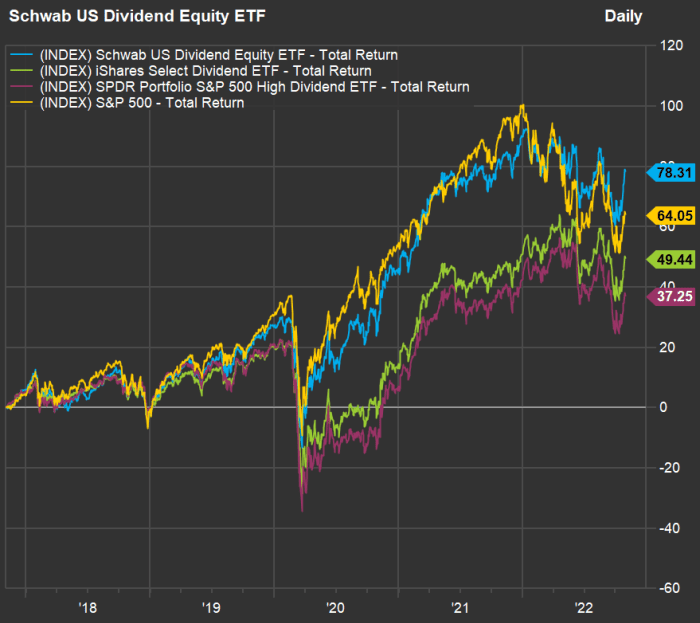

With the threat of inflation back at the forefront for many investors, there’s one large stock-market investor positioning for it to be a decade-long phenomenon. In a note posted to the firm’s website, Chief Investment Officer William Smead of Phoenix-based Smead Capital Management, which oversees $5.83 billion in assets, said “we are loaded with inflation beneficiary stocks like oil and gas stocks and useful real estate.” The firm likes home builder D.R. Horton DHI; Simon Property Group SPG, a real estate investment trust…

Tag: Merck & Co. Inc.

-

COVID-related ICU patients rise to 5-month high above 5,000—are new cases really falling?

While many have been focused on the apparent explosion of COVID cases in China, and the lack of reliable data from China’s government, there are signs suggesting the U.S. situation is also getting worse even as case counts and deaths are falling.

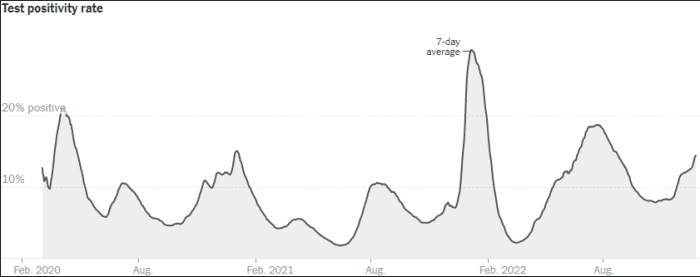

At first look, initial fears of another COVID surge in the U.S. over the holidays may be overblown. About a week after the year-end holiday gatherings began, the seven-day average of new COVID cases fell to a more than three-week low of 58,354 on Thursday, down 9% from two weeks ago and down 17% from a recent peak of 70,508 on Christmas Eve, according to a New York Times tracker.

And the daily average for deaths fell has fallen to a three-week low of 355, and has dropped 5% in two weeks.

But as the NYT tracker has been warning, case and death counts could be “artificially low” this week, as officials who track those numbers take vacation for the Christmas and New Year’s holidays. Therefore, hospitalization data, which is typically not affected by holidays, should remain more reliable.

And by that measure, the numbers are getting worrisome.

The daily average of hospitalizations rose to 41,620 on Thursday, up 3% from two weeks ago but also the highest number seen since mid-August.

There are 29 states that have seen hospitalizations increase from two weeks ago, including 20 states that have seen double-digit percentage increases, led by South Carolina at 54%, West Virginia at 52% and Louisiana at 47%.

The number of severe COVID cases is also seeing a troubling rise, the daily average of COVID-related patients in intensive care units (ICUs) climbed to 5,080 on Thursday. That’s up 10% from two weeks ago, and the most seen since July 30.

The New York Times

Another sign that the fall in case counts is artificial is that the test positivity rate has been rising, to a four-month high above 14% on Thursday, with 41 states seeing double-digit positivity rates.

“Higher test positivity rates are a sign that many infections are not reported — even if they are tested at home. This results in a more severe undercount of cases,” the NYT tracker said.

