Fuel prices, with the cost of gasoline and diesel at the pump both down from a month ago, don’t appear to be fazed by the escalating risks to oil supplies in the Middle East from the Israel-Hamas war, but they are.

The decline in fuel prices seen nationally is actually a “bit above what would be ‘normal’ for this time of year,” said Patrick De Haan, head of petroleum analysis at GasBuddy. However, he believes “prices won’t fall as far as they would have had the attacks on Israel not happened.”

On Friday, the average retail price for a gallon of regular gasoline stood at $3.528, down 5.7 cents from a week ago, while the average retail diesel price was at $4.465 a gallon on Friday, down 7.8 cents from Sept. 30, according to data from GasBuddy.

U.S. retail gasoline prices have fallen so far this month.

GasBuddy

“Geopolitical risk is now heightened, changing the calculus” for the fuel market, said Brian Milne, product manager, editor and analyst at DTN.

‘Seasonal component’

In considering retail gasoline prices during the fourth quarter, the “seasonal component is less pronounced than in years past,” said Milne. Demand for gasoline tends to fall following the summer travel season. Combined with a “strong slate of refinery maintenance,” which led to less fuel supply on the market, the rise in crude oil prices has slowed the decline in fuel prices, said Milne.

If not for the heightened geopolitical risk in the Middle East, he said he might have expected to see gasoline prices decline by another 30 cents to 40 cents per gallon into late December because of lower demand.

Retail gas prices may fall another 20 cents a gallon or more, depending on the location within the U.S., if we avoid broader hostilities in the Middle East, said Milne.

However, if a conflict breaks out beyond Israel and the Gaza Strip, gasoline prices are likely to move sharply higher because of a spike in crude costs, he said.

For its part, oil has seen volatile trading following the Hamas attack on Israel on Oct. 7, with futures prices for U.S. benchmark West Texas Intermediate crude

CLZ23,

CL.1,

higher for the week, but lower for the month.

California prices ‘plummet’

For now, California, which typically is among the states that pays the most per-gallon for gasoline partly due to taxes on the fuel, is seeing prices “plummet” — down nearly 60 cents in the last three weeks, said GasBuddy’s De Haan.

“The West Coast is certainly seeing a much larger decline than is ‘normal’ and it’s due to the refinery situation now improving drastically,” as well as California’s RVP waiver, he said.

The California Air Resources Board allowed gasoline sold or supplied for use in California that exceeds the RVP, or Reid Vapor Pressure, limits through the end of Oct. 31, marking an early transition for the state from the lower RVP gas used in the summer to help cut gasoline emissions to the higher RVP gas used in the winter.

On Friday, the average price for a gallon of regular gasoline in California sold for $5.476, GasBuddy data show. That’s down 16.7 cents in just the last week.

Gas price outlook

De Haan said he does not expect to see a spike in gas prices nationally at this point, and there’s still room for prices to fall — just not as much following the Hamas attack on Israel.

“If we get to November and Iran gets involved in the situation, then we certainly could see gas prices impacted in some way as the current drops will likely be fully passed on by then, giving stations no ‘room’ to absorb higher prices reflected by a potential rise in oil,” said De Haan.

Still, falling demand, as well as “seasonality in general,” are what are pushing prices down, “enhanced by refinery improvements in areas” that saw price surges, he said.

Prices may even fall further after refinery maintenance season wraps up in mid-November, and refiners have to find places to put even more gasoline output, said De Haan.

He’s comfortable with the gasoline price forecasts GasBuddy issued in December of last year, which predicted a monthly national average for the fuel of $3.53 for October — matching the current price. The forecast also called for an average of $3.36 a gallon for November and $3.17 for December.

GasBuddy doesn’t have a forecast for 2024 yet, but prices may look similar to this year, as long as the situation in the Middle East doesn’t further crumble,” said De Haan.

View on diesel

Diesel, however, is another story.

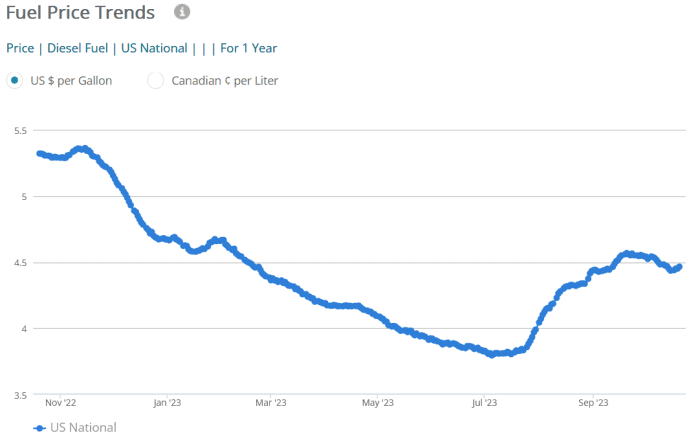

Price for that fuel have dropped by 85.5 cents a gallon from a year ago to Friday’s $4.465 level, GasBuddy data show.

U.S. retail diesel prices are sharply lower than a year ago.

GasBuddy

While down from a year ago, diesel prices are currently at a “very high level historically” because global supply is low, said DTN’s Milne.

At this time in 2022 diesel fuel inventory was even tighter than it is now, and Europe was heading into winter without Russian natural gas after it was cutoff following the invasion of Ukraine, he said.

That led to a spike in natural-gas prices and prices for gasoil, a European heating oil, also surged, lifting heating oil and diesel prices globally, explained Milne.

Like gasoline, diesel prices could move “sharply higher if the war in Israel expands, and oil flow is put at greater risk,” he said.

De Haan, meanwhile, said diesel prices could climb closer to $5 a gallon if there’s a “squeeze,” with relief then [coming] in the spring/summer” seasons.