The stock market always overreacts, and this year it seems as if investors believe dividend stocks have become toxic. But a look at yields on quality dividend stocks relative to the market underlines what may be an excellent opportunity for long-term investors to pursue growth with an income stream that builds up over the years.

The current environment, in which you can get a yield of more than 5% yield on your cash at a bank or lock in a yield of 4.57% on a10-year U.S. Treasury note

BX:TMUBMUSD10Y

or close to 5% on a 20-year Treasury bond

BX:TMUBMUSD20Y

seems to have made some investors forget two things: A stock’s dividend payout can rise over the long term, and so can it is price.

It is never fun to see your portfolio underperform during a broad market swing. And people have a tendency to prefer jumping on a trend hoping to keep riding it, rather than taking advantage of opportunities brought about by price declines. We may be at such a moment for quality dividend stocks, based on their yields relative to that of the benchmark S&P 500

SPX.

Drew Justman of Madison Funds explained during an interview with MarketWatch how he and John Brown, who co-manage the Madison Dividend Income Fund, BHBFX MDMIX and the new Madison Dividend Value ETF

DIVL,

use relative dividend yields as part of their screening process for stocks. He said he has never seen such yields, when compared with that of the broad market, during 20 years of work as a securities analyst and portfolio manager.

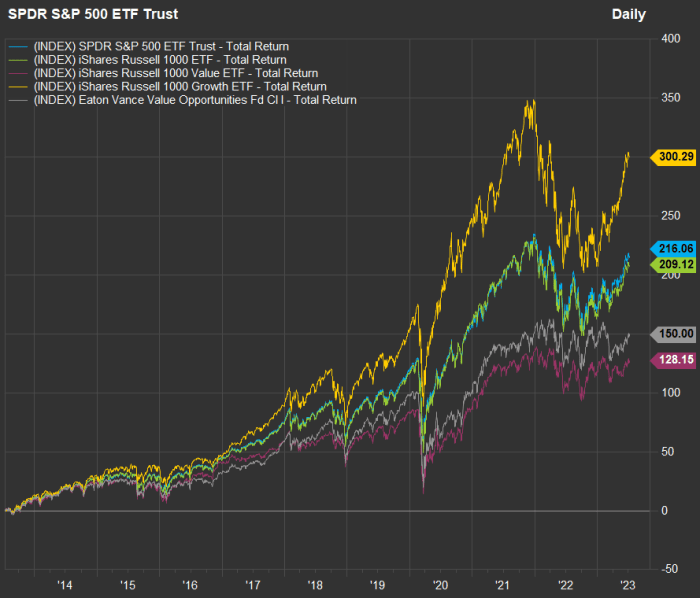

Dividend stocks are down

Before diving in, we can illustrate the market’s current loathing of dividend stocks by comparing the performance of the Schwab U.S. Equity ETF

SCHD,

which tracks the Dow Jones U.S. Dividend 100 Index, with that of the SPDR S&P 500 ETF Trust

SPY.

Let’s look at a total return chart (with dividends reinvested) starting at the end of 2021, since the Federal Reserve started its cycle of interest rate increases in March 2022:

FactSet

The Dow Jones U.S. Dividend 100 Index is made up of “high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios,” according to S&P Dow Jones Indices.

The end results for the two ETFs from the end of 2021 through Tuesday are similar. But you can see how the performance pattern has been different, with the dividend stocks holding up well during the stock market’s reaction to the Fed’s move last year, but trailing the market’s recovery as yields on CDs and bonds have become so much more attractive this year. Let’s break down the performance since the end of 2021, this time bringing in the Madison Dividend Income Fund’s Class Y and Class I shares:

| Fund | 2023 return | 2022 return | Return since the end of 2021 |

| SPDR S&P 500 ETF Trust | 14.9% | -18.2% | -6.0% |

| Schwab U.S. Dividend Equity ETF | -3.8% | -3.2% | -6.9% |

| Madison Dividend Income Fund – Class Y | -4.7% | -5.4% | -9.9% |

| Madison Dividend Income Fund – Class I | -4.7% | -5.3% | -9.7% |

| Source: FactSet | |||

Dividend stocks held up well during 2022, as the S&P 500 fell more than 18%. But they have been left behind during this year’s rally.

