Investors looking to get in on the recent rise in real estate stocks should focus on quality, according to Bank of America. The real estate sector of the S & P 500 has been moving higher over the past month or so and is now up 10% year to date, after being in the red earlier this year. The sector hit a 52-week high last week. Real estate investment trusts are also an income play, often paying out attractive dividends. “Stocks with healthy yields become increasingly attractive in a Fed cutting environment,” Jill Carey Hall, an equity and quant strategist at the bank, wrote in a Sept. 9 note that focused on small-cap and midcap REITs. Her work with small-cap and midcap stocks also suggests that dividend yield is the best factor to hedge cycle risk, she added. .SPLRCR YTD mountain S & P 500 Real Estate Sector The Federal Reserve started its rate-cutting cycle last week, slashing the federal funds rate by 50 basis points. The central bank also indicated another 50 basis points of cuts by the end of the year. In this environment, Bank of America likes health care, residential and retail REITs. Health-care real estate is a play on the aging of America , which will see more people seeking medical services and senior housing, Hall said. Residential REITs continue to see demand given housing affordability issues and a majority of retail REITs have beat and raised guidance, she added. When it comes to choosing specific stocks, analyst Jeffrey Spector, the bank’s head of U.S. REITs, suggests looking at names with quality growth, quality value and — with the anticipation of a soft-landing scenario — quality risk. “Higher quality REITs will offer the best earnings and distribution growth,” he wrote in the same note. Quality REITs have resilient pricing power, multiyear earnings visibility based on secular growth drivers, strong and flexible balance sheets and the highest prospect for global inflows. Here are some of the names that made Spector’s top picks list. Welltower is the only large-cap stock that made the cut. The rest are small-cap and midcap REITs. Welltower owns and develops senior housing, skilled nursing/post-acute care facilities and medical office buildings. Near term, Welltower will benefit the most from accelerating occupancy gains amid the post-Covid recovery, Bank of America believes. “In addition, we believe senior housing rate growth will remain robust in 2024 & beyond. WELL has the highest exposure to senior housing operating assets within our coverage universe and based on our demographic analysis has the best positioned portfolio,” the bank said. “Longer term, demographic trends are favorable as baby boomers continue to age.” Shares of Welltower are up 40% year to date. Mid-America Apartment Communities and American Homes 4 Rent are both residential housing plays. The former is a multifamily REIT that operates in communities across the Sunbelt region, where the bank sees robust job growth and a lower cost of living. The latter owns the second-largest single-family rental REIT portfolio in the U.S., Spector wrote. “We remain positive on AMH’s portfolio, limited new supply of single-family homes, structural demographic tailwinds with aging millennials, accretive consolidation/development opportunities, and a strong management,” he said. Mid-America Apartment Communities has gained nearly 18% year to date, while American Homes 4 Rent is up close to 7%. Lastly, Federal Realty Investment Trust owns, operates and develops retail-based properties in coastal markets. Spector said this “blue-chip retail REIT” has a diverse portfolio of shopping centers and should produce growth above its peers in the long term. The stock has moved more than 9% higher so far this year.

Tag: metals

-

OUE REIT CEO discusses earnings and business outlook

Han Khim Siew, CEO of the Singapore OUE Real Estate Investment Trust, says "we don't want to over-hedge at this point in time."

-

Asia’s top 4 up-and-coming rental markets that may be challenging traditional property hubs

Bangkok, Thailand has seen an 18.1% growth in residential rental prices on a year-on-year basis, according to JLL.

Alexander Spatari | Moment | Getty Images

Singapore and Hong Kong are generally considered Asia’s more vibrant real estate markets. But some up-and-coming cities are giving these traditional hubs a run for their money, with some even beating them on rental yields.

Among the known, established property markets, Hong Kong was the only one to make it to the top five in a list dominated by lesser-known cities, according to a recent report by realty services firm JLL.

“We remain bullish longer-term on more established markets like Hong Kong, but primarily we see more conspicuous rental growth in some of the region’s more developing markets including Ho Chi Minh City, Jakarta, Bangkok and Manila,” JLL Asia-Pacific Chief Research Officer Roddy Allan told CNBC Make It.

While rents in Asia-Pacific were largely stable in the first quarter of 2024, “supported by resilient leasing demand for high-quality properties and as return-to office rates and expatriate arrivals improved,” certain cities saw sharp growth, according to the JLL report.

The following four cities have led the recovery in rental growth in Asia so far this year:

Bangkok, Thailand

Residential rental growth in Q1 2024 (y/y): +18.1%

Average price to rent: THB 8,292 (about $226) per square meter annually

“Rental demand has been surging in Bangkok,” Allan said. “Much of the rental gains have been led by the luxury condo sector, but more broadly, rental demand for apartments has skyrocketed due to the prevailing rates environment and the return of tourism and expats to Bangkok,” he told CNBC.

“Inflated” selling prices, household debts and strong interest rates, have stoked the demand for rentals, according to the report.

By the end of 2024, a total of 2,800 units from 12 projects are set to be added to Bangkok’s market, which is expected to fuel rent growth even further, the report said.

Ho Chi Minh City, Vietnam

Residential rental growth in Q1 2024 (y/y): +5.9%

Average price to rent: $120 psm annually

“Vietnam’s largest city, Ho Chi Minh City, was also one of the region’s [best] performing markets from a residential perspective,” according to Allan. Rents in the city grew 5.9% on a year-on-year basis in the first quarter of 2024.

This rental growth has been influenced by the stronger rent prices recorded in new high-quality offerings in the city, according to the report.

“We also see new supply coming online in the lower-price segment and ongoing rates pressures will help demand,” said Allan.

Jakarta, Indonesia

Residential rental growth in Q1 2024 (y/y): +4.8%

Average price to rent: IDR 3,214,555 (about $200) psm annually

In Jakarta, sales of condominiums have been quite slow for the past three years and, in 2024, the presidential election has been a contributing factor to the limited sales, according to the report.

Despite the sales slowdown, demand for renting “remains robust” in the city, particularly at the upper end of the market, Allan told CNBC Make It.

“We expect new launches to remain muted in Jakarta throughout 2024 which will drive demand for high quality spaces across the city,” he said.

Manila, Philippines

Residential rental growth in Q1 2024 (y/y): +0.8%

Average price to rent: PHP 9,984 (about $172) psm annually

Manila’s residential rental market grew in Q1, as demand from executives and foreigners kept its steady rise amid a recovery in return-to-office rates, according to the report.

Leasing demand is expected to remain stable as return-to-office policies improve further into 2024, the report said.

While these lesser know markets have been on an upswing in terms of rentals, Asia’s more mature markets have declined. Singapore’s residential rental market has dropped sharply, down 15.7% on a year-on-year basis. Shanghai has fallen 3% from the previous year.

“Rents in Mainland China remain a little subdued due to the number of high-end apartments available for lease,” Allan told CNBC Make It. “Singapore has a similar situation of ample new stock,” he said.

“Over the longer term, we expect to see rents recover in Mainland China and Singapore due to more muted supply and a recovery in expatriate and wider demand for leasing of luxury residential.”

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

-

Here’s how much it costs to rent a 1-bedroom apartment across 10 major cities in Asia

Here’s the median price to rent a 1-bedroom across 10 cities in Asia.

Fraser Hall | The Image Bank | Getty Images

Renting a place is a big financial decision, especially when choosing to live in a major city where price tags are particularly hefty.

The general rule of thumb is to spend no more than approximately 30% of your pre-tax income on rent, according to financial experts.

Based on data gathered in April from various government websites and large real estate marketplaces in each country, researchers at the Global Property Guide compiled a list of median rental prices across several major cities in Asia.

