Dinesh Khara of the State Bank of India speaks to CNBC's Tanvir Gill about the Adani crisis and the bank's exposure to the company.

Tag: Investment strategy

-

Solar tech company Nextracker prices above range at $24 a share in good sign for IPO market

choja | E+ | Getty Images

The solar technology company Nextracker priced its initial public offering just above its stated $20 to $23 per share range, people with knowledge of the transaction told CNBC.

The order book for Fremont, California-based Nextracker was “well subscribed,” meaning demand allowed the company to exceed expectations on pricing, sources who declined to be identified speaking about the process told CNBC earlier Wednesday.

The IPO is expected to raise about $638 million by selling 26.6 million shares at $24 each, which is well above the $535 million upper limit the company said it was seeking in a filing last week. That is also before the so-called greenshoe option that allows bankers to sell more stock, the people said.

The development is a good sign for the moribund IPO market. Proceeds from public listings fell 94% last year after the Federal Reserve began its most aggressive rate-increasing campaign in decades. Investors soured on the shares of unprofitable tech companies in particular, many of which are still underwater after listing in 2020 and 2021.

The Nextracker IPO is arguably the first meaningful public listing this year as it is set to be the biggest U.S. IPO since autonomous driving firm Mobileye raised $990 million in October.

Bookrunners first secured anchor investments in Nextracker from BlackRock and Norges Bank Investment Management, which helped drive demand for shares, the people said.

Nextracker will begin trading on the Nasdaq exchange Thursday morning under the symbol NXT, according to one of the people.

The company, which was a subsidiary of manufacturer Flex, sells hardware and software that enables solar panels to follow the movement of the sun, improving the output of solar power plants.

JPMorgan Chase was lead advisor on the transaction, according to a regulatory filing.

-

FTX bankruptcy fees near $20 million for 51 days of work

The FTX logo on a laptop screen.

Andrey Rudakov | Bloomberg via Getty Images

FTX’s top bankruptcy, legal, and financial advisors have billed the company more than $19.6 million in fees for work done in 2022, according to Tuesday bankruptcy court filings. More than $10 million of that was for work done in Nov. 2022, as Sam Bankman-Fried’s crypto empire entered bankruptcy protection in Delaware.

The firms will initially only be paid a little over $15.5 million, or 80% of the value of their work, under a court-ordered interim compensation plan.

The law firms that billed FTX are Sullivan & Cromwell, Landis Rath & Cobb, and Quinn Emanuel Urquhart & Sullivan. Professional advisor Alvarez & Marsal and financial advisor AlixPartners also billed the company.

Some of the work that the firms billed for involved meetings with other companies that also were billing FTX for their time, or involved corresponding with former and current executives, including Caroline Ellison, the former CEO of Bankman-Fried’s hedge fund, Alameda Research.

Landis Rath & Cobb and Sullivan & Cromwell, FTX’s primary legal firms, billed the company a combined $10.7 million for over 8,400 hours of work. Landis Rath & Cobb billed $1.16 million for work done between Nov. 11 and Nov. 30.

Sullivan & Cromwell, a target for both lawmakers and Bankman-Fried over their pre-petition work with FTX, sought over $9.5 million in compensation for over 6,500 billable hours, in the period between Nov. 12 and Nov. 30. Over a third of those billable hours, totaling over $4.8 million, were for the work of partners, who typically charge the highest hourly rate.

Sullivan & Cromwell assigned over two dozen partners to FTX’s case, according to the filings. Jim Bromley, a partner at Sullivan & Cromwell and a lead attorney on the case, billed over 178 hours for the weeks between Nov. 12 and Nov. 30.

The legal filings offer a glimpse into the ferocious work done by advisors to untangle FTX’s complex web of accounts and slipshod accounting standards. Sullivan & Cromwell lawyers spent over 1,900 hours in November alone on work related to analyzing and recovering FTX’s global asset base, according to the filings.

Alvarez & Marsal, an advisory firm, billed $1.9 million for over 2,300 hours of work on “business operations,” meeting with lawyers, FTX executives, analyzing FTX’s holdings using blockchain explorers, and reviewing “cybersecurity scenarios.” Those operations included multiple hours in November corresponding with and calling Ellison, 5.3 hours in a single day imaging iPad files and other electronic devices, and a first-day hearing conference call that lasted 2.5 hours.

Quinn Emanuel, which billed over $1.5 million for work done between November and December, assigned over a dozen lawyers to the case, nine of whom were partners. One of those partners, Sascha Rand, billed over $13,000 for a single day’s work in November, corresponding and reviewing first-day issues. Another Quinn lawyer filed for over $17,000 on a “non-working travel” day trip beginning Nov. 21, returning on Nov. 22.

AlixPartners, a financial consulting firm, billed $1.1 million for work done over the course of a little more than a month, from Nov. 28 to Dec. 31.

FTX’s advisors aren’t entitled to their full fees yet. Under an interim compensation order, professional advisors are paid 80% of their filed fees, provided that no objection is filed. Full compensation for legal and advisor fees will not occur until a final fee application is filed, whenever FTX’s bankruptcy saga concludes.

