[ad_1]

These 5 tech stocks could let you play earnings season like a pro

[ad_2]

[ad_1]

Flutter Entertainment, the parent company of FanDuel, started trading on the New York Stock Exchange for the first time Monday, as the company tries to narrow the valuation gap between it and rivals including DraftKings.

Flutter said Monday that it’s planning to make the New York Stock Exchange its primary listing and will put that to a vote of its shareholders in May. Making the NYSE its home, rather than London, will help it get included in important U.S. indexes, the company said.

Launching Monday with the ticker FLUT, it’s targeting New York as its primary listing late in the second quarter and early in the third quarter.

Having a New York listing will also boost its profile in the U.S., help with recruitment and retention, and access “much deeper” capital markets.

Flutter CEO Peter Jackson spoke with Yahoo Finance about the company after it started trading on Monday. The total addressable U.S. sports betting market is expected to reach $40 billion by 2023 — but Jackson thinks that’s lowballing it. “I expect [$40 billion] will turn out to be conservative, because everything in America turns out bigger than you expect,” he said.

And when asked about betting on the Super Bowl matchup between the Kansas City Chiefs and the San Francisco 49ers, he said, “We’ll break records in a couple of weeks time.”

London-listed shares

FLTR,

drifted 0.3% lower on Monday, though the stock has gained 17% this year.

According to FactSet, DraftKings

DKNG,

trades on 8.2 times estimated fourth-quarter sales, compared to 2.6 times for Flutter Entertainment.

Flutter said it plans to retain its London listing, having already delisted from Euronext Dublin.

Flutter earlier this month said that FanDuel was the “clear number one sportsbook” in the U.S. during the fourth quarter.

Other Flutter brands include Betfair, PokerStars and Paddy Power.

Weston Blasi contributed.

[ad_2]

Source link

[ad_1]

Oil futures ended slightly lower Friday on the final trading day of 2023, capping crude’s first losing year since 2020 as concerns about the demand outlook outweighed potential supply disruptions and efforts by OPEC and its allies to limit production.

CLG24,

fell 12 cents, or 0.1%, to close at $71.65 a barrel on the New York Mercantile Exchange.

BRNH24,

the global benchmark, fell 11 cents, or 0.1%, to settle at $77.04 a barrel on ICE Futures Europe.

WTI, the U.S. benchmark, slumped 21.1% in the fourth quarter and suffered a yearly fall of 10.7%. Brent tumbled over 19% in the final three months of the year, posting an annual loss of 10.3%.

Gasoline futures dropped 14.5% in 2023, while heating oil declined 24.1%. Natural gas plunged nearly 44%.

Crude had rallied over the summer as the Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, maintained production cuts, with Saudi Arabia throwing in a voluntary reduction of 1 million barrels a day beginning in July and Russia moving to curb exports. While production cuts have been rolled over into early 2024, oil peaked in late September as expectations for a significant supply deficit failed to materialize.

Increased production by the U.S., which saw its output hit record levels in 2023, and other non-OPEC producers have also capped the upside for crude, analysts said.

Read: Why oil may not see a return to $100 a barrel in 2024

Oil futures jumped in the wake of the outbreak of the Israel-Hamas war in October on fears that a broader conflict could cramp supplies from the Middle East, but crude failed to challenge its September highs and soon eroded its geopolitical-risk premium. Prices bounced somewhat in December as attacks by Yemen’s Iran-backed Houthi rebels on shipping vessels in the Red Sea sparked a round of rerouting, but gains have proven difficult to sustain.

Instead, investors “have started to focus on the risk that there may be excessive supply in oil markets next year, and insufficient demand,” said Marios Hadjikyriacos, senior investment analyst at XM, in a note.

“Even though OPEC+ has taken repeated steps to rein in production and support prices, it is unlikely to pursue the same strategy for much longer, as it would forfeit more market share to U.S. producers who have dialed up their own production to record levels,” he wrote.

Natural-gas prices, meanwhile, have slumped recently on a warmer-than-normal winter, said Lu Ming Pang, senior analyst at Rystad Energy, in a Friday note.

The number of heating-degree days (HDDs), which reflect the extent of heating required, has been below normal so far, with a deviation of 28 fewer HDDs from the normal reported on Dec. 15, the analyst noted. HDDs are forecast to rise through Jan. 5 but remain slightly below normal.

“Gas demand for heating is likely to rise as a result but will still remain below seasonal norms,” Pang said. “A combination of warmer weather, high underground-storage levels, and high domestic gas production is expected to keep U.S. prices suppressed.”

