In the fast-paced and ever-evolving world of finance, staying ahead of the curve is crucial for those aiming to join the ranks of the financial elite. With the constant influx of new technologies and tools, navigating the sea of options can be overwhelming. That’s why we have compiled a comprehensive list of the top 50 finance tools you need to know in 2023.

From cutting-edge investment platforms to advanced budgeting apps and analytical software, this article will equip you with the knowledge and resources to enhance your financial prowess, streamline your operations, and elevate your success in the competitive realm of finance.

Justification:

Inclusion on our list of the top 50 finance tools in 2023 is a testament to the exceptional value and impact these tools can bring to individuals striving to be part of the financial elite. Each tool has been carefully selected based on its ability to revolutionize financial strategies, streamline processes, and unlock new opportunities for growth and success.

These finance tools encompass a wide range of functionalities, catering to various aspects of financial management. For instance, investment platforms with advanced algorithms and machine learning capabilities empower users to make data-driven investment decisions, optimizing portfolio performance and maximizing returns. Similarly, cutting-edge budgeting apps provide real-time tracking and analysis of personal and business finances, enabling users to make informed decisions, identify saving opportunities, and attain financial goals faster.

Moreover, the analytical software featured in our list equips finance professionals with powerful tools to extract valuable insights from vast datasets, enhancing risk assessment, forecasting accuracy, and strategic planning. The inclusion of these tools serves as a testament to their proven track record, user-friendly interfaces, and ability to empower individuals in achieving financial excellence. By incorporating these tools into their arsenal, aspiring financial elites can gain a significant competitive edge and unlock their full potential in the dynamic world of finance.

Mint (personal finance management)

Rating: 4.5 out of 5

Mint is an exceptional personal finance management tool that empowers users to take control of their financial life with ease and convenience. This all-in-one platform offers an array of features, including budgeting, bill tracking, expense categorization, and credit score monitoring, making it an indispensable asset for individuals seeking a comprehensive solution to their money management needs.

With intuitive and user-friendly interfaces, Mint helps users visualize and understand their financial landscape, promoting responsible financial habits and proactive decision-making.

One of Mint’s coolest features is its seamless integration with various financial institutions, enabling automatic synchronization of your bank accounts, credit cards, and loans onto a single platform. The real-time updates on transactions and balances, coupled with the insightful categorization of expenses, allow you to easily track and analyze your spending habits like a pro! What’s more, Mint’s goal-setting feature injects excitement and motivation, as it enables users to create personalized savings objectives, nudging them towards a more secure and fulfilling financial future. With Mint in your pocket, you have the power to steer your finances and achieve your money goals with confidence and enthusiasm!

QuickBooks (accounting software)

Rating: 4.7 out of 5.

QuickBooks is a versatile accounting software solution designed to cater to the financial and organizational needs of small to medium-sized businesses. This powerful tool streamlines various aspects of accounting, such as invoicing, expense tracking, payroll management, and financial reporting, making it an essential resource for entrepreneurs and business owners. Its user-friendly interface spares users the need to be accounting experts, and robust security measures ensure sensitive financial data remains protected. QuickBooks boasts seamless integration with third-party apps and offers a cloud-based option for those seeking accessibility on-the-go.

One of the coolest features of QuickBooks is its advanced invoicing capabilities, completely revolutionizing the way businesses handle their billing processes. Users can easily customize professional-looking invoices, set up recurring payments, and receive real-time notifications when invoices are viewed and paid—ultimately simplifying revenue management. Another fantastic feature is the bank integration, which effortlessly syncs and categorizes bank transactions for quick, accurate financial overviews. Say goodbye to manual data entry and hello to more time focusing on growing your business with QuickBooks’ cutting-edge features!

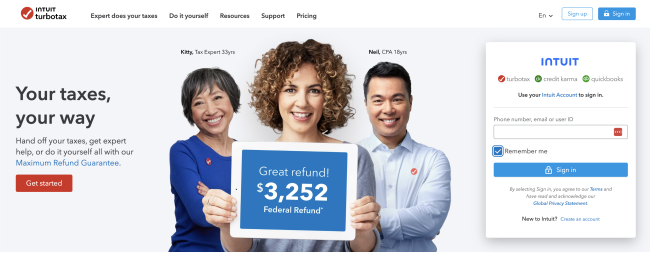

TurboTax (tax preparation software)

Rating: 4.5/5

TurboTax is a user-friendly, comprehensive, and reliable tax preparation software that assists individuals and businesses alike in processing and filing their tax returns accurately and efficiently. Developed by Intuit, TurboTax harnesses technology to streamline the tax filing process, ensuring that users receive the maximum refund they’re eligible for. The software offers step-by-step guided assistance, up-to-date tax law changes, and automatic error detection, making it a popular choice amongst those who want a hassle-free tax filing experience.

One of the coolest features of TurboTax is its innovative W-2 import functionality. With just a snap of a photo, TurboTax can extract pertinent information from your W-2 form, eliminating the need for manual data entry and minimizing potential errors. Another exciting feature is the Deduction Finder, which uses intelligent algorithms to identify tax-saving deductions and credits tailored to each user’s unique tax situation. As a bonus, TurboTax offers live, on-demand support with certified tax professionals to help answer any pressing questions, ensuring a smooth and stress-free tax preparation process. Overall, TurboTax delivers an intuitive and efficient tax filing experience through its sleek interface and cutting-edge features, making it a game-changer in the world of tax preparation.

PayPal (online payments)

Rating: 5/5

PayPal is a highly reputable and widely used online payment platform that allows individuals and businesses to securely send and receive payments across the globe. With its user-friendly interface, top-notch security measures, and extensive merchant support, PayPal has emerged as a leader in the digital payment landscape catering to the needs of millions of users worldwide. The platform offers seamless integrations with major e-commerce platforms and supports a variety of currencies, ensuring accessible and hassle-free transactions for both buyers and sellers. Given its unparalleled service, reliability, and convenience, I would rate PayPal a solid 5 out of 5.

Now, let’s talk about some of the coolest features of PayPal that truly set it apart! One remarkable feature is the ability to create and send custom invoices within minutes, making it incredibly easy for freelancers and businesses to bill their clients professionally. Additionally, PayPal’s One Touch feature lets you complete purchases rapidly without needing to re-enter your login information, ensuring a swift and smooth checkout experience. Furthermore, PayPal.Me, a personalized payment link, lets you request or accept payments in a snap by simply sharing your custom URL. With such innovative solutions designed to make your online payment experience as seamless as possible, it’s no wonder PayPal has earned the trust and loyalty of millions across the globe.

Stripe (online payment processing)

Rating: 5/5

Stripe is an exceptional online payment processing platform that streamlines the way businesses accept and manage transactions. Designed with powerful and flexible APIs, Stripe effortlessly integrates with numerous e-commerce and mobile platforms, helping businesses of all sizes to scale efficiently. The tool prioritizes security by employing advanced encryption technologies, ensuring that user information and payment data remain safe. Furthermore, Stripe’s transparent pricing model with competitive rates appeals to a wide range of users, from startups to established enterprises. Overall, I would rate Stripe a solid 5 out of 5 for its reliability, ease of use, and comprehensive features.

Of Stripe’s many cool features, two stand out as exceptionally exciting! The first is the ease with which Stripe can be integrated into virtually any online platform. Whether you’re using a popular e-commerce system or custom-built software, Stripe’s robust APIs quickly and seamlessly establish a connection, saving valuable time and getting businesses up and running in no time. Another remarkable aspect of Stripe lies in its powerful machine learning algorithms that continuously detect and prevent fraudulent activities from taking place. These advanced algorithms, coupled with a comprehensive support system, provide businesses with an extra layer of security for their payment transactions. Combine these cool features with unmatched efficiency and user experience, and it’s no wonder Stripe is a leader in the world of online payment processing!

