This week saw Bitcoin (BTC) hit a new yearly high; Sam Bankman-Fried testifies; Gemini sues Genesis Global, Elon Musk has crypto plans and regulatory efforts resurface.

Bankman-Fried testifies

FTX founder Sam Bankman-Fried took the stand on day 13 of his trial to deliver testimony, leveraging a remarkable “I don’t recall” approach in his speech to the judges.

Bankman-Fried claimed that FTX refrained from utilizing auto-deletion mechanisms for their decision-making channels and leaned heavily on Signal for security measures. Furthermore, he deflected accountability onto his legal counsel, underscoring his lack of knowledge regarding specific aspects.

The 14th day of the trial also saw Bankman-Fried on the stand. He attributed Alameda’s management turmoil to his former partner, Caroline Ellison, and candidly admitted to utilizing customer funds for political contributions.

Key highlights from his testimony involved vehemently refuting any allegations of fraud, asserting that he sourced funds from various channels for Alameda, and expressing dissent toward his colleagues’ moniker for the company.

He claimed their extensive global travels as a pursuit of a more ‘adaptable’ regulatory landscape and emphasized how FTX’s assertive promotional endeavors were underpinned by loans from Alameda.

Despite his proposing a $2 billion safety buffer, Alameda didn’t adhere to a hedge against its bets. Subsequently, in the autumn of 2022, he contemplated the closure of Alameda and told Adam Yedidia that FTX doesn’t possess an impervious shield against a collapse.

Turkey and Taiwan step up

Turkey reemerged in the crypto arena with a strategic agenda. They resolved to address cryptocurrency taxation and related regulatory measures as integral components of their 2024 Presidential Annual Program. In a departure from prior deliberations, tangible progress is now evident in the implementation of these regulations.

Taiwan decided to take a serious stance on cryptocurrencies, exemplified by the introduction of the Virtual Asset Management Bill in their legislative body, the Legislative Yuan.

The bill is all about bringing some order to the local crypto industry, with a 30-page document that defines virtual assets, sets rules for asset operators, tightens consumer protection, and insists on industry cooperation and regulatory approvals as a prerequisite for operation.

Regulatory uncertainty

Meanwhile, the regulatory atmosphere in the US remained uncertain, with complaints from industry leaders piling up each day. This week, SEC commissioner Hester Peirce lent her voice against the agency’s crackdown on the crypto industry.

Peirce expressed her dissatisfaction with the SEC’s approach to cryptocurrency enforcement, with a particular focus on their recent dispute with LBRY. She highlighted that LBRY had a functional blockchain with practical utility, and she attributed the SEC’s actions as a contributing factor to its demise.

Peirce raised questions regarding the overall benefit to investors and the market resulting from these actions. She characterized the SEC’s strategy in the crypto scene as “misguided” and posits that a more constructive path would involve developing clear regulatory frameworks instead of engaging in blame-oriented discourses.

Kraken has reluctantly decided to start the sharing of user information with the IRS, effective from next month. This decision stemmed from a court mandate received in June, leaving the exchange with limited alternatives.

The IRS and Kraken had been embroiled in a protracted legal dispute since May 2021, with the tax authority’s primary aim being the identification of tax evaders. Despite Kraken’s persistent resistance, the Federal Court ultimately adjudicated in favor of sharing user data to facilitate tax compliance verification.

Binance woes

As Binance’s regulatory woes mounted, the company witnessed another departure this week. Binance’s Chief of Compliance for the UK, Jonathan Farnell, made a notable departure from the company. He had relinquished his senior position at Binance Europe in June and finalized his departure from Binance Markets Limited at the close of September.

Meanwhile, U.S. legislators Cynthia Lummis and French Hill believe a comprehensive examination of Binance is long overdue. They have written a letter to the Department of Justice, recommending a thorough investigation of Binance and Tether.

Apparently, apprehensions have surfaced regarding the potential use of cryptocurrencies for less-savory purposes. Senator Lummis is urging a closer scrutiny of this matter, with the letter co-signed by Rep. French Hill.

This is in addition to existing legal issues Binance has with the U.S. SEC and the CFTC, and the recent staff departures. Amid these concerns, reports from this week suggested that Binance CEO Changpeng Zhao had seen his net worth drop by $11.9 billion to a current value of $17.3 billion.

DCG, Genesis and Gemini take the spotlight

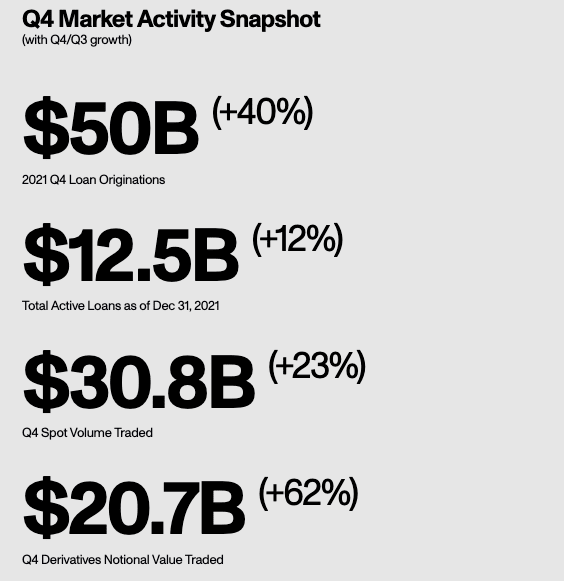

Notably, Digital Currency Group (DCG) and its bankrupt subsidiary Genesis Global took the spotlight this week along with Gemini, as the trio look to navigate their financial woes. DCG revealed a 23% surge in revenue to $188 million in its third-quarter revenue report.