[ad_2]

[ad_1]

The traditional portfolio of stocks and bonds has been on a tear over the past two months as the S&P 500 nears a record high, but it’s the big gains in fixed income that stand out, according to Bespoke Investment Group.

Fixed-income assets are typically the “insurance” part of the classic 60-40 portfolio, usually holding up during market weakness even if that wasn’t the case in 2022, Bespoke said in a note emailed Thursday. Both stocks and bonds in the U.S. have rallied during the fourth quarter and are up so far in 2023.

“With just two trading days left in the year, the market is on the verge of history,” Bespoke said. “After being written off for dead in the last year, the traditional 60/40 portfolio of 60% stocks and 40% bonds is within a whisker of its best two-month rally since at least 1990.”

Read: ‘The switch was flipped’: ETF flows pick up as stocks, bonds head for 2023 gains

In 2022, bonds failed to provide a cushion in the 60-40 portfolio as the Federal Reserve aggressively raised interest rates to battle surging inflation. Stocks and bonds tanked last year, with the S&P 500

SPX

seeing its ugliest annual performance since 2008, when the global financial crisis was wreaking havoc in markets.

Over the past two months, the classic 60-40 mix has seen a gain of 12.16% based on the total returns of the S&P 500 and Bloomberg Aggregate Bond Index, according to Bespoke. The current rolling two-month performance is stronger than gains seen in the two-month rally after the onset of the Covid-19 pandemic through May 2020, the firm found.

“The only other period that was better for the strategy was the two months ending in April 2009,” the firm said. “Back then, the strategy rallied 12.25%, so if the next two trading days even see marginal gains, the current rally will set the record.”

The Vanguard Total Bond Market ETF

BND

and iShares Core U.S. Aggregate Bond ETF

AGG

have each seen a total return of slightly more than 7% this quarter through Wednesday, according to FactSet data.

That puts the Vanguard Total Bond Market ETF on track for its best quarterly performance on record, while the iShares Core U.S. Aggregate Bond ETF is heading for its biggest total return since 2008, FactSet data show. The iShares Core U.S. Aggregate Bond ETF gained a total 7.4% in the fourth quarter of 2008.

In April 2009, “the bond leg” of the 60-40 portfolio was up just 1.87% on a rolling two-month basis, while in May 2020 it gained 2.25%, the Bespoke note shows.

“During this current period, bonds have rallied an unprecedented 8.87%, which far exceeds any other two-month period since at least 1990,” the firm said. “While they still underperformed stocks in the last two months, they have never acted as a smaller drag on the strategy during a period of strength.”

Bespoke found that the S&P 500, a gauge of U.S. large-cap stocks, is up 14.35% over the last two months on a total-return basis, “which is certainly strong relative to history but not anywhere close to a record.”

The U.S. stock market was trading slightly higher on Thursday afternoon, with the S&P 500 up 0.2% at around 4,791, according to FactSet data, at last check. That’s within striking distance of the index’s closing peak of 4,796.56, reached Jan. 3, 2022, according to Dow Jones Market Data.

As stocks were inching higher Thursday afternoon, shares of both the Vanguard Total Bond Market ETF and iShares Core U.S. Aggregate Bond ETF were trading down modestly, according to FactSet data, at last check.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

was rising about seven basis points on Thursday afternoon, at around 3.85%, but is down so far this quarter, FactSet data show. Bond yields and prices move in opposite directions.

Bond prices are rallying as many investors anticipate the Fed is done hiking rates — and may begin cutting them sometime next year — as inflation has fallen significantly from its 2022 peak.

As for year-to-date gains, the S&P 500 has surged 26.6% on a total-return basis through Wednesday, while the iShares Core U.S. Aggregate Bond ETF has gained a total 6.1% over the same period, FactSet data show.

[ad_2]

[ad_1]

Updated Dec 27, 2023, 7:34 am EST / Original Dec 27, 2023, 4:26 am EST

Stock futures traded slightly lower Wednesday after the S&P 500 finished higher Tuesday and just 0.45% below its record close of 4,796.56 hit Jan. 3, 2022. The broad market index has risen 24% this year and has gained 4.5% this month as traders bet the Federal Reserve will begin cutting interest rates as soon as March.

Continue reading this article with a Barron’s subscription.

[ad_2]

[ad_1]

U.S. stocks closed higher Tuesday, building on a streak of eight straight weekly gains as the final, holiday-shortened week of 2023 got under way.

On Friday, stocks finished a choppy pre-holiday trading session mostly higher, with the S&P 500, Dow and Nasdaq each scoring an eighth straight weekly gain. The S&P 500 finished 0.9% away from its record close of 4,796.56, set on Jan. 3, 2022.

Read:…

Already a subscriber?

Log In

[ad_2]

[ad_1]

U.S. stock indexes were higher on Wednesday as Wall Street tried to build on their year-end rally with a fresh record in sight for the S&P 500 index.

On Tuesday, the Dow booked a fifth straight record close, while the S&P 500 rose and the Nasdaq extended its winning streak to a ninth day.

U.S. stocks were edging higher on Wednesday with the S&P 500 less than 1% shy of the all-time closing high of 4796.56 it recorded at the start of January 2022, while the Dow industrials and Nasdaq were struggling to extend their nine consecutive daily gains.

The Wall Street large-cap benchmark S&P 500 has jumped 24.3% this year, partially powered by hopes that the U.S. economy has not been too badly damaged by the Federal Reserve’s ratcheting up of interest rates to cool inflation.

The latest leg of the rally reflects hopes that with inflation back down to 3.1%, the central bank will begin quickly trimming borrowing costs next year. Not even an concerted effort by Fed officials to counter the market’s rate-cut optimism has damped trader’s ardor.

This dismissal of less-dovish Fedspeak has left some observers bemused.

“Investors are dreaming of aggressive rate cuts in an environment of strong economic growth, and that is not the right recipe for easing inflation and keeping it sufficiently low,” Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “The robust economic data and high earnings expectations are not compatible with a dovish Fed,” she said.

See: Why the 60-40 portfolio is poised to make a comeback in 2024

Perhaps the current bullishness is also reflective of seasonal trends, with optimism about a festive bounce underpinning stocks. The “Santa Claus Rally” period stretches from the last five trading days of the year and first two trading days of the new year, according to the Stock Trader’s Almanac.

Since 1950, the S&P 500 has averaged a gain of 1.32% and closed higher 78.1% of the time over that period, according to Dow Jones Market Data.

In U.S. economic data, existing-home sales rose 0.8% in November to 3.82 million, the National Association of Realtors said on Wednesday. Sales of previously owned homes unexpectedly inched up last month, snapping a five-month slump as easing mortgage rates encouraged some U.S. homebuyers.

Meanwhile, U.S. consumer confidence index rose to 110 in December, up from a downwardly revised 101 in the previous month, the Conference Board said Wednesday.

“The consumer is feeling pretty well as rates move lower, employers add to their payroll, and income expectations improve,” said Jeffrey J. Roach, chief economist at LPL Financial. “So far, investors have a green light as they merge into the new year.”

That said, investors will continue seeking guidance from more economic data due later this week that may provide more clarity on the Fed’s interest-rate path in 2024. A revision of third-quarter GDP print is expected on Thursday morning, followed by Friday’s personal consumption expenditure (PCE) inflation report — the Fed’s preferred inflation gauge.

[ad_2]

[ad_1]

U.S. stocks closed mostly higher Friday, with major U.S. equity indexes booking a seventh straight week in the green in the wake of the Federal Reserve’s policy meeting.

The S&P 500 saw its longest weekly winning streak since November 2017, according to Dow Jones Market Data.

U.S. stocks finished mostly higher Friday, with the Dow Jones Industrial Average logging a third straight record close.

Equities broadly rallied this week after investors digested a closely watched reading on U.S. inflation as well as the Federal Reserve’s latest policy statement and projections on interest rates. The Dow, S&P 500 and Nasdaq Composite each logged a seventh straight week of gains.

The “more optimistic tone of markets over the last several weeks has been justified,” Russell Price, chief economist at Ameriprise Financial, said in a Friday phone call. It’s “reasonable” for the stock market to be pricing in rate cuts by the Federal Reserve in 2024, with the recent drop in 10-year Treasury yields helping to lift equities, he said.

Price said he’s expecting the Fed may begin cutting rates in June and the U.S. economy will slow to a “sustainable” pace of growth in 2024. In his view, real gross domestic product may rise 1.8% to 1.9% next year.

Nearly all of the S&P 500’s 11 sectors finished with gains this week, while small-capitalization stocks saw a stronger rally than large-cap equities.

The small-cap Russell 2000 index

RUT

posted a weekly gain of around 5.6%, FactSet data show. The S&P 500 rose around 2.5% this week.

At his press conference on Wednesday, Fed Chair Jerome Powell gave “a nod” that inflation was on the right path and lower rates were on the horizon next year, according to Price. But when it comes to the federal-funds futures, Price said that traders appear to have gotten “too far ahead” in their bets on rate cuts.

Fed-funds futures pointed to the central bank starting to reduce its benchmark rate as soon as March, according to the CME FedWatch Tool.

Stocks hit a speed bump in Friday’s trading session after New York Federal Reserve Bank President John Williams pushed back against those rate expectations during an interview with CNBC. “We aren’t really talking about cutting interest rates right now,” Williams said.

Inflation, as measured by the consumer-price index, slowed to a year-over-year rate of 3.1% in November, down significantly from last year’s peak of 9.1% in June. But “it’s too early to call ‘mission accomplished’ just yet” for the Fed’s goal of bringing inflation down to its 2% target, said Price.

Still, Powell was explicit during his press conference about not needing a recession to cut rates, according to Nationwide’s chief of investment research Mark Hackett. “That was code for a soft landing,” Hackett said by phone Friday.

See: Williams says the Fed isn’t ‘really talking about cutting interest rates right now’

On the economic news front Friday, the New York Fed’s Empire State manufacturing survey showed U.S. manufacturing activity continued to struggle as the gauge tumbled to a four-month low. Flash services and manufacturing PMIs from S&P affirmed that manufacturing activity remained weak, while services activity reached a five-month high.

Read: U.S. economy posts steady but lackluster growth at year’s end, S&P finds

Meanwhile, the yield on the 10-year Treasury note

BX:TMUBMUSD10Y

fell 31.7 basis points this week to 3.927%, the largest weekly drop since November 2022, according to Dow Jones Market Data.

The S&P 500 ended Friday about flat, but just 1.6% below its record close, reached Jan. 3, 2022.

“The momentum in the market is undeniably incredibly strong right now,” said Nationwide’s Hackett, though on Friday investors appeared to be taking “a natural break.”

[ad_2]

[ad_1]

U.S. stocks closed higher Friday, with the Dow Jones Industrial Average scoring its longest weekly winning streak since February 2019, as investors digested the latest job report.

For the week, the Dow eked out a gain of less than 0.1%, the S&P 500 edged up 0.2% and the Nasdaq advanced 0.7%. All three major indexes rose for a sixth straight week, according to Dow Jones Market Data.

U.S. stocks ended higher Friday as investors parsed a stronger-than-expected job report.

The U.S. Bureau of Labor Statistics said Friday that the economy added 199,000 jobs in November, while the unemployment rate fell to 3.7% from 3.9%. Economists polled by the Wall Street Journal had forecast that 190,000 jobs would be added in the month.

“It’s nice to see that a soft landing still can take place,” Yung-Yu Ma, chief investment officer at BMO Wealth Management, said by phone Friday. But the market had been getting “too optimistic” about potential interest-rate cuts by the Federal Reserve in the early part of next year, he added.

The job report is “perhaps a wash” for markets as “average hourly earnings growth came in a little on the high side,” Ma said. That could contribute to inflationary pressures and push a Fed pivot on rate cuts further out in 2024 than markets were expecting.

“The Fed can probably be patient for a while,” he said. Fed Chair Jerome Powell may “strike a bit more of a hawkish tone” after the central bank’s monetary-policy meeting next week, potentially pushing back against some of the enthusiasm for earlier rate cuts, Ma said.

Average hourly earnings rose 0.4% in November, up 4% year over year, the job report shows.

“Even though the headline 199,000 new jobs created is just slightly above consensus estimates for 190,000 new positions, the lower unemployment rate of 3.7%, coupled with higher-than-expected average hourly earnings, caused a jump higher in Treasury yields,” Quincy Krosby, chief global strategist at LPL Financial, said in emailed comments.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

climbed 11.5 basis points Friday to 4.244%, according to Dow Jones Market Data. That’s below its high this year of about 5% in October.

Meanwhile, the stock market’s so-called fear gauge remained low, with the CBOE Volatility Index

VIX

declining to 12.35 on Friday, FactSet data show.

See: The VIX says stocks are ‘reliably in a bull market’ heading into 2024. Here’s how to read it.

In other economic data released Friday, the University of Michigan’s gauge of consumer sentiment rose to a preliminary reading of 69.4 in December, its first increase in five months. Inflation expectations also moderated, the university’s survey of consumer sentiment showed.

Such a big swing for a single reading of the survey is unusual, said Claudia Sahm, a former Federal Reserve economist who now runs a consulting business. “These data usually don’t move like that,” she said during a phone interview with MarketWatch.

Next week’s economic calendar will include a reading on U. S. inflation from the consumer-price index as well as the outcome of the Fed’s two-day policy meeting, scheduled to conclude Dec. 13.

Meanwhile, the S&P 500 notched a sixth straight week of gains, its longest such winning streak since the stretch ending Nov. 15, 2019, according to Dow Jones Market Data. The Dow Jones Industrial Average logged its longest stretch of weekly gains since February 2019.

Steve Goldstein contributed.

[ad_2]

[ad_1]

Barring a sudden bout of post-Thanksgiving indigestion, the U.S. stock market looks poised to log a healthy November rally. And while there are certainly no guarantees, history says momentum is likely to beget momentum into year-end.

“I think the market is set up for a strong final six weeks of 2023 and I would expect the market to build on that momentum into year-end,” said Michael Arone, chief investment strategist at State Street, in a phone interview.

Drivers…

Already a subscriber?

Log In

[ad_2]

[ad_1]

Soros Fund Management, the investment firm founded by billionaire George Soros, took new positions or bulked up on IPOs and a number of tech names during the third quarter.

But it sold off small holdings of some of the largest — like Nvidia Corp. and Microsoft Corp. — as well as electric-vehicle maker Rivian Automotive.

According to a filing on Tuesday, the firm during the third quarter bought up 325,000 shares of chip designer Arm Holdings

ARM,

which went public in September, for $17.4 million. It also bought smaller stakes in recent IPOs such as Maplebear Inc.

CART,

better known as grocery-delivery platform Instacart, and digital-marketing firm Klaviyo Inc.

KVYO,

Those purchases were disclosed as investors remain cautious on new IPOs.

Elsewhere, the fund took a new position, of around 41,000 shares, in Apple Inc.

AAPL,

And it did so as well for Datadog Inc.

DDOG,

buying 62,000 shares during the quarter. It also bought up 574,962 shares of Splunk, and took fresh positions in Snowflake Inc.

SNOW,

and Taiwan Semiconductor

TSM,

Soros also packed on more to some of its other tech holdings. It added 125,000 shares to its stake in Uber Technologies Inc.

UBER,

boosting its position by 16.6% for a total of 878,955 shares. It also bought 42,000 more shares of another gig-economy player, DoorDash Inc.

DASH,

a 30.9% increase for 178,075 shares.

While Soros boosted its stake in General Motors

GM,

it sold off its 4.2 million shares in Rivian

RIVN,

The firm also sold off its positions — of roughly 10,000 shares apiece — in tech giants Microsoft

MSFT,

and Nvidia

NVDA,

Soros Fund Management also sold off its stake in Walt Disney Co.

DIS,

[ad_2]

[ad_1]

U.S. stocks ended sharply higher Friday, more than shaking off weakness seen the previous session in the aftermath of a poor Treasury bond auction and fresh signs that interest rates may stay higher for longer.

Technology stocks drove the bounce, with the Nasdaq Composite leading major indexes to the upside as it and the S&P 500 logged their highest finishes since September.

The rally left the Dow with a weekly gain of 0.7%, while the S&P 500 advanced 1.3% and the Nasdaq booked a rise of 2.4%. The Dow saw its highest close since Sept. 20, while the S&P 500 ended at its highest since Sept. 19 and the Nasdaq at its highest since Sept. 14.

Tech was in the driver’s seat. Shares of Microsoft Corp.

MSFT,

jumped 2.5%, with the Dow component scoring its third record close in four sessions. Intel Corp. shares

INTC,

rose 2.8% to lead Dow gainers.

Meanwhile, the S&P 500 tested important chart resistance at the 4,400 to 4,415 level, which marks the confluence of previous resistance and the 61.8% Fibonacci retracement of the July-October drop, according to Matthew Weller, global head of research at Forex.com, in a note (see chart below).

“From a bigger picture perspective, bulls will need to see the index conclusively break above 4415 before declaring that the post-July streak of lower lows and lower highs is over,” Weller wrote.

The S&P 500 and Nasdaq Composite ended their longest winning streaks since November 2021 on Thursday, after a poorly-received $24 billion sale of 30-year Treasury bonds.

A calmer bond market may have helped set the tone for stocks. The yield on the 30-year Treasury bond

BX:TMUBMUSD30Y

fell 3.2 basis points to 4.733%, after it nearly notched its biggest one-day jump since June 2022. The yield still saw a weekly decline, its third straight.