Square (payment processing)

Rating: 4.5/5

Square (payment processing) is a highly efficient and versatile tool that enables businesses of all sizes to accept credit card payments from customers. It operates smoothly on both iOS and Android devices, making it a popular choice for retailers, service providers, and other businesses requiring seamless transaction processing. The platform offers a user-friendly interface, secure payment processing, and a generous selection of features appealing to different business models. With its extensive support for various types of cards, including contactless ones, Square is an essential tool for businesses looking to modernize their operations and improve customer experience. Rating: 4.5/5

The coolest feature of the Square payment processing tool has to be its ability to generate professional invoices and receipts in no time! The Square invoicing feature allows you to effortlessly create digital invoices, customized with your business logo, and send them to your clients via email or text. Your customers can quickly pay their invoices through a secure online portal, making the process hassle-free for both parties. Furthermore, Square offers real-time tracking of invoice payments, allowing you to stay organized and maintain a healthy cash flow. The tool also supports contactless payments, accommodating customers who prefer using digital wallets like Apple Pay or Google Wallet. Ultimately, Square’s fantastic features simplify business transactions, promoting a smooth flow of operations and keeping both merchants and customers happy.

Venmo (peer-to-peer payments)

Rating: 4.5 out of 5

Venmo is a widely popular peer-to-peer payment tool designed to simplify financial transactions among friends, families, and even small businesses. The app offers users an incredibly user-friendly experience, allowing them to smoothly send, request, and receive money from their contacts with just a few taps on the screen. It stands out for its unique social twist, where users can publicly or privately share their transactions with a personalized message, making it feel more connected and enjoyable. Owned by PayPal, the tool is equipped with robust security features that provide a safe environment for its users’ financial information.

One of the coolest features of Venmo is the seamless integration of peer-to-peer payment with an engaging social feed! Users can add personality to their transactions by including a message, emoji, and even animated stickers, making it feel more like a social media feed full of fun interactions. Another fantastic feature is the Venmo card, which acts as a debit card linked to your Venmo balance-allowing for easy spending without the need to transfer funds to your bank account. The Venmo card also offers personalized cashback deals that cater to your spending habits, putting some money back in your pocket. Talk about convenience and fun in one app!

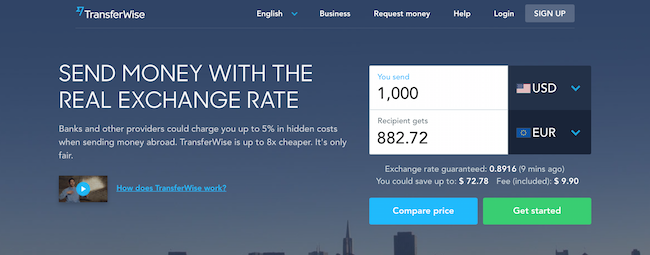

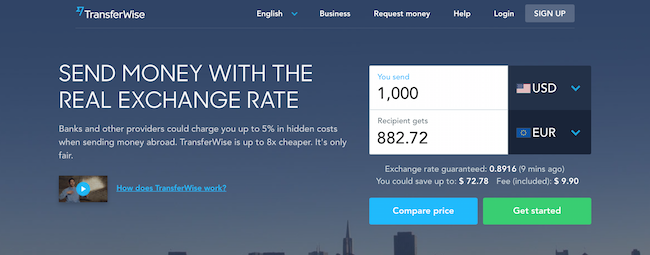

TransferWise (international money transfers)

Rating: 4.8/5

TransferWise, now known as Wise, is a groundbreaking and innovative financial technology (fintech) company specialized in providing international money transfers at an impressively low cost. This cloud-based solution has rapidly gained popularity among individuals and businesses globally, seeking an efficient alternative to traditional banking institutions. Wise’s platform is user-friendly, transparent, and consistently delivers on its promise to execute swift, secure transactions, which makes it an appealing choice for users across the board. Based on its performance and overall user experience, I would rate Wise 4.8 out of 5.

As for its coolest features, let’s dive right in! First and foremost, Wise stands out for its exceptional transparency, allowing you to see the real mid-market exchange rates and the minimal fees it charges right upfront, keeping any unpleasant surprises at bay. Secondly, the Borderless account feature is a game-changer, enabling you to hold and manage multiple currencies all under one account. That’s perfect for freelancers, remote workers, or frequent travelers who need a seamless way to receive and send money in various currencies. Lastly, Wise boasts an incredibly fast transaction time compared to traditional banking systems, meaning you no longer have to anxiously wait for days on end to ensure your money reaches its destination. It’s no wonder Wise has quickly become a fan-favorite for those seeking efficient and affordable international money transfers!

Coinbase (cryptocurrency exchange)

Rating: 4.5/5

Coinbase is a leading cryptocurrency exchange that offers its users an intuitive and user-friendly platform to buy, sell, and manage various cryptocurrencies. With a firm commitment to security, compliance, and stability, Coinbase has established itself as one of the most reliable and trusted cryptocurrency exchanges worldwide, providing access to popular digital assets such as Bitcoin, Ethereum, Litecoin, and many others. Its advanced features, competitive fees, and seamless integration with various payment methods make it an ideal choice for both beginners and experienced traders to engage with the rapidly evolving world of digital currencies.

One of the coolest features of Coinbase is its user-friendly and easy-to-navigate interface, which ensures a smooth and enjoyable experience for all users, regardless of their prior knowledge or expertise in cryptocurrencies. Furthermore, thanks to the robust security measures it employs, such as two-factor authentication and offline storage of digital assets, Coinbase ensures that your funds are safe and well-protected at all times. Also, with their Coinbase Pro platform, experienced traders can enjoy advanced charting tools, margin trading, and a variety of order types to optimize their trading strategies. To top it off, Coinbase also offers a comprehensive educational program called Coinbase Earn, allowing users to learn more about various cryptocurrencies and even earn rewards for completing quizzes and tasks. There’s no doubt that Coinbase truly stands out as a go-to cryptocurrency exchange!

Robinhood (investment and trading app)

Rating: 4.5/5

Robinhood is an innovative investment and trading app designed primarily for the modern retail investor seeking a user-friendly platform to buy and sell stocks, options, cryptocurrencies, and exchange-traded funds (ETFs). The app’s commission-free trading platform, intuitive design, and mobile-first approach have attracted a large user base, particularly among younger investors who value simplicity and easy access to financial markets. Despite some negative news and outages in recent years, Robinhood remains a popular choice for those looking to begin their investing journey or expand their portfolio in a cost-effective manner.

As for the coolest features, Robinhood’s fractional shares trading is a game changer! This allows users to invest in top-tier companies with expensive stocks, such as Amazon or Tesla, even if they don’t have the full amount needed to purchase a whole share. This democratizes investing and opens the door for small investors to build a diverse portfolio without breaking the bank. Another awesome feature is the app’s user interface, which is visually appealing and easy to navigate. The real-time data on stock prices, customizable watchlists, and educational content available right within the app make it absolutely thrilling for anyone to have the power of financial markets at their fingertips. Get ready to embrace the age of accessible investing!

Acorns (micro-investing)

Rating: 4.5/5

Acorns is a unique and innovative micro-investing platform designed to help users invest their spare change into a diversified portfolio. By rounding up everyday transactions and automatically investing the difference, Acorns has opened up the world of investing to users who may not have considered it before or felt they lacked the necessary funds to begin. The easy-to-use app provides a simple user interface and offers a range of features, such as recurring investments, retirement savings accounts, and earning rewards that can be invested in your account. Access to financial literacy content also enhances the platform’s appeal, making it a brilliant all-in-one investing tool for beginners and seasoned investors alike.

One of the coolest features of Acorns is its “Round-Ups” that completely revolutionizes the way we look at saving and investing. By seamlessly connecting to your debit or credit card, the app rounds up every transaction to the nearest dollar and invests the spare change in a diversified portfolio. The process is almost invisible, and before you know it, your small round-ups will accumulate into a significant sum of money. Additionally, the “Found Money” program allows you to earn rewards from partnered brands, which are automatically invested into your account, providing a bonus to your growth potential. And if you’re looking to learn more about personal finance, Acorns’ Grow Magazine offers valuable insights and advice to help you make informed financial decisions in an engaging and easy-to-understand language. Isn’t it fantastic to have a tool that simplifies investment and turns it into a fun, daily experience!