That doesn’t mean that advisors won’t get their due, however. A 2019 Federal Reserve study said professional and consulting fees in Lehman Brothers’ bankruptcy were over $2.56 billion.

Lawyers for Sullivan & Cromwell did $40,000 worth of work just to appear in FTX’s first bankruptcy hearing on Nov. 22, based on court filings of hours billed and hourly rates.

-

President Biden calls on Congress to crack down on ‘junk fees’

In his State of the Union address, President Joe Biden said his administration is cracking down on “junk fees” — including those from banks as well as hotels, airlines and other service providers.

The president said these unnecessary or hidden fees are weighing down families’ budgets and causing financial harm.

“Junk fees may not matter to the very wealthy, but they matter to most other folks in homes like the one I grew up in, like many of you did. They add up to hundreds of dollars a month,” Biden said in the annual speech before Congress.

What are junk fees?

Junk fees are additional, often hidden charges that can come from a range of lenders. They are not typically included in the initial price but tacked on at the time of payment.

To stop this practice, Biden called on Congress to pass the Junk Fees Prevention Act, which will reduce unexpected charges, such as airline booking fees; service fees for concert tickets; early termination fees for TV, phone, and internet; “resort fees” at hotels; and “excessive” credit card late fees.

“Americans are tired of being — we’re tired of being played for suckers,” Biden said Tuesday.

More from Personal Finance:

Biden to revisit ‘billionaire minimum tax’

Amid inflation, shoppers turn to dollar stores for groceries

Savers poised for big win in 2023 as inflation fallsThe initiative has been months in the making.

Last fall, the Consumer Financial Protection Bureau said it was scrutinizing certain fees that catch customers by surprise — and are “likely unfair and unlawful,” according to the agency.

The consumer watchdog proposed a new rule earlier this month prohibiting banks from charging surprise overdraft fees on debit transactions and reducing typical late fees from roughly $30 to $8, saving consumers as much as $9 billion a year, according to the White House.

“Despite recent progress in addressing overdraft fees, the job is far from complete,” Nadine Chabrier, the Center for Responsible Lending’s senior policy counsel, said in a statement.

“The Consumer Financial Protection Bureau took a big step by banning surprise overdraft fees,” she said. “We are encouraged that the consumer bureau announced it will take additional steps, and we urge the bureau to place strong limits on the size and frequency of these fees.”

More than a quarter of checking account holders, or 27%, are regularly hit with fees, which can add up to an average of $24 per month, or $288 per year, according to a recent survey from Bankrate.com.

The average overdraft fee costs $29.80, Bankrate’s research found, while the average nonsufficient funds fee is $26.58.

Some banking interest groups countered that offerings such as overdraft protection provide a much-needed safety net.

“The president’s use of the term ‘junk fee’ is overly broad and ignores the needs of low-income and middle-income consumers who depend on these services to resolve short-term financial difficulties,” Jim Nussle, president and CEO of the Credit Union National Association, said in a statement.

“It does not consider the costs involved in providing needed financial services that consumers depend on.”

Without the option of overdraft protection, “people are more likely to turn to predatory lenders, hurting the same people the administration seeks to help,” Nussle said.

-

Maersk, a global barometer for trade, posts record 2022 earnings but warns of a tough year ahead

The container ship Maersk Murcia sits moored in the port of Gothenburg, Sweden, on August 24, 2020.

JONATHAN NACKSTRAND | AFP | Getty Images

Maersk, one of the world’s largest container shipping firms, on Wednesday reported a fall in fourth-quarter earnings but posted the best full-year result in its history.

The Danish giant, widely seen as a barometer for global trade, said its earnings before interest, taxes, depreciation and amortization (EBITDA) reached $6.5 billion in the fourth quarter, below a Refinitiv consensus analyst forecast of $6.77 billion and down from $8 billion for the same quarter of 2021.

This took the full-year underlying EBITDA figure to $36.84 billion, fractionally below the company’s forward guidance of $37 billion but its strongest-ever full-year result.

Maersk experienced an “exceptional” year in 2022 on the back of a continued rise in ocean freight rates, but flagged in its record-breaking third-quarter earnings report that these rates had peaked and a normalization would negatively impact earnings, with former CEO Søren Skou warning of “dark clouds on the horizon.”

New CEO Vincent Clerc, who took the reins at the beginning of this year, said in a statement Wednesday that 2022 had been “remarkable in more than one way.”

“While we report the best financial result in the history of the company, we have also taken the partnerships with our customers to a new level by supporting their supply chains end to end during highly disruptive times,” Clerc said.

“As we enter a year with challenging macro-outlook and new types of uncertainties for our customers, we are determined to speed up our business transformation and increase our operational excellence to seize the unique opportunities in front of us.”

Global container market to grow between -2.5% and +0.5% in 2023

Fourth-quarter loaded volumes fell 14% on the year while loaded freight rates decreased by 3.5% on the year, leading revenues to fall slightly to $17.8 billion for the quarter.

Maersk also took a hit of $511 million over the course of the year from efforts to wind down its operations in Russia, with the ultimate aim of exiting the country entirely.