It was unclear whether the Treasury auction had been affected by a reported ransomware attack against the U.S. unit of the Industrial & Commercial Bank of China that apparently disrupted the U.S. Treasury market.

See: How ransomware attack on ICBC rattled the Treasury market and shook up a 30-year bond auction

Thursday’s setback was also tied to comments from Federal Reserve Chairman Jerome Powell, who told an International Monetary Fund panel on Thursday that the central bank was wary of “head fakes” from inflation, and the “2% goal was not assured.”

Much of Powell’s language was nearly identical to remarks he made on Nov. 1, when investors rallied stocks and bonds after the Fed chair didn’t explicitly commit to a further interest rate hike. But the subsequent rally for stocks after the Nov. 1 Fed meeting, with the S&P 500 jumping more than 6% over eight days, and a 50 basis point drop in the 10-year Treasury yield were “overdone and not governed by facts,” said Tom Essaye, founder of Sevens Report Research, in a note.

“Meanwhile, if we think about what the Fed said last week, namely that the rise in the 10-year yield was doing the Fed’s work for it and as a result they may not have to hike rates, then the short/sharp decline in the 10-year yield we’ve seen could essentially remove the reason for the Fed not having to hike rates — and that could put a rate hike back on the table!” he wrote. “That’s essentially what Powell reminded us of yesterday and that, along with the poor Treasury auction, pushed yields higher,” setting up pressure on stocks.

U.S. consumer sentiment fell in November for the fourth month in a row due to worries about higher interest rates as well as war in the Middle East. The preliminary reading of the sentiment survey declined to 60.4 from 63.8 in October, the University of Michigan said Friday. It’s the weakest reading since May.

Investors were also tuning into more comments by Fed officials Friday, including San Francisco Fed President Mary Daly, who said she didn’t know if rates were high enough to bring inflation back down to the central bank’s 2% target.

[ad_2]

[ad_1]

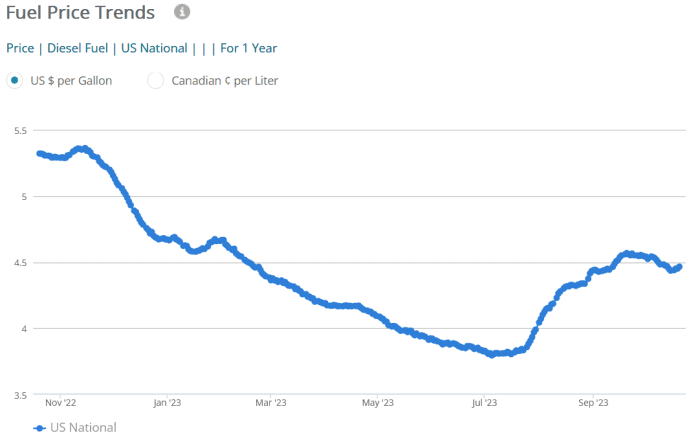

Fuel prices, with the cost of gasoline and diesel at the pump both down from a month ago, don’t appear to be fazed by the escalating risks to oil supplies in the Middle East from the Israel-Hamas war, but they are.

The decline in fuel prices seen nationally is actually a “bit above what would be ‘normal’ for this time of year,” said Patrick De Haan, head of petroleum analysis at GasBuddy. However, he believes “prices won’t fall as far as they would have had the attacks on Israel not happened.”

On Friday, the average retail price for a gallon of regular gasoline stood at $3.528, down 5.7 cents from a week ago, while the average retail diesel price was at $4.465 a gallon on Friday, down 7.8 cents from Sept. 30, according to data from GasBuddy.

GasBuddy

“Geopolitical risk is now heightened, changing the calculus” for the fuel market, said Brian Milne, product manager, editor and analyst at DTN.

In considering retail gasoline prices during the fourth quarter, the “seasonal component is less pronounced than in years past,” said Milne. Demand for gasoline tends to fall following the summer travel season. Combined with a “strong slate of refinery maintenance,” which led to less fuel supply on the market, the rise in crude oil prices has slowed the decline in fuel prices, said Milne.

If not for the heightened geopolitical risk in the Middle East, he said he might have expected to see gasoline prices decline by another 30 cents to 40 cents per gallon into late December because of lower demand.

Retail gas prices may fall another 20 cents a gallon or more, depending on the location within the U.S., if we avoid broader hostilities in the Middle East, said Milne.

