerhouses in the business. And after years of flooding customers with new films and shows, it’s trying to squeeze out sales via more boring ways: things like a password-sharing crackdown and ads.

Daniel Morgan, senior portfolio at Synovus Trust Co., said Netflix still faced a plenty of streaming competition amid “muted” subscriber growth. But Wedbush analyst Michael Pachter said investors should look at Netflix as a profitable, albeit more mature company.

“We think Netflix is well-positioned in this murky environment as streamers are shifting strategy, and should be valued as an immensely profitable, slow-growth company,” Pachter said in a research note on Friday.

“Even while the ad-supported tier is not yet directly accretive (we think it will be accretive over time), the ad-tier should continue to reduce churn and draw new subscribers to the service,” he continued.

Tesla sales. Electric-vehicle maker Tesla Inc. also reports second-quarter results on Wednesday. And like streaming, some analysts say the fervor for EVs has faded.

However, they also said that Tesla

TSLA,

had so far been immune from the malaise. And even though Elon Musk remains preoccupied with Twitter — which now faces competition from Meta Platforms Inc.’s

META,

Threads — Tesla’s second-quarter deliveries were far above expectations. Sales are expected to be big. And one analyst said that price cuts, which Tesla has used to capture more of the auto market in China, were likely “fairly minimal” during the second quarter. But some analysts wondered what the blowout delivery figures would mean for margins. And the industry, broadly, has increasingly tested the patience of profit-minded investors.

“We’ve now seen a market where demand is constrained, capital has been tighter, and there is less tolerance for EV related losses,” Barclays analysts said in a note last week, adding that there was a “step back from EV euphoria.”

Claudia Assis contributed reporting.

Continued uncertainty about whether a debt-ceiling resolution can come together fast enough to avoid a government default pushed yields on Treasury bills maturing between early and mid-June toward 6% on Tuesday.

The yield on Treasury bills maturing on June 6 touched that level before slipping slightly to 5.997% Tuesday afternoon, according to Bloomberg data. Meanwhile, the rate on T-bills maturing on June 8 was at 5.905%.

In addition, the one-year T-bill issued in June 2022 and which matures on June 15 was yielding 6.141%, though analysts said that was likely being impacted by a government auction on Tuesday. That 6.141% yield was the highest of any government obligation maturing within two weeks after the so-called X-date of June 1 — when Treasury Secretary Janet Yellen said the government might be unable to pay all its bills if no action is taken on the debt ceiling.

The Treasury bill market is where debt-ceiling angst has played out the most and Tuesday brought wild trading as investors questioned whether the government will be forced to miss payments after June 1. At the moment, the T-bill market is in a state of dislocation — one in which yields ranged from as little as 2.924% on the government obligation maturing on May 30 to as high as 6.141% on the 1-year bill maturing in three weeks.

The higher the yield on a Treasury obligation, the more investors are demanding to be compensated for the risk of holding that bill. Yields also rise when investors are selling off or staying away from the underlying maturity. Tuesday’s moves suggest that investors and traders are factoring in at least some risk that the government could cross the X-date without a debt-ceiling resolution.

Right now, the market regards bills maturing between June 6 and June 15 as “the most at risk for a delayed payment and no one wants to own” them, said Lawrence Gillum, the Charlotte, N.C.-based chief fixed income strategist at LPL Financial.

“Ultimately, markets expect something to get done, but money managers who have to own those T-bills are not taking any chances,” he said via phone.

For much of Tuesday, the broader financial market appeared to be relatively confident that a debt-ceiling agreement could be reached by June 1, a day after President Joe Biden and House Speaker Kevin McCarthy each described talks as “productive” on Monday. Then came word of McCarthy telling House Republicans on Tuesday that negotiators were nowhere near a deal yet, with Bloomberg citing Republican Representative Ralph Norman and another unidentified person in the room.

All three major U.S. stock indexes

DJIA,

COMP,

finished lower, while Treasury yields beyond the 2-year rate slipped toward the end of Tuesday’s New York trading session — a sign of fading optimism in the outlook for the U.S. economy.

Read: ‘Survival of the strongest’: How pandemic-era shifts may upend market’s recession narrative

One of the financial market’s favorite indicators of impending U.S. recessions — the difference between the 2- and 10-year Treasury yields — has been persistently inverted since July 5, 2022. That’s the longest such streak since May 1980, and yet no recession has been declared so far by the only arbiters who matter, those at the National Bureau of Economic Research.

On Tuesday, fed funds futures traders priced in a 28.1% chance of another quarter-point rate hike by the central bank in June, which would take the main policy rate target to between 5.25%-5.5%. They also factored in a slight 5.6% likelihood of another similar-size rate hike in July.

Gillum and Greg Faranello, head of U.S. rates at AmeriVet Securities in New York, said they see a small chance of no debt-ceiling agreement by June 1. Under such a scenario, the Treasury market would fall into “disarray,” with T-bill yields spiking in a manner reminiscent of last year’s crisis of confidence in the U.K. bond market, they said. It would also make it harder for the Fed to hike rates on June 14, and likely lead to a flight-to-quality trade in longer-term Treasurys as equities sell off.

See: ‘Doomsday machine’: Here’s what could happen if the debt ceiling is breached

As of Tuesday, the T-bill market was “definitely showing some signs of stress, there’s no question about it,” Faranello said via phone. Meanwhile, “the economy is doing better than the narrative of recession,” even after the recent turmoil in regional banks, and a move toward 4% in the 10-year rate this year “can’t be ruled out.” However, that could change quickly based on the outcome of the debt-ceiling debate.

Getting something done on the debt ceiling by June 1 “is going to be a challenge,” Faranello said. The risk of default “is small but not a zero-percent probability,” as is the prospect of chaos if negotiators come too close to the wire and create a period of confusion in the Treasury market.

“At a minimum, there would be pretty severe economic damage” from a default or any confusion, it “could be chaotic,” and “you would see that impact on risk assets,” he said.