NEWYou can now listen to Fox News articles!

Christina Haack traded winter layers for a bikini and a tropical getaway.

The HGTV star shared a series of vacation photos on Instagram from Kapalua, Hawaii, where she spent time soaking in ocean views and warm weather alongside boyfriend Chris Larocca.

Haack posed poolside with Larocca, wearing a white bikini top paired with a matching wrap skirt. She accessorized with oversized sunglasses and a purple lei as rows of pool loungers and palm trees framed the scene behind her.

Larocca stood beside her in a black T-shirt, white shorts and flip-flops as the couple smiled for the camera.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

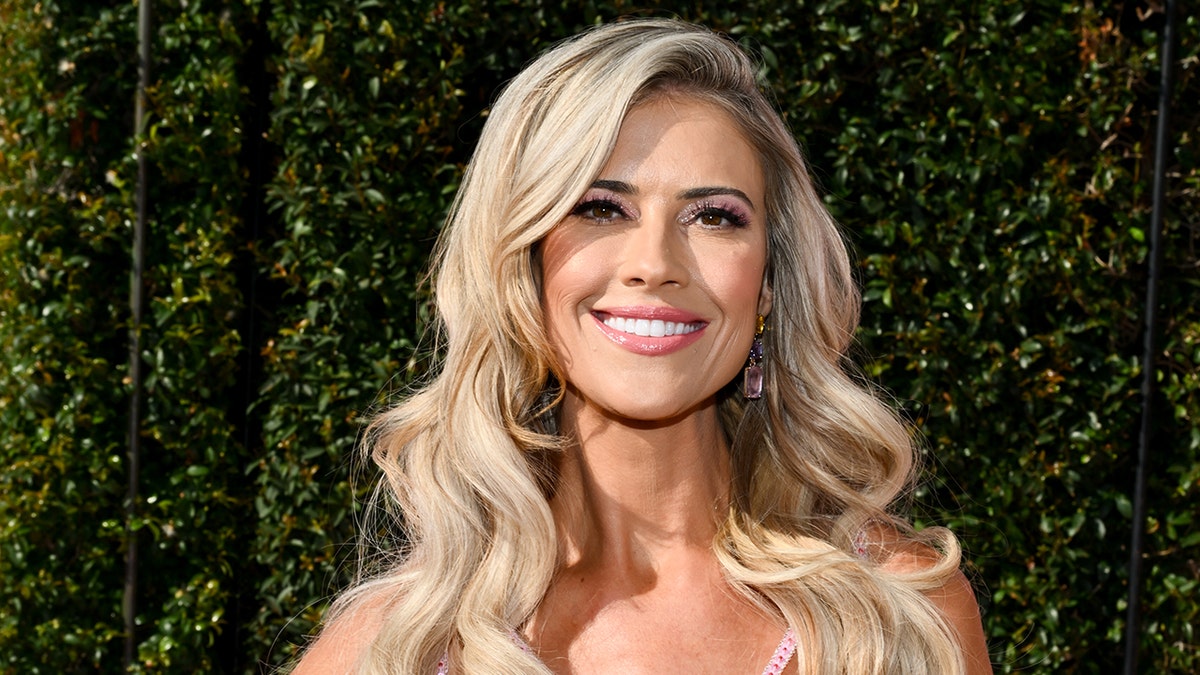

Christina Haack poses poolside with boyfriend Chris Larocca during a Hawaii vacation in Kapalua. (Christina Haack/Instagram)

The 42-year-old mother of three shared a close-up selfie while lounging with a drink in hand, smiling broadly as she wore the same white bikini and lei.

Haack captioned the post, “Aloha 2026. Hands down my fav January yet. 🤍🌸” The couple enjoyed a romantic getaway, and Haack shared a glimpse of the stunning views with her followers.

Christina Haack smiles in a close-up selfie while relaxing during her Hawaiian getaway. (Christina Haack/Instagram)

Before heading to Hawaii, the couple bundled up for a blended-family winter trip to Park City, Utah.

