WASHINGTON — The U.S. and British militaries were bombing more than a dozen sites used by the Iranian-backed Houthis in Yemen on Thursday, in a massive retaliatory strike using warship-launched Tomahawk missiles and fighter jets, several U.S. officials told The Associated Press. The military targets included logistical hubs, air defense systems and weapons storage locations, they said.

Associated Press journalists in Yemen’s capital, Sanaa, heard four explosions early Friday local time but saw no sign of warplanes. Two residents of Hodieda, Amin Ali Saleh and Hani Ahmed, said they heard five strong explosions. Hodieda lies on the Red Sea and is the largest port city controlled by the Houthis.

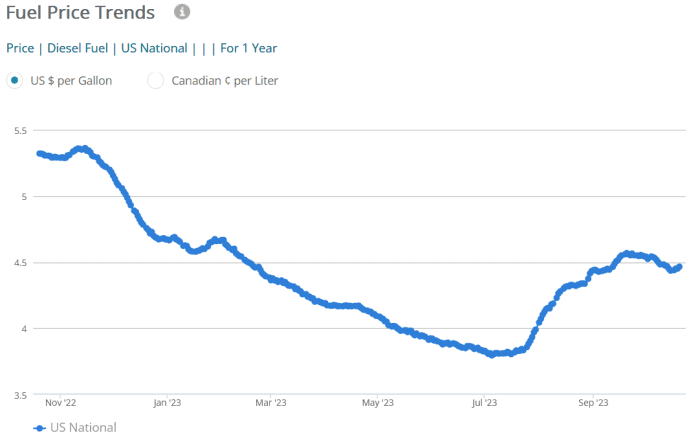

Oil prices

CL.1,

jumped more than 2% immediately after news of the attacks, on fears that a wider Middle East war could imperil oil production and shipments.

The strikes marked the first U.S. military response to what has been a persistent campaign of drone and missile attacks on commercial ships since the start of the Israel-Hamas. The coordinated military assault comes just a week after the White House and a host of partner nations issued a final warning to the Houthis to cease the attacks or face potential military action. The officials confirmed the strikes on condition of anonymity to discuss military operations.

The warning appeared to have had at least some short-lived impact, as attacks stopped for several days. On Tuesday, however, the Houthi rebels fired their largest-ever barrage of drones and missiles targeting shipping in the Red Sea, with U.S. and British ships and American fighter jets responding by shooting down 18 drones, two cruise missiles and an anti-ship missile. On Thursday, the Houthis fired an anti-ship ballistic missile into the Gulf of Aden, which was seen by a commercial ship but did not hit the ship.

The rebels, who have carried out 27 attacks involving dozens of drones and missiles just since Nov. 19, said Thursday that any attack by American forces on its sites in Yemen will spark a fierce military response.

“The response to any American attack will not only be at the level of the operation that was recently carried out with more than 24 drones and several missiles,” said Abdel Malek al-Houthi, the group’s supreme leader, during an hour-long speech. “It will be greater than that.”

The Houthis say their assaults are aimed at stopping Israel’s war on Hamas in the Gaza Strip. But their targets increasingly have little or no connection to Israel and imperil a crucial trade route linking Asia and the Middle East with Europe.

Meanwhile, the U.N. Security Council passed a resolution Wednesday that demanded the Houthis immediately cease the attacks and implicitly condemned their weapons supplier, Iran. It was approved by a vote of 11-0 with four abstentions — by Russia, China, Algeria and Mozambique.

Britain’s participation in the strikes underscored the Biden administration’s effort to use a broad international coalition to battle the Houthis, rather than appear to be going it alone. More than 20 nations are already participating in a U.S.-led maritime mission to increase ship protection in the Red Sea.

U.S. officials for weeks had declined to signal when international patience would run out and they would strike back at the Houthis, even as multiple commercial vessels were struck by missiles and drones, prompting companies to look at rerouting their ships.

On Wednesday, however, U.S. officials again warned of consequences.

“I’m not going to telegraph or preview anything that might happen,” Secretary of State Antony Blinken told reporters during a stop in Bahrain. He said the U.S. has made clear “that if this continues as it did yesterday, there will be consequences. And I’m going to leave it at that.”

The Biden administration’s reluctance over the past several months to retaliate reflected political sensitivities and stemmed largely from broader worries about upending the shaky truce in Yemen and triggering a wider conflict in the region. The White House wants to preserve the truce and has been wary of taking action in Yemen that could open up another war front.

MarketWatch contributed to this report.