Most homebuyers use mortgages to purchase their homes. However, with dozens of lenders to choose from, it can be challenging to pick the one that best suits your needs. For instance, are you a first-time homebuyer or purchasing an investment property?

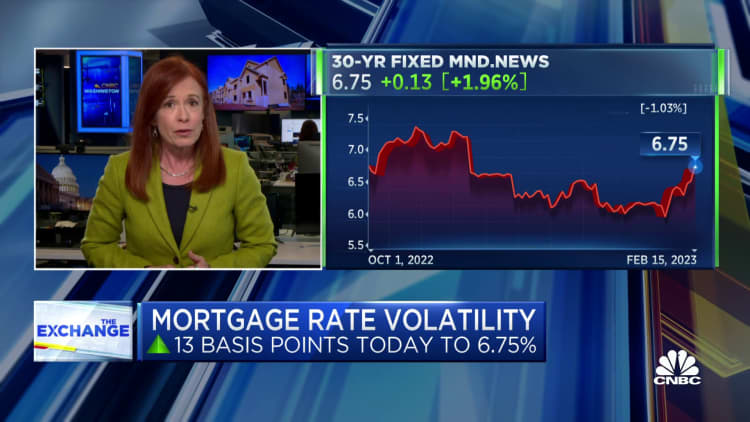

Mortgage interest rates can fluctuate quite often, and the rate you are likely to receive will heavily depend on your location, credit score and credit report.

The mortgage approval and acceptance process also comes with many fees, collectively called “lender fees.” This can include an origination fee, processing fee, application fee and an underwriting fee. In addition to lender fees, you may also pay a document preparation fee, an appraisal fee, title search fee, title insurance and more.

Some lenders may waive certain fees or provide discounts on fees so it’s always a good idea to ask which fees have the potential to be waived. However, when you decide to move forward with a particular loan from a lender, prepare yourself to account for these additional charges.

Below, CNBC Select rounded up a list of five of the best mortgage lenders of 2022 based on the types of loans offered, customer support and minimum down payment amount, among others (see our methodology below.)

-

Apply online for personalized rates

-

Conventional loans, FHA loans, VA loans and Jumbo loans

-

8 – 29 years, including 15-year and 30-year terms

-

Typically requires a 620 credit score but will consider applicants with a 580 credit score as long as other eligibility criteria are met

-

3.5% if moving forward with an FHA loan

Pros

- Can use the loan to buy or refinance a single-family home, second home or investment property, or condo

- Can get pre-qualified in minutes

- Rocket Mortgage app for easy access to your account

Cons

- Runs a hard inquiry in order to provide a personalized interest rate, which means your credit score may take a small hit

- Doesn’t offer USDA loans, HELOCs, construction loans, or mortgages for mobile homes

- Doesn’t manage accounts for jumbo loans after closing

Who’s this for? Rocket Mortgage is one of the biggest U.S. mortgage lenders and has become a household name. Most mortgage lenders look for a minimum credit score of 620 but Rocket Mortgage accepts applicants with lower credit scores at 580.

The lender even has a program called the Fresh Start program that’s aimed at helping potential applicants boost their credit scores before applying. Keep in mind, though, that if you apply for a mortgage with a lower credit score, you may be subject to interest rates on the higher end of the lender’s APR range.

This lender offers conventional loans, FHA loans, VA loans and jumbo loans but not USDA loans, which means this lender may not be the most appealing for potential homebuyers who want to make a purchase with a 0% down payment. Rocket Mortgage doesn’t offer construction loans (if you want to build a brand new custom home) or HELOCs, but if you’re a homebuyer who only plans to purchase a single-family home, a second home, or a condo that’s already on the market, this shouldn’t be a drawback for you.

This lender offers flexible loan repayment terms that range from 8 – 29 years in addition to standard 15-year and 30-year terms.

On average, it takes about 47 days to close on a home through Rocket Mortgage. However, keep in mind that, in general, much of the closing timeline will depend on how quickly you can provide all the information and documentation that’s needed and whether or not they can be processed without a major hitch.