The numbers listed below are based on the median buying price per square meter and the median monthly rental price for a 1-bedroom apartment in the most expensive region within each respective city:

Mumbai, India

Median rent for a 1-bedroom: $481

Buying price per square meter: $3,882

Hanoi, Vietnam

Median rent for a 1-bedroom: $688

Buying price per square meter: $2,280

Jakarta, Indonesia

Median rent for a 1-bedroom: $698

Buying price per square meter: $1,726

Kuala Lumpur, Malaysia

Median rent for a 1-bedroom: $735

Buying price per square meter: $3,903

Manila, Philippines

Median rent for a 1-bedroom: $805

Buying price per square meter: $3,813

Taipei, Taiwan

Median rent for a 1-bedroom: $816

Buying price per square meter: $17,551

Bangkok, Thailand

Median rent for a 1-bedroom: $1,080

Buying price per square meter: $6,485

Tokyo, Japan

Median rent for a 1-bedroom: $1,216

Buying price per square meter: $8,837

Hong Kong

Median rent for a 1-bedroom: $2,173

Buying price per square meter: $25,802

Singapore

Median rent for a 1-bedroom: $4,590

Buying price per square meter: $16,619

In 2023, Asia’s housing market faced a downturn amid weakening economic growth and the inflationary environment, according to a report by Global Property Guide.

“Hong Kong’s housing market woes continue, amidst [a] struggling economy,” as residential construction activity in the region fell by more than 34% year-over-year and inflation-adjusted residential property prices plunged by more than 9% in 2023, according to the report.

Prices for housing in regions of Southeast Asia such as Ho Chi Minh City, Vietnam (-1.18%) and Malaysia (-1.06%) have also fallen.

On the other hand, cities like Taipei and Singapore remain resilient despite the overall market environment — with housing prices up 5.17% and 2.74% in 2023, respectively.

Overall, the global housing market seems to be stabilizing as inflationary pressures ease in many countries and central banks pause their rate hikes, according to the report.

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

-

U.S. commercial real estate debt crisis: Watch the smaller and regional banks, strategist says

Share

Uma Moriarity, senior investment strategist at CenterSquare Investment Management, discusses the debt troubles in U.S. commercial property, and says the exposure of smaller and regional banks to the sector has “really increased.”

-

Hong Kong's property market won't see a strong 'V-shaped' rebound, analyst says

Share

Marcos Chan, head of research at CBRE Hong Kong, says demand for residential property will nevertheless pick up, and a “couple of percentage points up” in prices is possible.

-

Gold futures soar to record close. Here’s what’s driving the rally.

Gold futures ended Friday at their highest on record, with prices on the cusp if a so-called golden cross — signaling the potential for further upside in the precious metal.

Gold prices surged as the market reacted to the escalating tensions in the Middle East, said Bas Kooijman, CEO and asset manager of DHF Capital, in market commentary. The end of the truce in the region could “continue to fuel risk aversion and investors’ concerns.”

The escalation has “helped extend gold’s uptrend of the last two months as traders take into account changing expectations regarding monetary policy,” he said. “Traders have been betting on an end to the interest rate hiking cycle and possible rate cuts in the first half of next year, which could continue to support gold’s rise over the medium term.”

On Friday, gold for February delivery

GC00,

+0.10% GCG24,

+0.10%

climbed by $32.50, or 1.6%, to settle at $2,089.70 an ounce on Comex. Prices based on the most-active contracts, settled at an all-time high, surpassing the Aug. 6, 2020 record-high finish of $2,069.40, according to Dow Jones Market Data.Prices traded as high as $2,095.70 on an intraday basis on Friday, surpassing the previous record intraday high of $2,089.20 from Aug. 7, 2020.

Gold’s rally started after the release of the October consumer-price index, Edmund Moy, senior IRA strategist for U.S. Money Reserve and a former director of the U.S. Mint, told MarketWatch. The data released Nov. 14 showed that the U.S. cost of living was unchanged in October.

The market viewed that reading as saying the Fed has “tamed inflation and is probably finished raising rates and will, in all probability, start reducing rates sooner and faster than previously predicted,” said Moy.

Lower Fed rates mean lower Treasury yields, and since Treasurys are purchased in dollars, falling demand for Treasurys means falling demand for the dollar, he said, which can boost the price for dollar-denominated gold.

“While gold’s current rally is a bit overheated, both the golden cross and the proximity of an all-time high acting like a magnet for the price means that we’re likely to see further gains in the very immediate term,” Brien Lundin, editor of Gold Newsletter, told MarketWatch.

Most-active gold futures on Friday were close to reaching a bullish indicator known as a golden cross, when an asset’s short-term moving average moves above its long-term moving average. The 50-day moving average was at $1,955.44, pennies below the 200-day moving average of $1,955.51 Friday.

Gold prices around the globe had already rallied to fresh record price highs in other currencies and with the U.S. dollar gold price joining the party, “you can expect another wave of buying momentum to come into the market now,” said Peter Spina, president of GoldSeek.com.

““The end of the stealth phase move of the gold bull market is over. It will finally be acknowledged and recognized by the mainstream.””

— Peter Spina, GoldSeek.com

“I fully expect significantly higher gold prices in the months ahead,” he told MarketWatch. “The end of the stealth phase move of the gold bull market is over. It will finally be acknowledged and recognized by the mainstream.”

Read: Gold rallies toward ‘golden cross’ after defying bearish signal

Spina said it’s important to note that gold prices are “not hitting record highs, but rather the U.S. dollar is hitting record lows against superior money.”

That says the U.S. dollar’s purchasing power is “being eroded even further, more aggressively now,” he said. The ICE U.S. Dollar Index

DXY,

a measure of the currency against a basket of six major rivals, is down 0.3% for the year to date after a November pullback.The precious metal remains supported by Federal Reserve interest-rate cut bets even after Fed Chairman Jerome Powell signaled that it was too soon for the Fed to claim victory over the inflation beast, said Lukman Otunuga, manager, market analysis at FXTM.

Read: Powell won’t endorse market expectations for quick rate cuts

The Fed’s ability to cut interest rates in March is likely to be influenced by key data including CPI and jobs data, among others,” said Otunuga. “Given how the Relative Strength Index (RSI) on the daily charts remains in overbought regions, gold could experience a technical throwback before pushing higher.”

Lundin, meanwhile, also warned that the all-time high for gold may mark a “quadruple top” unless gold is able to decisively break through a new plateau, probably somewhere over $2,100 an ounce.

-

Gold posts first weekly loss in more than a month

Gold futures fell on Friday, as hawkish comments from Federal Reserve Chairman Jerome Powell on Thursday and weaker investor appetite for the haven metal prompted prices to post their first weekly decline since early October.

“The tailwind in gold has gone silent,” said Adam Koos, president at Libertas Wealth Management Group. The yellow metal was formerly supported, in part, by the thought that the U.S. would be hitting a ceiling on interest rates and dissipating inflation, but “none of that seems to matter under the shadow of the Fed.”

On Friday, gold for December delivery fell $32.10, or 1.6%, to settle at $1,937.70 an ounce on Comex, down 3.1% for the week, according to Dow Jones Market Data. Prices based on the most-active contract marked the biggest daily decline since mid-April and first weekly loss in five weeks.

Fed helps set overhead resistance

In remarks on a panel at the International Monetary Fund Thursday, Powell said Fed officials are “gratified” with the progress made so far to bring down U.S. inflation but weren’t yet confident that interest rates are high enough to bring inflation down to their 2% target over time.

“Gold is an inmate within the confines of overhead resistance, and the door to freedom resides at $2,060,” Koos told MarketWatch. “Just when an exit plan seems near — when a break-out with parole seems promising — Jerome Powell came in like the warden on Thursday, saying that he’s unconvinced that monetary policy has been sufficient thus far, and that inflation could still warrant future rate hikes.”

Read: Powell says Fed is wary of ‘head fakes’ from inflation

Risk aversion

Gold prices have also been influenced by a fall in investor appetite, as fears that Middle East tensions will spill over to wider regions have eased, said Lukman Otunuga, manager, market analysis, at FXTM.

If concerns over the spread of the Middle East conflict continue to ease, that may “pave the way for further downside” in gold prices, he told MarketWatch.

However, should fears return and intensify over a potential spillover of the Israel-Hamas conflict, there may be a “fresh wave of risk aversion” that would send investors towards “safe-haven destinations” like gold, said Otunuga.

“It’s not only the developments in the Middle East, but also Russia’s invasion of Ukraine that could fan fears about a global recession,” he said.

Price potential

For now, gold has the potential to extend its losses, said Otunuga.

Ahead of Friday’s gold-price settlement, he warned that a “solid breakdown and daily close” below $1,945 would open the doors toward a fall to the 200-day simple moving average at $1,934, before the U.S. October consumer price index report on Nov. 14.