Simultaneously, the company remains committed to resolving the financial obligations associated with its crypto-lending platform, Genesis. The financial boost is attributed to the crypto market’s recent resurgence, marking a rebound from the challenges of the previous year.

However, DCG is still embroiled in legal troubles with Letitia James, the New York State Attorney General. Alongside Gemini and Genesis, DCG faces a lawsuit alleging involvement in a $1 billion investor-unfriendly scheme relating to Gemini’s Earn program.

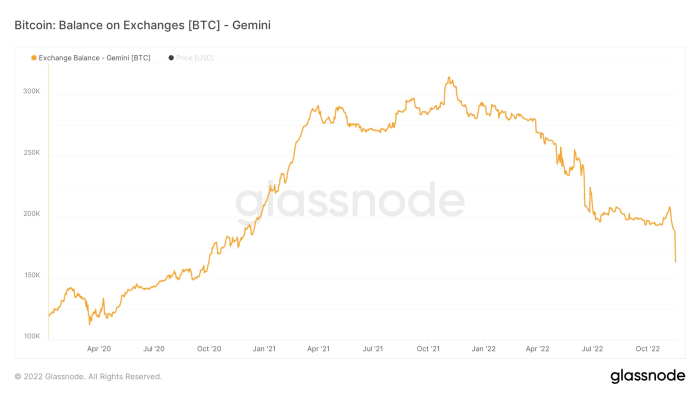

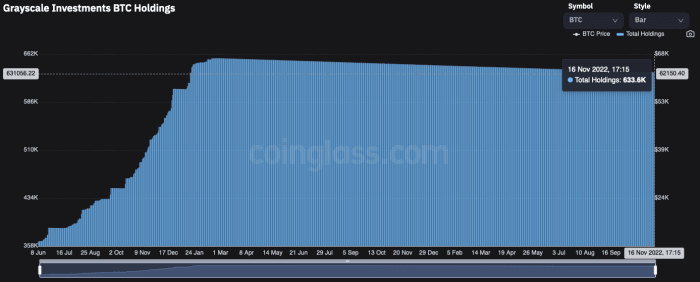

This week, Gemini and Genesis officially entered into a legal tussle over $1.6 billion worth of Grayscale Bitcoin Trust (GBTC) shares. Gemini filed a legal motion, aiming to nullify Genesis’ claim to these shares, stemming from their previous partnership in the Earn program.

Gemini views these GBTC shares as a potential solution to assist stranded Earn Users who have been unable to access their funds since Genesis halted withdrawals. This conflict occurs within the context of Genesis’ ongoing bankruptcy, and Gemini suggests that Genesis may access funds intended for Earn customers.

Bitcoin hits new yearly high above $35K

The chaos in the crypto scene did little to hamper Bitcoin’s growth. The asset continued to register more gains after its impressive performance last week. Amid the sustained bullish run, reports confirmed that Michael Saylor’s MicroStrategy was now seeing a $54.27 million profit in its bag as BTC traded at $29,925.

Bitcoin continued the upsurge, eventually rallying to a high of $35,280 on Oct. 24, its highest value this year and since May 2022. The BTC rally reverberated across the crypto ecosystem, triggering an increase in crypto-related shares such as Coinbase’s COIN and Grayscale’s GBTC. As these shares increased, Ark Invest sold $5.8 million worth.

In the wake of the renewed optimism, several industry leaders and crypto-focused firms began projecting higher price levels, especially in the context of a spot ETF approval. Grayscale predicted a 74% increase in Bitcoin’s value a year after the approval of a spot ETF.

On Oct. 26, veteran market analyst Peter Brandt asserted that Bitcoin has already witnessed its bottom. The trader projected a sudden surge to new highs, in a journey characterized by rocky price movements.

Bitcoin eventually dropped from the $35,000 price threshold but has held up well above $34,000, sustaining the positive sentiments. However, not all pundits are bullish. Glauber Contessoto advised caution amid the price surge, warning it could be a bull trap.

Overall, this week was generally bullish for Bitcoin, as the asset recorded five winning days out of seven. Bitcoin’s intraday losses only came up on Oct. 26 and 27, when the asset dropped by a mere 1.76% in both days. In all, BTC saw a 14.8% increase this week.

Elon Musk’s big plans for crypto: analyst

Elon Musk will likely incorporate Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE) and potentially other major cryptocurrencies into X’s services. The so-called “everything app” could also potentially utilize Lightning Network for instant transfers and have a built-in crypto wallet and exchange.

If Musk executes these ambitions, it would be a huge catalyst for crypto adoption, according to analyst CryptosRUs. Combined with other potential developments like spot Bitcoin ETF approvals and new regulations in 2024, the analyst predicts it will be a breakout year for the crypto market.

Also, in an all-hands call on Oct. 26, Musk reportedly shared his vision for X becoming a central hub for financial matters. With previous reports of quiet Dogecoin development and the CEO’s history of sparking price rallies, new 2024 features of X remain of interest to the cryptocurrency industry.

Follow Us on Google News