The New York Times

Stay up to date on COVID news through MarketWatch’s daily “Coronavirus Update” column.

Meanwhile in China, amid a “lack of adequate and transparent” data from China’s government, there is reason to believe the situation will still get a lot worse before it gets better.

U.K. health firm Airfinity estimates that new daily COVID cases in China is currently running at about 1.8 million, based on data from China’s regional provinces, and on new-case trajectories from areas that also lifted zero-COVID policies, such as Hong Kong.

That case number is expected to more than double, to about 3.7 million a day, in mid-January, Airfinity estimates, before another surge in March takes the number up to about 4.2 million per day.

As a result of the concerns over surging case counts, Spain joined the growing number of countries that are requiring COVID tests for air passengers arriving from China, as the Associated Press reported. This comes after the European Union said Thursday that it is “assessing” the situation in China.

The U.S. will also require those arriving from China to take a PCR test, starting Jan. 5, while Japan started requiring a test on Friday. Other countries requiring a test for air passengers from China include Italy, India and South Korea.

The BBC reported that the U.K. was set to announce that travelers will need to show a negative COVID test before they board a plane from China.

In other COVID news, China’s National Medical Products Administration has given emergency approval to Merck & Co. Inc.’s

MRK,

-0.33%

COVID antiviral molnupiravir. That joins Pfizer Inc.’s

PFE,

-0.96%

Paxlovid, which has already been approved for use in China. Merck’s stock, which fell 0.4% in afternoon trading Friday, has soared 44.0% in 2022, while the Dow Jones Industrial Average

DJIA,

-0.88%

has lost 9.4%.Novavax Inc.

NVAX,

+0.21%

said Friday that it has initiated a Phase 2 trial for its COVID-19-Influenza Combination (CIC) vaccine candidate in people aged 50 through 80. “We believe that like influenza, COVID-19 will also be seasonal moving forward, and that there is room in the market for new alternatives to provide better protection against the impact of influenza, particularly in older adults, and to explore the potential to combine this with protection from COVID,” said Chief Executive Stanley Erck. Novavax’s stock, which eased 0.3% Friday, has plunged 93.2% year to date while the S&P 500 index

SPX,

-1.03%

has dropped 20.1%. -

All 30 Dow stocks rise, led by Disney and Apple, the previous session’s worst performers

The Dow Jones Industrial Average’s

DJIA,

+1.11%

307-point rally in morning trading Thursday was unanimous, as all 30 components were gaining ground. The top performers were shares of Walt Disney Co.

DIS,

+4.43% ,

up 4.1%, and Apple Inc.

AAPL,

+3.15% ,

up 2.7%. Those two stocks happened to be the Dow’s worst performers on Wednesday when the Dow dropped 366 points, with Apple shares shedding 3.1% and Disney’s stock dropping 2.2%. Intel Corp.’s stock

INTC,

+2.33% ,

which is the Dow’s biggest loser year to date, was the Dow’s third-biggest gainer on Thursday with a 2.1% rise. The worst performer on Thursday was Merck & Co. Inc.’s stock

MRK,

+0.09% ,

which ticked up just 0.1%. Merck’s stock was the Dow’s second-best year-to-date performer with a 45.0% gain, behind Chevron Corp.’s

CVX,

+0.68%

51.4% rally. -

As COVID cases rise, how to steer clear of viruses during the holiday season

Amid the holiday season, here are some expert-recommended ways to keep yourself and loved ones safe from COVID-19 and other viruses in circulation.

Stay home if you’re sick. “For far too many years, whether in the workplace or for important social engagements, people took it as a badge of pride that they would tough it out and go to work even if they were sick,” James Conway, a physician specializing in pediatric infectious diseases at the University of Wisconsin in Madison, told Vox. “I think people have finally come around to recognizing that’s both impractical and a little disrespectful to others.”

Consider wearing a mask. “Everyone needs to know that masking really does protect individuals against all three viruses,” meaning SARS-CoV-2, the flu, and respiratory syncytial virus, Diego Hijano, an infectious disease specialist at St. Jude Children’s Research Hospital in Memphis, said in an interview with CNBC.

Los Angeles County, New York City, and Oakland are once again recommending that residents mask up in certain shared indoor spaces as COVID cases continue to rise.

Test before you go. Some hosts are asking their guests to take a test before they get to the party, according to the New York Times. One New Yorker sent out invitations asking friends to “join me in super-spreading holiday cheer.” Other suggestions? Opening the windows and taking the party outside.