Betterment (robo-advisor)

Rating: 4.5/5

Betterment is a top-tier robo-advisor designed to streamline and optimize the investing process for users of all expertise levels. By leveraging advanced algorithms, Betterment creates tailored investment portfolios that meet each user’s financial goals and risk tolerance. As a low-cost alternative to traditional financial advisors, Betterment offers incredibly competitive pricing and has a user-friendly platform with a seamless experience that allows clients to create accounts, set financial goals, choose the desired level of risk, and deposit funds. I would rate this tool a 4.5 out of 5 for its remarkable features, ease of use, and affordability.

Now, let me share with you some of Betterment’s coolest features! Firstly, their tax-loss harvesting and tax-coordinated portfolio strategies are absolutely game-changing, potentially saving clients significant money on taxes. Secondly, they offer personalized advice for external accounts which goes above and beyond just managing the assets on their platform. And perhaps the most exciting feature is their fractional shares trading, allowing clients to optimize their portfolios because every dollar invested is fully utilized. Betterment’s array of advanced features and their commitment to continuously innovating and improving the investment experience make it an incredibly attractive robo-advisor choice for optimizing your financial future!

Wealthfront (robo-advisor)

Rating: 4.5/5

Wealthfront is an innovative and reliable robo-advisor platform that delivers personalized, comprehensive financial planning services to a broad range of clients. As the first robo-advisor to offer direct indexing, Wealthfront has a straightforward, user-friendly interface that makes investment management effortless for both novice and experienced investors. The platform’s robust algorithm-driven advice takes tax efficiency, risk tolerance, and financial goals into consideration, ensuring that clients achieve their objectives with a tailored approach. Wealthfront’s low advisory fees and account minimums further enhance its appeal, making it accessible to many users. Overall, I would rate Wealthfront a solid 4.5 out of 5.

Wealthfront is packed with amazing features that set it apart from its competition! One of the coolest and most unique features is its Tax-Loss Harvesting, which allows you to maximize returns by strategically selling investments to offset taxable gains. This essentially optimizes your portfolio for tax efficiency, freeing up extra money for you to invest. Another remarkable feature is the Time-Weighted Return calculator, which keeps you informed about your investments’ performance by providing a breakdown of your returns in a clear, visually appealing manner. The Path tool is also a fan-favorite, offering customizable wealth planning advice to help you meet your goals, whether it’s about buying a house or saving for retirement. The fantastic features just keep coming with Wealthfront, making it an exciting robo-advisor to try out!

E*TRADE (online brokerage)

Rating: 4.5 out of 5.

E*TRADE is a cutting-edge online brokerage platform that offers a comprehensive suite of tools and resources for investors and traders of all experience levels. This intuitive platform provides advanced charting, research capabilities, trading tools, and a user-friendly interface that streamlines the investing process. E*TRADE has achieved wide recognition for its easy-to-navigate design, efficient trade execution, and comprehensive educational resources that cater to both novice and experienced users, making it a powerful all-in-one solution for modern investors. E*TRADE’s dedication to innovation and customer satisfaction has solidified its position as one of the top online brokerage platforms in the industry.

Now let’s talk about E*TRADE’s coolest features! With E*TRADE, you get access to its extraordinary Power E*TRADE trading platform, which offers advanced charting, risk analysis, and more than 100 technical studies, allowing you to make data-driven decisions with ease. Their innovative Snapshot Analysis tool lets you conduct a quick yet in-depth evaluation of potential investments, giving you a clear insight into company performance and market trends. The cherry on top? E*TRADE’s top-notch mobile app, which allows you to monitor and manage your portfolio from virtually anywhere. Harnessing the power of cutting-edge technology and a user-friendly approach, E*TRADE places the entire stock market at your fingertips, providing an unparalleled advantage for investors and traders alike.

Vanguard (investment management)

Rating: 4.5 out of 5.

Vanguard, a renowned investment management software/tool, brings a comprehensive approach to managing financial portfolios seamlessly. Offering a wide array of services, including retirement planning, wealth management, and investor education, this platform is designed to cater to individual investors, financial professionals, and institutions alike. Its user-friendly interface and strong emphasis on cost-efficiency makes it a reliable choice for various investment needs. Vanguard is well-respected in the industry for its selection of competitive index funds and ETFs, personalized advice, and commitment to transparency.

Now, let’s dive into the coolest features of Vanguard! For starters, Vanguard boasts an excellent lineup of low-cost ETFs and mutual funds, which are perfect for both seasoned investors and beginners seeking a diversified, cost-effective investment strategy. Another fantastic feature is their retirement planning tools, which make it incredibly easy and stress-free for users to make crucial decisions about their retirement savings. Not to mention, Vanguard Personal Advisor Services, where the platform pairs you with a dedicated financial advisor who crafts a tailored investment plan based on your unique goals and preferences. With Vanguard’s powerful tools and services, navigating the world of investment has never been more exciting and empowering!

Fidelity (investment management)

Rating: 4.5 out of 5

Fidelity is an exceptional investment management software and tool designed to offer a comprehensive suite of services to cater to a vast array of investors. It covers everything from stock trading, mutual funds, ETFs, and retirement accounts like IRAs to advanced investing tools and resources. Fidelity’s well-organized interface, top-notch research capabilities, and round-the-clock customer support contribute to an optimal user experience that appeals to both beginners and seasoned investors alike.

Let’s dive into some of Fidelity’s coolest features that make investing an absolute breeze! One standout is its cutting-edge research tools that give you access to expert insights and analysis, helping you make informed decisions backed by solid data. Additionally, the Active Trader Pro platform unlocks an impressive suite of advanced investing tools that let you track the markets, execute trades, and manage your portfolio with ease – how awesome is that? And, we simply cannot forget about Fidelity’s commission-free trading on U.S. stocks, options, and ETFs, which makes it one of the most cost-effective platforms in the game. With all of these excellent features, Fidelity empowers you to unlock your full investing potential!

Charles Schwab (investment management)

Rating: 4.5/5

Charles Schwab is a prominent investment management tool that offers a comprehensive suite of services catering to individual investors, businesses, and institutions. This platform has gained significant reputation due to its competitive pricing, exceptional customer service, and extensive range of investment options, including stocks, bonds, mutual funds, and ETFs. Among the tool’s most noteworthy features are user-friendly interfaces, robust research tools, and seamless integration with mobile and desktop devices, all of which contribute to its widespread appeal in the world of financial management.

When it comes to Charles Schwab’s coolest features, one must definitely rave about its innovative and cutting-edge technology, making the investment experience efficient and enjoyable. The StreetSmart Edge, their advanced trading platform, offers customizable charts, powerful research tools, and an impressive degree of personalization, allowing users to efficiently monitor the market, manage their investments, and develop effective trading strategies. Furthermore, Schwab’s trading app for mobile devices takes convenience to a whole new level, allowing on-the-go investing and account management. To complete the package, the company has also incorporated an extensive network of branches and 24/7 phone support, ensuring every user’s needs are catered to and that expert help is always available.

Ally Bank (online banking)

Rating: 5/5

Ally Bank is an innovative and secure online banking platform that offers a wide range of financial services and products to its users. As an exclusively digital bank, Ally Bank provides customers with convenient access to their accounts, competitive interest rates, and an intuitive user interface, making it easy for users to manage their money effectively. Their banking services include savings and checking accounts, CDs, investment options, loans, and more. With exceptional customer service, extensive digital tools, and no monthly maintenance fees or minimum balance requirements, Ally Bank stands as an exceptional choice for individuals who prefer a streamlined digital banking experience. I would rate Ally Bank a solid 5 out of 5 for its comprehensive set of features and user-friendly system.

One of the coolest features that Ally Bank offers is its industry-leading savings rates, allowing customers to grow their money faster than with other traditional banks. Ally Bank is also known for its versatile mobile app with impressive functionalities like depositing checks through the app by taking pictures, easy account management, and robust financial tracking and budgeting tools. Moreover, Ally Bank’s user experience is enhanced by their 24/7 customer support, ensuring that all customers receive prompt assistance whenever needed. Lastly, Ally Bank has uniquely integrated the popular Zelle® money transfer service, enabling users to send and receive money quickly and securely within their platform. All these innovative features reinforce the superiority of the Ally Bank experience, making it a top-choice for anyone looking for a reliable and feature-rich online banking platform.