The company reported an increased free cash flow of $6.5 billion in the fourth quarter of 2022 versus the previous year and issued a $685 million share buyback.

Maersk raised its dividend to 4,300 Danish krone ($620.33) per share from 2,500 DKK per share.

For 2023, Maersk expects underlying EBITDA to plummet to between $8 billion and $11 billion.

It said the guidance was based on the “expectation that inventory correction will be complete by the end of H1 leading to a more balanced demand environment, that 2023 global GDP growth remains muted, and that the global ocean container market will grow in a range of -2.5% to +0.5%.”

-

BNP Paribas is very well diversified, CFO says

BNP Paribas CFO Lars Machenil discusses the French bank's latest quarterly earnings report.

-

Adani rout deepens despite soothing words from India’s government and billionaires

Art school teacher Sagar Kambli gives final touches to a painting of Indian businessman Gautam Adani (L) highlighting the ongoing crisis of the Adani group in Mumbai on February 3, 2023.

Indranil Mukherjee | Afp | Getty Images

Shares of most Adani Group companies fell further on Monday, continuing to drop as a feud between the conglomerate and short-seller firm Hindenburg deepened.

Adani Enterprises lost 4%, and Adani Transmission fell 10% in Mumbai’s morning session. Adani Green Energy, Adani Power and Adani Total Gas fell 5% each. Adani Port and Special Economic Zone bucked the trend and traded 2% higher, but they remained volatile.

Bernstein warned there will be more pain ahead in its latest “India Strategy” report.

“There will be more volatility in India this year; hence the market is prone to a correction,” analyst Venugopal Garre wrote in a Monday note. “The best way to pick up such transactions is to look for arbitrages in implied growth.”

Goldman Sachs echoed the likes of Nomura and HSBC in saying that the latest developments are unlikely to result in a spillover effect for the wider Indian stock market.

“We believe credit concerns are likely to be idiosyncratic in nature and are less likely to have broader contagion or systemic issues for the India offshore credit market,” Goldman Sachs analysts Kenneth Ho and Chakki Ting said in a Friday note.

They noted uncertainties surrounding Adani, saying its outstanding U.S. dollar bonds may hurt investor sentiment, but those concerns will be “unlikely to have a broader contagion impact.”

Adani Group’s total gross debt reached 2.2 trillion Indian rupees ($26.8 billion) as of end-March in 2022, according to the latest statement it’s released in response to Hindenburg accusations of stock manipulation and fraud.

The group is likely to scrap plans to raise roughly $500 million in overseas bond sales and will “explore other financing options” instead, India’s Economic Times reported.

Meanwhile, the Bloomberg Billionaires Index showed founder and Chairman Gautam Adani’s net worth fell further on Friday. His personal wealth has more than halved so far this year, down by 51.1%, or $61.6 billion.

‘Resilient and stable’

The Security and Exchange Board of India over the weekend aimed to defend Indian markets – saying the country’s two main indexes have demonstrated “ongoing stability” and are “continuing to function in a transparent, fair and efficient manner.” The Sensex is the benchmark index of the BSE — formerly the Bombay Stock Exchange — and the Nifty 50 is the flagship index of the National Stock Exchange of India.

“SEBI is committed to ensuring market integrity and to ensuring that the markets continue to have the appropriate structural strength to function in an uninterrupted, transparent and efficient manner as has been the case so far,” it said in a statement.

Gautam Adani, chairman of Adani Group, speaks during the Forbes CEO Summit in Singapore, on Tuesday, Sept. 27, 2022.

Bloomberg | Bloomberg | Getty Images

Without mentioning Adani companies by name, the regulator noted “unusual price movements in the stocks of a business conglomerate,” adding that it is monitoring those moves.

The regulator mentioned the Additional Surveillance Measure (ASM) framework – which compiles a list of companies about which the regulator advises investors to be “extra cautious while dealing in these securities,” according to the National Stock Exchange of India.

Several Adani Group-affiliated companies are included on the ASM framework’s long-term and short-term list, according to a notice on the NSE’s website updated Monday.

Adani Power is included on the long-term list, while Adani Enterprises, Adani Green Energy, Adani Ports and Special Economic Zone, Adani Transmission and Adani Total Gas are on the short-term list.

SEBI’s message of stability followed that of India’s central bank on Friday. The Reserve Bank of India said that “the banking sector remains resilient and stable,” citing its own assessment of the situation. It added that it will continue to monitor the stability of the industry.

“Various parameters relating to capital adequacy, asset quality, liquidity, provision coverage and profitability are healthy,” the RBI said in a Friday statement. “Banks are also in compliance with the Large Exposure Framework (LEF) guidelines issued by the RBI.”

Indian billionaires weigh in

Anand Mahindra, the chairman of Mahindra Group, defended India’s economy despite the whirlwind of recent media coverage surrounding Adani Group.

“I’ve lived long enough to see us face earthquakes, droughts, recessions, wars, terror attacks,” he said in a tweet on Saturday, without mentioning Adani Group by name.

“All I will say is: never, ever bet against India,” he said.

