This is an opinion editorial by Frank Nuessle, a publishing entrepreneur, former university professor and social system architect.

In this essay, I argue that Bitcoin and the Lightning Network are, by themselves, not enough to successfully implement an American sound money system, and that following evolutionary economics, new social technologies and new social system designs need to be part of the equation.

The primary purpose of money is to facilitate the exchange of value. Money is also our most critical, most important, baseline social system. Bitcoin is not yet money. Bitcoin fulfills one of the three functions of money in that it is a trustworthy technology for the electronic store of value. Once Bitcoin is integrated with newly-developed social system technologies, it no doubt will fulfill that primary purpose of money — to facilitate the exchange of value.

The Problems With The American Fiat System

Before launching into my argument, let me explain why my focus is on the implementation of an American Bitcoin economy.

First, being an American, I know more about America than anywhere else.

Secondly and more importantly, America has the most to lose when the U.S. dollar is no longer recognized as the world’s only reserve currency, or the dollar becomes worthless through exponential printing. Under either outcome, there will be hell to pay — cataclysmic disruption in the United States without there being a parallel sound money system operating successfully alongside the current Federal Reserve system.

Even today, the evidence is everywhere that the American economy is not working for everyone. Disruption and anger are spilling out all over. Mass killings happening every few days are waking people up to the fact that there is a mental sickness of hate and nihilism that seems to be spreading.

America’s national political parties are not meeting the moment. The monstrous scale of American financial inequality makes genuine democracy impossible. A few years ago, ABC News reported that 40% of Americans couldn’t raise $400 to cover an emergency. How can anyone think their votes give them the same political power as, say, Jeff Bezos who makes such an obscene amount of money?

And now the crypto industry has to deal with the perfidy of Sam Bankman-Fried, who The New York Times once nicknamed the “Crypto Emperor” because he embodied the pretension of the renegade, “people’s” billionaire. He lived the lifestyle embodied by Elon Musk, Bezos and other tech billionaires, but turned out to be too young to recognize that you can’t get there by cooking the books.

Maybe, Bankman-Fried’s downfall will be a wake-up call for the crypto industry to understand that Bitcoin and blockchain are not about individuals becoming the next billionaires, but are about utilizing Bitcoin technology to create real products and services that solve real human and planetary needs, and by so doing, moving America into an expanding state of societal well being.

In his book, “The Price of Tomorrow,” Jeff Booth writes, “The trend of more wealth inequality, more polarization, and more discord is a major threat to our collective future. And it is all being caused by the same thing: adherence to an economic system designed for a different time.”

The current economic system favors large corporations and is the enemy of local commerce. This system extracts value from the local marketplace and delivers it to remote shareholders and to corporate management.

Bankman-Fried, like others in the get-rich-quick crypto community, lives out of the unexamined mindset that life is a dog-eat-dog struggle and that getting filthy rich is how you win the game. It is rumored that Bankman-Fried played video games during investor meetings. This mindset rules corporate capitalism, and let’s be honest, we all are afflicted, to some degree, with this mental state.

The most important product of many corporations today is no longer whatever they provide to customers, but the shares they sell to investors. In his book “Team Human,” Douglas Rushkoff writes, “Corporations destroy the markets on which they depend or sell off their most productive divisions in order to increase the bottom line on their quarterly reports.”

In America today, producing money is more important than producing a sustainable product or service. The corporation takes money out of the local economy — out of the land and labor — and delivers it to its shareholders.

The Importance Of Money As A Social System

Money is the most important and powerful social system ever invented by man. Civilization began with the exchange of value. The primary purpose of money is to facilitate the exchange of value within a community. A community is a group of people who rely on each other.

The true nature of the human being is to be in relationship with the planet and within a community. Only a money system that is built upon that understanding can hope to fulfill the dreams we each have invested in the future of Bitcoin and in our own communities.

The Bitcoin sound money economy must be designed for the distribution of wealth, not just the exporting of capital to the already wealthy.