Koos, meanwhile, said gold is likely to remain in “price prison, staring at the ceiling of $2,060” an ounce, until the Fed decides to slow its role in fighting inflation.

A move beyond that price level represents “freedom and new all-time-highs,” he said. “Until then, patience will be a requirement, at the very least.”

-

How the cost of homebuying and selling will change after landmark court loss over real estate commissions

Toronto Star | Toronto Star | Getty Images

A recent jury verdict against the National Association of Realtors and large residential brokerages could upend the residential real estate industry.

The real estate compensation model is at the heart of the issue. Plaintiffs contend that commission rates are too high, buyer brokers are being overpaid and NAR rules, along with the corporate defendants’ practices, lead to fixed pricing. By contrast, NAR contends the rules promote competition and efficient, transparent and equitable local broker marketplaces.

NAR, whose CEO left shortly after the landmark court loss, is appealing the $1.8 billion jury verdict, so it could be several years before the case — which covers the Missouri markets of Kansas City, St. Louis, Springfield and Columbia — is resolved. But coupled with similar lawsuits that are in process, the potential for policy changes that could impact realtors’ pocketbooks is palpable.

The impact on the market continues to spread. Shares of Re/Max Holdings, for example, were down over 8% on Tuesday amid fears of litigation, even though it had settled with plaintiffs before the recent NAR case verdict.

Here’s what real estate agents, homebuyers and sellers need to know about potential changes in residential real estate economics.

A bad time for bad news in real estate

The jury verdict comes at a time when many real estate agents are already feeling a pinch.

The rapid rise in interest rates caused by the Federal Reserve’s fight against inflation recently led to the 30-year fixed mortgage average rate topping 8%, exacerbating an existing affordability crisis in the U.S. housing market. Potential sellers don’t want to move if they have to contemplate a mortgage rate as much if not more than double their current one, while millions of potential homebuyers can’t make the monthly payment and are currently shut out of the market.

Existing home sales recently dropped to their lowest level since 2010. According to an October report from University of Colorado Boulder scholar-in-residence Mike DelPrete, existing home sales are on pace for 4.15 million transactions this year, based on NAR data, which would be down from over 6 million in 2021 and 5 million in 2022.

At a time when home sales are already under pressure, “this lawsuit is just another punch in the gut for real estate franchises,” said Bill Gross, a self-employed real estate broker associate in California with eXp Realty.

Thus far, there’s been little-to-no trickle-down effect for individual brokers and agents as a result of the legal proceedings, but that may not be the case forever, depending on how legal battles, taking place on multiple fronts, shape up. An analysis from Keefe, Bruyette & Woods analyst Ryan Tomasello published last month, before the jury verdict was reached, estimated a 30% reduction in the $100 billion paid in real-estate commissions annually and as many as 1.6 million agents losing their source of income.

Pressure on transaction fees will increase

Fees generally have been under pressure for the past number of years, with technology leading to more transparency and the recent court battles intensify that industry pressure.

Also, as home prices have gone up, the fees are more apparent relative to the deal size, said Gilbert J. Schipani, founder of Tempus Fugit Law, which represents buyers, sellers, realtors, lenders and businesses through commercial and residential real estate transactions.

Lawsuits focused on fees reinforce the general trend of trying to lower fees in the real estate market, Schipani said.

“It’s another step in the direction that we’ve been going for the past 10 years,” he said.

As the court cases progress, there’s likely to be more disclosure around fees in the future, for transparency purposes, he said.

As Glenn Kelman, CEO of tech-led real estate brokerage firm Redfin recently wrote, “In the weeks leading up to the verdict, the National Association of Realtors already updated its guidelines to let agents list homes for sale that don’t offer a commission to the buyer’s agent. … Traditional brokers will undoubtedly now train their agents to welcome conversations about fees. … This is as it should be.”

RedFin, and another tech-focused realty brokerage firm, Compass, are among targets added to new legal challenges.

Buyers agents could be the biggest losers

Plaintiffs argue that buyers, not sellers, should foot the bill for the buyer’s agent, but that could have an untoward impact on how readily buyers’ agents are used.

“If plaintiffs had their way, home buyer representation would be a thing of the past in what is for many the most significant and complex purchase they will make in their lifetime,” said NAR spokesperson Mantill Williams, in an email.

If courts force today’s norms to change, more home-buyers are likely to try finding properties on their own to save money, and bargain with listing agents, thinking they’ll get a discounted fee since the latter is already being compensated by the seller, Gross said.

Not all real estate professionals will agree to work both sides of a deal because of the “inherent bias,” but it could happen more often depending on how the market shapes up, Gross said. There’s also the possibility that new rules imposed by courts could prohibit real estate professionals from working both sides of a deal, Schipani said.

Kelman noted in his post-verdict analysis that if buyers still hire a buyer’s agent, they’re likely to negotiate a lower fee given the heightened focus and because it may no longer be part of the home price, which allowed it to be financed by a mortgage.

This also suggests new agents may be less likely to enter the industry, according Gavin Myers, managing partner at Prudence, a venture capital firm that invests in the real estate sector. Most new agents start on the buy side and there’s a risk when you’re trying to break into the industry. If there are questions about how they get paid, or if they’ll get paid, people might not want to work on the buy side, or you might not find high-quality people, Myers said.

Local housing market changes will be key

Local market rules could change based on what’s happening in the courts, or broader market shifts.

For example, the Real Estate Board of New York (REBNY), which is unaffiliated with NAR, recently announced upcoming changes to its rules, in a stated effort to promote transparency and consumer confidence in the residential marketplace. The changes, which had been in the works for months, were voted on in October.

Starting Jan. 1, offers of compensation to buy-side brokers must originate from the seller/owner, according to the change. Listing brokers will no longer be permitted to make the offer of compensation to the buy-side broker, even on the seller’s behalf. Also, listing brokers will no longer pay the buy-side compensation. Rather, the buyer’s broker will be directly compensated by the seller or owner of the exclusive property, which should occur at the closing as is customary in the New York City area, the group said.

“Decoupling the buy side compensation represents the future of how residential real estate is transacted, and expect other listing services to follow this lead,” REBNY said in a FAQ on its website discussing the changes.

Commissions are already negotiable

Right now, real estate professionals don’t have to change their way of doing business, while legal challenges are ongoing. But NAR strongly recommends the use of buyer representation agreements for clarity and understanding purposes. NAR also urges members to continue to tell clients that commissions are negotiable and set between brokers and their clients.

A separate suit against NAR and brokerages, involving multiple markets, could go to trial next year, and there’s also another recently filed nationwide lawsuit to contend with.

“No matter what happens with the Missouri judge, or in any other courtroom, one thing is certain: there’s no going back to the way things were,” Kelman, whose company left NAR before the verdict, wrote in his recent post.

Real estate professionals should stay tuned.

“This is a time to read the fine print, stay as informed as possible both for the sake of your business as an agent and for your client’s best interests,” said Vickey Barron, a licensed associate real estate broker with Compass in New York City.

-

Hong Kong’s property prices won’t pop any time soon. Here’s why

Residential buildings in Hong Kong, China on October 23, 2023.

Vernon Yuen | Nurphoto | Getty Images

Hong Kong’s leader John Lee this week eased the city’s decade-old residential property cooling measures — but questions remain on whether it’s enough to boost market sentiment and low transaction volumes for the private housing sector.

“Although relaxation of property restrictions was highly anticipated, the BSD [buyers’ stamp duty] cut from 15.0% to 7.5% surprised us; the other relaxations were in-line,” Citi’s Ken Yeung wrote in a note.

He doesn’t expect the move to reverse downward trend in Hong Kong’s property prices as interest rates remain high.

According to data from real estate agency Midland Realty, the second-hand property market average turnover ratio between 2017 and 2023 stands at 3.7%. That’s compared with 8.7% before the cooling measures took effect in 2010.

Buggle Lau, chief analyst at Midland Realty told CNBC the average turnover ratio in 2022 to 2023 are at historic lows, as property prices have corrected down by nearly 20% since their peak in August 2021.

He expects the policy address will give property prices “a chance to stabilize” and for volumes to pick up.

For the market to fully recover, both in terms of price and volume, interest rates will have to come down next year, the property analyst said.

He expects a further 5% downside on prices in the first half of next year should there be a rate cut.