Fellow billionaire Uday Kotak, CEO of Kotak Mahindra Bank and India’s wealthiest banker, also tweeted over the weekend: “I do not see systemic risk to Indian financial system from recent events.”

He noted large Indian companies “rely more on global sources for debt and equity finance,” adding that it leads to challenges and vulnerabilities.

“Time to further strengthen Indian underwriting and capacity building,” he said.

– CNBC’s Michael Bloom contributed to this report.

-

Jim Cramer says strong January jobs report shows the economy can handle more rate hikes

CNBC’s Jim Cramer on Friday said that the January jobs report shows that the economy will remain resilient, despite the Federal Reserve’s interest rate hikes.

“If the Fed Chief wants to raise interest rates quarter after quarter, this economy can actually handle it. And that’s the real takeaway from this amazing job growth number,” he said.

The U.S. economy added 517,000 jobs in January, crushing the Dow Jones estimate of a 187,000 gain. That marks the biggest increase in nonfarm payrolls since July 2022.

Stocks teetered on the news but ultimately slipped to end the trading session. The S&P 500 fell 1.04%, while the Nasdaq Composite declined 1.59%. The Dow Jones Industrial Average shed 0.38%.

Cramer said that while stocks fell because the market is in “good news is bad news” mode – the stronger the economy is, the more the Fed will likely have to raise interest rates – the market still held up, more or less.

“My take is that the comeback from the initial negative reaction in the stock market today, before a move lower in the afternoon, has to do with faith. Faith in thinking that there won’t be a recession. Faith that if the Fed wants to hit us with one or two more rate hikes, we’ll be fine,” he said.

The strong economic data comes after the Fed on Wednesday raised interest rates by a quarter percentage point. Chairman Jerome Powell signaled that the central bank isn’t done raising rates despite economic indications that inflation is cooling down.

Cramer said that while the Fed still wants to tamp down inflation more, he believes a severe recession is “near impossible” with job growth being so strong.

“Anyone who thinks the Fed will have to swiftly cut rates later this year because the economy’s too weak [is] clearly fooling themselves,” he said.

-

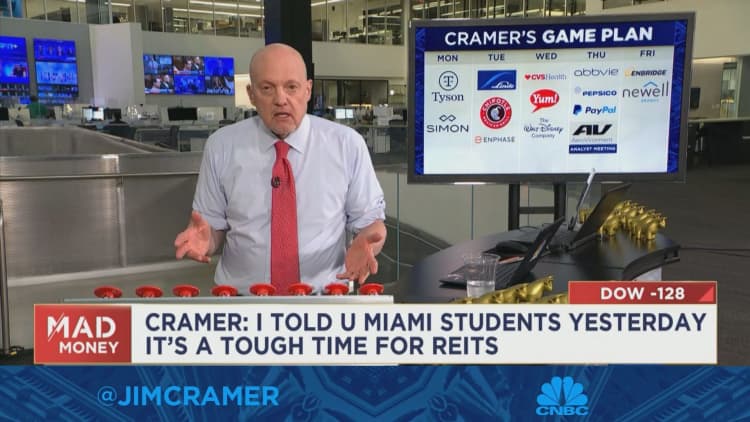

Cramer’s week ahead: Take advantage of the bull market by selling some shares

CNBC’s Jim Cramer on Friday advised investors to ring the register on some of their positions to take advantage of the bull market.

“I don’t know if we can continue this week’s bizarrely bullish behavior, but it’s worth sticking around and … you can trim a bit of some stock that you’re up a lot,” he said

Stocks fell on Friday after a strong January jobs report renewed fears that the Federal Reserve will continue hiking interest rates. The S&P 500 and Nasdaq Composite still managed to end the week on the positive side, with the tech-heavy index notching its fifth consecutive winning week.

Cramer also reviewed next week’s slate of earnings. All estimates for earnings, revenue and economic data are courtesy of FactSet.

Monday: Tyson Foods, Simon Property Group

- Q1 2023 earnings release at 7:30 a.m. ET; conference call at 9 a.m. ET

- Projected EPS: $1.31

- Projected revenue: $13.51 billion

Cramer said the conference call should give insight into the state of food inflation at grocery stores.

- Q4 2022 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $3.15

- Projected revenue: $1.29 billion

“They may pull a rabbit out of a hat” despite it being a tough time for companies in the office property business, he said.

Tuesday: Chipotle Mexican Grill, Enphase Energy

- Q4 2022 earnings release at 4:10 p.m. ET; conference call at 4:30 p.m. ET

- Projected EPS: $8.91

- Projected revenue: $2.23 billion

Cramer said he expects the quarter to be phenomenal given the company’s plan to hire 15,000 restaurant workers ahead of the busy spring months.

- Q4 2022 earnings at 4:05 p.m. ET; conference call at 4:30 p.m. ET

- Projected EPS: $1.27

- Projected revenue: $707 million

“I always say the same thing — if you believe that solar can be even bigger than it is now, then Enphase is the right stock for you,” he said.

Wednesday: CVS Health, Disney

- Q4 2022 earnings release at 6:30 a.m. ET; conference call at 8 a.m. ET

- Projected EPS: $1.92

- Projected revenue: $76.33 billion

Cramer said that he’s curious why the company’s stock has become “a real bow-wow.”

