Dow Jones futures were little changed Thursday morning, along with S&P 500 futures and Nasdaq futures. U.S. stock markets will be closed Thursday the Thanksgiving holiday. The stock market rally had another solid broad advance. The major indexes moved further above their 50-day moving averages. Leading stocks continued to act well, with chips, gold and other metal plays standing out.…

Tag: etf news

-

Futures Rise With Market Above Key Level; What To Do

Dow Jones futures rose slightly early Wednesday, along with S&P 500 futures and Nasdaq futures. The stock market rally had a strong Tuesday, with the major indexes and small-cap Russell 2000 regaining their 50-day moving averages, shrugging off weakness in Nvidia (NVDA) and Advanced Micro Devices (AMD). The 10-year Treasury yield fell to the key 4% level as weak economic…

-

Futures: China Trade Deal Close; Huge Earnings On Tap

Dow Jones futures will open Sunday evening, along with S&P 500 and Nasdaq futures after the stock market rally hit record highs Friday. Now get ready for a huge week of earnings, another Fed rate cut and a Trump-Xi meeting A “comprehensive” U.S.-China trade deal is close after weekend talks, setting the stage for President Donald Trump and Chinese President…

-

Futures Rise With China Trade Talks, CPI, Big Earnings Due

Dow Jones futures rose slightly Sunday evening, along with S&P 500 futures and Nasdaq futures. Tesla (TSLA), GE Vernova (GEV), Netflix (NFLX) and GE Aerospace (GE) headline big earnings with the September CPI inflation report due Friday. But the biggest market news may be U.S.-China trade talks. The stock market rally enjoyed strong weekly gains. But the major indexes and…

-

Why This Market Is So Dangerous. Tesla, GE, CPI Data Due

Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures. Tesla (TSLA), GE Vernova (GEV), Netflix (NFLX) and GE Aerospace (GE) headline a big earnings week capped by the September CPI inflation report. The stock market rally enjoyed strong weekly gains. But after Monday’s rebound, the major indexes and many leaders have seen big intraday…

-

Futures: Trump Says ‘Don’t Worry’ After 100% China Tariff

Dow Jones futures will open Sunday evening, along with futures for the S&P 500 and Nasdaq, as investors react to a flurry of U.S.- China news. Late Friday President Donald Trump moved to impose an extra 100% tariff on China, but on Sunday that “it will all be fine.” The stock market sold off Friday as Trump threatened tariffs over…

-

Why Is The Bitcoin Price Down Today?

The Bitcoin price is in a decline once more, after seeing some recovery on Wednesday due to the turnaround in the Spot Bitcoin ETFs net flows. However, just one day later, it seems the pioneer cryptocurrency has resumed the downtrend and this decline after the recovery has begun a worrying trend. So, what are the factors that are driving this decline?

Bitcoin Price Suffers From Sell-Offs

One of the major factors that have been behind the Bitcoin decline is the major sell-offs that have rocked the digital asset. These sell-offs are not just from any investor, but rather large BTC sells being orchestrated by large governments.

Related Reading

One of the major news that rocked the space was the fact that the German government had begun selling coins. In total, the German government sold around 2,786 BTC, which was worth around $$140 million at the time of the sale.

However, the German government is not the only one that has been selling. News also broke that the US government had begun moving Bitcoin seized from the Silk Road bust once again. On-chain data aggregator Arkham reported that the US government had moved almost 4,000 BTC from its wallets to the Coinbase exchange.

In total, the US government moved 3,940 BTC to the exchange, which amounted to $241.22 million at the time of the transaction. This transfer is worrying as coins are usually moved to centralized exchanges such as Coinbase for sale as these trading platforms possess deeper liquidity compared to their decentralized counterparts.

Has BTC Reached Its Bottom?

While the downtrend looks to have resumed, there are signs that point to the bottom being closed. One of these signs is the return of demand into the market. For example, the Spot Bitcoin ETFs had seen seven consecutive days of outflows, which eventually turned around on Tuesday. Data from Coinglass shows that between Tuesday and Wednesday, inflows into the Spot Bitcoin ETFs have crossed $50 million, ending the brutal week of outflows.

Related Reading

Another possible tell is the profit and loss margin for investors. This shows how many Bitcoin investors are currently seeing profit, and the higher the profitability, the higher the likelihood of a sell-off as investors take profit from their positions.

However, the profitability levels have dropped, meaning that investors are less likely to sell their holdings as they wait for better prices. This often gives demand time to build up and create a possible bounce point for a recovery.

For now, the Bitcoin price is holding steady at the $61,000 support at the time of writing. But if sell-offs resume, then the pioneer cryptocurrency could fall to the $60,000 level soon.

Bulls reclaim control of BTC price | Source: BTCUSD on Tradingview.com Featured image created with Dall.E, chart from Tradingview.com

Scott Matherson

Source link -

US Mega Banks JP Morgan And Wells Fargo Unveil Bitcoin Exposure As BTC Drops To $60,000

JP Morgan and Wells Fargo, two of the largest banks in the United States, have announced their investments into Spot Bitcoin ETFs, unveiling their exposure to BTC, the world’s largest cryptocurrency. This significant development comes amidst the persistent downturn in the crypto market, resulting in BTC’s price dipping slightly above $60,000.

US Financial Banks Expose Spot Bitcoin ETF Holdings

American financial services companies, Wells Fargo and JP Morgan, have revealed their exposure to BTC by disclosing their adoption of Spot Bitcoin ETFs in a recent filing. This decision to invest in BTC ETFs marks a notable change from the banks’ previous cautious approach to cryptocurrencies.

