CNBC’s Jim Cramer on Friday told investors what to watch for on Wall Street next week, highlighting JPMorgan‘s market-moving health-care conference in San Francisco. Taking place from Monday to Thursday, the conference is one of the year’s largest gatherings of major industry CEOs where they reveal earnings guidance and updates on clinical trial research.

“The new year has started with a redistribution of cash out of the ‘Magnificent Seven’ and on to the sidelines,” Cramer said, pointing to health-care stocks as a particularly notable group that will likely be “propelled by what people expect to hear from the JPMorgan Healthcare Conference.”

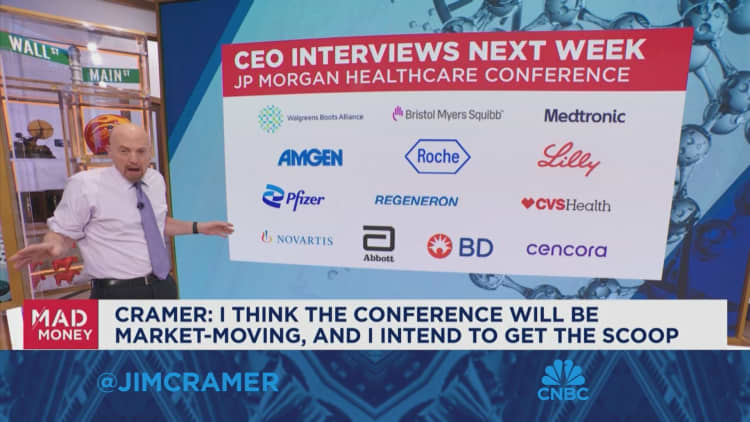

Cramer will interview several CEOs at the conference, starting with Walgreens CEO Tim Wentworth on Monday. Cramer said he’s interested to hear how the company plans to get its groove back after cutting its dividend nearly in half this week. Cramer will also speak with leadership from Amgen and Medtronic, as well as the new CEO of Bristol Myers, Chris Boerner, whom he’ll ask about the company’s rigorous biotech acquisition plans.

On Tuesday and Wednesday, Cramer will continue to interview the CEOs of major industry names, including Eli Lilly CEO David Ricks. Cramer said he’s particularly interested in the company’s diabetes and weight loss drug as well as its Alzheimer’s initiative. He’ll also speak with CVS Health CEO Karen S. Lynch to discuss the company’s ongoing transition from drug store to health-care provider. Cramer will also hear from the CEOs of Pfizer, Regeneron, Novartis, Abbott Labs and Cencora.

Thursday brings the consumer price index for December. Cramer said he thinks those hoping for soft figures will be disappointed. Cramer will also be tuning into CES, the Consumer Electronics Show, next week. The tech event will include commentary by leadership from Nvidia and Dell.

Earnings season kicks off Friday with reports from major banks including JPMorgan, Bank of America and Wells Fargo. BlackRock will also report, and Cramer said he thinks the company’s earnings could give investors a solid overview of the financial industry. He’ll also be paying attention to Friday reports from UnitedHealth Group and Delta.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Eli Lilly.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com