- Q1 2023 earnings release at 4:05 p.m. ET; conference call at 4:30 p.m. ET

- Projected EPS: 79 cents

- Projected revenue: $23.44 billion

He predicted that Disney’s performance will improve now that CEO Bob Iger is back at the company’s helm.

Thursday: PepsiCo, PayPal

- Q4 2022 earnings release at 6 a.m. ET; conference call at 8:15 a.m. ET

- Projected EPS: $1.65

- Projected revenue: $26.84 billion

“I actually think they will deliver good numbers on Thursday, but if we have a growth hangover it might not matter to the market,” he said.

- Q4 2022 earnings release at 4:15 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $1.20

- Projected revenue: $7.39 billion

“Who needs PayPal when Apple Pay is built into your phone?” he said.

Friday: Enbridge, Newell Brands

- Q4 2022 earnings release before the opening bell; conference call at 9 a.m. ET

- Projected EPS: 54 cents

- Projected revenue: $10 billion

Cramer said he wants to hear the company talk about where the price of natural gas is headed.

- Q4 2022 earnings release at 6 a.m. ET; conference call at 8:30 a.m. ET

- Projected EPS: 11 cents

- Projected revenue: $2.23 billion

The company had a “compelling” turnaround, according to Cramer.

Disclaimer: Cramer’s Charitable Trust owns shares of Apple and Disney.

-

Watch CNBC’s full interview with PNC CEO Bill Demchak on mortgage market

Bill Demchak, PNC CEO, joins ‘Closing Bell’ to discuss the jobs report, the likelihood of a recession and the state of the economy and consumer.

08:34

3 hours ago

-

Bitcoin briefly rises above $24,000, extending its new year rally amid a broader gain in tech stocks

Bankruptcy filings from Celsius and Voyager have raised questions about what happens to investors’ crypto when a platform fails.

Rafael Henrique | Sopa Images | Lightrocket | Getty Images

Bitcoin briefly touched the $24,000 level on Thursday, reaching a key technical level and building on its January rally.

The up move came a day after the Federal Reserve raised its benchmark interest rate by a quarter percentage point. But Fed Chairman Jerome Powell noted that a disinflationary process has started, soothing investors that are betting on inflation to fall and causing them to take on more risk.

Bitcoin was last trading about 1% higher at $23,819.26, according to Coin Metrics. The cryptocurrency rose to $24,069.00 earlier in the afternoon, after rising as high as $24,249.70 Wednesday night, its highest level since Aug. 17.

“The market took the latest FOMC as dovish, but bitcoin’s rally remains precarious,” said Yuya Hasegawa, crypto market analyst at Japanese bitcoin exchange Bitbank. “The price did rise on Wednesday, but failed to close above $24k and its momentum seems to be on the decline.”

Hasegawa echoed the Fed’s warning that although inflation appears to be decelerating, it “remains elevated” and the central bank will need “substantially more evidence to confidently say that inflation is coming closer to their 2% target.”

The jump also coincided with a broader rally in stocks led by the Nasdaq as well as a drop in U.S. Treasury yields and the U.S. Dollar Currency Index (DXY), which tend to move inversely to crypto.

Bitcoin has rallied more than 40% since the start of the year, quickly paring losses from its disastrous 2022. Many investors and analysts are wary, however, that despite the current bullish trend, crypto isn’t ready for a rocket ship rally yet, and prices could pull back at least once more before it is.

January was bitcoin’s best month since October 2021 and its best January since 2013.

-

Charlie Munger says the U.S. should follow in China’s footsteps and ban cryptocurrencies

Charlie Munger at the Berkshire Hathaway press conference, April 30, 2022.

CNBC

Berkshire Hathaway Vice Chairman Charlie Munger urged the U.S. government to ban cryptocurrencies like China, saying a lack of regulation enabled wretched excess and a gambling mentality.

“A cryptocurrency is not a currency, not a commodity, and not a security,” the 99-year-old Munger said in an op-ed published in the Wall Street Journal Wednesday evening.

“Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity,” Munger said. “Obviously the U.S. should now enact a new federal law that prevents this from happening.”

Munger, along with his business partner Warren Buffett, have been longtime cryptocurrency skeptics, arguing that they are not tangible or productive assets. Munger’s latest comments came as the crypto industry was plagued with problems from failed projects to a liquidity crunch, exacerbated by the fall of FTX, once one of the world’s largest exchanges.

The cryptocurrency market lost more than $2 trillion in value last year. The price of bitcoin, the world’ largest cryptocurrency, plunged 65% in 2022 and it has rebounded about 40% to trade around $23,824, according to Coin Metrics.

The renowned investor said in recent years, privately owned companies have issued thousands of new cryptocurrencies, and they have become publicly traded without any governmental pre-approval of disclosures. Some has been sold to a promoter for almost nothing, after which the public buys in at much higher prices without fully understanding the “pre-dilution in favor of the promoter,” Munger said.

