Why are mortgage rates still so high?

After a year of mortgage rates near 8%, home buyers are eager for good news. Some forecasters have buoyed their hopes, estimating that the rate on the 30-year mortgage will drop to 6% or lower this year.

But rates have not fallen by much thus far. The 30-year rate is currently averaging 6.64%, according to Freddie Mac. That’s despite the fact that the U.S. Federal Reserve hasn’t raised its benchmark interest rate since July 2023 and signaled in December that it would cut that rate in 2024. Meanwhile, economists in the real-estate sector have been anticipating a drop in mortgage rates since last fall.

“Homebuyers may be feeling like the lower mortgage rates they’ve been promised in 2024 are not materializing,” Lisa Sturtevant, chief economist at Bright MLS, said in a statement. In a recent survey of Americans’ feelings about the housing market, 36% of respondents said they expect mortgage rates to fall in the next 12 months.

While the Fed doesn’t set mortgage rates, it can influence them, just as it influences the overall U.S. economy through monetary policy. But even though the central bank has hit the brakes on tightening monetary policy, with the economy giving off mixed signals of strength and weakness, the timing of anticipated cuts to the benchmark rate remains unclear.

That in turn creates uncertainty about when mortgage rates will drop enough to “unfreeze” the housing market. Home buyers are probably going to have to wait until the Fed acts definitively before they see those lower rates.

The effect of a strong economy

The strength of the U.S. economy is one reason mortgage rates have not yet fallen much, economists say. The job market is still hot, and inflation remains higher than the Fed’s goal, which is why the latest read on inflation, out Feb. 13, will be so closely watched. The fact that rates haven’t fallen this year is “a result of uncertainty about the economy and the timing of the Fed’s rate cuts,” Sturtevant said.

“The strong job market is good news for the spring buying season, as higher household incomes are a necessary component, but it also means that mortgage rates are not likely to drop much further at this point,” Mike Fratantoni, chief economist at the Mortgage Bankers Association, told MarketWatch.

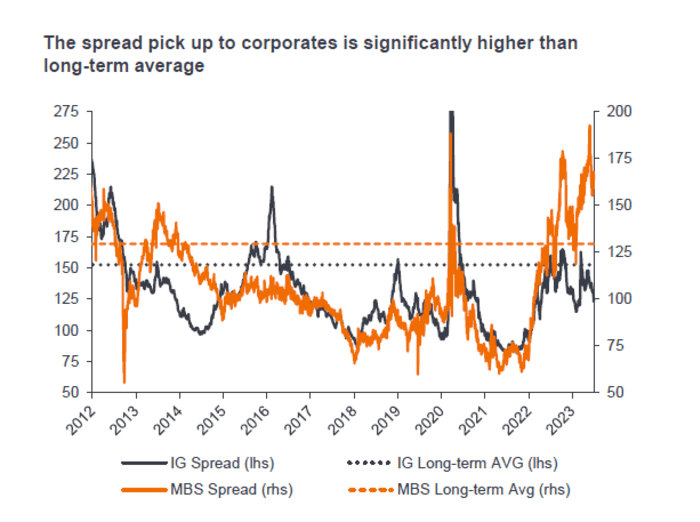

Another reason mortgage rates are still high is that lenders are trying to protect themselves against lower rates in the future, Cris deRitis, deputy chief economist at Moody’s Analytics, told MarketWatch. If rates fall, lenders run the risk that a borrower will pay off a loan early by refinancing. That would limit how much in interest that lender could expect to make.

“In an odd sort of way, then, the expectation that mortgage rates will be lower in the future can lead lenders to increase rates today to compensate for the prepayment risk,” deRitis said.

Lower rates, more competition among buyers

So when can prospective buyers expect mortgage rates to fall significantly?

“Homebuyers should expect mortgage rates to move lower as we head through 2024,” Sturtevant said. While Fannie Mae expects rates to fall below 6% by the end of the year, other economists, like Fratantoni, expect the 30-year rate to finish the last quarter of 2024 at 6.1%.

But even if rates do fall, that won’t necessarily mean buyers will be better able to afford a home, because a drop in rates could heat up competition for homes even as it boosts buyers’ purchasing power.

“There is still very low inventory in the market, and buyers need to act quickly when they find the right home for them,” Sturtevant said.

For the many homeowners who currently have a mortgage rate below 4%, rates stuck in the 6% range may be leading them to put off plans to sell their home and buy a new one.

But it’s worth noting that since 2000, rates on 30-year mortgages have ranged from a high of about 8.62% to a low of 2.81%, averaging about 5% over that span. And compared with the historical average of the 1970s, which was 7.7%, the current rates in the 6% rage are not that high, deRitis noted.