Homeowners’ struggles

Hong Kong homeowner KC Mok has been trying to sell his apartment before his family immigrates at the end of the year — a popular reason for people selling their property in recent years.

The 41-year-old told CNBC that his 707 sq. ft. 3-bedroom apartment is currently listing at $9.5 million Hong Kong dollars ($1.21million), 20% lower than his purchase price in 2019.

He said many people have been viewing his place, but the only offer he received so far is a mismatch.

“Now when we come to selling the apartment, we found that the value of the apartment [is] already like $2 million dollars less, so a little bit depressed but we have to leave so it’s the timing maybe,” Mok said, acknowledging that the latest cooling measures “will help a little bit” for his situation.

Meanwhile, 33-year-old Kitty Yiu considers herself “lucky” as she sold her apartment and started renting in February, just before property prices fell and interest rates rose.

Yiu gave birth to her firstborn earlier this year and needed a bigger home to accommodate her growing family.

“To be honest, we are still in a struggle to see whether we should buy a new flat, like to buy a flat again,” she said.

“I think the price at this moment is still high, even if it’s having a downward trend, but for me I think it’s still overpriced,” said Yiu who doesn’t think the latest policy relief would increase her appetite to purchase a house.

Unlike Mok and Yiu, Eugene Law faces the struggle of rising mortgage rates as a new homeowner.

Together with his mother, Law, who is 30, purchased a flat at pre-construction in 2021 and moved in last year. His mortgage rate started at 1.9% and is currently at 3.375%. That means he needs to pay an additional HKD $6,000 ($767.09) per month for the interest, which he says makes him feel “so bad.”

“[It was] unexpected … because I expected the HIBOR may rise but I didn’t expect the prime rate will also rise, and also in a very high percentage.”

Prospective homebuyers in Hong Kong can choose to peg their mortgage rate with HIBOR or prime rate – known as the “H Plan” and “P Plan.” HIBOR refers to the interest rate for interbank borrowing, while prime rate is determined by individual banks.

In a low interest rate environment, the prime rate is usually the more popular choice as it is considered more stable, and easier for the mortgagor to make financial plans.

Despite regretting the timing of his purchase, Law said the latest easing of policy would not have affected the decision.

Risks for Hong Kong property

A recent report from UBS showed Hong Kong is the 6th overvalued city on their Global Real Estate Bubble Index. Zurich, Tokyo and Miami are the top three.

“Biggest risk [to Hong Kong’s property market] will be [a] pro-longed high-rate environment, and hence further mortgage cost increase. Longer run will be geopolitical risk,” said UBS’s china property market Mark Leung in an email to CNBC.

While describing the current sentiment as “a bit weak,” he expects the policy address would release sizable purchasing power from non-local expats who are waiting to become permanent residents.

With the second-hand market bid-ask spread remaining high and many homeowners not willing to sell their properties at a discount, Leung said he expects little room for property prices to reverse the downward trend.

For the primary market, he expects developers will now be more willing to cut prices in order to boost sales and “recycle cash, given higher interest rate environment.”

“Price-wise should be muted, as we think developers may be aggressive in price setting, hence cap the price rebound potential,” he added.

-

Why uranium prices have climbed to their highest in over a decade

Uranium prices have reached their highest level in more than a decade as a global supply shortage persists, with the bull market for uranium investments still in its “earliest days.”

The market is “definitely in a structural deficit as demand is growing at a 5% annual rate and the current (2023) gap between global production and consumption remains at over 50 million pounds,” Scott Melbye, executive vice president at mining company Uranium Energy Corp.

UEC,

+0.78% ,

told MarketWatch.Weekly spot uranium prices stood at $72.75 a pound as of Oct. 2, the highest since February 2011, according to data from nuclear-fuel consulting firm UxC, and were last at $69 as of Oct. 9. Weekly prices have climbed nearly 45% since the end of last year.

Weekly prices for uranium have climbed around 45% year to date, data from UxC show.

UxC

In late August, Jonathan Hinze, president at UxC, told MarketWatch that the market was seeing the “best set up for nuclear power expansion” that he’d ever seen. That observation still holds, he said.

It is clear that the uranium supply/demand balance remains “extremely tight, and it will likely only get tighter” in the coming 12 to 24 months as demand continues to rise, “while new supplies are taking more time to materialize, and inventories keep getting drawn down,” he said.

Since late August, financial players, including hedge and publicly traded funds active in uranium, have been quite active buying additional uranium off the spot market, said Hinze. These funds “clearly believe that prices are set to rise further, and investors are therefore adding money to their coffers to allow them to buy physical uranium.”

This is demand that isn’t fully anticipated in the market and this has added to the overall positive demand picture, he said.

Price pullback

Still, Melbye pointed out that uranium prices have pulled back a bit more recently as some traders took some “very handsome profits on their accumulated long positions.”

That pullback may have also come as an “overreaction,” he said, to news from Kazakhstan, which produced the world’s largest share of uranium from mines in 2022, according to the World Nuclear Association. Kazatomprom, Kazakhstan’s national operator for the export and import of uranium, announced in late September a return to full production in 2025 to meet global nuclear energy demand.

Melbye believes there was an overreaction in uranium prices because “this will ultimately have little impact on Western supply and demand as most analysts had them producing close to those levels by that time in their forecasts.”

Even with that production assumption, the market is “still dramatically undersupplied,” and based on Melbye’s estimation, requires eight to 10 new mines starting up globally by 2030, he said.

And while uranium has been among the best performing commodities year to date, it has only recently reached the level which “incentivizes the world’s best mines,” he said.

This bull market in uranium investments is “still in its earliest days,” said Melbye.

Among the exchange-traded funds, the Global X Uranium ETF

URA

has gained more than 25% on the year through Friday afternoon, while the Sprott Uranium Miners ETF

URNM

has added almost 36%. The Sprott Physical Uranium Trust

SRUUF,

a closed-end fund, trades nearly 39% higher.Broader new mine developments with significant capital investments in an inflationary environment require higher prices to move ahead, Melbye said. “Even at those levels, the long lead times needed to achieve these necessary start ups could leave the market in a short squeeze for several years.”

The recent spot market move lower in prices marks a “temporary pause, and not a peak,” he said. “Buyers should be active on this welcome dip.”

Supply ‘challenges’

Contributing to supply concerns, a July coup has disrupted mining operations in the country of Niger in West Africa. Niger produced just over 4% of the world’s uranium in 2022, according to World Nuclear News.

The coup caused borders to close, and major uranium mine and mill operation called Somair has been halted, said UxC’s Hinze. The mine, operated by the French company Orano, sells most of uranium to customers in Europe, he said.

Meanwhile, Cameco Corp.

CCJ,

+0.64% ,

one of the world’s largest providers of uranium, said it’s encountered challenges at its mine and milling operation in Canada. The company now expects to produce nearly 3 million pounds of uranium concentrate less this year than previously anticipated, said Hinze.“These production challenges add to the overall view that the supply/demand balance is very tight and will get even tighter,” he said.

-

Alcoa’s stock rocked after unexpected CEO transition

Shares of Alcoa Corp. slumped to a multiyear low Monday as the aluminum company said that Roy Harvey had been replaced as chief executive officer after seven years in the role.

The company named William Oplinger as president and CEO, effective Sunday. Oplinger had served as Alcoa’s chief operations officer since February and before that as chief financial officer since November 2016.

Alcoa’s stock

AA,

-5.20%

dropped 5.1% in morning trading. That put it on track for the lowest close since March 1, 2021. It has tumbled 18% over the past three months and plunged 40.8% year to date, while the S&P 500

SPX

has rallied 12.8% this year.“In our opinion, investors have expressed concern around cash flow and the company’s medium to long-term outlook,” B. Riley analyst Lucas Pipes wrote in a note to clients. “While the timing of the transition is somewhat unexpected, we believe Mr. Oplinger is the most well-positioned candidate for the CEO role.”

Harvey had been CEO since the company completed its separation from Arconic Inc. in November 2016. Arconic was acquired by Apollo Global Management Inc.

APO,

+1.55%

in a deal that was completed in August 2023.“The transition of the president and CEO roles reflects the company’s succession planning process,” Alcoa said in a statement.

