Posted on: February 6, 2026, 12:38h.

Last updated on: February 6, 2026, 04:58h.

- A 2024 op-ed from the Washington Post scolded legal sports betting

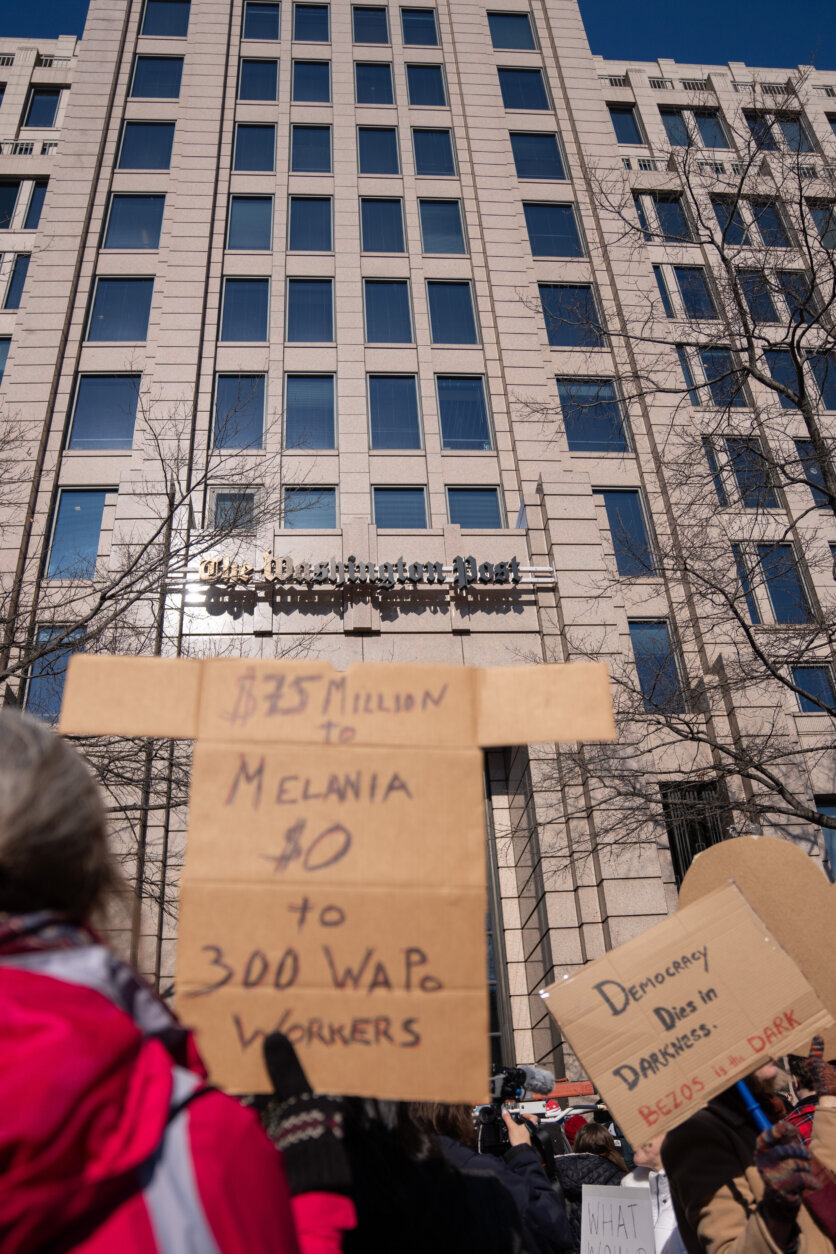

- About a third of the newspaper’s staff was let go this week in Washington

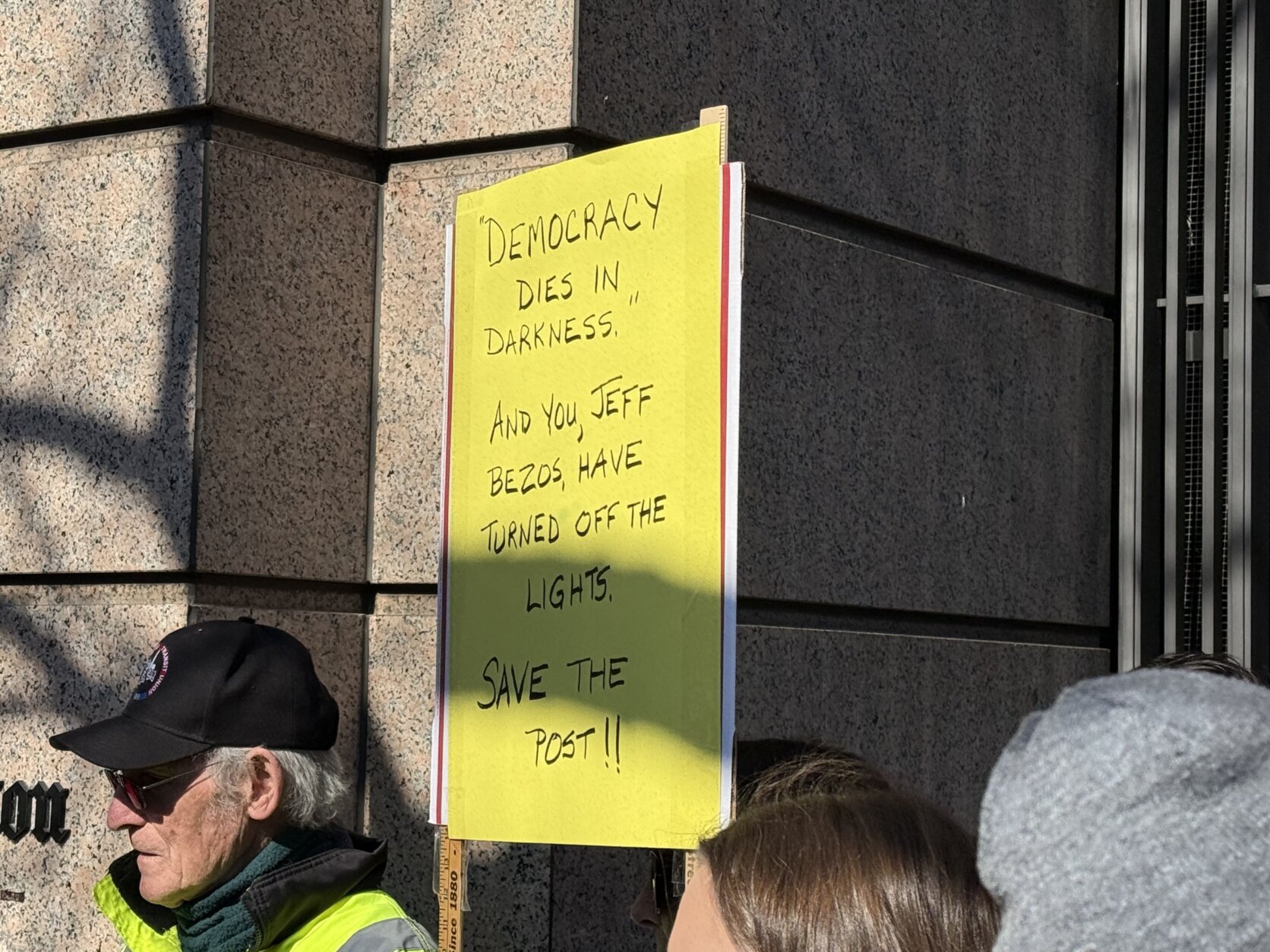

The Washington Post continues to make headlines after the daily newspaper based in the nation’s capital laid off a third of its staff on Wednesday.

Among the biggest WaPo job casualties was the sports department, which is being entirely shuttered. Notable former Post sports journalists include John Feinstein, Michael Wilborn and Tony Kornheiser, who would go on to create and host ESPN’s “Pardon the Interruption,” and Christine Brennan, the first woman to cover the Washington Commanders, then the Redskins, in 1985.

DC has struggled to be a true “sports town” compared to other East Coast cities like Baltimore, Philadelphia, New York, and Boston. The capital’s transient, politically-obsessed, government-focused population has been critiqued for being too occupied with those matters to care and support their local teams.

“For decades, however, the Post treated sports as a vital part of life in the District. Whatever the rest of the country thought about Washington’s teams and fans, there was no better place to read about sports than the nation’s capital,” wrote Associated Press reporter Noah Trister.

Scott Van Pelt, whose sportscasting career began in DC at FOX5, and today hosts “SportsCenter at Night” from Washington, also chimed in on the Post job cuts.

“Growing up reading the Post, I didn’t realize it wasn’t like this in other cities. I didn’t know how lucky we were to enjoy giants of their craft like Kornheiser, Wilbon, Boswell, Kindred & Feinstein,” SVP wrote on X.