The Madison Dividend Income Fund was established in 1986. The Class Y shares have annual expenses of 0.91% of assets under management and are rated three stars (out of five) within Morningstar’s “Large Value” fund category. The Class I shares have only been available since 2020. They have a lower expense ratio of 0.81% and are distributed through investment advisers or through platforms such as Schwab, which charges a $50 fee to buy Class I shares.

The opportunity — high relative yields

The Madison Dividend Income Fund holds 40 stocks. Justman explained that when he and Brown select stocks for the fund their investible universe begins with the components of the Russell 1000 Index

RUT,

which is made up of the largest 1,000 companies by market capitalization listed on U.S. exchanges. Their first cut narrows the list to about 225 stocks with dividend yields of at least 1.1 times that of the index.

The Madison team calculates a stock’s relative dividend yield by dividing its yield by that of the S&P 500. Let’s do that for the Schwab U.S. Equity ETF

SCHD

(because it tracks the Dow Jones U.S. Dividend 100 Index) to illustrate the opportunity that Justman highlighted:

| Index or ETF | Dividend yield | 5-year Avg. yield | 10-year Avg. yield | 15-year Avg. yield | Relative yield | 5-year Avg. relative yield | 10-year Avg. relative yield | 15-year Avg. relative yield |

| Schwab U.S. Dividend Equity ETF | 3.99% | 3.41% | 3.20% | 3.16% | 2.6 | 2.1 | 1.8 | 1.6 |

| S&P 500 | 1.55% | 1.62% | 1.79% | 1.92% | ||||

| Source: FactSet | ||||||||

The Schwab U.S. Equity ETF’s relative yield is 2.6 — that is, its dividend yield is 2.6 times that of the S&P 500, which is much higher than the long-term averages going back 15 years. If we went back 20 years, the average relative yield would be 1.7.

Examples of high-quality stocks with high relative dividend yields

After narrowing down the Russell 1000 to about 225 stocks with relative dividend yields of at least 1.1, Justman and Brown cut further to about 80 companies with a long history of raising dividends and with strong balance sheets, before moving further through a deeper analysis to arrive at a portfolio of about 40 stocks.

When asked about oil companies and others that pay fixed quarterly dividends plus variable dividends, he said, “We try to reach out to the company and get an estimate of special dividends and try to factor that in.” Two examples of companies held by the fund that pay variable dividends are ConocoPhillips

COP,

and EOG Resources Inc.

EOG,

Since the balance-sheet requirement is subjective “almost all fund holdings are investment-grade rated,” Justman said. That refers to credit ratings by Standard & Poor’s, Moody’s Investors Service or Fitch Ratings. He went further, saying about 80% of the fund’s holdings were rated “A-minus or better.” BBB- is the lowest investment-grade rating from S&P. Fidelity breaks down the credit agencies’ ratings hierarchy.

Justman named nine stocks held by the fund as good examples of quality companies with high relative yields to the S&P 500:

| Company | Ticker | Dividend yield | Relative yield | 2023 return | 2022 return | Return since the end of 2021 |

| CME Group Inc. Class A |

CME, |

2.04% | 1.3 | 31% | -23% | 1% |

| Home Depot, Inc. |

HD, |

2.79% | 1.8 | -3% | -22% | -25% |

| Lowe’s Cos., Inc. |

LOW, |

2.17% | 1.4 | 3% | -21% | -19% |

| Morgan Stanley |

MS, |

4.24% | 2.7 | -3% | -10% | -13% |

| U.S. Bancorp |

USB, |

5.89% | 3.8 | -22% | -19% | -37% |

| Medtronic PLC |

MDT, |

3.62% | 2.3 | 1% | -23% | -22% |

| Texas Instruments Inc. |

TXN, |

3.30% | 2.1 | -3% | -10% | -12% |

| United Parcel Service Inc. Class B |

UPS, |

4.17% | 2.7 | -8% | -16% | -23% |

| Union Pacific Corp. |

UNP, |

2.52% | 1.6 | 2% | -16% | -15% |

| Source: FactSet | ||||||

Click on the tickers for more about each company, fund or index.