Munger listed two “interesting precedents” that may guide the U.S. into sound action. Firstly, China has strictly prohibited services offering trading, order matching, token issuance and derivatives for virtual currencies. Secondly, from the early 1700s, the English Parliament banned all public trading in new common stocks and kept this ban in place for about 100 years, Munger said.

“What should the U.S. do after a ban of cryptocurrencies is in place? Well, one more action might make sense: Thank the Chinese communist leader for his splendid example of uncommon sense,” Munger said.

(Read the full piece in the WSJ here.)

-

Deutsche Bank smashes profit expectations in fourth quarter as higher interest rates bolster revenue

A statue is pictured next to the logo of Germany’s Deutsche Bank in Frankfurt, Germany, September 30, 2016.

Kai Pfaffenbach | Reuter

Deutsche Bank on Thursday reported its 10th straight quarter of profit, receiving a boost from higher interest rates and favorable market conditions.

Deutsche Bank reported a 1.8 billion euro ($1.98 billion) net profit attributable to shareholders for the fourth quarter, bringing its annual net income for 2022 to 5 billion euros, a 159% increase from the previous year.

The German lender almost doubled a consensus estimate among analysts polled by Reuters of 910.93 million euro net profit for the fourth quarter, and exceeded a projection of 4.29 billion euros on the year.

In 2019, Deutsche Bank launched a sweeping restructuring plan to reduce costs and improve profitability, which involved exiting its global equities sales and trading operations, scaling back its investment banking and slashing around 18,000 jobs by the end of 2022.

The annual result marks a significant improvement from the 1.9 billion euros reported in 2021, and CEO Christian Sewing said the the bank had been “successfully transformed” over the last three and a half years.

“By refocusing our business around core strengths we have become significantly more profitable, better balanced and more cost-efficient. In 2022, we demonstrated this by delivering our best results for fifteen years,” Sewing said in a statement Thursday.

“Thanks to disciplined execution of our strategy, we have been able to support our clients through highly challenging conditions, proving our resilience with strong risk discipline and sound capital management.”

Post-tax return on average tangible shareholders’ equity (RoTE), a key metric identified in Sewing’s transformation efforts, was 9.4% for the full year, up from 3.8% in 2021.

Deutsche also recommended a shareholder dividend of 30 cents per share, up from 20 cents per share in 2021, but did not announce a share buyback at this stage.

“On the share repurchases, given the uncertainty of the environment today that we see, also some regulatory changes that we’d like to see both the timing and the extent of, we’re holding back for now. We think that’s the prudent action to take, but we intend to revisit that,” CFO James von Moltke told CNBC on Thursday.

He added that the bank would likely reassess the outlook in the second half of this year, and reaffirmed Deutsche’s target for 8 billion euros in capital distributions to shareholders through to the year 2025.

Here are the other quarterly highlights:

- Loan loss provisions stood at 351 million euros, compared to 254 million euros in the fourth quarter of 2021.

- Common equity tier 1 (CET1) ratio — a measure of bank solvency — came in at 13.4%, compared to 13.2% at the end of the previous year.

- Total net revenue was 6.3 billion euros, up 7% from 5.9 billion euros for the same period in 2021 but slightly below consensus estimates, bringing the annual total to 27.2 billion euros in 2022.

Deutsche’s corporate banking unit posted a 39% growth in net interest income, aided by “higher interest rates, strong operating performance, business growth and favorable FX movements.”

Some of the tailwinds were offset by a slump in dealmaking that has affected the wider industry in recent months.

“The fourth quarter tailed off a little bit for us in November and December, but still was a record quarter in our FIC (fixed income and currencies) business for a fourth quarter, 8.9 billion [euros] for the full-year,” the CFO von Moltke told CNBC’s Annettee Weisbach.

“We’re thrilled with that performance but…it came a little bit short of analyst expectations and our guidance late in the year.”

He said that January had been a month of strong performance for the bank’s trading divisions, as market volatility persisted.

“That gives us some encouragement that our general view, which was that volatility and conditions in the macro businesses would taper off over time, but would be replaced if you like from a revenue perspective with increasing activity in micro areas like credit, M&A, equity and also debt issuance,” he said.

“We see that still intact as a thesis of what ’23 will look like.”

-

Gautam Adani calls off $2.5 billion equity sale as regulatory concerns grow

A signage of Adani group is pictured outside the Chatrapati Shivaji Mumbai International Airport in Mumbai on July 28, 2021. (Photo by Indranil MUKHERJEE / AFP) (Photo by INDRANIL MUKHERJEE/AFP via Getty Images)

Indranil Mukherjee | Afp | Getty Images

On Wednesday, Gautam Adani announced he’s scrapping his firm’s $2.5 billion equity sale.

He withdrew the offering for shares in Adani Enterprises, the flagship of the Indian conglomerate Adani Group, after the stock tanked by nearly 30%.

Breaking his silence to the media, Adani said, “Today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the Company’s board felt that going ahead with the issue will not be morally correct.”

In a Jan. 24 report, short seller Hindenburg Research alleged that “Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme.” The report went on to raise concerns around the debt and valuations of seven Adani companies.