“Our board believes Bill’s extensive experience with Alcoa makes him well-positioned to carry the company forward,” said Steven Williams, Alcoa’s board chair.

B. Riley’s Pipes said that as Alcoa has faced challenging aluminum markets in recent quarters, and given the troubles associated with approvals of mine plans in Australia, he believes the change in leadership reflects the company’s desire to reposition its asset base for stronger cash-flow generation.

“While Mr. Harvey has successfully transformed Alcoa in recent years, particularly as [Alcoa] has aggressively deleveraged, we believe the transition will be viewed favorably by investors,” Pipes wrote.

-

How Wall Street’s REIT giants are reshaping U.S. real estate

U.S real estate investment trusts today manage $4.5 trillion in real estate worldwide. Many groups on Wall Street offer these tax-friendly funds to retail investors.

KKR’s real estate business is one of the big players in the REIT game. The private equity firm manages multiple REIT funds. The KKR Real Estate Select Trust, which currently manages $1.5 billion in assets, paid a dividend of 5.4% to its investors in July 2023.

But the benefits extend beyond returns.

“When you look at the after tax equivalent of that yield, it is very compelling.” said Billy Butcher, CEO of KKR’s global real estate business. “The depreciation from our properties has covered 100% of the income generated by our properties, and there’s no tax on that dividend,” he said in an interview with CNBC.

Larger funds sometimes contain a diversified pool of assets. Categories may include office, student housing, casino, timberlands, radio and cell towers, server farms, self-storage properties, billboards, and much more.

“Back in the 1960s, there were three or four different types [of REITs], said Sher Hafeez, a managing director at Jones Lang LaSalle, a real estate services firm. “Now, I can count at least 20 different types.”

Top performing REIT sub-sectors in recent years include data centers, self-storage properties, residential housing and tower REITs. Residential housing delivered a return of 16% from 2010 to 2020, according to a S&P Global Investments report.

The investor-friendly tax rules can also increase the pace of large-scale development.

“Having REITs there as a potential exit helps the market, and helps the availability of financing,” said Michael Pestronk, CEO and co-founder of Post Brothers, a Philadelphia-based housing developer.

Some funds like Invitation Homes and American Homes 4 Rent were founded in the yearslong slowdown in U.S. home construction. At the time, REITs bought and managed commercial-scale properties, which could include products like master-planned communities or traditional apartment complexes.

In recent years, publicly traded trusts have targeted single-family rental market, and today, these REITs have grown tremendously — enough to build new neighborhoods in their entirety.

Watch the video above to learn the fundamentals of real estate investment trusts.

-

Nvidia may be the AI stock for now, but here are the picks for later, says Goldman Sachs

Wall Street looks ready to build on Monday’s gains, the first in five sessions for the S&P 500

SPX

and Nasdaq Composite

COMP.

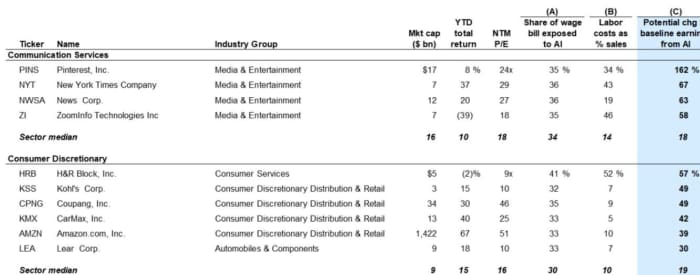

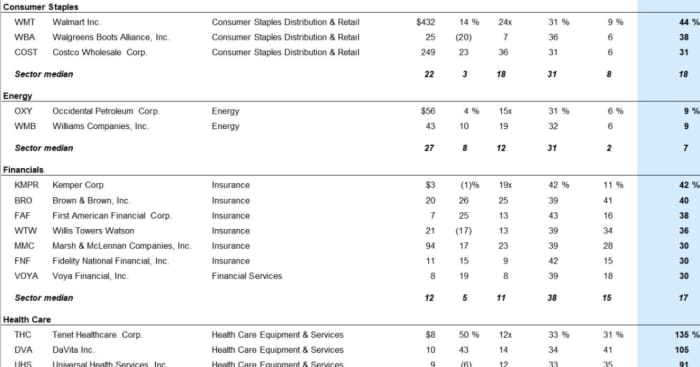

That’s as expectations build around Nvidia, which has had a lackluster August, to knock it out of the park with earnings on Wednesday.Investors have had months to focus on AI darlings such as Nvidia. In our call of the day, Goldman Sachs takes a look at stocks to trade after the big AI trade. A team led by strategists Ryan Hammond and David Kostin complied a basket of companies with the biggest potential long-term earnings per share boost from the impact of AI adoption on labor productivity.

Their analysis indicates that following widespread AI adoption, EPS for the median stock in that basket could be 72% higher than the baseline, versus 19% for the median Russell 1000 stock.

“We estimate the potential productivity-related EPS boost from increased revenues or increased margins, using a combination of company-level estimates of the share of the wage bill exposed to AI automation and the labor cost to revenue ratio,” said the Goldman team.

Since early 2023, when AI emerged as a theme for investors, they note their long-term basket of stocks has outperformed the equal-weight S&P 500 by just 6 percentage points, far less than near-term beneficiaries such as Nvidia

NVDA,

-0.49% ,

Microsoft

MSFT,

+0.94%

or Meta

META,

+0.51% .

Goldman Sachs Investment Research

“The estimated AI-driven earnings boost is likely to occur over the next few years, but should be reflected in stock valuations sooner. However, the eventual share price impact will depend on the ability of companies to use AI to enhance earnings,” said Goldman.

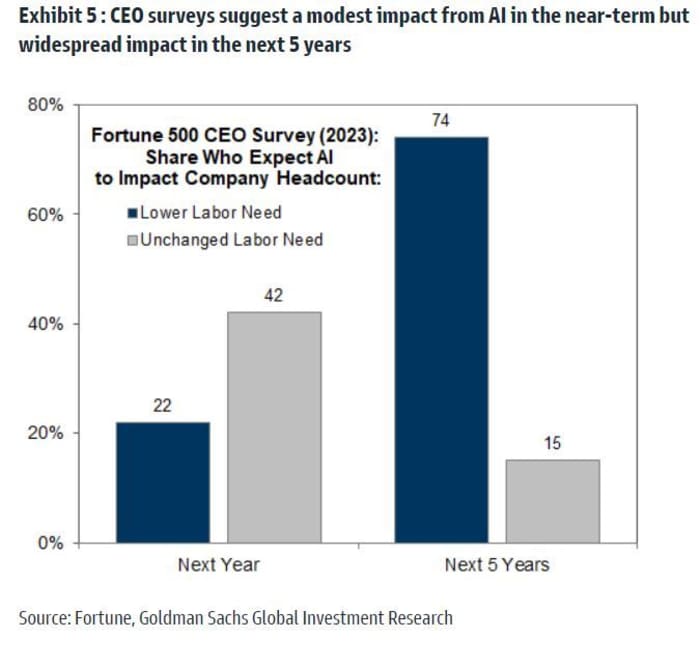

While unable to pin it exactly, Goldman expects AI adoption will start to a have a “meaningful macro impact” between 2025 and 2030, with regulatory constraints and data privacy concerns likely to slow widespread adoption. Nearly 75% of CEOs see AI take-up impacting companies or cutting labor needs within the next five years, even if they don’t right now.

Firms with the biggest workforce exposure to AI and larger and more innovative ones, will likely adopt generative AI earlier than others, say the strategists. They say to “expect valuation multiples for these companies to increase first as the adoption timeline crystallizes, even if actual adoption and the associated EPS boost is occur later.”

Goldman’s estimates on the potential earnings boost for those long-term AI beneficiaries consist of several factors: the share of each company’s wage bill exposed to AI automation, how much of a company’s wage bill is exposed to AI automation and labor cost as a share of revenue.

“For the typical Russell 1000 stock, 33% of the wage bill is potentially exposed to AI automation and labor costs currently represent 14% of total sales. The potential boost from higher sales would increase earnings by 11% and reduced labor costs would increase earnings by 26%, all else equal,” say the strategists.

