[ad_1]

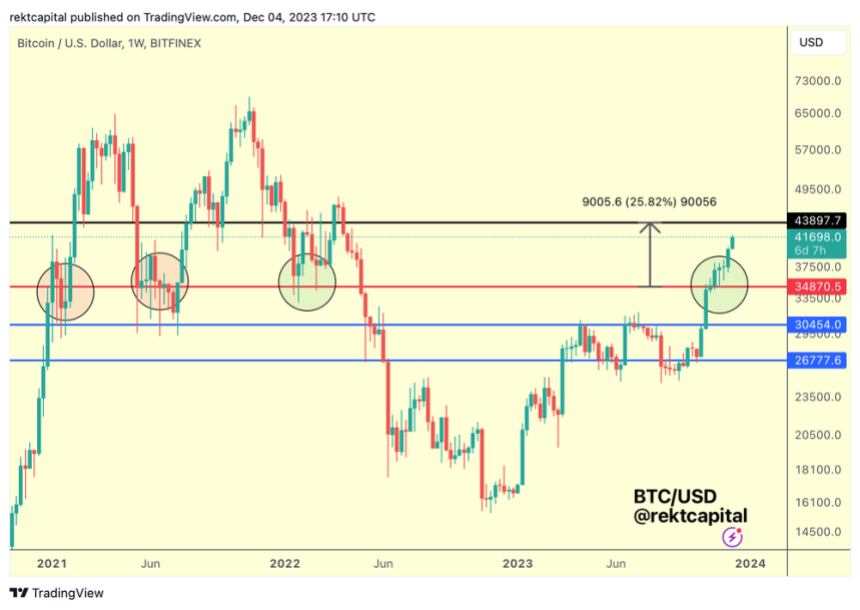

The Bitcoin price experienced a notable downturn as selling pressure intensified, resulting in a decline of over 4% from its annual peak of $44,500. This downturn was further exacerbated by the loss of the crucial $42,000 support level.

However, the largest cryptocurrency in the market received a substantial uplift from the US Financial Accounting Standards Board (FASB), which has spurred a rapid 1.8% surge in BTC’s value within the past two hours. As a result, Bitcoin has successfully recovered the $42,000 support level.

FASB’s Fair Value Recognition Brings Clarity To BTC?

In a significant development for the cryptocurrency industry, the FASB has announced new accounting rules that require companies, including prominent entities like MicroStrategy, Tesla, and Block, to measure their cryptocurrency holdings at fair value.

These rules, set to go into effect in 2025, allow businesses to capture the real-time highs and lows of their Bitcoin and Ethereum (ETH) assets, providing a more accurate representation of their holdings.

Under the previous accounting practices, companies were only allowed to record the lows, resulting in a one-sided accounting treatment that often led to reduced valuations and diminished earnings for businesses holding cryptocurrencies. The highly volatile nature of crypto values further exacerbated the issue.

The FASB’s new rules address these concerns by mandating the recording of cryptocurrencies at fair value, a measurement technique aimed at reflecting the most up-to-date value of these assets.

Changes in fair value will now be recorded in net income, allowing companies to account for fluctuations in the value of their crypto holdings more comprehensively.

The positive news for BTC lies in the fact that the new FASB rules provide greater transparency and accuracy in assessing the true value of cryptocurrency assets. By capturing fluctuations in fair value, companies will have a more realistic representation of their holdings, enabling better decision-making and financial reporting.

Bitcoin, being the most widely recognized and valuable cryptocurrency, stands to benefit significantly from these changes. The recognition of its fair value allows companies to showcase the true worth of their BTC holdings, potentially boosting investor confidence and attracting further institutional interest.

Turbulent Times Ahead For Bitcoin Price

Following these recent developments, the Bitcoin price has successfully rebounded to previously lost levels, demonstrating heightened volatility after a brief consolidation phase just below $42,000.

However, according to CoinGlass’ liquidation heatmap, Bitcoin’s price may be facing further volatility that could lead to a significant amount of liquidation of both long and short positions.

The liquidation heatmap from CoinGlass highlights substantial indications of liquidation leverage exceeding $200 million both above and below the current Bitcoin price.

Of particular concern is the thick liquidation leverage below $41,000, as seen in the chart above, which, combined with the prevailing trend, could become a probable target for the Bitcoin price in the coming days.

Conversely, following BTC’s correction, additional liquidation leverage has emerged in CoinGlass’s heatmap, particularly in the $42,000 and $43,000 range of short positions. This added selling pressure has contributed to the retracement of the Bitcoin price.

This potential scenario suggests a potential price swing up and down before a stable continuation of either the downward or upward momentum. The outcome remains uncertain as to which side will give way first and what prevailing trend will shape the latter part of the year.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Ronaldo Marquez

Source link