Shiba Inu on-chain data reveals an unusual increase in new-user traction as SHIB price erased another zero, reaching a daily time-frame peak of $0.000011 on Jan. 11.

Shiba Inu has dominated the memecoin sector so far in 2024. Since the widespread liquidations that rocked the cryptocurrency markets on Jan. 3, SHIB price has rebounded by 25.4%. Meanwhile, its rival mega cap memecoins, PEPE and Dogecoin (DOGE) have only mustered 22.1% and 5.6% respectively.

As depicted above, Shiba Inu has outperformed DOGE and PEPE in the past week. But looking past the price charts, a vital on-chain data points toward further exacerbation of this trend in the days ahead.

SHIB is attracting an unusually high number of new user transactions

Recent on-chain data trends suggest Shiba has gained the upper hand in the memecoin markets due an unusual wave of new user transactions. IntoTheBlock’s new adoption rate metric measures the percentage of total active addresses that conducted their first transaction on a given day.

This gives clear insights into the rate at which crypto investors are bringing new money into the SHIB spot markets.

Shiba Inu recorded a new adoption rate of 42.75% on Jan. 10, as depicted by the blue trendline in the chart below. A close look at the chart shows that the Jan. 10 figure is significantly higher than the 30-day average of 39.1%, signaling an unusually high trend.

When new user adoption increases it signals that the underlying token is still attracting high demand. It emphasizes that SHIB new users are not only joining the network, but they are also participating in economic transactions.

If sustained, this rising demand could make a compelling case for Shiba Inu price to enter another leg-up in the days ahead.

SHIB price prediction: $0.000013 target in focus

Based on the aforementioned data points, the rising spate of new user transactions could drive SHIB price toward $0.000013 in the coming days.

But, Shiba Inu holders’ historical accumulation trends suggest that the $0.000012 area could pose a major obstacle. IntoTheBlock’s In/Out of the Money Around price data shows key resistance and support level by grouping current SHIB holders according to their historical entry points.

As depicted below, 180,610 addresses had acquired 92,721 trillion SHIB at the average price of $0.000012. If this major cluster of investors book profits early, SHIB price could retrace from that resistance area.

But if the new users keep bringing in fresh capital, the Shiba Inu bulls could orchestrate a decisive breakout above, $0.000013 as predicted.

Conversely, SHIB could experience a major downswing if the bears force an unexpected reversal below $0.00008. In that case, the chart above also shows that 185,880 holders had acquired 100.52 trillion SHIB at the average price of $0.000009. To avoid slipping into losses, this cluster of investors could make frantic short-covering purchases and inadvertently trigger an early rebound.

Ibrahim Ajibade

Source link

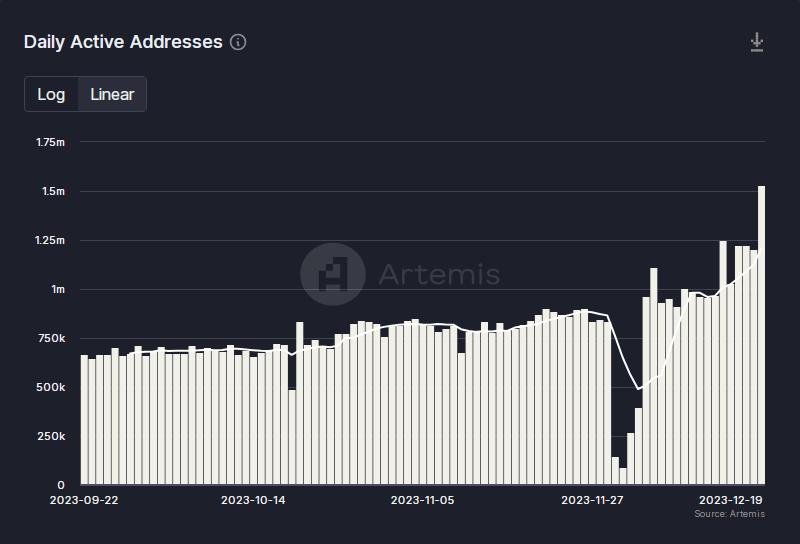

Source: Artemis

Source: Artemis