Adani Group has denied the allegations, saying they have “no basis” and stem from an ignorance of Indian law. The group has always made the necessary regulatory disclosures, it added.

Speculation is growing that the Securities and Exchange Board of India (SEBI) will conduct some type of investigation into Adani’s businesses.

“My understanding is that a cancellation would mean a mandatory SEBI inquiry,” said Pramit Chaudhuri, Eurasia Group’s head of South Asia practice, to CNBC.

Chaudhuri, like many, said he was “surprised” to see Adani scrap plans after achieving the $2.5 billion target.

The stunning reversal caps a week in which Adani went on a full mission to ensure his equity sale was successful following immense pressure tied to his falling stock price.

Adani tapped high net worth individuals inside India and looked to the Middle East as well. International Holding Co., an Abu Dhabi-based conglomerate, contributed $400 million to the deal. It was widely seen as a vote of confidence. Goldman’s trading desk participated in the deal as well, a source familiar with the matter told CNBC. Adani Enterprises’ stock ended higher on Tuesday following news of the fully subscribed $2.5 billion offering.

Investors woke up to an ugly picture on Wednesday when Adani Enterprise’s stock plunged, falling by as much as 28% and prompting Adani to cancel his equity sale.

“We are working with our Book Running Lead Managers (BRLMs) to refund the proceeds received by us in escrow and to also release the amounts blocked in your bank accounts for subscription to this issue,” added Adani.

The move also raises questions about where else Adani will look for financial support.

As CNBC reported, Adani has established relationships with a slate of international banks and private equity investors. The tycoon, once the second richest person in the world, has slipped to the 13th position in the Bloomberg Billionaires Index as of Feb. 1.

-

Bond king Jeffrey Gundlach says he expects one more Fed rate hike

DoubleLine Capital CEO Jeffrey Gundlach said he sees one additional rate hike from the Federal Reserve before the central bank ends its tightening cycle.

“I think one more,” Gundlach said Wednesday on CNBC’s “Closing Bell: Overtime.” “I think it’s tough to make the statement ‘ongoing increases’ with an ‘s’ at the end of the word ‘increase’ and do zero unless you had very substantial change in economic conditions.”

The Fed on Wednesday raised its benchmark interest rate by a quarter percentage point, taking its target range to 4.5%-4.75%, the highest since October 2007. The Fed’s statement included language noting that the central bank still sees the need for “ongoing increases in the target range.”

The so-called bond king said Fed Chairman Jerome Powell had a “clarifying” statement at the press conference Wednesday, saying the real yields are positive across the curve. Gundlach said he was referring to the Treasury Inflation-Protected Securities (TIPS), whose yields have stopped their ascent.

“He’s looking at the TIPS market, which had a huge increase in yields last year. That was a major headwind for risk assets in the stock market,” Gundlach said. “They’ve stopped going up and I have a feeling that real yields are going to not go up in the first part of this year. So that keeps a little bit of runway, I think.”

Stocks staged a big comeback in January, led by beaten-down technology names. The S&P 500 rallied 6.2% in January, notching its best start of the year since 2019. The tech-heavy Nasdaq Composite jumped 10.7% last month for its best monthly performance since July.

In Powell’s press conference, the Fed chief said the central bank could conduct a few more rate hikes to bring inflation down to its target.

“We’ve raised rates four and a half percentage points, and we’re talking about a couple of more rate hikes to get to that level we think is appropriately restrictive,” Powell said. “Why do we think that’s probably necessary? We think because inflation is still running very hot.”

Asked if Gundlach sees the Fed cutting rates this year, he said it’s a coin flip, depending on the incoming inflation data.

“I kind of think that they’ll cut rates in the second half of the year, but I’m not really committed to that idea firmly at all,” Gundlach said.

The widely followed investor also said he believes the odds for a recession this year have decreased, but they are still above 50%.

-

Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your money

The Federal Reserve raised the target federal funds rate for the eighth time in a row on Wednesday, in its continued effort to tame persistent inflation.

At its latest meeting, the central bank approved a more modest 0.25 percentage point increase after recent signs that inflationary pressures have started to cool.

“The easing of inflation pressures is evident, but this doesn’t mean the Federal Reserve’s job is done,” said Greg McBride, chief financial analyst at Bankrate.com. “There is still a long way to go to get to 2% inflation.”

What the federal funds rate means to you

The federal funds rate, which is set by the U.S. central bank, is the interest rate at which banks borrow and lend to one another overnight. Although that’s not the rate consumers pay, the Fed’s moves do affect the borrowing and saving rates consumers see every day.

This rate hike will correspond with a rise in the prime rate and immediately send financing costs higher for many forms of consumer borrowing — putting more pressure on households already under financial strain.

“Inflation has shredded household budgets and, in many cases, households have had to lean against credit cards to bridge the gap,” McBride said.

On the flip side, “with rates still rising and inflation now declining, it is the best of both worlds for savers,” he added.

How higher interest rates can affect your money

1. Your credit card rate will rise

Since most credit cards have a variable rate, there’s a direct connection to the Fed’s benchmark. As the federal funds rate rises, the prime rate does, as well, and your credit card rate follows suit within one or two billing cycles.