However, if a conflict breaks out beyond Israel and the Gaza Strip, gasoline prices are likely to move sharply higher because of a spike in crude costs, he said.

For its part, oil has seen volatile trading following the Hamas attack on Israel on Oct. 7, with futures prices for U.S. benchmark West Texas Intermediate crude

CLZ23,

CL.1,

higher for the week, but lower for the month.

For now, California, which typically is among the states that pays the most per-gallon for gasoline partly due to taxes on the fuel, is seeing prices “plummet” — down nearly 60 cents in the last three weeks, said GasBuddy’s De Haan.

“The West Coast is certainly seeing a much larger decline than is ‘normal’ and it’s due to the refinery situation now improving drastically,” as well as California’s RVP waiver, he said.

The California Air Resources Board allowed gasoline sold or supplied for use in California that exceeds the RVP, or Reid Vapor Pressure, limits through the end of Oct. 31, marking an early transition for the state from the lower RVP gas used in the summer to help cut gasoline emissions to the higher RVP gas used in the winter.

On Friday, the average price for a gallon of regular gasoline in California sold for $5.476, GasBuddy data show. That’s down 16.7 cents in just the last week.

De Haan said he does not expect to see a spike in gas prices nationally at this point, and there’s still room for prices to fall — just not as much following the Hamas attack on Israel.

“If we get to November and Iran gets involved in the situation, then we certainly could see gas prices impacted in some way as the current drops will likely be fully passed on by then, giving stations no ‘room’ to absorb higher prices reflected by a potential rise in oil,” said De Haan.

Still, falling demand, as well as “seasonality in general,” are what are pushing prices down, “enhanced by refinery improvements in areas” that saw price surges, he said.

Prices may even fall further after refinery maintenance season wraps up in mid-November, and refiners have to find places to put even more gasoline output, said De Haan.

He’s comfortable with the gasoline price forecasts GasBuddy issued in December of last year, which predicted a monthly national average for the fuel of $3.53 for October — matching the current price. The forecast also called for an average of $3.36 a gallon for November and $3.17 for December.

GasBuddy doesn’t have a forecast for 2024 yet, but prices may look similar to this year, as long as the situation in the Middle East doesn’t further crumble,” said De Haan.

Diesel, however, is another story.

Price for that fuel have dropped by 85.5 cents a gallon from a year ago to Friday’s $4.465 level, GasBuddy data show.

GasBuddy

While down from a year ago, diesel prices are currently at a “very high level historically” because global supply is low, said DTN’s Milne.

At this time in 2022 diesel fuel inventory was even tighter than it is now, and Europe was heading into winter without Russian natural gas after it was cutoff following the invasion of Ukraine, he said.

That led to a spike in natural-gas prices and prices for gasoil, a European heating oil, also surged, lifting heating oil and diesel prices globally, explained Milne.

Like gasoline, diesel prices could move “sharply higher if the war in Israel expands, and oil flow is put at greater risk,” he said.

De Haan, meanwhile, said diesel prices could climb closer to $5 a gallon if there’s a “squeeze,” with relief then [coming] in the spring/summer” seasons.

[ad_2]

[ad_1]

Oil traders on Sunday said crude prices were likely to remain supported in the near term, as investors assessed the fallout from the surprise attack by Hamas on Israel and focused on the role played by Iran and the potential impact on that country’s petroleum exports.

The conflict may also hold market-moving consequences for talks aimed at normalizing relations between Saudi Arabia and Israel.

“While in the short term there is no impact directly on supply, it’s obvious how things play out over the next 24 to 48 hours could change that,” Phil Flynn, an analyst at Price Futures Group in Chicago, told MarketWatch.

Brent crude futures

BRN00,

the global benchmark, and West Texas Intermediate oil futures

CL00,

CL.1,

jumped more than 3% when the market opened Sunday night. U.S. stock-index futures

ES00,

traded lower, while traditional havens, including gold

GC00,

and the U.S. dollar

DXY

rose.

Movements in oil prices, meanwhile, will also serve as a gauge for broader market worries around the conflict, analysts said.

See: Israeli stocks slump in first day of trade since Gaza attack

Hamas, the Iran-backed, Palestinian militant group that controls the Gaza Strip, staged a sweeping attack on southern Israel early Saturday. News reports put Israeli deaths at more than 700. The Gaza Health Ministry said 413 people, including 78 children and 41 women, were killed in the territory as Israel retaliated, according to the Associated Press. Injuries in Israel and Gaza were both said to be around 2,000.

