A weak session is setting up for Tuesday, with oil under pressure after unexpectedly downbeat China export data. So the preference is for bonds this morning, as stock futures tilt south.

Prince touches on asset liability mismatches, such as what was seen during the banking crisis earlier this year. He explains that one big factor behind a crisis is when a certain economic regime exists for an extended period of time and “people extrapolate that into the future on the basis of leverage and asset liability mismatches. Then you get a shift in that regime.”

The events of March, which saw the collapse of SVB, Signature Bank and Silvergate, were a perfect example of that, Prince says. Then he turns to what he calls the “broader effects of a transition from 15 years of abundant free money,” that was first used to battle deleveraging pressures in the financial system in 2008 and then the pandemic.

One long-term effect of that gets particular attention by Prince, who points out how U.S. government Treasury debt to GDP was about 70% in 2008, around where it had been for decades.

“The after effects of offsetting deleveraging and pandemic, you’ve had a massive wealth shift from the public sector to the private sector and that’s left the government with debt to GDP up from 70% up to 120%. And the particular vulnerability of that is in the debt rollovers and the gross issuance that you’re going to see in the coming decades . You’re stuck with that debt until you pay it off and that means you have to roll it over like anybody else does,” said Prince.

“Gross debt issuance will be running at 25% for as far as the eye can see, that means every year you’re issuing 25% of GDP in debt. In 1960, the average amount of debt issuance was 12% of GDP,” he said.

Prince says most people really don’t pay attention to debt rollovers because they just assume those will get done, but notes that when countries have experienced balance of payments crisis in the past, mostly emerging markets, that is because they have been unable to roll over that debt.

In the U.S. case, it’s crucial to look at who is holding the debt, particularly the 27% held by foreign investors and 18% by central banks. “Foreign investors would normally be a reliable source of investment but it does heighten sensitivity to geopolitical risk, and so geopolitical risk converges with debt rollovers and gross issuance of the Treasury is an issue that you need to pay attention to in the coming years.

While not an “acute problem,” he says, it’s a lingering one, and when it comes to central banks it’s also unclear whether their holdings also present a “rollover risk.”

Prince also touches on the fact that that all that “abundant free money” has fueled a private-equity boom, but with interest rates now at 8% instead of 2% or 3%, “the pace and transaction cycle is bound to slow,” and they are starting to see that.

“When we talk to institutional investors around the world, many of them are experiencing liquidity issues right now and the liquidity issues result from the fact so much money was allocated to private assets and the transaction cycle is slowing,” he said.

MarketWatch 50: Forget U.S. stocks for now. Invest here instead, says Bridgewater’s co–investment chief

A team of analysts at Citigroup led by Nathan Sheets have also weighed in on government debt, telling clients in a new note that “it’s unwise for policy makers to experiment or test” where the threshold for too much debt lies. Here’s their chart showing the bleak trajectory:

Dirk Willer, head of global asset allocation at Citigroup, said a debt crisis scenario in the U.S. would likely mean a selloff of risk assets globally. He notes that bonds in rival countries may not be the best bet as they don’t always benefit. And both gold and bitcoin underperformed during the U.K. gilt crisis, so those may be out.

Also in attendance at the conference in Hong Kong, Deutsche Bank’s CEO is worried geopolitics could create another market event and Citadel’s Ken Griffin said investors should put money in China.

Read: ‘Stock-market correction is over’ after broad surge amid ‘epic’ market rallies

The markets

Stock futures

ES00,

-0.02%

NQ00,

+0.31%

are pointing to a weak to flat session ahead, while the 10-year Treasury yield

BX:TMUBMUSD10Y

eases back. U.S. crude

CL.1,

-2.20%

is under $80 a barrel after worse-than-forecast China exports signaled more economic bumps in the global growth engine. The dollar

DXY

is up.

The buzz

Planet Fitness stock

PLNT,

-0.27%

is surging on upbeat results and an improved growth outlook. Uber

UBER,

+0.82%

is up as earnings beat forecasts, but revenue fell short. D.R. Horton

DHI,

-0.96%

stock is also getting a boost from results. EBay

EBAY,

-0.44%,

Occidental Petroleum

OXY,

-2.00%,

Akamai Tech

AKAM,

-0.06%

and Gilead Sciences

GILD,

-0.55%

after the close.

Reporting late Thursday, Tripadvisor

TRIP,

+2.29%

delivered blowout results and the stock is surging, while Sanmina

SANM,

-1.03%

is down 14% after the manufacturing services provider’s disappointing results.

UBS

UBS,

-0.49%

UBSG,

+2.79%

swung to a $785 million quarterly loss on lingering effects of its Credit Suisse takeover, but it pulled in $33 billion in new deposits and shares are up.

After a decade of turmoil, office-sharing group WeWork

WE,

-24.73%

filed for Chapter 11 bankruptcy protection on Monday.

The U.S. trade deficit climbed 5% in September to $61.5 billion as imports rebounded. Still to come is consumer credit at 3 p.m. Fed Vice Chair for Supervision Michael Barr speaks at 9:15 a.m., followed by Fed Gov. Christopher Waller at 10 a.m.

The International Monetary Fund boosted its China outlook for 2023 and 2024.

Best of the web

Big banks are cooking up new ways to offload risk.

Retirees continue to flock to places where climate risk is high.

How to know when it’s time to retire

The chart

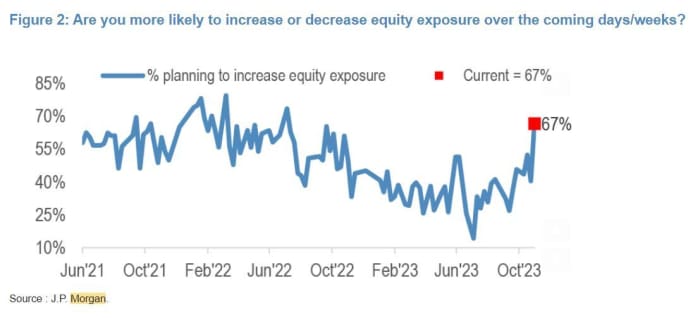

According to this recent JPMorgan survey, two-thirds of investors are ready to start pumping more money into equities, while just 19% plan to increase bond exposure. Also, note that 67% also said they did not expect performance of the Magnificent 7 stocks — Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta — to “crack before the end of the year.”

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

TSLA,

-0.31%

|

Tesla

|

AMC,

+2.15%

|

AMC Entertainment

|

NVDA,

+1.66%

|

Nvidia

|

AAPL,

+1.46%

|

Apple

|

NIO,

-3.16%

|

NIO

|

GME,

-2.45%

|

GameStop

|

AMZN,

+0.82%

|

Amazon.com

|

PLTR,

-1.85%

|

Palantir Technologies

|

MULN,

+3.88%

|

Mullen Automotive

|

MSFT,

+1.06%

|

Microsoft

|

NVDA,

+1.66%

|

Nvidia

|

Random reads

Fifteen people ended up with eye pain and sight issues after a Bored Ape NFT event.

A death metal band asked for singers on social media. A choir responded.

undefined