Washington Post Sports Betting Coverage

The Washington Post’s sports section is being remembered fondly by the people who worked in the department. But when it came to the legalization of sports betting across the country, an opportunity made possible by a May 2018 decision in the US Supreme Court, the Post was no fan.

In a December 2024 opinion, the Washington Post Editorial Board concluded that legalizing sports betting was a “terrible bet.” The op-ed, one of many where the WaPo editors wrote against the landmark SCOTUS decision, held that legal sports betting has delivered societal harms to vulnerable people.

When easy access to addictive substances or experiences, such as gambling, increases, so does addiction. Unsurprisingly, then, problem gambling and addiction are rising, along with associated financial distress, bankruptcies, foreclosures, job losses, and suicides,” the Dec. 2024 editorial read.

The WaPo editors blamed the sportsbooks for the problems caused.

“Legalized sports betting was supposed to enable gambling companies to identify and weed out problem bettors. Instead, the opposite has happened: High rollers who lose are targeted and courted as VIPs, showered with quick credit and other perks, and encouraged to gamble more — to ‘chase’ their losses, in industry parlance. Those who actually win big get limits imposed on how much they can bet,” the op-ed continued.

Sports Betting Landscape

Today, sports betting is legal in 39 states and the District of Columbia. In the nation’s capital, bettors can place legal sports bets online and in person.

Anyone aged 18 and older can make a sports bet in DC.

Devin O’Connor

Source link

-14.jpg)