Related Reading

Wells Fargo revealed in its new filing to the United States Securities and Exchange Commission (SEC) that it currently holds 2,245 shares of Grayscale Bitcoin Trust (GBTC), valued at $121,207, which it has since converted into an ETF. Additionally, the American bank holds 37 shares of the ProShares Bitcoin Strategy ETF (BITO), valued at $1,195.

On the other hand, JP Morgan, which holds about $2.9 trillion in Assets Under Management (AUM), has revealed its total Spot BTC ETF holdings in an SEC filing. The bank reported that it had purchased about $760,000 worth of shares of BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale Bitcoin Trust (GBTC), Bitwise Bitcoin ETF, and ProShares Bitcoin Strategy ETF (BITO).

Moreover, JP Morgan also owns about 25,021 shares valued at $47,000 in cryptocurrency ATM provider, Bitcoin Depot. The investment company also unveiled its exposure to Spot BTC ETFs just hours after Wells Fargo’s announcement.

Despite the regulatory uncertainty and the market’s continuous volatility, institutional interest in cryptocurrencies, particularly BTC, has been growing rapidly. Bloomberg senior analyst, Eric Balchunas also forecasted that more financial services companies would likely follow JP Morgan and Wells Fargo’s footsteps to unveil holdings in Spot Bitcoin ETFs as market makers or Authorized Participants (APs).

BTC Price sUFFERS More Declines

Despite the increasing interest from traditional financial institutions seeking exposure to BTC, the price of the cryptocurrency has shown a surprising lack of bullish momentum. Since its halving event on April 20, BTC has been trading sideways, witnessing continuous declines that have pushed its price down to around $57,000 previously.

The cryptocurrency, which recorded an all-time high above $73,000 in March, has seen a 14.20% drop over the past month. Additionally, Bitcoin gave up a large portion of its gains before the halving and is currently trading at $60,494, according to CoinMarketCap.

Blockchain analytics platform, Santiment, revealed that the ongoing lack of interest in BTC and the broader market sentiments could be a strong sign that the cryptocurrency is getting close to its bottom.

BTC price falls below $61,000 | Source: BTCUSD on Tradingview.com

Featured image from PlasBit, chart from Tradingview.com

Scott Matherson

Source link -

Here Are The Largest Institutional Buyers Of Bitcoin This Week

The Spot Bitcoin ETFs have lived up to the hype, as these funds have ramped up institutional adoption of the flagship cryptocurrency, Bitcoin. This is further evident in a recent analysis that captured how much Bitcoin BlackRock and other issuers amassed in this week alone.

Spot Bitcoin ETF Issuers Purchased Over 19,908 BTC This Week

Data from the on-chain analytics platform Lookonchain shows that the Spot Bitcoin ETF issuers combined to purchase over 19,908 BTC ($860 million) this week. Meanwhile, it is worth mentioning that Lookonchain’s data didn’t capture WisdomTree’s BTC purchases in its analysis, suggesting that the figure could be way higher when the asset manager’s purchases are also factored in.

Further data obtained from Arkham Intelligence provided insights into how much Bitcoin Wisdom Tree obtained for its Bitcoin fund this week. 74 BTC is shown to have gone into the asset manager’s wallet address for its Spot Bitcoin ETF. The addition of these crypto tokens means that all Spot Bitcoin ETF issuers combined to purchase almost 20,000 BTC this week alone.

Interestingly, Bitcoin ETFs were recently reported to hold 3.3% of Bitcoin’s circulating supply, underscoring their success since launching. Data from Lookonchain shows that these ETFs currently hold over 657,000 BTC (excluding WisdomTree).

Matt Hougan, Bitwise’s Chief Investment Officer (CIO), also revealed how these funds have seen flows of $1.7 billion after their first 14 trading days. This is more impressive as he made a comparison to Gold ETFs, which saw $1.3 billion in a similar time frame. In another X post, he mentioned how these Spot Bitcoin ETFs have taken $700 million in net inflows this week alone.

BTC price recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock Finally Trumps Grayscale

Bloomberg analyst James Seyffart mentioned in an X post that BlackRock’s IBIT looks to have become the first ETF to trade more than Grayscale’s GBTC in a single day. Before now, Grayscale had continued to record the most daily trading volume, although IBIT had come close on a couple of occasions.

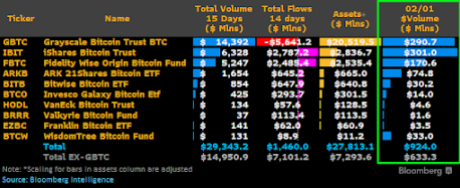

From the data that Seyffart shared, IBIT looks to have recorded $301 million in trading volume on February 1, while GBTC saw $290 in trading volume. However, he further stated that the total trading on the day “was kind of a dud,” with all Spot Bitcoin ETFs combined recording $924 million in trading volume.

Interestingly, that happened to be the first day that the daily volume for Spot Bitcoin ETFs was under $1 billion. The Bloomberg analyst didn’t, however, give any opinion as to what could have caused this relatively sub-par performance.

Featured image from U.S. Global Investors, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Scott Matherson

Source link -

Bitcoin Spot ETFs Approved After 14 Years- The Journey So Far

The year 2024 marks the dawn of a new era, not just for technology but for finance, as a major victory was achieved for Bitcoin Spot ETFs (Exchang-Traded Funds). It’s now the era where the past will be appreciated for its foresight and doggedness.

When the pioneer cryptocurrency and digital currency, Bitcoin launched in January 2009, it was nothing like a real-world asset or of an ‘agreed’ digital value, but an almost neglected bag of gold as it faced enough rejection from all phases. Even with Satoshi’s Whitepaper, Bitcoin wasn’t given a cordial welcome in the world of finance.

However, for all its promise, BTC remained shrouded in an air of mystery and skepticism. It took several years for Bitcoin to cement its value in the world of technology, finance, and the digital economy, assuming a giant role amidst many other cryptocurrencies.

However, On January 10, 2024, the SEC, in its official filing, approves all 11 Bitcoin Spot ETFs. This long-awaited green light from the US SEC marked a watershed moment, not just for Bitcoin, but for the entire cryptocurrency industry.

The 14-year journey to this point was arduous and paved with skepticism; regulatory hurdles loomed large, with the SEC citing concerns about market manipulation and investor protection as justification for repeated rejections. Attempts like Bitcoin futures ETFs offered limited exposure, failing to capture the true essence of a spot ETF’s direct price tracking.

Bitcoin Spot ETF Explained

The recent approval of Bitcoin spot ETFs has stirred excitement across the financial landscape. But what exactly are these instruments, and what impact will they have on the future of BTC and, more broadly, on the investment landscape?

Bitcoin “Spot” ETFs (exchange-traded funds), unlike their futures-based counterparts, don’t track the price of Bitcoin futures contracts. Instead, they take a more direct approach, holding the underlying asset – Bitcoin itself – in secure digital custodians.

This eliminates the potential for “basis risk,” a phenomenon where futures prices deviate from the actual cash price of Bitcoin. Simply put, Spot ETFs offer a more straightforward and transparent way to gain exposure to BTC’s price movements, akin to traditional gold-backed ETFs.

Bitcoin Spot ETFs function similarly to their traditional counterparts, such as those tracking stock market indices. They pool investor capital, purchasing Bitcoin and holding it securely. Each share of the ETF represents a fractional ownership of the pooled Bitcoin, allowing investors to participate in the market without directly holding or managing the cryptocurrency themselves. This eliminates technical complexities and potential security risks, particularly for those with limited crypto experience, potentially broadening the base of Bitcoin investors.

The Genesis Of Bitcoin ETFs (Early Days and Conceptualization – 2013-2017)

The earliest sparks of a Bitcoin ETF concept date back to 2013, when the Winklevoss twins first proposed their Gemini ETF. Winklevoss twins, Cameron and Tyler, both tech entrepreneurs with a vision in 2013, submitted the first application for a Bitcoin ETF, the Gemini ETF, sparking the decade-long journey to regulatory approval.

This audacious proposal was outrightly rejected by the SEC during the tenure of its former chairman, Jay Clayton, who later resigned in 2020 and became a supporter of cryptocurrency. Interestingly, Clayton is now actively involved in crypto regulations when he joined the advisory board of Fireblocks, a crypto custody platform.

The following years were a crucible of innovation and uncertainty. While Bitcoin’s market capitalization surged, attracting both fervent supporters and cautious observers, the SEC remained hesitant. The regulator’s concerns about market manipulation, price volatility, and the nascent state of blockchain technology were cited as justifications for repeated rejections of subsequent ETF proposals, including Grayscale’s attempt to convert its Bitcoin Investment Trust into a spot ETF.

Yet, amidst the rejections, there were flickers of progress. Technological advancements improved blockchain security and custody solutions, addressing initial concerns about vulnerability and potential wash trading. The global adoption of Bitcoin, particularly in Canada with its approval of Spot ETFs in 2021, served as a compelling case study for increased accessibility and market stability.

This period also saw the SEC’s stance slowly evolve. The appointment of Gary Gensler as SEC Chair in 2021 brought a newfound openness to dialogue and exploration of potential regulatory frameworks for cryptocurrencies. The approval of the first US-listed futures-based bitcoin ETF in October 2021, despite its limitations, offered a glimpse of what could be.

The Turning Point: A Decade Of Persistence Pays Off (2018-2023)

While the 2017-2018 crypto boom and subsequent crash sent shockwaves through the industry, it also served as a crucible, forging resilience and fueling a renewed focus on compliance and innovation. Industry figures like Grayscale, undeterred by previous rejections, continued to refine their proposals, incorporating crucial safeguards and addressing regulatory concerns.

This relentless pursuit of approval finally yielded results in 2023. In May, Cathie Wood’s ARK Investments filed for a spot bitcoin ETF, setting a definitive deadline for the SEC’s decision.

Then, in June, BlackRock’s entry into the arena with its own Spot Bitcoin ETF application sent ripples of excitement through the financial world. This move by a traditional financial giant signalled a crucial shift in sentiment, demonstrating growing institutional confidence in BTC’s potential.

The months that followed were a whirlwind of activity. A flurry of applications from firms like Fidelity and Invesco poured in, fueled by the momentum of BlackRock’s move and the prospect of imminent approval. In August, a pivotal legal victory for Grayscale in the D.C. Circuit Court further strengthened the case for spot ETFs, forcing the SEC to re-examine its previous rejections.

Finally, the SEC, in a historic decision, greenlighted 11 spot bitcoin ETF proposals, including those from BlackRock, Fidelity, and VanEck. This moment marked the culmination of a decade-long struggle, signifying the mainstream acceptance of investor participation in the cryptocurrency space.

Ripples Across The Crypto Landscape: Implications Of Bitcoin Spot ETFs (2024)

The arrival of spot ETFs has cast a wide net, sending ripples across various spheres of the financial world. There are a lot of potentials and challenges presented by spot ETFs, vital impact on market stability, institutional adoption, and regulatory oversight. There are positive predictions that the Bitcoin market cap could rise above $1 Trillion after the launch of Bitcoin Spot ETFs.

Let’s contemplate the broader significance of this pivotal moment, what it means for the future of finance, and its relationship between technology and traditional financial systems here.

Investor Crossroads

For retail investors, Spot ETFs offer a convenient and familiar way to participate in the Bitcoin market without directly holding the cryptocurrency. This opens the door to broader adoption and increased liquidity, potentially leading to smoother price discovery and reduced volatility. The influential American magazine, Forbes predicted the BTC price will trade as high as $80,000 as a result of Bitcoin Spot ETFs’ approval.

The year 2024 is also shaping up to be a good one, if not one of the best seasons for cryptocurrency, especially Bitcoin, as it’s the season for Bitcoin halving, which will have another mega impact on the crypto industry.

However, the inherent risks of Bitcoin, including price fluctuations and potential exposure to fraud, must not be underplayed. Investors should approach spot ETFs with cautious optimism, ensuring a proper understanding of the technology, market dynamics, and associated risks before venturing in.

Institutional Embrace Bitcoin

The arrival of spot ETFs marks a significant step towards institutional acceptance of Bitcoin. The involvement of established financial institutions like BlackRock and Fidelity lends credibility to the cryptocurrency and paves the way for further integration with traditional financial products and services.

Concerns remain about the impact of institutional involvement on market manipulation and potential conflicts of interest. However, regulatory oversight and robust compliance frameworks will be crucial in ensuring a fair and transparent market for all participants.

Market Redefined

Spot ETFs could potentially lead to greater market stability by introducing institutional investors and their risk management expertise. This could mitigate some of the inherent volatility of the cryptocurrency market, attracting a wider range of investors and fostering sustainable growth.

The SEC’s approval represents a cautious acceptance, not a blank check. Further regulatory clarity and potential adaptation of existing frameworks might be required to effectively address the unique challenges posed by the integration of cryptocurrencies into mainstream financial systems.

Beyond Bitcoin

Spot ETFs could act as a gateway for investors to explore the broader crypto landscape. Their familiarity and ease of access might encourage exploration of other promising blockchain-based projects, accelerating the overall growth and development of the cryptocurrency ecosystem.

The success of spot ETFs will hinge on the continued evolution of blockchain technology and associated infrastructure. Scalability, security, and user experience will remain key areas of focus for ensuring the smooth functioning and widespread adoption of crypto-based financial products.

The 11 Spot Bitcoin ETFs products (with their ticker symbols) approved on January 10, 2024, are:

- Blackrock’s iShares Bitcoin Trust (IBIT)

- ARK 21Shares Bitcoin ETF (ARKB)

- WisdomTree Bitcoin Fund (BTCW)

- Invesco Galaxy Bitcoin ETF (BTCO)

- Bitwise Bitcoin ETF (BITB)

- VanEck Bitcoin Trust (HODL)

- Franklin Bitcoin ETF (EZBC)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Valkyrie Bitcoin Fund (BRRR)

- Grayscale Bitcoin Trust (GBTC)

- Hashdex Bitcoin ETF (DEFI)

Conclusion

The approval of Bitcoin spot ETFs is a watershed moment, not just for the cryptocurrency itself, but for the entire financial landscape. It marks a new chapter in the saga of Bitcoin, one where its disruptive potential can be harnessed within the framework of established financial systems.

Also, this path forward is paved with both opportunities and challenges. Navigating regulations and addressing investor risk concerns are important to ensure seamless integration with traditional financial systems and regulatory bodies, which will be crucial in determining the ultimate success of this technological leap.

Final Thoughts

The approval of Bitcoin spot ETFs is not merely a regulatory green light; it’s a resounding declaration of Bitcoin’s arrival on the main stage of finance.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

However, the journey is far from over. This approval is a milestone, not a destination. As we stand at this turning point, it’s important to remember the spirit of defiance that birthed BTC. It was born from a desire for autonomy, for freedom from centralised control, and for a more equitable financial system.

While ETFs offer a bridge between this decentralized world and the established financial order, it’s crucial not to lose sight of these core principles.

BTC price struggles post-Bitcoin Spot ETF approval | Source: BTCUSD on Tradingview.com

Featured image from Cryptopolitan, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Scott Matherson

Source link -

Bitcoin Spot ETF: VanEck’s Head Of Research Says BlackRock Has $2 Billion In Investments Lined Up

VanEck’s Head of Research, Matthew Sigel, recently hinted that the Spot Bitcoin ETF of the world’s asset manager, BlackRock, could see a record-breaking amount of inflows upon launch. This comes as an approval order by the Securities and Exchange Commission (SEC) looks imminent.

BlackRock’s Bitcoin ETF Could See Inflows Of Over $2 Billion

Sigel mentioned on an X (formerly Twitter) space hosted by the media platform, The Block, that he heard from a reliable source that BlackRock has “more than $2 billion lined up in week one.”

This investment capital is said to be coming from existing Bitcoin holders who are looking to increase their exposure to the flagship cryptocurrency.

He quickly added that he couldn’t be 100% certain of this information. However, it is a possibility, considering that issuers would be looking to get investors that can inject huge sums into their respective ETFs.

Sigel went on to highlight how significant it could be if BlacRock’s ETF indeed saw $2 billion of inflows in the first week of trading, saying that it would “blow away” their initial projections. They estimate that the Spot Bitcoin ETFs could see $2.5 billion of inflows in the first quarter of trading. Meanwhile, they believe the market could grow to $40 billion in the next two years.

BTC price struggles to reclaim $44,000 | Source: BTCUSD on Tradingview.com

Not Out Of Place For BlackRock

Commenting on the possibility of BlackRock seeing this significant amount of inflows, Bloomberg analyst Eric Balchunas noted that such an occurrence isn’t unusual for the world’s largest asset manager. According to him, BlackRock is known for lining up and injecting big cash into new ETFs on the first day of trading. That way, it registers as volume for them.

Balchunas further noted that BlackRock’s Bitcoin ETF, seeing $2 billion of inflows, would shatter all records relating to first-day and week volume for an ETF. Interestingly, BlackRock already holds the record for the most successful ETF launch going by the amount of inflows recorded on day one.

The world’s asset manager further dominates the top 10 list of most successful ETF launches. Balchunas, however, clarified that those inflows were mainly lined up cash and not organic, as they were readily available before the ETF launched. He also mentioned that he got a second source to confirm Sigel’s claims that BlackRock has a big day one lined up.

Meanwhile, the Bloomberg analyst provided an update on when the approval order from the SEC was likely to come. Citing multiple sources, he stated that the SEC is lining up all issuers for a potential launch on January 11.

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Scott Matherson

Source link -

Bitcoin Breaks Through Securities Barrier: Registered Funds Want Exposure To BTC

An interesting trend looks to be developing among institutional players as their interest in the flagship cryptocurrency, Bitcoin, continues to rise. This interest has in no small way been thanks to the frenzy around the Spot Bitcoin ETFs, which could be approved sooner than later.

Other ETFs Considering Bitcoin As An Investment Option

Crypto commentator and music producer Marty Party recently drew the crypto community’s attention to an emerging trend among fund managers and their ETFs. He noted how these asset managers are amending the prospectus of funds they manage so they can gain exposure to Bitcoin.

These institutions are said to be looking to use 15% to 50% of assets under their management to gain exposure to BTC. One way they will be looking to achieve this is through the Spot Bitcoin ETFs that could potentially launch anytime soon.

Marty Party specifically highlighted the case of Advisors Preferred Trust, which is already looking to gain the SEC’s permission to invest up to 15% of its AuM in Bitcoin-related ETFs like Grayscale’s Bitcoin Trust (GBTC) and ProShares Bitcoin Strategy ETF.

MicroStrategy’s Executive Chairman and Co-founder, Michael Saylor, had previously hinted that something like this was going to happen soon enough. Then, he suggested that more institutional players were going to direct more of their capital to Bitcoin.

A rule that was implemented by the Financial Accounting Standards Board (FASB) has also paved the way for more companies like MicroStrategy to include BTC on their balance sheet.

The launch of Spot Bitcoin ETFs will also make it easier for these institutional investors to gain direct exposure to the flagship cryptocurrency.

For a long time now, those who had a prior interest in the crypto token have had to either invest in Bitcoin futures ETFs or other Bitcoin derivatives on exchanges like the Chicago Mercantile Exchange (CME). But this is changing with the potential approval of a Spot Bitcoin ETF.

BTC price holds $45,000 | Source: BTCUSD on Tradingview.com

Grayscale Leading In The “Cointucky Derby”

As highlighted recently by Bloomberg Analyst James Seyffart, Grayscale looks to set the lead the way, assuming all pending Spot Bitcoin ETFs were approved simultaneously. This is because the asset manager has already established itself with GBTC and would likely have more capital than other issuers upon launch.

Bloomberg Analyst Eric Balchunas highlighted this fact and hinted that the Securities and Exchange Commission (SEC) could decide not to let Grayscale launch on day one because of this. If that doesn’t happen and all funds launch simultaneously, then Grayscale is likely to have a sort of ‘first mover advantage.’

However, other asset managers will be looking to assert their dominance by adopting different strategies. One such strategy will be these issuers undercutting themselves in terms of the fees they will charge to manage their respective funds. Invesco already made it known that they will be waiving fees for the first six months and the first $5 billion in assets.

Featured image from Finra, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Scott Matherson

Source link -

Bitcoin Spot ETF: Bitwise Closes Ranks With $200 Million Seed Fund

The competition among the Spot Bitcoin ETF issuers is heating up as the period for potential approval of these funds draws nearer. Asset manager Bitwise is the issuer currently making waves as it could potentially outrank the world’s largest asset manager, BlackRock, in terms of seed funds for their respective ETFs.

Bitwise’s Bitcoin ETF Could See $200 Million Seed Fund

Bitwise’s latest amendment to its S-1 filing with the Securities and Exchange Commission (SEC) shows that the asset manager has gotten interest from an investor to have its ETF seeded with $200 million upon launch. Bloomberg analyst Eric Balchunas highlighted its significance as he stated that it “blows away” BlackRock’s initial seed fund of $10 million.

The analyst noted that Bitwise actually seeding its ETF with such an amount could be a “huge help” in the early days of the race. It is believed that the SEC is likely to approve the pending ETF applications simultaneously. As such, Bitwise being able to create $200 million of shares could give the asset manager an advantage in terms of meeting demands by clients.

Bitwise had previously shown its intention to lead the way from the get-go following the release of its Bitcoin ETF commercial. This move could help the asset manager gain much interest in its Bitcoin ETF even before launch. That way, the public sees it as the first choice upon launching.

Notably, Bitwise didn’t mention who the authorized participant (AP) for its ETF would be. The AP would act as the middleman between the ETF investor and issuer, as they are responsible for creating and redeeming the ETF shares. While Bitwise failed to name its AP, other issuers like BlackRock however included it in their latest S-1 filing with the SEC.

BTC price above $42,000 once again | Source: BTCUSD On Tradingview.com

BTC ETF Issuers Show Their Hands In Latest Wave Of Filings

Spot Bitcoin ETF issuers made some notable inclusions in their latest and final amendment to their S-1 filings. These inclusions also give an idea of what strategy these issuers may be looking to adopt in order to lure investors to their funds. In Fidelity’s case, the asset manager will be looking to entice investors with its relatively low fees.

Balchunas noted that Fidelity’s ‘sponsor fee’ of 0.39% happens to be the lowest so far among other issuers that have made theirs known. Interestingly, Invesco is adopting a more enticing strategy as they revealed in their latest amendment that they will be waiving fees for the first six months and the first $5 billion in assets.

The Bloomberg analyst mentioned that the fee war is going to continue being a thing in the Spot Bitcoin ETF terrain as issuers will be looking to outdo themselves.

Featured image from Crypto Briefing, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Scott Matherson

Source link -

Ethereum ETF Race: BlackRock Wants An Ether Spot ETF

BlackRock has joined the Ethereum Spot ETF race as the asset management company has officially applied to the US SEC and is currently waiting for approval.

BlackRock Files For An Ethereum Spot ETF

Following its Spot Bitcoin ETF filing, BlackRock, an American investment company has taken the proactive step by filing an Ethereum Spot Exchange Traded Fund (ETF) with the United States Securities and Exchange Commission (SEC).

The asset management company submitted the application on November 15, however, BlackRock has stated it formed the Trust as early as November 9.

According to BlackRock, the iShares Ethereum Trust would be used to facilitate the ownership of Ether through the issuance of shares, allowing investors to own a fractional undivided beneficial interest in the net assets of the Trust.

“The Trust was formed as a Delaware statutory trust on November 9, 2023. The purpose of the Trust is to own ether transferred to the Trust in exchange for Shares issued by the Trust. Each Share represents a fractional undivided beneficial interest in the net assets of the Trust. The assets of the Trust consist primarily of ether held by the Ether Custodian on behalf of the Trust,” BlackRock said in its filing.

Presently, the US SEC has not approved any Ethereum Spot ETF filing as well as Spot Bitcoin ETF applications. The regulatory body has delayed multiple applications to be reviewed from January 2024.

The crypto community has remained enthusiastic that the regulatory agency would eventually approve the pending ETF applications, as this could significantly push the growth and development of the crypto ecosystem as well as the cryptocurrencies involved.

Ethereum Price Surges

The price of Ethereum is on the rise following BlackRock’s Ethereum ETF filing. The cryptocurrency’s price climbed almost 2% moving to $2,080 at some point following the announcement of the filing.

The sharp reaction has caused a stir in the cryptocurrency community, as investors gear up for a potential bull run if the US SEC gives its official authorization of Ethereum Spot ETFs.

The price of Bitcoin has also been growing steadily as new companies apply for Spot Bitcoin ETFs. Currently, Bitcoin’s price is trading at $36,408, while ETH is down from its initial surge and trading at $1,952.

The crypto ecosystem is presently watching closely for more updates on the US SEC’s ETF filing approvals and the price changes that follow them.

ETH price falls to $1,945 | Source: ETHUSD on Tradingview.com

Featured image from Bitcoin News, chart from Tradingview.com

Scott Matherson

Source link -

$9 Trillion BlackRock Files Ethereum Spot ETF, What’s So Special About It?

Following BlackRock’s official filing of Spot Ethereum with Nasdaq, reports have confirmed that BlackRock’s Ether ETF plan has been confirmed by Nasdaq and is on its way to the US SEC to gain final approval.

BlackRock Ethereum Spot ETF Confirmed

American multinational investment company, BlackRock has been making waves in the crypto space after news spread of NASDAQ listing the investment firm’s Ethereum Spot ETF, iShares Ether Trust in Delaware.

“BlackRock’s Ethereum ETF confirmed. They just submitted a 19b-4 filing with Nasdaq,” Bloomberg Research Analyst, Jeff Seyffart stated.

While BlackRock’s Spot Bitcoin ETF proposal remains to be approved by the United States Securities and Exchange Commission (SEC), the $9 trillion asset management company has placed its focus on Ethereum Spot ETFs while it waits for the SEC’s final decision on Spot Bitcoin ETFs.

The news of the Nasdaq Ethereum ETF filing comes as a major development for BlackRock’s move into the ETF world. Although the investment company remains tight-lipped on the ETH ETF reports flowing through the space, the possibility of an Ether Spot ETF approval could be a sign of the SEC’s approval of Spot Bitcoin ETFs in the future.

Many crypto enthusiasts have predicted that the US SEC may continue its efforts to stop the growth of Spot Bitcoin ETFs by declining BlackRock’s Ether Spot ETF filing.

However, in the case the regulatory body does approve the asset management company’s Ethereum Spot ETF, the SEC could be faced with potential contradictions in its decision-making processes. The acceptance of ETH Spot ETFs would stand in stark contrast to the previous disapproval of Spot Bitcoin ETFs.

Presently, the crypto community has been largely positive, as market metrics signal a potential rally for altcoins following BlackRock’s Ethereum Spot ETF confirmation.

A crypto member has stated that the asset management company’s move into Ether Spot ETFs indicates strategic confidence in securing approval for Spot Bitcoin ETF in the future.

ETH Price Skyrockets

Following the news of NASDAQ registering BlackRock’s Ethereum Spot ETF, the price of ETH has increased by over 9% and is currently trading at $2,086.92 according to CoinMarketCap.

Reports of the Ethereum Spot ETF filing have sparked a rally in the cryptocurrency, topping over $2,000 for the first time since April this year. ETH’s market volume has also increased by 171.53%.

Many crypto investors are looking forward to more positive developments in the cryptocurrency regarding Ethereum Spot ETFs as an official approval may indicate a potential long-term bull run for ETH.

ETH bulls retest $2,100 | Source: ETHUSD on Tradingview.com

Featured image from BlockWorks, chart from Tradingview.com

Scott Matherson

Source link -

Galaxy Digital and Invesco Bitcoin Spot ETF Join BlackRock On The DTCC

In a recent development, another proposed Spot Bitcoin ETF has been listed on the Depository Trust and Clearing Corporation’s (DTCC) website, becoming the second proposed Spot Bitcoin ETF to appear on the corporation’s website.

BTCO Joins IBTC On DTCC Website

The Invesco Galaxy Bitcoin ETF under the ticker ‘BTCO’ recently appeared on the DTCC website, joining BlackRock’s spot Bitcoin ETF, which goes under the ticker ‘IBTC’ as uncertainty around a possible approval of these funds continues to heighten.

Source: DTCC website

Many had speculated an approval was imminent when BlackRock’s IBTC was earlier listed. However, the optimism has sort of cooled off following a recent revelation by a spokesperson for the financial services company. The representative clarified that the listing of these ETFs was simply “Standard Practice” and that it doesn’t indicate any potential approval by the SEC.

An ETF expert had also weighed in and stated that DTCC’s listing didn’t mean anything in the grand scheme of things regarding a possible approval of Bitcoin ETFs by the United States Securities and Exchange Commission (SEC). Going by this, the DTCC listing only suggests that these asset managers are preparing just in case they get approved by the SEC.

Such preparations also include asset managers BlackRock and VanEck recently revealing their plans to begin seeding for their respective funds. While such a move doesn’t guarantee that the SEC is likely to approve these funds anytime soon, it, however, shows the optimism of these firms that their Spot Bitcoin ETF will launch sooner or later.

Valkyrie Joins The Spot Bitcoin ETF Amendment Train

In a post shared on his X (formerly Twitter) platform, Bloomberg analyst James Seyffart noted that the asset management firm Valkyrie had joined the “prospectus amendment train” with the latest filing of their revised Spot Bitcoin ETF prospectus. Valkyrie joins the likes of ARK Invest, BlackRock, Fidelity, and Bitwise, who have also filed amendments to their prospectus.

Seyffart happens to be one of those who believe that these amendments could mean something. ARK Invest was the first asset manager to amend its prospectus, which led Seyffart and fellow Bloomberg analyst Eric Balchunas to predict that the US Securities and Exchange Commission (SEC) could approve a fund as early as next year.

Meanwhile, it is worth mentioning that the SEC has so far not said anything regarding Grayscale’s application despite the Commission opting not to file an appeal. But that could change soon as ETF enthusiast and prominent financial lawyer Scott Johnsson said that the Commission is set to have a closed meeting on November 2; its first since the Grayscale deadline expired, and one of the agenda for the meeting includes resolving litigation claims.

BTC price hovering above $34,400 | Source: BTCUSD on Tradingview.com

Featured image from iStock, chart from Tradingview.com

Scott Matherson

Source link -

Bitcoin Resumes Rally After Brief Hiatus, Here’s What Happened

Bitcoin saw a brief stall in its rally which triggered a decline back down to $33,700. This decline, seemingly out of nowhere, may have not been random given some developments in the crypto space. As the rally resumes once more, here’s a look at these developments.

BlackRock Spot Bitcoin ETF Listing Taken Down

The BlackRock Spot Bitcoin ETF was first listed on the Depository Trust and Clearing Corporation’s (DTCC) on Tuesday, triggering the first wave of the Bitcoin rally. However, in the same day, crypto community members noticed that the listing on DTCC had been mysteriously taken down.

The listing would remain off the site for several hours while community members speculated on what could be the cause of this. Around this time, the price of Bitcoin began to fall, seemingly driven by the fact that investors saw the removal of the BlackRock listing as a sign that a Spot Bitcoin ETF wasn’t coming as soon as they expected.

Hours later, Bloomberg Analyst Joe Light revealed that the listing was back up on the site. Apparently, the initial listing and the subsequent ones had carried one small change in detail which was a change in the Create/Redeem section from a “Y” to a “N.”

Another Bloomberg analyst James Seyffart explained that this likely meant that it was to indicate whether the ETF listing was open to creations/redemptions. When Light asked if this change could point out a launch without using that attribute, to which Seyffart said:

“I personally don’t think this means all that much if I’m being honest. Think it indicates Blackrock is getting everything ready to launch if and when they get an SEC approval. And that the N just means it’s not open for create redeem because it’s not live yet.”

BTC recovers to $34,400 | Source: BTCUSD on Tradingview.com

BTC Price Bounces Back

The return of the BlackRock Spot Bitcoin ETF on the DTCC sparked enthusiasm across the space once more than it did before. The price of Bitcoin quickly started to recover and by Wednesday morning, was back above the $34,000 mark once more.

These events outline the importance of a Spot ETF and how it is the major driver behind the most recent price rally. So an approval or a rejection would both have a major impact on the digital asset’s price. For one, an approval would likely see Bitcoin clear above $40,000. However, a rejection would be detrimental to the rally, and will probably send it back below $30,000.

Presently, Bitcoin is maintaining bullish momentum above $34,100. But it is seeing small losses of 0.99% on the 24-hour chart, and its daily trading volume is down 34.58%.

Best Owie

Source link -

Bitcoin Spot ETF: Crypto Research Firm Reveals What Will Happen In The First Three Years | Bitcoinist.com

The potential approval of a Spot Bitcoin ETF by the US Securities and Exchange Commission (SEC) is expected to have significant effects on Bitcoin and the Spot Bitcoin ETF market. Addressing what investors can expect, the crypto research firm Galaxy Digital recently provided insights as to what could happen in the first three years upon the launch of this fund.

What To Expect In The First Three Years

In a research paper released on October 24, Galaxy Digital’s research associate Charles Yu provided a vivid illustration of the heights a Spot Bitcoin ETF could attain in terms of market size and inflows in the first three years.

Source: Galaxy Research

As to market size, Yu made his predictions on the addressable market size of a US Bitcoin ETF based on how they expect various wealth channels to adopt the fund. According to him, RIA (Registered Investment Advisor) will ramp up starting at 50% in the first year and increasing to 100% in the third year.

Meanwhile, broker-dealers and bank channels will ramp up at a slower pace, starting at 25% and increasing to 75% by the third year. If their assumption comes true, they estimate the market size to hit $14 trillion in the first year, $26 trillion in the second, and $39 trillion in the third year.

The firm’s estimates of inflows into the Bitcoin ETFs are based on their market size estimates. Going by this, they predict that these funds could see $14 billion of inflows in the first year, $27 billion by the second year, and up to $39 billion by the third year after launch.

Yu noted that factors such as a potential delay or denial of the pending Spot Bitcoin ETFs could affect their analysis. Other factors like poor price performance could also cause a low adoption rate, which they believe will potentially affect their estimates.

BTC price retraces to $33,900 | Source: BTCUSD on Tradingview.com

Potential Impact On Bitcoin’s Price

Yu also provided insight into the effect that these Spot Bitcoin ETFs could have on BTC’s price. They predict that Bitcoin’s price could see a 74.1% increase in the first year of these funds launching. He made this estimate using the expected amount of inflows ($14 trillion), which is expected to come into these funds in the first year while making comparisons to Gold ETFs.

Source: Galaxy Research

Source: Galaxy ResearchSpecifically, they project that Bitcoin’s price could see a 6.2% increase in the first month of these funds’ launch as they estimate an adjusted inflow of over $10 billion in the first month. This price increase in the first month is expected to keep ramping down to a 3.7% price impact in the last month of the first year of launch, all of which will cumulatively add up to the 74.1% increase.

Featured image from The Conversation, chart from Tradingview.com

Scott Matherson

Source link -

Coinbase Exec Uses The Law To Back Why SEC Should Approve A Spot Bitcoin ETF | Bitcoinist.com

Coinbase’s Chief Legal Officer, Paul Grewal has recently used the law to back the approval of a Spot Bitcoin Exchange Traded Fund (ETF) by the United States Securities and Exchange Commission (SEC), highlighting that the US regulator should fulfill its responsibilities.

Coinbase CLO Optimism On The Approval Of A Spot BTC ETF

In an interview on Friday, with CNBC’s Arjun Kharpal, Paul expressed his optimism about the approval of Bitcoin ETF applications by the SEC. The Coinbase CLO said that he is quite confident that the SEC will soon approve a spot Bitcoin ETF, backing his belief under the law.

“I’m quite hopeful that these [ETF] applications will be granted, if only because they should be granted under the law,” Paul stated.

Following the interview, Paul highlighted his beliefs in the early success of approval, noting that the firms that have stepped forward with well-structured ETF proposals for these products and services are crucial players in the financial service industry.

I think that the firms that have stepped forward with robust proposals for these products and services are among some of the biggest blue chips in financial services. So that, I think, suggests that we will see progress there in short order.

However, Paul did not give a time frame as to when the approval will happen since the final decision about the approval ultimately lies with the SEC. However, he is still confident that the US regulator is likely to approve a Bitcoin ETF in a short period due to recent developments.

Paul further backed his optimism following the SEC’s recent court setback when a judge from the US Court of Appeals stated that the US regulator had no grounds to deny Grayscale’s approval to convert its Grayscale Bitcoin (BTC) into a spot Bitcoin ETF, calling the SEC’s decision an arbitrary move.

“I think that, after the U.S. Court of Appeals made clear that the SEC could not reject these applications on an arbitrary or capricious basis, we’re going to see the commission fulfill its responsibilities. I’m quite confident of that,” Paul stated.

BTC breaks above $29,800 | Source: BTCUSD on Tradingview.com

In addition, Paul also highlighted the SEC’s failure to file an appeal on the ruling indicating a potential approval of a spot BTC ETF soon within the stipulated timespan that was given to them by the court.

If an approval of a Spot ETF is made, BTC could experience a major rally. A Bitcoin ETF serves as a means for investors to invest in BTC without having to make a direct purchase of the digital asset from an exchange.

One of the major cryptocurrency exchanges that will benefit a lot from any Bitcoin ETF approval is Coinbase. This is because the crypto exchange’s common stock is held in portfolios tailored to give investors exposure to cryptocurrencies.

JPMorgan On A Spot Bitcoin ETF Approval

Analysts from JPMorgan, have also expressed their optimism on a Bitcoin ETF approval, that the ETF product could be available to the public by this Christmas.

Due to recent developments following the approval of a Spot Bitcoin ETF, the financial giant believes that there is a high chance that an ETF could gain approval before January 10, 2024.

In addition, analysts from Bloomberg also believe that there is a 90% chance that a Bitcoin ETF will be approved next year.

Featured image from Forkast News, chart from Tradingview.com

Scott Matherson

Source link