Year-over-year sales were flat. Subscriber rolls were down compared to the final three months of 2024. Earnings per share estimates were much more robust than the actual EPS. That latter win led investors to express pleasure with the Q4 2025 results from Sirius XM Holdings Inc., with CEO Jennifer Witz gushing over longtime talk host Howard Stern on the company’s early Thursday earnings call for shareholders and other interested parties.

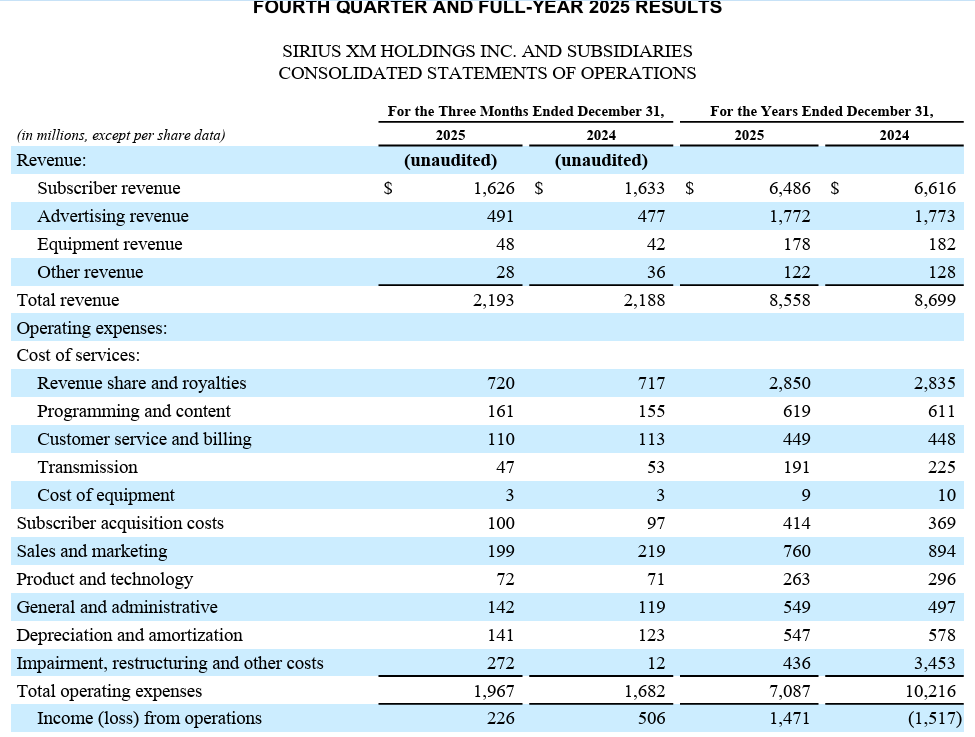

With Witz declaring that “Howard Stern is more relevant than ever,” as the longtime host signed a new three-year contract during autumn 2025, total revenue in Q4 increased to $2.193 billion, from $2.188 billion, as net income dipped to $99 million ($0.24 per diluted share) from $287 million ($0.83).

The EPS was a big miss, coming in 53 cents lower than consensus average of $0.77 per share. However, the total revenue surpassed the $2.17 billion consensus estimate of some 13 analysts polled by Yahoo! Finance.

Adjusted EBITDA increased to $691 million, from $688 million, in Q4 ’25.

Advertising revenue was $1.77 billion, roughly flat year-over-year, driven primarily by strength in podcasting and improving programmatic demand late in the year. This offset an ongoing weakness in streaming music advertising.

As of 3:45pm Eastern, Nasdaq-traded “SIRI” was up by 9.3% from Wednesday’s closing price, at $22.66 per share. While that’s welcomed news, Sirius XM stock is down by nearly 11% in value from 52 weeks ago.

“We entered 2025 with renewed strategic focus as a fully independent public company, and we’re pleased to have overdelivered on our commitments, finishing the year with a strong fourth quarter, meaningful free cash flow growth, and exceeding our full-year guidance,” Witz said.

Full-year guidance was offered by Sirius XM, and it expects to have total revenue of approximately $8.5 billion in 2026, with adjusted EBITDA of approximately $2.6 billion and Free Cash Flow of approximately $1.35 billion expected.

It’s the FCF that could have investors particularly excited. By comparison, total revenue of $8.56 million was seen in 2025, down from $8.7 million in 2024. Adjusted EBITDA for full-year 2024 was $2.67 billion, off from $2.73 billion in 2023. Free Cash Flow was $1.26 billion, up from $1.02 billion.

“In 2026, we are providing robust guidance that we believe reflects the overall stabilization of the business as we continue to lean into our strengths — our unique programming, leadership in the car, and audio advertising capabilities — to create deeper connections with listeners, deliver unparalleled audio experiences, and drive compelling results for our shareholders,” Witz added.

On the earnings call, Witz also signaled Sirius XM’s path paved at the end of 2024, when it “refocused” its growth strategy by diminishing its marketing and promotion of the Sirius XM smartphone app due to strong competition from a wide variety of audio content purveyors. With many consumers considering Sirius XM as primarily an in-dash on-the-road audio offering, “we have remained laser-focused on bolstering our core SiriusXM in-car audience and expanding the reach of our ad network,” Witz told those on the call.

That’s not to say on-demand audio is a fiscal flop. On the contrary, podcasting ad revenue grew 41% for the full year, on top of double-digit growth in 2024, Witz shared.

Joining Witz in his first earnings review for investors was Chief Financial Officer Zach Coughlin. He succeeds Tom Barry.

Coughlin’s key takeaway? “Our core subscriber base remains stable, as reflected in full-year churn of 1.5%, one of the lowest levels in our history, and an improvement from 1.6% last year, supported by a durable subscriber base, with over half of our subscribers having been with SiriusXM for more than 10 years,” he said on the call. “We view our strong churn performance as a key result of improving our value proposition and overall customer satisfaction, and looking forward, we expect it to remain in the 1.5%-1.6% range. From an ARPU perspective, fourth quarter ARPU was up $0.06 to $15.17 as rate increases rolled through the base, partially offset by an increase in subscribers on promotional plans. For the full year, ARPU was $15.11, down $0.10 from last year.”

With liquidity “strong,” and access to a $2 billion revolving credit facility that remains largely undrawn in place, Coughlin says Sirius XM ended 2025 with a net debt to Adjusted EBITDA ratio of approximately 3.6x, “continuing our path towards our long-term target range of low- to mid-3x, which we expect to reach by late this year.”