Other COVID news to know:

• The XBB subvariant is spreading in the U.S. The latest data from the Centers for Disease Control and Prevention shows that XBB now makes up an estimated 18% of new COVID cases in the U.S., up from 11% for the week ending Dec. 17. BQ.1 and BQ.1.1 still make up the majority of new infections.

• China’s COVID surge. Health authorities estimate that 37 million people in China got sick with COVID one day this week, according to Bloomberg, and as many as 248 million likely contracted the virus in the first 20 days of December.

• Merck’s

MRK,

+0.06%

Lagevrio doesn’t prevent hospitalizations. That’s according to a new open-label, randomized, controlled study published Thursday in The Lancet. The research looked at clinical data from 26,411 people in the U.K. in the first half of the year, and it found that the antiviral didn’t reduce the risk of hospitalization or death in high-risk vaccinated individuals. However, patients who took Lagevrio recovered faster and had fewer doctor’s visits.• The U.S. reports 70,000 cases for the first time since Sept. 7. The seven-day daily average of new infections rose 5% from two weeks ago to 70,479 on Thursday, according to a New York Times tracker. Hospitalizations increased 9% to 40,758 over the past 14 days, while those in intensive care units grew 13% to 4,835, and 422 people died on Wednesday.

-

The Dow industrials are on the verge of a ‘golden cross,’ even as BlackRock predicts recession like no other

Despite worries about inflation and an impending recession, there is at least one sign that some bullish market technical analysts might latch onto.

An upbeat golden cross appears to be forming in the Dow Jones Industrial Average

DJIA,

-0.90% ,

more than nine months after a bearish death cross formed back in March, as the hawkish agenda of the Federal Reserve shattered bullishness on Wall Street.A golden cross occurs when the 50-day moving average for an asset price trades above the 200-day MA, while a death cross, comparatively, is when the 50-day falls below the long-term average.

The 50-day moving average for the Dow stands at 32,200.32, at last check Friday afternoon, while the 200-day sits at 32,460.71, a roughly 260-point difference that could be traversed in the coming week or two, based on its current trajectory.

FactSet

A golden cross would mark the first for the Dow industrials since 2020 of August, according to Dow Jones Market Data.

The bullish chart formation also would appear at an odd time for investors, with an apparent uptrend materializing in the stock market, even as the threat of a recession in 2023 grows.

See: Goldman Sachs CEO says recession is likely, with 35% chance of a soft landing

BlackRock, the world’s largest asset manager, is anticipating a unique recession unlike others that we’ve seen in U.S. history.

“The new macro regime is playing out. We think that requires a new, dynamic playbook based on views of market risk appetite and pricing of macro damage,” wrote BlackRock’s Investment Institute team led by Jean Boivin.

The BlackRock team said markets aren’t necessarily pricing in the recession that is being predicted.

“Central banks appear set on doing ‘whatever it takes’ to fight inflation, making recession foretold, in our view,” the team at BlackRock wrote.

As MarketWatch’s Tomi Kilgore notes, crosses, overall, aren’t necessarily good market-timing indicators.

Check out: MarketWatch’s live blog of the market

On top of that, MarketWatch columnist Mark Hulbert concludes that the U.S. stock market on average has performed no better in the wake of a golden crosses as it did at other times.

In many cases, a golden cross can help put an asset’s move into perspective, however, they tend to be well telegraphed.

Interestingly, the recession is also being widely predicted and some don’t think investors are getting the memo. As BlackRock notes, investors aren’t reflecting the damage that is to come, particularly as earnings expectations from American companies are right-sized.

So, it might be worth it for investors to take any golden crosses in assets with a grain of salt.

So far, the Dow industrials have outperformed over the past three months, up about 5%, compared with a decline of 2.5% for the S&P 500

SPX,

-0.73%

and an 8.2% drop for the Nasdaq Composite

COMP,

-0.70% .Over the past three months, the Dow industrials have recent in aggregate on the back of gains in shares of Caterpillar

CAT,

-1.56% ,

Boeing Co.

BA,

+0.20%

Merck & Co.

MRK,

-1.86% ,

IBM

IBM,

-0.47%

and Travelers Cos.

TRV,

-1.10% .For the year so far, the Dow is down 7%, while the S&P 500 is off 17% and the Nasdaq is down nearly 30%.