Here is a taster of their long-term AI beneficiaries basket:

Goldman Sachs

And a few more:

Goldman Sachs

Read: U.S. stocks may bounce this week, but summer selloff is only halfway done, analysts warn

The markets

U.S. stocks

SPXCOMP

are trading mixed. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

is steady at 4.33%.For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Microsoft

MSFT,

+0.94%

has proposed a Ubisoft license to win U.K. regulatory approval for its Activision Blizzard

ATVI,

+1.09%

buyout. Activision shares and Ubisoft

UBI,

+9.93%

surged in Paris.On the heels of a 7% surge, EV-maker Tesla

TSLA,

+2.77%

is up 1.8%.Opinion: SoftBank’s Arm is going public, but it faces a rapidly growing threat

Lowe’s shares

LOW,

+3.34%

are up after the DIY retailer’s earnings topped expectations, though it notes lower discretionary demand.Among Monday’s late earnings news: Fabrinet

FN,

+27.25%

is up 18% after the high-tech manufacturing services company upbeat forecast, with new AI products helping drive results. Videoconferencing group Zoom Video Communications

ZM,

-4.15%

is up 4% after reporting an earnings jump and guidance.Read: Why Amazon is this analyst’s top internet stock pick

The world’s biggest miner BHP

BHP,

-0.98%

reported a 58% slump in annual profit amid tumbling commodity prices in part due to China’s economic troubles. U.S.-listed shares are up 4%.Arm Holdings filed its long-awaited IPO, which could be the year’s biggest. The chip designer aims to raise up to $10 billion with a valuation of $60 billion to $70 billion.

Existing home sales for July are due at 10 a.m., with several Fed speakers throughout the day: Richmond Fed President Tom Barkin at 7:30 a.m. and Chicago Fed President Austan Goolsbee and Fed. Gov. Michelle Bowman both at 2:30 p.m.

Best of the web

New video shows the day police raided 98-year old Kansas newspaper owner’s home.

Hitler’s birth house in Austria will be turned into a police station with a human rights training center.

The tickers

These were the top tickers on MarketWatch as of 6 a.m.:

Ticker Security name TSLA,

+2.77% Tesla NVDA,

-0.49% Nvidia AMC,

-17.31% AMC Entertainment NIO,

-1.87% Nio APE,

-11.32% AMC Entertainment Holdings preferred shares TTOO,

-6.13% T2 Biosystems GME,

-3.63% GameStop AAPL,

+0.63% Apple MULN,

-19.19% Mullen Automotive AMZN,

+0.15% Amazon.com The chart

Is tech dancing to the beat of its own drum? The Chart Report flagged this one from Scott Brown, founder of Brown Technical Insights, showing performance of the Technology Select Sector SPDR ETF

XLK

:

@scottcharts

“It’s only been a week, but consensus and conventional wisdom suggest higher yields are bad for Growth/Tech stocks. Meanwhile, Tech is acting like it never got the memo. It’s still too early to tell if Tech is trying to tell us something, but Scott points out that the sector is facing a crucial test this week at the March 2022 highs (around $163). $XLK is solidly above $163 after today’s bounce, but where it ends the week will likely hinge on $NVDA, as the company releases earnings on Wednesday evening,” says Patrick Dunuwila, editor and co-founder of The Chart Report.

Random reads

“We are the champions.” Spain erupted in celebrations to welcome its Women’s World Cup victors. And England’s Lionesses got a 1,000 soccer-ball tribute.

No, Tropical Storm Hilary didn’t flood Dodger Stadium.

These thirsty beer-drinking thieves are raccoons.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

-

Here’s what’s stopping cities from converting offices into apartments

Share

Some U.S. mayors are loosening up rules that determine how developers convert office buildings into apartment complexes. The conversion trend sped up in the 2020s, as the Covid pandemic remote work boom reshaped cities. Declines in office leasing activity is constraining funding for services like education and transit, leading some local leaders to prioritize conversion of dated buildings. These rule changes may create some additional housing supply in regions like the U.S. East Coast.

11:46

Sat, Jul 15 20237:00 AM EDT

-

Singapore and Hong Kong in ‘completely different’ stages of the property cycle: Real estate company

Share

Henry Chin of CBRE says Singapore residential and commercial real estate rents have risen substantially, but things are “bottoming out” for Hong Kong.

-

These features may ‘set you ahead of the competition’ when selling your home, research finds

A prospective home buyer is shown a home by a real estate agent in Coral Gables, Florida.

Joe Raedle | Getty Images

Today’s home sellers may be able to command higher prices due to recent increases.

Certain luxury features may help sell your home for more money or faster than expected, according to new research from Zillow.

“If you have these features in your home already, you should definitely flaunt them in your listing description,” said Amanda Pendleton, Zillow’s home trends expert. “That is going to set you ahead of the competition.”

The real estate website evaluated 271 design terms and features included in almost 2 million home sales in 2022. Those that came out on top may add up to about $17,400 on a typical U.S. home.

More from Personal Finance:

Don’t fall for these 9 common money myths

U.S. passport delays are months long and may get worse

How to work remotely indefinitely, according to a digital nomadTwo chef-friendly features topped the list of those that helped sell homes for more — steam ovens, which helped push prices up 5.3% over similar homes without them, and pizza ovens, which increased prices by 3.7%.

Other features that rounded out the top 10 included professional appliances, which had price premiums of 3.6%; terrazzo, 2.6%; “she sheds,” 2.5%; soapstone, 2.5%; quartz, 2.4%; a modern farmhouse, 2.4%; hurricane or storm shutters, 2.3%; and mid-century design, 2.3%,

Zillow also looked at which features helped sell homes faster than expected.

Doorbell cameras topped that list, helping to sell homes 5.1 days faster. That was followed by soapstone, with a 3.8 day advantage; open shelving, 3.5; heat pumps, 3; fenced yards , 2.9; mid-century, 2.8; hardwood, 2.4; walkability, 2.4; shiplap walling or siding, 2.3; and gas furnaces, 2.3.

To be sure, homeowners should not necessarily add these features with the idea they will see sale premiums, Pendleton said.

Moreover, some more unique features — like she sheds, spaces dedicated specifically to female home dwellers and their hobbies — may make it so it takes a bit longer to find a buyer who appreciates the amenities.

However, the features are signals of perceived qualify a buyer associates with a nice home right now.

“These personalized features kind of add that wow factor to a home,” Pendleton said.

Emphasis on improvements that spark joy

The current housing market is “anything but traditional,” Pendleton notes.

For buyers, there’s not as many listings to choose from as homeowners do not want to give up their ultra-low interest rates, she noted.

“Homes that are well priced and well marketed are going to find a buyer very quickly today,” Pendleton said.

Existing homeowners are now more likely to be thinking of different ways to re-envision their space, according to Jessica Lautz, deputy chief economist at the National Association of Realtors.

Personalized features kind of add that wow factor to a home.

Amanda Pendleton

home trends expert at Zillow

“There are a lot of people who want to remodel because they are locked into low interest rates and have no intention of leaving their property,” Lautz said.

At the top of homeowners’ wish lists are ways to maximize the square footage of their home, Lautz said, such as basement remodels or attic or closet conversions. Adding home offices is also very popular as people continue to live hybrid lifestyles.

Some improvements also stand to provide a 100% or more return when a home is put on the market.

The top of that list includes hardwood floor refinishing, according to Lautz, which not only makes a home look more beautiful but also makes it more marketable.

“It brings a lot of joy, and it has a lot of bang for the buck when you go to sell your home,” Lautz said.

Putting in new wood flooring or upgrading the home’s insulation also tend to provide returns of 100% or more, she said.

Zillow’s research found certain features may actually hurt a home’s resale value. That includes tile countertops or laminate flooring or countertops. Walk-in closets may also negatively impact a home’s value, as buyers may prefer to use the space for other purposes.

-

Dow ends about 200 points lower as economy shows more signs of sputtering

Major U.S. stock indexes fell on Tuesday, with the Dow and S&P 500 both snapping a 4-session win streak, as economic data showed more signs of a sputtering U.S. economy. The Dow Jones Industrial Average

DJIA,

-0.59%

fell about 198 points, or 0.6%, ending near 33,403, while the S&P 500 index

SPX,

-0.58%

shed 0.6% and the Nasdaq Composite Index

COMP,

-0.52%

fell 0.5%, according to preliminary FactSet data. Investors were eyeing less robust economic data out Tuesday. The number of U.S. job openings in February fell to a 21-month low, while orders for manufactured goods fell for the third time in the past four months. Gold prices

GC00,

-0.04%

were flirting with a return to record territory, trading above $2,000 an ounce. The 2-year Treasury rate

TMUBMUSD02Y,

3.854%

stayed below 4% at 3.84%. -

Look for stocks to lose 30% from here, says strategist David Rosenberg. And don’t even think about turning bullish until 2024.