Capital One (banking and credit cards)

Rating: 5/5

Capital One is a well-established financial institution that provides an exceptional suite of services, including banking and credit cards, which seamlessly cater to the various financial needs of its users. With their commitment to customer satisfaction, Capital One ensures that its software and tools effectively streamline their services, making it easy for users to manage their accounts, pay bills, and plan their financial budgets. The platform boasts an intuitive interface, robust security features, and round-the-clock customer support, ensuring a smooth and secure experience for its patrons. Based on its ease of use, outstanding services, and reliability, I would rate Capital One 5 out of 5.

Now, let’s dive into some of the coolest features Capital One has to offer! One of the most fantastic aspects of the software is its AI-driven assistant, Eno, which actively monitors your accounts to keep you informed about potential fraud, duplicate charges, and assists with on-time bill payments. Also, the CreditWise feature is a game-changer for those looking to monitor and improve their credit scores with access to insightful tips and updates. Furthermore, the ability to lock your credit card with a single tap on the app provides an unmatched level of security and control in the palm of your hand. Capital One’s robust suite of financial tools combined with these killer features makes it a top choice for users, keeping their finances in check and hassle-free!

Chase (banking and credit cards)

Rating: 4.7 out of 5

Chase bank offers an efficient, user-friendly software/tool for its banking and credit card services. As an all-in-one financial management platform, it allows users to easily access their accounts, pay bills, transfer funds, and manage their credit cards with just a few clicks. The software also offers a mobile app, which is compatible with both iOS and Android devices, providing the utmost convenience to customers while they are on the go. Security is a top priority for Chase, as the software is equipped with multiple layers of protection to ensure the safety of users’ data and financial resources. Overall, I would rate the Chase banking and credit card software/tool a solid 4.7 out of 5.

I cannot help but feel enthusiastic about some of the coolest features of this tool! One of the most notable features is the Chase Ultimate Rewards program, which lets credit cardholders earn points on every purchase made. The points can be redeemed for gift cards, travel, or even cash back, making it an exciting bonus for those who use their credit cards frequently. Another amazing feature is the real-time fraud monitoring and instant transaction alerts, ensuring that users have full control over their financial activities and can take immediate action in case of any suspicious activity. Additionally, the budgeting and spending summary tools prove to be extremely handy in keeping users on track with their financial goals, helping to make smarter decisions with their money. It’s no wonder that the Chase banking and credit card software/tool has become a popular choice amongst savvy consumers!

American Express (credit cards)

Rating: 4.5/5

American Express, popularly known as Amex, is a global financial services provider well-known for its top-notch credit card offerings. The company’s credit cards are geared towards a variety of consumers, from frequent travelers to small business owners, catering to their unique needs with an extensive range of features and benefits. With a powerful rewards program, Membership Rewards, American Express cardholders can earn and redeem points for travel, merchandise, gift cards, and more. The unparalleled customer service, fraud protection, and additional perks grant users a seamless and secure experience, keeping them loyal to the brand.

The coolest features about American Express credit cards are undeniably the incredible rewards program and the exceptional additional benefits! As an Amex cardholder, you can rack up points quickly with Membership Rewards, thanks to their accelerated earning rates on various categories like travel and dining. Redeeming your rewards is equally exciting with options like booking flights, shopping online, and even transferring points to airline and hotel partners. But that’s not all – American Express goes above and beyond with their extra perks such as access to exclusive events, complimentary airport lounge entry, travel insurance, and impressive discounts at select merchants. All of these fantastic features truly elevate the cardholder experience, leaving you feeling like a VIP while spending and saving simultaneously!

NerdWallet (personal finance advice)

Rating: 4.5/5

NerdWallet is an exceptional personal finance advice software/tool designed to help users make informed decisions regarding their money. Providing expert advice on a variety of financial topics such as credit cards, loans, mortgages, investing, and savings accounts, NerdWallet arms users with the knowledge and understanding they need to manage their personal finances with confidence. By utilizing data-driven recommendations, NerdWallet enables users to compare financial products and determine the best options based on their unique circumstances, making it a reliable source of information for anyone seeking financial guidance. Based on its vast array of features and comprehensive guidance, I would rate NerdWallet a solid 4.5 out of 5.

Now, let me tell you about some of the coolest features that have left users raving about NerdWallet! Their suite of calculators alone is nothing short of amazing – mortgage, student loan repayment, retirement planning, and even credit card payoff calculators, to name just a few. NerdWallet’s side-by-side financial product comparison feature is a fantastic resource that allows users to closely examine various offerings and make educated choices based on their unique needs. To top it off, they offer personalized recommendations tailored to each user’s financial goals, ensuring that you have a specialized roadmap to financial success. NerdWallet truly goes the extra mile in providing tools and resources to make personal finance management a breeze!

Credit Karma (credit scores and reports)

Rating: 4.5/5

Credit Karma is a comprehensive and user-friendly financial tool that offers free credit scores, credit reports, and seamless monitoring services. The platform’s easy-to-navigate interface assists users in understanding their credit scores, offering personalized insights and tips to help them make smarter financial decisions. With an array of features such as credit monitoring alerts, seamless integration with various financial accounts, and tax filing services, Credit Karma stands out as an incredibly versatile and valuable personal finance tool.

The coolest features of Credit Karma will undoubtedly leave you impressed! For starters, say goodbye to paying for credit reports as Credit Karma offers them for free, pulling data from two major credit bureaus, TransUnion and Equifax! Not only that, but Credit Karma also provides an intuitive Credit Score Simulator, allowing you to see how various financial moves may affect your score, making financial planning a breeze. Also, the app’s innovative Identity Monitoring feature takes security up a notch with alerts for potential data breaches and identity theft. Let’s not forget about the Credit Karma Tax service! It’s an easy, free, and accurate way to file your federal and state taxes. In a nutshell, Credit Karma’s feature-rich platform makes it an indispensable partner in managing and enhancing your financial well-being!

Zillow (real estate information)

Rating: 4.5/5

Zillow is a comprehensive real estate platform that offers a wide range of services and tools to facilitate the process of buying, selling, and renting properties. With an extensive database of over 110 million U.S. homes, Zillow provides users with up-to-date information on home values, local market trends, and an array of related data. This user-friendly platform caters to homeowners, buyers, sellers, and agents by offering unique features such as Zestimate, a home valuation algorithm that estimates a property’s current market value. Overall, Zillow deserves a solid 4.5 out of 5 rating for its outstanding features and ease of use.

Now, let’s dive into Zillow’s coolest features! To begin with, Zillow’s 3D Home Tours present an innovative way to virtually explore properties from the comfort of your home. This immersive experience allows potential buyers to have a comprehensive view of the property and understand its layout before deciding to visit in person. Next up is the Zillow Offers feature, where Zillow directly purchases homes from sellers, eliminating the hurdles of traditional home selling processes. No more stressful listing and negotiation! Moreover, Zillow’s Mortgage Calculator makes estimating your monthly mortgage payment a breeze; just plug in some basic information, and the tool does the rest! These exciting features set Zillow apart from other real estate platforms and make the whole process of finding and buying your dream home a truly delightful experience.

SoFi (personal loans and refinancing)

Rating: 4.5/5

SoFi, short for Social Finance, is a versatile financial platform offering personal loans and refinancing options for individuals seeking to consolidate debt, finance large purchases, or achieve their financial goals. With a streamlined online application process and competitive interest rates, SoFi has positioned itself as an industry leader in personal finance. Thanks to its excellent customer service and a focus on transparency, users can expect a hassle-free experience when exploring the various options available on the platform.

The coolest features of SoFi are undoubtedly the competitive rates, flexible terms, and additional benefits they offer to their users! With fixed and variable interest rates ranging from 2.99% to 6.28% for personal loans and refinancing options, ensuring affordable options for various financial needs. Moreover, SoFi offers loan terms between 5 to 20 years, giving borrowers the freedom to find a repayment plan that fits their budget. But that’s not all! SoFi also provides member-exclusive benefits such as unemployment protection, career coaching, financial planning, and networking events, truly showcasing SoFi’s commitment to helping users succeed both financially and professionally!