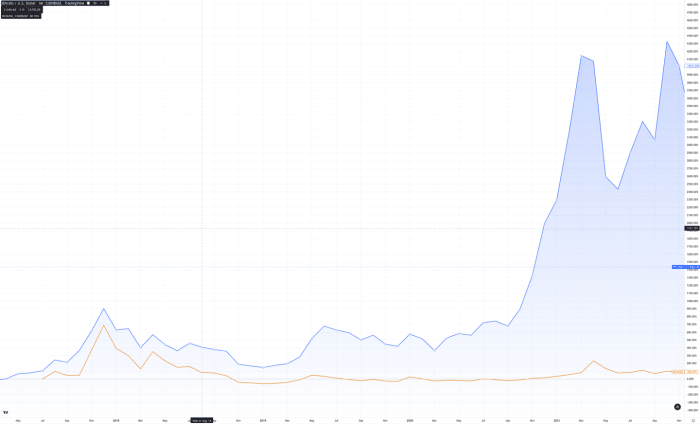

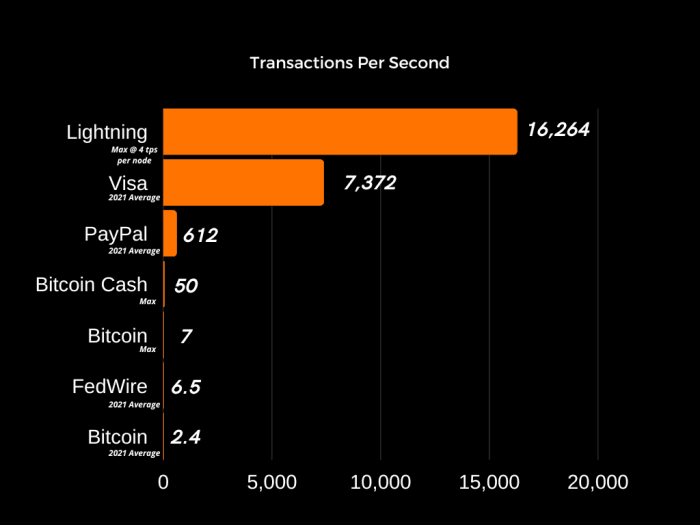

Clearly, the Lightning Network allows for the velocity of transactions that can make the Bitcoin sound money economy possible in the United States. Yet the Lightning Network is not enough.

I agree with Rushkoff, who believes that we cannot solve America’s problems solely with more technology. He writes that Bitcoin and blockchain “may disintermediate exploitive financial institutions, but it doesn’t help rehumanize the economy, or reestablish the trust, cohesion and ethos of mutual aid that is undermined by digital capitalism.”

Because Bitcoin, as a technologically-sound money system, represents a potential transformative evolution of our social reality, its successful implementation requires that we must delicately design its implementation to embed our best and most highly-refined human traits such as honesty, integrity, generosity and forgiveness.

To do so, we must remember the work of the evolutionary economist, Eric Beinhocker, and his proposal that economic evolution is not a single process, but rather the result of three interlocked processes — physical technology, social system technology and system design fitness.

To be successful, Bitcoin through the Lightning Network must ignite the evolutionary search engine that is localized, free market capitalism.

Bitcoin and the Lightning Network are clearly the needed physical technologies, but what are the social technologies and the social system design that will allow the Bitcoin sound money system to spread like a virus?

Integrating With The Current Fiat Money System

To answer the above question, Bitcoiners must fully understand what we are up against when we think about social technologies to change the American preference for the current money system.

First, there is the very strong human resistance to change because nation-controlled money systems have been predominant for hundreds of years.

Secondly, money carries so much self-worth-related emotional baggage that there is a strong reluctance to talk openly about money and even less interest in the systems for money creation. Money, like sex, is just not talked about.

When considering the strong human resistance to change, it is helpful to understand a little bit of history. First, there is the historical axiom that whoever is in power in a society creates its money.

From the 10th to the 13th centuries, a historical period in Europe known as the Middle Ages, currencies were issued by local lords, and then periodically recalled and reissued with a tax collected in the process. This was a form of demurrage that made money less desirable as a store of value. The result was the blossoming of culture and widespread wellbeing throughout Europe. This prosperity corresponded exactly to the time period when these local currencies were issued.

We are talking about 600 years of enculturation which provide a strong psychological headwind against the successful implementation of an alternative, American, bitcoin-based money system. We have all faced this headwind when trying to convince friends or relatives about the significance of the Bitcoin innovation.

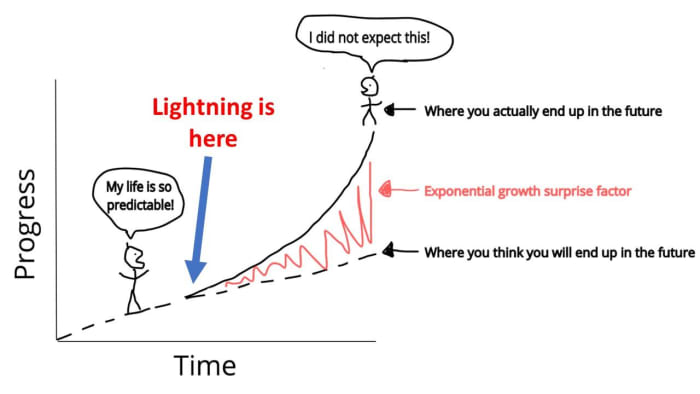

There is an interesting new concept from complex systems theory called “basins of attraction” that can help to visualize this headwind.