In one photo from the New Year’s trip, Haack posed alongside ex-husband Tarek El Moussa, his wife Heather Rae El Moussa and boyfriend Chris Larocca as the group participated in après-ski activities. The foursome smiled for the camera while bundled in winter layers, marking the holiday together despite lighter-than-expected snowfall.

Haack acknowledged the conditions in the caption, joking that it was “the saddest amount of snow” she had seen in Park City, while noting that the blended family still made the most of the trip.

Christina Haack, Chris Larocca, Tarek El Moussa and Heather Rae El Moussa during a trip to Park City, Utah. (Christina Haack/Instagram)

KYLIE JENNER, BRITTANY ALDEAN AND MORE STARS SHARE SIZZLING HOLIDAY VACATION LOOKS

Another image from the post focused on the children, showing Haack’s 6-year-old son Hudson, whom she shares with ex-husband Ant Anstead, posing with her and El Moussa’s son Brayden, 10, along with Tarek and Heather Rae El Moussa’s 2-year-old son, Tristan. The kids appeared bundled against the cold as the snowy mountain landscape stretched out behind them.

The group’s vacation comes as Haack and Heather Rae El Moussa continue to collaborate professionally. The two star together on HGTV’s house-flipping competition series “The Flip Off,” which follows the women — alongside Tarek El Moussa — as they compete to see which couple can achieve the biggest profit renovating homes. The series was renewed for a second season set to air in 2026.

Despite their complicated history, Haack and El Moussa have embraced a collaborative blended-family dynamic, frequently sharing moments from group trips and holidays while continuing to work together on television.

Christina Haack and Tarek El Moussa’s children during a trip to Park City, Utah. (Christina Haack/Instagram)

Haack’s Hawaii and Park City trips come as the HGTV star continues to navigate a highly public personal life that has unfolded alongside her television career.

Haack first rose to prominence alongside former husband Tarek El Moussa, whom she married in 2009 after the two met while working as real estate agents in California. The pair later starred together on HGTV’s hit series “Flip or Flop,” building both a business and a family before their relationship ended.

Despite their split, Haack has spoken candidly about how her relationship with El Moussa has evolved over time. During an appearance on SiriusXM’s Radio Andy in January 2025, she reflected on how he has changed since their marriage.

“He’s way different,” Haack said. “He’s much more calm. Thank God for everybody. And I think he wants to make his relationship work.”

Christina Haack, Tarek El Moussa and Heather Rae El Moussa star together on HGTV’s house-flipping competition series “The Flip Off.” (Phillip Faraone/Getty Images for HGTV)

Haack also addressed her dynamic with El Moussa’s wife, Heather Rae El Moussa, noting that the two developed a strong working relationship while filming together.

“I actually really like her,” Haack said. “She’s a hard worker, she puts up with Tarek and she’s a great stepmom.”

HGTV STAR CHRISTINA HAACK BREAKS DOWN HOW SHE STAYS CLOSE FRIENDS WITH BOTH HER EX-HUSBANDS

After her divorce from El Moussa was finalized in 2018, Haack married British TV personality Ant Anstead. The former couple welcomed a son together before announcing their separation in 2020 and finalizing their divorce the following year.

Haack later married real estate agent Josh Hall in October 2021, a relationship that ended in a contentious split, with the divorce not finalized until May 2025. Speaking openly on Radio Andy, Haack detailed the status of the divorce proceedings back January 2025.

Christina Haack has three children from her previous marriages. (Michael Buckner/Getty Images)

LIKE WHAT YOU’RE READING? CLICK HERE FOR MORE ENTERTAINMENT NEWS

“Not even close,” she said when asked if the couple had reached a settlement. “We’re going to be going to trial I hear.”

She also confirmed hiring prominent divorce attorney Laura Wasser during the process.

“Yeah, it’s not cheap,” Haack said.

Amid the ongoing legal battle, Haack confirmed in February 2025 that she had moved on with current boyfriend Chris Larocca. Since then, she has shared glimpses of their relationship through social media and blended-family gatherings.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP