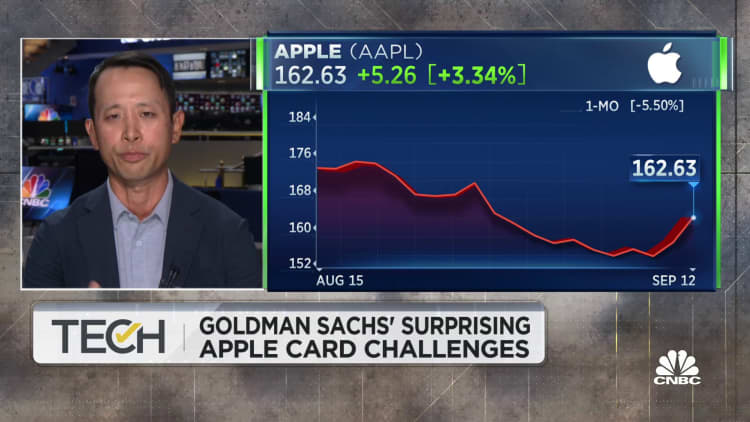

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. Markets : It has been a choppy session for stocks Tuesday, with the S & P 500 trying to go for two positive sessions in a row after falling four straight last week. The big tech stocks were having a solid day, rallying on Oracle’s upbeat comments about artificial intelligence demand. All of our Super Six megacaps were higher, even Club stock Apple was pushing to stay in the green after getting mixed reviews on Monday’s iPhone 16 event. We think that focusing on what was said on the stage about the AI-enabled device and not the runway being created is shortsighted. Banks : The financial sector was getting hammered Tuesday. It’s hard to get a broader market rally going when the banks act this poorly. A disappointing update from JPMorgan at Barclays Global Financial Services Conference was acting as a drag on the whole group. At the event, JPMorgan President and COO Daniel Pinto shared a discouraging view on its current quarter (third quarter) capital markets business. But what dropped the hammer was when Pinto was asked about 2025. He said he thinks the Street is modeling net interest income (NII) and expense estimates that are “too optimistic.” In other words, Pinto thinks JPMorgan will need to spend a little more and will earn a little less versus what analysts are currently forecasting. That means every analyst needs to lower its earnings estimate for next year. Stock prices tend to follow earnings, which was why Dow stock JPMorgan shares dropped nearly 5.5% on Tuesday. JPMorgan’s comments are reverberating across the sector, with many believing that if estimates for the gold standard are too high, then everyone else’s are also too high. It’s too early to know if Pinto is practicing UPOD –under promise, over deliver, in typical CEO Jamie Dimon fashion. But sometimes, it’s better for stocks when you get the bad news out of the way, which alternatively could be the case. It’s worth mentioning that Club name Wells Fargo backed its 2024 guide at the conference Tuesday while fellow Club holding Morgan Stanley said M & A and IPO revenue will be below trendline through the rest of the year before ramping up in 2025. Both stocks were lower on the session. New boss : Starbucks CEO Brian Niccol has officially been on the job for only two days, but he already published an open letter discussing the four key areas he’s focused on in his first 100 days. They are: (1) Empowering baristas to take care of customers; (2) Get the morning right, every morning; (3) Reestablishing Starbucks as the community coffeehouse; and (4) Telling our [Starbucks’] story. We think it’s clear that Niccol is hitting the ground running. “This letter was strong. Niccol recognizes complexity is the enemy and the baristas have not been empowered to make changes. That will change going forward,” Jim Cramer said Tuesday. The Club owns shares of Starbucks. In the letter, Niccol said the U.S. is where he needs to focus first with planned investments in technology to enhance the partner and customer exposure, improve the supply chain, and enhance the app and mobile ordering platform. Outside the United States, Niccol wrote that in China Starbucks needs to “understand the potential path to capture growth” and capitalize on its strengths. That’s an interesting line because you could argue that Starbucks needs to pullback its aggressive expansion plans in the world’s second-largest economy. Elsewhere, around the world, Niccol said he sees “enormous potential for growth” in international markets, especially in the Middle East where he said Starbucks will “work to dispel misconceptions about our brand.” Up next : After Tuesday’s closing bell, GameStop , Dave & Buster’s , and Petco report earnings. On Wednesday, it’s the August consumer price index. Expectations call for a headline CPI increase of 2.5% year over year and a 3.2% year-over-year rise in the core rate, which excludes volatile food and energy prices. The report could provide some clarity around the debate on whether the Fed should cut 25 or 50 basis points at its Sept. 17-18 meeting. Thursday brings the August producer price index, though it could be said that the Fed is more focused on the softening labor market right now. The Fed’s dual mandate calls for fostering maximum employment and price stability. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street.