“Credit card interest rates are already as high as they’ve been in decades,” said Matt Schulz, chief credit analyst at LendingTree. “While the Fed is taking its foot off the gas a bit when it comes to raising rates, credit card APRs almost certainly will keep climbing for at least the next few months, so it is important that cardholders continue to focus on knocking down their debt.”

Credit card annual percentage rates are now near 20%, on average, up from 16.3% a year ago, according to Bankrate. At the same time, more cardholders carry debt from month to month while paying sky-high interest charges — “that’s a bad combination,” McBride said.

At more than 19%, if you made minimum payments toward the average credit card balance — which is $5,474, according to TransUnion — it would take you almost 17 years to pay off the debt and cost you more than $7,528 in interest, Bankrate calculated.

Altogether, this rate hike will cost credit card users at least an additional $1.6 billion in interest charges in 2023, according to a separate analysis by WalletHub.

“A 0% balance transfer credit card remains one of the best weapons Americans have in the battle against credit card debt,” Schulz advised.

Otherwise, consumers should consolidate and pay off high-interest credit cards with a lower-interest personal loan, he said. “The rates on new personal loan offers have climbed recently as well, but if you have good credit, you may be able to find options that feature lower rates that what you currently have on your credit card.”

2. Mortgage rates will stay higher

Rates on 15-year and 30-year mortgages are fixed and tied to Treasury yields and the economy. As economic growth has slowed, these rates have started to come down but are still at a 10-year high, according to Jacob Channel, senior economist at LendingTree.

The average interest rate for a 30-year fixed-rate mortgage is now around 6.4% — up almost 3 full percentage points from 3.55% a year ago.

“Relatively high rates, combined with persistently high home prices, mean that buying a home is still a challenge for many,” Channel said.

This rate hike has increased the cost of new mortgages by around 10 basis points, which translates to roughly $9,360 over the lifetime of a 30-year loan, assuming the average home loan of $401,300, WalletHub found. A basis point is equal to 0.01 of a percentage point.

“We’re still a ways away from the housing market being truly affordable, even if it has recently become a bit less expensive,” Channel said.

Other home loans are more closely tied to the Fed’s actions. Adjustable-rate mortgages, or ARMs, and home equity lines of credit, or HELOCs, are pegged to the prime rate. Most ARMs adjust once a year, but a HELOC adjusts right away. Already, the average rate for a HELOC is up to 7.65% from 4.11% a year ago.

More from Personal Finance:

64% of Americans are living paycheck to paycheck

What is a ‘rolling recession’ and how does it impact you?

Almost half of Americans think we’re already in a recession3. Auto loans will get more expensive

Even though auto loans are fixed, payments are getting bigger because the price for all cars is rising along with the interest rates on new loans, so if you are planning to buy a car, you’ll shell out more in the months ahead.

The average interest rate on a five-year new car loan is currently 6.18%, up from 3.96% last year.

The Fed’s latest move could push up the average interest rate even higher, although consumers with higher credit scores may be able to secure better loan terms or look to some used car models for better deals.

Paying an annual percentage rate of 6% instead of 4% would cost consumers $2,672 more in interest over the course of a $40,000, 72-month car loan, according to data from Edmunds.

“The ever-increasing costs of financing remain a challenge,” said Ivan Drury, Edmunds’ director of insights.

4. Some student loans will get pricier

Federal student loan rates are also fixed, so most borrowers won’t be affected immediately. But if you are about to borrow money for college, the interest rate on federal student loans taken out for the 2022-23 academic year already rose to 4.99%, up from 3.73% last year and any loans disbursed after July 1 will likely be even higher.

If you have a private loan, those loans may be fixed or have a variable rate tied to the Libor, prime or T-bill rates, which means that as the central bank raises rates, borrowers will likely pay more in interest, although how much more will vary by the benchmark.

Currently, average private student loan fixed rates can range from just under 4% to almost 15%, according to Bankrate. As with auto loans, they also vary widely based on your credit score.

For now, anyone with existing federal education debt will benefit from rates at 0% until the payment pause ends, which the Education Department expects to happen sometime this year.

What savers should know about higher interest rates

The good news is that interest rates on savings accounts are finally higher after the recent run of rate hikes.

While the Fed has no direct influence on deposit rates, they tend to be correlated to changes in the target federal funds rate, and the savings account rates at some of the largest retail banks, which have been near rock bottom during most of the Covid pandemic, are currently up to 0.33%, on average.

Also, thanks, in part, to lower overhead expenses, top-yielding online savings account rates are as high as 4.35%, much higher than the average rate from a traditional, brick-and-mortar bank.

Rates on one-year certificates of deposit at online banks are even higher, now around 4.75%, according to DepositAccounts.com.

As the Fed continues its rate-hiking cycle, these yields will continue to rise, as well. However, you have to shop around to take advantage of them, according to Yiming Ma, an assistant finance professor at Columbia University Business School.

“If you haven’t already, it’s really important to benefit from the high interest environment by getting a higher return,” she said.

Still, because the inflation rate is now higher than all of these rates, any money in savings loses purchasing power over time.