A basin of attraction is any complex system, such as a biological ecosystem, a human social system or ideas about a money system, that has multiple, local equilibrium states rather than a single equilibrium point. This is easier to understand with a visual representing two basins of attraction placed near each other.

Picture a ball, representing the ideas about a money system or money in general, lying at the bottom of one of these basins and think about how it must move to another basin of attraction for lasting change to occur.

You can imagine how the current money system will resist incremental change and that it will have the capacity to absorb many shocks to retain its historical attraction. There are over 600 years of pull into the state-controlled money system basin of attraction.

What’s needed is a new basin of attraction, a new configuration of ideas, with its own gravitational pull.

Bitcoin as sound money is that new basin of attraction.

Any conscious attempt to move that ball into a new bitcoin basin of attraction must include exposure and acceptance by a tipping point of public acceptance within a marketplace. To successfully move the culture to the bitcoin basin of attraction will require a change to the American story about money. More about that later in this essay.

Money As A Measure Of Self Worth And Survival

When considering the strong human resistance to thinking about money systems, it is helpful to dive into the deeper emotional issues people have about money.

Money is one of the primary taboos of American society, along with sex and death. Money is really the last taboo. Think about it: it’s less taboo today to talk about who you slept with last night than about how much money you have. It’s a real cultural blind spot.

To understand what those taboos have in common, we need to delve into collective psychology best described by archetypes. Archetypes are patterns of emotions and behavior that can be observed across civilizations and time periods.

One important archetype is the great mother, which represents the mother figure in mythology, religion and Jungian psychology. Repression of the great mother archetype is clear in the American collective consciousness. When you repress an archetype, it manifests itself through its specific shadows — with money, that turns out to be greed and fear of scarcity.

The earliest currencies all directly related to the great mother.

For instance, thousands of years before the common era, the original Sumerian shekel was closely linked to Inanna, the goddess of life, death and sexuality. Grain backed the money of the time. Farmers were given shekels for their grain which they could exchange for sex with the virgins of the temple. This was how they assured grain storage for the lean years they had often experienced in their history.

For the Sumerians, it was the priests who controlled the money. They gave receipts for wheat delivered to the temples as tax. The receipts could be used as currency to pay for sex with the temple priestesses or for other goods in the marketplace. These receipts were something like a modern-day, tax-funded welfare system — the wheat was a buffer stock, the sex, a fertility ritual and a charm against harvest failure (think of it as a type of early insurance).

It’s also interesting to note that the English word “money” itself derives from the Roman temple of Juno Moneta in Rome from whose basement the mint of the empire operated. Juno was the Italic goddess of the menstrual cycle, sexuality, pregnancy, birth… and, of course, money.

How To Convince Others Of The Value Of Bitcoin

So, how does one burst through the very strong human resistance to change and the unconscious mental taboos that surround fears about money?

Many Bitcoiners have come to realize that you are never going to overcome their brother-in-law’s beliefs through the force of logic and evidence. People arrange the evidence to align with their existing beliefs and their outlooks on life.

These individual personal beliefs are woven into a cultural story that becomes a consensus reality about money or, in the language of cultural systems theory, America’s current basin of attraction for money.

The current American cultural story about money is a story about scarcity and about there never being enough. This is a design feature of the current debt-based money system where the money supply must grow to pay back the interest because there is literally “never enough” so people must fight over what there is. This design feature is the fiat money system growth imperative which must, at some point, go exponential or go through a process of debt forgiveness.

As Charles Eisenstein writes, “As long as most people acquiesce to the present system, those heavily invested in its perpetuation (i.e. the already rich) will find ways to keep pretending that it is sustainable.”

To change existing opinions and beliefs about money requires giving people an experience that does not fit the existing story or an experience that resonates with a new story.

Buckminster Fuller used to say that you never change anything by fighting the existing reality. To change a social system, build a new model that makes the existing model obsolete.

Eisenstein believes that the most direct way to disrupt the American story of scarcity is to give people an experience not based on scarcity. That could be “an act of generosity, forgiveness, attention, truth or unconditional acceptance.” This new story must be an invitation to a new way of being in the world, unafraid and connected. It must be an offer. One cannot compel another person to change beliefs.

Remembering Beinhocker’s three interlocked processes of economic evolution, we are back to the seminal question: “What are the social technologies and the social system design parameters that will integrate with Bitcoin technology to allow the Bitcoin sound money system to spread like a virus?”

This is a guest post by Frank Nuessle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.