Israeli troops on Sunday were engaged in fierce fighting in an effort to retake territory in southern Israel as Hamas launched further barrages of missiles. Israeli citizens and soldiers were captured and are being held hostage in Gaza, according to the Israeli military.

Read: Israel declares war, approves ‘significant’ steps to retaliate after surprise attack by Hamas

The Wall Street Journal reported that Iranian security officials helped Hamas plan the attack. U.S. officials said they haven’t seen evidence of Iran’s involvement, the report said.

“Iran remains a very big wild card and we will be watching how strongly [Israeli] Prime Minister Netanyahu blames Tehran for facilitating these attacks by providing Hamas with weapons and logistical support,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a Sunday morning note.

Iranian crude exports have risen in recent years, indicating the Biden administration has adopted a soft approach to sanctions enforcement, Croft said. Some analysts have put Iranian crude production at more than 3 million barrels a day and exports above 2 million barrels a day — the highest levels since the Trump administration pulled the U.S. out of the Iranian nuclear accord in 2018, according to the Wall Street Journal. Sales fell to around 400,000 barrels a day in 2020 as the U.S. reimposed sanctions.

Hedge-fund manager Pierre Andurand, one of the world’s best energy traders, said in a social-media post that a large price spike for oil isn’t likely in coming days, but emphasized the market focus on Iran.

“Now, over the last six months we have seen a very large increase in Iranian supply due to weak enforcement of sanctions. As Iran is also behind Hamas’ attacks on Israel, there is a good probability that the U.S. administration will start enforcing those sanctions on Iranian oil exports more tightly,” he wrote. “That would further tighten the oil market. Also the probability that this will lead to direct conflict with Iran is not zero.”

Meanwhile, the Wall Street Journal late Friday reported that Saudi Arabia had told the White House it would be willing to boost oil production next year if crude prices remained high, as part of an effort aimed at winning goodwill in Congress for a deal that would see the kingdom recognize Israel and in return get a defense agreement with the U.S.

A Saudi production cut of 1 million barrels a day that was implemented in July and recently extended through the end of the year has been given much of the credit for a rally that took global benchmark Brent crude within a few dollars of the $100-a-barrel threshold before retreating this past week. The U.S. benchmark last week briefly topped $95 a barrel for the first time in 13 months.

In a statement, Saudi Arabia’s foreign ministry called on both sides to halt the escalation and exercise restraint, but also recalled its “repeated warnings of the dangers of the explosion of the situation as a result of the continued occupation, the deprivation of the Palestinian people of their legitimate rights, and the repetition of systematic provocations against its sanctities.”

With the Israeli government vowing an unprecedented response, “it is hard to envision how Saudi normalization talks can run on a parallel track to a ferocious military counteroffensive,” said RBC’s Croft.

Beyond oil, much will depend on the potential for the conflict to widen.

Stocks have stumbled, retreating from 2023 highs set in late July, as yields on U.S. Treasurys have jumped. The yield on the 30-year Treasury bond

BX:TMUBMUSD30Y

rose 23.2 basis points last week to end Friday at 4.941%, its highest since Sept. 20, 2007. The 10-year Treasury note yield

BX:TMUBMUSD10Y

topped 4.80% on Oct. 3, its highest since Aug. 8, 2007, and ended the week at 4.783%. Yields and debt prices move opposite each other.

The U.S. bond market will be closed Monday for the Columbus Day and Indigenous People’s Day holiday, while U.S. stock markets will be open.

The S&P 500 index

SPX

rose 0.5% last week, breaking a streak of four straight weekly declines, while the Dow Jones Industrial Average

DJIA

fell 0.3% and the Nasdaq Composite

COMP

gained 1.6%.

“I think there will be a negative reaction. However, I don’t see a meltdown,” Peter Cardillo, chief market economist at Spartan Capital Securities, told MarketWatch.

Traditional haven plays, including gold, the dollar and U.S. Treasurys may see a strong move upward, with price gains for Treasurys pulling yields down.

“Geopolitical crises in the Middle East have usually caused oil prices to rise and stock prices to fall,” said economist Ed Yardeni, president of Yardeni Research Inc., in a note. “More often than not, they’ve also tended to be buying opportunities in the stock market.”

The broader market reaction will depend on whether the crisis turns out to be a short-term flare-up or “something much bigger, like a war between Israel and Iran,” he said. The latter is unlikely, but tensions between the two are likely to escalate.

“The price of oil may be a good way to assess the likelihood of a broader conflict,” he said.

[ad_2]