David Rosenberg, the former chief North American economist at Merrill Lynch, has been saying for almost a year that the Fed means business and investors should take the U.S. central bank’s effort to fight inflation both seriously and literally.

Rosenberg, now president of Toronto-based Rosenberg Research & Associates Inc., expects investors will face more pain in financial markets in the months to come.

“The recession’s just starting,” Rosenberg said in an interview with MarketWatch. “The market bottoms typically in the sixth or seventh inning of the recession, deep into the Fed easing cycle.” Investors can expect to endure more uncertainty leading up to the time — and it will come — when the Fed first pauses its current run of interest rate hikes and then begins to cut.

Fortunately for investors, the Fed’s pause and perhaps even cuts will come in 2023, Rosenberg predicts. Unfortunately, he added, the S&P 500

SPX,

-0.61%

could drop 30% from its current level before that happens. Said Rosenberg: “You’re left with the S&P 500 bottoming out somewhere close to 2,900.”At that point, Rosenberg added, stocks will look attractive again. But that’s a story for 2024.

In this recent interview, which has been edited for length and clarity, Rosenberg offered a playbook for investors to follow this year and to prepare for a more bullish 2024. Meanwhile, he said, as they wait for the much-anticipated Fed pivot, investors should make their own pivot to defensive sectors of the financial markets — including bonds, gold and dividend-paying stocks.

MarketWatch: So many people out there are expecting a recession. But stocks have performed well to start the year. Are investors and Wall Street out of touch?

Rosenberg: Investor sentiment is out of line; the household sector is still enormously overweight equities. There is a disconnect between how investors feel about the outlook and how they’re actually positioned. They feel bearish but they’re still positioned bullishly, and that is a classic case of cognitive dissonance. We also have a situation where there is a lot of talk about recession and about how this is the most widely expected recession of all time, and yet the analyst community is still expecting corporate earnings growth to be positive in 2023.

In a plain-vanilla recession, earnings go down 20%. We’ve never had a recession where earnings were up at all. The consensus is that we are going to see corporate earnings expand in 2023. So there’s another glaring anomaly. We are being told this is a widely expected recession, and yet it’s not reflected in earnings estimates – at least not yet.

There’s nothing right now in my collection of metrics telling me that we’re anywhere close to a bottom. 2022 was the year where the Fed tightened policy aggressively and that showed up in the marketplace in a compression in the price-earnings multiple from roughly 22 to around 17. The story in 2022 was about what the rate hikes did to the market multiple; 2023 will be about what those rate hikes do to corporate earnings.

“ You’re left with the S&P 500 bottoming out somewhere close to 2,900. ”

When you’re attempting to be reasonable and come up with a sensible multiple for this market, given where the risk-free interest rate is now, and we can generously assume a roughly 15 price-earnings multiple. Then you slap that on a recession earning environment, and you’re left with the S&P 500 bottoming out somewhere close to 2900.

The closer we get to that, the more I will be recommending allocations to the stock market. If I was saying 3200 before, there is a reasonable outcome that can lead you to something below 3000. At 3200 to tell you the truth I would plan on getting a little more positive.

This is just pure mathematics. All the stock market is at any point is earnings multiplied by the multiple you want to apply to that earnings stream. That multiple is sensitive to interest rates. All we’ve seen is Act I — multiple compression. We haven’t yet seen the market multiple dip below the long-run mean, which is closer to 16. You’ve never had a bear market bottom with the multiple above the long-run average. That just doesn’t happen.

David Rosenberg: ‘You want to be in defensive areas with strong balance sheets, earnings visibility, solid dividend yields and dividend payout ratios.’

Rosenberg Research

MarketWatch: The market wants a “Powell put” to rescue stocks, but may have to settle for a “Powell pause.” When the Fed finally pauses its rate hikes, is that a signal to turn bullish?

Rosenberg: The stock market bottoms 70% of the way into a recession and 70% of the way into the easing cycle. What’s more important is that the Fed will pause, and then will pivot. That is going to be a 2023 story.

The Fed will shift its views as circumstances change. The S&P 500 low will be south of 3000 and then it’s a matter of time. The Fed will pause, the markets will have a knee-jerk positive reaction you can trade. Then the Fed will start to cut interest rates, and that usually takes place six months after the pause. Then there will be a lot of giddiness in the market for a short time. When the market bottoms, it’s the mirror image of when it peaks. The market peaks when it starts to see the recession coming. The next bull market will start once investors begin to see the recovery.

But the recession’s just starting. The market bottoms typically in the sixth or seventh inning of the recession, deep into the Fed easing cycle when the central bank has cut interest rates enough to push the yield curve back to a positive slope. That is many months away. We have to wait for the pause, the pivot, and for rate cuts to steepen the yield curve. That will be a late 2023, early 2024 story.

MarketWatch: How concerned are you about corporate and household debt? Are there echoes of the 2008-09 Great Recession?

Rosenberg: There’s not going to be a replay of 2008-09. It doesn’t mean there won’t be a major financial spasm. That always happens after a Fed tightening cycle. The excesses are exposed, and expunged. I look at it more as it could be a replay of what happened with nonbank financials in the 1980s, early 1990s, that engulfed the savings and loan industry. I am concerned about the banks in the sense that they have a tremendous amount of commercial real estate exposure on their balance sheets. I do think the banks will be compelled to bolster their loan-loss reserves, and that will come out of their earnings performance. That’s not the same as incurring capitalization problems, so I don’t see any major banks defaulting or being at risk of default.

But I’m concerned about other pockets of the financial sector. The banks are actually less important to the overall credit market than they’ve been in the past. This is not a repeat of 2008-09 but we do have to focus on where the extreme leverage is centered.

It’s not necessarily in the banks this time; it is in other sources such as private equity, private debt, and they have yet to fully mark-to-market their assets. That’s an area of concern. The parts of the market that cater directly to the consumer, like credit cards, we’re already starting to see signs of stress in terms of the rise in 30-day late-payment rates. Early stage arrears are surfacing in credit cards, auto loans and even some elements of the mortgage market. The big risk to me is not so much the banks, but the nonbank financials that cater to credit cards, auto loans, and private equity and private debt.

MarketWatch: Why should individuals care about trouble in private equity and private debt? That’s for the wealthy and the big institutions.

Rosenberg: Unless private investment firms gate their assets, you’re going to end up getting a flood of redemptions and asset sales, and that affects all markets. Markets are intertwined. Redemptions and forced asset sales will affect market valuations in general. We’re seeing deflation in the equity market and now in a much more important market for individuals, which is residential real estate. One of the reasons why so many people have delayed their return to the labor market is they looked at their wealth, principally equities and real estate, and thought they could retire early based on this massive wealth creation that took place through 2020 and 2021.

Now people are having to recalculate their ability to retire early and fund a comfortable retirement lifestyle. They will be forced back into the labor market. And the problem with a recession of course is that there are going to be fewer job openings, which means the unemployment rate is going to rise. The Fed is already telling us we’re going to 4.6%, which itself is a recession call; we’re going to blow through that number. All this plays out in the labor market not necessarily through job loss, but it’s going to force people to go back and look for a job. The unemployment rate goes up — that has a lag impact on nominal wages and that is going to be another factor that will curtail consumer spending, which is 70% of the economy.

“ My strongest conviction is the 30-year Treasury bond. ”

At some point, we’re going to have to have some sort of positive shock that will arrest the decline. The cycle is the cycle and what dominates the cycle are interest rates. At some point we get the recessionary pressures, inflation melts, the Fed will have successfully reset asset values to more normal levels, and we will be in a different monetary policy cycle by the second half of 2024 that will breathe life into the economy and we’ll be off to a recovery phase, which the market will start to discount later in 2023. Nothing here is permanent. It’s about interest rates, liquidity and the yield curve that has played out before.