-

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

-

Conventional loans, FHA loans, VA loans, DreaMaker℠ loans and Jumbo loans

-

-

-

3% if moving forward with a DreaMaker℠ loan

Pros

- Chase DreaMaker℠ loan allows for a slightly smaller down payment at 3%

- Discounts for existing customers

- Online support available

- A number of resources available for first-time homebuyers including mortgage calculators, affordability calculator, education courses and Home Advisors

Cons

- Doesn’t offer USDA loans or HELOCs

- Existing customers discounts apply to those who have large balances in their Chase deposit and investment accounts

Who’s this for? Chase Bank provides several options for homebuyers who would prefer to make a lower down payment on their home. The traditional advice has been to make a down payment that’s about 20% of the price of the home, however, Chase offers a loan option called the DreaMaker loan that would allow homebuyers to make a down payment that’s as low as 3% (by comparison, the FHA loan requires borrowers to make a 3.5% down payment).

This option is made for those who can only afford a smaller down payment, but it also comes with stricter income requirements compared to their other loans (the annual income used to qualify the customer must not exceed 80% of the Area Median Income (AMI), according to the Chase team). If you meet the income requirements for the DreaMaker loan, this option could be very attractive for those who would prefer to make a down payment that’s as small as possible so they can have more money reserved for other homebuying expenses.

In addition to the DreaMaker loan, Chase also offers a conventional loan, FHA loan, VA loan and jumbo loan (USDA loans and HELOCs are not offered by this lender). Much like other lenders, Chase has a minimum credit score requirement of 620 for their mortgage options.

Chase offers mortgage terms that range from 10 years to 30 years, as well as fixed-rate and adjustable-rate mortgages (ARM). This lender also offers discounts for existing customers, but the requirements are rather high: For $500 off your mortgage processing fee, you need to have $150,000–$499,999 between Chase deposit accounts and Chase investment accounts; $500,000 or more in these accounts can get you up to $1,150 off the processing fee.

On top of this, Chase provides a number of resources to help their customers navigate the process and feel comfortable managing their mortgage, including online customer support, mortgage calculators and educational articles. Chase customers typically close on their house within three weeks.

-

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

-

Conventional loans, HomeReady loan and Jumbo loans

-

-

-

3% if moving forward with a HomeReady loan

Pros

- Ally HomeReady loan allows for a slightly smaller downpayment at 3%

- Pre-approval in just three minutes

- Application submission in as little as 15 minutes

- Online support available

- Existing Ally customers can receive a discount that gets applied to closing costs

- Doesn’t charge lender fees

Cons

- Doesn’t offer FHA loans, USDA loans, VA loans or HELOCs

- Mortgage loans are not available in Hawaii, Nevada, New Hampshire, or New York

Who’s this for? It’s common for lenders to charge a number of fees on mortgage applications, including an application fee, origination fee, processing fee and underwriting fee — these fees can end up costing a significant amount during the home-buying process. Ally Bank doesn’t charge any of these fees (they may, however, charge an appraisal fee and recording fee, and may charge title search and insurance). You can get pre-approved for a loan in as little as three minutes online and submit your application in just 15 minutes as long as you have all the necessary documents handy.

Ally offers a HomeReady mortgage program that is geared toward low- to mid-income homebuyers (regardless of whether it’s their first time or if they’re a repeat buyer) that would allow them to put down as little as 3% for a down payment. Applicants must also have a debt-to-income ratio of no more than 50%, their income must be equal to or less than 80% of the area’s median income and at least one borrower must take a homeowner education course.

In addition to this loan option, homebuyers can also apply for a jumbo loan (FHA loans, VA and USDA loans are not available through this lender). Customers can also choose between fixed rate and adjustable rate mortgages, and 15-year, 20-year and 30-year loan terms.

Ally Bank customers also take an average of 36 days to close on their home. One important drawback, though, is that Ally mortgage loans are not available in every state — residents of Hawaii, Nevada, New Hampshire and New York would be unable to apply.