-

China’s three-week COVID case tally tops 253,000 and daily average is rising, government says

More than 253,000 coronavirus cases have been found in China in the past three weeks and the daily average is rising, the government said Tuesday, the Associated Press reported.

The trend is putting pressure on officials who are trying to ease economic disruption by easing strict controls that have confined millions of people to their homes.

China is the only major country in the world still trying to curb virus transmissions through strict lockdown measures and mass testing. The ruling Communist Party promised earlier this month to reduce disruptions from its “zero- COVID” strategy by making controls more flexible, but so far, progress has been slow.

Beijing, which announced its first COVID death in about six months over the weekend, has locked down parks, populous districts, stores and offices and many school kids have resumed online learning.

The past week’s average of 22,200 daily cases is double the previous week’s rate, the official China News Service reported, citing the National Bureau of Disease Prevention and Control.

On Tuesday, the government reported 28,127 cases found over the past 24 hours, including 25,902 with no symptoms. Almost one-third, or 9,022, were in Guangdong province, the heartland of export-oriented manufacturing adjacent to Hong Kong.

In the U.S., known cases of COVID are rising again with the daily average standing at 41,530 on Monday, according to a New York Times tracker, up 4% from two weeks ago.

Don’t miss: Confused about COVID boosters? Here’s what the science and the experts say about the new generation of shots.

Cases are rising in 24 states, plus Washington, D.C., Guam and Puerto Rico. Washington state has replaced Nebraska as leader by new cases, which have climbed 423% from two weeks ago. That’s followed by Arizona, where they are up 110% and California, up 60%.

The daily average for hospitalizations was down 1% at 27,547, but again, the trend is not uniform across the U.S. Hospitalizations are up 60% in Alaska, up 47% in Arizona and up 30% in Wyoming.

The daily average for deaths is down 2% to 294.

Physicians are reporting high numbers of respiratory illnesses like RSV and the flu earlier than the typical winter peak. WSJ’s Brianna Abbott explains what the early surge means for the coming winter months. Photo illustration: Kaitlyn Wang

Coronavirus Update: MarketWatch’s daily roundup has been curating and reporting all the latest developments every weekday since the coronavirus pandemic began

Other COVID-19 news you should know about:

• Japan approved an antiviral pill from Shionogi & Co.

4507,

+2.77%

to treat COVID after the company provided new data to show the drug’s efficacy, the Wall Street Journal reported. The treatment is the first locally developed alternative to Pfizer Inc.’s

PFE,

+1.45%

Paxlovid and Merck & Co.’s

MRK,

+0.93%

Lagevrio, which have been authorized for emergency use in Japan. Shionogi aims to win approval from the Food and Drug Administration for its pill in the U.S. Osaka-based Shionogi filed in February for emergency approval for the drug, known as Xocova, in Japan. The health ministry panel said in July it needed to see results from a larger human trial because data submitted at the time didn’t sufficiently show improvements in symptoms associated with COVID.• Dubai International Airport passenger numbers surpassed pre-COVID pandemic levels in the third quarter of 2022, the airport’s chief executive said, causing the airport to revise its annual forecast by another 1 million passengers, the AP reported. Paul Griffiths, who oversees the world’s busiest airport, told the Associated Press the annual forecast at Dubai International, or DXB, is more than 64 million. The airport saw 18.5 million passengers in the third quarter of this year, up from 17.8 million during the first quarter of 2020—prior to and at the dawn of the pandemic.

• Get ready for long lines at U.S. airports and traffic jams galore—just like old times. Airports and roads may be “jam-packed” this year, according to the AAA. It estimates that 53.6 million people will travel for the Thanksgiving weekend, reaching 98% of pre-pandemic Thanksgiving travel. “Families and friends are eager to spend time together this Thanksgiving, one of the busiest for travel in the past two decades,” said Paula Twidale, senior vice president, AAA Travel. “Plan ahead and pack your patience, whether you’re driving or flying.”

Here’s what the numbers say:

The global tally of confirmed cases of COVID-19 topped 638.5 million on Monday, while the death toll rose above 6.62 million, according to data aggregated by Johns Hopkins University.

The U.S. leads the world with 98.4 million cases and 1,077,225 fatalities.

The Centers for Disease Control and Prevention’s tracker shows that 228.2 million people living in the U.S., equal to 68.7% of the total population, are fully vaccinated, meaning they have had their primary shots.

So far, just 35.3 million Americans have had the updated COVID booster that targets the original virus and the omicron variants, equal to 11.3% of the overall population.