MarketWatch: Where do you advise investors to put their money now, and why?

Rosenberg: My strongest conviction is the 30-year Treasury bond

TMUBMUSD30Y,

3.674% .

The Fed will cut rates and you’ll get the biggest decline in yields at the short end. But in terms of bond prices and the total return potential, it’s at the long end of the curve. Bond yields always go down in a recession. Inflation is going to fall more quickly than is generally anticipated. Recession and disinflation are powerful forces for the long end of the Treasury curve.As the Fed pauses and then pivots — and this Volcker-like tightening is not permanent — other central banks around the world are going to play catch up, and that is going to undercut the U.S. dollar

DXY,

+0.70% .

There are few better hedges against a U.S. dollar reversal than gold. On top of that, cryptocurrency has been exposed as being far too volatile to be part of any asset mix. It’s fun to trade, but crypto is not an investment. The crypto craze — fund flows directed to bitcoin

BTCUSD,

+0.35%

and the like — drained the gold price by more than $200 an ounce.“ Buy companies that provide the goods and services that people need – not what they want. ”

I’m bullish on gold

GC00,

+0.22%

– physical gold — bullish on bonds, and within the stock market, under the proviso that we have a recession, you want to ensure you are invested in sectors with the lowest possible correlation to GDP growth.Invest in 2023 the same way you’re going to be living life — in a period of frugality. Buy companies that provide the goods and services that people need – not what they want. Consumer staples, not consumer cyclicals. Utilities. Health care. I look at Apple as a cyclical consumer products company, but Microsoft is a defensive growth technology company.

You want to be buying essentials, staples, things you need. When I look at Microsoft

MSFT,

-0.61% ,

Alphabet

GOOGL,

-1.79% ,

Amazon

AMZN,

-1.17% ,

they are what I would consider to be defensive growth stocks and at some point this year, they will deserve to be garnering a very strong look for the next cycle.You also want to invest in areas with a secular growth tailwind. For example, military budgets are rising in every part of the world and that plays right into defense/aerospace stocks. Food security, whether it’s food producers, anything related to agriculture, is an area you ought to be invested in.

You want to be in defensive areas with strong balance sheets, earnings visibility, solid dividend yields and dividend payout ratios. If you follow that you’ll do just fine. I just think you’ll do far better if you have a healthy allocation to long-term bonds and gold. Gold finished 2022 unchanged, in a year when flat was the new up.

In terms of the relative weighting, that’s a personal choice but I would say to focus on defensive sectors with zero or low correlation to GDP, a laddered bond portfolio if you want to play it safe, or just the long bond, and physical gold. Also, the Dogs of the Dow fits the screening for strong balance sheets, strong dividend payout ratios and a nice starting yield. The Dogs outperformed in 2022, and 2023 will be much the same. That’s the strategy for 2023.

-

Meat bans, soaring gold prices and ‘un-Brexit’? One bank’s ‘outrageous’ predictions for 2023

Meat bans, soaring gold prices and Britain voting to ‘un–Brexit’ could be on the cards for 2023, according to Saxo’s Outrageous Predictions.

Bloomberg / Contributor / Getty Images

Saxo Bank’s “outrageous predictions” for 2023 include a ban on meat production, skyrocketing gold prices and Britain voting to “un-Brexit.”

The Danish bank’s annual report, published earlier this month, expects global economies to shift into “war economy” mode, “where sovereign economic gains and self-reliance trump globalisation.”

The forecasts, while not representative of the bank’s official views, looked at how decisions from policymakers next year could impact both the global economy and the political agenda.

Gold to hit $3,000

Among the bank’s “outrageous” calls for next year, Saxo Head of Commodity Strategy Ole Hansen predicted the price of spot gold could exceed $3,000 per ounce in 2023 – around 67% higher than its current price of about $1,797 per ounce.

The report puts its forecasted surge down to three factors: “an increasing war economy mentality” that makes gold more appealing than foreign reserves, a big investment in new national security priorities, and increasing global liquidity as policymakers try to avoid debt debacles in their respective recessions.

“I would not be surprised to see commodity driven economies wanting to go to gold because of a lack of better alternatives,” Steen Jakobsen, chief investment officer at Saxo, told CNBC’s “Squawk Box Europe” on Dec. 6.

“I think gold is going to fly,” he added.

While analysts are expecting an increase in the price of gold in 2023, a surge of that magnitude is unlikely, according to global commodities intelligence company CRU.

“Our price expectations are much more moderate,” Kirill Kirilenko, a senior analyst at CRU, told CNBC.

“A less hawkish Fed is likely to lead to a weaker USD, which could in turn give gold bulls more breathing space and energy to stage a rally next year, lifting prices closer to $1,900 per ounce,” he said.

Kirilenko highlighted, however, that it’s all dependent on moves by the Federal Reserve. “Any hint of increasing ‘hawkishness’ from the US central bank would likely pressure gold prices lower,” he said.

Britain will vote to un-Brexit

The “outrageous prediction” most likely to occur next year, according to Saxo’s Jakobsen, is for there to be another referendum on Brexit.

“I actually think it’s one of the things that will have a high probability,” he told CNBC.

Saxo Market Strategist Jessica Amir said British Prime Minister Rishi Sunak and his Finance Minister Jeremy Hunt may take Conservative Party ratings to “unheard-of lows” as their “brutal fiscal programme throws the UK into a crushing recession.”

This, the bank forecasted, could prompt the English and Welsh public to rethink the Brexit vote, with younger voters leading the way, and force Sunak to call a general election.

Saxo predicts there could be another Brexit referendum on the cards for Britain.

NurPhoto / Contributor / Getty Images

Saxo’s Amir said the opposition Labour party may then win the election and promise a referendum to reverse Brexit for Nov. 1, with the “re-join” vote winning.

“Business people are saying the only thing they’ve gained from Brexit is U.K-specific GDPR,” Saxo’s Jakobsen told CNBC. “The rest is just increased red tape,” he said.

Anand Menon, director of the think tank UK in a changing Europe, said this prediction “just doesn’t compute.”

“I don’t think there will be another referendum and the idea that [Labour leader Keir] Starmer would adopt that position is for the birds,” he said.

Starmer told a business conference in September that his party would “make Brexit work.”

Public sentiment toward Brexit has changed since the referendum, Menon said, after the vote resulted in a slim majority of 52% of voters opting to leave the EU back in 2016.

“It’s absolutely the case that public opinion seems to be turning,” he said.

Research carried out by YouGov in November showed 59% of the 6,174 people surveyed thought Brexit had gone “fairly badly” or “very badly” since the end of 2020, while only 2% said it had gone “very well.”

Meat production to be banned

Meat is responsible for 57% of emissions from food production, according to research published by Nature Food, and with countries across the world having made net-zero commitments, Saxo says it is possible at least one country could cut out meat production entirely.

One nation “looking to front-run others” on its climate credentials may decide to heavily tax meat from 2025 and could ban all domestically produced live animal-sourced meat entirely by 2030, Saxo Market Strategist Charu Chanana said.

Meat is responsible for 57% of emissions from food production, according to research published by Nature Food.

Future Publishing / Contributor / Getty Images

“I wouldn’t be surprised to see schools in Denmark and Sweden banning meat altogether, it’s definitely going that way,” Saxo’s Jakobsen told CNBC. “It sounds crazy for us old people,” he added.

The U.K., countries in the European Union, Japan and Canada are among the nations with legally binding net-zero pledges.

The U.K’s Department for Environment Food and Rural Agriculture said there were “no plans” to introduce a meat tax or ban meat production when contacted by CNBC.

An eventful 2023?

Some of the other “outrageous predictions” for next year from Saxo include the resignation of French President Emmanuel Macron, Japan pegging the yen to the U.S. dollar at a rate of 200 and the formation of a united European Union military.

The predictions should all be taken with a pinch of salt, however. Saxo’s Jakobsen told CNBC that there was a 5-10% chance of each forecast coming true.

The bank has made a set of “outrageous predictions” each year for the last decade and some have actually come true — or at least come close.

In 2015, Saxo forecasted that the U.K. would vote to leave the European Union following a United Kingdom Independence Party landslide, it predicted Germany would enter a recession in 2019 – which the country narrowly avoided – and it wagered that bitcoin would experience a meteoric rally in 2017.