LendingClub (peer-to-peer lending)

Rating: 4.5/5

LendingClub is an innovative peer-to-peer lending platform that connects borrowers with investors, offering a streamlined loan application process and competitive interest rates. This online marketplace empowers individuals and businesses by providing financing solutions tailored to their specific needs while offering investors the opportunity to diversify their portfolios and earn solid returns. LendingClub’s transparent fee structure and commitment to customer satisfaction have contributed to its status as a leader in the rapidly evolving fintech industry.

LendingClub is packed with some of the coolest features that make it a user-friendly and efficient platform! One of the top features is their proprietary credit grading system, which ensures investor confidence and helps borrowers get lower interest rates based on their credit scores. Additionally, LendingClub’s Auto Invest tool allows investors to automatically diversify their funds by investing in a custom mix of loans, saving time and effort on manually selecting individual loans. Last but not least, the platform’s intuitive user interface enables a seamless borrowing and investing experience, with straightforward tracking and management capabilities available at your fingertips. With these state-of-the-art features, LendingClub is revolutionizing the peer-to-peer lending landscape and is the go-to solution for both borrowers and investors!

Quicken (personal finance software)

Rating: 4.5/5

Quicken is a versatile personal finance software designed to help users effectively manage their financial life with ease. It offers powerful tools to stay on top of expenses, investments, and bill payments all in one integrated platform. Compatible with both Windows and Mac operating systems, Quicken is a well-designed software that is trusted by millions for its ability to simplify complex financial tasks, making it an indispensable tool for individuals and small businesses alike.

Now let me tell you about some of the coolest features of Quicken that make it stand out from other personal finance software! First and foremost, you’ve got the incredibly useful budgeting and spending tracking, which allows you to set spending goals and monitor your progress effortlessly. Its comprehensive investment tracking feature lets you keep a close eye on your portfolios and make informed decisions from its built-in market comparisons. And let’s not forget the ability to synchronize your financial data with over 14,000 financial institutions, ensuring seamless integration with your bank accounts, credit cards, and other financial products. Cheers to Quicken for revolutionizing the way we manage our money!

YNAB (You Need a Budget – budgeting software)

Rating: 4.5/5

YNAB, or You Need a Budget, is an innovative budgeting software designed to help individuals and families gain control over their finances and achieve financial stability. This intuitive and user-friendly tool adapts to your unique financial situation, connecting directly with your bank accounts to import transactions and track your spending habits. By utilizing its “Four Rules” methodology, YNAB encourages users to take proactive steps towards financial security, such as allocating income towards specific expenses and building an emergency fund. It is available on multiple platforms, making it easily accessible for users on the go or at home.

Now, let’s talk about some of the coolest features of YNAB that set it apart from other budgeting software! Firstly, the “Age of Money” metric is an innovative way of determining how long your hard-earned dollars have been in your possession before being spent. This encourages users to save money and break the paycheck-to-paycheck cycle. Additionally, YNAB’s seamless synchronization across multiple devices ensures that you can keep track of your budget anytime, anywhere – whether on your phone, tablet or computer. The software also provides highly visual and easy-to-understand reports and graphs, giving users a clear insight into their financial progress. With YNAB’s active and supportive community, complete with educational resources and workshops, you have everything you need to take control of your financial future!

Morningstar (investment research)

Rating: 4.5/5

Morningstar is a powerful and comprehensive investment research tool, designed to streamline the process of analyzing stocks, funds, industries, and worldwide economies. Highly regarded among financial professionals and casual investors alike, Morningstar offers a wealth of information, including thoroughly researched data, expert analysis, and insightful tools that provide users with the knowledge they need to make well-informed, confident decisions in today’s fast-paced market. Boasting a user-friendly interface and an extensive database, Morningstar consistently delivers up-to-date, accurate content that caters to a wide spectrum of users’ investment needs.

Now, let’s talk about some of the coolest features Morningstar has to offer! For a start, their Portfolio X-Ray tool is absolutely amazing, allowing you to dive deep into your investments and scrutinize your overall performance, exposure, risk, and potential diversification. Additionally, the Morningstar Ratings for stocks, mutual funds, ETFs, and closed-end funds make it easy for you to cut through the noise and quickly identify top-performing securities. Perhaps the most exciting part is the wealth of expert-written articles and up-to-date news, keeping you well-informed on market happenings, investment trends, and opportunities! Morningstar truly goes above and beyond, incorporating a variety of innovative elements to create an indispensable resource for anyone involved in the world of investing.

Bloomberg Terminal (financial data and analytics)

Rating: 5/5

The Bloomberg Terminal is a cutting-edge financial data and analytics software that provides users with an extensive array of information on diverse financial markets and instruments. Designed specifically for finance professionals, this powerful tool combines real-time data streaming, in-depth market intelligence, and execution capabilities into a comprehensive solution tailored to the needs of traders, portfolio managers, and research analysts. Leveraging Bloomberg’s vast network and expertise, the Terminal ensures quick and seamless access to a vast pool of financial news, research, and analytical tools that enable users to make informed decisions in this fast-paced and ever-changing industry. Overall, I rate the Bloomberg Terminal a solid 5 out of 5 for its impressive range of features, excellent user interface, and unparalleled market access.

In an enthusiastic tone: Get ready to be blown away by the coolest features of the Bloomberg Terminal! The Terminal’s data-rich environment empowers users with lightning-fast and accurate real-time data on stocks, bonds, commodities, and currencies – all displayed in sleek, customizable charts and graphs. Stay ahead of the game with Bloomberg’s top-notch news and analytics, and gain invaluable insights from industry titans, as well as exclusive Bloomberg reports, to help you make smarter investment strategies. Moreover, the Terminal’s robust integration capabilities allow seamless connection with other tools for maximized productivity. Whether you’re a seasoned financial expert or a newcomer, the Bloomberg Terminal is the ultimate one-stop-shop for all your financial analytics needs – ensuring you stay on top of the markets at all times!

Zoho Books (accounting software)

Rating: 4.5/5

Zoho Books is an all-inclusive, cloud-based accounting software designed to cater to the financial needs of small and medium-sized businesses. With a user-friendly interface and a wide range of features, this software streamlines and automates daily financial operations, including invoicing, expense tracking, and bank reconciliation. It even handles tax compliance and provides insightful financial reports, offering a comprehensive solution for managing your finances. The seamless integration with other Zoho applications, third-party apps, as well as its mobile availability, highlights the software’s adaptability to cater to diverse business demands. Overall, Zoho Books deserves a solid rating of 4.5 out of 5.

Now let’s talk about some of the coolest features that make Zoho Books an outstanding accounting tool! The software’s sophisticated automation capabilities are genuinely awe-inspiring, as it dramatically reduces manual work – this means, bye-bye to data entry nightmares! The time tracking and project billing features are absolute game-changers, allowing you to track your employees’ billable hours with ease and bill clients accordingly. The multi-currency functionality is a godsend for businesses with a global clientele, making currency conversions a breeze! Lastly, the custom reporting feature is probably one of our favorites, as it enables you to create personalized reports, empowering you to analyze the financial data that matters the most to your business. So, why wait? Level up your company’s financial management with Zoho Books today!

Wave (small business accounting)

Rating: 4.5/5

Wave is an innovative small business accounting software that offers a broad range of features designed to streamline and simplify financial management for entrepreneurs and owners. This cloud-based solution provides multiple easy-to-use functionalities including invoice creation, expense tracking, receipt scanning, and payroll processing, making it an ideal choice for businesses looking to efficiently maintain accurate financial records. Its user-friendly interface and thoughtful integrations help small business owners save time and stay organized, allowing them to focus on growing their venture.

Rating: 4.5 out of 5

Wave’s coolest features really set it apart from the competition, making financial management a breeze for business owners! Its slick invoice customization allows you to create stylish, professional invoices that can be easily tailored to suit your brand’s identity. The built-in receipt scanning tool is an absolute game changer – simply snap a picture of your receipts and watch as Wave automatically extracts and organizes the relevant information. Additionally, Wave’s seamless bank connections enable real-time transaction updates, eliminating the need for manual data entry and ensuring accurate financial records. Wave’s fusion of style, innovation, and usability truly delivers a top-notch small business accounting experience for its users!

Xero (cloud accounting software)

Rating: 4.5/5

Xero is an innovative cloud-based accounting software designed to simplify the management and tracking of business financials for small to medium-sized enterprises. This robust tool makes it easy for users to monitor their cash flow, generate reports, issue invoices, and manage payroll seamlessly. Xero is user-friendly, offering an aesthetically pleasing interface and dashboard, coupled with a wide range of useful integrations, making it a one-stop solution for business owners who need to efficiently maintain their financial records. Overall, I would rate Xero a solid 4.5 out of 5 for its functionality, ease of use, and comprehensive financial-management features.

Now let’s talk about some of the coolest features of Xero that truly set it apart! One of the standout features that users adore is the bank reconciliation process. Xero’s smart auto-reconciliation system makes it a breeze to synchronize your bank account transactions with the software, reducing manual data entry and potential human errors. Not only that, but Xero’s real-time dashboard vastly improves decision-making, as users have instant access to their financial position at any given time. Need to manage expenses on the go? No worries! Xero’s mobile app enables you to manage invoicing, reconciliation, and other financial tasks right from your mobile device. Furthermore, Xero’s multi-currency support is a game-changer for businesses operating in global markets, allowing for seamless transactions in various foreign currencies. With all these features and more, Xero is undoubtedly an essential tool for any modern business.

FreshBooks (small business invoicing)

Rating: 4.5/5

FreshBooks is an intuitive and comprehensive invoicing and accounting software designed specifically for small businesses and freelancers. The platform simplifies the invoicing process by providing customizable templates, automatic reminders, and seamless integration with various payment gateways to facilitate smooth transactions. Furthermore, it optimizes financial management with its time-tracking, expense tracking, and reporting tools that enable users to gain better insight into their business performance. The user-friendly interface coupled with a vast array of features has made FreshBooks an essential tool for managing finances efficiently, allowing small business owners more time to focus on core business tasks.

One of the coolest features of FreshBooks is its ability to streamline your workflow by automating essential tasks, such as recurring invoices, expense categorization, and payment reminders! With FreshBooks, you can even snap photos of your receipts and have the sophisticated expense tracking module categorize them with unparalleled accuracy. And, let’s not forget how FreshBooks simplifies collaboration through its project management tools, allowing you to invite team members, clients or contractors to your projects to keep everyone on the same page. If you’re always on the go, the mobile app is a lifesaver, providing you with the flexibility to track your time, expenses and send invoices directly from your smartphone. Above all, FreshBooks is the embodiment of a modern, efficient tool poised to revolutionize the way small businesses approach their financial management!

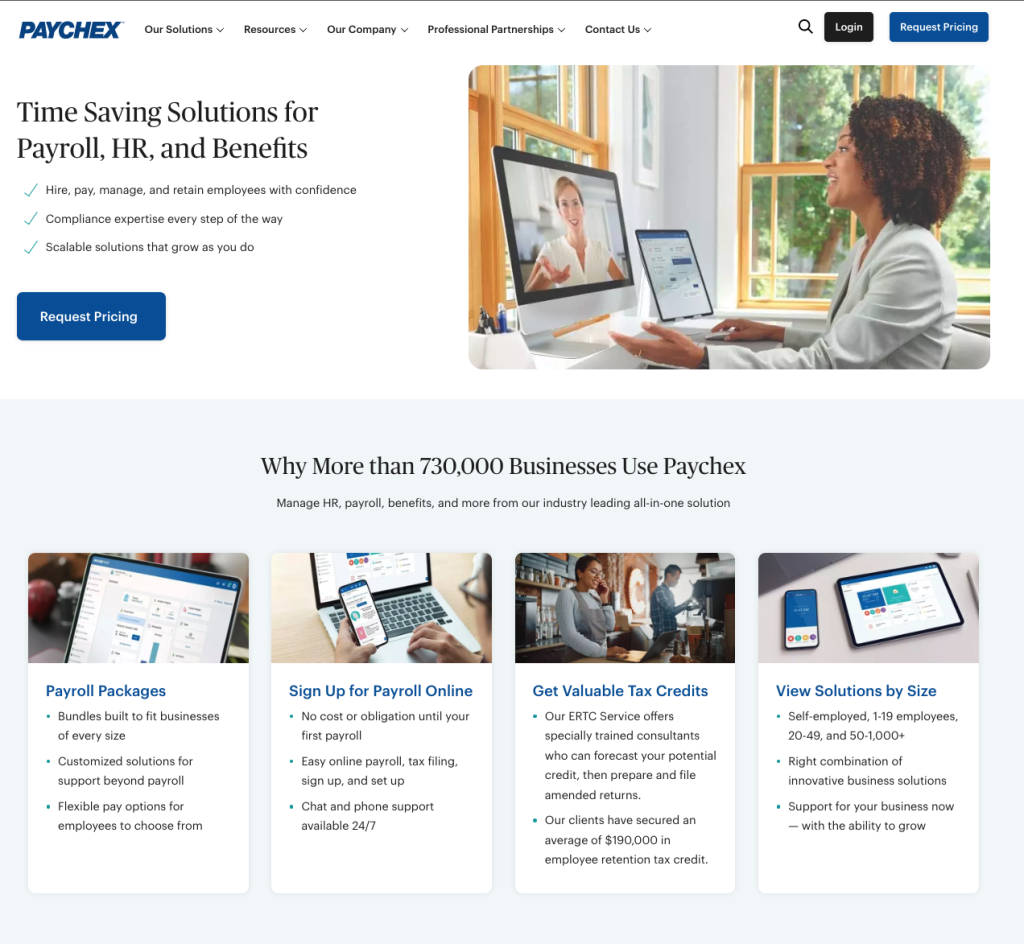

Paychex (payroll and HR services)

Rating: 4.5/5

Paychex is a comprehensive payroll and HR services tool designed to cater to the needs of businesses of various sizes. Its robust platform streamlines payroll processing, tax filing, and employee benefits management, while also offering HR support and solutions to enhance workforce productivity. Paychex’s user-friendly interface enables seamless management of payroll data, along with tools for tracking employee hours, integrating with accounting solutions, and providing real-time analytics for more effective decision-making. Furthermore, its exceptional customer support ensures that businesses receive timely assistance and guidance during critical processes. With its feature-rich offerings, Paychex earns a well-deserved 4.5 out of 5 rating.

One of the coolest features of Paychex has to be the cloud-based Paychex Flex platform! Its intuitive dashboard brings together all the essential HR solutions with just a few clicks, granting access to a suite of advanced tools for payroll, tax compliance, workforce management, employee benefits administration, and employee onboarding. Paychex Flex also offers seamless integration with numerous third-party applications to create a centralized and efficient workflow. The cherry on top is the Paychex Flex mobile app, which enables both employers and employees to manage their payroll-related tasks on-the-go. Coupled with top-notch customer support, Paychex truly revolutionizes the way businesses handle their HR and payroll functions!

ADP (payroll and HR services)

Rating: 5/5

ADP is a comprehensive and robust payroll and HR services software/tool that has become an essential component for many businesses worldwide. This well-designed platform streamlines and automates various payroll and HR-related tasks, such as employee timesheet tracking, managing employee benefits, attendance, and tax document processing. The intuitiveness and efficiency of the user interface make it easy to navigate and allows businesses to focus on their core operations. This software easily adapts to the unique needs of various industries, providing tailored solutions that help organizations stay compliant and save time. On a scale of 1 to 5, ADP earns a solid 5 for its ease of use, comprehensive features, and excellent customer support.

Now, let’s talk about some of the coolest features of ADP! The analytical and reporting capabilities of this tool are truly next-level, providing you with insights on employee trends and actionable data, enabling you to make well-informed HR and payroll decisions. Another impressive feature is its seamless integration with other enterprise systems, such as ERP and accounting software, which makes the overall data management hassle-free. ADP’s mobile app is also a game-changer, as it allows employees and managers to access crucial information and perform tasks on-the-go, fostering flexibility and convenience. The tool’s constant updates to stay compliant with tax laws and regulations ensure businesses remain up-to-date without any extra effort. Honestly, ADP is a game-changing tool, and its feature set is outstanding, transforming the way organizations manage their payroll and HR processes.

FactSet (financial data and analytics)

Rating: 4.5/5

FactSet is a highly sophisticated financial data and analytics software that enables finance professionals to access, analyze, and share crucial data for informed decision-making. This powerful tool provides a comprehensive platform with a wealth of features, including data feeds and APIs, research management, portfolio analysis, risk management, and customizable reporting tools. With its remarkable capacity to integrate thousands of data sources into a single, streamlined interface, FactSet has become a top choice for asset managers, risk analysts, and financial research experts seeking actionable intelligence in today’s ever-evolving market landscape.

When it comes to the coolest features of FactSet, there’s a lot to be excited about! For starters, FactSet’s extensive integration capabilities allow users to seamlessly combine various data sources, including proprietary data and third-party providers. This empowers users with a more comprehensive view of the financial landscape and makes it much easier to identify trends, risks, and opportunities. Additionally, the platform’s powerful analytics engine enables finance professionals to perform sophisticated quantitative analysis and modeling using state-of-the-art statistical and machine learning methods. The interactive and visually engaging dashboard also allows users to create customized visuals and graphics to help communicate critical financial insights more effectively. FactSet’s collaborative tools make it easy to share data, analysis, and reports with your team, ensuring everyone stays informed and aligned. With all these amazing features, it’s no wonder FactSet is an indispensable tool for finance professionals!

Thomson Reuters Eikon (financial data and news)

Rating: 4.5/5

Thomson Reuters Eikon is an innovative and comprehensive financial data and news platform designed to cater to the needs of professionals in the finance industry. This powerful tool integrates market data, analytics, trading, and messaging capabilities, allowing users to make timely and informed decisions based on accurate insights. Eikon stands out for its ability to provide a sophisticated and user-friendly experience while ensuring seamless access to relevant information. Its compatibility with various asset classes, including equities, fixed income, foreign exchange, and commodities, establishes Eikon as a one-stop solution for financial data and news dissemination.

Now, let’s delve into the coolest features that make Thomson Reuters Eikon stand out from the crowd! Users are sure to be thrilled by the cutting-edge visualization tools which provide striking clarity and impressive presentation of the data. With their powerful coding capabilities, the Eikon Data API presents endless customization opportunities for advanced analysts. The icing on the cake is Eikon’s intelligent search functionality, making it effortless to fetch the most relevant information among the vast databases it has access to. Additionally, Eikon Messenger is incredibly handy, enabling users to connect with other professionals in the financial industry, fostering collaboration and knowledge sharing. It’s no wonder why Thomson Reuters Eikon is a preferred tool among financial enthusiasts and seasoned professionals alike!

Bloomberg Professional (financial data and news)

Rating: 4.5/5

Bloomberg Professional is a leading financial data and news software, designed to provide finance professionals with extensive market information, data analytics, and communication capabilities. This all-inclusive tool offers rich insights into various asset classes, in-depth analytical instruments, and real-time financial news, enabling informed decision-making for investors, traders, and other market players. Bloomberg Professional streamlines the understanding of financial markets and trends through its user-friendly interface and powerful search functions, catering to the needs of its vast user base.

Now, let’s talk about some of the coolest features of Bloomberg Professional that undoubtedly make it a must-have tool for financial enthusiasts! Firstly, the Launchpad functionality allows users to create fully customizable and interactive workspaces, ensuring they have immediate access to all the relevant and vital data they need. And, of course, who could forget the Bloomberg Terminal Chat feature? This exciting addition makes it possible for professionals to connect, share ideas, and forge essential relationships with peers, paving the way for exceptional real-time collaboration. Not to mention, Bloomberg’s powerful predictive analytics and back-testing lounge help you dig deeper into investment ideas and make more precise financial forecasts – a truly indispensable tool in today’s fast-paced market!

Quodd (real-time financial market data)

Rating: 4.5/5

Quodd is an exceptional real-time financial market data tool that provides users with comprehensive, accurate, and reliable information on a wide array of global markets. As an expert reviewer, I find Quodd to be both user-friendly and incredibly versatile, catering to investment professionals, brokers, traders, and financial researchers alike. Combining its low-latency infrastructure with state-of-the-art technological advancements, Quodd delivers optimal performance, ensuring its users stay ahead of ever-changing market conditions.

Now, let’s talk about Quodd’s coolest features! Standing out from the competition, Quodd’s UltraCache technology places the power of data manipulation right at your fingertips. Say goodbye to lagging data as Quodd’s unparalleled low-latency infrastructure keeps you in sync with the pulse of the market, giving you the edge you need to make informed decisions. Additionally, Quodd offers customization options that enable you to craft a data feed suitable to your unique industry requirements. But wait, there’s more! Quodd’s robust data offering covers everything from Level I & II quotes, full order book depth, historical data, and much more! Experience financial market data like never before with Quodd.

Intrinio (financial data feeds)

Rating: 4.8/5

Intrinio is an innovative and robust financial data platform designed to cater to the needs of everyone from individual investors to large enterprises, providing a wide array of data feeds that encompass a vast range of financial data. The platform excels in offering high-quality, comprehensive data spanning across several domains, including financial statements, economic data, stock market data, and more. What sets Intrinio apart is its commitment to accessibility and affordability, making it a perfect choice for businesses of all sizes and individuals with varied financial expertise. Based on its versatility, ease of use, and the sheer volume of data it provides, I would rate Intrinio 4.8 out of 5.

Intrinio’s coolest features are undeniably its impressive variety of data feeds and seamless integration capabilities! The platform offers more than 200 data types for thousands of companies worldwide, empowering users to access cutting-edge information on stocks, options, commodities, Forex, ETFs, and many more. With tools like the Excel add-in or an assortment of APIs, users can conveniently extract the precise data they require and integrate it with their existing tools, analytical applications, or software solutions. Moreover, Intrinio’s user-friendly Web App makes it simple to analyze data online and share valuable insights seamlessly with your team or clients. Get ready to supercharge your financial analysis with Intrinio!

Refinitiv (financial data and infrastructure)

Rating: 4.5/5

Refinitiv is a cutting-edge financial data and infrastructure software that provides users with an extensive range of tools and resources for better decision-making and enhanced workflow productivity. This comprehensive platform offers insightful analytics, current and historical financial data, expert research, and powerful collaboration tools to streamline the user experience. As an expert reviewer, I am impressed by the seamless integration of various features within the software and the user-friendly interface, which makes accessing reliable financial data an effortless task. Based on its extensive capabilities, I would rate Refinitiv a solid 4.5 out of 5.

Now, let’s dive into some of the coolest features of Refinitiv that are sure to blow your mind! The software facilitates detailed analysis with its Eikon Data API, allowing users to access an extensive range of data with unparalleled speed and accuracy. Moreover, the platform’s intuitive visualization tools make data interpretation a breeze, allowing you to conquer even the most complex financial markets. To top it all off, Refinitiv’s innovative collaboration tools and flawless integration with Microsoft products enable users to share their findings with their team effortlessly, fostering a seamless and effective communication channel. With Refinitiv, the sky is the limit when it comes to discovering unparalleled financial insights!

Morningstar Direct (institutional investment research)

Rating: 4.8/5

Morningstar Direct is an exceptional institutional investment research software and analytics tool designed to cater to the needs of asset managers, wealth managers, and asset owners. It provides a versatile platform that offers an extensive range of advanced analytics, robust research capability, and visual presentation features that are crucial for making informed investment decisions. This all-encompassing tool grants users access to comprehensive data on investment vehicles like stocks, bonds, ETFs, and mutual funds, allowing them to analyze portfolios, screen investments, and assess performance. Taking into account the capabilities and essential features that Morningstar Direct offers, I would rate this tool at a solid 4.8 out of 5.

Now, let me share some of the coolest features that make Morningstar Direct stand out in the investment research environment! The software boasts a sleek and customizable user interface that allows users to view investment data and perform detailed analysis with ease. One of the most innovative aspects of this tool is the incorporation of Artificial Intelligence (AI) in the form of the Morningstar Quantitative Rating, which predicts the future performance of funds by simulating the decisions of expert analysts. Additionally, Morningstar Direct empowers users to construct powerful benchmarks, perform peer group analysis, and create visually stunning marketing presentations to showcase their strategies. Without a doubt, this advanced software not only simplifies the entire investment research process, but also enables users to gain valuable insights and fine-tune their investment strategies based on robust research capability.

S&P Capital IQ (financial research and analysis)

Rating: 4.5/5

S&P Capital IQ is a comprehensive financial research and analysis tool that offers an extensive range of data and intelligence for professionals across various industries including finance, investment, and corporate strategy. This powerful platform provides users with an impressive array of financial data points such as company financials, market and economic data, valuations, and mergers and acquisitions information. By leveraging predictive analytics, robust data visualization tools, and seamless Excel integration, S&P Capital IQ streamlines the decision-making process and helps businesses make informed decisions backed by solid evidence. Rating: 4.5/5

Now, hold onto your hats because S&P Capital IQ has some seriously amazing features that will blow your mind! This incredible platform allows users to access a global database of millions of public and private companies, as well as detailed financial data on various fixed income instruments, industry metrics, and more. Are you a fan of customizable charts? Well, get ready to dive into a plethora of advanced charting functionality that will make visualizing complex information a breeze! And let’s not forget the Excel Plug-in that transforms your spreadsheet into a supercharged financial analysis tool, allowing you to easily import, compare, and analyze vast amounts of data on companies, sectors, and financial markets. Get ready to elevate your financial analysis game with S&P Capital IQ!

Moody’s Analytics (financial research and risk management)

Rating: 4.5/5

Moody’s Analytics is a cutting-edge financial research and risk management software designed to provide comprehensive solutions for both investors and financial industry professionals. With a strong commitment to innovation and consistent data accuracy, this suite of powerful tools enables users to make informed and timely decisions by leveraging robust predictive analytics, credit risk modeling, and actionable insights into global financial markets. A product of years of expertise in credit analysis, Moody’s Analytics helps navigate today’s complex financial landscape with speed and efficiency.

Now, let’s dive into the coolest features of Moody’s Analytics! One of the most fantastic aspects of this software is its extensive library of customizable credit risk models, empowering you to build unique analyses tailored to your requirements. Another standout feature is the award-winning Economic Scenario Generation system, which allows you to simulate and predict potential market outcomes by adjusting various economic variables. And if you’re a visual learner, you’ll love the interactive global heatmap, offering an at-a-glance synthesis of credit risk across multiple countries and industries. Moody’s Analytics is undoubtedly a must-have tool for anyone looking to tackle financial challenges with confidence and expertise!

Riskalyze (risk assessment software)

Rating: 4.5/5

Riskalyze (now rebranded as Nitrogen) is an innovative risk assessment software that serves as an indispensable tool for financial advisors, providing them with a comprehensive approach to risk management. With an intuitive user-interface and robust features, the software effectively empowers advisors to efficiently evaluate their clients’ risk tolerance levels and align their portfolio accordingly. Taking a scientific, quantitative approach to analyze risk, Riskalyze generates a unique “Risk Number” for each investor, streamlining the process of making well-informed investment decisions.

If there’s one thing to get excited about with Riskalyze, it’s the incredible coolest features this software brings to the table! First and foremost, the groundbreaking Risk Number system which not only simplifies risk gradient measurement but also enables investors to mitigate losses with a personalized approach. The Retirement Plans feature seamlessly integrates the retirement scenario planning process into the risk assessment framework, crafting a holistic view of potential retirement outcomes. Additionally, the Compliance Cloud is a game-changer, ensuring advisors and their clients remain fully compliant with ever-evolving regulatory environments. Riskalyze truly stands out as a premier risk assessment tool, revolutionizing the way financial advisors cater to individual investor needs.

BlackRock Aladdin (investment and risk management)

Rating: 4.5/5

BlackRock Aladdin is a remarkable investment and risk management software/tool that has established itself as an authoritative player in the finance industry. With its state-of-the-art technology and sophisticated features, Aladdin directs users towards making informed decisions and mitigating risks in their investment portfolios. From asset allocation to comprehensive analytics, the tool assists in addressing complexity and providing efficient insights into investment strategies for both institutional and wealth management clients. Considering its holistic approach towards risk management and investment planning, I would rate BlackRock Aladdin a solid 4.5 out of 5.

Now, let me elucidate some of the coolest features of BlackRock Aladdin in an enthusiastic tone! The platform’s cutting-edge AI technology instills a sense of confidence in its users, unraveling complex market patterns and offering actionable insights in real-time. Its integrated trading and portfolio management capabilities create a seamless experience, streamlining the entire investment process. Moreover, Aladdin’s robust, cloud-based infrastructure ensures top-notch security and accessibility. The platform’s impressive, user-friendly interface and customizable dashboards allow users to keep a close eye on every aspect of their portfolios, making it an indispensable tool for any serious investor. So gear up for a thrilling journey of investment mastery with BlackRock Aladdin!

Calypso/Adenza (trading and risk management)

Rating: 4.5/5

Calypso (now rebranded as Adenza) is a comprehensive and sophisticated trading and risk management tool designed to cater to the needs of various industry segments including banks, hedge funds, central banks, asset managers, and insurance companies. It encompasses end-to-end processing capabilities including front-to-back office trade processing, collateral management, funding optimization, and liquidity management. Built on a distributed architecture, Calypso offers unparalleled support for cross-asset trading, risk management, and scalability, enabling users to effectively manage their trading operations while remaining compliant with evolving regulations.-

Calypso’s coolest features provide users with unparalleled ease and efficiency! The platform’s real-time, cross-asset trading capabilities allow for seamless management across different asset classes and product types, including complex derivatives. The powerful risk management module provides cutting-edge analytics, enabling users to evaluate risk across an entire portfolio, mitigating potential losses and enhancing strategic decision-making processes. Another standout feature is Calypso’s collateral management system, which streamlines collateral optimization and enables the optimal use of assets. The system’s modularity and flexibility make it adaptable to various business requirements, proving Calypso to be an essential tool for staying ahead in the ever-evolving financial industry!

Oracle Financial Services (banking and financial solutions)

Rated a 4.5 out of 5

Oracle Financial Services is a comprehensive suite of banking and financial solutions designed to meet the diverse needs of financial institutions. Combining cutting-edge technology with unparalleled industry expertise, Oracle’s innovative software offers robust functionality spanning core banking, risk management, analytics, and customer experience. With a focus on addressing the evolving regulatory and compliance environment, this integrated solution empowers organizations to streamline their operations, drive growth, and deliver exceptional customer service. Rated a 4.5 out of 5, Oracle Financial Services sets the standard for end-to-end banking and financial platforms.

Now, let’s talk about some of Oracle Financial Services’ coolest features! One standout is the Oracle Financial Services Analytical Applications (OFSAA), a powerful set of tools offering banks deep insight into their business data. The platform’s risk management capabilities are also top-notch, providing advanced risk analytics and a comprehensive risk reporting framework. Not to mention, Oracle’s flexible architecture allows seamless integration with third-party systems, ensuring an adaptive and future-proof solution for any organization. With these remarkable features and more, Oracle Financial Services truly revolutionizes the way financial services adapt and thrive in an increasingly dynamic era.

SAS (analytics and risk management)

Rating: 4.5/5

SAS is a versatile and powerful software suite that offers comprehensive analytics and risk management solutions to businesses and organizations worldwide. This tool is known for its cutting-edge visual interface and user-friendly approach, making complex and extensive data analytics tasks seamlessly accessible to users without a technical background. With a broad array of functionality ranging from data exploration and predictive modeling to risk assessment and reporting, SAS empowers its users to transform raw data into actionable insights and address risk-related challenges strategically. The software stays ahead of the curve by continuously integrating the latest developments in the world of data analytics and risk management.

SAS has some jaw-dropping features that set it apart from other analytics tools available in the market. One of its coolest features is the incorporation of advanced Artificial Intelligence (AI) and Machine Learning (ML) techniques to facilitate predictive modeling, analysis, and forecasting while crunching massive amounts of data. SAS Visual Analytics is another game-changing component that allows users to create visually engaging reports, dashboards, and interactive applications with ease. It’s there to make sure that even the most complex information and analytics findings can be effortlessly communicated and shared among team members and decision-makers. Moreover, the tool’s proficiency in handling risk management aspects like fraud detection, stress testing, and credit risk modeling only adds to its impressive list of features. With SAS, there’s truly no limit to the insights and benefits you can derive from your data.

Frequently Asked Questions (FAQ)

Q: How can finance tools help me become part of the financial elite?