Now let’s see how these companies have grown their dividend payouts over the past five years. Leaving the companies in the same order, here are compound annual growth rates (CAGR) for dividends.

Before showing this next set of data, let’s work through one example among the nine stocks:

-

If you had purchased shares of Home Depot Inc.

HD,

-0.39%

five years ago, you would have paid $193.70 a share if you went in at the close on Oct. 10, 2018. At that time, the company’s quarterly dividend was $1.03 cents a share, for an annual dividend rate of $4.12, which made for a then-current yield of 2.13%. - If you had held your shares of Home Depot for five years through Tuesday, your quarterly dividend would have increased to $2.09 a share, for a current annual payout of $8.36. The company’s dividend has increased at a compound annual growth rate (CAGR) of 15.2% over the past five years. In comparison, the S&P 500’s weighted dividend rate has increased at a CAGR of 6.24% over the past five years, according to FactSet.

- That annual payout rate of $8.36 would make for a current dividend yield of 2.79% for a new investor who went in at Tuesday’s closing price of $299.22. But if you had not reinvested, the dividend yield on your five-year-old shares (based on what you would have paid for them) would be 4.32%. And your share price would have risen 54%. And if you had reinvested your dividends, your total return for the five years would have been 75%, slightly ahead of the 74% return for the S&P 500 SPX during that period.

Home Depot hasn’t been the best dividend grower among the nine stocks named by Justman, but it is a good example of how an investor can build income over the long term, while also enjoying capital appreciation.

Here’s the dividend CAGR comparison for the nine stocks:

| Company | Ticker | Five-year dividend CAGR | Dividend yield on shares purchased five years ago | Dividend yield five years ago | Current dividend yield | Five-year price change | Five-year total return |

| CME Group Inc. Class A |

CME, |

9.46% | 2.44% | 1.55% | 2.04% | 20% | 42% |

| Home Depot Inc. |

HD, |

15.20% | 4.32% | 2.13% | 2.79% | 54% | 75% |

| Lowe’s Cos, Inc. |

LOW, |

18.04% | 4.14% | 1.81% | 2.17% | 91% | 109% |

| Morgan Stanley |

MS, |

23.16% | 7.62% | 2.69% | 4.24% | 80% | 108% |

| U.S. Bancorp |

USB, |

5.34% | 3.60% | 2.78% | 5.89% | -39% | -26% |

| Medtronic PLC |

MDT, |

6.65% | 2.90% | 2.10% | 3.62% | -20% | -9% |

| Texas Instruments Inc. |

TXN, |

11.04% | 5.24% | 3.10% | 3.30% | 59% | 82% |

| United Parcel Service Inc. Class B |

UPS, |

12.23% | 5.56% | 3.12% | 4.17% | 33% | 56% |

| Union Pacific Corp. |

UNP, |

10.20% | 3.37% | 2.07% | 2.52% | 34% | 49% |

| Source: FactSet | |||||||

This isn’t to say that Justman and Brown have held all of these stocks over the past five years. In fact, Lowe’s Cos.

LOW,

was added to the portfolio this year, as was United Parcel Service Inc.

UPS,

But for most of these companies, dividends have compounded at relatively high rates.

When asked to name an example of a stock the fund had sold, Justman said he and Brown decided to part ways with Verizon Communications Inc.

VZ,

last year, “as we became concerned about its fundamental competitive position in its industry.”

Summing up the scene for dividend stocks, Justman said, “It seems this year the market is treating dividend stocks as fixed-income instruments. We think that is a short-term issue and that this is a great opportunity.”

Don’t miss: How to tell if it is worth avoiding taxes with a municipal-bond ETF