An analyst predicts a further Ethereum price retrace below $3,000 due to thin support levels, as the asset declined 6% in 24 hours.

Naga Avan-Nomayo

Source link

An analyst predicts a further Ethereum price retrace below $3,000 due to thin support levels, as the asset declined 6% in 24 hours.

Naga Avan-Nomayo

Source link

Internet Computer’s token price reached $17 today, its highest in two years.

The price increase represents a 500% increase from its lowest price just six months ago. The network reached three billion blocks today, indicating a high activity level and robustness, reflecting its capacity to handle transactions and interactions efficiently.

According to CoinMarketCap, the token’s daily trading volume surged 126%. ICP’s surge reflects growing investor interest and confidence in the token, contributing to its price increase.

The network also recently rolled out ckBTC, a digital asset mirroring Bitcoin. The new digital asset allows Internet Computer to create solutions incorporating Bitcoin transactions, with ckBTC already securing over $12 million in total value locked (TVL).

The renewed interest in ICP is also driven by the network’s experimental integration of AI technologies. The network revealed the world’s first blockchain-based AI smart contract, which potentially signifies that AI has become a core component of web3 developments. The Internet Computer network now enables developers to craft AI-powered applications.

AI-based tokens have surged throughout this bull market, fueled by the latest developments and the introduction of next-gen technologies. Worldcoin, a venture of OpenAI CEO Sam Altman, has rallied over 400% since last year.

Mohammad Shahidullah

Source link

Bitcoin’s price tumbled to a weekly low of $50,664 on Feb. 21, narrowly avoiding massive liquidations; on-chain data analysis pinpoints the likely causes of the recent pullbacks.

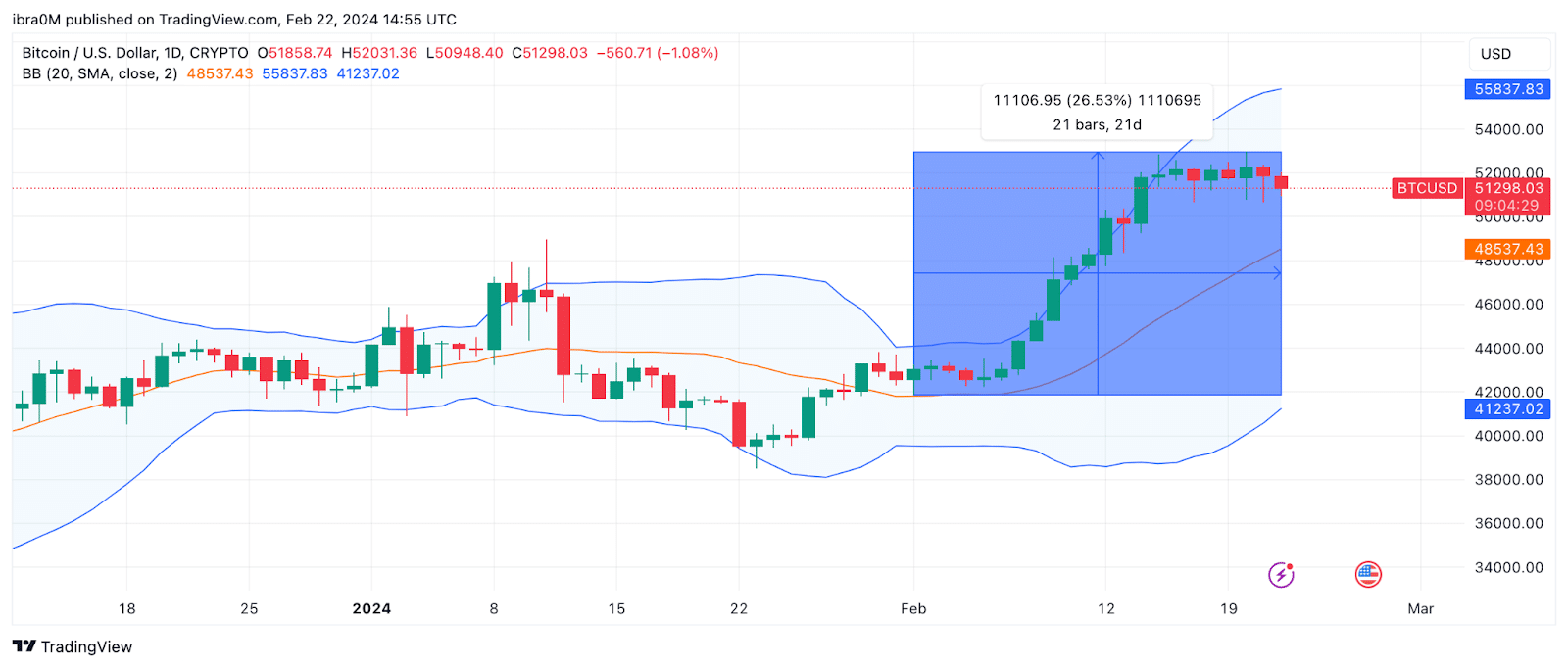

After a remarkable 27% February uptick that saw Bitcoin (BTC) hit a 3-year peak of $52,985 on Feb. 20, Bitcoin is struggling to maintain momentum.

With miners ramping up profit-taking ahead of the upcoming halving event, a decline in ETF inflows threatens to scuttle the BTC price rally.

Bitcoin price dipped $50,664 on Feb. 21, sparking concerns of widespread liquidations as the bears looked to break below $50,000 for the first time since the Valentine’s Day rally. Market data shows the Bitcoin miners’ selling trend, and a slight blip in ETF inflows this week contributed to the pullback.

Bulls have managed to stage an instant rebound toward $51,500 at press time on Feb. 22, but a closer look at the on-chain data trail suggests the bull rally is not yet back on track.

Cryptoquant’s miner reserves metric monitors real-time balances held by BTC miners. It shows that BTC validators hold a cumulative balance of 1,824,201 BTC as of Feb. 22, a 160,000 BTC decline from the balances held on Jan. 31.

Valued at about $51,500 per coin, the recently-traded 160,000 BTC are worth approximately $8.2 billion. Notably, the chart illustrates how the miners had intensified the selling frenzy by $102 million after BTC’s price hit a local peak of $52,858 on Feb. 15.

Typically, a sell-off among miners indicates a bearish sentiment among a significant bloc of stakeholders. With approximately 10% of the total circulation supply in their custody, the BTC miners significantly influence Bitcoin price action.

Without a commensurate demand surge, it is unsurprising that the latest wave of miners’ sell-off has coincided with Bitcoin prices tumbling to a weekly low.

The BTC price rally in the first half of February was attributed to the Bitcoin ETF making record-breaking inflows.

Ahead of the ETF’s weekly trading opening on Feb. 19, BTC hit a new 2024 peak in the early GMT hours as strategic investors looked to front-run potential gains if the ETFs pick up the buying trend from where they left off in the previous week. But that has not happened.

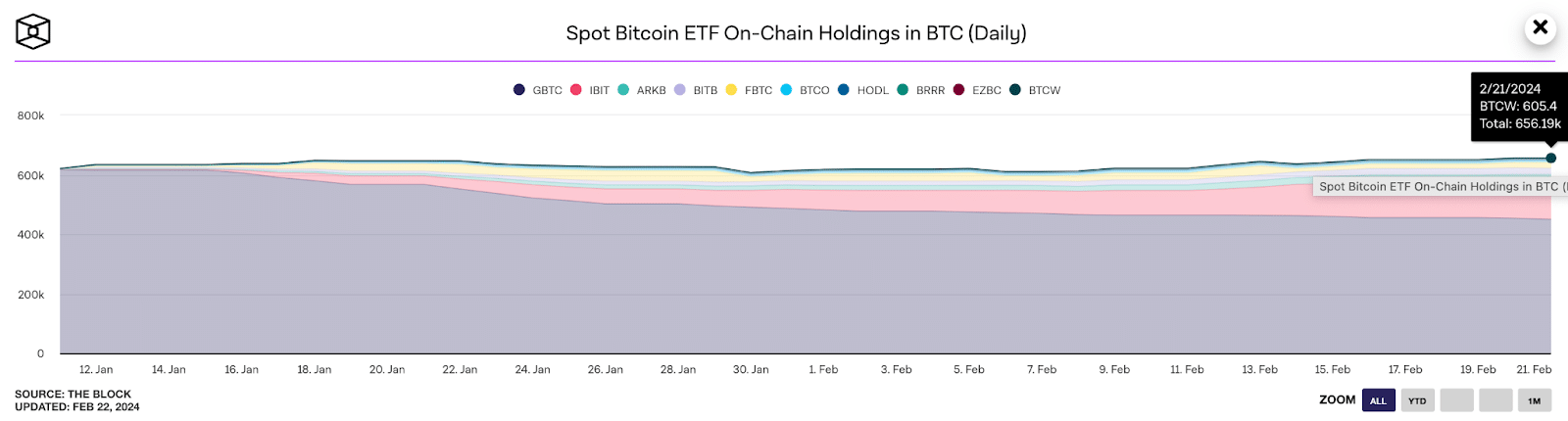

For context, TheBlock’s ETF on-chain flow chart above shows historical changes in BTC balances held by Bitcoin ETF.

Unlike last week’s 17,480 BTC accumulation, Bitcoin ETFs have slowed the buying trend by 73%, acquiring only 4,680 BTC between Feb. 19 and Feb. 22.

In summary, there has been a decline in ETF demand this week, while miners are intensifying their selling spree ahead of the halving.

The two critical factors have been pivotal to BTC price tumbling towards $50,000 rather than breakout towards a new all-time high above $60,000 as the bulls anticipated, with the rapid accumulation ahead of the ETF trading hours on Feb. 19.

Amid dwindling ETF demand and miner’s mounting selling frenzy, BTC price looks likely to hold above $48,500 if it loses the $50,000 psychological support level in the short term.

The Bollinger Band technical indicator further underscores this outlook by providing insights into potential support and resistance levels for Bitcoin’s short-term price movement.

With the 20-day Simple Moving Average (SMA) price currently at $48,560, it is a crucial support level below the $50,000 threshold.

This suggests that if the price were to drop below $50,000, the $48,560 level may act as a significant area of support, potentially halting further downward momentum.

If bullish momentum prevails and Bitcoin reclaims the $53,000 level, the upper Bollinger band indicates that the bears may emerge again, establishing a sell-wall at around $55,830.

This signifies a key resistance level that could impede upward movement, potentially leading to a consolidation phase or a pullback.

Given these technical dynamics, strategic swing traders may consider setting short-term stop-loss orders around the $45,000 area to manage risk in case of a breakdown below the $48,560 support level.

Conversely, bullish traders may target take-profit orders around the $55,000 mark, anticipating potential resistance near $55,830 and aiming to capitalize on any further upward movement.

Ibrahim Ajibade

Source link

Ethereum price managed to hold the $2,200 support as the crypto market downturn intensified this week, on-chain signals highlight rising whale demand.

On Jan. 22, the crypto market suffered significant bearish headwinds as Bitcoin (BTC) prices wobbled below $40,000 for the first time in 50 days. At press time on Jan. 25, the global crypto market capitalization has shrunk 7%, with $108.5 billion in valuation wiped out within the weekly timeframe.

Losing 5% in Ethereum (ETH) price has maintained a relatively more resilient performance than the industry average between Jan. 22 and Jan. 24.

Ethereum price has managed to keep losses below the 5% threshold this week, while Bitcoin and the global crypto market cap shrunk by up to 7%, respectively, before making a mild rebound. On-chain data trends suggest that the rising level of whale trading activity recorded on the Ethereum network this week has been pivotal to ETH’s resilient price performance.

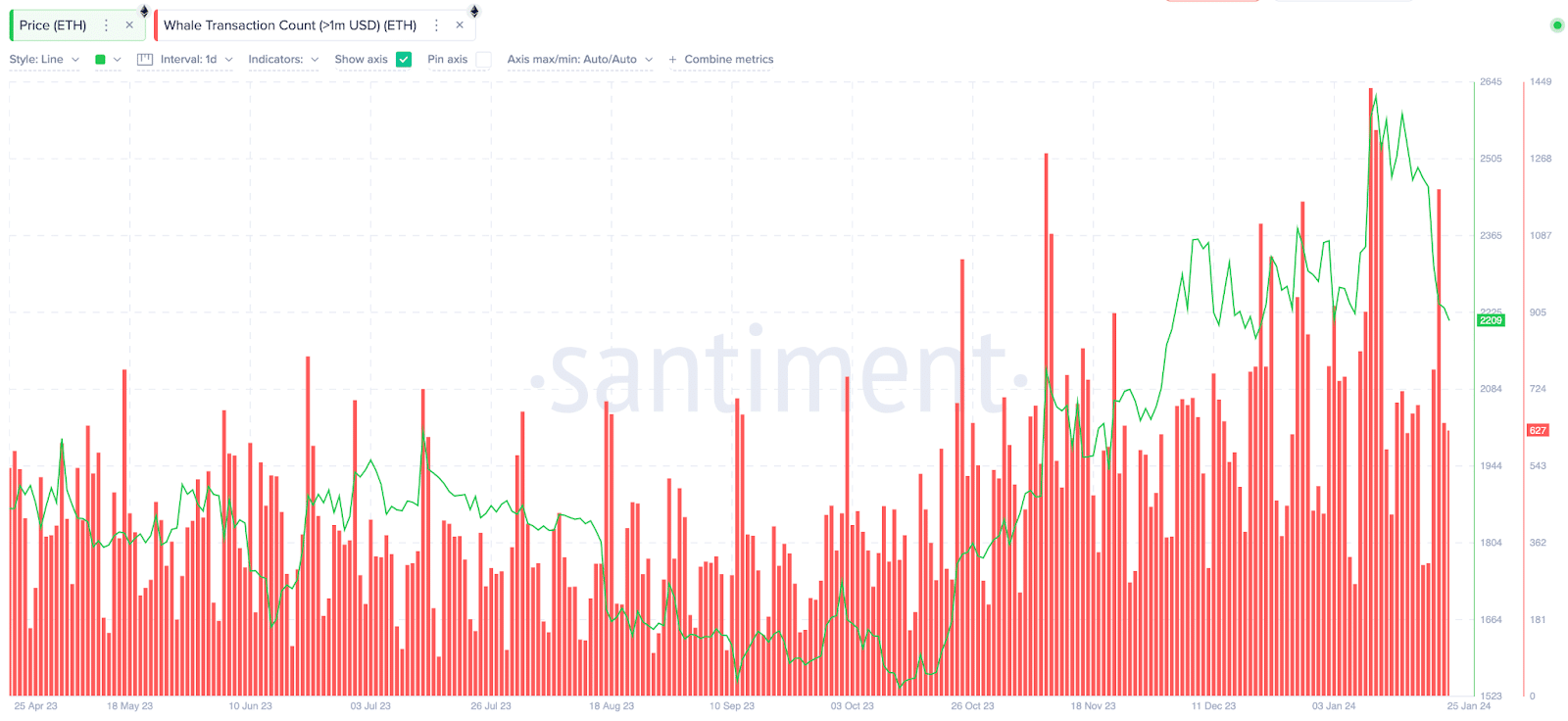

Santiment’s Whale transaction count metric tracks the daily number of transactions involving a particular cryptocurrency that exceeds $100,000.

On Jan. 23, the Ethereum Whale Transaction Count surged above 1,190. A closer look at the chart below shows this was the highest recorded since the ETH price raced to a 20-month peak of $2,690 on Jan. 11.

Corporate entities accumulate ETH at significantly high volumes despite the broader market retreat. This could be attributed to investors and fund sponsors looking to acquire Ethereum ahead of a looming ETH spot ETF verdict.

During market downtrends, an increase in whale transactions impacts the price of a crypto asset positively in two major ways. Firstly, it provides market liquidity, enabling bearish panic sellers to execute their trades at favorable prices. It also reinforces confidence among small-scale retail traders.

These factors have played a vital role as ETH battles to hold above the $2,200 support level amid market-wide sell-offs this week.

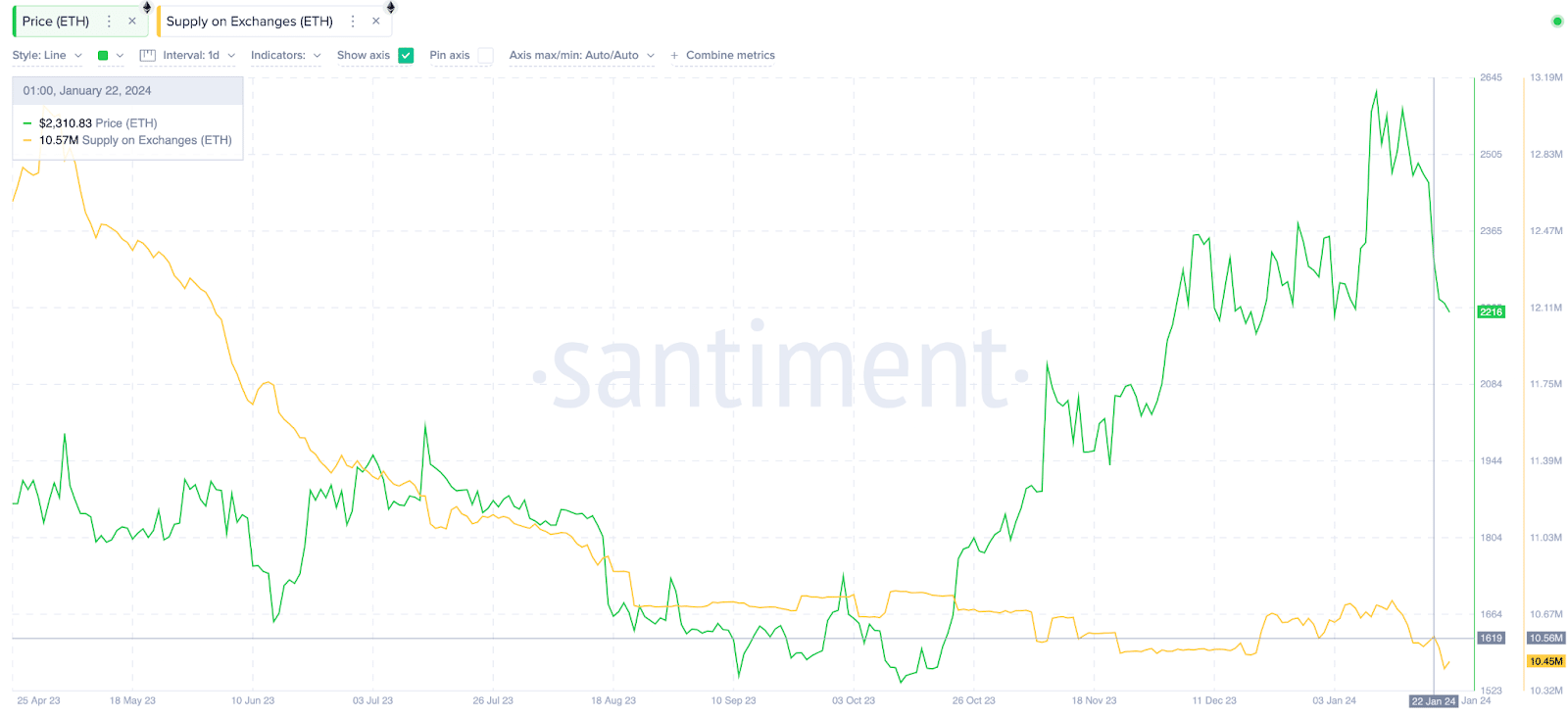

Furthermore, Ethereum has also recorded a steady decline in exchange reserves this week, which could be linked to the rise in whale activity.

Corporate entities and whales are known to be value investors who tend to hold for longer periods. Unsurprisingly, the rising volumes of whale transactions on the Ethereum network in recent months have coincided with a rapid decline in supply deposited on exchanges.

At the start of the week on Jan. 22, Ethereum supply on exchanges stood at 10.5 million ETH. But interestingly, that figure has dropped sharply to 10.4 ETH by Jan. 25.

Effectively, this means that investors have shifted 150,000 ETH worth approximately $330 million from exchanges and trading platforms into long-term storage or staking contracts.

Despite bearish headwinds, Ethereum Supply on Exchanges dropped by 150,000 ETH in the last four days, signaling a dominant preference for long-term holding and passive income staking among current holders.

Notably, Ethereum exchange supply has been in a downtrend since the Proof of Stake (PoS) transition in May 2023, a move that has coincided with an extended period of price uptrend.

As the downward trend in exchange supply persists, fewer ETH coins are readily available to be traded in spot markets. This appears to have decelerated the selling pressure on Ethereum this week relative to the broader altcoins market. Combined with the steady rise in whale transactions, Ethereum price is in a prime position to defend the $2,000 territory.

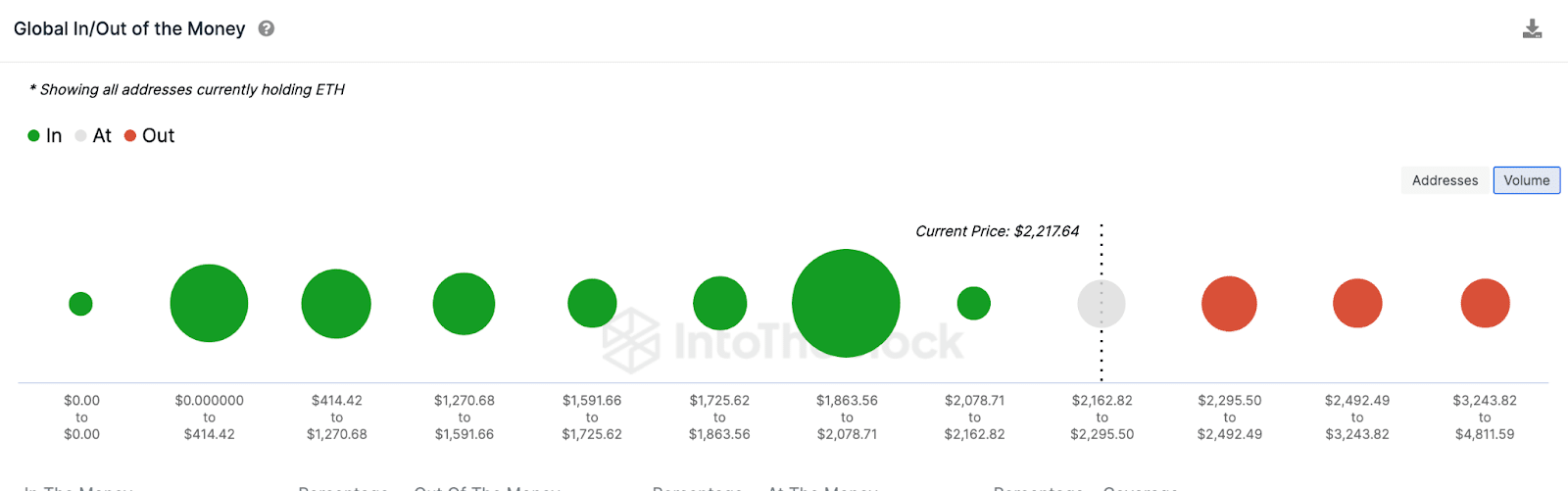

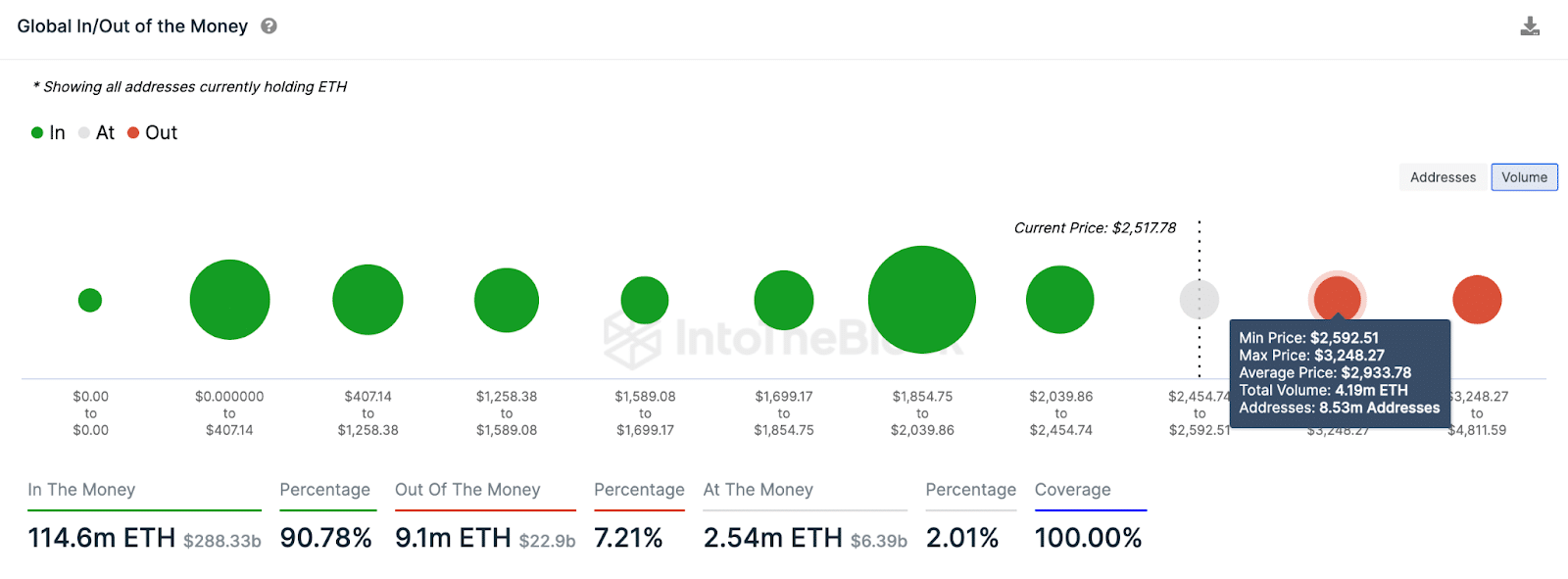

IntoTheBlock’s in/out of the money around price data, which groups all existing ETH holders by their entry prices, also affirms this stance.

It shows that 8.3 million addresses, the largest cluster of ETH holders, had acquired 46.5 million ETH at the maximum price of $2,078. If Ethereum price slides toward $2,100, many of these holders could make frantic covering purchases to defend their positions to avoid slipping into net-loss positions. This could effectively trigger an instant Ethereum price rebound.

On the upside, Ethereum bulls could overturn the bearish pressure if it reclaims the $2,500 territory. But this looks unlikely within the current market dynamics. As seen above, a significant cluster of 3.7 million addresses had acquired 7.1 million ETH at an average price of $2,400.

If they engage in mild profit-taking as prices hit their break-even point, Ethereum could slide into another correction phase.

Ibrahim Ajibade

Source link

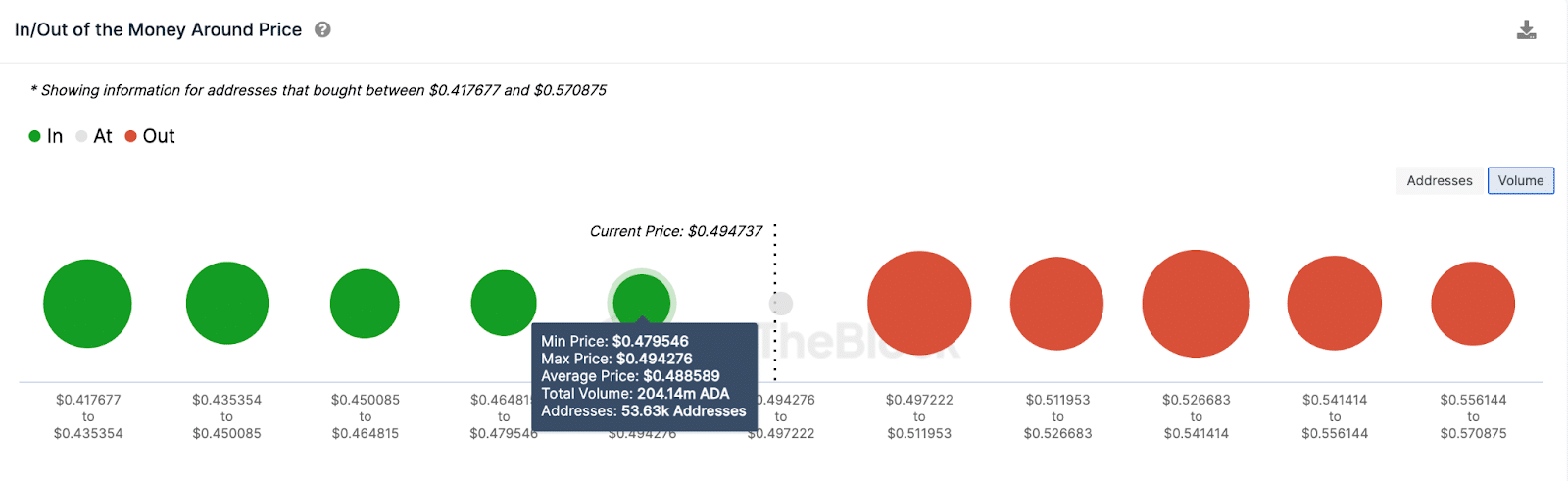

Cardano price wobbled below the vital $0.50 level in the early hours of Jan. 19, on-chain data trail reveals key details surrounding the price downtrend.

Cardano price entered sizable gains in the first 10 days of January as investors gradually shifted focus from Bitcoin (BTC) to the altcoin markets. However, a wave of bearish headwinds and widespread market liquidations saw ADA prices tumble below $0.50 on Jan. 19.

What are the factors behind the current ADA price downtrend, and what can traders anticipate in the coming days?

Cardano’s price dropped below $0.50 on Jan. 19, down 25% from its peak of $0.62 on Jan 11. But looking past the price charts, the on-chain data trail reveals that the recent price downtrend could be attributed to a significant sell-off among Cardano whale investors.

Santiment whales’ wallet balances chart tracks the real-time balances in wallets holding at least $100,000 worth of a cryptocurrency.

Cardano whales holding 1 million and 100 million coins held a cumulative balance of 18.3 billion ADA as of Jan. 16. Since then, they have gone on a selling spree. Between Jan. 17 and Jan. 19, they have sold 240 million ADA, cutting their balances down to 8.1 billion ADA.

Valued at the current price of $0.50, the Cardano whales have sold off LINK tokens worth $120 million in the last three days. Singularly, a decline in balances held by whale investors is interpreted as a bearish signal.

As ADA, worth $120,000, hit the market, Cardano’s price slumped. If it persists, the whales’ outsized sell-orders could crowd out bullish retail traders, putting ADA price under intense downward pressure.

From an on-chain standpoint, the whales’ selling frenzy appears to be a major drive behind the ongoing Cardano price downtrend. Without a significant surge in market demand, ADA price looks set for further downsizing.

However, the bulls could mount a significant buy wall at the $0.48 area. According to IntoTheBlock’s IOMAP data, 53,600 addresses had acquired 204 million ADA at a minimum price of $0.48.

But if bears can break down this initial buy-wall, it could trigger another wave of panic sell-off, pushing prices toward $0.45.

On the flip side, the bulls could invalidate this negative forecast, if Cardano price can breakout $0.60 again. But as depicted above, the looming sell-wall at the $0.51 area could prove daunting.

Ibrahim Ajibade

Source link

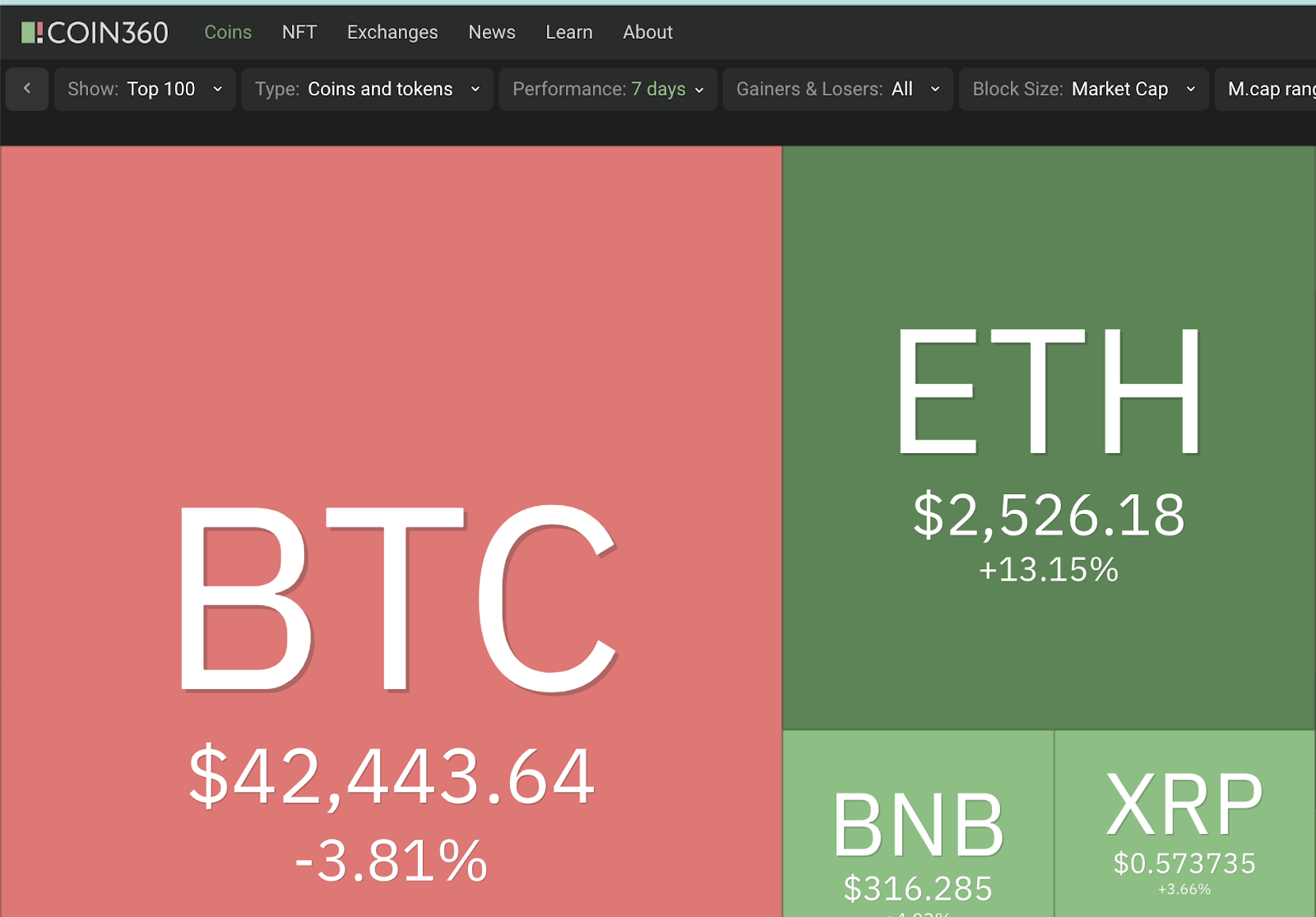

Ethereum is outperforming Bitcoin, driven by market anticipation of potential spot ETH ETF approvals.

Ethereum (ETH) is showing signs of outperforming Bitcoin (BTC) in the midterm, according to QCP Capital’s latest market update report. This shift in market dynamics is linked to the anticipation of potential approvals for spot ETH ETFs.

Recently, the U.S. Securities and Exchange Commission (SEC) approved multiple spot Bitcoin ETFs, following which Ether’s value saw an uptick of over 5%. In contrast, Bitcoin’s price experienced a decline of more than 6% during the same period.

QCP Capital analysts project that Ethereum’s upward trajectory is likely to persist, especially with the narrative shifting toward the likelihood of ETH spot ETF approvals. Furthermore, the report highlights a notable ETH/BTC exchange rate increase, rising from 0.05 to 0.06 within a week.

Upcoming significant events in the crypto space, such as Bitcoin’s halving in mid-April and potential spot Ethereum ETF approvals starting from May, are also expected to impact market trends.

The potential for a spot Ether ETF gained further momentum following remarks from BlackRock CEO Larry Fink, who acknowledged the value of such a product in the United States. BlackRock, the world’s largest asset manager, had previously filed with the SEC for a spot Ethereum ETF in November, following its application for a spot Bitcoin ETF in June.

The percentage of Ether’s circulating supply in profit has also risen over the past week, reaching a multi-year high of 91.8%. Bitcoin has decreased to 86.2%, indicating growing investor confidence in Ethereum compared to Bitcoin.

Bralon Hill

Source link

Ethereum price has prodded above $2,500 on Jan. 15, further stretching its post-ETF approval lead over BTC, on-chain data trends provide vital insights into the underlying drivers.

‘Buy-the-rumor, sell-the-news’ is a popular trading strategy where speculators make acquisitions ahead of a material news event in hopes of selling at a profit when news is confirmed. BTC speculators capitalized on this trading strategy to earn historic gains in the build-up to the spot Bitcoin ETF approval verdict. Vital on-chain data trends now reveal that Ethereum (ETH) has also begun to show early signs of a similar phenomenon.

The Bitcoin spot ETF approval quest suffered multiple setbacks recently, with the U.S. Securities and Exchange Commission (SEC) citing market manipulation, oversight, and liquidity concerns.

However, on June 15, 2023, things turned positive when BlackRock (NASDAQ: BLK) officially filed for a spot Bitcoin ETF with the SEC. With over $13 trillion in assets under management (AUM), BlackRock is one of the largest asset management firms in the world.

BlackRock’s entry into the fray raised optimism about Bitcoin derivatives and effectively spun the rumor mill.

As of June 15, Blackrock’s official filing date, Bitcoin price was trading around $24,800. Within the first two weeks, speculators who aped-in early on the rumor sent Bitcoin price rallying 25% to hit $30,000 for the first time in 12 months, dating back to June 2022.

Between June 15 and Jan. 11, when the SEC eventually confirmed the news, Bitcoin price nearly doubled, moving from $24,800 to a local top of $48,890. This effectively sent speculators who bought the rumor after BlackRock’s filing into 97% profit.

Unsurprisingly, the wave of profit-taking that ensued in the aftermath of the SEC approval has sent BTC price spiraling to 15% toward $42,500 as of Jan. 15. This affirms the full cycle of the buy-the-rumor, sell-the-news cycle on the spot Bitcoin ETF narrative.

With the Bitcoin ETF now at a conclusion, investors have switched focus to Ethereum. BlackRock had filed for spot Ethereum ETF on Nov. 16. In a recent interview on Jan. 12, BlackRock CEO Larry Fink re-emphasized the value of an Ethereum spot ETF as an asset class.

While the BTC price has dropped by 3.8%, Ethereum has increased by 13.5% in the past week. In effect, ETH price has outperformed BTC by approximately 10%.

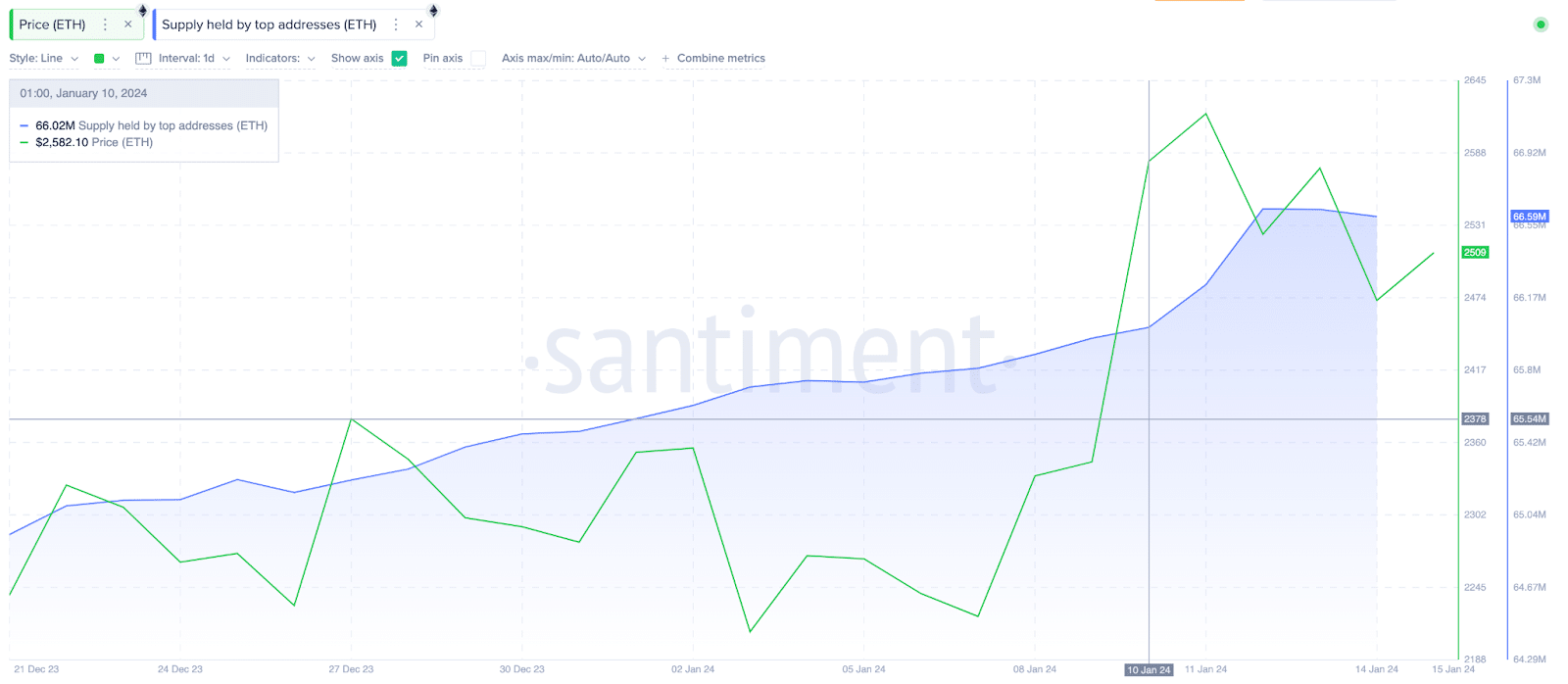

Interestingly, in addition to this divergent interplay between ETH and BTC price movement over the past week, strategic on-chain movements from Ethereum whales since Jan. 11 also corroborate early signals of the buy-the-rumor strategy playing out in ETH markets.

On paper, Ethereum price has outperformed BTC by 10% in the past week, per Coin360 data. Looking beyond the price charts, a vital on-chain indicator has revealed that ETH’s performance has been boosted by corporate entities and high net-worth investors who increased their buy pressure shortly after the Bitcoin ETF approval verdict.

Santiment’s ‘supply held by top addresses’ metric shows a real-time snapshot of the aggregate balances currently controlled by the largest wallets in a crypto ecosystem.

The latest readings show that the top 1,000 Ethereum wallets held just 66 million ETH in cumulative balances as of Jan. 10.

But since the focus switched to spot Ethereum ETF, strategic ETH investors have entered a buying spree, adding 570,000 ETH to bring their balances to 66.5 million ETH at press time on Jan. 15.

Valued at the current price of $2,540, the Ethereum ‘top holder supply’ chart above illustrates that the top 1,000 investors have added ETH coins worth $1.4 billion to their holdings in the last four days alone.

Intuitively, when the largest stakeholders increase their balances rapidly by hundreds of millions, it is interpreted as a strong bullish signal. Firstly, the buying trend among the largest stakeholders increases overall confidence within the cryptocurrency’s ecosystem.

Given that large holders are often likely to hold longer than small-holder swing traders, this accumulation puts ETH in a prime position to score historic gains in the weeks ahead.

But more importantly, the timing of the recent buying spree suggests that investors are buying the rumor with optimism that Bitcoin’s ETF approval will increase the likelihood that ongoing ETH applications will also obtain a positive verdict from the SEC.

The Ethereum Dominance (ETH.D) chart further affirms this stance. Ethereum has cornered 14% more market share between Jan. 10 and Jan. 15, while Bitcoin price has declined at a nearly identical 15%.

This suggests that speculative traders are selling the news on BTC, rapidly buying the rumor ahead of a possible spot ETH ETF approval verdict.

From the data points analyzed above, the large holder wallets’ accumulation and the rising ETH dominance suggest that the buy-the-rumor strategy is now widely in play in the Ethereum markets.

Given that Bitcoin had scored 97% gains in the build-up to the spot ETF approval verdict, a similar performance could put ETH in line to reach $5,000 in the instance of a positive outcome.

But in the short term, the ETH bulls will have to scale the $2,900 resistance to keep the momentum going. IntoTheBlock’s Global In/Out of the Money chart, which highlights potential support/resistance points using the historical entry prices of current ETH holders, also supports this ETH prediction

It shows that with ETH prices currently trading above $2,500, 91% of all ETH holders are now in profit positions. With the ETH ETF approval process on the front burner, these holders could increasingly become less inclined to sell.

However, the 8.5 million Ethereum holders who bought 4.1 million ETH coins could pose significant resistance if they book early profits as prices approach their break-even point.

The bears could negate this bullish prediction if the ETH price unexpectedly retreats below $2,000. However, 7.9 million investors acquired 43.4 million ETH at the maximum price of $2,039.

Considering this is the largest cluster of ETH current holders, they will likely have enough in the tank to overturn such bearish pressure.

Ibrahim Ajibade

Source link

Tron just took the throne, beating Ethereum and Bitcoin with the most daily active addresses, with 1.4 million addresses active on Jan. 8.

According to Token Terminal data, Tron (TRX) is followed by BNB Chain (BNB) with its 1.36 million, Polygon (MATIC) with under 600,000 Bitcoin (BTC) with just under 400,000 and Ethereum (ETH) with 362,000.

The significance of daily active addresses (DAAs) as a metric extends beyond mere numbers; it offers a multifaceted insight into the vitality and user engagement within a blockchain network. When discussing Tron’s recent achievement in surpassing Ethereum and Bitcoin in terms of DAAs, it’s crucial to understand the implications of this metric.

Daily active addresses represent the number of unique addresses actively conducting transactions on a network within a 24-hour period. A high number of DAAs could suggest robust network utilization but also imply that the blockchain is experiencing growth and adoption.

Still, it is hard to judge how much of this activity is automated since bots sending transactions and single users controlling many addresses also count as daily active addresses — this is why referring to this metric as “daily active users” is not entirely correct.

Still, the DAAs reflect the engagement level of users with the blockchain. An increasing count signals that more people consistently find value in the network’s services. This engagement is critical for the blockchain’s long-term viability and growth.

The health and stability of a network can also be gauged through DAAs. A network that consistently handles a high volume of transactions efficiently demonstrates its capability and reliability, crucial factors for retaining and attracting new users.

Adrian Zmudzinski

Source link

The price of Powerledger has jumped over 40% this week, accompanied by growing social media chatter surrounding the energy trading platform.

According to data from Santiment, Powerledger (POWR) was the second most mentioned cryptocurrency on social media over the past 24 hours. Nearly 1% of all crypto discussions on social media over the 24 hours by press time centered around Powerledger, with 57% conveying positive sentiment, 33% negative sentiment, and the rest being neutral.

This spike in attention comes on the heels of Powerledger unveiling xGrid 2.0, an upgrade to its energy exchange network. The new version touts a minimalist interface, enhanced tracking features, and improved flexibility for energy trading — but this reveal does not seem important enough to explain the surge on its own.

Powerledger leverages blockchain technology to facilitate peer-to-peer energy transactions. The platform creates a decentralized market where individuals can buy and sell excess solar, wind, or other renewable energy with each other.

By removing middlemen from the equation, Powerledger promises reduced costs and democratization of clean energy generation and distribution. The Australia-based startup has already seen its platform implemented in various pilot projects from Japan to the United States. However, as an emerging player in the blockchain sector, Powerledger still has its fair share of obstacles and uncertainty ahead.

Adrian Zmudzinski

Source link

Bitcoin SV continues its rally, crossing the $100 threshold for the first time since February 2022.

This significant uptick in price, representing an increase of over 102% within a week, is largely attributed to growing interest and trading activities in the South Korean market. The Korean cryptocurrency exchange Upbit has been a focal point of this heightened activity around BSV. Today, Upbit recorded a substantial $275 million in BSV trading volume.

The price jump follows an even more impressive trading day on Boxing Day last week, where the exchange saw over $500 million in Bitcoin SV transactions. The trend is not limited to Upbit, as OKX has also experienced a significant rise in the token’s trading, with today’s volume exceeding $47.5 million. BSV’s trading volume has increased by over 300% in the last 24 hours.

Bitcoin SV, short for Bitcoin Satoshi Vision, is a cryptocurrency that emerged from a hard fork of Bitcoin Cash in November 2018. It aims to stay true to the original vision of Bitcoin as outlined by its pseudonymous creator, Satoshi Nakamoto.

Advocates of Bitcoin SV emphasize its scalability, stability, and security, aiming to make it an enterprise-level blockchain and peer-to-peer cash system. Bitcoin’s recent rally and the prospects of spot ETF approval by the SEC drive interest in BSV.

Mohammad Shahidullah

Source link

A Crypto Banter YouTube channel analyst sees the crypto market cycle accelerating into an intense altcoin season soon.

In a YouTube video posted on Dec. 28, the analyst laid out his perspective on where he sees the market heading in the near future.

“We are at the stage of a bull market party,” the analyst stated, referring to the gains seen across crypto assets over the past few months. However, he believes there will be two major legs to this bull run — the first taking us to new all-time highs for Bitcoin (BTC) and major altcoins, then a cooldown period, followed by a breakout above those all-time highs later this year.

The analyst sees “altcoin season” accelerating rapidly now, saying, “We’re getting to the point where things are speeding up fast.” He attributes this to the slowing momentum in Bitcoin, allowing altcoins to “catch up fast.”

With Bitcoin dominance dropping and money flowing out from Bitcoin into altcoins, the analyst thinks the market will see “the biggest alt surge to Bitcoin that we’ve seen in a very long time” coming. His target is for Bitcoin dominance to fall to the 48-49% level in the near future.

It’s a phase of when altcoins really rally up quickly, and then I do think there’s a cool down going into the possible halving.

Crypto Banter

Rather than exiting positions completely, the analyst advises rotating profits into Bitcoin and stablecoins to weather any potential market correction while remaining invested for continued upside.

“Don’t be afraid to bank a whole bunch of cash,” he suggests, noting there may be a four-to-six-week period of consolidation before the next leg higher.

Regarding key levels, the analyst is watching to see if Bitcoin can break through resistance around $46,000-$48,000. Meanwhile, he has a short-term target of $2,500 for Ethereum (ETH), beyond which he believes ETH could rapidly rally to $3,500.

Adrian Zmudzinski

Source link

A crypto analyst behind the LuckSide Crypto channel predicts Cardano will make a major price move within days based on technical signals he sees converging in the charts.

In his Dec. 27 YouTube video, the analyst laid out a technical analysis predicting that the Cardano (ADA) cryptocurrency will make a decisive bullish or bearish move in the next few days.

This is the moment of truth for ADA. It needs to make a decision here about whether obviously it’s going to move to the upside or to the downside.

LuckSide Crypto

The analyst pointed to converging signals in ADA’s price charts showing a build-up toward an explosive price swing one way or the other.

Specifically, the analyst highlighted a large price gap between resistance around the $0.60 to $0.67 range, where ADA has repeatedly run into selling pressure recently, and support around the $0.40 level. In between lies open air with little price history.

According to the analyst, ADA could surge upward to test resistance around $0.70 or break downwards and “come down and test” the key support level around $0.40 before the end of December. The analyst sees signs of strength in the market that make him believe an upward breakout is more likely.

For example, ADA holds key support levels and moving averages, while broader metrics like Bitcoin’s (BTC) price and volatility show stability. Additionally, the analyst believes the crypto market is building momentum before Bitcoin’s closely approaching biennial “halving” event in mid-2024, which has historically sparked sharp rallies.

Still, the analyst acknowledged the possibility of surprise events that could alter the market’s course. And he said a drop toward $0.40 could present “more opportunities to buy cheaper.”

The analyst concluded that ADA will decide which direction it is heading in the next few days.

Adrian Zmudzinski

Source link

A crypto analyst from the More Crypto Online YouTube channel said Cardano is stuck in a trading range and could continue moving sideways.

In a Dec. 26 video, the analyst projected that Cardano (ADA) token will likely continue trading sideways in the short term but could be gearing up for a larger price move.

“ADA continues to be in this sideways range, hasn’t broken the structure,” the analyst said, referring to the trading range ADA has been stuck in for the past several weeks under $0.65.

The analyst believes ADA is forming either an Elliott Wave triangle pattern or a more complex corrective pattern on its price chart. Both patterns suggest ADA is in the late stages of a correction from its November highs and could soon break out into a new trend, at this time unknown to be positive or negative.

“Normally, they break out like two-thirds into a triangle. Then you normally get a breakout,” the analyst explained, noting ADA could be close to resolving its current triangular consolidation.

However, the analyst acknowledged uncertainty around which direction ADA will break out. An upside breakout above $0.65 would indicate the triangle is complete and could foreshadow further gains, possibly up to $1. But a downside break below the support would negate the triangle and open the door for declines, the analyst said.

The analyst believes its price action will likely remain directionless until ADA resolves the triangle pattern by breaking above or below key levels.

Anything that happens between here and the support is really just noise because the fifth wave is still expected.

More Crypto Online

Still, the analyst maintains a longer-term bullish outlook, expecting an eventual fifth-wave rally after the current corrective period runs its course. But he says traders need to watch critical chart levels closely in the days ahead for the next definitive signal on ADA’s major trend.

Adrian Zmudzinski

Source link

The analyst says Solana is stuck between support at $110 and resistance at $120 as it trades in a rangebound state.

In his latest YouTube video on Dec. 26, the analyst behind the popular Cilinix Crypto channel shared his thoughts on recent price action in the Solana (SOL) market. He believes the altcoin remains fundamentally strong, but traders should remain patient amid questionable year-end trading conditions.

Speaking to his viewers, the analyst said Solana is currently rangebound between support at $110 and resistance around $120. Yesterday, Solana briefly broke above $120 but failed to hold those gains. According to the analyst, this kind of fake out is not uncommon, given lower liquidity and irregular trading activity around the holidays.

A fake out does not necessarily mean that we’re going to crash. […] Solana right now is still doing great.

Cillinix Crypto

The analyst also pointed to healthy trading volumes and open interest in Solana futures contracts as signs of ongoing strength. Looking ahead, he thinks Solana will likely see a bullish breakout above $120 or a bearish breakdown below $110 soon. He believes a drop towards $95 is possible if Bitcoin (BTC) fails to hold above $42,000. However, he says either scenario fits a longer-term bullish trajectory for Solana.

“Fundamentally, Solana is still very bullish,” he concluded, advising traders to wait patiently for a definitive breakout in either direction.

Despite recent volatility, he remains optimistic about Solana overall, citing strong on-chain activity and developer participation. But he cautions traders to consider reducing risk ahead of potential near-term downside before a longer-term move higher.

Adrian Zmudzinski

Source link

NEAR Protocol tops daily and weekly gains in the crypto market, with a 54% surge this week.

The NEAR Protocol’s native token has demonstrated a remarkable performance in 2023. The value of NEAR has soared by over 175% this year, achieving a notable increase of 20% just today, reaching approximately $3.55. This surge has elevated the market capitalization of NEAR to about $3.5 billion.

The increasing adoption of the NEAR Protocol is evident through on-chain metrics. The count of active daily wallets on the network has seen a dramatic increase of 975%, from 93,000 to over a million, from Dec. 1 to Dec. 19. In parallel, the network’s total daily transactions have risen by 170% since Dec. 3.

Analysts anticipate a surge in discussions and interest in the NEAR Protocol in the forthcoming weeks as it gains more visibility. Thanks to its lower, fully diluted valuation and arguably superior technology, NEAR is positioned for substantial growth, especially compared to rivals such as TIA.

There’s also a narrative among analysts that retail investors have maintained their interest despite venture capitalists stepping back from NEAR during the cryptocurrency downturn. This trend suggests that when institutional investors re-engage with the cryptocurrency market in future cycles, these retail investors might be able to sell their holdings at significantly higher prices.

Mohammad Shahidullah

Source link

A crypto analyst believes the smart contract oracle network Chainlink is set to “shock the crypto world” next year.

In a recent YouTube video, popular crypto analyst Lark Davis presented an optimistic forecast for the blockchain oracle network Chainlink (LINK) in 2024. While acknowledging the inherent risks of investing in cryptocurrencies, Davis — who discloses owning a significant amount of LINK — believes the project remains undervalued relative to its technology and partnerships.

Chainlink is going to shock the crypto world in 2024. […] How more people have not woken up to what has happened with Chainlink boggles the mind.

– Lark Davis

The analyst cited growing interest in Chainlink from institutional investors, evidenced by the Grayscale Chainlink Trust trading at premiums over 200% to the spot LINK price. He believes such interest stems from recognizing that Chainlink provides essential infrastructure across blockchains and crypto applications.

Specifically, Davis highlighted Chainlink’s new cross-chain interoperability protocol (CCIP) as a major development. He explained that by enabling seamless transactions between public blockchains and private networks, CCIP could unlock trillions in real-world asset value.

To that end, Davis noted nascent CCIP integrations by financial services giants DTCC, Euroclear, and SWIFT, which clear quadrillions in trades annually.

“These are the biggest and most important financial services companies in the freaking world,” he remarked.

While acknowledging potential competitors, Davis believes Chainlink’s first-mover advantage and expansive capabilities make it difficult to displace. He predicted continuing CCIP rollouts and major announcements in 2024.

Chainlink is far more than just Oracles.

– Lark Davis

An oracle in the blockchain context refers to a third-party information source that provides external data to blockchains. Since blockchains cannot access external data independently, oracles are critical bridges between off-chain data and on-chain smart contracts.

For example, a decentralized finance lending platform may need real-time price feeds of crypto assets to determine loan-to-value ratios. An oracle would provide these continually updated prices to the defi platform from external crypto exchanges. The lending protocol relies on the oracle to supply accurate and timely asset price data to function properly.

Adrian Zmudzinski

Source link

Several analysts suggest that Bitcoin’s value could skyrocket to nearly $160,000 by 2024.

This surge is anticipated due to the Bitcoin halving event and the growing excitement around potential spot ETFs in the United States.

The Bitcoin halving will effectively reduce the availability of new BTC on the market, and it has been a historical precursor to significant price rallies. The next halving is set for April 2024, and market traders seem to be factoring in its potential impact on the cryptocurrency’s value.

CryptoQuant, an on-chain analytics provider, recently told CoinDesk that Bitcoin is poised for a massive rally next year. According to their analysis, ETF approval and the impact of halving could push the leading token’s price to a minimum of $50,000.

Discussions are ongoing between several major traditional financial institutions and the SEC regarding ETFs, as many believe several applications will likely be approved together in January. Yesterday, another new application was filed by 7RCC Global, which wants to launch the first-ever environment-friendly Bitcoin ETF.

7RCC Global Inc. will primarily invest in Bitcoin while allocating a significant portion of its portfolio to carbon-credit futures. The ETF, if approved, will trade under the ticker BTCK, and crypto exchange Gemini will be its custodian.

Furthermore, there is an expectation that the U.S. Federal Reserve might reduce interest rates in 2024 in response to a decline in inflation rates. Historically, lower interest rates have spurred investments in higher-risk assets, including technology stocks and cryptocurrencies. However, there’s a cautionary note: Bitcoin prices could experience short-term volatility as recent investors grapple with substantial unrealized gains.

Mohammad Shahidullah

Source link

Crypto analyst behind the Pingu Charts channel believes that Dogecoin (DOGE) may present a buying opportunity after testing a key support level.

The analyst points out that Dogecoin (DOGE) recently found support near $0.088 after a steep sell-off. This created a V-shaped recovery, with the price bouncing sharply off the support zone.

You can see that Doge, of course, had a very nice V-shaped recovery. Of course, the bulls did come in after we were in extreme oversold condition.

Pingu Charts

The analyst believes the move back above DOGE’s short-term exponential moving averages (EMAs) is a positive sign. He views these EMAs as potential support levels for another move higher.

As long as we hold above these exponential moving averages, we are not looking for any sort of swing shorting positions, and dip opportunities are buying opportunities.

Pingu Charts

MeCharts has a price target of 11 cents for DOGE soon. This level aligns with resistance on the crypto asset’s chart. A decisive move above it could signal a broader breakout from the recent trading range.

If we do end up seeing that breakout formation, we are still focusing on 11 cents. I told you guys this multiple times. The fact that as long as Doge can hold above 0.088, we are not looking for any sort of swing short opportunities.

Pingu Charts

The crypto trading expert also verifies the analysis of DOGE’s daily timeframe. The cryptocurrency continues trading above its EMAs on the daily chart, with buyers defending support.

Adrian Zmudzinski

Source link

A prominent crypto analyst who goes by the name LuckSide Crypto shared an upbeat outlook on Cardano in his latest YouTube video on Dec. 12th.

Despite the market performing like dog crap right now, ADA’s actually been pretty resilient.

LuckSide Crypto

While acknowledging the broader turbulence, he cited technical analysis indicators that suggest Cardano (ADA) may be bottoming out and poised to break out. Specifically, the LuckSide Crypto host pointed to a bullish pennant pattern forming on ADA’s price chart, typically signaling a continuation of the prior trend.

We’re printing this nice, big bullish pendant.

LuckSide Crypto

As for what’s sparking the latest crypto sell-off, the analyst theorized it could represent the “one last big shakeout” in the market that he had anticipated for months. He believes large players could be intentionally stoking fear to consolidate their positions. However, he thinks the attempted manipulation is failing to gain much traction.

The analyst cited $40,000 as a key level for Bitcoin (BTC) to close 2022 above, which he believes would set the stage for a big upside in 2024. He thinks all-time highs for Cardano could still be a couple of years away.

The LuckSide Crypto host also touched on the possibility of a spot Bitcoin ETF approval, helping boost crypto sentiment in early 2023. Additionally, he believes lingering volatility presents lucrative swing trading opportunities. However, he personally avoids such risky strategies during bear markets.

Adrian Zmudzinski

Source link

Crypto analyst KrissPax believes Dogecoin has found a floor of around 9 cents despite retreating from recent highs.

In a video posted to his YouTube channel on Dec. 12, crypto analyst and influencer KrissPax weighed in with his latest thoughts on the price action and outlook for popular memecoin Dogecoin (DOGE).

The analyst believes the broader crypto market is currently in a period of pullback and consolidation after the sharp run-up across many major cryptocurrencies last month. He cited Bitcoin (BTC) falling below $42,000 as an example of the market resetting from overheated conditions.

Turning his focus to Dogecoin, the analyst noted that DOGE had retreated from local highs above 10 cents reached earlier this month. However, he believes the coin has found support around the 9 cent level, near where it was trading just one week ago on Dec. 5.

“Now resetting back to that level, we’ll be looking at where Doge goes from here,” the analyst commented. He still believes there could be further dips in the near term but considers the 9-cent zone an important area of potential buying interest.

A key potential catalyst for Dogecoin is the upcoming DOGE-1 mission to the Moon in late December, which the analyst predicts could create excitement and drive the price above 11 cents. However, he cautions traders to be wary of excessive leverage usage, which has led to cascading liquidations during recent volatility.

The analyst maintains a bullish medium-term outlook, stating that if Dogecoin can break above resistance around 11 cents, it opens the door for prices to revisit levels near 16 cents reached in late 2022. His year-end price target remains 12 cents.

Adrian Zmudzinski

Source link