-

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

-

Conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, HELOCs, Community Loan and Medical Professional Loan

-

-

-

0% if moving forward with a USDA loan

Pros

- Offers a wide variety of loans to suit an array of customer needs

- Available in all 50 states

- Online and in-person service available

- Pre-approval in as little as 30 minutes

Cons

- Doesn’t offer home renovation loans

Who’s this for? It’s sometimes tough to find lenders that offer USDA loans in addition to other standard mortgage options, but PNC Bank includes USDA loans in their lineup. This lender also offers conventional loans, FHA loans, VA loans, jumbo loans and a PNC Bank Community Loan, which is a special program that allows homebuyers to put down as little as 3% (without paying private mortgage insurance) while still choosing between fixed-rate and adjustable-rate mortgage terms.

This lender also offers a special loan option catered to medical professionals who are looking to buy a primary residence only. With this loan, medical professionals can apply for as much as $1 million and won’t have to pay private mortgage insurance (PMI), regardless of their down payment amount. They can also choose between fixed-rate and adjustable-rate terms.

PNC Bank offers online and in-person mortgage application processes, which can be a plus for homebuyers who don’t live near a PNC Bank location but still want to apply for a loan. You can get online pre-approval in as little as 30 minutes as long as you have all the documentation on hand and similar to most other lenders, PNC Bank has a minimum credit score requirement of 620.

-

Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included

-

Conventional loans, jumbo loans, HELOCs

-

-

-

Pros

- Fast pre-qualification

- Provides access to Mortgage Loan Officers for guidance

- $500 discount for existing SoFi members

- 0.25% price reduction when you lock in a 30-year rate for a conventional loan

- Offers up to $9,500 cash back if you purchase a home through the SoFi Real Estate Center

Cons

- Doesn’t offer FHA, VA or USDA loans

- Mortgage loans are not available in Hawaii

Who’s this for? SoFi offers homebuyers a number of discounts that can help them save as much money as possible throughout their home buying process. When you lock in 30-year rate for a conventional loan, you can receive a 0.25% discount. And when you purchase a home through the SoFi Real Estate Center, which is powered by HomeStory, you can receive up to $9,500 in cash back. Another appealing perk is that SoFi members can get a $500 discount on their mortgage loan.

This lender offers an online-only experience for those looking to qualify for a conventional loan, jumbo loan, or HELOC (SoFi doesn’t offer FHA, VA, or USDA mortgage loans). Terms range from 10 to 30 years and are both fixed and adjustable-rate. Similar to most other lenders, SoFi considers applicants with a minimum credit score of 620.

Homebuyers can also take advantage of a host of resources from SoFi, like a home affordability calculator, a mortgage calculator and a home improvement cost calculator, which can really come in handy if you’re purchasing a home that needs some work done and you need to figure out ahead of time how much to budget for renovations.

Just keep in mind, though, that SoFi’s mortgage loans are only available in 47 states and Washington, D.C. — residents of Hawaii, New York and New Mexico would be unable to apply.

What is pre-approval and how does it work?

Pre-approval is a statement or letter from a lender that details how much money you can borrow to purchase a home and what your interest rate might be. To get pre-approved, you may have to provide bank statements, pay stubs, tax forms and employment verification, to name a few. Once you’re pre-approved, you’ll receive a mortgage pre-approval letter, which you can use to begin viewing homes and start making offers. It’s best to get pre-approved at the start of your home-buying journey before you start looking at homes.

How do mortgages work?

A mortgage is a type of loan that you can use to purchase a home. It’s also an agreement between you and the lender that essentially says that you can purchase a home without paying for it in-full upfront — you’ll just put some of the money down upfront (usually between 3% and 20% of the home price) and pay smaller, fixed equal monthly payments for a certain number of years plus interest.

For example, you probably can’t pay $400,000 for a home upfront, however, maybe you can afford to pay $30,000 upfront; a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for $370,000 (the remaining amount) and you agree to repay that amount plus interest to the lender over the course of 15 or 30 years.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance (PMI) payments in addition to your monthly mortgage payments. However, you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

What is a conventional loan?

A conventional loan is a loan that’s funded by private lenders and sold to government enterprises like Fannie Mae and Freddie Mac. It’s the most common type of loan and some lenders may require a down payment as low as 3% or 5% for this loan.

What is an FHA loan?

A Federal Housing Administration loan (FHA loan) is a loan that typically allows you to purchase a home with looser requirements. For example, this type of loan may allow you to get approved with a lower credit score and applicants may be able to get away with a higher debt-to-income ratio. You typically only need a 3.5% down payment with an FHA loan.

What is a USDA loan?

A USDA loan is a loan offered through the United States Department of Agriculture and is aimed at individuals who want to purchase a home in a rural area. A USDA loan requires a minimum down payment of 0% — in other words, you can use this loan to buy a rural home without making a down payment.

What is a VA loan?

A VA mortgage loan is provided through the U.S. Department of Veterans Affairs and is meant for service members, veterans and their spouses. They require a 0% down payment and no mortgage insurance.

What is a jumbo loan?

A jumbo loan is meant for home buyers who need to borrow more than $647,200 to purchase a home. Jumbo loans are not sponsored by Fannie Mae or Freddie Mac and they typically have stricter credit score and debt-to-income ratio requirements.

How is my mortgage rate decided?

Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. While the Federal Reserve doesn’t set mortgage rates, mortgage rates tend to move in reaction to actions taken by the Federal Reserve on its interest rates.

Market forces may influence the general range of mortgage rates but your specific mortgage rate will depend on your location, credit report and credit score. The higher your credit score, the more likely you are to be qualified for a lower mortgage interest rate.

What is the difference between a 15-year and a 30-year term?

A 15-year mortgage gives homeowners 15 years to pay off their mortgage in fixed, equal amounts plus interest. By contrast, a 30-year mortgage gives homeowners 30 years to pay off their mortgage. With a 30-year mortgage, your monthly payments will be lower since you’ll have a longer period of time to pay off the loan. However, you’ll wind up paying more in interest over the life of the loan since interest is charged monthly. A 15-year mortgage lets you save on interest but you will likely have a higher monthly payment.

Subscribe to the Select Newsletter!

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

To determine which mortgage lenders are the best, CNBC Select analyzed dozens of U.S. mortgages offered by both online and brick-and-mortar banks, including large credit unions, that come with fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best mortgages, we focused on the following features:

- Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. With a fixed rate APR, you lock in an interest rate for the duration of the loan’s term, which means your monthly payment won’t vary, making your budget easier to plan.

- Types of loans offered: The most common kinds of mortgage loans include conventional loans, FHA loans and VA loans. In addition to these loans, lenders may also offer USDA loans and jumbo loans. Having more options available means the lender is able to cater to a wider range of applicant needs. We have also considered loans that would suit the needs of borrowers who plan to purchase their second home or a rental property.

- Closing timeline: The lenders on our list are able to offer closing timelines that vary from as promptly as two weeks after the home purchase agreement has been signed to as many as 45 days after the agreement has been signed. Specific closing timelines have been noted for each lender.

- Fees: Common fees associated with mortgage applications include origination fees, application fees, underwriting fees, processing fees and administrative fees. We evaluate these fees in addition to other features when determining the overall offer from each lender. Though some lenders on this list do not charge these fees, we have noted any instances where a lender does charge such fees.

- Flexible minimum and maximum loan amounts/terms: Each mortgage lender provides a variety of financing options that you can customize based on your monthly budget and how long you need to pay back your loan.

- No early payoff penalties: The mortgage lenders on our list do not charge borrowers for paying off the loan early.

- Streamlined application process: We considered whether lenders offered a convenient, fast online application process and/or an in-person procedure at local branches.

- Customer support: Every mortgage lender on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances.

- Minimum down payment: Although minimum down payment amounts depend on the type of loan a borrower applies for, we noted lenders that offer additional specialty loans that come with a lower minimum down payment amount.

After reviewing the above features, we sorted our recommendations by best for overall financing needs, quick closing timeline, lower interest rates and flexible terms.

Note that the rates and fee structures advertised for mortgages are subject to fluctuate in accordance with the Fed rate. However, once you accept your mortgage agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan, unless you choose to refinance your mortgage at a later date for a potentially lower APR. Your APR, monthly payment and loan amount depend on your credit history, creditworthiness, debt-to-income ratio and the desired loan term. To take out a mortgage, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.