With mortgage rates firmly above 7%, homeownership has become much more expensive. But will rates go even higher?

Three experts told MarketWatch that if the economy continues to show signs of strength, and the U.S. Federal Reserve hikes its benchmark interest rate once again, rates could go up to 8%.

High rates have already taken a toll on the U.S. housing market. Even home builders, who have in recent months experienced strong demand from homebuyers, are reporting a drop in buyer traffic as those rising rates rattle their customers.

But experts also stressed that the U.S. economy is showing early signs of cooling, and that the rate of inflation is easing. That could lead to a slowdown — or even a drop — in mortgage rates. But such forecasts are not a guarantee, as Tuesday’s stronger-than-expected U.S. retail sales figures suggested.

How high can rates go?

Even though the 30-year fixed mortgage rate was averaging 7.26% as of Tuesday evening, the highest level since November 2022, economists say rates could go up further.

The 30-year is “at a critical stage,” Lawrence Yun, chief economist at the National Association of Realtors, told MarketWatch.

“If the 30-year-fixed mortgage rate can hold at a high mark of 7.2% — and the 10-year yield holds at 4.2% — then this would be the high for mortgage rates before retreating,” Yun said. “If it breaks this line and easily goes above 7.2%, then the mortgage rate reaches 8%.”

As of Tuesday afternoon, the 10-year Treasury note

BX:TMUBMUSD10Y

was above 4.2%.

“Mortgage rates could rise significantly if global investors demand higher yields for fixed-income assets,” Cris deRitis, deputy chief economist at Moody’s Analytics, told MarketWatch.

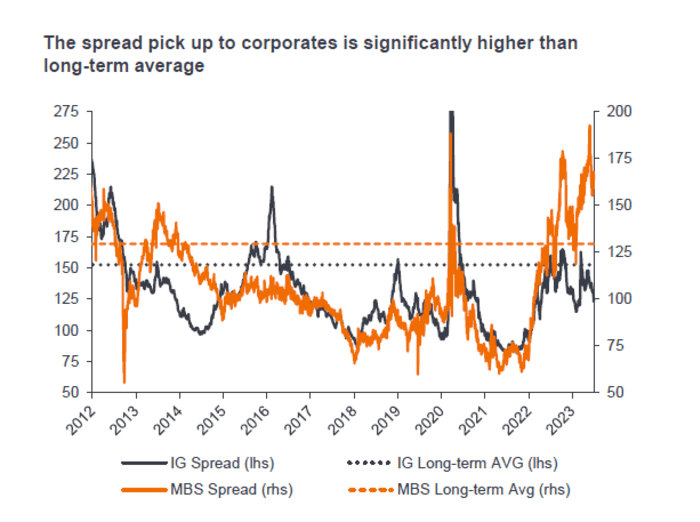

Currently, the spread between the 30-year fixed-rate mortgage and a 10-year Treasury bond is around 300 basis points, which is “elevated and highly unusual,” he said.

“‘Historically, the mortgage-rate spread has only been around this level only during periods of financial crisis such as the Great Recession or the early 1980s recession.’”

— Cris deRitis, deputy chief economist at Moody’s Analytics

“Historically, the mortgage-rate spread has only been around this level only during periods of financial crisis such as the Great Recession or the early 1980s recession,” deRitis added. “The historical average is closer to 175 basis points.”

If the 10-year continues to rise — and the U.S. Federal Reserve chooses to interest rates once again — it could go beyond 5%. If the spread stays elevated at 300 basis points, deRitis added, “a mortgage rate of 8% or more is a distinct possibility in the near term.”

Consumers seem to be prepared for 8% rates. In February, households surveyed by the New York Federal Reserve as part of its Survey of Consumer Expectations, found that they expect mortgage rates to rise to 8.4% by the following year, and 8.8% in three years’ time. Yet few saw the moment as an opportunity to buy.

To be clear, rates have been far higher in the past. In 1981, the 30-year mortgage rate went up to 18%, according to Freddie Mac

FMCC,

+31.97%.

That year, the rate of inflation was 10.3%, according to the Minneapolis Fed.

“So in theory, mortgage rates can go up as much,” Selma Hepp, chief economist at CoreLogic, told MarketWatch. “But I don’t think they’re gonna go much beyond where they are right now.”

The yearly rate of inflation in July was just 3.2%. There was runaway inflation in the early 1980s. Though the year isn’t over yet, it is highly unlikely that the rate will suddenly surge, as economists expect the cost of housing — one of the biggest drivers of inflation — to ease in the coming months.

What happens to housing if rates surge?

If the 30-year mortgage interest rate reached 8%, there would be serious consequences for the housing market, Yun said. “At 8%, the housing market will re-freeze, with fewer buyers and far fewer sellers,” he added.

But don’t expect high rates to hurt home prices just yet, Yun added: “As long as the job market doesn’t turn negative, then home prices will be stable — though home sales will take another step downward. If there is a job-cutting recession, then home prices will fall as some will be forced to sell while there are few buyers.”

Other experts said that high rates have already taken a toll on the U.S. housing sector. “A mortgage rate in excess of 6% has already sidelined a large number of potential homebuyers, especially first-time home buyers,” deRitis said.

He noted that the monthly mortgage payment for a median-priced home at the prevailing 30-year mortgage rate has risen from close to $1,100 per month in January 2019 to over $2,100 today. “At 8%, the monthly payment would rise to over $2,300, excluding an even larger number of potential buyers with above-average incomes,” deRitis added.

High rates also discourage homeowners from selling, since they may have to surrender an ultra-low mortgage with a low monthly payment for a high rate. They may end up with a smaller budget to purchase a home, or worse, not find any listings at all, given an ongoing inventory crunch.

With high rates, many home buyers may be priced out of the market. Yet some buyers — particularly baby boomers — who have the means to put in all-cash offers on homes are keeping home prices elevated, Hepp said.

So who would be able to buy and sell? Cash buyers. “They tend to be older people like baby boomers who own their homes free and clear,” she added. “If they live in more expensive areas, like anywhere in California, they can sell their home and walk away with in excess of $500,000. And that in some markets buys them two homes.”

deRitis said that the ultimate fate of home prices falls on the strength of the job market. Even though rates are high for now, home prices may not fall significantly, as some buyers can still purchase homes with cash, he added.

But “if the labor market should weaken and unemployment rise, home foreclosures would rise,” deRitis added, “placing downward pressure on home prices.”

“So the housing market is definitely suffering from high rates,” Hepp said. “But I think even higher rates would be pretty devastating for the housing market.”